Canned Food Packaging Market Report

Published Date: 31 January 2026 | Report Code: canned-food-packaging

Canned Food Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the global canned food packaging market, covering market dynamics, trends, segmentation, and forecasts from 2023 to 2033, along with regional analyses and key market players.

| Metric | Value |

|---|---|

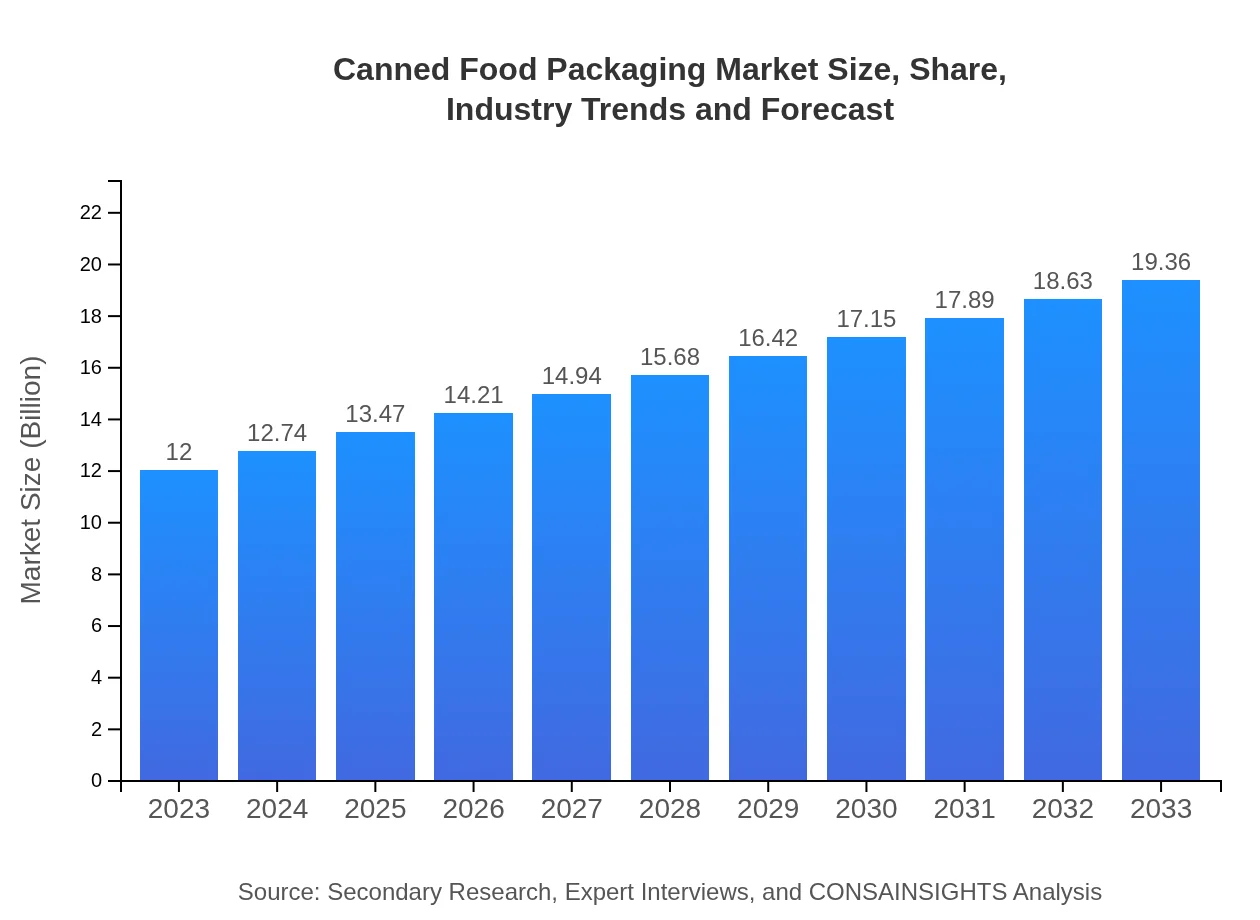

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $19.36 Billion |

| Top Companies | Ball Corporation, Crown Holdings, Inc., Silgan Containers, Amcor |

| Last Modified Date | 31 January 2026 |

Canned Food Packaging Market Overview

Customize Canned Food Packaging Market Report market research report

- ✔ Get in-depth analysis of Canned Food Packaging market size, growth, and forecasts.

