Cardiac Implants Market Report

Published Date: 31 January 2026 | Report Code: cardiac-implants

Cardiac Implants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive examination of the Cardiac Implants market from 2023 to 2033. It offers insights into market size, growth trends, technology advancements, product performance, and a comprehensive analysis of key regions and players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

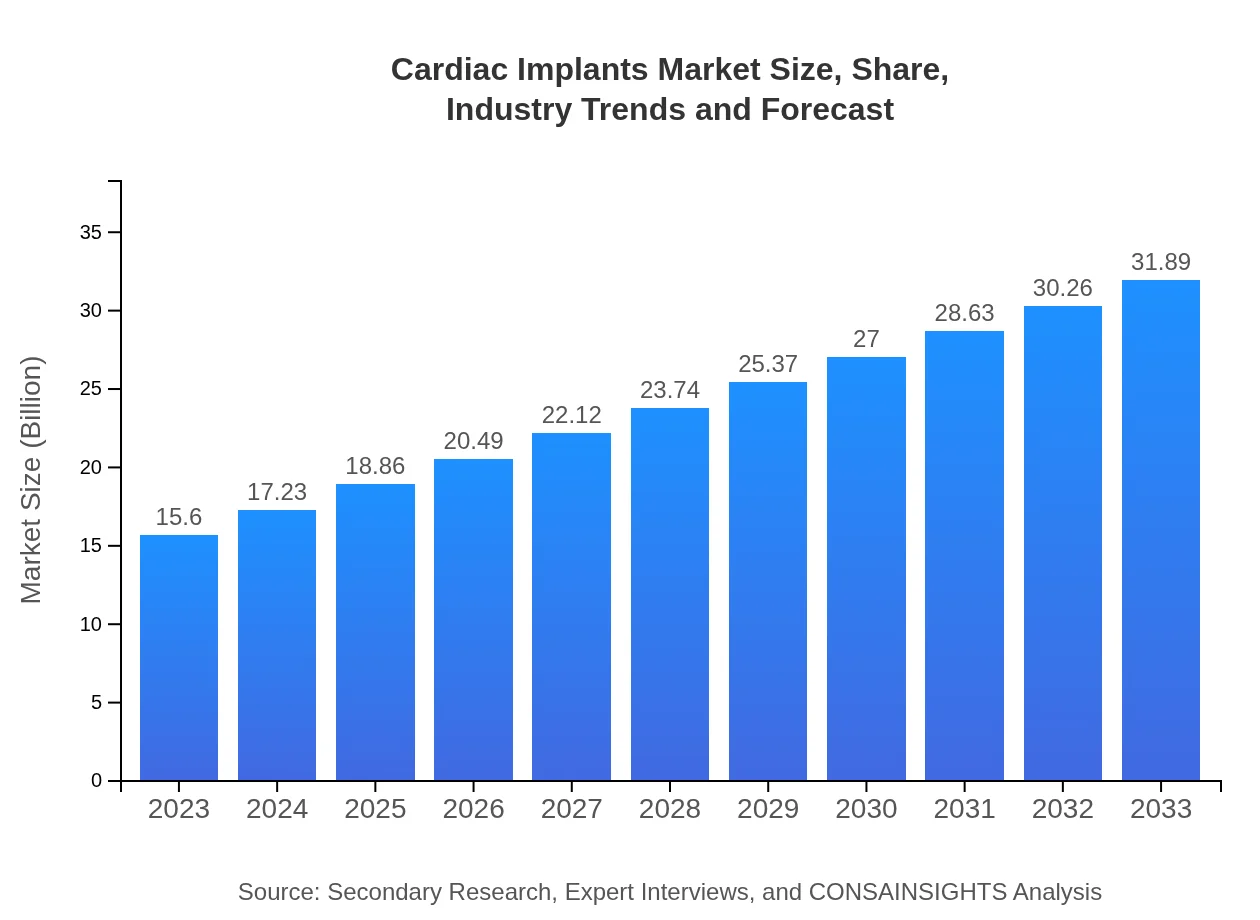

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $31.89 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Boston Scientific, Johnson & Johnson (DePuy Synthes), Edwards Lifesciences |

| Last Modified Date | 31 January 2026 |

Cardiac Implants Market Overview

Customize Cardiac Implants Market Report market research report

- ✔ Get in-depth analysis of Cardiac Implants market size, growth, and forecasts.

