Capacitive Pressure Sensor Market Report

Published Date: 31 January 2026 | Report Code: capacitive-pressure-sensor

Capacitive Pressure Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the capacitive pressure sensor market, covering trends, growth forecasts, industry insights, and detailed segmentation from 2023 to 2033.

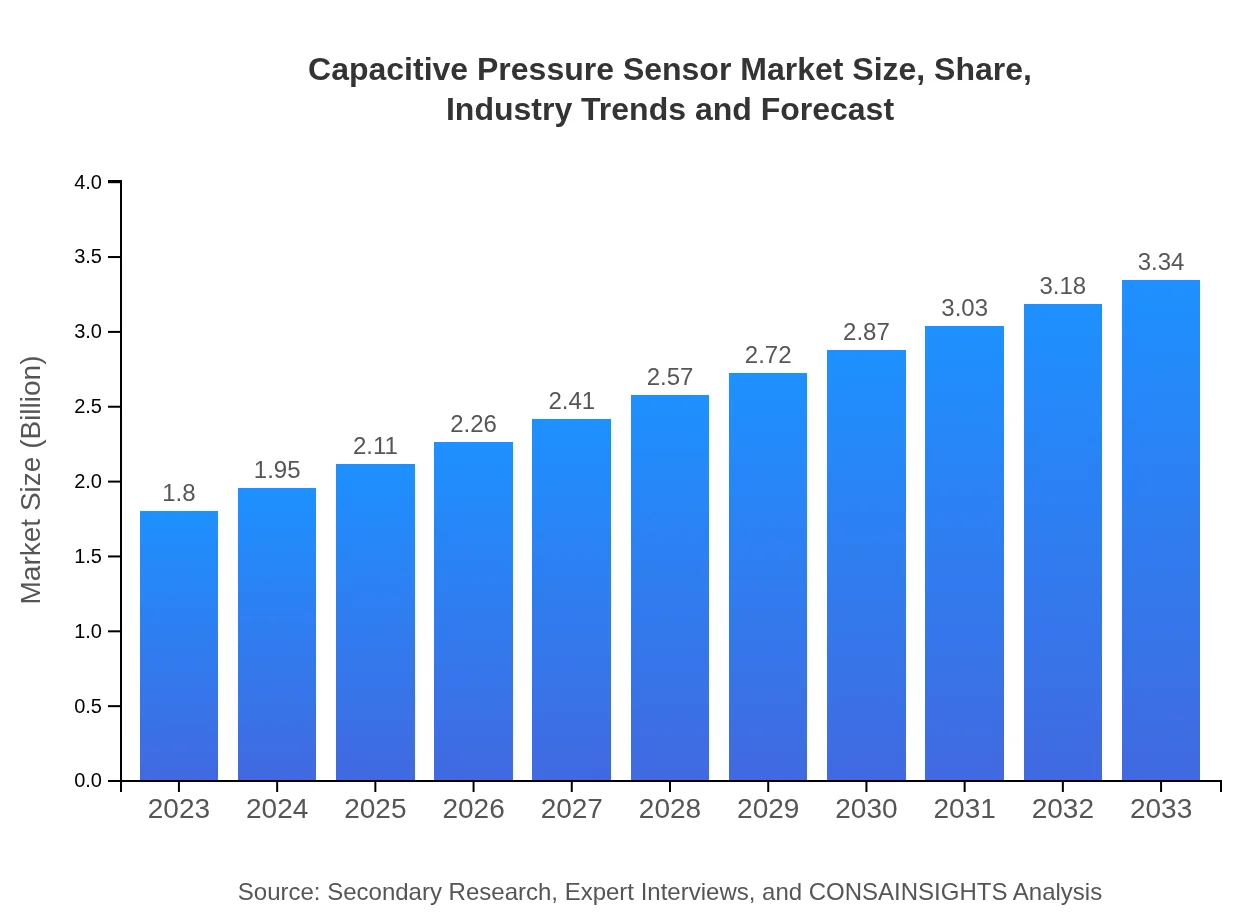

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Honeywell International Inc., Texas Instruments, Bosch Sensortec, STMicroelectronics |

| Last Modified Date | 31 January 2026 |

Capacitive Pressure Sensor Market Overview

Customize Capacitive Pressure Sensor Market Report market research report

- ✔ Get in-depth analysis of Capacitive Pressure Sensor market size, growth, and forecasts.

