Cardiac Mapping Market Report

Published Date: 31 January 2026 | Report Code: cardiac-mapping

Cardiac Mapping Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the global Cardiac Mapping market from 2023 to 2033, highlighting insights such as market trends, size, growth forecasts, and regional dynamics that influence the industry landscape.

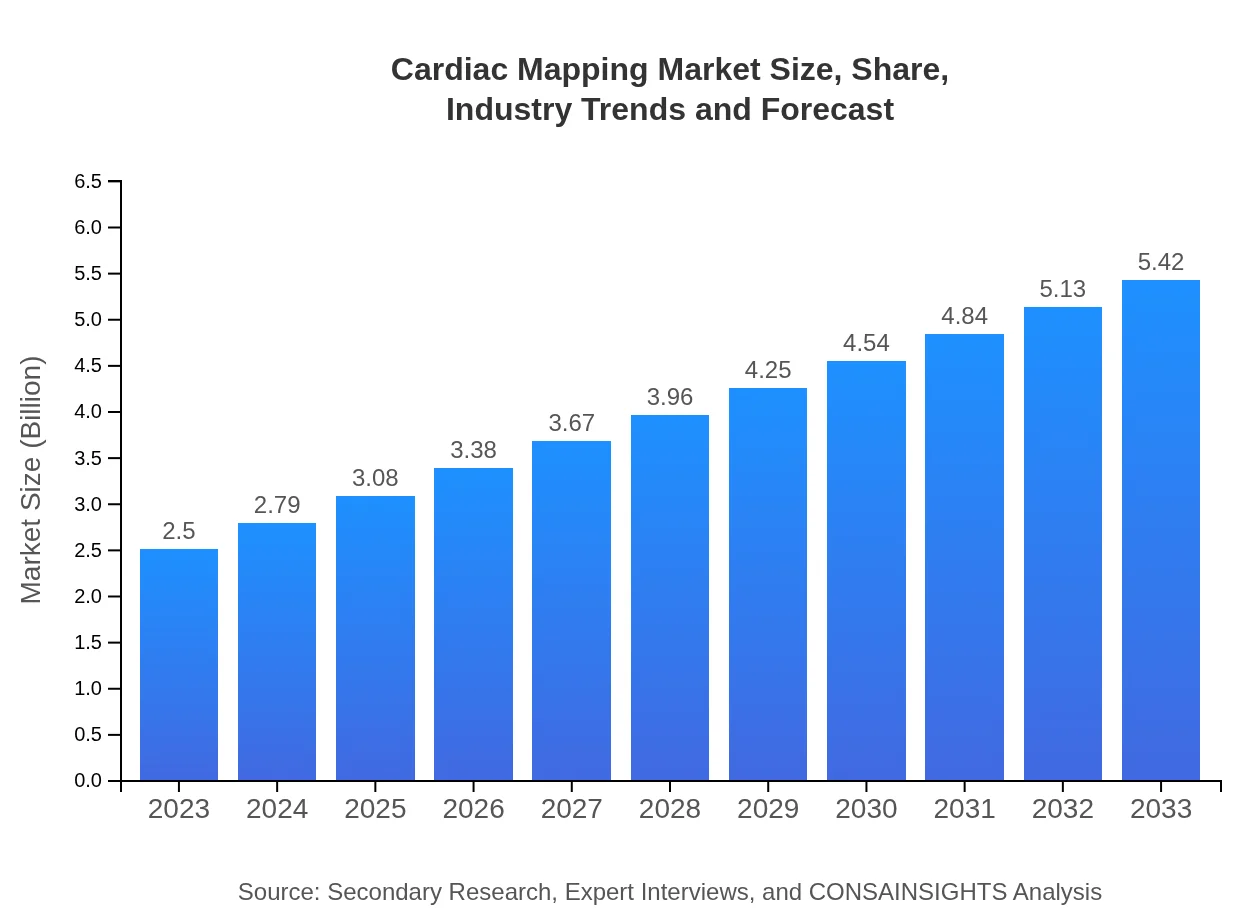

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Abbott Laboratories, Biosense Webster (Johnson & Johnson), Medtronic , Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Cardiac Mapping Market Overview

Customize Cardiac Mapping Market Report market research report

- ✔ Get in-depth analysis of Cardiac Mapping market size, growth, and forecasts.

