Cancer Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: cancer-diagnostics

Cancer Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cancer Diagnostics market for the forecast period of 2023 to 2033, highlighting key market insights, trends, segmentation, and region-specific developments.

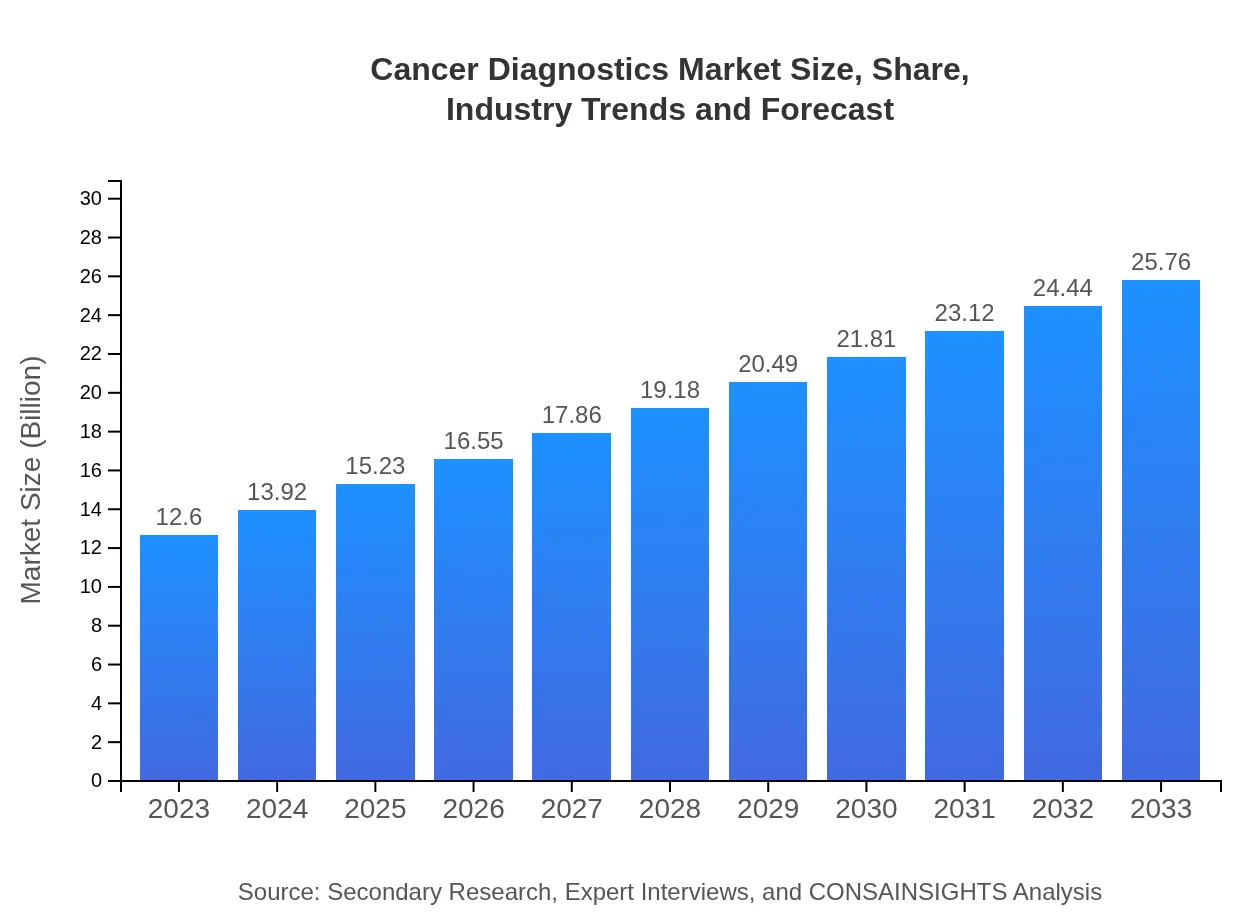

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $25.76 Billion |

| Top Companies | Roche Diagnostics, F. Hoffmann-La Roche AG, Abbott Laboratories, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

Cancer Diagnostics Market Overview

Customize Cancer Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Cancer Diagnostics market size, growth, and forecasts.

