Car Sharing

Published Date: 31 January 2026 | Report Code: car-sharing

Car Sharing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a thorough analysis of the Car Sharing market, covering insights into market dynamics, size, growth prospects, and regional analysis from 2024 to 2033. It outlines key trends, segmentation, and the competitive landscape to help stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

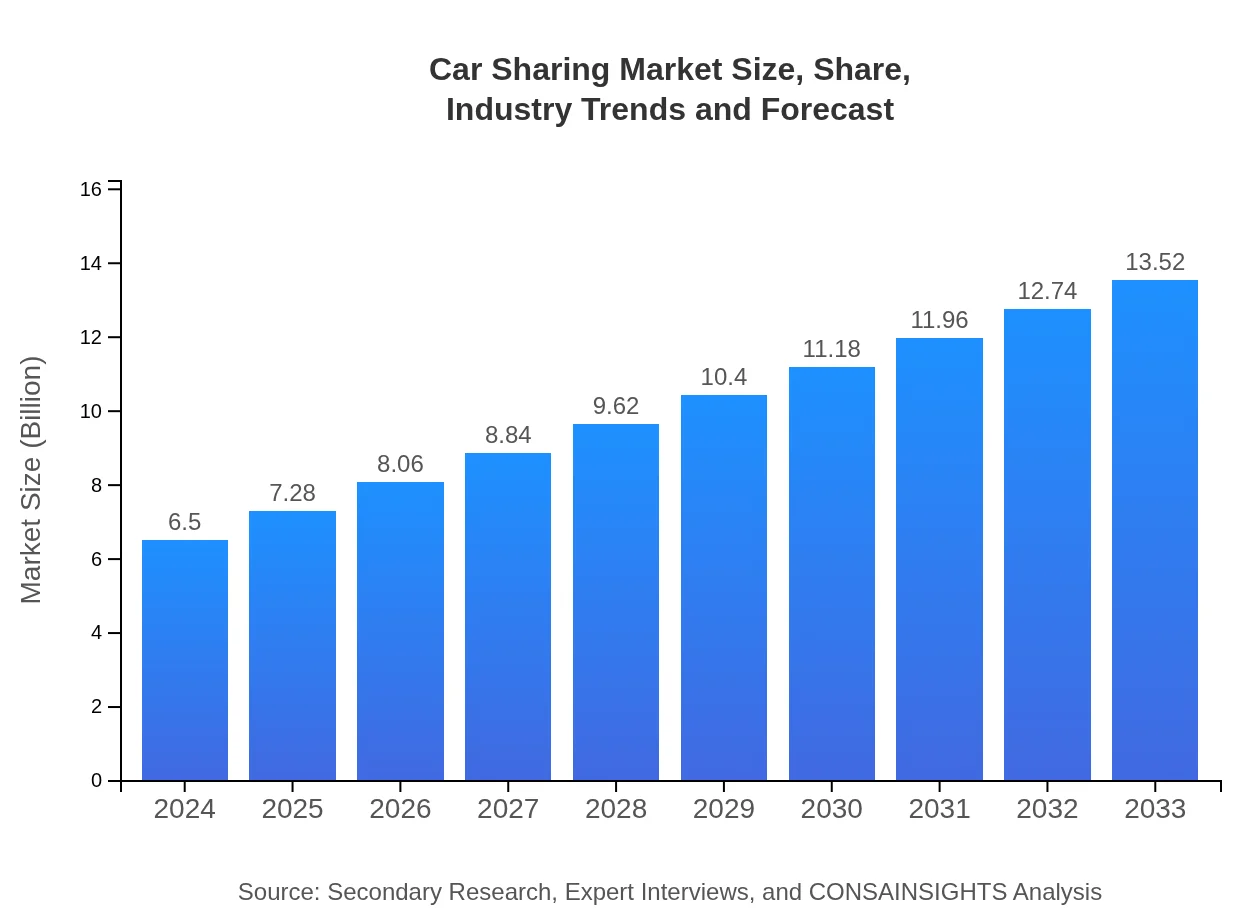

| 2024 Market Size | $6.50 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $13.52 Billion |

| Top Companies | Zipcar, Turo , Getaround, Car2Go, Lyft |

| Last Modified Date | 31 January 2026 |

Car Sharing Market Overview

Customize Car Sharing market research report

- ✔ Get in-depth analysis of Car Sharing market size, growth, and forecasts.