- ✔ Understand Cardiac Implants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiac Implants

What is the Market Size & CAGR of Cardiac Implants market in 2023-2033?

Cardiac Implants Industry Analysis

Cardiac Implants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiac Implants Market Analysis Report by Region

Europe Cardiac Implants Market Report:

The European market for cardiac implants is expanding significantly, projected to grow from $4.96 billion in 2023 to $10.15 billion by 2033. Aging populations and rising healthcare expenditure are pivotal drivers for market expansion in this region.Asia Pacific Cardiac Implants Market Report:

The Asia Pacific region is witnessing notable growth in the cardiac implants market, primarily driven by a burgeoning population, increasing healthcare access, and rising disposable incomes. By 2033, the market size is expected to reach approximately $5.85 billion, compared to $2.86 billion in 2023.North America Cardiac Implants Market Report:

As the largest market for cardiac implants, North America, particularly the United States, showcases a substantial market size of $5.50 billion in 2023, expected to reach $11.24 billion by 2033. Increasing adoption of advanced medical technologies and a robust healthcare system underpin this growth.South America Cardiac Implants Market Report:

In South America, the cardiac implants market is evolving due to enhanced healthcare policies and growing recognition of cardiovascular diseases. The market is projected to grow from $1.51 billion in 2023 to $3.08 billion by 2033, indicating a strengthening healthcare infrastructure.Middle East & Africa Cardiac Implants Market Report:

The Middle East and Africa region represent a smaller market size, estimated at $0.77 billion in 2023, with growth anticipated to reach $1.58 billion by 2033, driven by improvements in healthcare delivery and investment in technology.Tell us your focus area and get a customized research report.

