Carbonated Beverage Processing Equipment Market Report

Published Date: 31 January 2026 | Report Code: carbonated-beverage-processing-equipment

Carbonated Beverage Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the dynamics of the Carbonated Beverage Processing Equipment market, presenting a comprehensive analysis from 2023 to 2033. Insights include market size, industry trends, segmentation, and forecasts, providing stakeholders with critical data for decision-making.

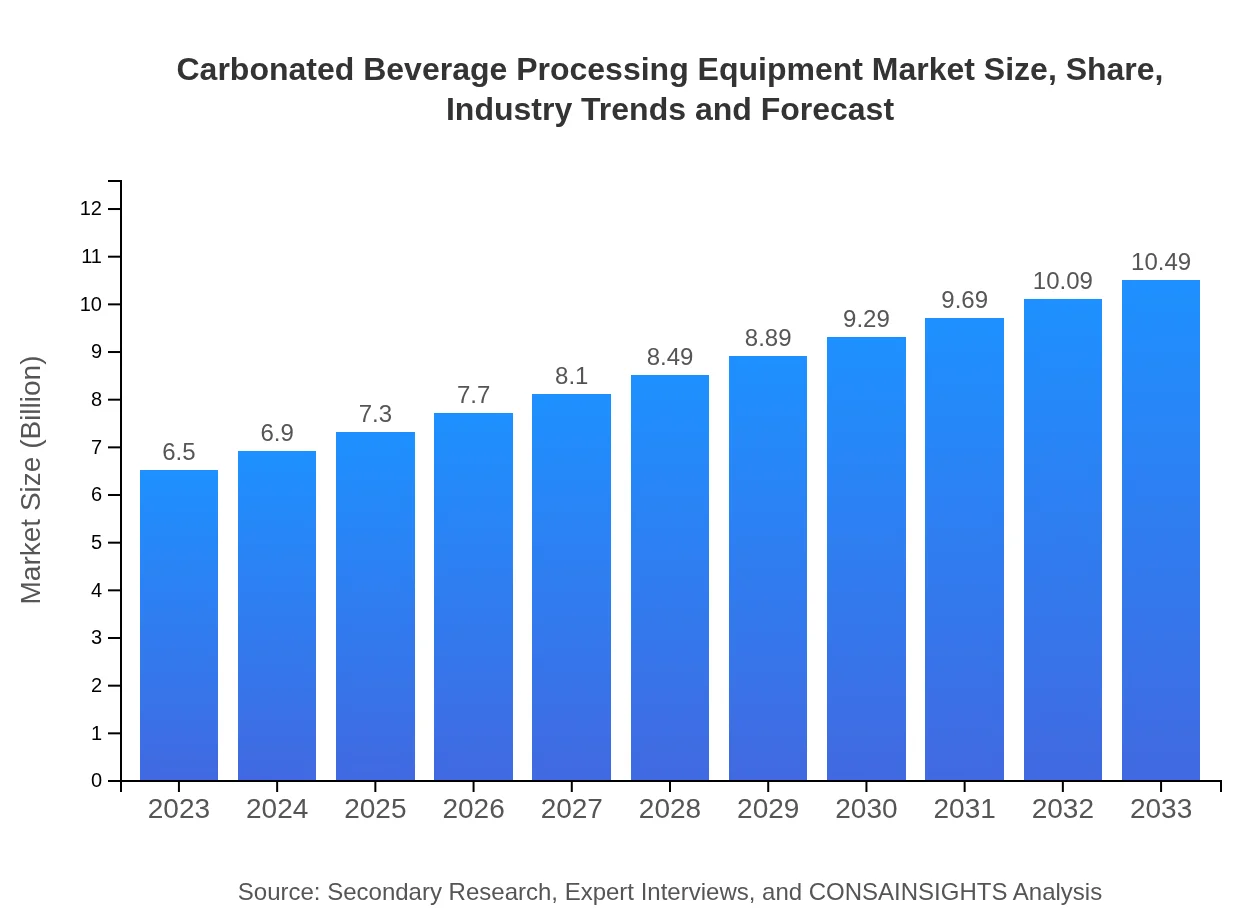

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $10.49 Billion |

| Top Companies | Krones AG, GEA Group, Tetra Pak, Sidel Group |

| Last Modified Date | 31 January 2026 |

Carbonated Beverage Processing Equipment Market Overview

Customize Carbonated Beverage Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Carbonated Beverage Processing Equipment market size, growth, and forecasts.