- ✔ Understand Cancer Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cancer Diagnostics

What is the Market Size & CAGR of Cancer Diagnostics market in 2023?

Cancer Diagnostics Industry Analysis

Cancer Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cancer Diagnostics Market Analysis Report by Region

Europe Cancer Diagnostics Market Report:

The European market is anticipated to grow from $3.82 billion in 2023 to $7.81 billion by 2033. Factors driving this growth include stringent regulations on healthcare quality, increasing awareness of cancer prevention, and strong emphasis on research and innovation in countries like Germany, France, and the UK.Asia Pacific Cancer Diagnostics Market Report:

The Asia Pacific region, valued at approximately $2.32 billion in 2023, is expected to reach $4.75 billion by 2033. Driving factors include an increase in cancer cases, growing healthcare expenditure, and advancements in diagnostic technologies. Countries such as China, India, and Japan are pivotal players due to their expansive healthcare systems and investments in research.North America Cancer Diagnostics Market Report:

North America leads the global Cancer Diagnostics market, valued at $4.57 billion in 2023, with expectations to grow to $9.34 billion by 2033. The region benefits from advanced healthcare technologies, high healthcare expenditure, and significant investment in cancer research and development, particularly in the United States.South America Cancer Diagnostics Market Report:

In South America, the market is projected to grow from around $1.00 billion in 2023 to approximately $2.05 billion in 2033. The expansion is supported by government initiatives aimed at improving healthcare infrastructure and accessibility to advanced diagnostic tools in Brazil and Argentina.Middle East & Africa Cancer Diagnostics Market Report:

The Middle East and Africa Cancer Diagnostics market is valued at approximately $0.88 billion in 2023, expected to grow to $1.81 billion by 2033. Growth is attributed to increasing healthcare investments, rising awareness about cancer screenings, and improving healthcare infrastructures in regions like the UAE and South Africa.Tell us your focus area and get a customized research report.