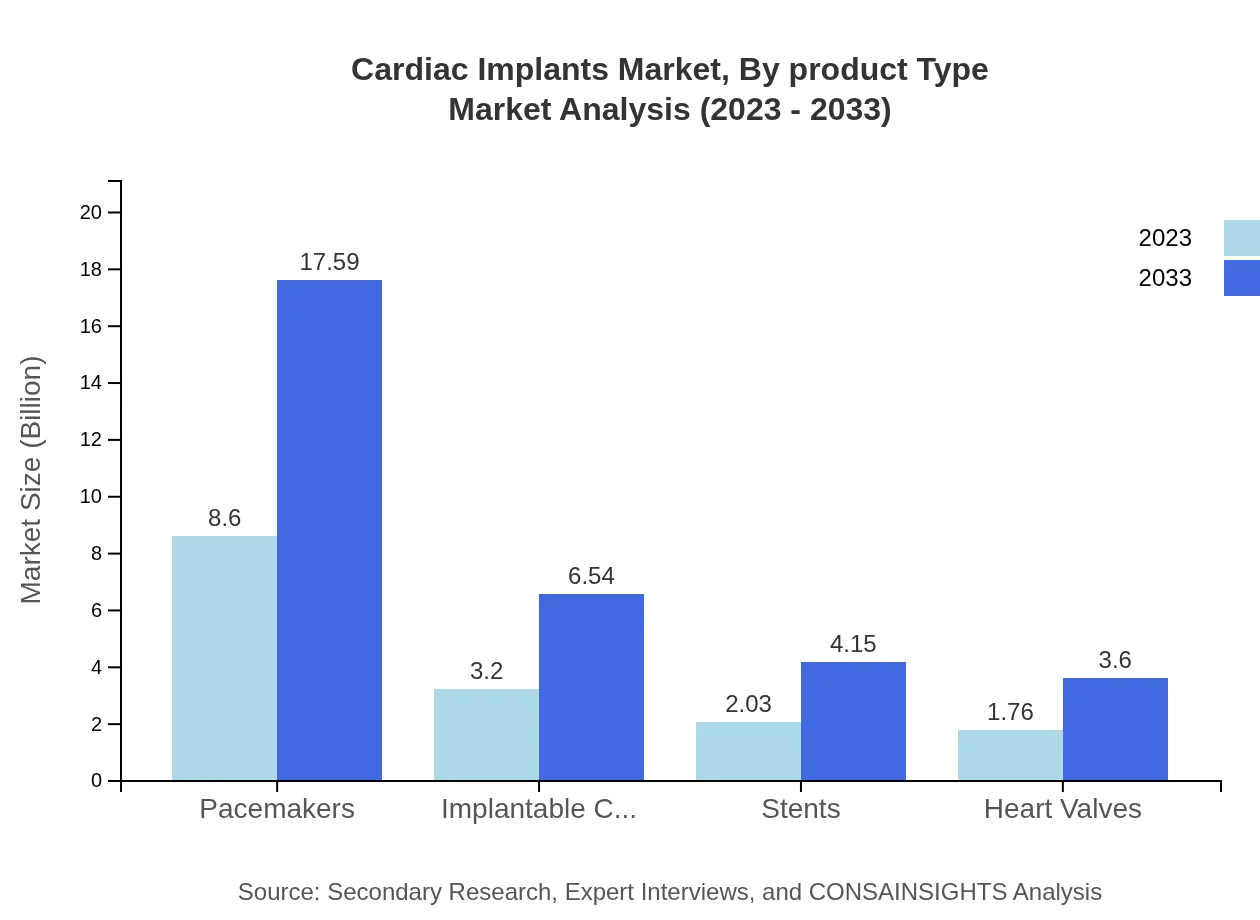

Cardiac Implants Market Analysis By Product Type

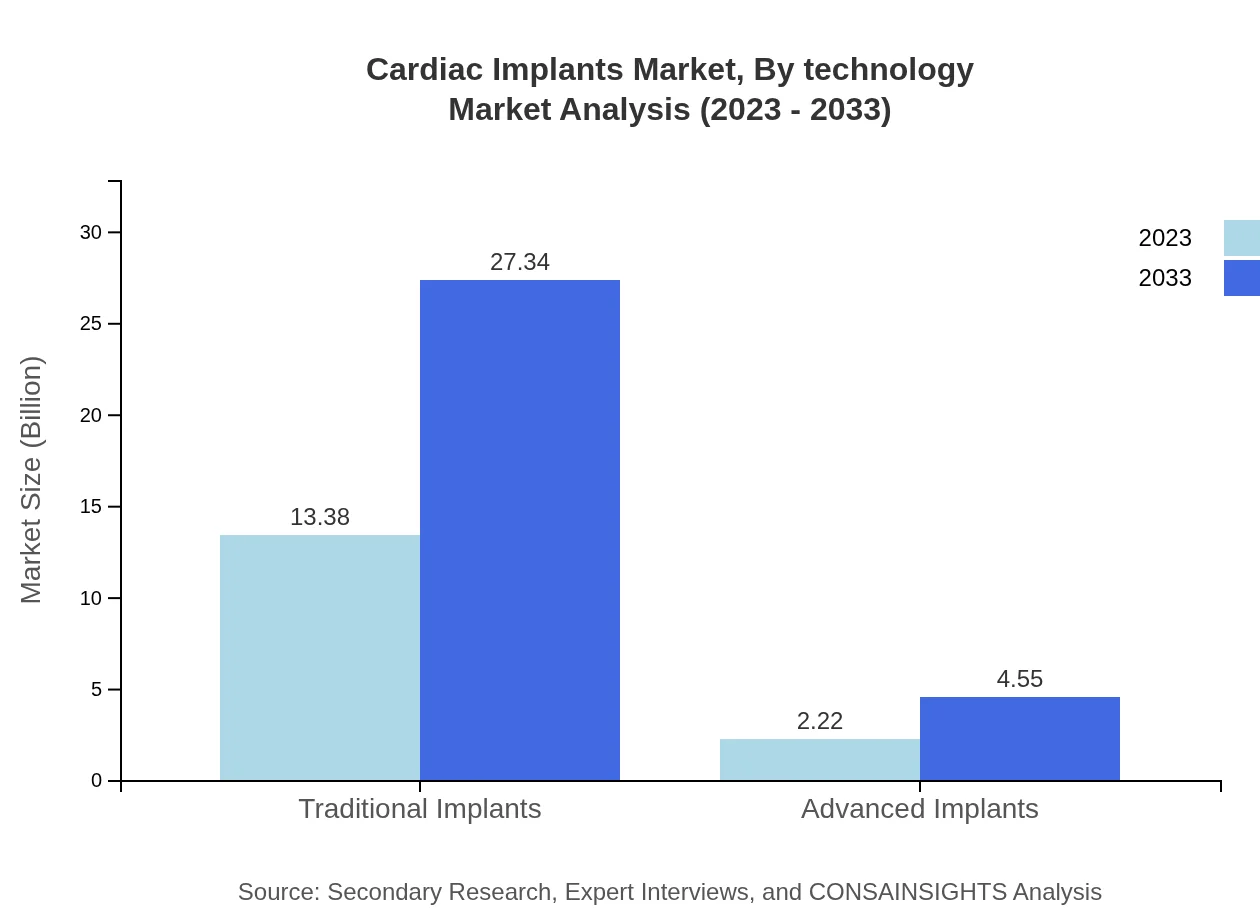

The market exhibits robust growth across various product types: Traditional implants dominate the market, accounting for $13.38 billion, expected to grow to $27.34 billion. Advanced implants are also gaining attention, increasing from $2.22 billion to $4.55 billion by 2033. Pacemakers lead in share with 55.16% in 2023, followed closely by ICDs with 20.52%.

