Cardiac Monitoring Cardiac Rhythm Management Market Report

Published Date: 31 January 2026 | Report Code: cardiac-monitoring-cardiac-rhythm-management

Cardiac Monitoring Cardiac Rhythm Management Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Cardiac Monitoring and Cardiac Rhythm Management market, providing insights on market size, growth forecasts from 2023 to 2033, and current trends. Key player analysis and regional breakdown are also included, offering a comprehensive view of this critical healthcare sector.

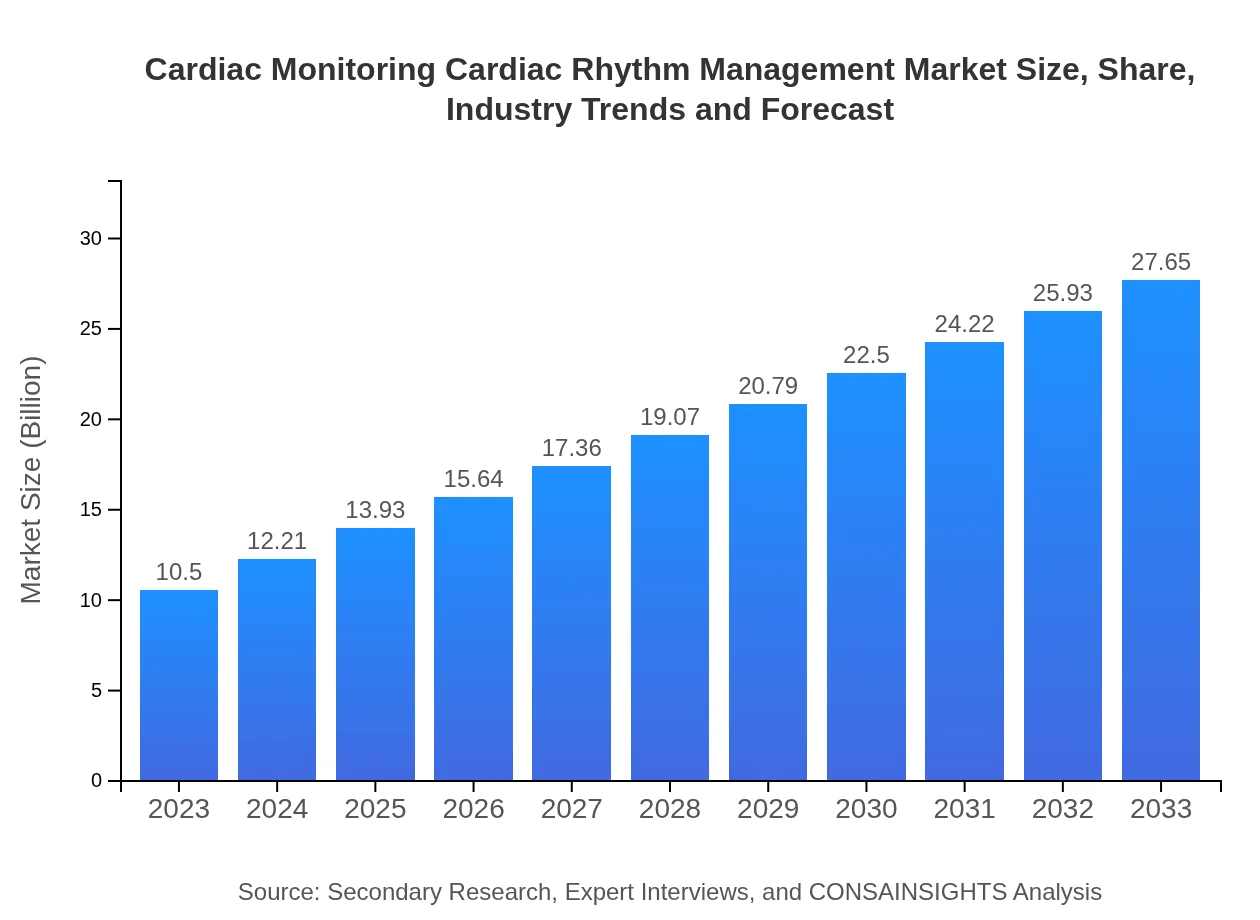

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $27.65 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Philips Healthcare, Boston Scientific |

| Last Modified Date | 31 January 2026 |

Cardiac Monitoring Cardiac Rhythm Management Market Overview

Customize Cardiac Monitoring Cardiac Rhythm Management Market Report market research report

- ✔ Get in-depth analysis of Cardiac Monitoring Cardiac Rhythm Management market size, growth, and forecasts.

