Captive Power Plant Market Report

Published Date: 22 January 2026 | Report Code: captive-power-plant

Captive Power Plant Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Captive Power Plant market, focusing on market trends, growth forecasts, and technological advancements from 2023 to 2033.

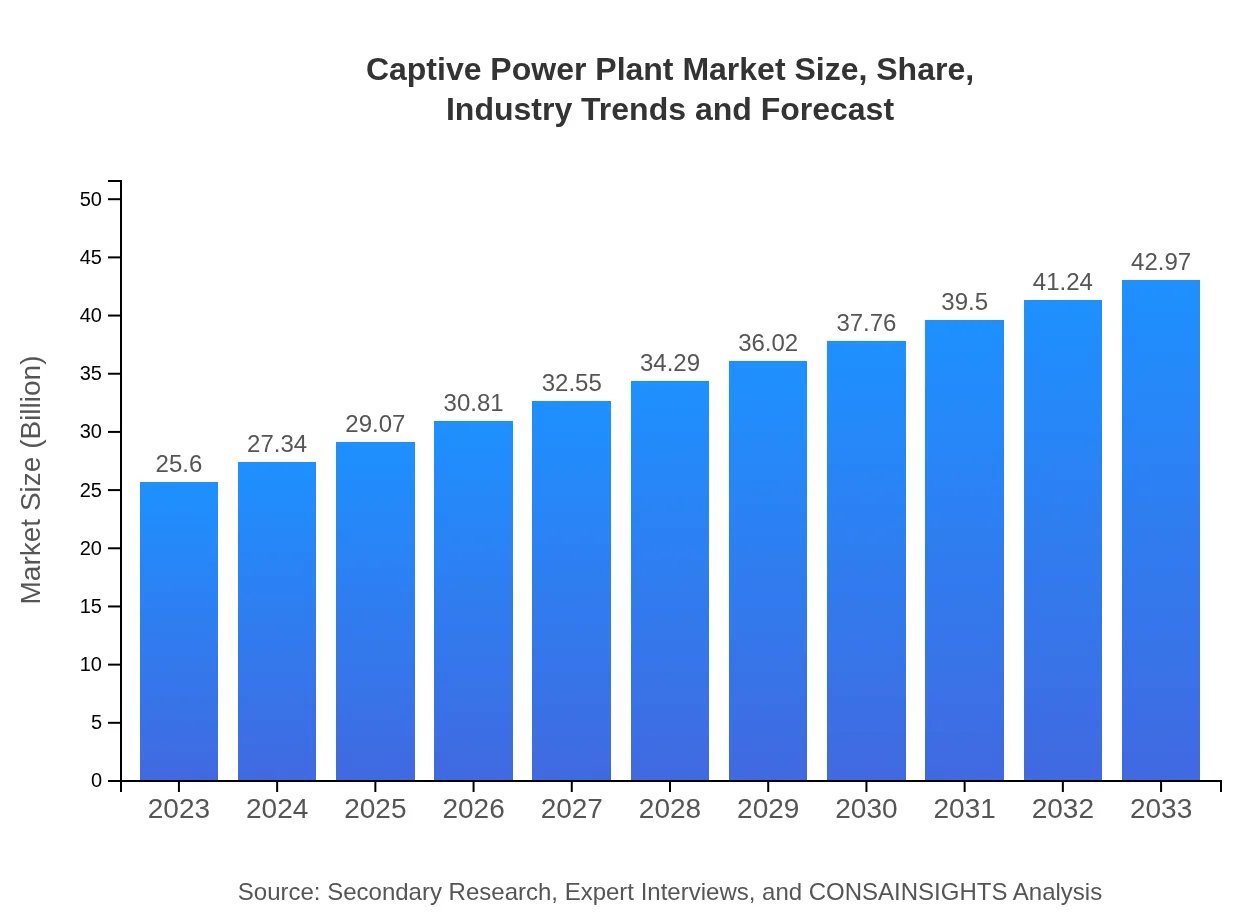

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $42.97 Billion |

| Top Companies | General Electric, Siemens AG, Schneider Electric, ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Captive Power Plant Market Overview

Customize Captive Power Plant Market Report market research report

- ✔ Get in-depth analysis of Captive Power Plant market size, growth, and forecasts.