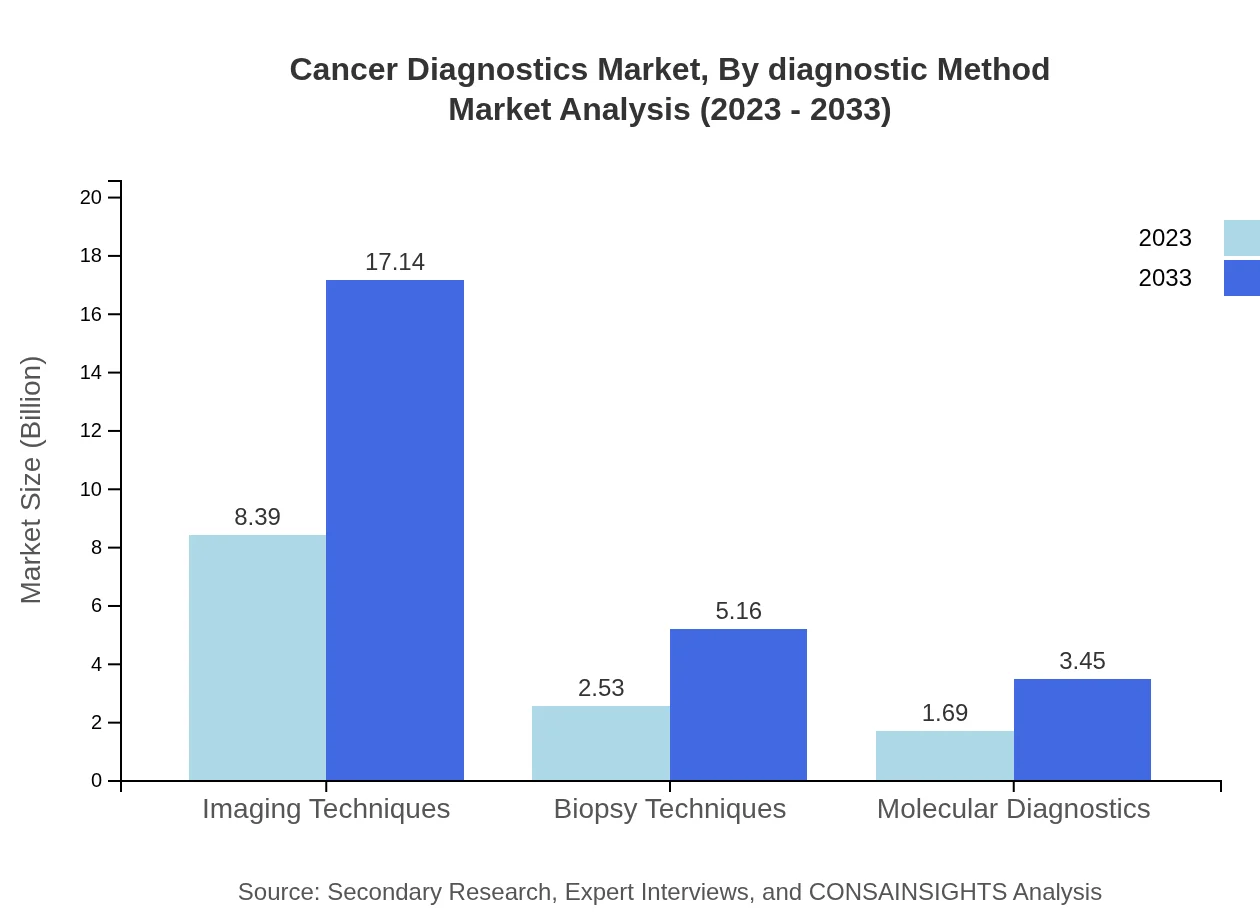

Cancer Diagnostics Market Analysis By Diagnostic Method

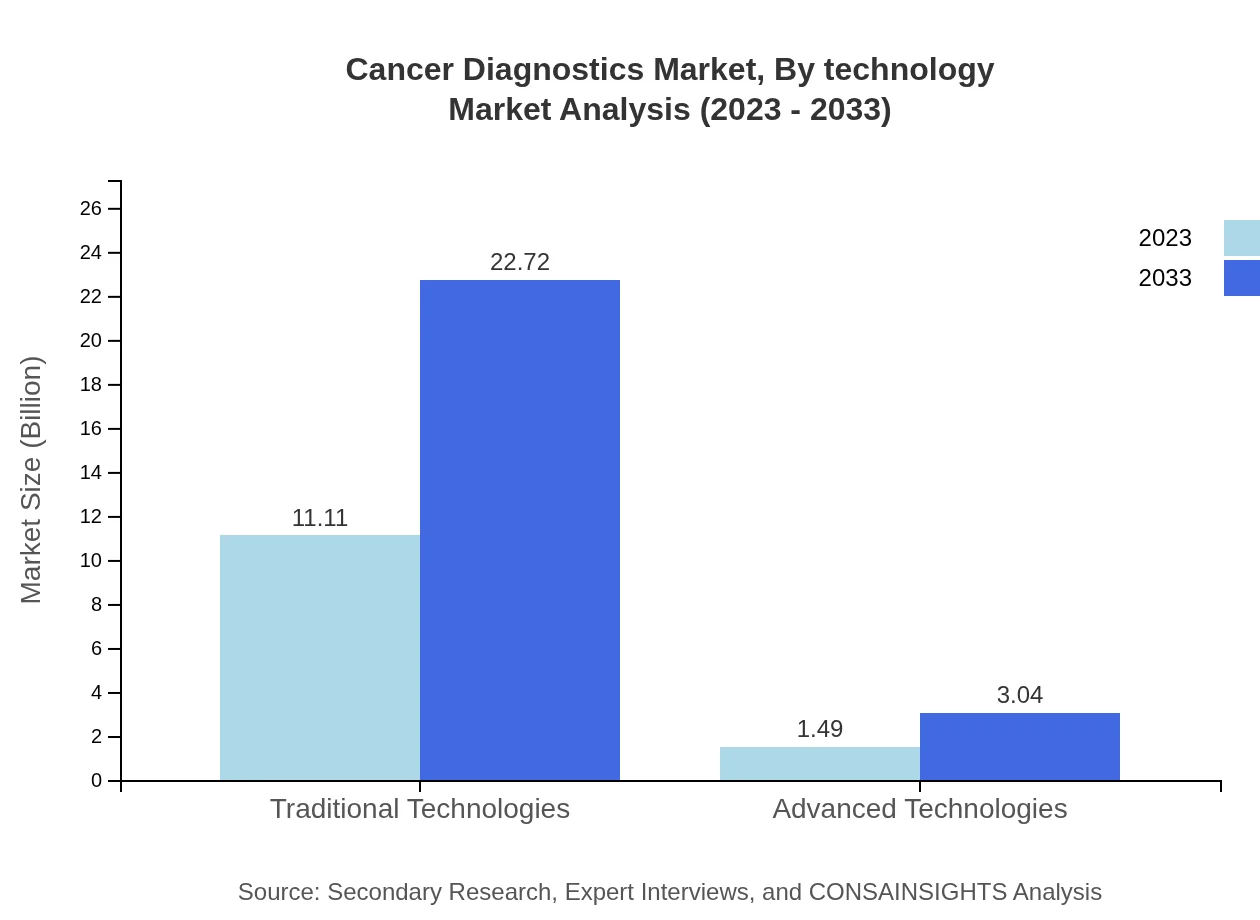

In 2023, the by-diagnostic-method segment is expected to be dominated by traditional technologies, accounting for a market size of $11.11 billion, with significant contributions from advanced technologies, which are valued at $1.49 billion. Traditional technologies currently hold an 88.21% market share, while advanced technologies comprise 11.79%.