- ✔ Understand Capacitive Pressure Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Capacitive Pressure Sensor

What is the Market Size & CAGR of the Capacitive Pressure Sensor market in 2033?

Capacitive Pressure Sensor Industry Analysis

Capacitive Pressure Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Capacitive Pressure Sensor Market Analysis Report by Region

Europe Capacitive Pressure Sensor Market Report:

The European capacitive pressure sensor market is expected to increase from $0.50 billion in 2023 to $0.92 billion by 2033. The region's focus on sensor technology for automation and strict regulatory environments to ensure quality and safety enhance the demand for advanced pressure sensing solutions in various industries.Asia Pacific Capacitive Pressure Sensor Market Report:

The Asia Pacific region is a significant player in the capacitive pressure sensor market, projected to grow from $0.38 billion in 2023 to $0.71 billion by 2033. Increased industrialization and technological advancements in countries like China, Japan, and India are key drivers. The demand for smart devices and automation in manufacturing is expected to bolster market growth in this region.North America Capacitive Pressure Sensor Market Report:

North America holds a substantial share of the capacitive pressure sensor market, with projections showing growth from $0.60 billion in 2023 to $1.11 billion by 2033. This increase is driven by the robust automotive and healthcare sectors, as well as advancements in IoT technologies that demand high-performance sensors for data collection and monitoring.South America Capacitive Pressure Sensor Market Report:

In South America, the market for capacitive pressure sensors is anticipated to grow from $0.15 billion in 2023 to $0.27 billion by 2033. The growth is supported by rising investments in industrial infrastructure and the growing need for advanced sensors in various applications, including healthcare and environmental monitoring.Middle East & Africa Capacitive Pressure Sensor Market Report:

The Middle East and Africa region is forecasted to see an increase in the capacitive pressure sensor market from $0.18 billion in 2023 to $0.33 billion by 2033. Growth factors include the expanding oil & gas industry in the Middle East requiring precise pressure measurements and heightened infrastructure developments across the region.Tell us your focus area and get a customized research report.