- ✔ Understand Captive Power Plant's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Captive Power Plant

What is the Market Size & CAGR of Captive Power Plant market in 2033?

Captive Power Plant Industry Analysis

Captive Power Plant Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Captive Power Plant Market Analysis Report by Region

Europe Captive Power Plant Market Report:

Europe's market size is expected to increase from USD 6.29 billion in 2023 to USD 10.56 billion by 2033. This growth is underpinned by strict regulatory frameworks aimed at reducing carbon emissions, alongside robust investments in renewable captive power technologies.Asia Pacific Captive Power Plant Market Report:

In the Asia Pacific region, the Captive Power Plant market is expected to grow from USD 5.41 billion in 2023 to USD 9.08 billion by 2033. The surge is primarily driven by rapid industrialization and urbanization in countries like India and China, where energy demand is soaring. Additionally, government initiatives focusing on infrastructure development and renewable integration significantly bolster market growth.North America Captive Power Plant Market Report:

North America demonstrates one of the most lucrative markets for captive power, growing from USD 9.92 billion in 2023 to USD 16.66 billion in 2033. The rise in demand for energy independence in the industrial sector and the regulatory landscape increasingly favoring cleaner energy sources contribute to this rapid growth.South America Captive Power Plant Market Report:

South America’s Captive Power Plant market is projected to shift from USD 2.02 billion in 2023 to USD 3.39 billion by 2033. The growth is fueled by increasing investments in mining and agriculture, where reliable power sources are critical. Additionally, the region is gradually focusing on renewable energy sources to expand its captive power capabilities.Middle East & Africa Captive Power Plant Market Report:

In the Middle East and Africa, the Captive Power Plant market is projected to grow from USD 1.95 billion in 2023 to USD 3.28 billion by 2033. The region's focus on diversification away from oil dependency and growth in the construction and mining sectors are pivotal influences on market expansion.Tell us your focus area and get a customized research report.

