Capacitor Market Report

Published Date: 22 January 2026 | Report Code: capacitor

Capacitor Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the Capacitor market, including market size, growth forecasts, trends, and competitive landscape from 2023 to 2033. Insights into regional performance, segment analysis, and key industry players are also included.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

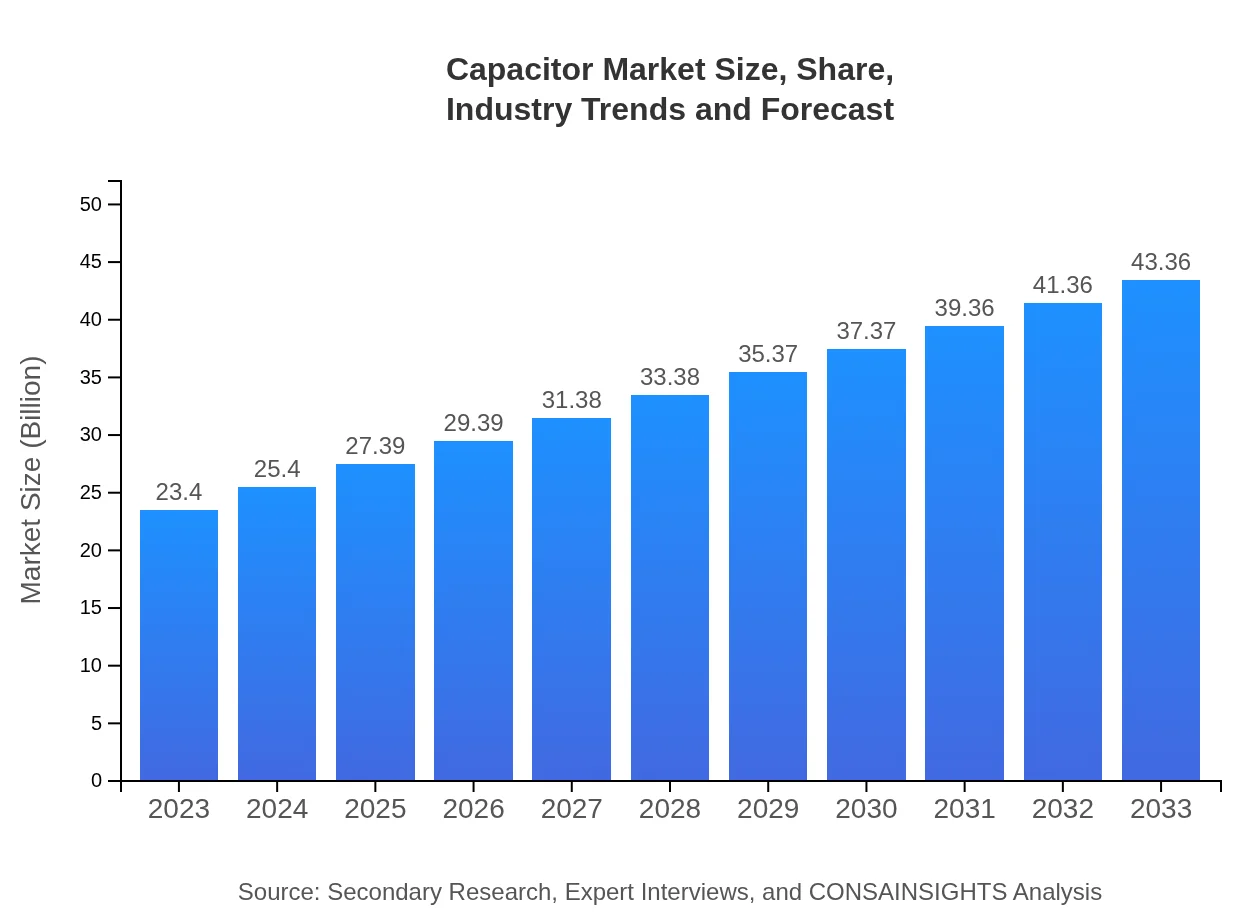

| 2023 Market Size | $23.40 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $43.36 Billion |

| Top Companies | Murata Manufacturing Co., Ltd., AVX Corporation, Kemet Corporation, Texas Instruments, STMicroelectronics |

| Last Modified Date | 22 January 2026 |

Capacitor Market Overview

Customize Capacitor Market Report market research report

- ✔ Get in-depth analysis of Capacitor market size, growth, and forecasts.