- ✔ Understand Cardiac Mapping's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiac Mapping

What is the Market Size & CAGR of the Cardiac Mapping market in 2023?

Cardiac Mapping Industry Analysis

Cardiac Mapping Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiac Mapping Market Analysis Report by Region

Europe Cardiac Mapping Market Report:

The European market is projected to grow from $0.81 billion in 2023 to $1.75 billion by 2033. Key factors include government initiatives promoting cardiovascular health and the presence of major healthcare providers and research institutions driving innovation in cardiac mapping technologies.Asia Pacific Cardiac Mapping Market Report:

In 2023, the Asia Pacific Cardiac Mapping market is valued at $0.44 billion, projected to grow to $0.95 billion by 2033. The growth is driven by increasing investments in healthcare infrastructure and technological advancements in countries like China and India. Rising awareness around heart health and the prevalence of cardiovascular diseases further augment this growth.North America Cardiac Mapping Market Report:

In North America, the Cardiac Mapping market is valued at $0.94 billion in 2023, expected to reach $2.03 billion by 2033. The market here is driven by the high prevalence of cardiac disorders, technological innovations, and established healthcare systems that support advanced treatment procedures.South America Cardiac Mapping Market Report:

The South American Cardiac Mapping market is currently valued at -$0.01 billion, indicating potential market challenges and limited developments. However, forecasts project a minor decline to -$0.02 billion by 2033 due to economic factors and resource constraints in the region.Middle East & Africa Cardiac Mapping Market Report:

In the Middle East and Africa, the market stands at $0.33 billion in 2023, with expectations to grow to $0.71 billion by 2033. Increasing healthcare expenditure and awareness regarding cardiovascular diseases in urban areas are significant growth propellers.Tell us your focus area and get a customized research report.

