Car Insurance

Published Date: 22 January 2026 | Report Code: car-insurance

Car Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Car Insurance market spanning from 2024 to 2033. It offers a concise overview of market dynamics, size, growth trajectories, segmentation, and regional performance while addressing technological advancements and product innovations. The insights presented here are designed to support informed investment decisions and strategic planning over the forecast period.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

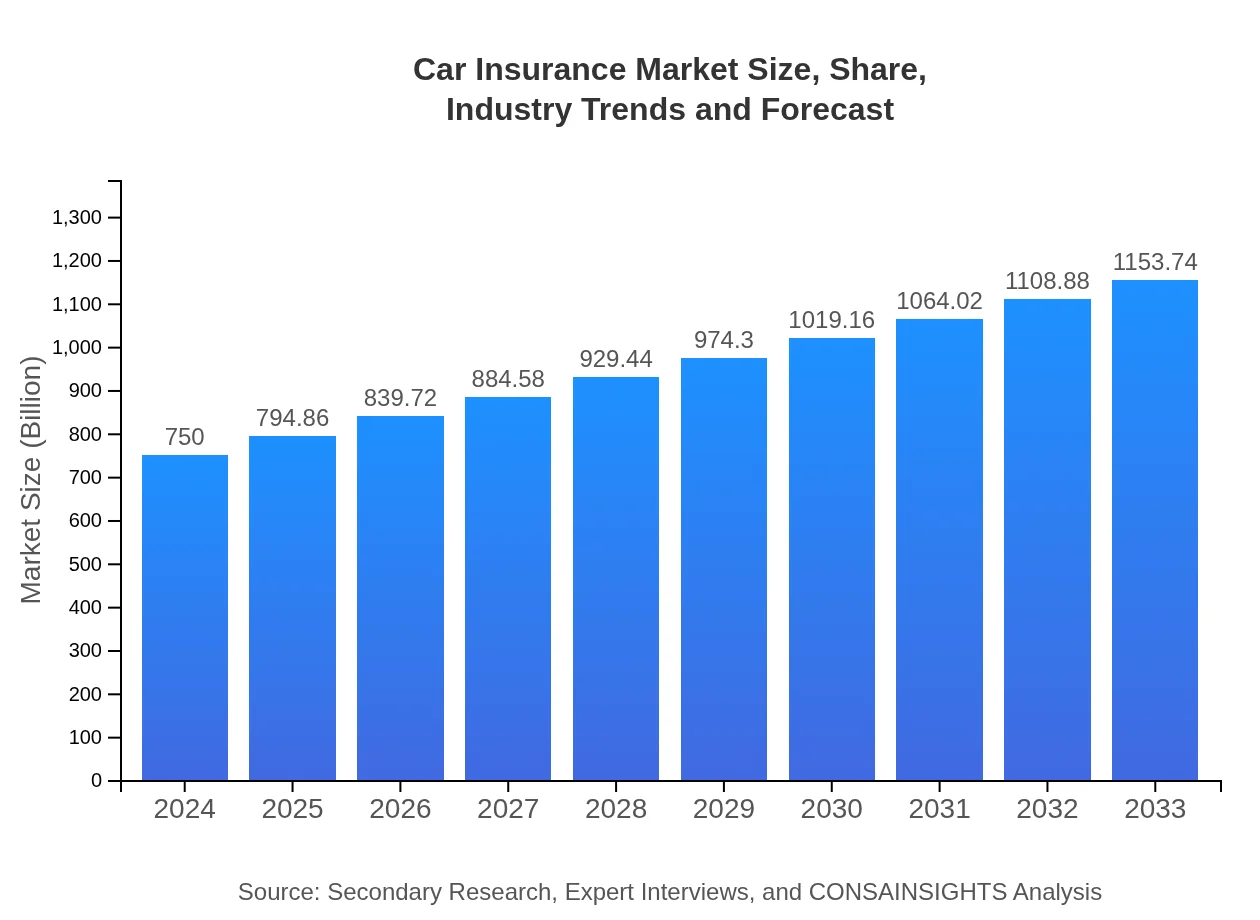

| 2024 Market Size | $750.00 Billion |

| CAGR (2024-2033) | 4.8% |

| 2033 Market Size | $1153.74 Billion |

| Top Companies | State Farm, Geico, Allstate, Liberty Mutual |

| Last Modified Date | 22 January 2026 |

Car Insurance Market Overview

Customize Car Insurance market research report

- ✔ Get in-depth analysis of Car Insurance market size, growth, and forecasts.