- ✔ Understand Capacitor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Capacitor

What is the Market Size & CAGR of Capacitor market in 2023?

Capacitor Industry Analysis

Capacitor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Capacitor Market Analysis Report by Region

Europe Capacitor Market Report:

Europe's capacitor market size was approximately $6.22 billion in 2023 and is projected to reach $11.52 billion by 2033. The European automotive sector, especially the electric vehicle market, is propelling growth.Asia Pacific Capacitor Market Report:

The Asia Pacific region is a significant contributor to the global capacitor market, valued at approximately $4.60 billion in 2023, projected to grow to $8.51 billion by 2033. Countries like China and Japan are leading manufacturers and consumers, benefiting from the booming electronics and automotive sectors.North America Capacitor Market Report:

In North America, the market is projected to grow from $9.07 billion in 2023 to $16.81 billion in 2033. This region sees rapid adoption of capacitors in high-tech applications, especially in automotive and renewable energy sectors.South America Capacitor Market Report:

The South American capacitor market is relatively small, with a market size of $0.55 billion in 2023, expected to reach $1.02 billion by 2033. Growth is driven largely by increasing electronics manufacturing in Brazil and Argentina.Middle East & Africa Capacitor Market Report:

The Middle East and Africa market, starting at $2.96 billion in 2023, is expected to grow to $5.49 billion by 2033. This growth is largely attributed to increased investments in energy infrastructure and telecommunications.Tell us your focus area and get a customized research report.