- ✔ Understand Car Sharing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Car Sharing

What is the Market Size & CAGR of Car Sharing market in 2024?

Car Sharing Industry Analysis

Car Sharing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Car Sharing Market Analysis Report by Region

Europe Car Sharing:

The European car sharing market is expected to grow from $1.89 billion in 2024 to $3.92 billion by 2033. Countries like Germany, the UK, and France are pushing forward with car sharing initiatives to reduce carbon emissions and encourage sustainable urban transport, with governments providing regulatory support.Asia Pacific Car Sharing:

The Asia Pacific car sharing market is expected to grow from $1.14 billion in 2024 to $2.36 billion by 2033, driven by urbanization, increased disposable incomes, and tech-savvy populations. Chinese cities are leading this transformation, supported by government initiatives promoting sustainable transportation solutions. Japan and South Korea are also adopting car sharing models as part of their transport strategies.North America Car Sharing:

North America is projected to lead the market, expanding from $2.52 billion in 2024 to $5.25 billion by 2033. The U.S. and Canada are experiencing significant growth due to high consumer awareness, widespread technology adoption, and strong corporate investments in car sharing services as businesses seek sustainable transportation options for employees.South America Car Sharing:

In South America, the car sharing market is anticipated to grow from $0.40 billion in 2024 to $0.84 billion by 2033. Brazil and Argentina are at the forefront of this growth, with increasing urbanization and a shift in consumer preferences toward affordable mobility solutions, coupled with investments in technology.Middle East & Africa Car Sharing:

The Middle East and Africa market is projected to increase from $0.55 billion in 2024 to $1.15 billion by 2033. With rising urban populations and evolving attitudes toward shared mobility, countries like South Africa and the UAE are spearheading the adoption of car sharing services, pairing them with public transport systems to enhance overall mobility.Tell us your focus area and get a customized research report.