- ✔ Understand Car Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Car Insurance

What is the Market Size & CAGR of Car Insurance market in 2024?

Car Insurance Industry Analysis

Car Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Car Insurance Market Analysis Report by Region

Europe Car Insurance:

Europe’s Car Insurance market is characterized by high standards in regulatory compliance and mature consumer segments. With a market size of 210.08 in 2024 and a projected increase to 323.16 in 2033, the region integrates stringent risk management practices with customer-focused innovations. Enhanced digitization and the growing influence of data analytics are central to shaping policy offerings and driving growth across the continent.Asia Pacific Car Insurance:

In Asia Pacific, the Car Insurance market is growing steadily with a marked increase from a market size of 145.80 in 2024 to an estimated 224.29 in 2033. The region benefits from rapid urbanization, rising disposable incomes, and increased vehicle registrations. Technological adaptation and improved digital infrastructures are also fueling market growth. Regional insurers are investing in innovative products tailored to local customer needs.North America Car Insurance:

North America remains a mature yet dynamic market, with significant market sizes recorded at 251.03 in 2024 and expected to reach 386.16 by 2033. The growth in this region is supported by high insurance penetration, consistent technological improvements, and advanced risk assessment tools. Insurers are focused on offering innovative policy options that address emerging risks while maintaining robust service levels to meet consumer expectations.South America Car Insurance:

South America is witnessing moderate growth in the Car Insurance sector, with market figures moving from 71.03 in 2024 to a forecasted 109.26 in 2033. Despite economic fluctuations and regulatory challenges, the market is driven by urbanization and an increasing number of motor vehicles. Local insurers are gradually adopting digital solutions to streamline operations and enhance customer satisfaction.Middle East & Africa Car Insurance:

In the Middle East and Africa, the Car Insurance market is projected to grow from 72.07 in 2024 to 110.87 in 2033. The region's growth is stimulated by improved economic conditions, increased motorization, and progressive insurance reforms. Although still developing, the market is gradually witnessing the adoption of modern technology and innovative product designs aimed at boosting coverage accessibility and customer engagement.Tell us your focus area and get a customized research report.

