Caramel Colour Market Report

Published Date: 31 January 2026 | Report Code: caramel-colour

Caramel Colour Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Caramel Colour market, highlighting current trends, market forecasts from 2023 to 2033, industry insights, and segmentation analysis. It aims to equip stakeholders with data-driven insights to inform decision-making processes.

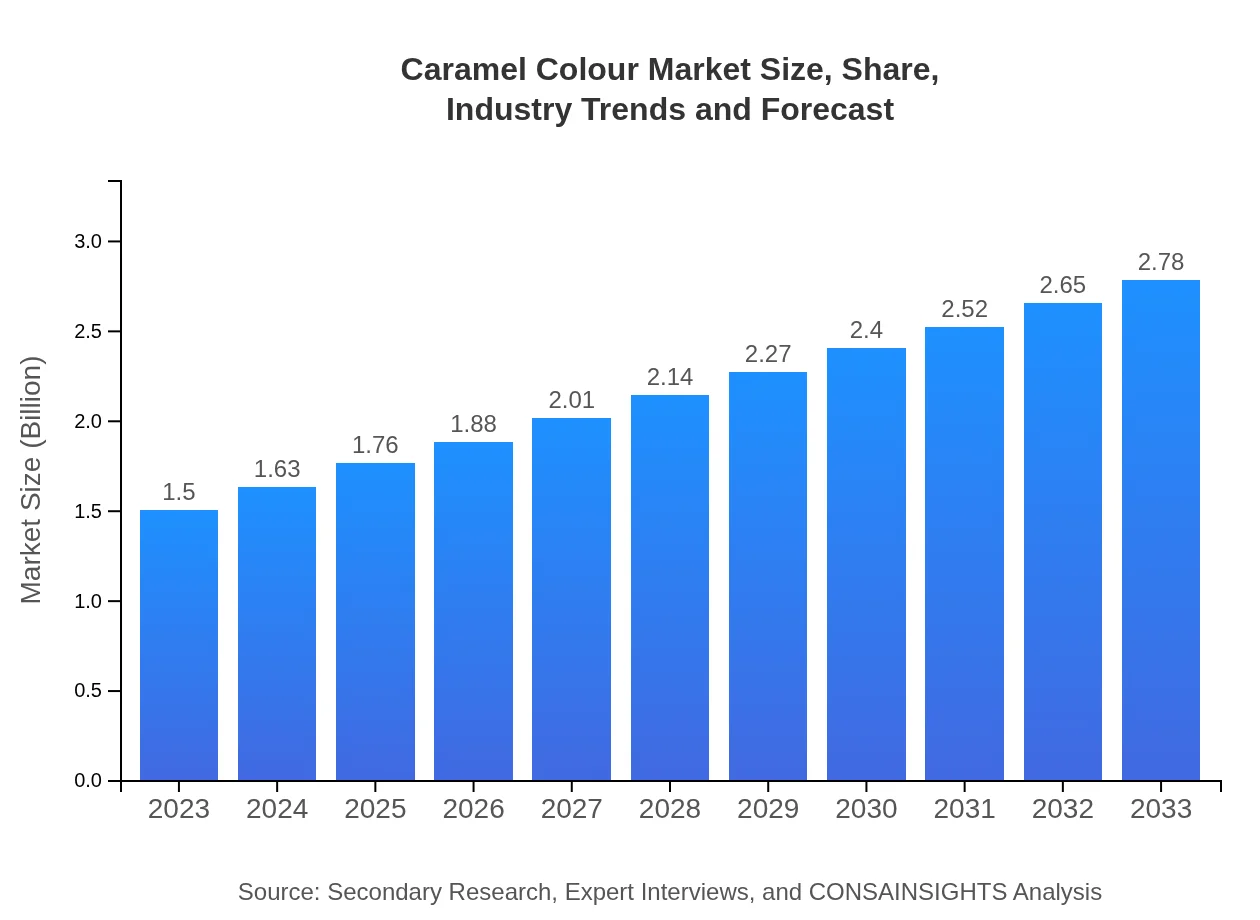

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Cargill, Inc., Kerry Group plc., DDW The Color House, Sensient Technologies Corporation, Manchester United Foods Ltd. |

| Last Modified Date | 31 January 2026 |

Caramel Colour Market Overview

Customize Caramel Colour Market Report market research report

- ✔ Get in-depth analysis of Caramel Colour market size, growth, and forecasts.