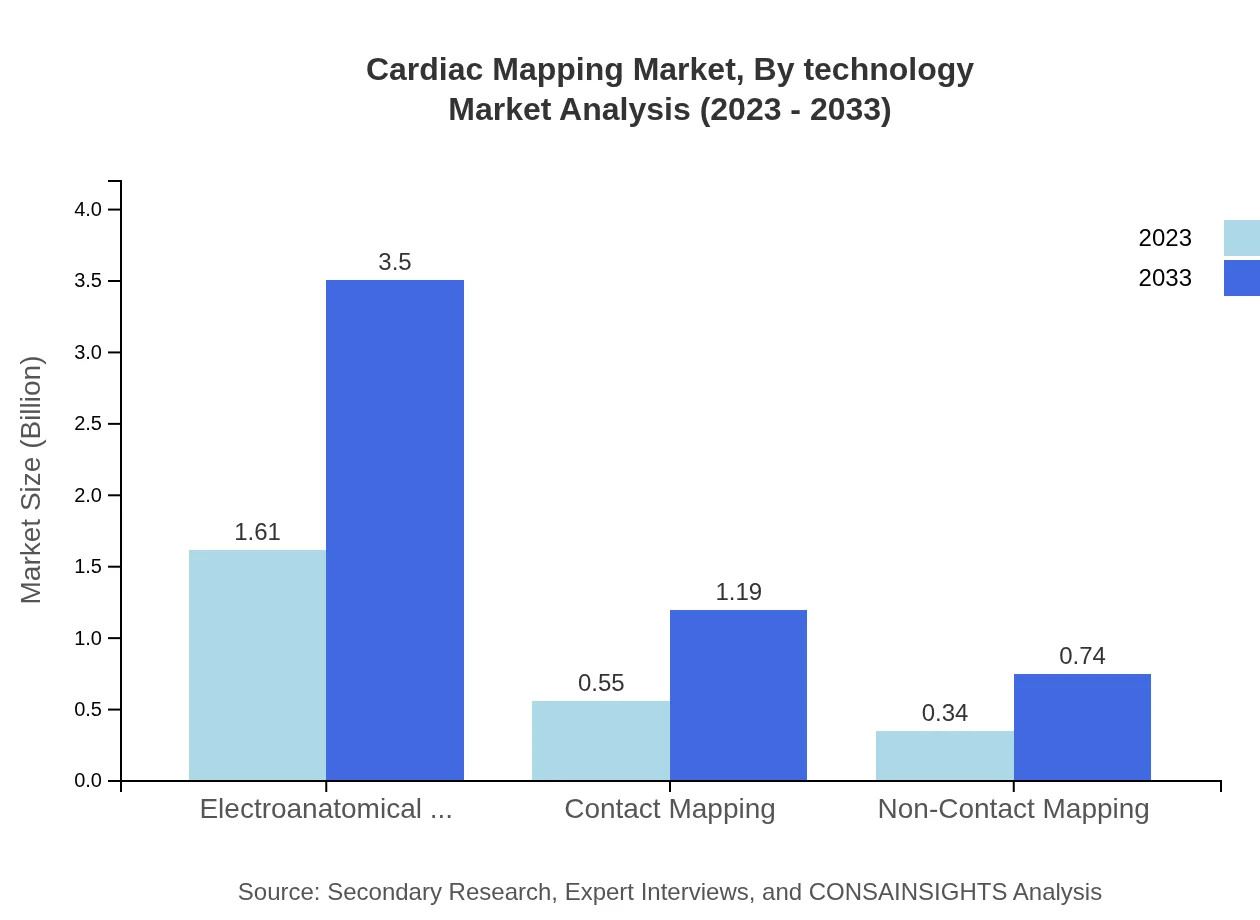

Cardiac Mapping Market Analysis By Technology

The Cardiac Mapping market by technology consists of electroanatomical mapping, contact mapping, and non-contact mapping. As of 2023, electroanatomical mapping dominates the market with a size of $1.61 billion, anticipated to reach $3.50 billion by 2033. Contact mapping, valued at $0.55 billion currently, is expected to grow similarly, indicating its 21.92% market share across ten years.