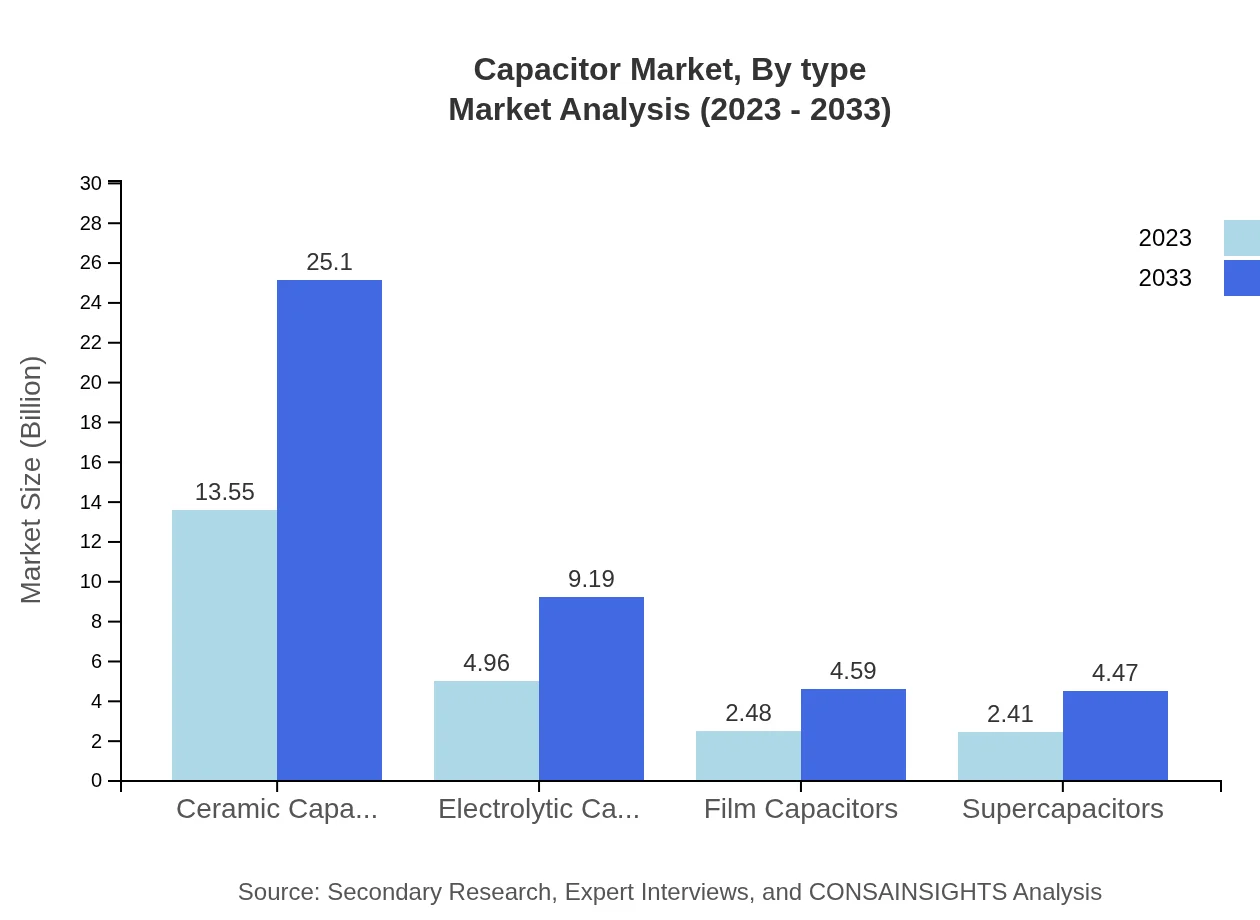

Capacitor Market Analysis By Type

The capacitor market segmented by type reveals the following insights: - **Ceramic Capacitors**: 2023 market size of $13.55 billion, projected to increase to $25.10 billion by 2033, maintaining a significant market share of 57.9%. - **Electrolytic Capacitors**: Current market size is $4.96 billion with a forecasted rise to $9.19 billion, holding a 21.2% market share. - **Film Capacitors**: Size growing from $2.48 billion to $4.59 billion, capturing a 10.58% share. - **Supercapacitors**: Expected to increase from $2.41 billion to $4.47 billion, with a 10.32% market share.