- ✔ Understand Caramel Colour's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Caramel Colour

What is the Market Size & CAGR of Caramel Colour market in 2023?

Caramel Colour Industry Analysis

Caramel Colour Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Caramel Colour Market Analysis Report by Region

Europe Caramel Colour Market Report:

The European market is forecasted to expand from $0.49 billion in 2023 to $0.91 billion by 2033. The demand in this region is bolstered by strict regulations surrounding food additives and a growing consumer preference for natural and organic ingredients, significantly impacting market dynamics.Asia Pacific Caramel Colour Market Report:

In the Asia Pacific region, the Caramel Colour market is expected to grow from $0.25 billion in 2023 to $0.46 billion by 2033. The rise in disposable income, coupled with an expanding food and beverage sector, is significantly influencing market growth. Countries like China and India witness high demand for processed foods and beverages, leading to increased utilization of Caramel Colour.North America Caramel Colour Market Report:

North America exhibits a robust market for Caramel Colour, with projections escalating from $0.55 billion in 2023 to $1.01 billion in 2033. The region's strong regulatory framework concerning food safety and quality complements the rise in demand for clean label products in diverse applications, especially in the beverage and bakery sectors.South America Caramel Colour Market Report:

The market in South America, while smaller, is projected to grow from $0.06 billion in 2023 to $0.11 billion in 2033. Consumer trends toward premium and natural products are driving demand in key segments such as beverages and confectionery, albeit at a lesser scale than in other regions.Middle East & Africa Caramel Colour Market Report:

In the Middle East and Africa, the Caramel Colour market is anticipated to witness growth from $0.16 billion in 2023 to $0.29 billion by 2033. Population growth, urbanization, and a corresponding rise in the food service industry are likely to enhance demand for Caramel Colour, though challenges regarding sustainability and sourcing must be addressed.Tell us your focus area and get a customized research report.