- ✔ Understand Cardiac Monitoring Cardiac Rhythm Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiac Monitoring Cardiac Rhythm Management

What is the Market Size & CAGR of Cardiac Monitoring Cardiac Rhythm Management market in 2023?

Cardiac Monitoring Cardiac Rhythm Management Industry Analysis

Cardiac Monitoring Cardiac Rhythm Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiac Monitoring Cardiac Rhythm Management Market Analysis Report by Region

Europe Cardiac Monitoring Cardiac Rhythm Management Market Report:

Europe holds a substantial market share with growth projected from USD 3.35 billion in 2023 to USD 8.81 billion in 2033, bolstered by stringent regulations for cardiovascular disease management.Asia Pacific Cardiac Monitoring Cardiac Rhythm Management Market Report:

In the Asia Pacific region, the cardiac monitoring market is set to grow from USD 1.86 billion in 2023 to USD 4.89 billion by 2033, driven by increased health awareness and advancements in medical devices.North America Cardiac Monitoring Cardiac Rhythm Management Market Report:

In North America, the market is estimated to expand from USD 3.85 billion in 2023 to USD 10.14 billion by 2033, fueled by innovative technologies and high healthcare spending.South America Cardiac Monitoring Cardiac Rhythm Management Market Report:

South America is expected to experience a moderate growth from USD 0.13 billion to USD 0.35 billion from 2023 to 2033, with key focus on improving healthcare infrastructure.Middle East & Africa Cardiac Monitoring Cardiac Rhythm Management Market Report:

The Middle East and Africa market is forecast to reach USD 3.46 billion by 2033, growing from USD 1.31 billion in 2023, driven by increasing access to medical care in urban areas.Tell us your focus area and get a customized research report.