- ✔ Understand Canned Food Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Canned Food Packaging

What is the Market Size & CAGR of Canned Food Packaging market in 2023?

Canned Food Packaging Industry Analysis

Canned Food Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Canned Food Packaging Market Analysis Report by Region

Europe Canned Food Packaging Market Report:

Europe's canned food packaging market will increase from $3.15 billion in 2023 to $5.09 billion by 2033, bolstered by stringent food safety regulations and a growing preference for organic and health-oriented canned products.Asia Pacific Canned Food Packaging Market Report:

The Asia Pacific region, valued at approximately $2.30 billion in 2023, is anticipated to grow to $3.71 billion by 2033, driven by urbanization, an expanding middle class, and increasing demand for convenience foods, particularly in countries like India and China.North America Canned Food Packaging Market Report:

In North America, the market is expected to expand from $4.59 billion in 2023 to $7.40 billion by 2033. The region benefits from strong retail and food service sectors, with consumers increasingly opting for eco-friendly packaging options and ready-to-eat meals.South America Canned Food Packaging Market Report:

South America is projected to see growth from $0.63 billion in 2023 to $1.02 billion by 2033. The rising trend of vegetable and fruit preservations among local consumers, alongside an increase in agricultural exports, is propelling the canned food packaging sector here.Middle East & Africa Canned Food Packaging Market Report:

The Middle East and Africa market is forecasted to grow from $1.33 billion in 2023 to $2.14 billion by 2033. Increasing expatriate populations and transforming lifestyles in urban areas are contributing to rising demand for canned food products.Tell us your focus area and get a customized research report.