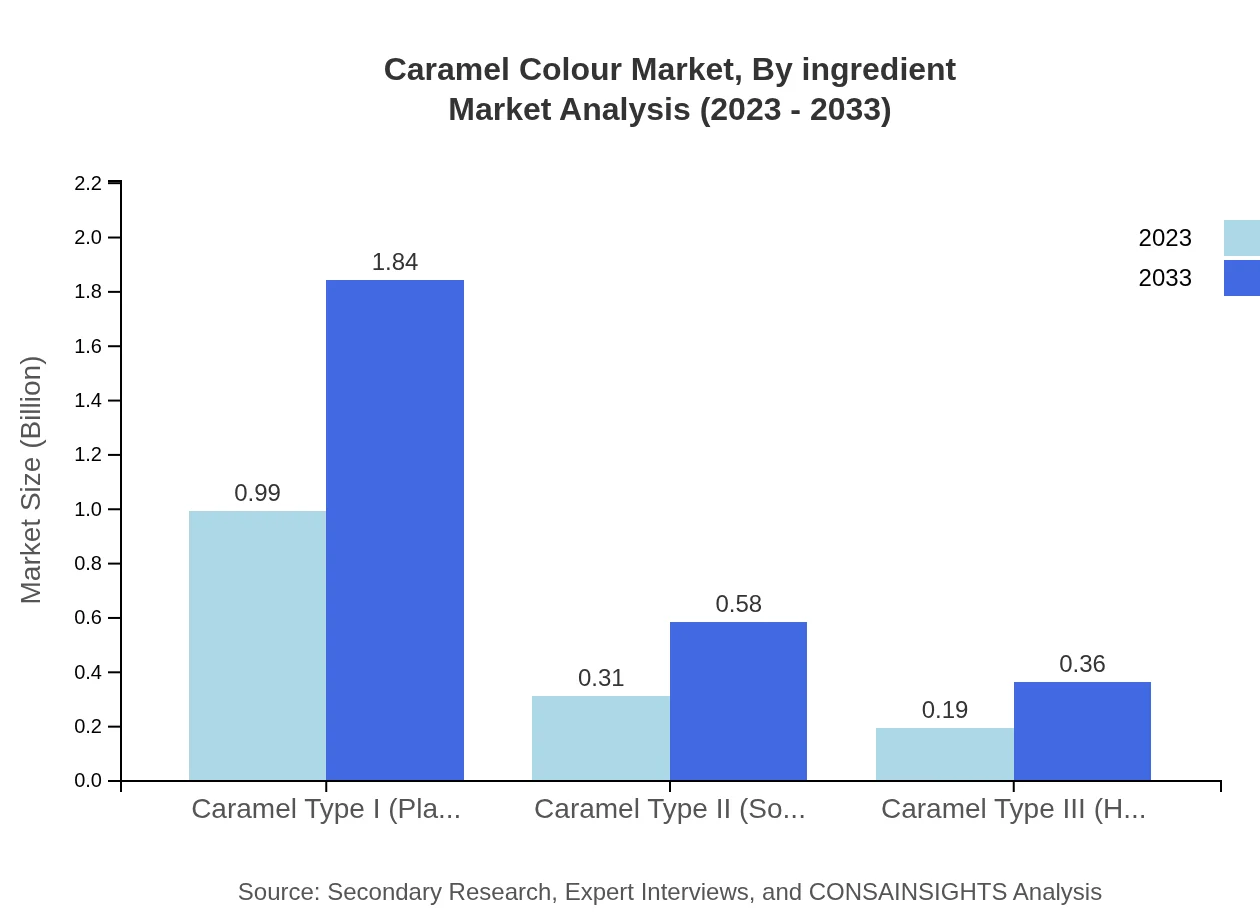

Caramel Colour Market Analysis By Ingredient

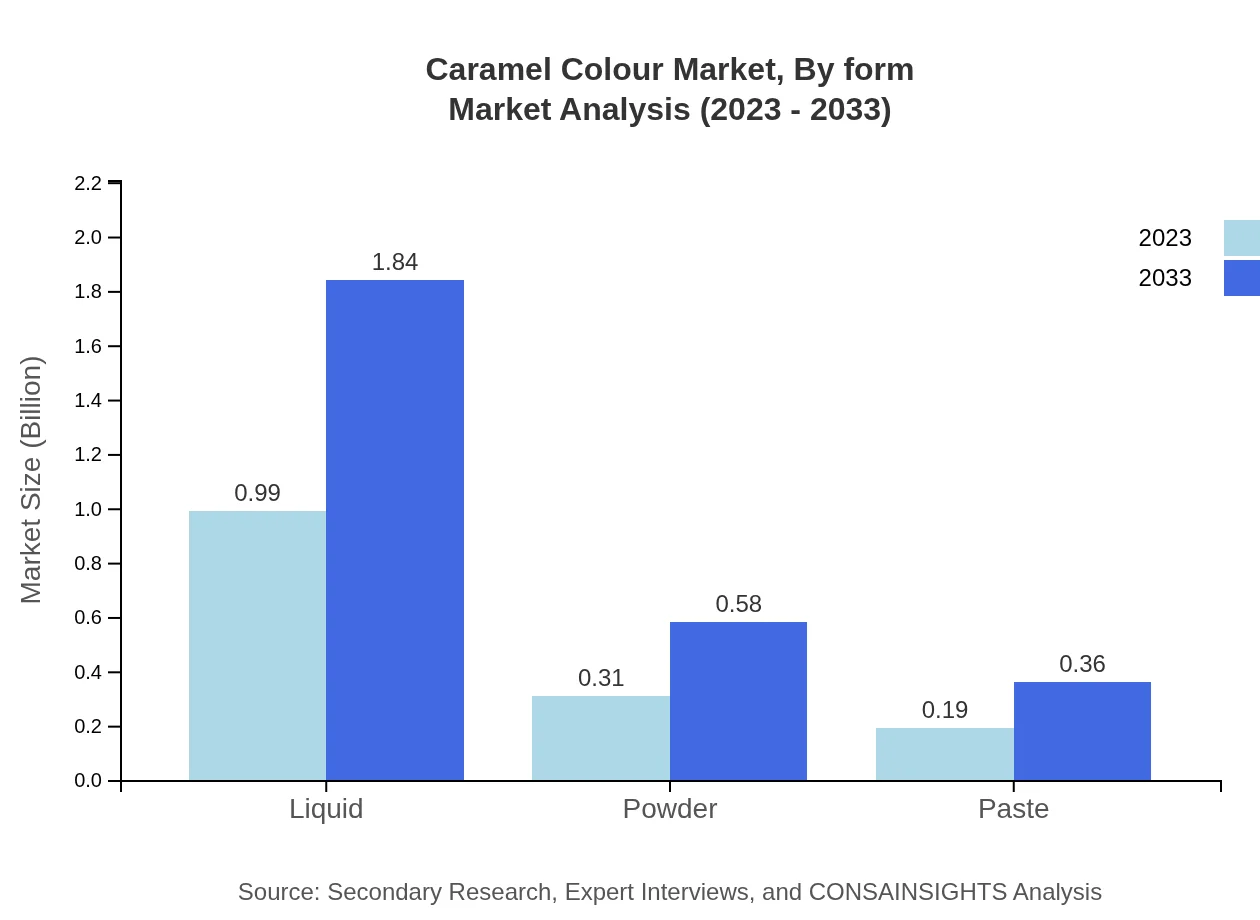

Liquid Caramel Colour dominates the market, accounting for significant size and share, reaching $0.99 billion in 2023 with expectations to grow to $1.84 billion by 2033. Powder and paste forms are also significant, albeit smaller, with projected growth reflecting evolving consumer preferences and application methodologies.