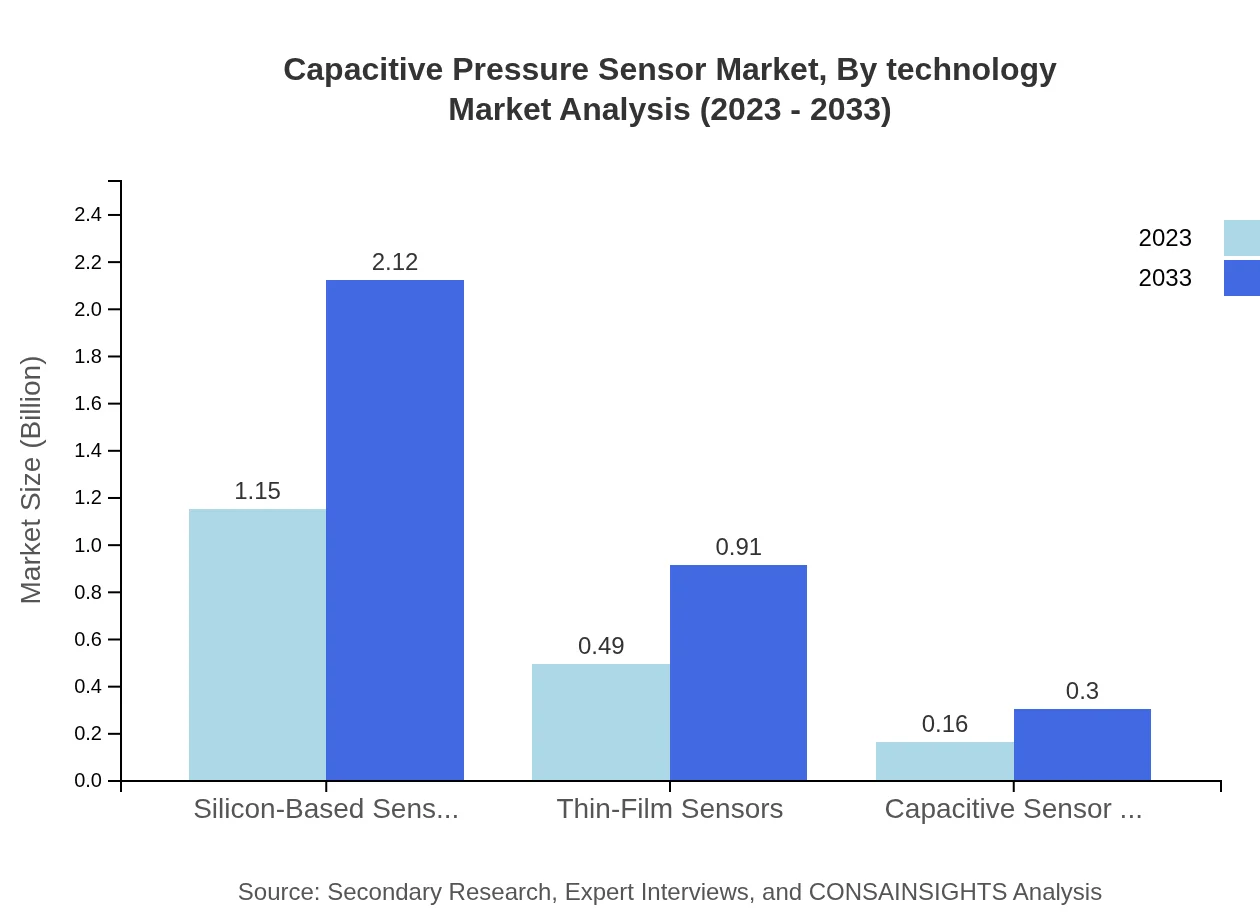

Capacitive Pressure Sensor Market Analysis By Technology

In 2023, silicon-based sensors comprised the largest segment, valued at $1.15 billion, maintaining a share of 63.62%. Thin-film sensors are gaining traction, increasing from $0.49 billion to $0.91 billion by 2033, driven by their low cost and high efficiency. Capacitive sensor chips are projected to grow from $0.16 billion to $0.30 billion, appealing in compact applications.