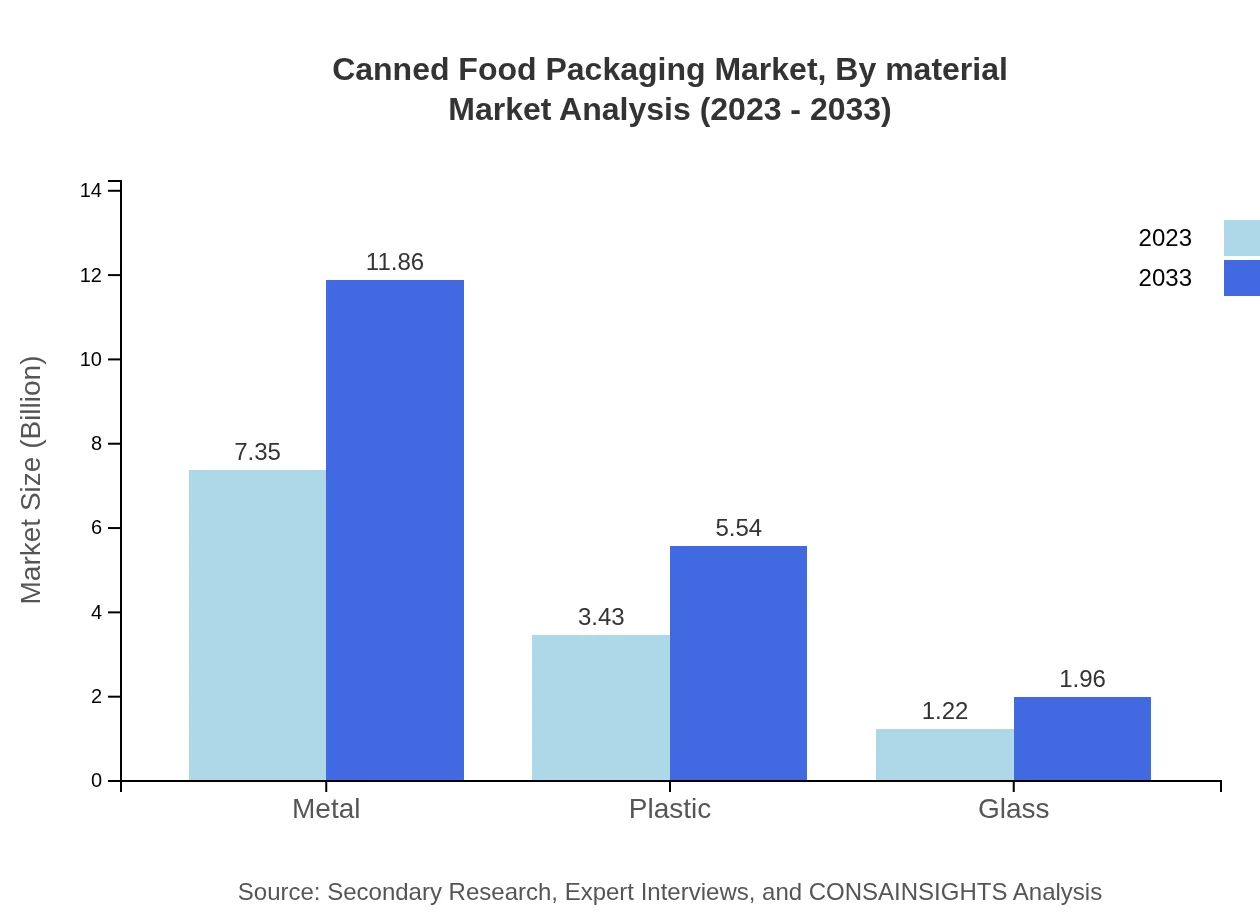

Canned Food Packaging Market Analysis By Material

The material segment dominates the canned food packaging sector, with metal packaging capturing 61.27% market share in 2023, projected to grow to 61.27% by 2033. This growth is supported by its excellent preservation capabilities. Plastic accounts for 28.6% with expectations of similar performance, reflecting versatility in packaging design.