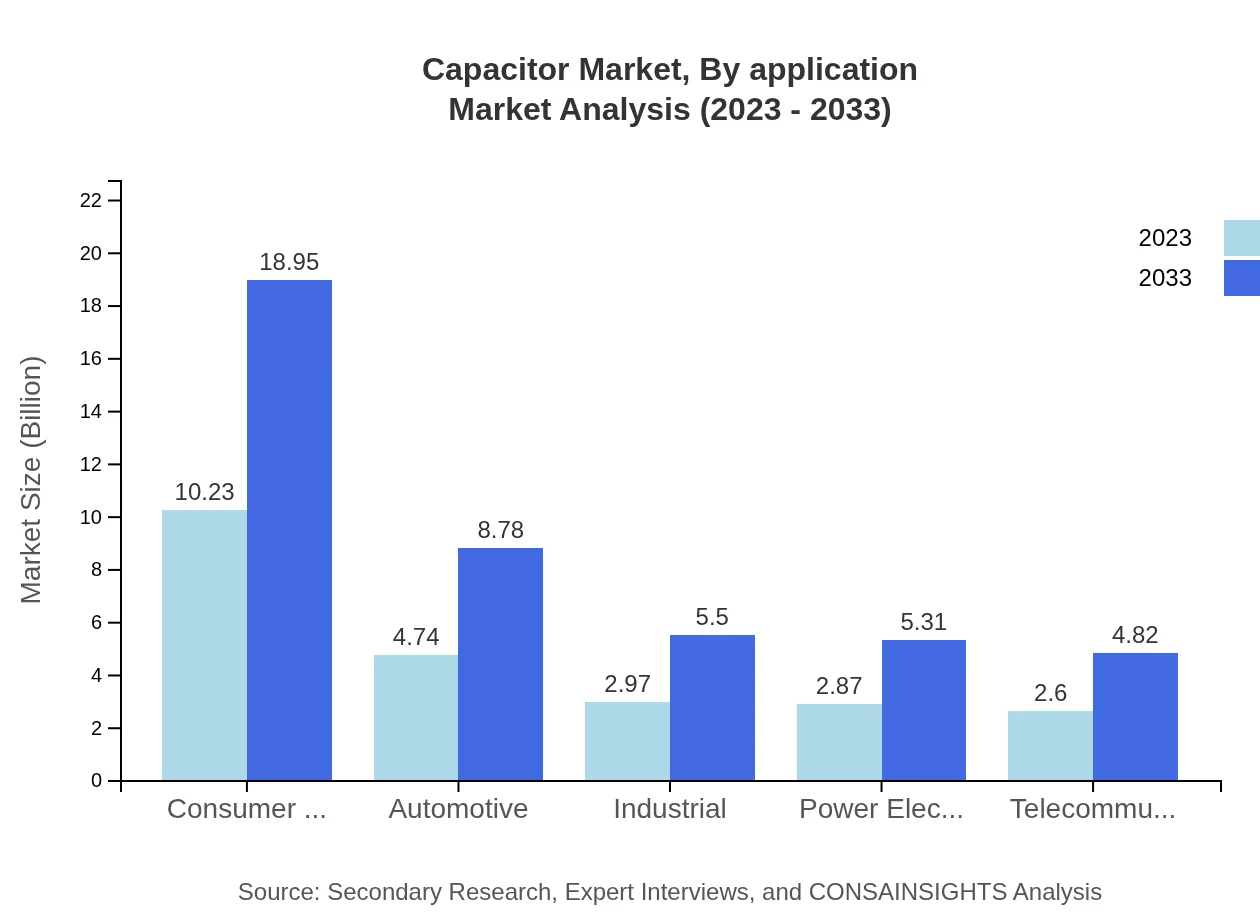

Capacitor Market Analysis By Application

Segments based on application include: - **Consumer Electronics**: Estimated at $10.23 billion in 2023, growing to $18.95 billion, 43.71% market share. - **Automotive**: Starting at $4.74 billion, forecast to rise to $8.78 billion, commanding a 20.24% share. - **Industrial**: From $2.97 billion to $5.50 billion, 12.68% share. - **Power Electronics**: Projected growth from $2.87 billion to $5.31 billion, maintaining a 12.25% share. - **Telecommunications**: Expected growth from $2.60 billion to $4.82 billion, 11.12% share.