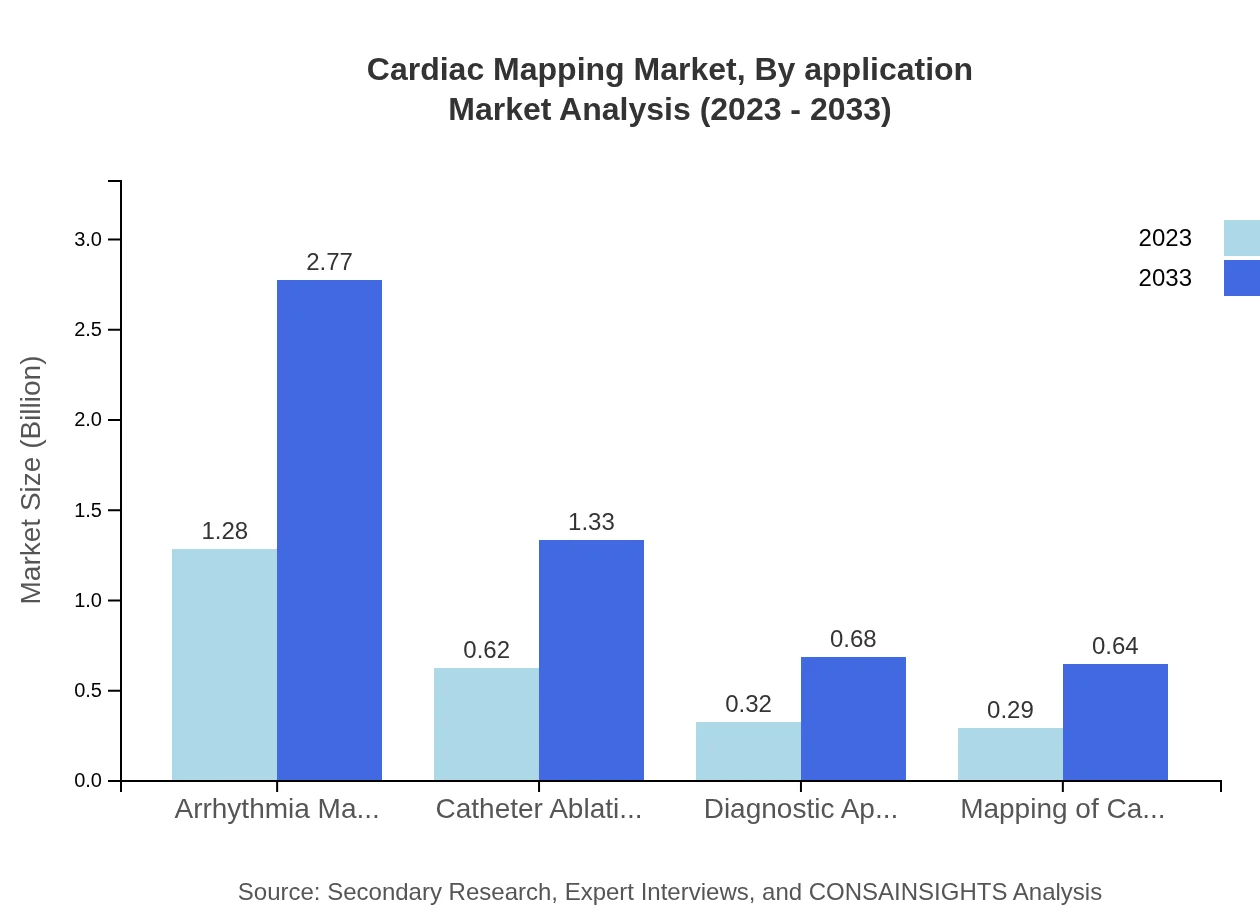

Cardiac Mapping Market Analysis By Application

Within applications, interventional procedures hold a sizable market share of 64.49% in 2023, with further projections indicating significant growth. Diagnostic evaluations account for 21.92% of 2023's market share, expected to increase steadily. With growing clinical needs, the focus on follow-up care applications is also likely to see growth.