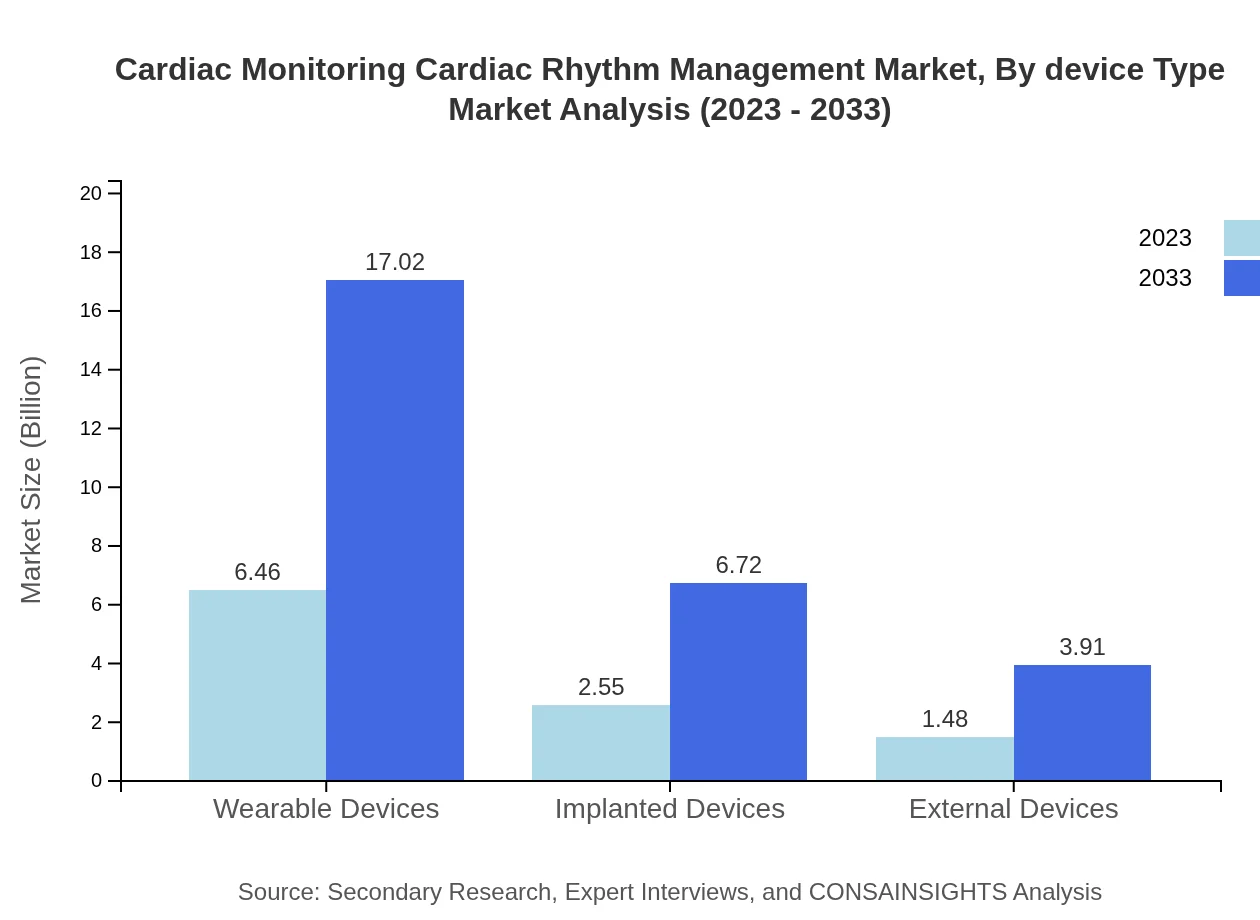

Cardiac Monitoring Cardiac Rhythm Management Market Analysis By Device Type

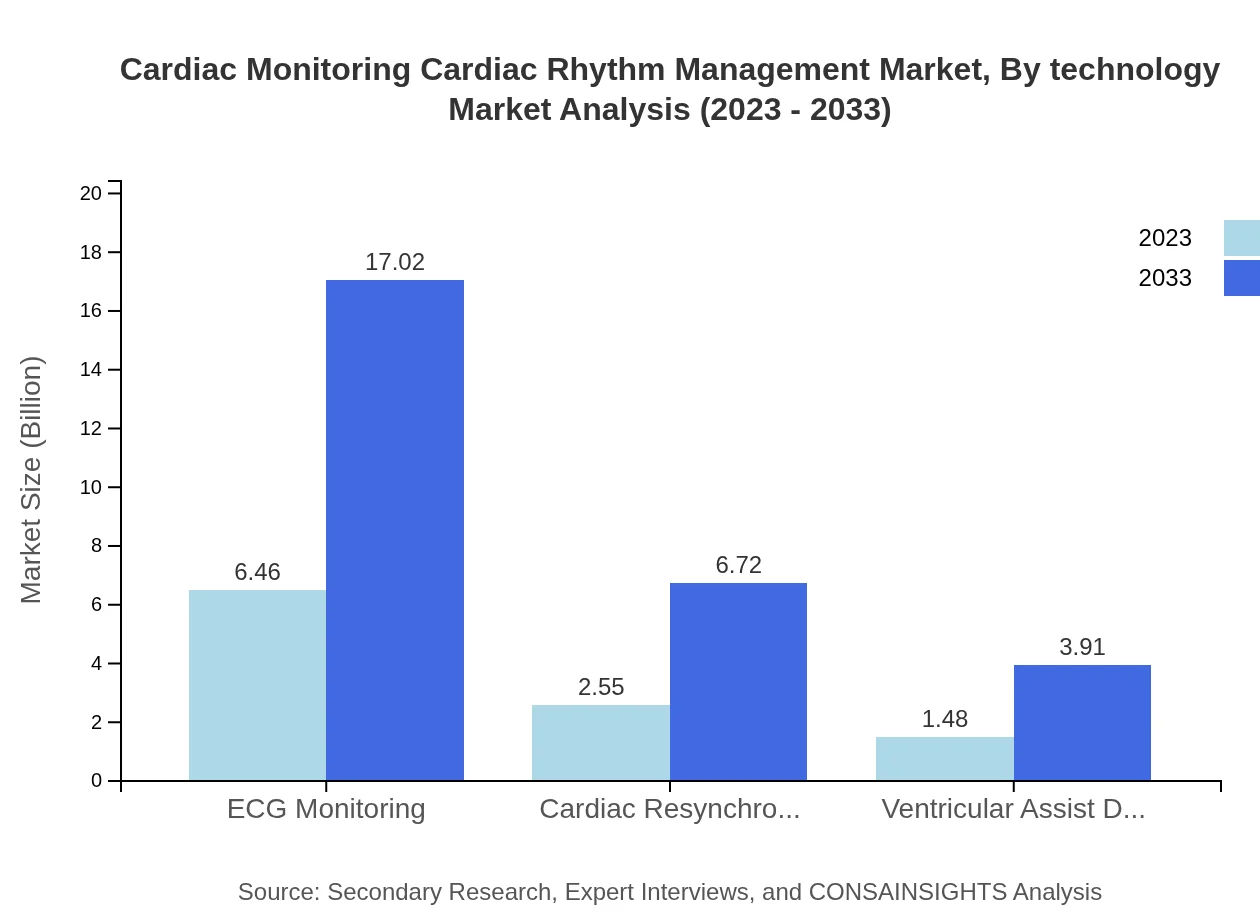

The Cardiac Monitoring Market is primarily segmented into ECG Monitoring, Cardiac Resynchronization Therapy, Ventricular Assist Devices, and other related devices. ECG Monitoring leads the segment with a market size of USD 6.46 billion in 2023, expected to rise to USD 17.02 billion by 2033, capturing 61.56% of the total market share throughout this period.