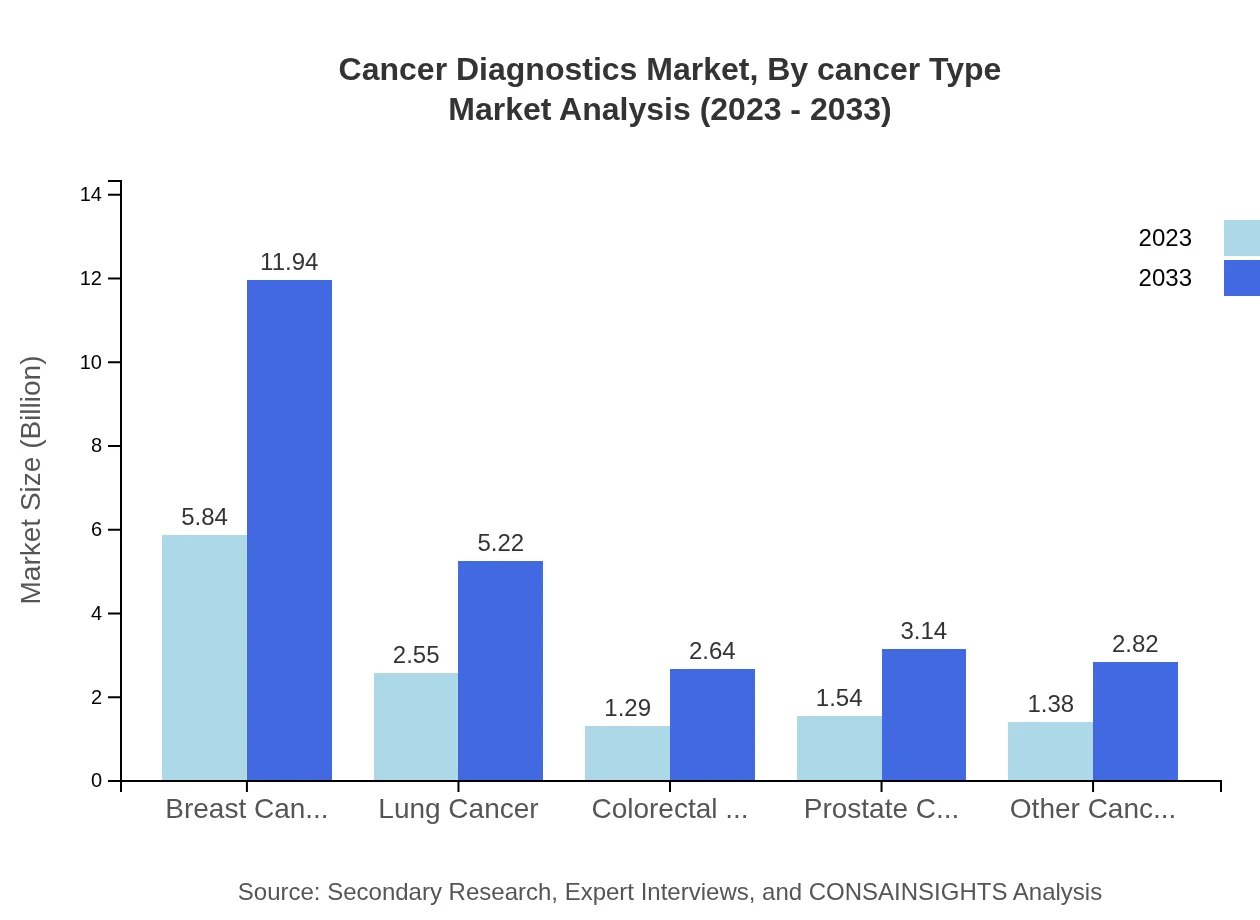

Cancer Diagnostics Market Analysis By Cancer Type

Breast cancer diagnostics represent the largest segment, with a market size of $5.84 billion in 2023, expected to reach $11.94 billion by 2033. Lung cancer diagnostics follow with a market size of $2.55 billion, while other cancers also contribute significantly, totaling approximately $1.38 billion.