- ✔ Understand Carbonated Beverage Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Carbonated Beverage Processing Equipment

What is the Market Size & CAGR of Carbonated Beverage Processing Equipment market in 2023?

Carbonated Beverage Processing Equipment Industry Analysis

Carbonated Beverage Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Carbonated Beverage Processing Equipment Market Analysis Report by Region

Europe Carbonated Beverage Processing Equipment Market Report:

The European market shows a size increase from $2.18 billion in 2023 to $3.51 billion by 2033. The adoption of sustainable practices and growing health consciousness are key drivers, along with technological advancements in processing equipment.Asia Pacific Carbonated Beverage Processing Equipment Market Report:

In the Asia Pacific region, the market for Carbonated Beverage Processing Equipment was valued at $1.13 billion in 2023 and is expected to reach $1.82 billion by 2033. The growth is attributed to increasing urbanization and a rising population interested in carbonated soft drinks and flavored sparkling waters.North America Carbonated Beverage Processing Equipment Market Report:

North America’s market size is anticipated to grow from $2.30 billion in 2023 to $3.71 billion by 2033. This increase is supported by the high consumption rate of carbonated beverages and the presence of major beverage manufacturers investing in advanced processing technologies.South America Carbonated Beverage Processing Equipment Market Report:

The South American market reached $0.58 billion in 2023 and is projected to grow to $0.94 billion by 2033. This growth is driven by a rise in disposable income and changing consumer preferences towards innovative beverage offerings, particularly in Brazil and Argentina.Middle East & Africa Carbonated Beverage Processing Equipment Market Report:

The Middle East and Africa market is expected to experience growth from $0.31 billion in 2023 to $0.50 billion by 2033, spurred by an increase in beverage innovation and a growing restaurant and café culture in this region.Tell us your focus area and get a customized research report.