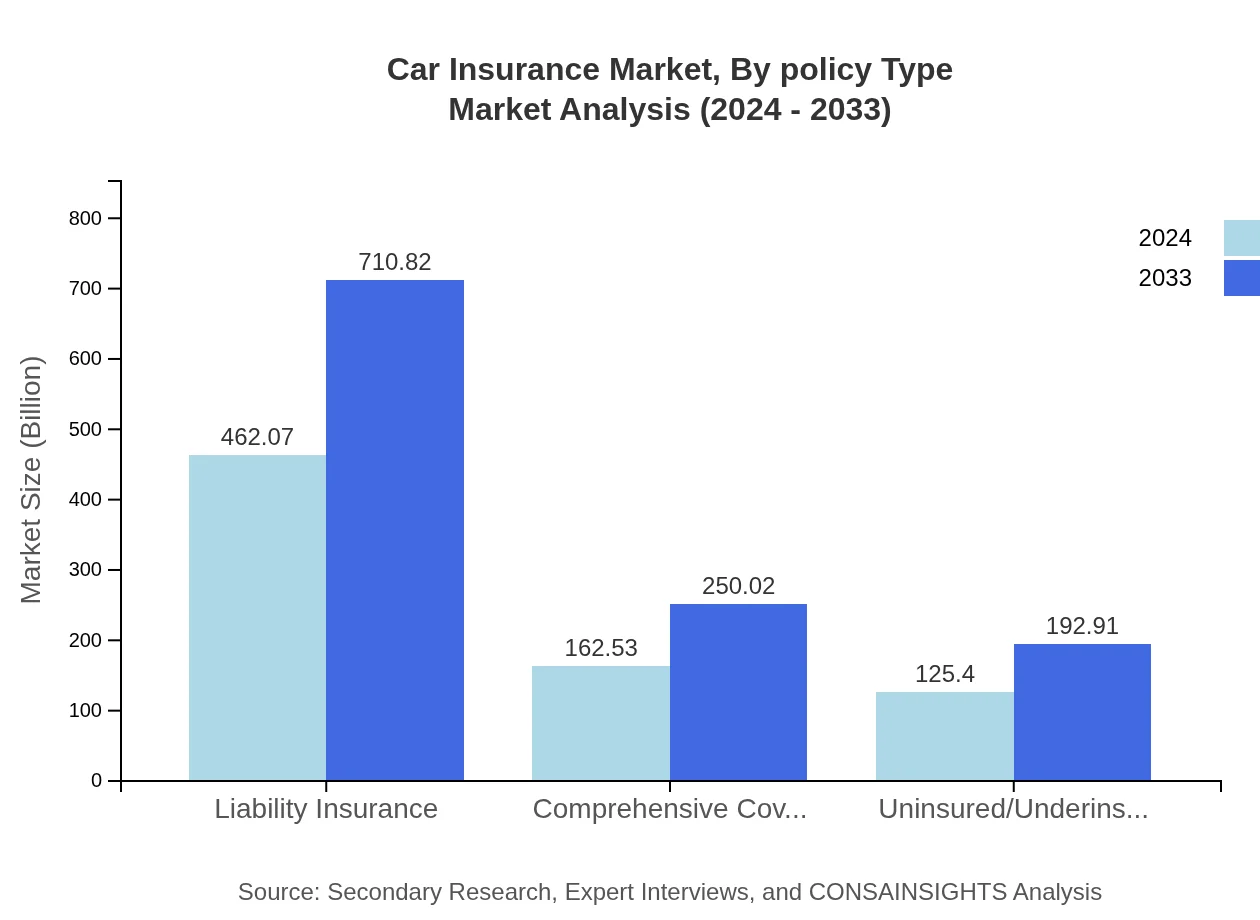

Car Insurance Market Analysis By Policy Type

This segment covers key policy types such as Liability Insurance, Comprehensive Coverage, and Uninsured/Underinsured Motorist Coverage. Liability Insurance shows substantial market strength with figures rising from 462.07 in 2024 to 710.82 in 2033, reflecting consistent demand. Comprehensive Coverage and other policy types similarly contribute to the robust dynamics of the market, maintaining steady share percentages over the forecast period.