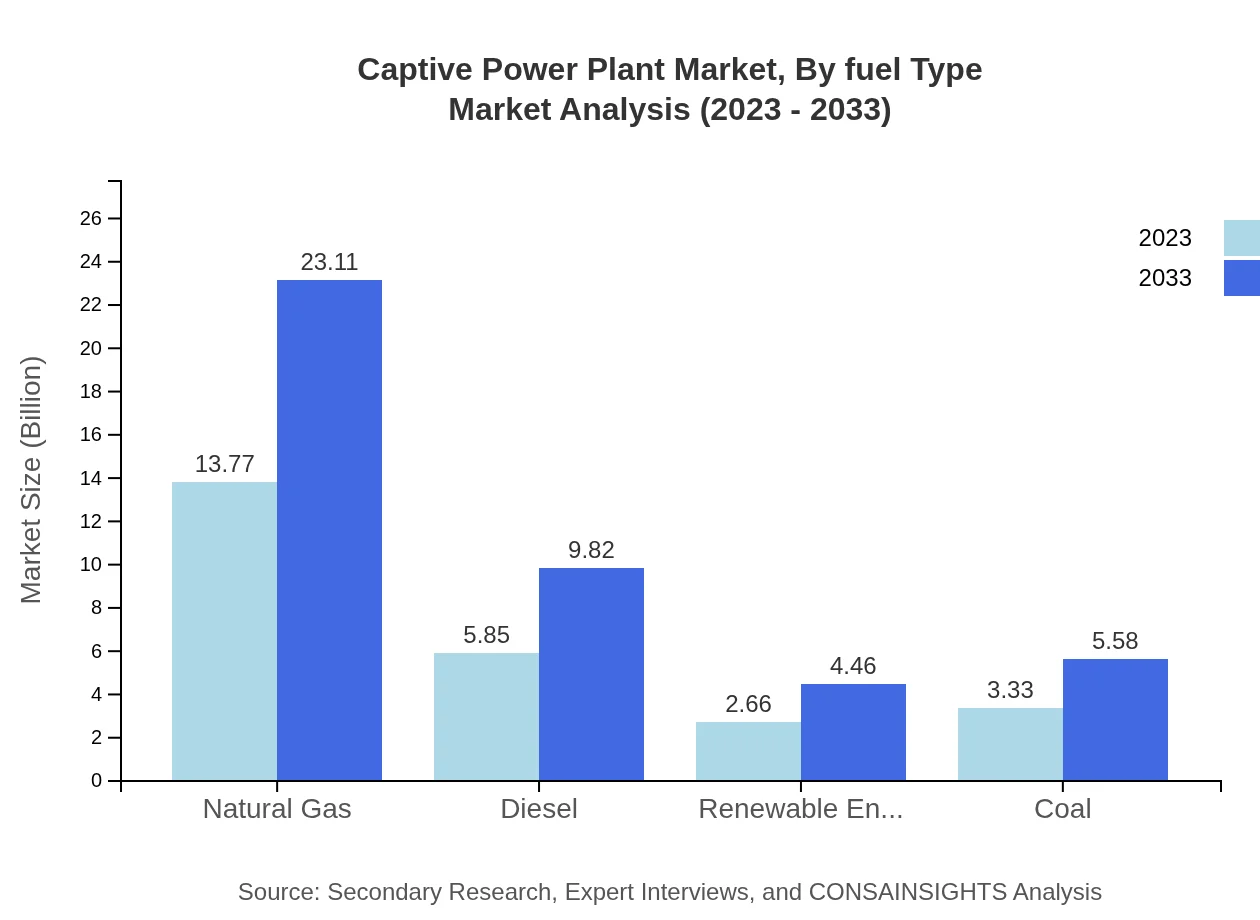

Captive Power Plant Market Analysis By Fuel Type

In 2023, the Captive Power Plant market by fuel type shows significant prevalence in natural gas, accounting for USD 13.77 billion, representing a 53.78% market share. By 2033, its market size is expected to grow to USD 23.11 billion. Diesel plants demonstrate notable significance with a market size expanding from USD 5.85 billion (22.85%) in 2023 to USD 9.82 billion by 2033. Renewable energy sources and coal also play essential roles in diversifying energy channels, with expected increases in their market sizes, indicating a gradual transition towards cleaner energy alternatives.