Cardiac Monitoring Cardiac Rhythm Management Market Analysis By Technology

Technologically, the market is influenced by advancements in wearable devices, implantable devices, and external monitoring systems. Wearable monitoring devices will grow significantly from USD 6.46 billion in 2023 to USD 17.02 billion by 2033, as technology improves and user convenience increases.

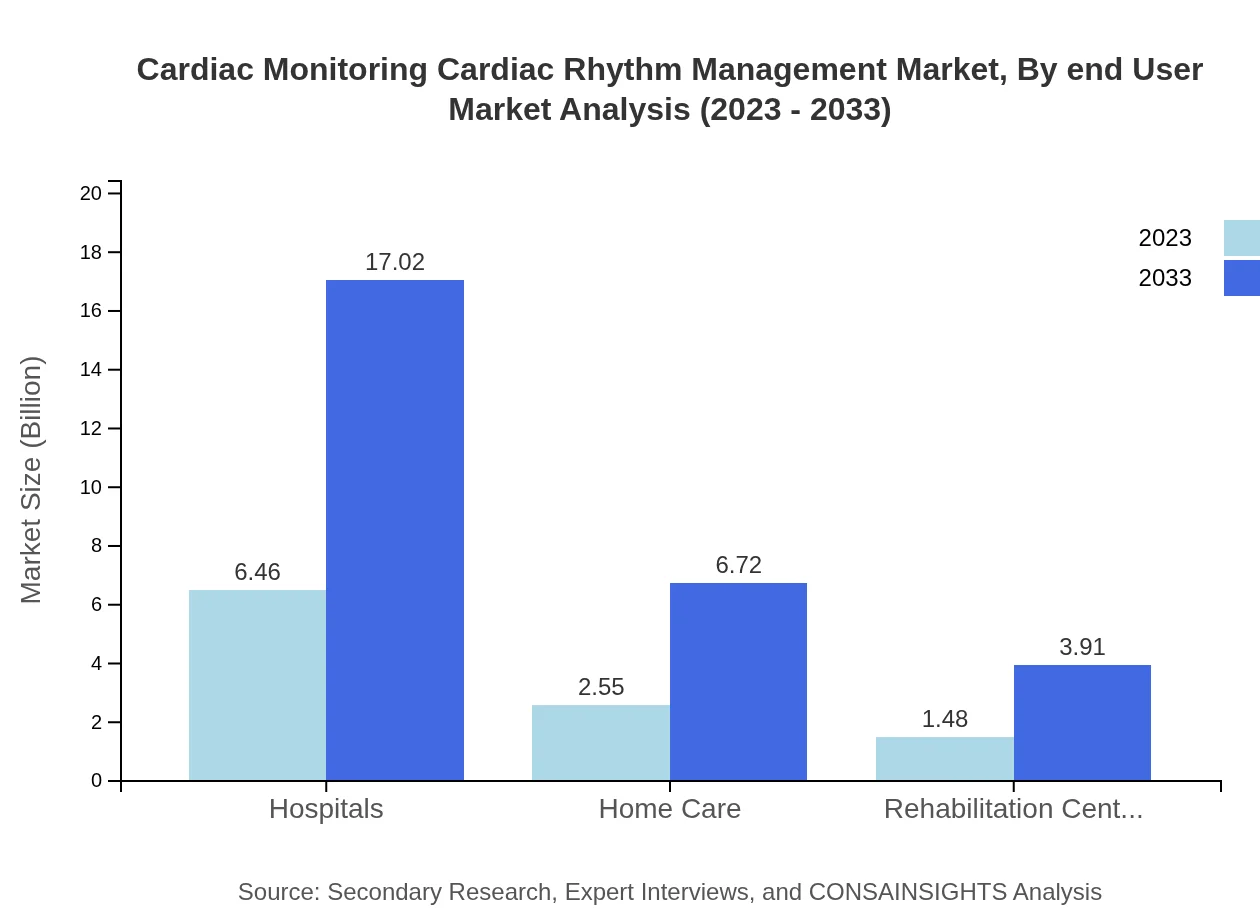

Cardiac Monitoring Cardiac Rhythm Management Market Analysis By End User

The market can be segmented into Hospitals, Home Care, and Rehabilitation Centers, with hospitals leading at USD 6.46 billion in 2023 and expected to reach USD 17.02 billion by 2033, maintaining a substantial market share of 61.56%.