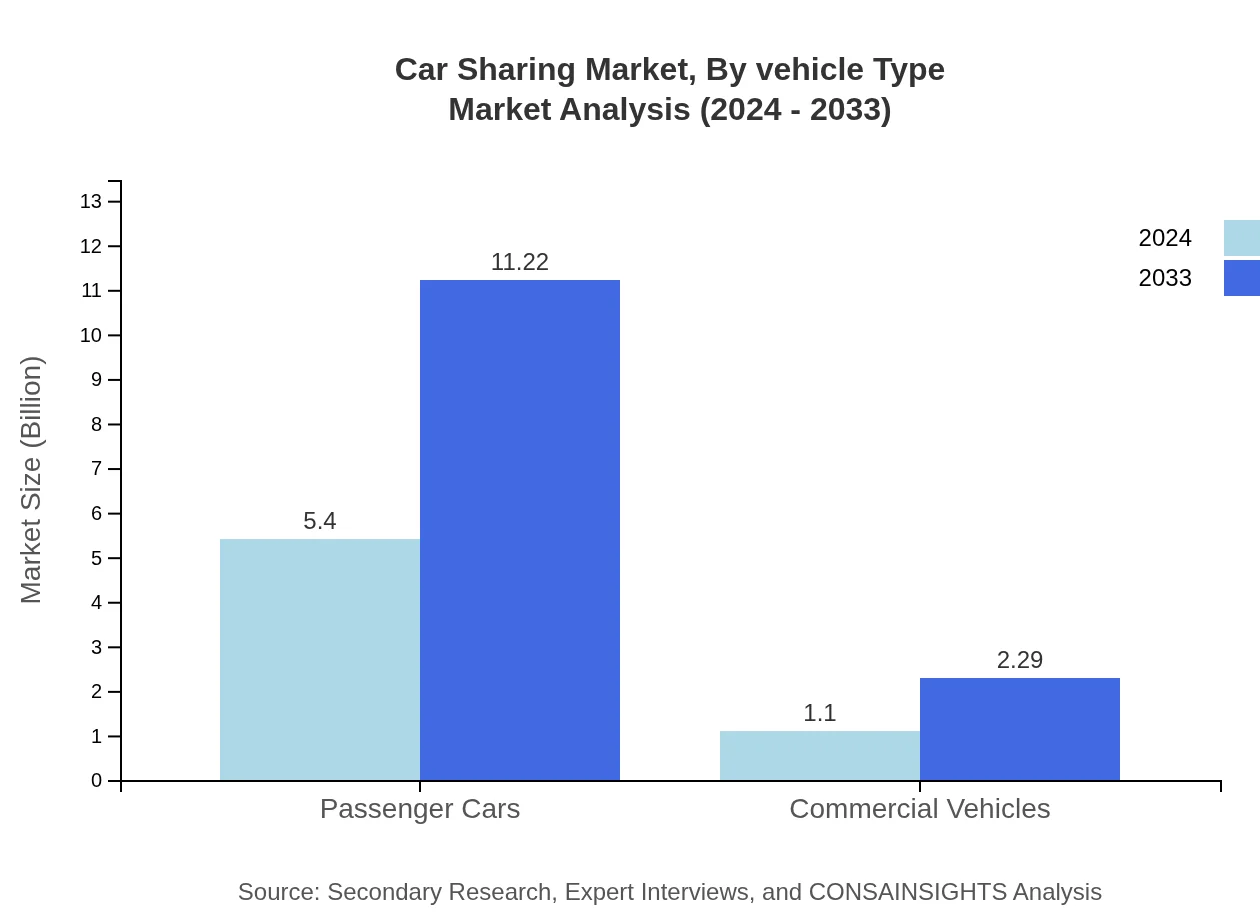

Car Sharing Market Analysis By Vehicle Type

In the Car-Sharing Market by Vehicle Type segment, Passenger Cars dominate with a market size of $5.40 billion in 2024 and project to reach $11.22 billion by 2033, accounting for 83.03% market share. Commercial Vehicles contribute to $1.10 billion in 2024, projected to grow to $2.29 billion by 2033, capturing 16.97% market share. The significance of passenger cars lies in their flexibility and greater appeal to the average consumer.