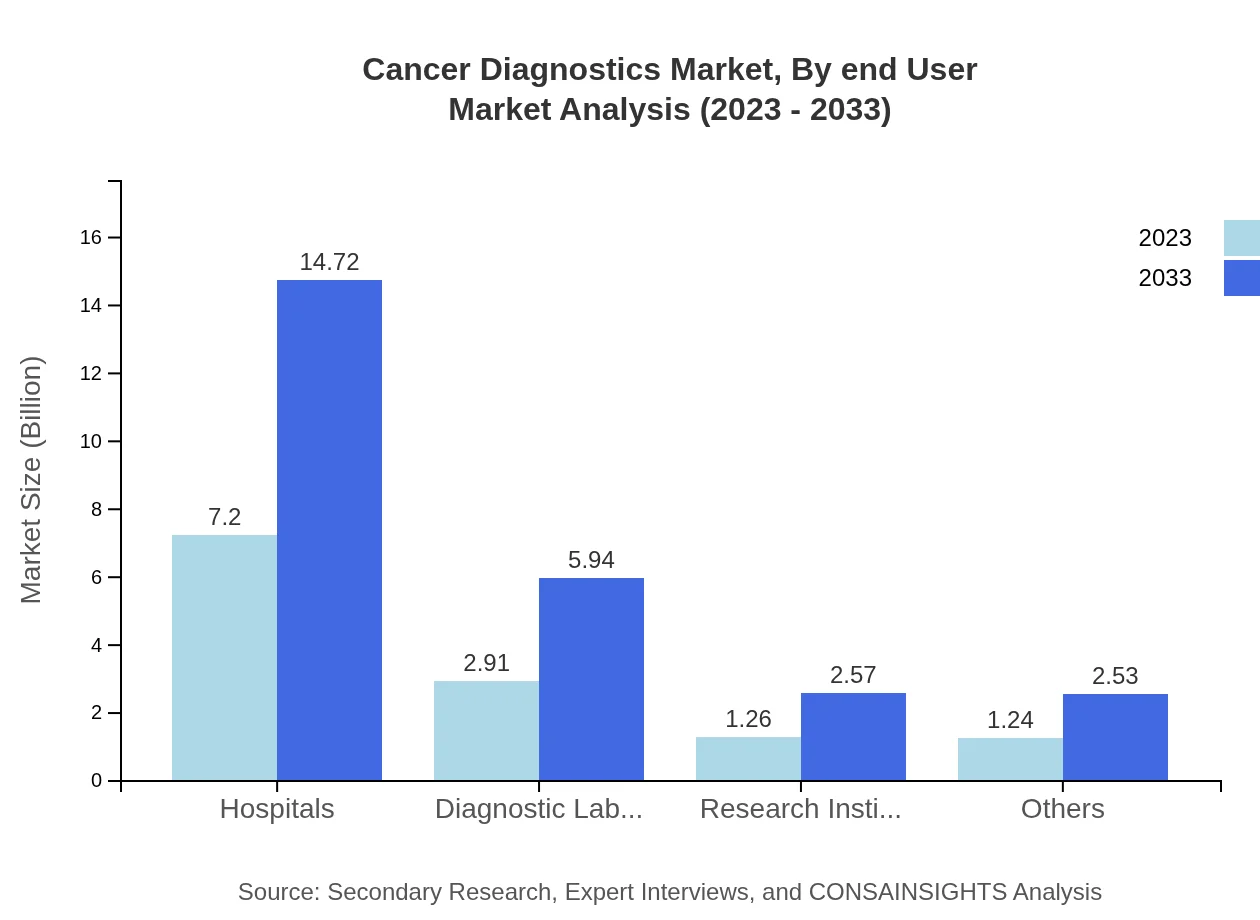

Cancer Diagnostics Market Analysis By End User

Hospitals will continue to be the largest end-user in 2023, accounting for a market share of 57.14% and a projected market size of $7.20 billion. Diagnostic laboratories are projected at $2.91 billion, while research institutes will add $1.26 billion to this market.

Cancer Diagnostics Market Analysis By Technology

The market underscores the dominance of traditional technologies, while advanced technologies are gaining traction. Traditional technologies are projected to reach $22.72 billion by 2033, indicating a growing interest in innovative diagnostics solutions.