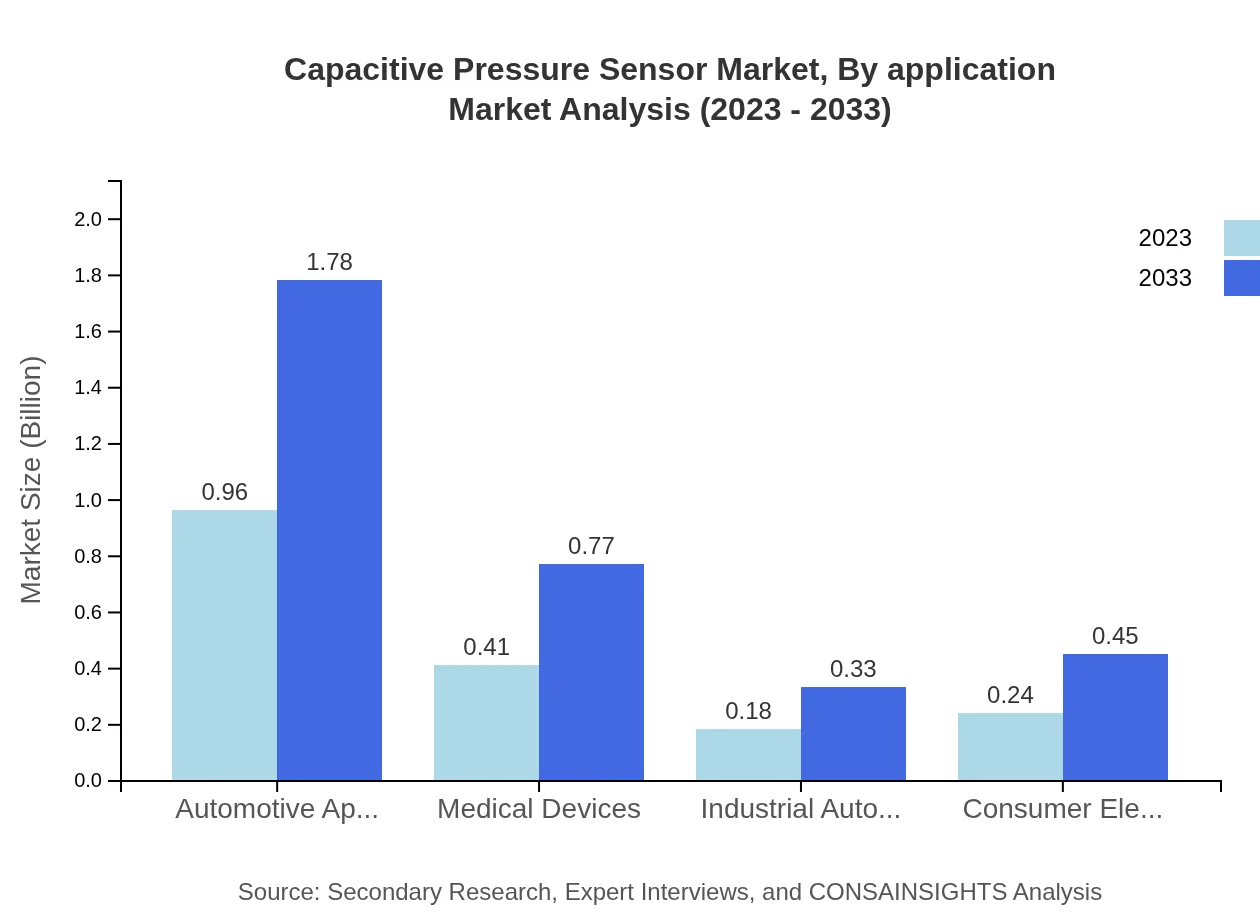

Capacitive Pressure Sensor Market Analysis By Application

The healthcare segment stands out with a market share of 53.44%, valued at $0.96 billion in 2023 and increasing to $1.78 billion by 2033. Automotive applications also show robust growth, projected from $0.96 billion to $1.78 billion, reflecting a significant need for precise monitoring systems in vehicles and medical devices.