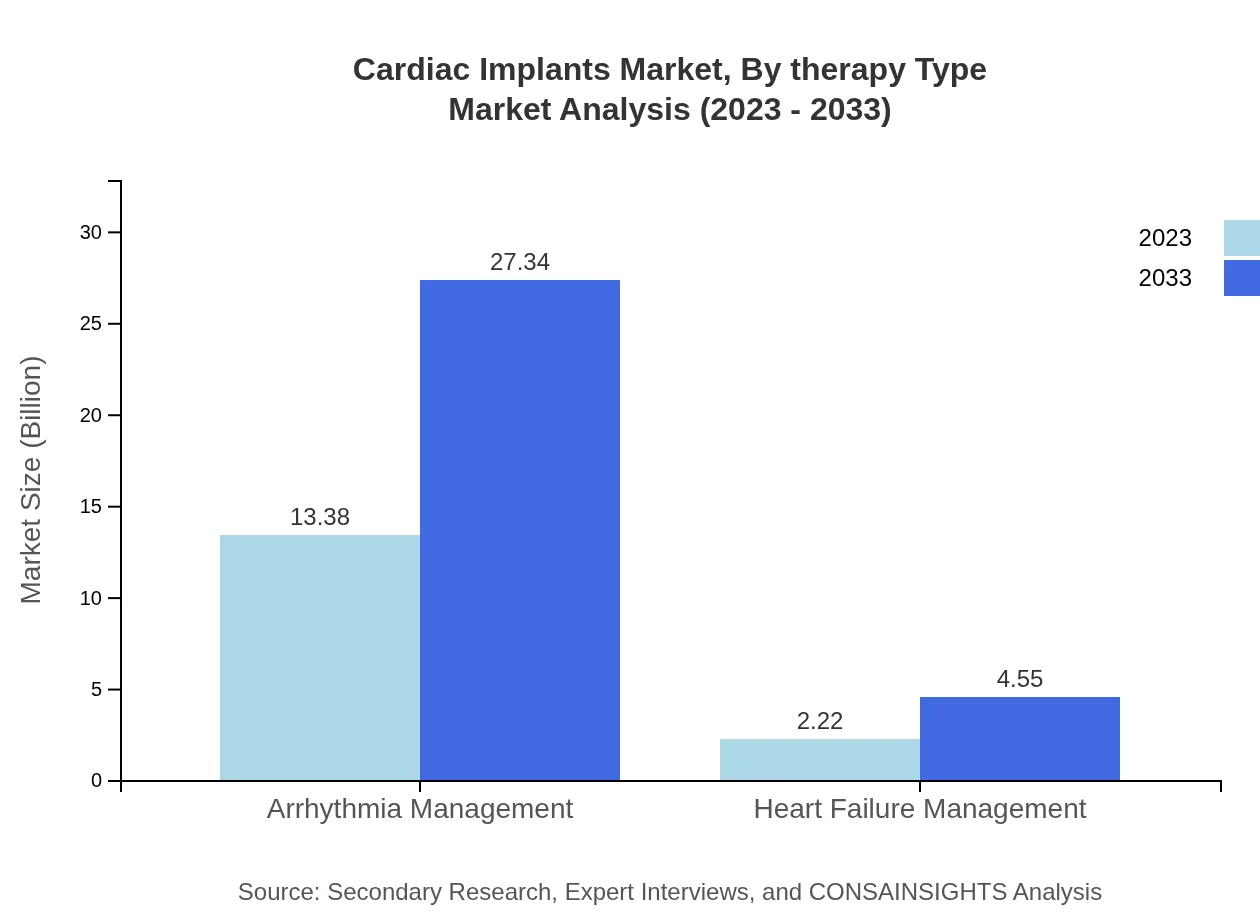

Cardiac Implants Market Analysis By Therapy Type

In terms of therapy type, arrhythmia management is a leading segment, commanding a significant share of 85.74% in 2023. This reflects the critical importance of rhythm stability in cardiac health management. Heart failure management also holds relevance, with expectations of growth from $2.22 billion to $4.55 billion through the forecast period.