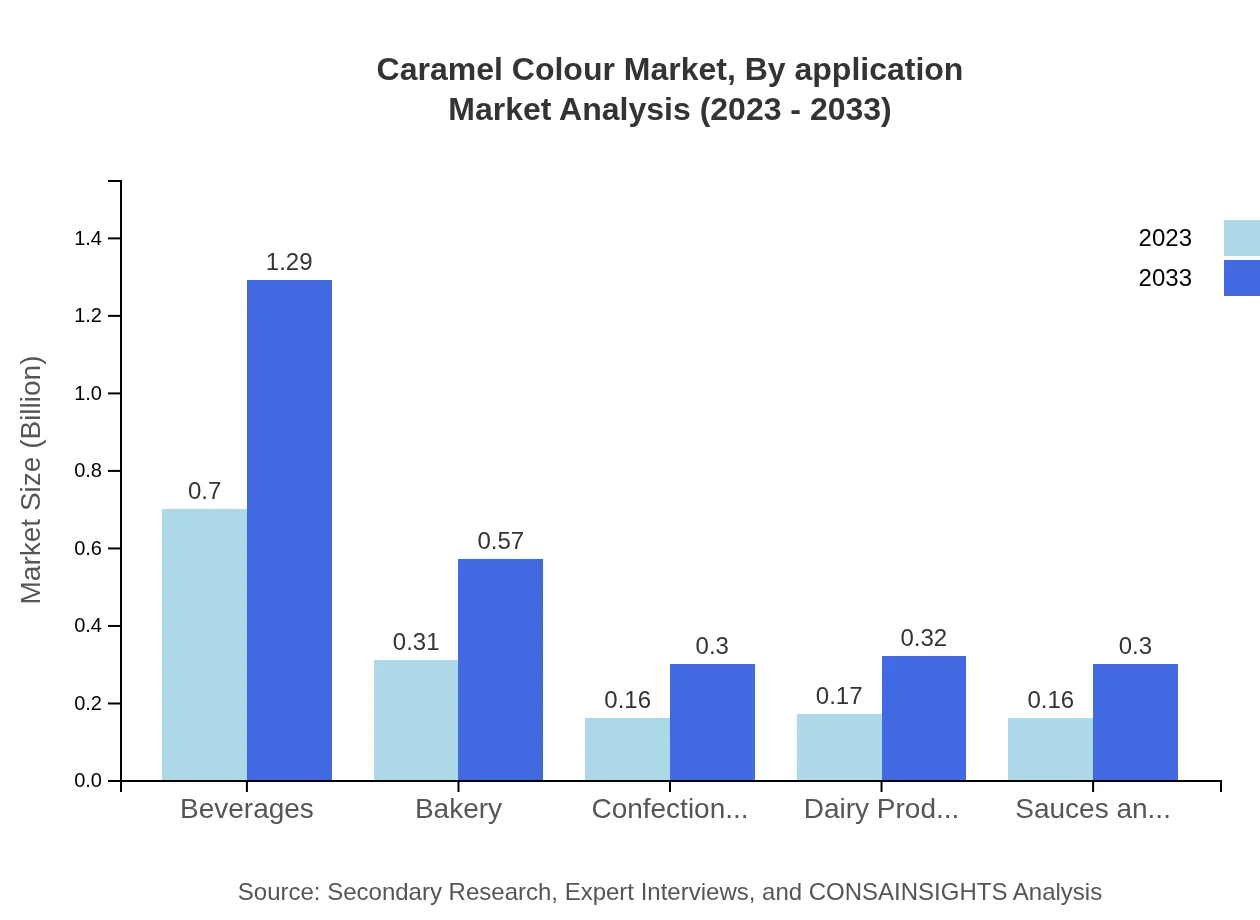

Caramel Colour Market Analysis By Application

Within applications, the beverage sector remains the largest consumer, with a size of $0.70 billion in 2023 projected to increase to $1.29 billion by 2033. Other key applications include bakery, dairy products, and sauces, each with distinct growth drivers reflecting consumer trends.

Caramel Colour Market Analysis By Form

The market is further dissected into natural and synthetic forms. Natural Caramel Colours command a larger share, driven by the clean label trend, while synthetic formulations remain relevant due to their cost-effectiveness and stability in various applications.