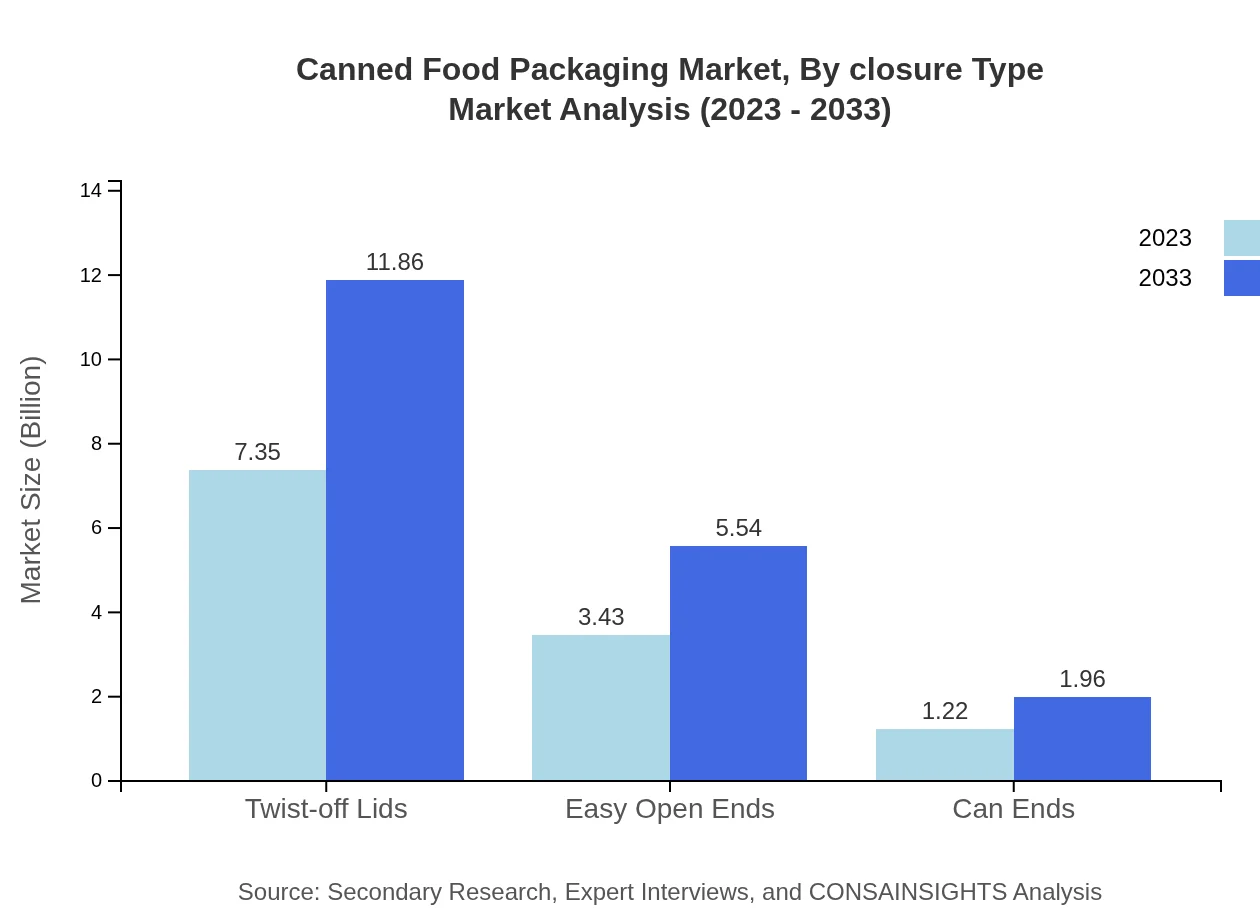

Canned Food Packaging Market Analysis By Closure Type

Closure types such as twist-off lids and easy open ends constitute the majority of the market share. Twist-off lids accounted for 61.27% in 2023 and are expected to retain that share by 2033, while easy open ends hold 28.6% of the market, underscoring the demand for convenience.