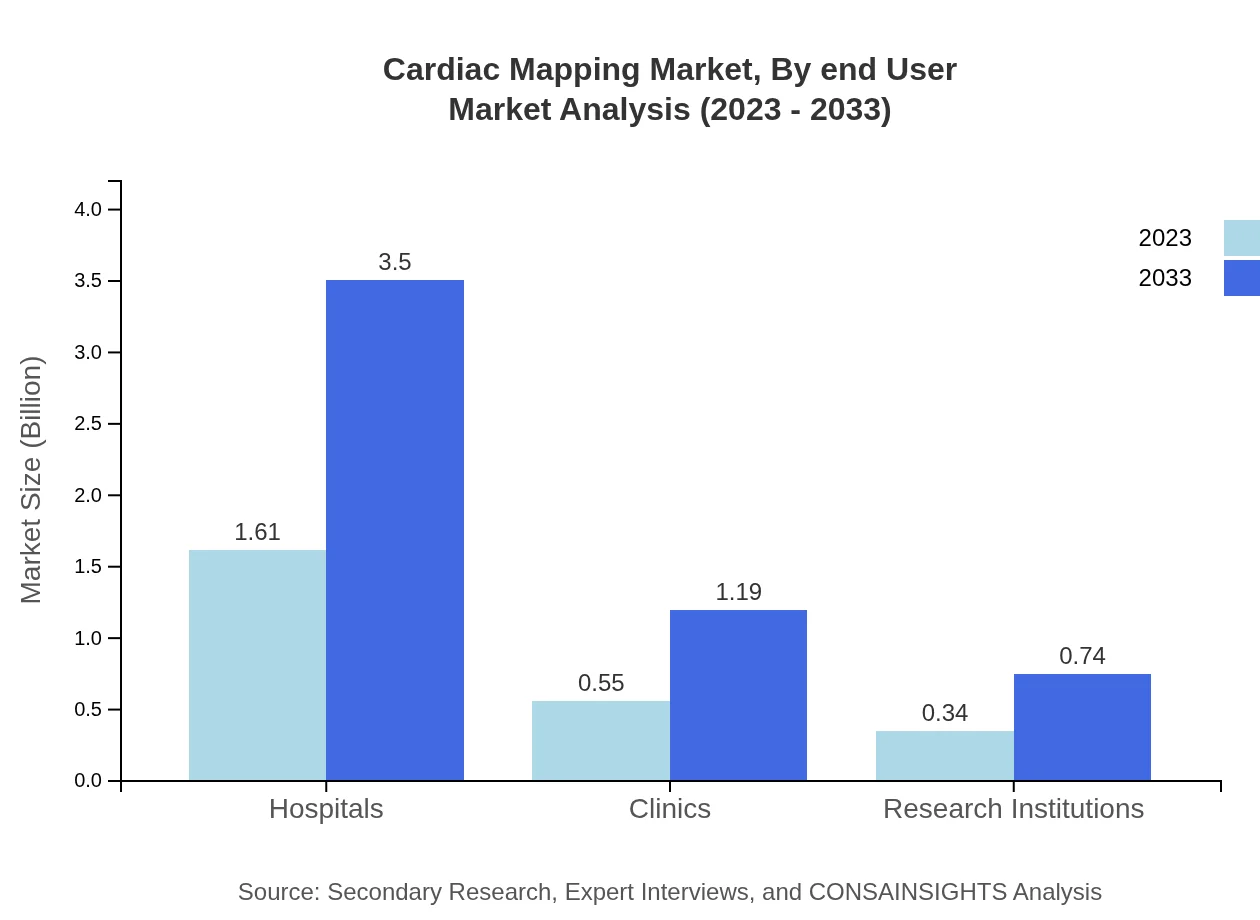

Cardiac Mapping Market Analysis By End User

The Cardiac Mapping market is primarily segmented by end-user into hospitals, clinics, and research institutions. Hospitals account for a significant share of 64.49%, while clinics hold 21.92%. Research institutions, although smaller, provide critical data for innovation in this field, holding a 13.59% share.

Cardiac Mapping Market Analysis By Product Type

This segment showcases a diverse array of products including mapping catheters, mapping systems, and software. Mapping catheters currently dominate with 64.49% market share, valued at $1.61 billion in 2023. Mapping systems and software follow closely with growth anticipated due to advancing healthcare requirements.

Cardiac Mapping Market Analysis By End Use

The end-use segment emphasizes key utilization areas of cardiac mapping technologies. Cardiac mapping systems facilitate both diagnostic and therapeutic applications, significantly improving patient care outcomes across varied healthcare environments.

Cardiac Mapping Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Cardiac Mapping Industry

Abbott Laboratories:

A leader in medical technology and innovation, Abbott provides a range of cardiac mapping technologies, enhancing patient care through its advanced diagnostic and therapeutic solutions.Biosense Webster (Johnson & Johnson):

Noteworthy for its cutting-edge electroanatomical mapping systems, which play a key role in the catheter ablation procedures for cardiac arrhythmias.Medtronic :

Medtronic is a giant in healthcare technology, known for its development of various cardiac mapping and monitoring devices that improve patient outcomes.Siemens Healthineers:

Recognized for innovative medical technologies, Siemens provides integrated solutions for cardiac mapping, playing a crucial role in enhancing diagnostic capability.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiac mapping?

The global cardiac mapping market size is estimated at approximately $2.5 billion as of 2023, with an expected compound annual growth rate (CAGR) of 7.8%. This growth reflects advancing technologies and the rising demand for cardiac care solutions.

What are the key market players or companies in the cardiac mapping industry?

Key players in the cardiac mapping market include companies like Biosense Webster (Johnson & Johnson), Abbott Laboratories, Medtronic, Siemens Healthineers, and GE Healthcare. These firms lead through innovative solutions and extensive research development.

What are the primary factors driving the growth in the cardiac mapping industry?

Growth in the cardiac mapping industry is mainly driven by the increasing prevalence of cardiac diseases, technological advancements in mapping systems, growing geriatric population, and the shift towards minimally invasive procedures, which enhances procedural outcomes.

Which region is the fastest Growing in the cardiac mapping market?

North America is the fastest-growing region in the cardiac mapping market, projected to expand from $0.94 billion in 2023 to $2.03 billion by 2033. This growth is fueled by a robust healthcare infrastructure and rising healthcare expenditure.

Does ConsInsights provide customized market report data for the cardiac mapping industry?

Yes, ConsInsights offers customized market reports tailored to specific needs in the cardiac mapping industry. These reports can address unique queries related to market trends, competition analysis, and sector-specific growth opportunities.

What deliverables can I expect from this cardiac mapping market research project?

Deliverables from the cardiac mapping market research project include comprehensive market analysis, segmentation insights, trend forecasts, competitive landscape assessments, and actionable recommendations tailored for strategic decision-making.

What are the market trends of cardiac mapping?

Emerging trends in the cardiac mapping market include a surge in advanced mapping technologies, increased collaboration among medical institutions, integration of Artificial Intelligence in diagnostics, and a focus on patient-centered care practices.