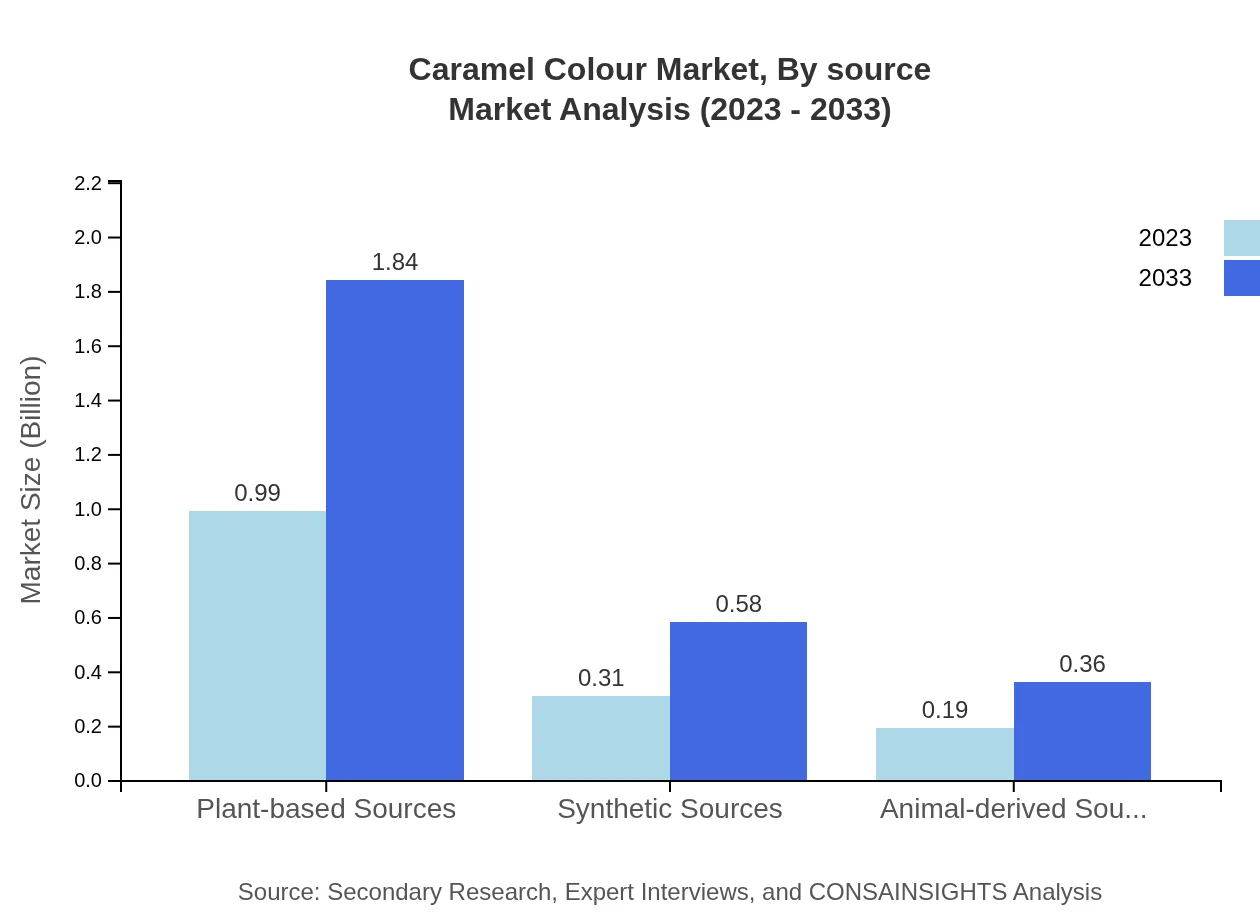

Caramel Colour Market Analysis By Source

The Caramel Colour segment by source includes plant-based, synthetic, and animal-derived categories. Plant-based sources dominate in terms of size at $0.99 billion in 2023, reflecting the shift towards vegetarian and vegan products.