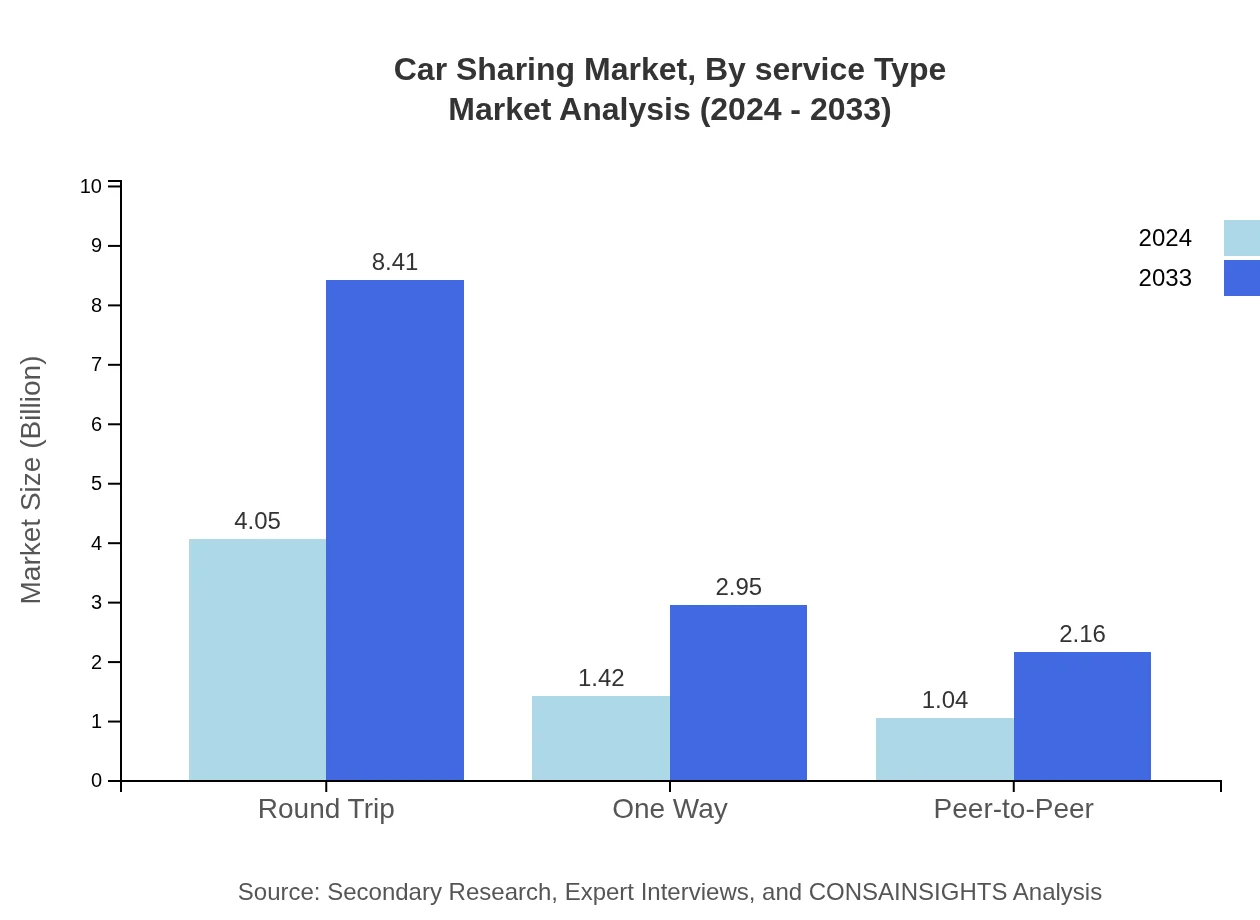

Car Sharing Market Analysis By Service Type

Regarding Service Type, App-Based platforms lead with a market size of $5.40 billion in 2024, expected to hit $11.22 billion by 2033, holding 83.03% of the market share. Web-Based services follow, with a size of $1.10 billion growing to $2.29 billion, with a share of 16.97%. The strong preference for app-based access highlights consumers' desire for convenience and real-time solutions.