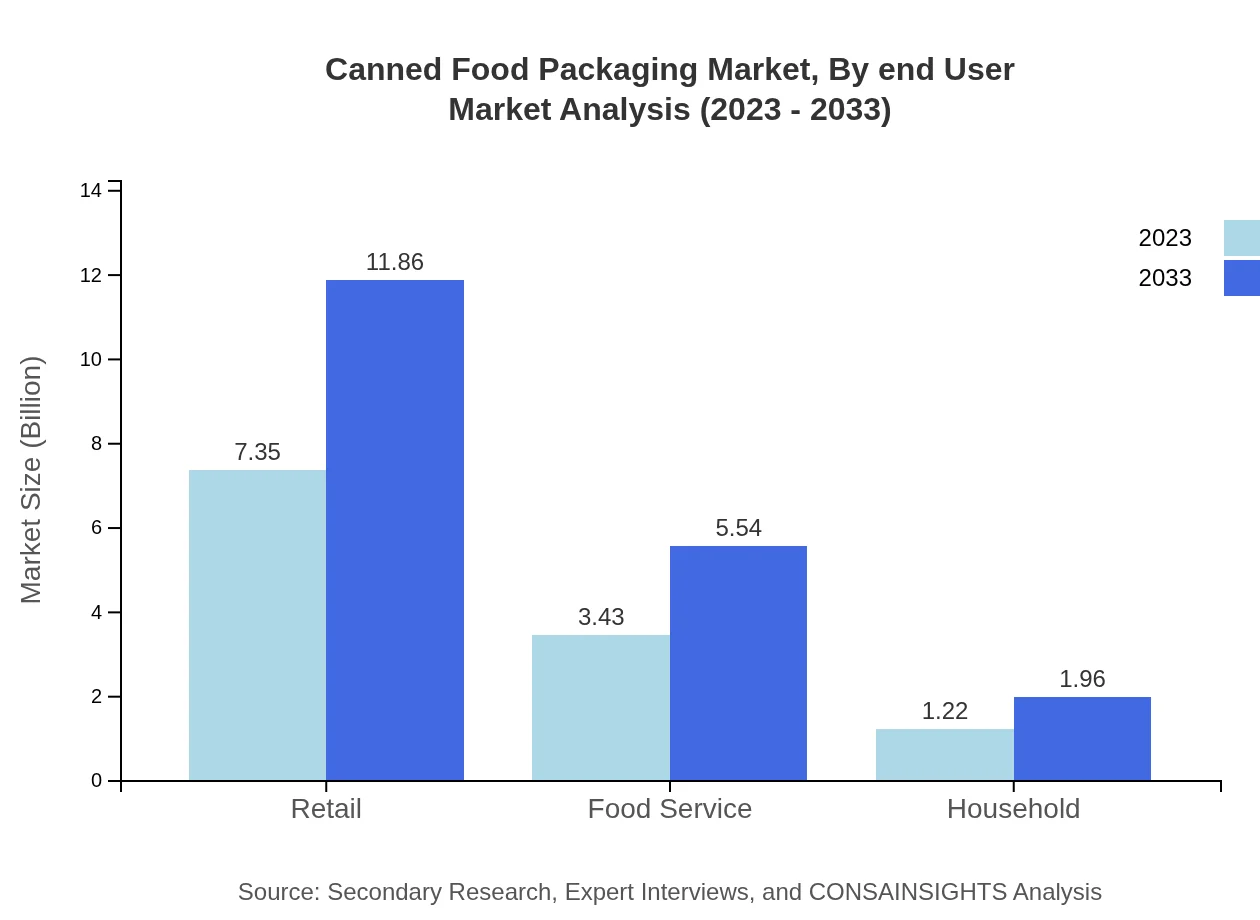

Canned Food Packaging Market Analysis By End User

The retail segment is the largest end-user of canned food packaging, registering $7.35 billion in 2023 and projected to grow to $11.86 billion by 2033. The food service sector follows, with a significant growth trajectory attributed to an increase in dining-out trends and ready-to-eat options.