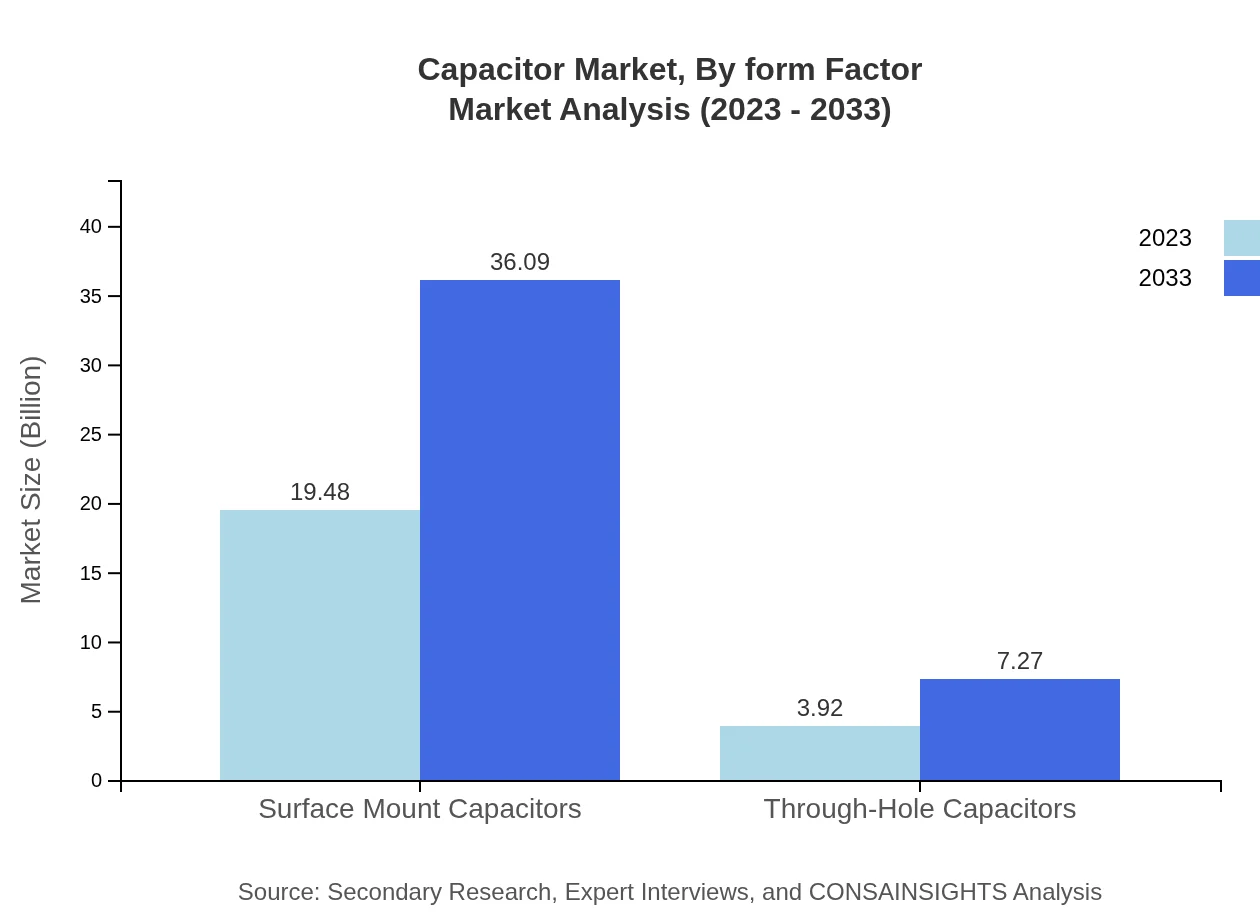

Capacitor Market Analysis By Form Factor

In terms of form factor, the market is segmented into: - **Surface Mount Capacitors**: Market was $19.48 billion in 2023, expected to reach $36.09 billion by 2033, holding a substantial 83.24% share. - **Through-Hole Capacitors**: From $3.92 billion to $7.27 billion, this segment maintains a 16.76% share.