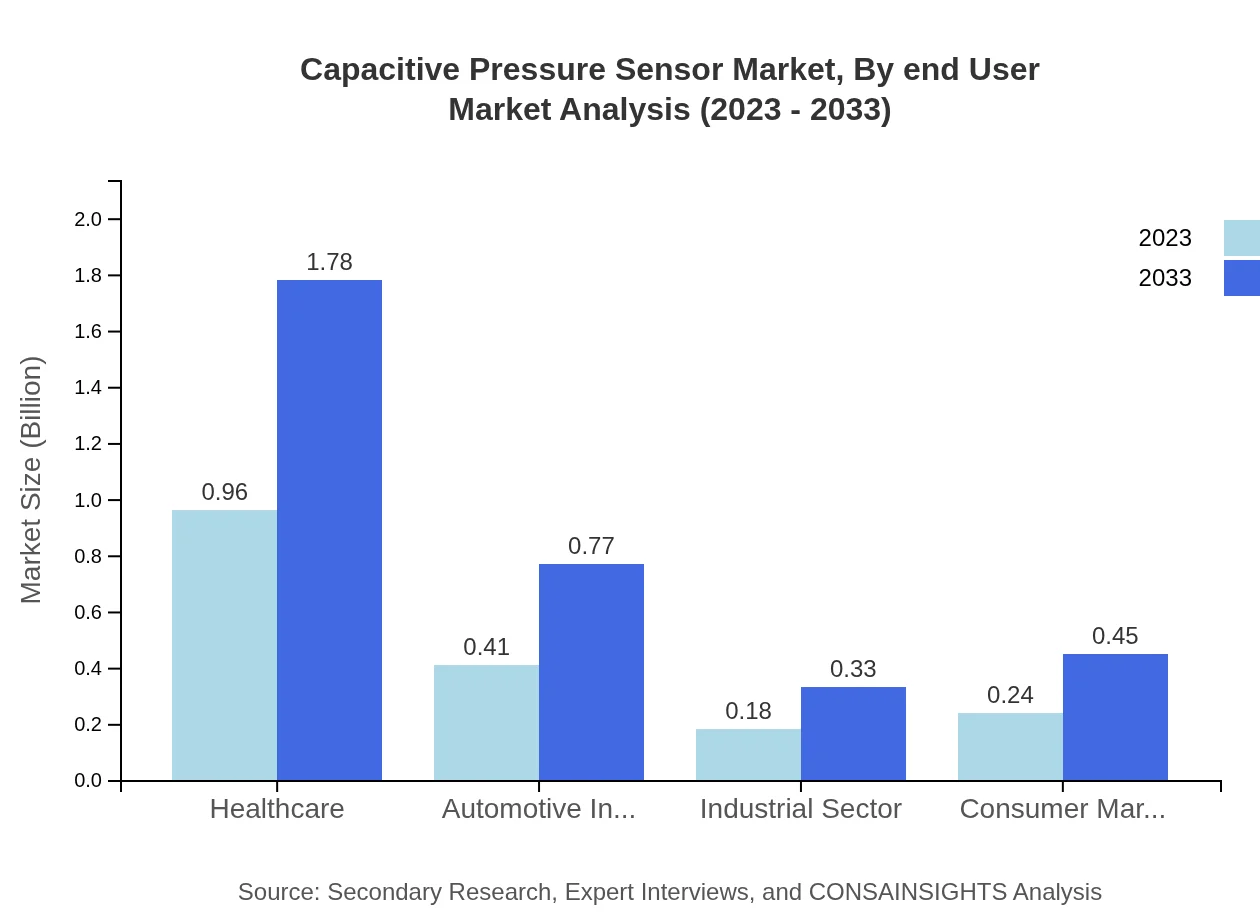

Capacitive Pressure Sensor Market Analysis By End User

The automotive industry holds a share of 22.94%, while the consumer electronics segment represents 13.58%, indicating diverse end-use applications. Medical devices are increasingly utilizing capacitive pressure sensors, with an expected growth in share from 22.94% to support new technologies in health monitoring.