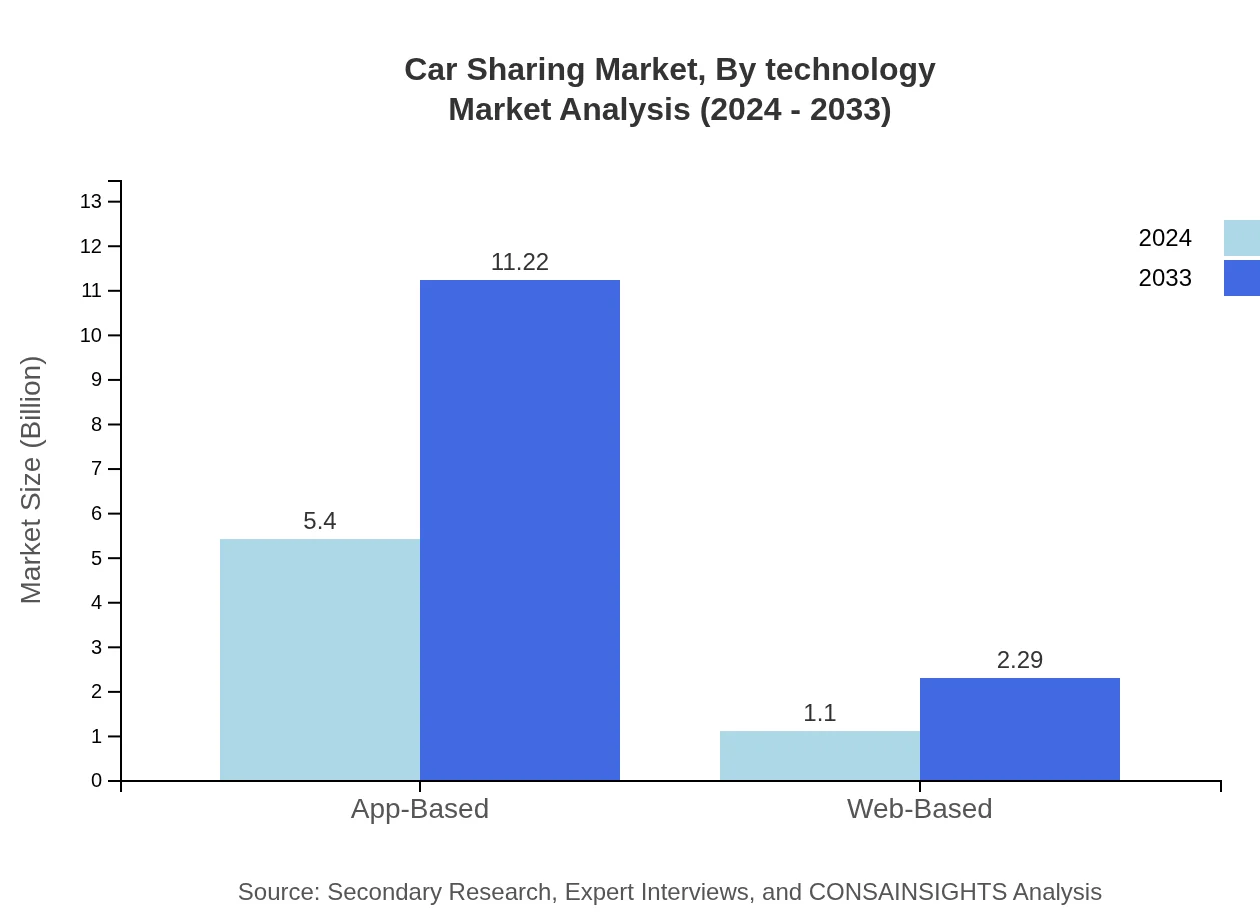

Car Sharing Market Analysis By Technology

Technological advancements have revolutionized the Car-Sharing Market. The growing trend in electric and hybrid vehicles is reshaping car sharing fleets, offering eco-friendly alternatives to traditional cars. Real-time tracking and management systems enhance customer experience, emphasizing the role of technology in improving operational efficiency and user engagement.