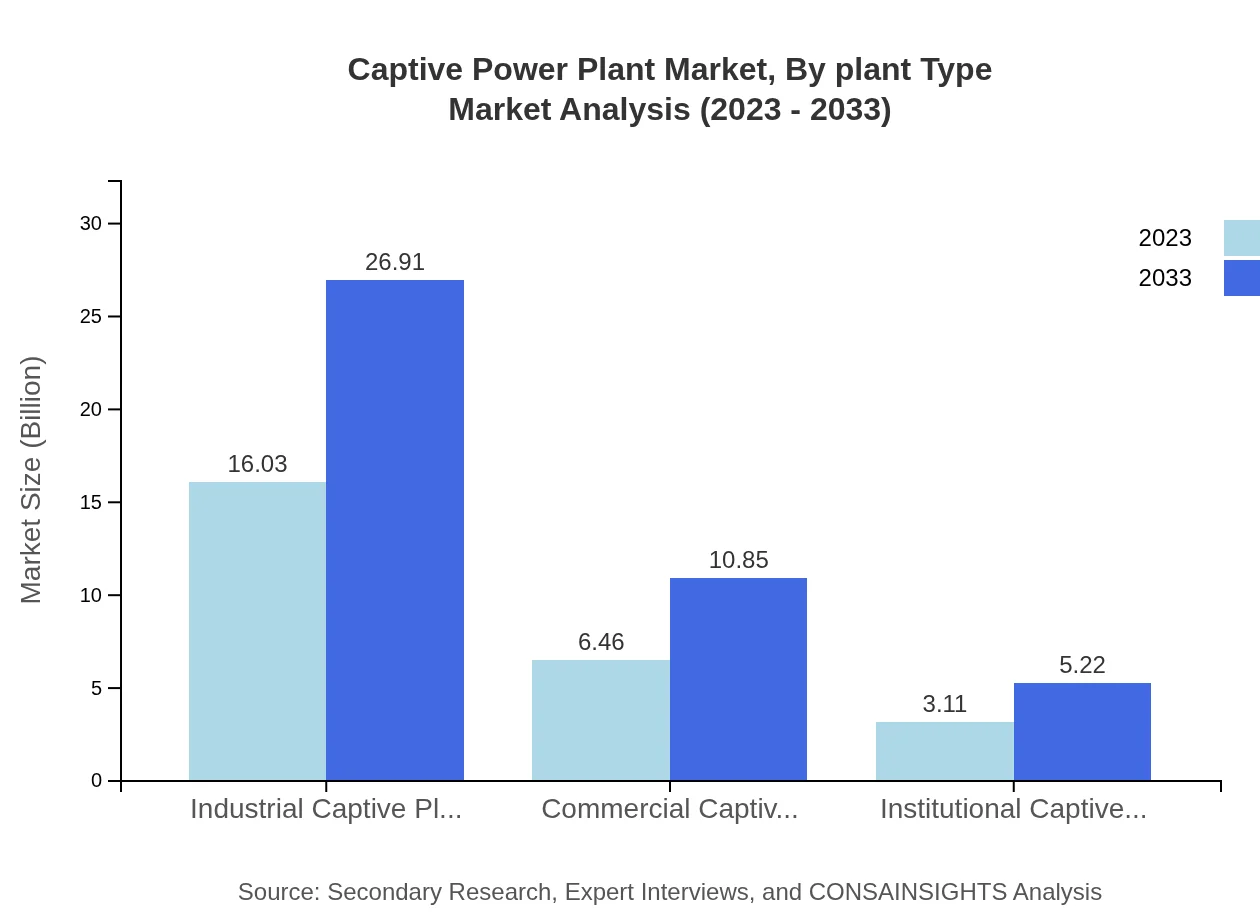

Captive Power Plant Market Analysis By Plant Type

The market is dominated by industrial captive plants, which accounted for USD 16.03 billion (62.61% share) in 2023, growing to USD 26.91 billion by 2033. Commercial captive plants also have a notable presence, transitioning from USD 6.46 billion (25.25%) in 2023 to USD 10.85 billion by 2033. Institutional captive plants show steady growth, elevating their position from USD 3.11 billion (12.14%) in 2023 to USD 5.22 billion by 2033, emphasizing the role of these plants in ensuring reliable power for institutions.