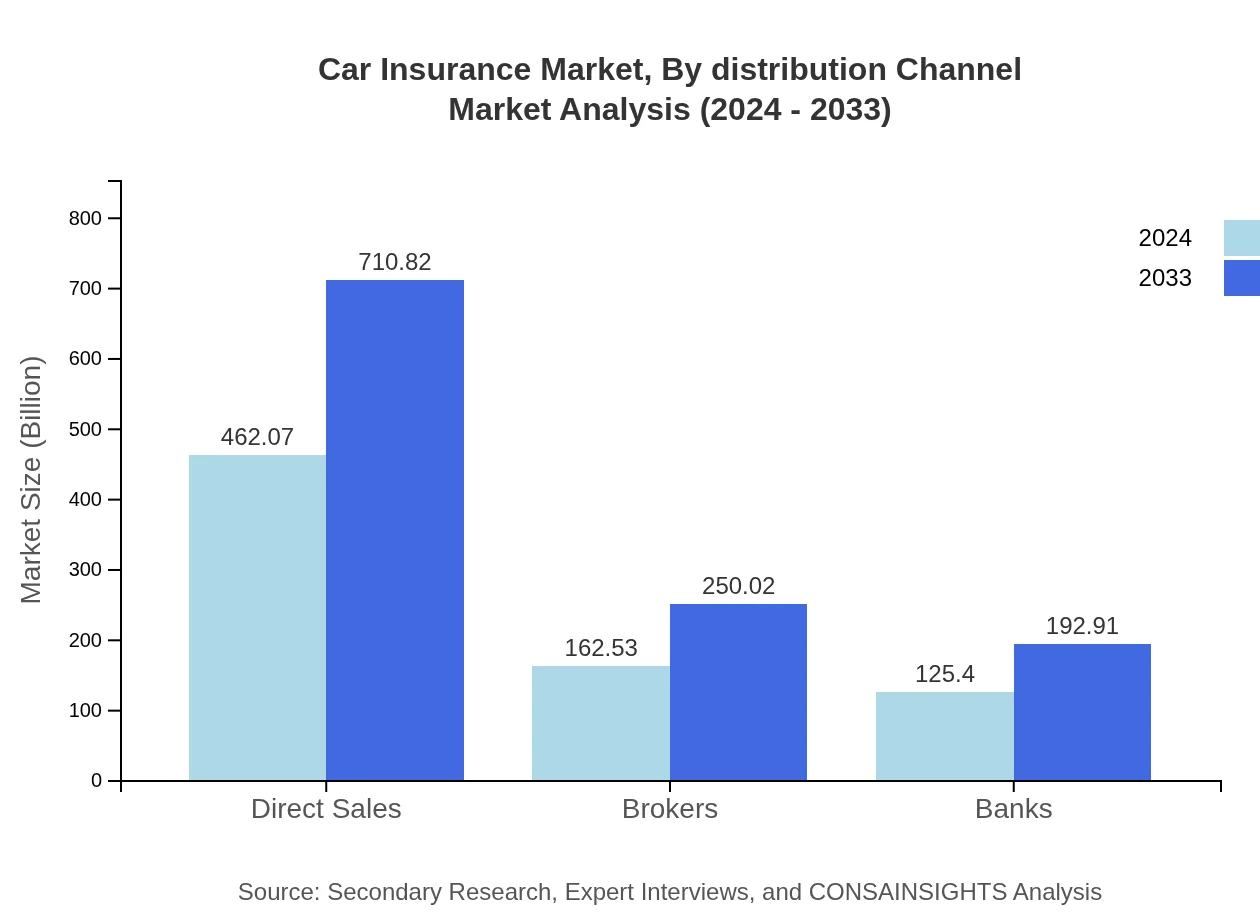

Car Insurance Market Analysis By Distribution Channel

Distribution channels in the Car Insurance market include Direct Sales, Brokers, and Banks. Direct Sales, noted for its efficiency and customer reach, presents strong performance metrics with market sizes increasing in tandem with technological enablement. Broker channels continue to offer specialized advisory services, while banks integrate insurance offerings into broader financial portfolios, collectively supporting market expansion and diversified customer acquisition.