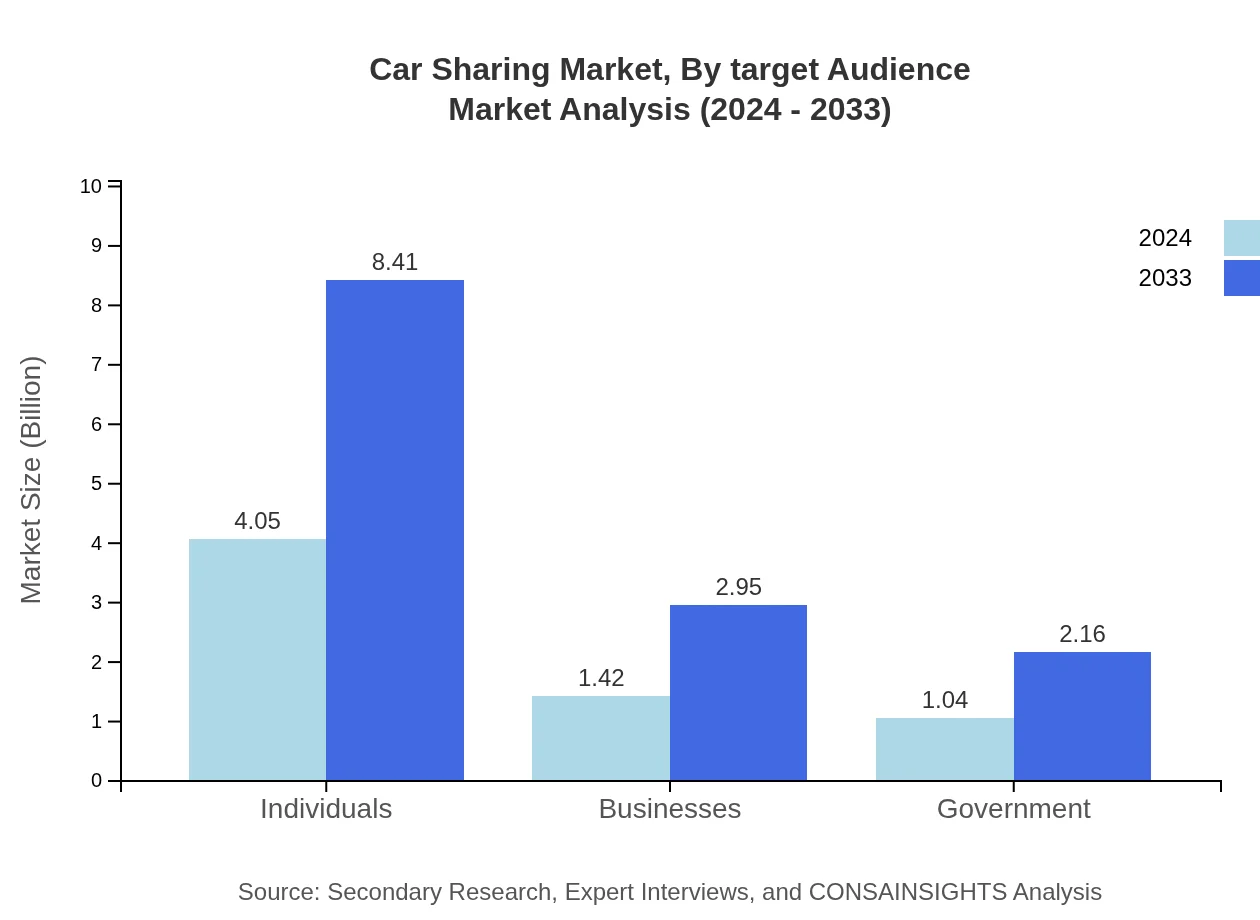

Car Sharing Market Analysis By Target Audience

The target audience in the car sharing industry is segmented into Individuals (62.24% share), Businesses (21.8%), and Government entities (15.96%). Each segment holds distinct needs, with many individuals opting for flexible use, businesses seeking cost-effective logistics solutions, and governments looking to reduce city congestion and emissions.