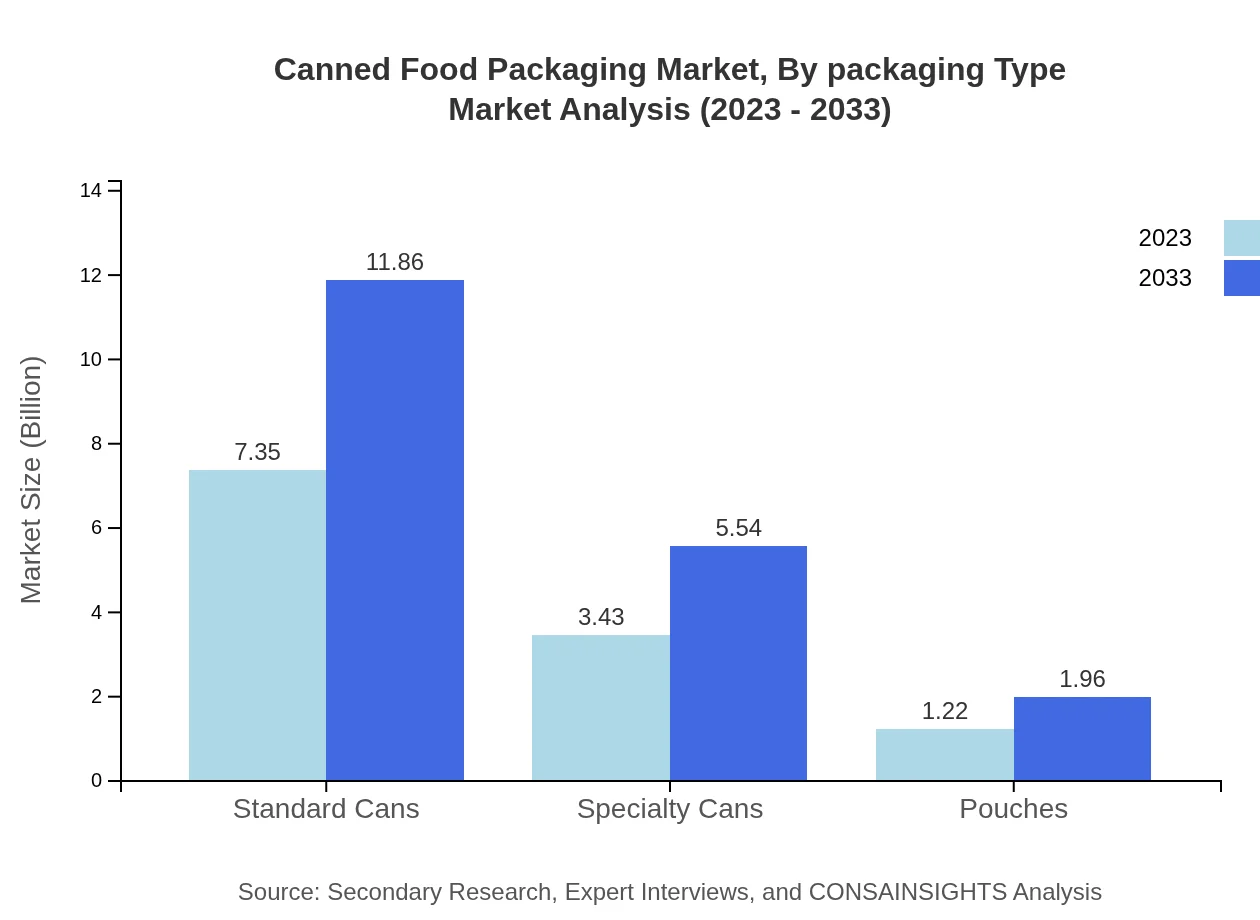

Canned Food Packaging Market Analysis By Packaging Type

Standard and specialty cans dominate the packaging segment, with standard cans maintaining a steady 61.27% share. Specialty cans capture a niche market, reflecting innovative uses and designs catering to specific consumer needs.