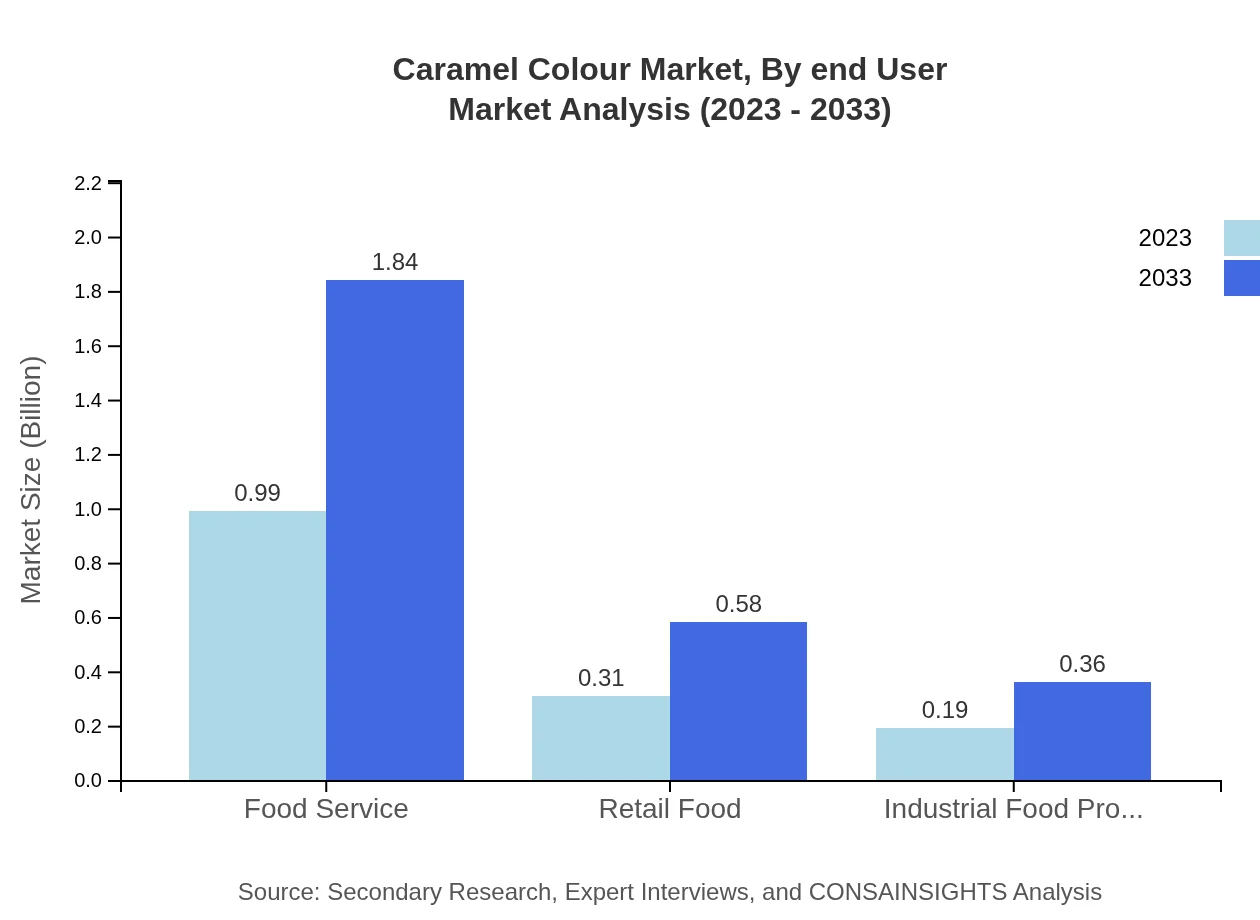

Caramel Colour Market Analysis By End User

The food service and industrial food producers sectors are pivotal consumers of Caramel Colour, demonstrating significant growth potential alongside rising demand for value-added food products across various industries.

Caramel Colour Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Caramel Colour Industry

Cargill, Inc.:

A global leader in agricultural products, Cargill produces a variety of food ingredients, including Caramel Colour, known for its diverse applications across food and beverages.Kerry Group plc.:

Kerry Group specializes in food technology and ingredients, offering innovative caramel solutions that cater to various sectors including bakery and beverage industries.DDW The Color House:

With a extensive portfolio of natural colors, DDW leads in offering various Caramel Colour applications, focusing on sustainable practices and quality assurance.Sensient Technologies Corporation:

Sensient provides a vast range of color solutions, using modern technology to enhance product performance and meet customer needs in the Caramel Colour sector.Manchester United Foods Ltd.:

A regional player focusing on natural caramel formulations, they emphasize quality ingredients for the food service and retail markets.We're grateful to work with incredible clients.

FAQs

What is the market size of caramel Colour?

The caramel colour market is currently valued at approximately $1.5 billion, with a projected compound annual growth rate (CAGR) of 6.2% from 2023 to 2033. This growth indicates a robust demand for caramel colour across various applications.

What are the key market players or companies in the caramel Colour industry?

Key players in the caramel colour industry include major manufacturers and suppliers who contribute significantly to market dynamics. These companies focus on innovation, strategic partnerships, and expanding their product lines to capture a larger market share.

What are the primary factors driving the growth in the caramel Colour industry?

Growth in the caramel colour industry is primarily driven by factors such as rising consumer demand for natural food additives, increasing applications in the food and beverage sectors, and the thriving trend of clean-label products favoring caramel colour.

Which region is the fastest Growing in the caramel Colour market?

The fastest-growing region in the caramel colour market is anticipated to be Europe, with growth driven by enhanced consumption in the food and beverage industries. North America and Asia Pacific also show significant growth potential, driven by diversified applications.

Does ConsInsights provide customized market report data for the caramel Colour industry?

Yes, ConsInsights offers tailored market report data for the caramel colour industry. The customization allows businesses to gain insights specific to their strategic needs and market dynamics, ensuring informed decision-making.

What deliverables can I expect from this caramel Colour market research project?

Expect comprehensive deliverables from the caramel colour market research project, including detailed market analysis, competitive landscape, growth forecasts, regional insights, and segment data, providing actionable insights for strategic planning.

What are the market trends of caramel Colour?

Current trends in the caramel colour market include a shift towards plant-based and natural sources, increased regulatory focus on food safety, and heightened innovation in product offerings, particularly in the beverage and bakery sectors.