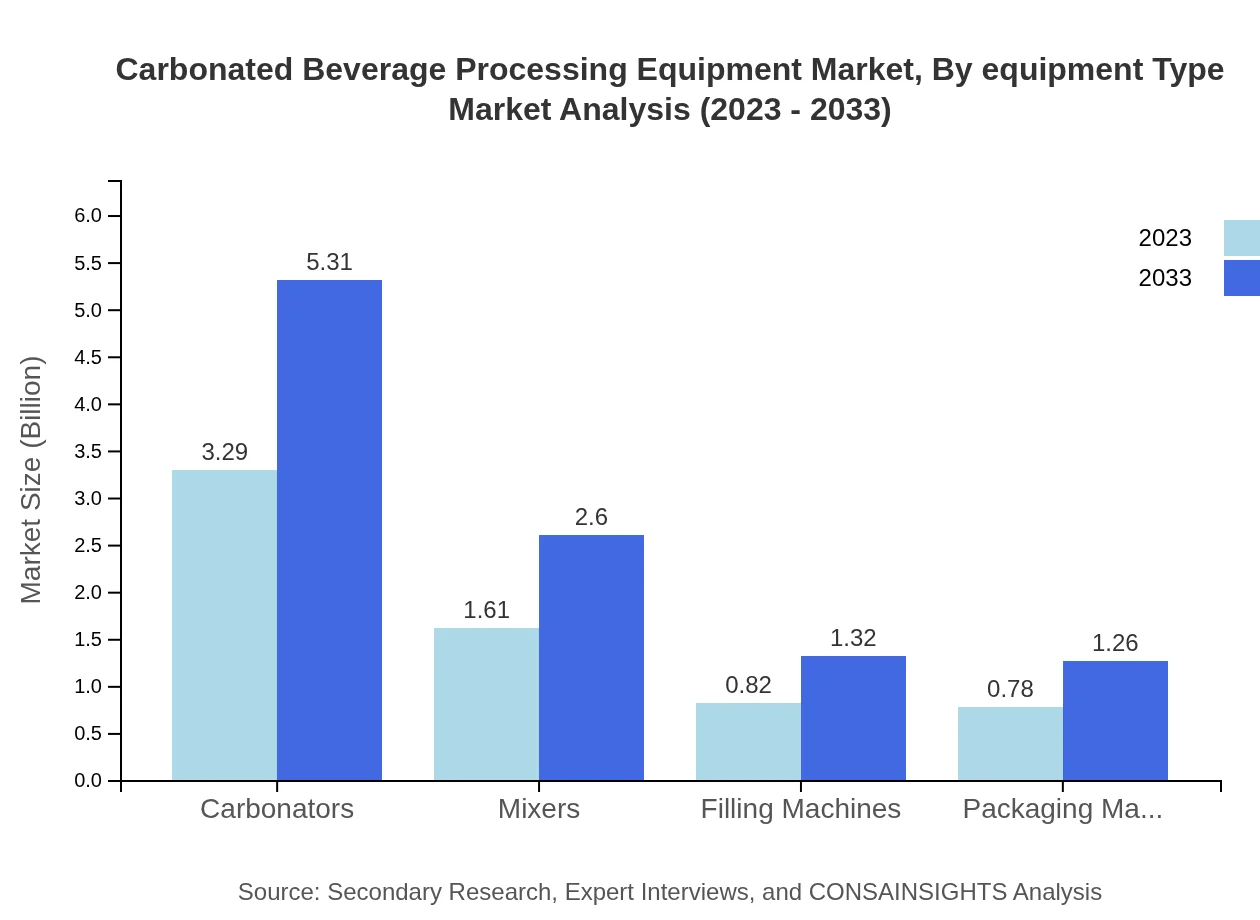

Carbonated Beverage Processing Equipment Market Analysis By Equipment Type

The market is dominated by carbonators, which accounted for approximately 50.65% of the total market share in 2023, valued at $3.29 billion, and is expected to reach $5.31 billion by 2033. Other significant segments include mixers and filling machinery, reflecting the diverse applications of processing equipment in different beverage types.