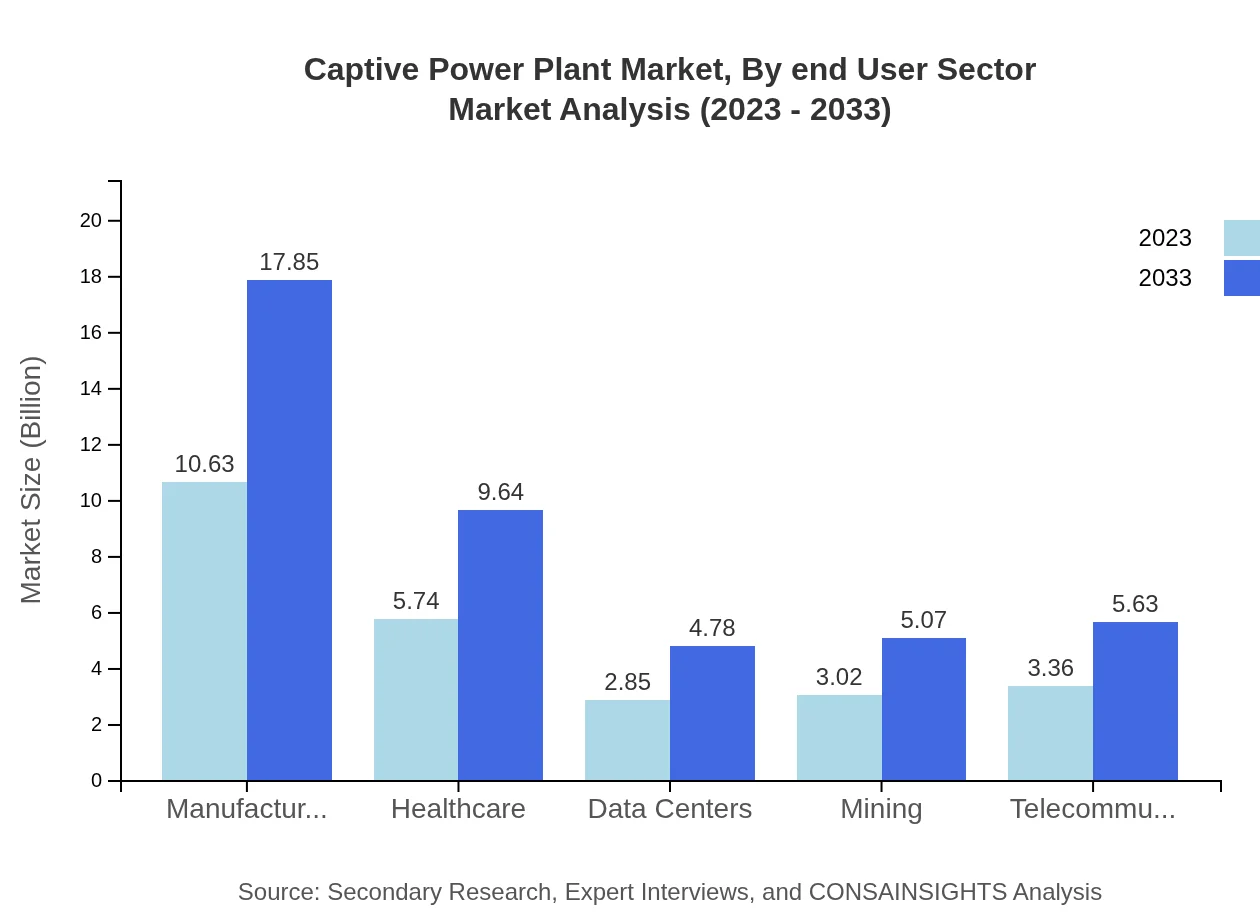

Captive Power Plant Market Analysis By End User Sector

In terms of end-user sectors, manufacturing holds a significant stake with a size of USD 10.63 billion, growing to USD 17.85 billion (41.53% share) by 2033. The healthcare sector also represents a crucial segment, exhibiting growth from USD 5.74 billion (22.44%) in 2023 to USD 9.64 billion by 2033. Data centers and telecommunications sectors further exemplify sustained growth, fueled by the continuous demand for uninterrupted power supply in critical operations.