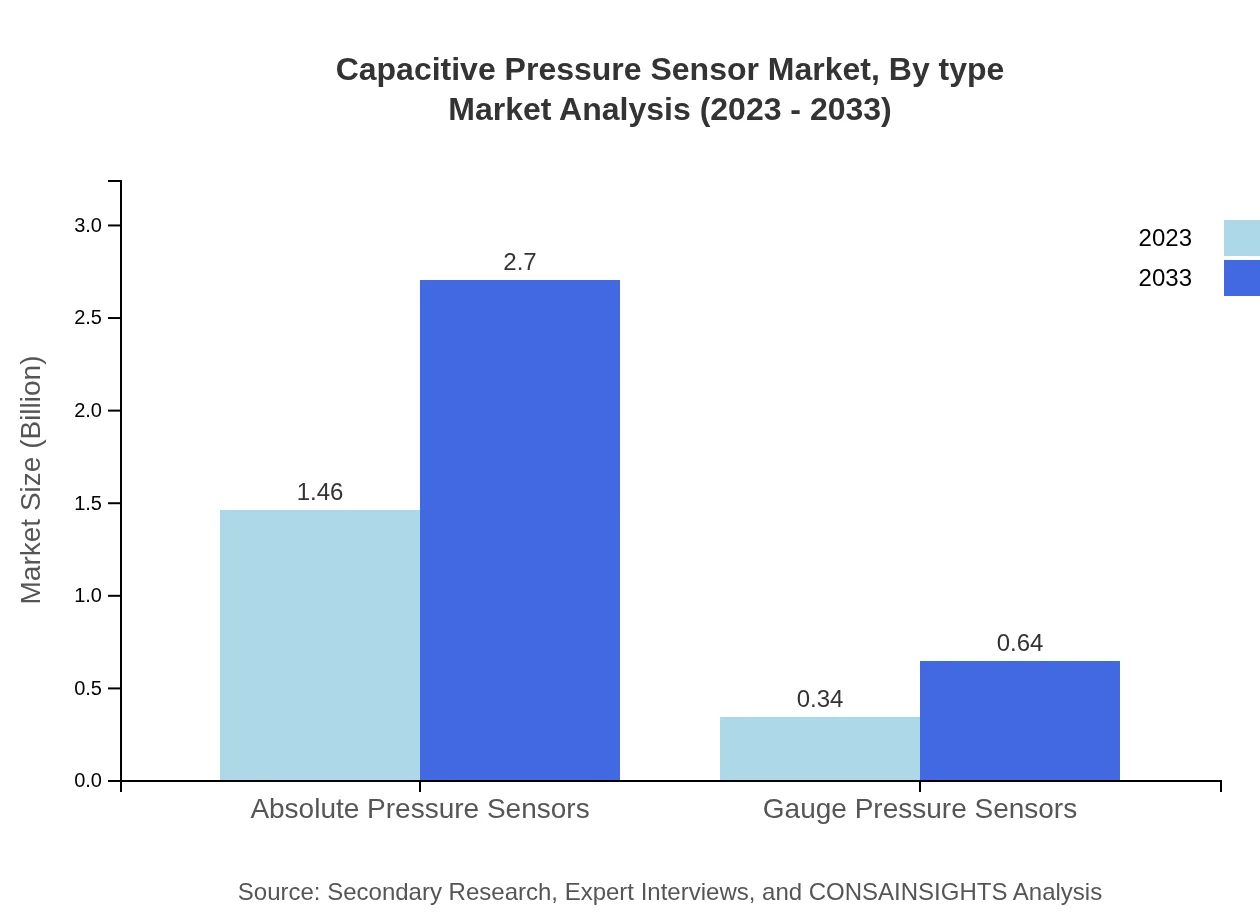

Capacitive Pressure Sensor Market Analysis By Type

Absolute pressure sensors dominate the market with a significant share of 80.94%, valued at $1.46 billion in 2023 and growing to $2.70 billion. Gauge pressure sensors also play a crucial role, with an anticipated rise in value from $0.34 billion to $0.64 billion, making them an essential component across various sectors.

Capacitive Pressure Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Capacitive Pressure Sensor Industry

Honeywell International Inc.:

A leading manufacturer of capacitive sensors, Honeywell focuses on innovative sensing technologies across industrial and commercial applications.Texas Instruments:

Texas Instruments is prominent in the sensor market, offering a range of capacitive pressure sensors for automotive and consumer electronics sectors.Bosch Sensortec:

Bosch is known for its extensive portfolio of MEMS technology, including capacitive pressure sensors widely used in automotive and industrial automation.STMicroelectronics:

This company specializes in high-performance capacitive pressure sensors for diverse applications in IoT and smart devices.We're grateful to work with incredible clients.

FAQs

What is the market size of capacitive Pressure Sensor?

The global capacitive pressure sensor market is projected to reach $1.8 billion by 2033, growing at a CAGR of 6.2% from its current valuation. This growth is driven by increasing demand in various sectors including automotive, healthcare, and industrial automation.

What are the key market players or companies in this capacitive Pressure Sensor industry?

Key players in the capacitive pressure sensor industry include Honeywell, Bosch Sensortec, and Analog Devices. These companies are recognized for their innovative technologies and extensive product offerings, contributing greatly to market growth and development.

What are the primary factors driving the growth in the capacitive Pressure Sensor industry?

Growth in the capacitive pressure sensor industry is primarily driven by advancements in sensor technologies, the increasing integration of sensors in healthcare devices, and the growing automotive sector that requires precise pressure measurements for optimal performance.

Which region is the fastest Growing in the capacitive Pressure Sensor?

The North American region is the fastest-growing market for capacitive pressure sensors, projected to increase from $0.60 billion in 2023 to $1.11 billion by 2033, due to the surge in demand across various industries including automotive and healthcare.

Does ConsaInsights provide customized market report data for the capacitive Pressure Sensor industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements in the capacitive pressure sensor industry, allowing clients to focus on particular market segments, regions, or consumer behaviors for targeted insights.

What deliverables can I expect from this capacitive Pressure Sensor market research project?

Clients can expect comprehensive deliverables including market analysis reports, customized data insights, regional trends, segment performance data, and forecasts tailored specifically for the capacitive pressure sensor market over the specified reporting period.

What are the market trends of capacitive Pressure Sensor?

Current market trends in the capacitive pressure sensor industry include a rising focus on miniaturization and integration of sensors in smart devices, increasing adoption in the healthcare sector, and a significant push towards sustainability in manufacturing.