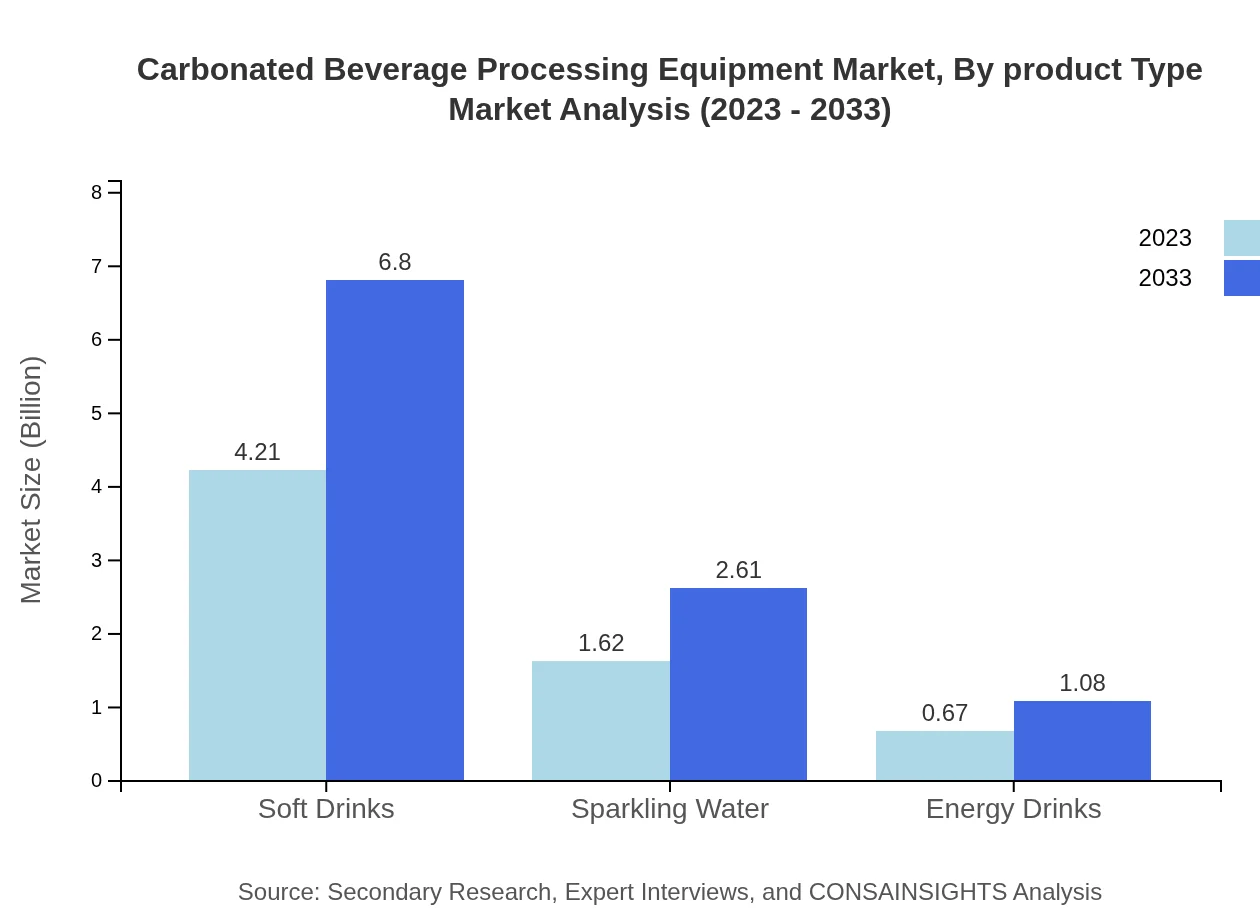

Carbonated Beverage Processing Equipment Market Analysis By Product Type

The soft drinks segment represents the largest share of the market, holding a 64.82% market share in 2023, valued at $4.21 billion, projected to grow to $6.80 billion by 2033. Sparkling water and energy drinks also show robust growth, reflecting shifting consumer preferences towards these beverage categories.