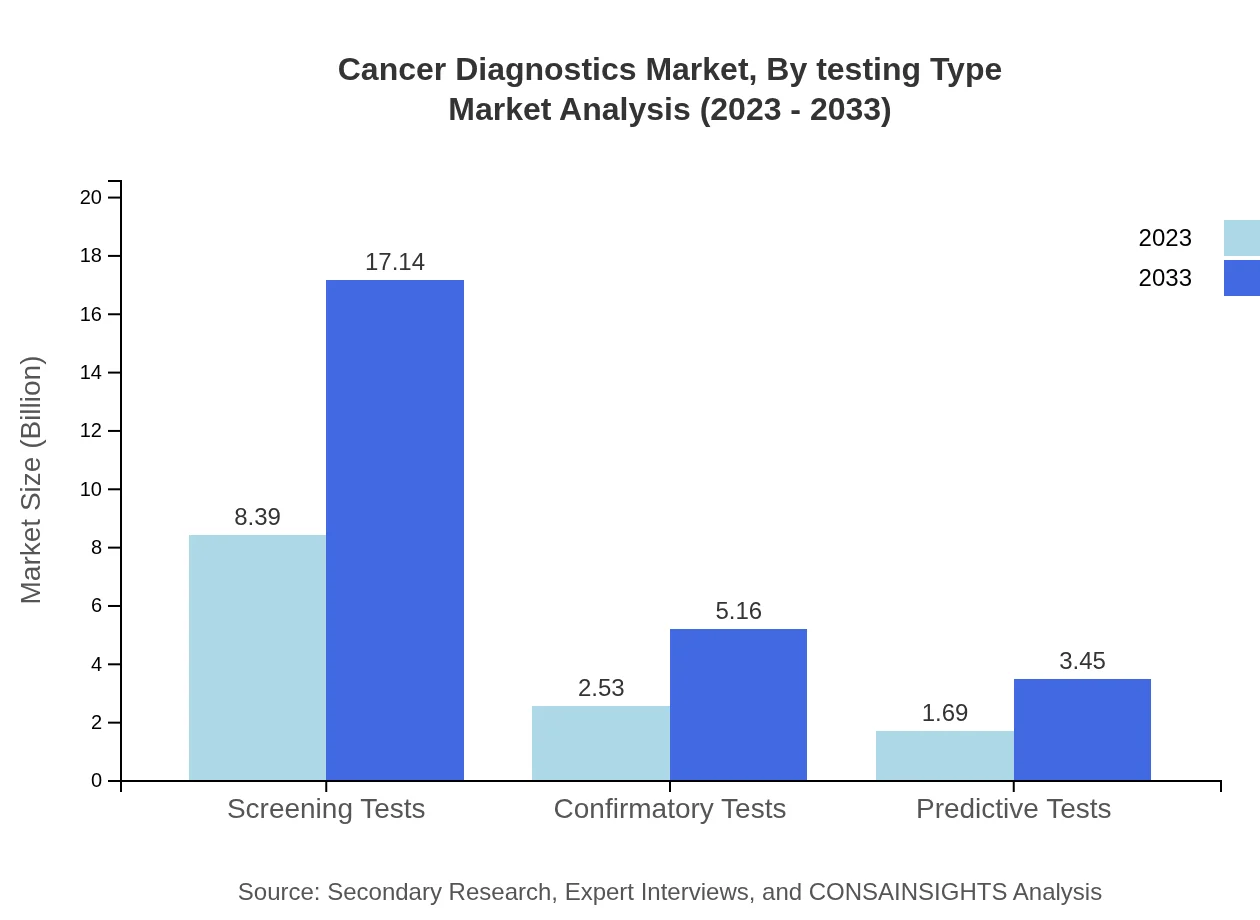

Cancer Diagnostics Market Analysis By Testing Type

Screening tests continue to lead the market with a share of 66.56% in 2023, valued at $8.39 billion. Confirmatory tests and predictive tests also play critical roles, contributing market sizes of $2.53 billion and $1.69 billion respectively.

Cancer Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cancer Diagnostics Industry

Roche Diagnostics:

Roche is a pioneer in cancer diagnostics, providing comprehensive solutions that enable early detection and treatment monitoring for various cancers.F. Hoffmann-La Roche AG:

Known for its innovative cancer screening tests and diagnostic platforms, F. Hoffmann-La Roche AG is committed to improving patient outcomes through advanced diagnostic solutions.Abbott Laboratories:

Abbott operates in various healthcare segments, offering cutting-edge cancer diagnostic tools that significantly enhance the early detection of malignancies.Thermo Fisher Scientific:

Thermo Fisher provides a broad array of diagnostic testing solutions, specializing in molecular diagnostics and precision medicine aimed at cancer treatment.We're grateful to work with incredible clients.

FAQs

What is the market size of cancer Diagnostics?

The global cancer diagnostics market is projected to reach USD 12.6 billion by 2033, growing at a CAGR of 7.2% from 2023. This growth reflects advancements in diagnostic technologies and increasing cancer prevalence.

What are the key market players or companies in this cancer diagnostics industry?

Key players in the cancer diagnostics market include Roche, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, and Illumina. These companies lead through innovative diagnostics and strategic partnerships, enhancing their market presence.

What are the primary factors driving the growth in the cancer diagnostics industry?

Major growth drivers include rising cancer incidence, increasing healthcare expenditure, advancements in diagnostic technologies, and a favorable regulatory environment. Expanding awareness of early detection also fuels market expansion, aiding patient outcomes.

Which region is the fastest Growing in the cancer diagnostics market?

North America is the fastest-growing region in the cancer diagnostics market, projected to grow from USD 4.57 billion in 2023 to USD 9.34 billion by 2033. This growth is driven by robust healthcare infrastructure and high R&D investments.

Does ConsaInsights provide customized market report data for the cancer diagnostics industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs. By analyzing market dynamics and trends, we provide insights that cater to individual strategic objectives within the cancer diagnostics sector.

What deliverables can I expect from this cancer diagnostics market research project?

Expect comprehensive deliverables including market analysis reports, competitive landscape assessments, regional insights, segment data, and forecasts. We also provide actionable recommendations to inform strategic business decisions.

What are the market trends of cancer diagnostics?

Current trends include increasing adoption of liquid biopsy, advancements in genomics and molecular profiling, and a shift towards personalized medicine. The integration of AI in diagnostics is also reshaping the landscape, enhancing accuracy and efficiency.