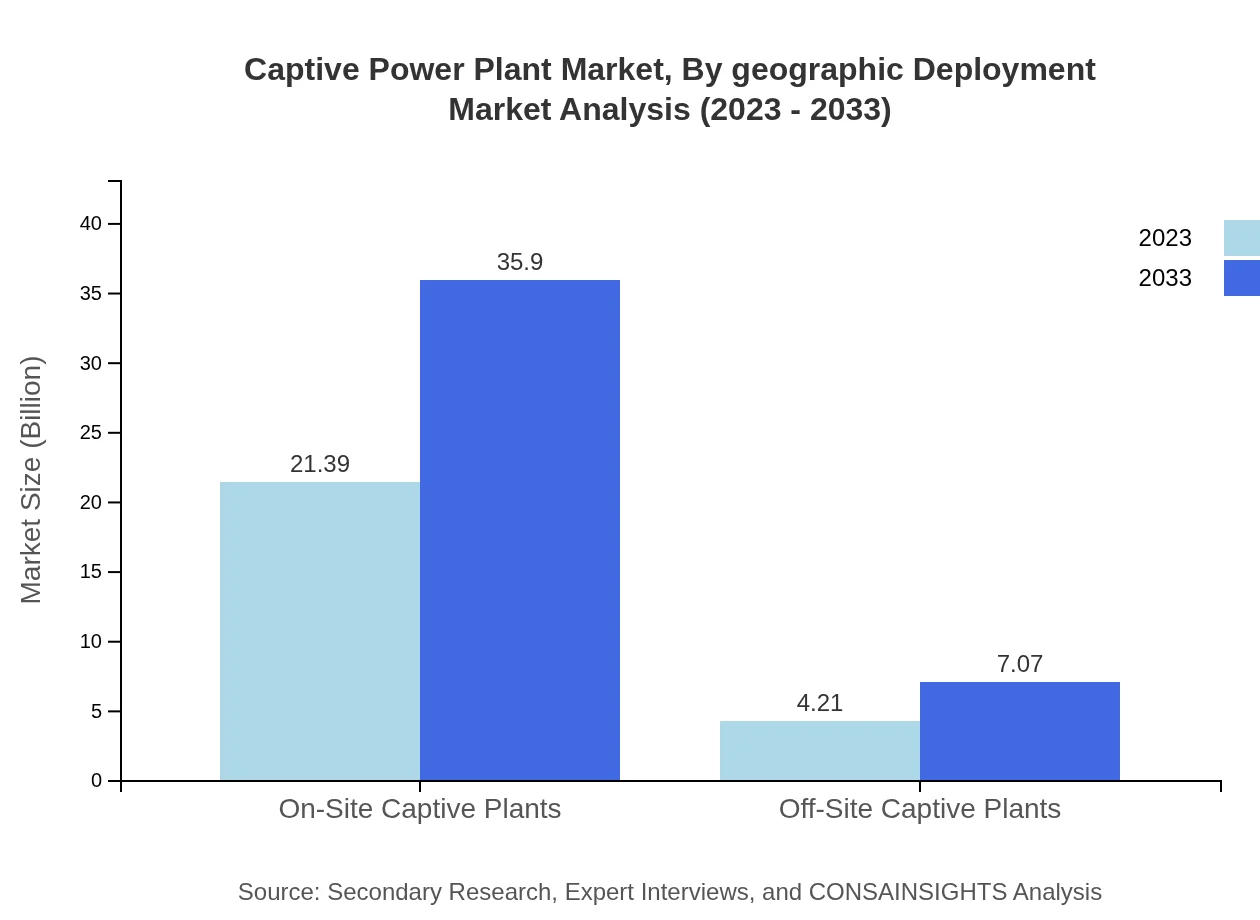

Captive Power Plant Market Analysis By Geographic Deployment

Geographic deployment of captivity power generation shows diverse growth patterns, with substantial expansions in regions like Asia Pacific and North America, while Europe positions itself as a leader in renewable energy transitions. Each region’s unique dynamics influence investment decisions and strategies, with companies focusing their efforts on optimizing energy production catering to specific local needs.

Captive Power Plant Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Captive Power Plant Industry

General Electric:

A leader in power generation technology, GE focuses on efficient and sustainable energy solutions and is significantly involved in the captive power sector, providing equipment and systems for various segments.Siemens AG:

Siemens specializes in electrical engineering and automation technology, offering innovative solutions like hybrid captive power configurations tailored to meet diverse customer needs in multiple industries.Schneider Electric:

A prominent player emphasizing energy efficiency and sustainability measures, Schneider Electric provides comprehensive energy management and automation solutions, integral to the captive power market.ABB Ltd.:

ABB is a key contributor to power systems that optimize energy use and integrate renewable sources, supporting the growth of the captive power sector through innovative technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of captive Power Plant?

The global captive power plant market is estimated to reach USD 25.6 billion by 2033, growing at a CAGR of 5.2%. This growth reflects the increasing demand for reliable power sources across various industries.

What are the key market players or companies in this captive Power Plant industry?

Key players in the captive power plant industry include General Electric, Siemens AG, Cummins Inc., and Wärtsilä Corporation. These companies are prominent for their innovations and sustainable energy solutions.

What are the primary factors driving the growth in the captive Power Plant industry?

Driving factors include rising energy demand, the shift towards renewable sources, and stricter regulations on emissions. Additionally, the need for energy security in industries fuels the demand for captive power plants.

Which region is the fastest Growing in the captive Power Plant market?

Currently, North America is the fastest-growing region, projected to reach a market size of USD 16.66 billion by 2033, up from USD 9.92 billion in 2023, driven by industrial demand.

Does ConsaInsights provide customized market report data for the captive Power Plant industry?

Yes, ConsaInsights offers customized market report data tailored to client needs, including specific insights into market dynamics, competitor analysis, and segment performance.

What deliverables can I expect from this captive Power Plant market research project?

Typical deliverables include a comprehensive market report, data analytics, trend forecasts, SWOT analysis, and strategic recommendations suited to your business objectives.

What are the market trends of captive Power Plant?

Current trends include a shift to renewable energy sources, increased efficiency in energy generation technologies, and the implementation of smart grid solutions to optimize power usage.