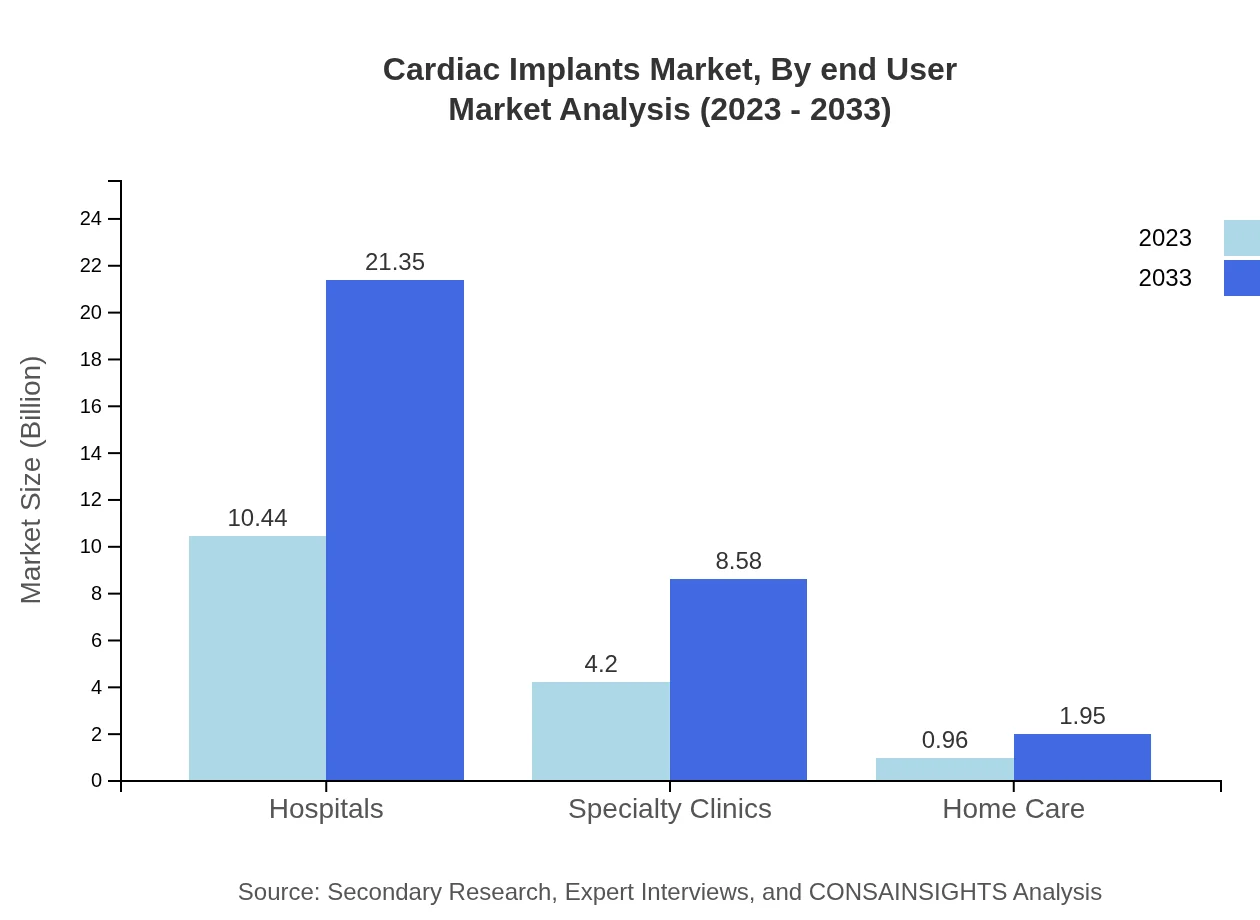

Cardiac Implants Market Analysis By End User

Hospitals remain the primary end-users of cardiac implants, holding a market share of 66.95% in 2023. Specialty clinics and home care segments are growing, indicating shifts towards outpatient services and patient-centered care.

Cardiac Implants Market Analysis By Technology

Technological advancements continue to shape the cardiac implants market, with innovations such as remote monitoring capabilities, minimally invasive procedures, and bioresorbable devices gaining traction. These technologies are enhancing the quality of care and patient compliance.

Cardiac Implants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiac Implants Industry

Medtronic :

A leader in the cardiac implants market, specializing in a range of devices from pacemakers to advanced heart failure management systems.Abbott Laboratories:

Known for its innovative devices, Abbott continues to advance in the field of cardiovascular care with cutting-edge technologies.Boston Scientific:

Offers a comprehensive portfolio of cardiac devices, focusing on minimally invasive therapeutic solutions.Johnson & Johnson (DePuy Synthes):

A major player in the market, providing various surgical solutions including stents and implantable devices.Edwards Lifesciences:

Specializes in heart valve technology and monitoring solutions, contributing to improved patient outcomes in cardiac care.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiac implants?

The cardiac implants market was valued at approximately $15.6 billion in 2023 and is projected to grow at a CAGR of 7.2% to reach substantial growth by 2033.

What are the key market players or companies in the cardiac implants industry?

Key players in the cardiac implants industry include Medtronic, Abbott Laboratories, Boston Scientific, Johnson & Johnson, Biotronik, and St. Jude Medical. These companies are significant contributors to technological innovations and market expansions.

What are the primary factors driving the growth in the cardiac implants industry?

Growth in the cardiac implants market is stimulated by an increasing aging population, rising prevalence of cardiovascular diseases, advancements in implant technologies, and a surge in healthcare expenditure directed towards cardiac care.

Which region is the fastest Growing in the cardiac implants market?

The Asia-Pacific region is predicted to be the fastest-growing segment within the cardiac implants market, expanding from $2.86 billion in 2023 to approximately $5.85 billion by 2033, fueled by improving healthcare infrastructure.

Does ConsaInsights provide customized market report data for the cardiac implants industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the cardiac implants industry, ensuring clients receive insights that align with their unique research objectives and market interests.

What deliverables can I expect from this cardiac implants market research project?

Deliverables from the cardiac implants market research will typically include comprehensive market analysis reports, segmentation data, growth forecasts, competitive landscape evaluations, and actionable insights for strategic planning.

What are the market trends of cardiac implants?

Current trends in the cardiac implants market include a shift towards minimally invasive surgeries, increased adoption of remote monitoring technologies, rising demand for advanced implants, and a focus on integrated healthcare solutions.