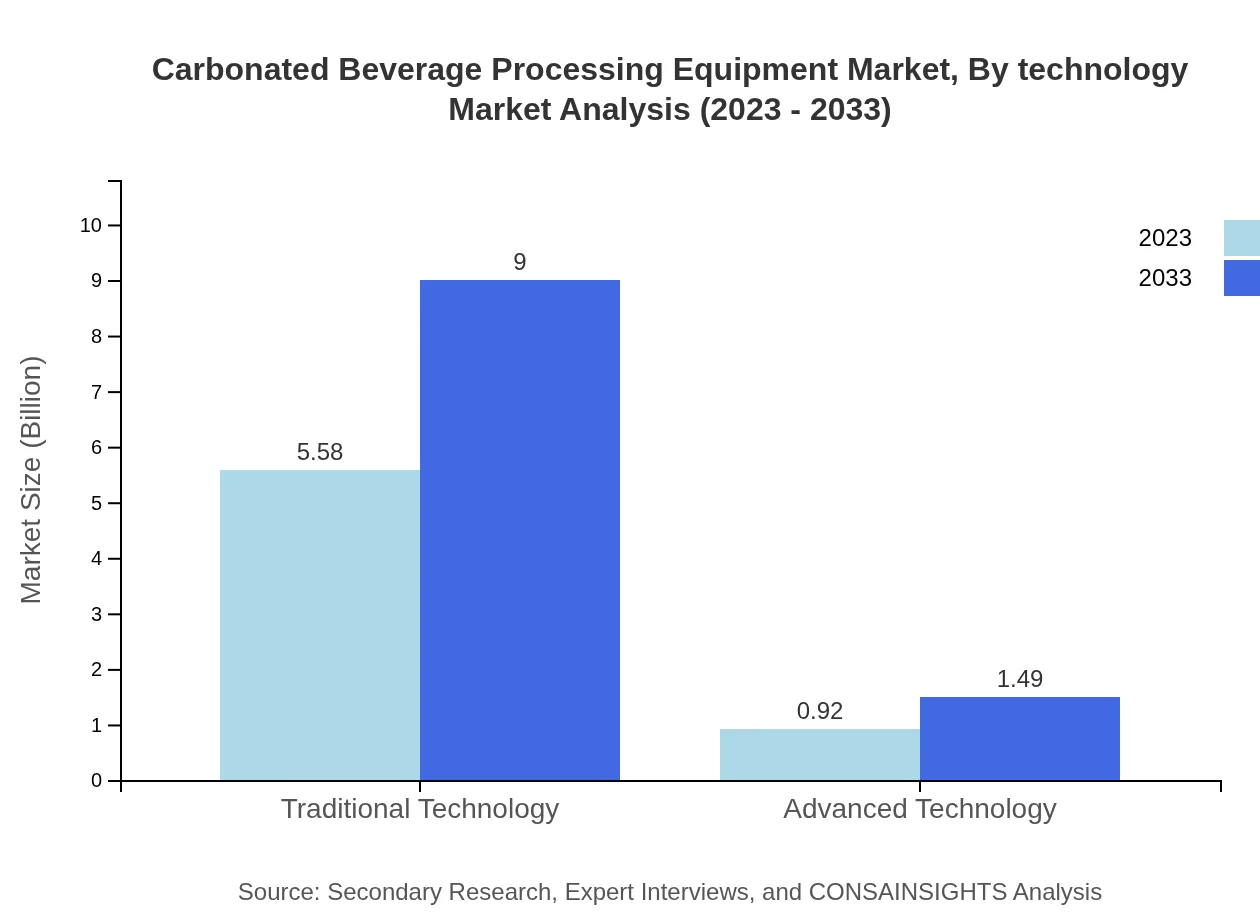

Carbonated Beverage Processing Equipment Market Analysis By Technology

Traditional technology remains dominant, making up 85.77% of the market share with a size of $5.58 billion in 2023. However, advanced technology is forecasted to grow rapidly due to rising efficiency needs, currently at $0.92 billion and expected to reach $1.49 billion by 2033.