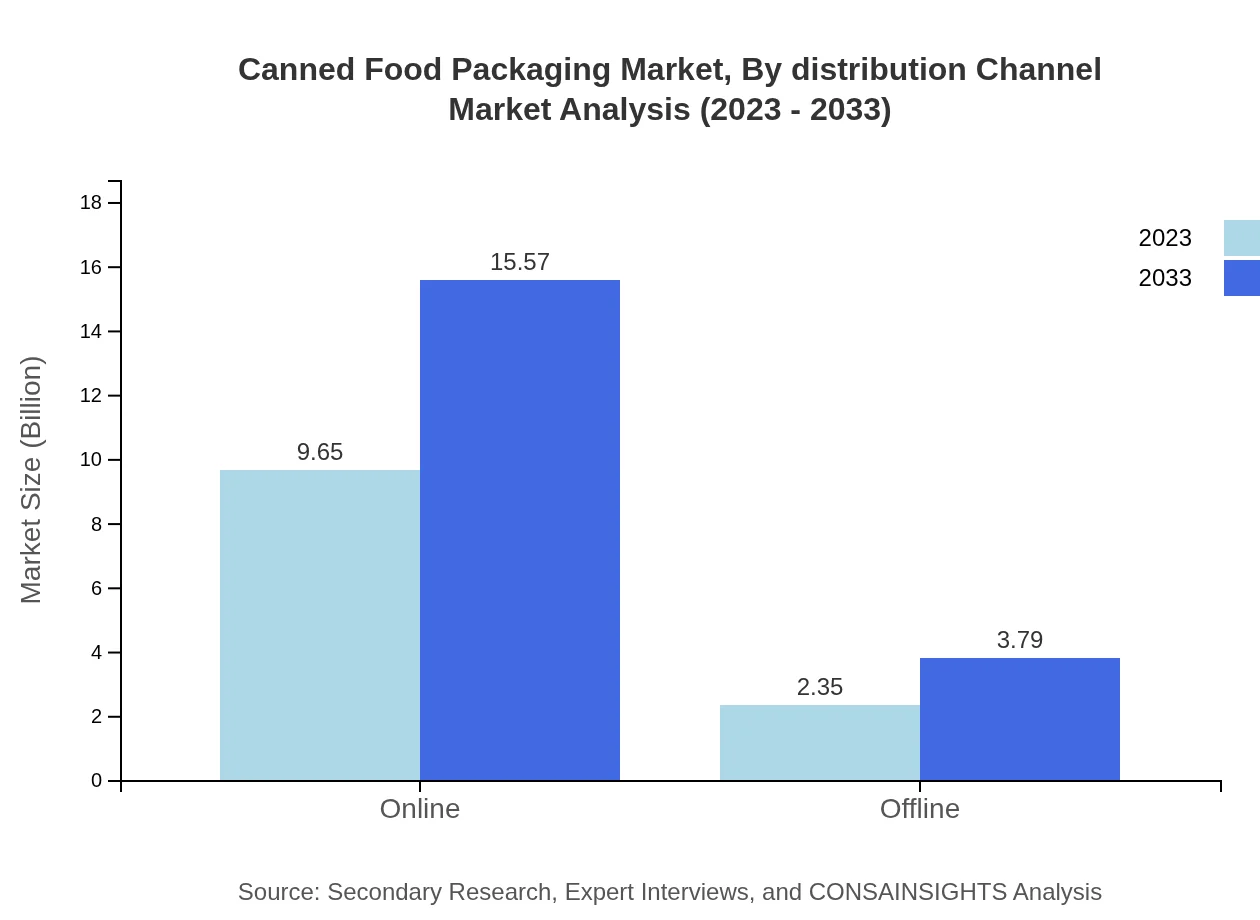

Canned Food Packaging Market Analysis By Distribution Channel

The online channel leads in distribution, projected to grow from $9.65 billion in 2023 to $15.57 billion by 2033. This surge reflects changing consumer shopping habits due to convenience and increased digital engagement, while offline channels remain relevant with $2.35 billion in 2023, expected to grow as well.

Canned Food Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Canned Food Packaging Industry

Ball Corporation:

A leading manufacturer of metal packaging products for beverages, foods, and household items, Ball Corporation focuses on sustainable packaging solutions and innovation.Crown Holdings, Inc.:

Specializing in metal packaging for food and beverages, Crown Holdings is recognized for its eco-friendly initiatives and extensive global reach.Silgan Containers:

Silgan Containers is a top provider in the packaging sector, known for its high-quality metal containers and customer-centric approach.Amcor:

Amcor is a global leader in packaging solutions, offering innovative products across different material types, including flexible and rigid containers.We're grateful to work with incredible clients.

FAQs

What is the market size of canned Food Packaging?

The global canned food packaging market is estimated at $12 billion in 2023, with a projected CAGR of 4.8% through 2033. This growth reflects the increasing demand for preserved food products worldwide.

What are the key market players or companies in this canned Food Packaging industry?

Leading companies in the canned food packaging industry include Crown Holdings, Inc., Ball Corporation, Silgan Holdings Inc., and Bemis Company, Inc., among others. These players significantly impact the market with their innovative packaging solutions.

What are the primary factors driving the growth in the canned Food Packaging industry?

Key drivers of growth in the canned food packaging industry include the rising demand for convenience foods, extended shelf life offered by canned products, and advancements in packaging technology enhancing product safety and preservation.

Which region is the fastest Growing in the canned Food Packaging?

The Asia-Pacific region is the fastest-growing market for canned food packaging, projected to increase from $2.30 billion in 2023 to $3.71 billion by 2033, fueled by urbanization and changing consumer lifestyles.

Does ConsaInsights provide customized market report data for the canned Food Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the canned food packaging industry, ensuring clients receive relevant insights and analyses pertinent to their market conditions.

What deliverables can I expect from this canned Food Packaging market research project?

Deliverables from the canned food packaging market research project include comprehensive reports, market analysis, forecasts, segment insights, and detailed profiles of key market players and their strategies.

What are the market trends of canned Food Packaging?

Trends in the canned food packaging market include a shift toward eco-friendly materials, increasing adoption of advanced packaging technologies, and a growing preference for ready-to-eat meals among consumers.