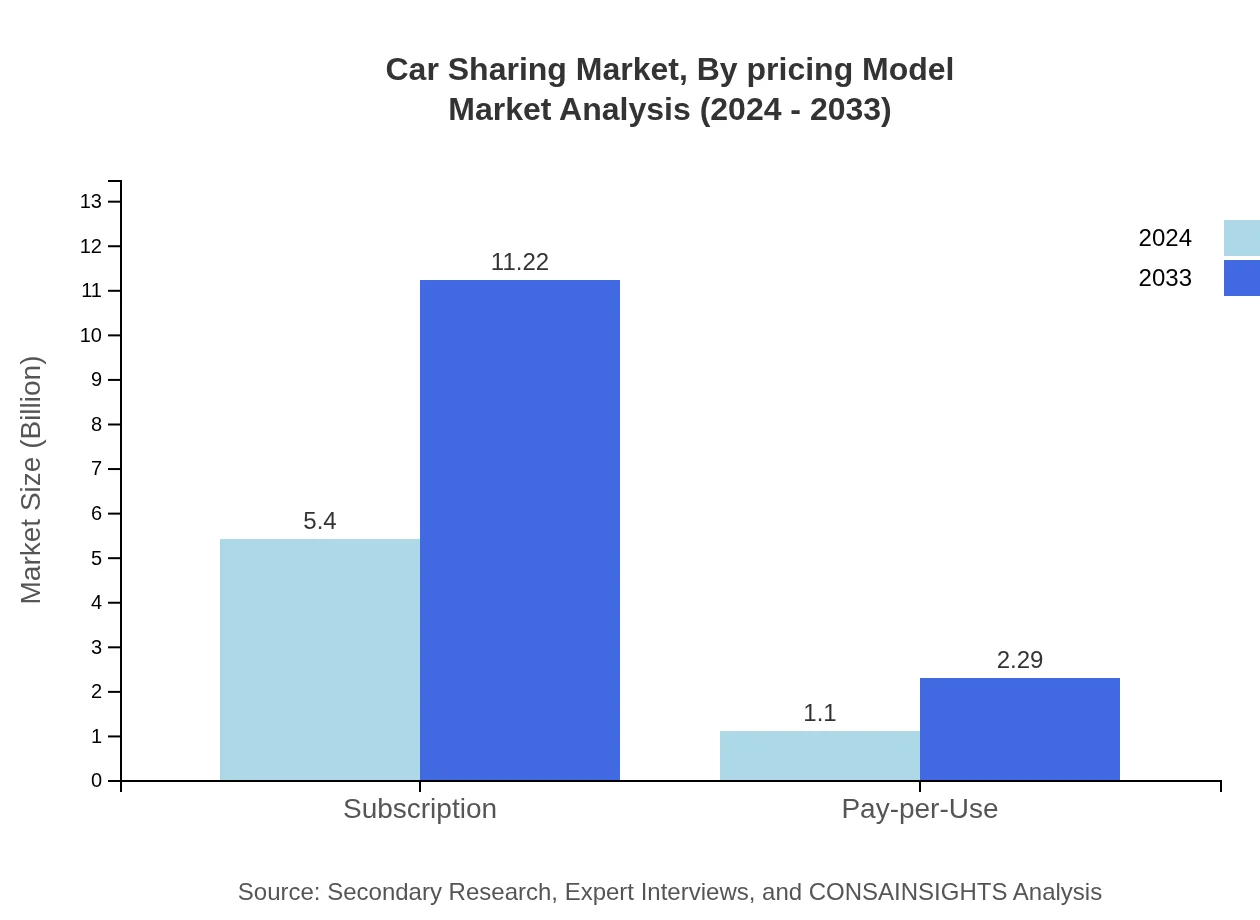

Car Sharing Market Analysis By Pricing Model

The Car-Sharing Market is segmented into two primary pricing models: Subscription (83.03% share) and Pay-per-Use (16.97% share). Subscription-based models are increasingly favored for their predictability and convenience, especially among individuals who seek regular access to vehicles without the overhead of ownership.

Car Sharing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Car Sharing Industry

Zipcar:

A pioneer in the car sharing industry, offering a wide range of vehicles and flexible membership plans across multiple countries.Turo :

A peer-to-peer car sharing platform that allows individuals to rent their cars to other users, facilitating a unique, localized experience.Getaround:

Offers an innovative app-based platform for peer-to-peer car sharing, empowering owners to monetize their vehicles.Car2Go:

Part of Daimler AG, Car2Go operated a fleet of smart cars, providing convenient mobility options for urban residents.Lyft:

Though primarily known for ridesharing, Lyft has integrated car sharing services into its platform, broadening its mobility offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of car Sharing?

The car-sharing market is projected to reach $6.5 billion by 2024, with a CAGR of 8.2% through 2033. This growth reflects the increasing demand for shared mobility solutions in urban areas.

What are the key market players or companies in this car Sharing industry?

Key players in the car-sharing industry include Zipcar, Turo, Getaround, and enterprise companies like BMW and Daimler. These companies are focusing on expanding their service areas and integrating new technologies to enhance user experiences.

What are the primary factors driving the growth in the car Sharing industry?

The growth in the car-sharing industry is driven by urbanization, shifts towards sustainability, cost-saving measures for consumers, and advancements in mobile app technology that enhance accessibility and convenience for users.

Which region is the fastest Growing in the car Sharing market?

North America is the fastest-growing region in the car-sharing market, expected to increase from $2.52 billion in 2024 to $5.25 billion by 2033, driven by high consumer adoption and infrastructure development.

Does ConsaInsights provide customized market report data for the car Sharing industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, allowing businesses to gain insights into the car-sharing industry based on unique operational requirements and market conditions.

What deliverables can I expect from this car Sharing market research project?

Deliverables from the car-sharing market research project will include detailed reports on market size, trends, segment analysis, regional performance data, along with actionable insights and strategic recommendations for market stakeholders.

What are the market trends of car Sharing?

Current trends in the car-sharing market include the rising popularity of app-based services, an increase in subscription models, environmental sustainability consciousness, and the growing integration of IoT and AI technologies to enhance optimization and user experience.