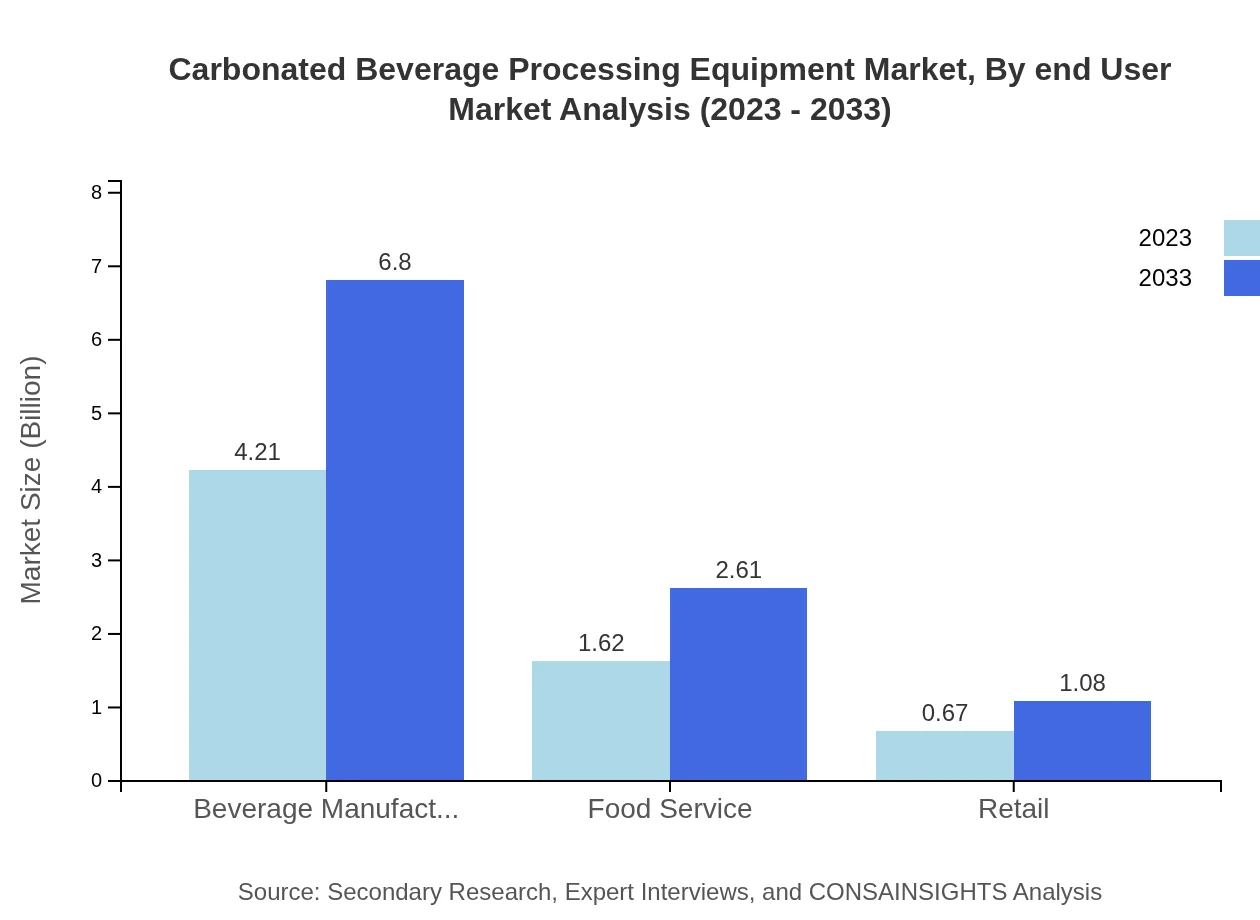

Carbonated Beverage Processing Equipment Market Analysis By End User

The beverage manufacturing segment leads the market, sharing 64.82% with a size of $4.21 billion in 2023 and projected to reach $6.80 billion by 2033. The food service sector, while smaller, is expected to grow significantly, reflecting the increasing popularity of carbonated drinks in cafes and restaurants.

Carbonated Beverage Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Carbonated Beverage Processing Equipment Industry

Krones AG:

Krones AG is a leading provider of processing and bottling technology, offering innovative solutions tailored to the beverage manufacturing sector. Their equipment is renowned for its efficiency and sustainability.GEA Group:

GEA Group specializes in advanced processing equipment, specifically tailored for liquid food applications, including carbonated beverages. Their focus on technological advancement aids clients in improving operational efficiency.Tetra Pak:

Tetra Pak is notable for providing a comprehensive range of food processing and packaging solutions, emphasizing sustainability while catering to the rapidly changing beverage market.Sidel Group:

Sidel Group offers integrated packaging solutions and technology for the beverage industry, enhancing productivity and optimizing production lines.We're grateful to work with incredible clients.

FAQs

What is the market size of carbonated Beverage Processing Equipment?

The carbonated beverage processing equipment market is currently valued at approximately $6.5 billion, with a projected CAGR of 4.8% from 2023 to 2033. This growth reflects increased demand and advancing technologies in beverage production.

What are the key market players or companies in the carbonated Beverage Processing Equipment industry?

Key players in the carbonated beverage processing equipment industry include major beverage manufacturers and specialized equipment suppliers that focus on carbonation technology, bottling, and packaging machines, ensuring efficiency and quality in production.

What are the primary factors driving the growth in the carbonated Beverage Processing Equipment industry?

Growth is driven by rising consumer demands for carbonated drinks, innovative processing technologies, and increased investment in beverage manufacturing. Sustainability practices and health-conscious trends are also influencing equipment upgrades.

Which region is the fastest Growing in the carbonated Beverage Processing Equipment?

Among regions, Europe is expected to exhibit strong growth, increasing from $2.18 billion in 2023 to $3.51 billion in 2033, alongside North America, which grows from $2.30 billion to $3.71 billion over the same period.

Does ConsaInsights provide customized market report data for the carbonated Beverage Processing Equipment industry?

Yes, ConsaInsights offers customized market report data, allowing clients to obtain tailored insights and analysis specific to their needs within the carbonated beverage processing equipment industry.

What deliverables can I expect from this carbonated Beverage Processing Equipment market research project?

Deliverables include comprehensive market analysis, segment performance data, competitive landscape insights, and regional growth projections, enabling informed decision-making in the carbonated beverage sector.

What are the market trends of carbonated Beverage Processing Equipment?

Notable trends include the shift towards advanced technology in production, increasing interest in healthier beverage options, and sustainable processing solutions, all shaping the future of the carbonated beverage processing equipment market.