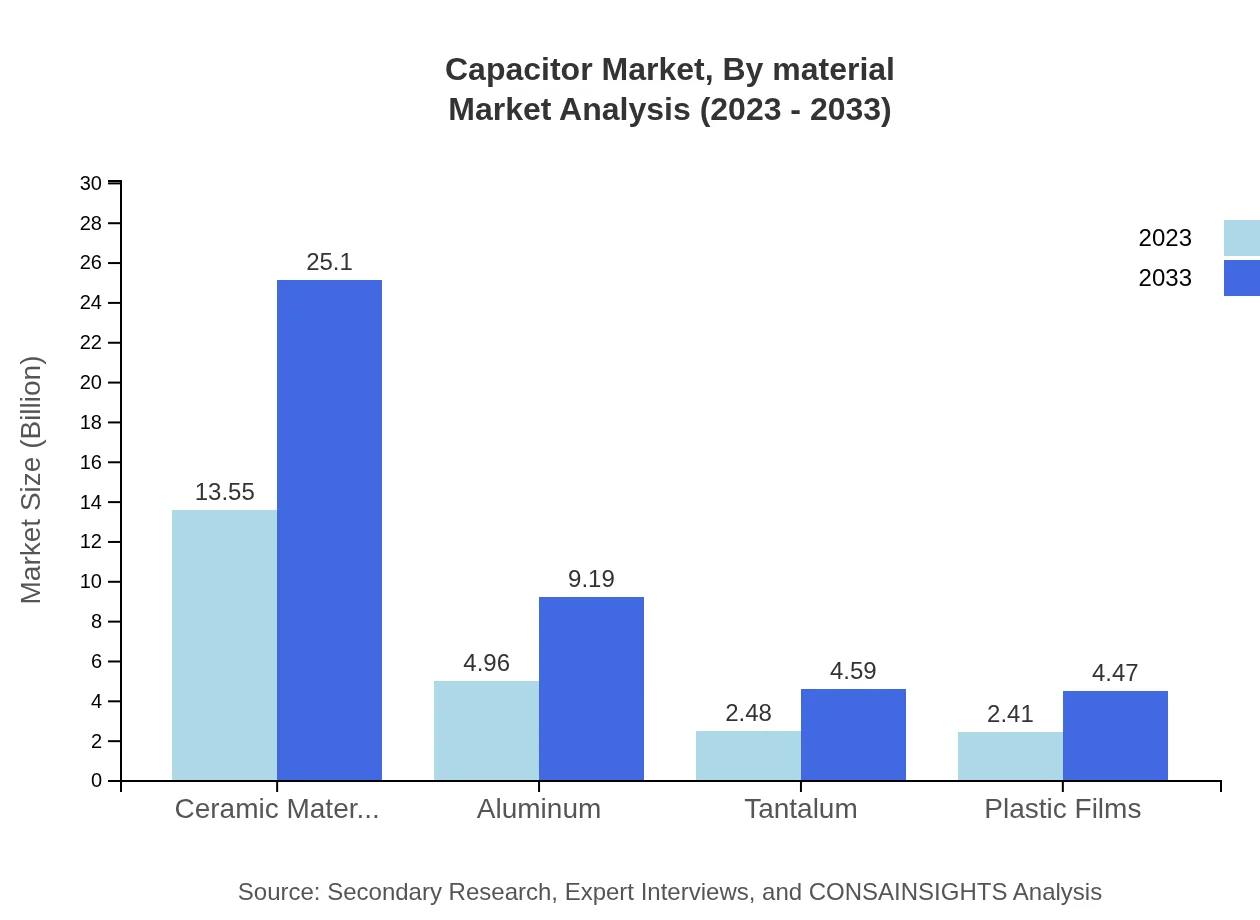

Capacitor Market Analysis By Material

By material, the capacitor market reveals the following: - **Ceramic Materials**: Dominant segment, growing from $13.55 billion to $25.10 billion with a 57.9% share. - **Aluminum**: Expected to rise from $4.96 billion to $9.19 billion, 21.2% share. - **Tantalum**: Growing from $2.48 billion to $4.59 billion, holding 10.58% share. - **Plastic Films**: Increasing from $2.41 billion to $4.47 billion with a 10.32% share.

Capacitor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Capacitor Industry

Murata Manufacturing Co., Ltd.:

A leading manufacturer of ceramic capacitors and electronic components, Murata plays a crucial role in the automotive and consumer electronics markets.AVX Corporation:

Specializes in capacitors and passive components, AVX's innovations in capacitor technology have established it as a key player in various sectors, including telecommunications.Kemet Corporation:

Known for their capacitors and custom solutions, Kemet focuses on advanced capacitors that cater to both industrial and consumer markets.Texas Instruments:

A major player in the semiconductor industry, Texas Instruments produces a variety of capacitive components that are critical in electronic devices.STMicroelectronics:

Engaged in the production of a wide array of semiconductors and capacitive components, STMicroelectronics is instrumental in the evolution of the global electronics industry.We're grateful to work with incredible clients.

FAQs

What is the market size of capacitor?

The global capacitor market is valued at approximately $23.4 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching significant growth by 2033.

What are the key market players or companies in this capacitor industry?

Key players in the capacitor market include major manufacturers such as Murata Manufacturing Co., Ltd., Panasonic Corporation, Vishay Intertechnology, Inc., and KEMET Corporation, which significantly influence market trends.

What are the primary factors driving the growth in the capacitor industry?

The growth in the capacitor market is driven by increasing demand in consumer electronics, automotive applications, industrial automation, and advancements in power electronics technology, alongside a rising adoption of electric vehicles.

Which region is the fastest Growing in the capacitor market?

Asia Pacific is the fastest-growing region in the capacitor market, projected to increase from $4.60 billion in 2023 to $8.51 billion by 2033, reflecting a robust growth trajectory and strong market demands.

Does ConsaInsights provide customized market report data for the capacitor industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the capacitor industry, providing clients with relevant insights and data to support informed decision-making.

What deliverables can I expect from this capacitor market research project?

The deliverables from the capacitor market research project include comprehensive reports featuring market analysis, segment insights, competitive landscape data, trends forecast, and regional market dynamics.

What are the market trends of capacitor?

Current market trends in the capacitor industry include a shift towards miniaturization of components, growth in renewable energy applications, and increasing demand for advanced capacitors like supercapacitors for fast energy storage solutions.