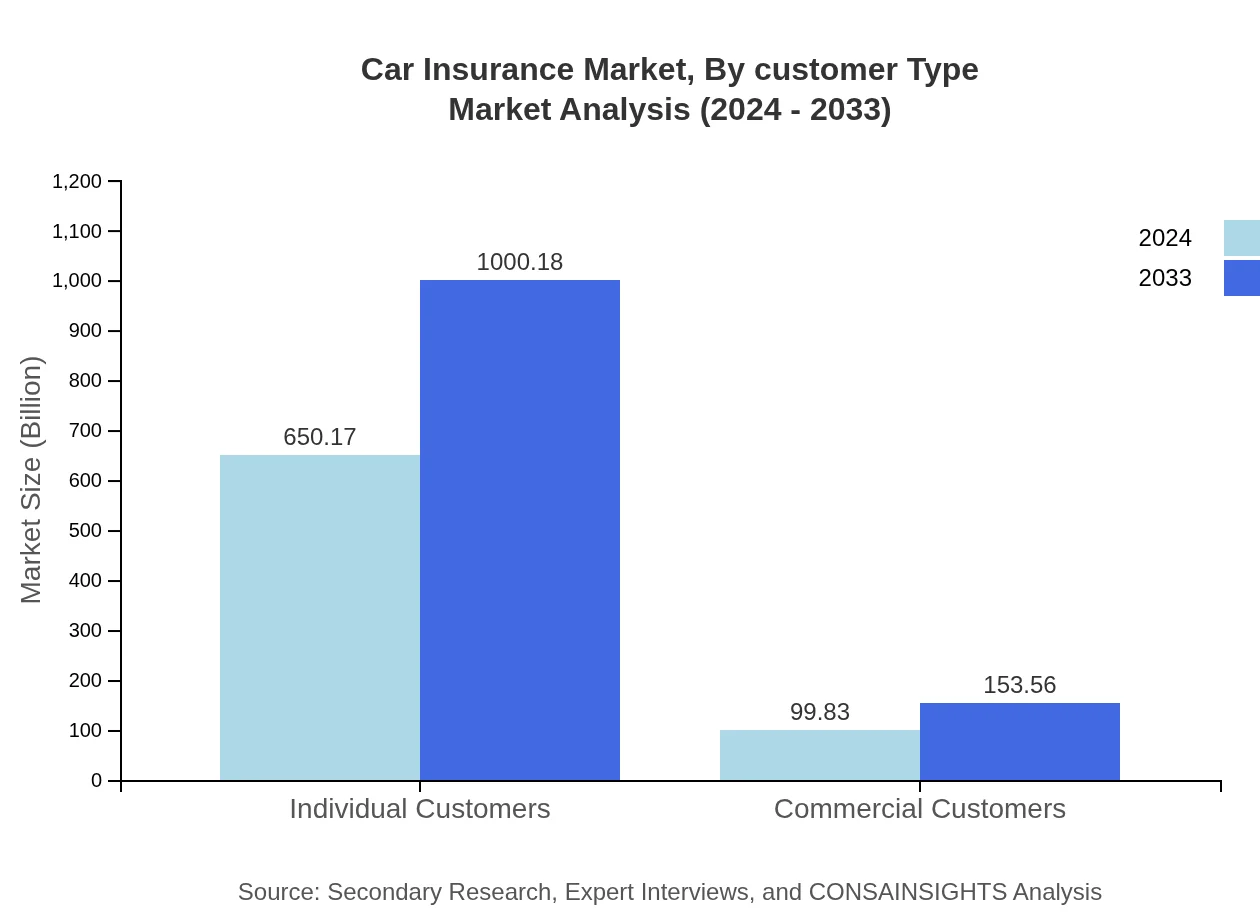

Car Insurance Market Analysis By Customer Type

Segmentation by customer type divides the market into Individual Customers and Commercial Customers. Individual Customers dominate the market with large size figures, reflective of personal vehicle insurance needs and a high penetration rate, whereas Commercial Customers, though smaller in size, display significant growth potential as small businesses and fleet operations invest in risk management solutions to secure their assets.

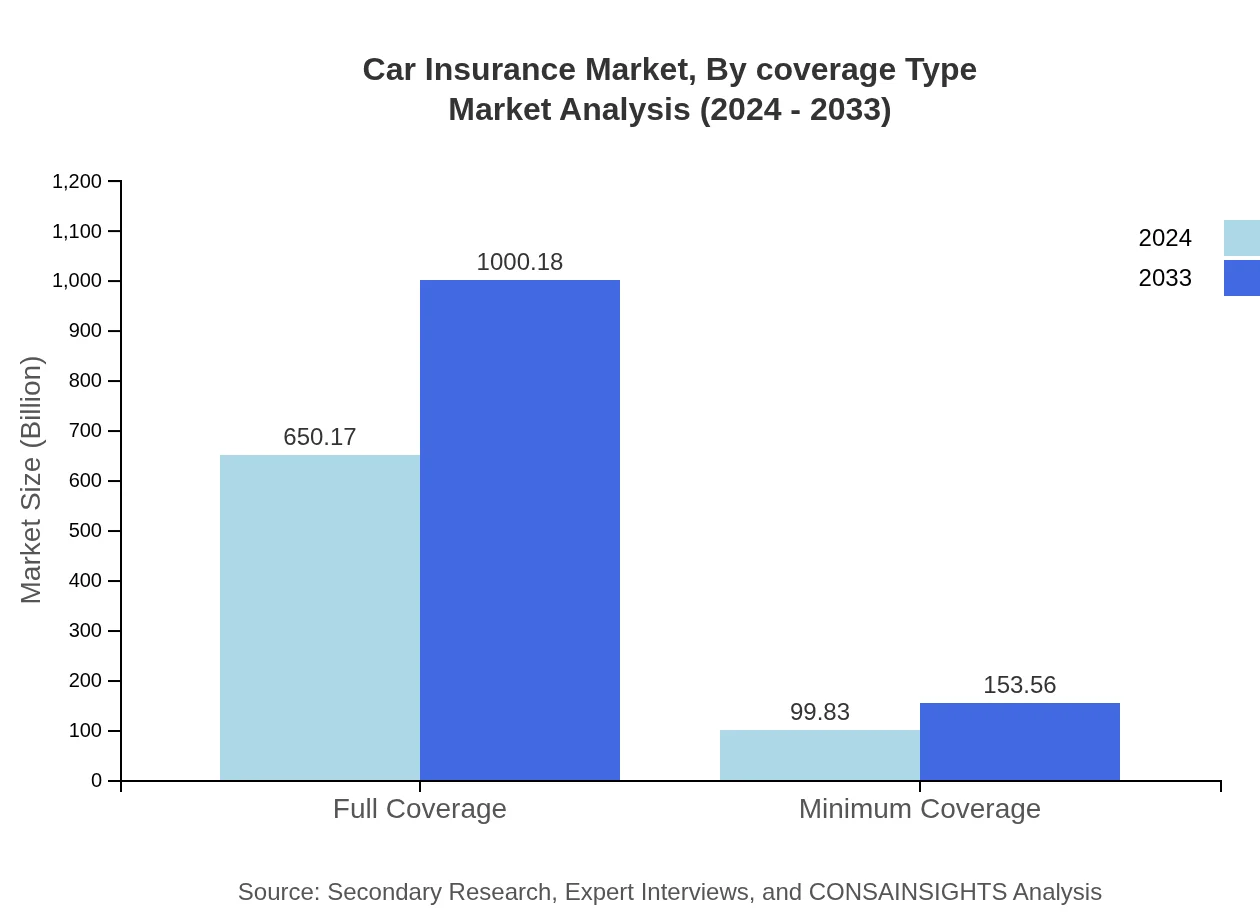

Car Insurance Market Analysis By Coverage Type

Coverage type segmentation distinguishes between Full Coverage and Minimum Coverage policies. Full Coverage policies, which ensure extensive protection, represent a major portion of the market, supported by high consumer preference and premium willingness. In contrast, Minimum Coverage policies, while more affordable, cater to cost-conscious consumers, providing essential protection while sustaining a stable market share.

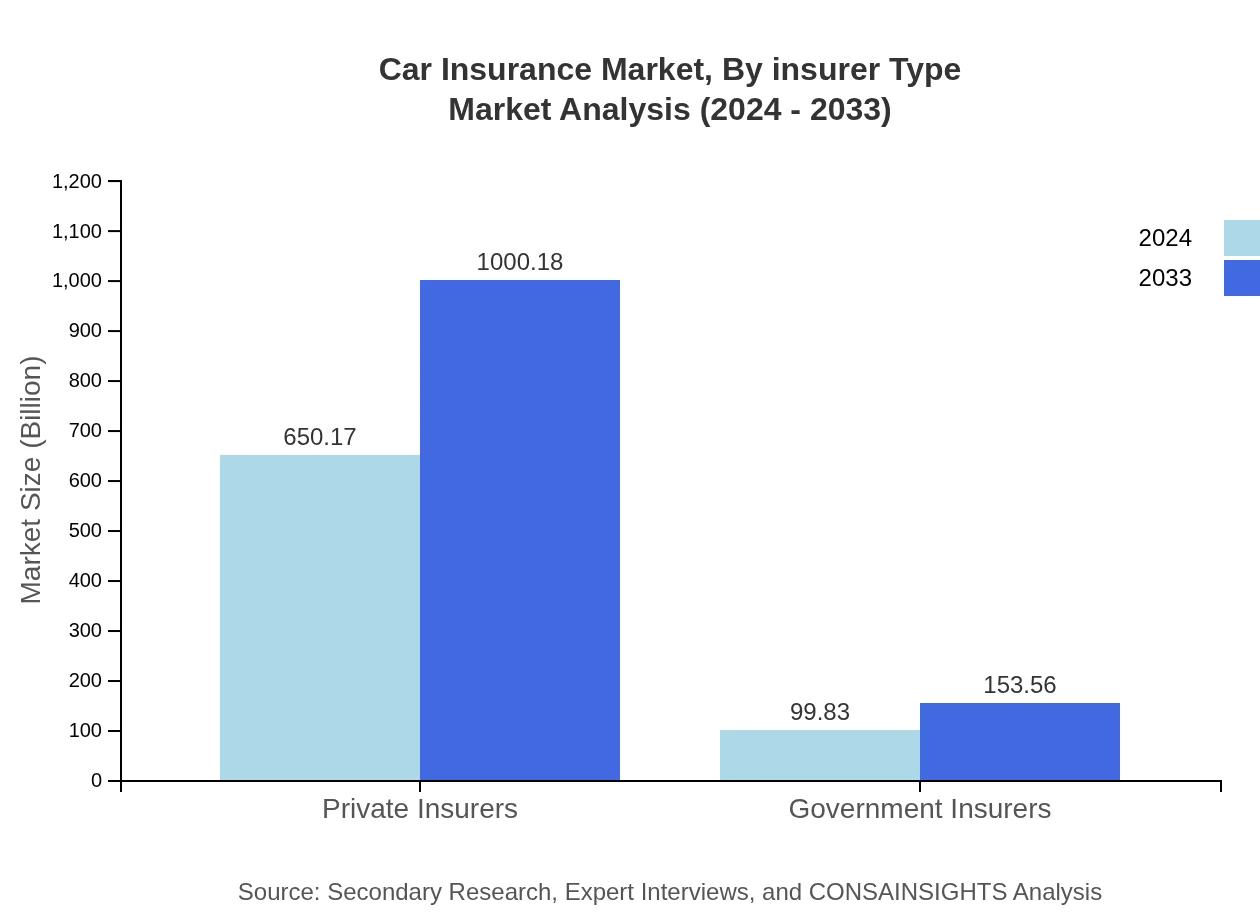

Car Insurance Market Analysis By Insurer Type

The market is bifurcated by insurer type into Private Insurers and Government Insurers. Private Insurers account for the majority with a significant market footprint driven by extensive product portfolios and dynamic pricing strategies. Government Insurers, on the other hand, ensure standardized offerings and regulatory compliance, contributing to market stability and serving as a benchmark for industry practices.

Car Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Car Insurance Industry

State Farm:

State Farm is a dominant player known for its extensive network and innovative digital solutions, providing comprehensive car insurance coverage across multiple segments.Geico:

Geico leverages cutting-edge technology and efficient customer service to offer competitive pricing and flexible policy options, setting industry standards in digital engagement.Allstate:

Allstate’s customer-centric approach and tailored insurance products have fortified its position as a key market leader, driven by advanced analytics and robust risk management.Liberty Mutual:

Liberty Mutual is renowned for its diverse product portfolio and innovative claims processing systems that consistently enhance customer satisfaction in a competitive market.We're grateful to work with incredible clients.

FAQs

What is the market size of car Insurance?

The global car insurance market is projected to reach a size of $750 billion with a CAGR of 4.8% from 2024 to 2033. This growth reflects the increasing demand for coverage across various customer segments, ensuring protection against vehicle-related risks.

What are the key market players or companies in this car Insurance industry?

Key players in the car insurance industry include major insurers such as State Farm, Geico, Progressive, Allstate, and Farmers Insurance. These companies dominate the market through innovative products, customer-centric services, and expansive distribution networks.

What are the primary factors driving the growth in the car Insurance industry?

Growth in the car insurance industry is driven by increased vehicle sales, rising awareness of road safety, technological advancements in insurance underwriting, and a growing emphasis on comprehensive coverage solutions tailored to individual needs.

Which region is the fastest Growing in the car Insurance market?

The North American region is the fastest-growing in the car insurance market, projected to expand from $251.03 billion in 2024 to $386.16 billion by 2033. This growth is fueled by high vehicle ownership rates and technological innovations in insurance.

Does ConsaInsights provide customized market report data for the car Insurance industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the car insurance industry. Clients can receive in-depth analyses based on their unique business requirements, helping them navigate market challenges more effectively.

What deliverables can I expect from this car Insurance market research project?

Deliverables from the car insurance market research project include comprehensive reports, data analytics, market segmentation insights, competitor analysis, and customized recommendations aimed at improving strategic decision-making for your business.

What are the market trends of car insurance?

Current trends in the car insurance market include a shift towards digital insurance solutions, a greater focus on telematics for personalized pricing, the rise of usage-based insurance, and increasing demand for environmentally friendly vehicle coverage options.