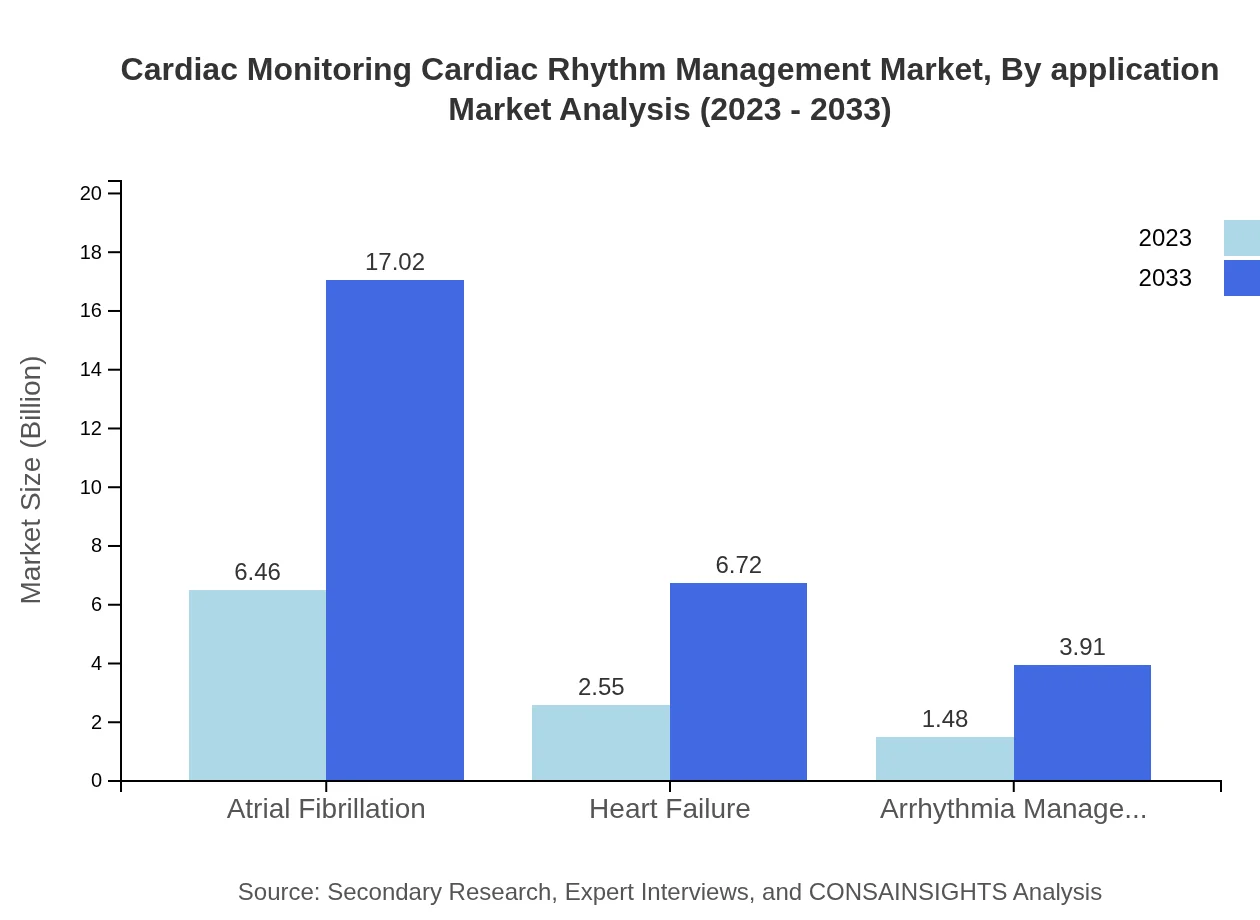

Cardiac Monitoring Cardiac Rhythm Management Market Analysis By Application

Key applications include Atrial Fibrillation Management, Heart Failure, and Arrhythmia Management. Atrial Fibrillation holds a significant market segment with a valuation of USD 6.46 billion in 2023, projected to double in size by 2033, showcasing the critical need for effective rhythm management solutions.

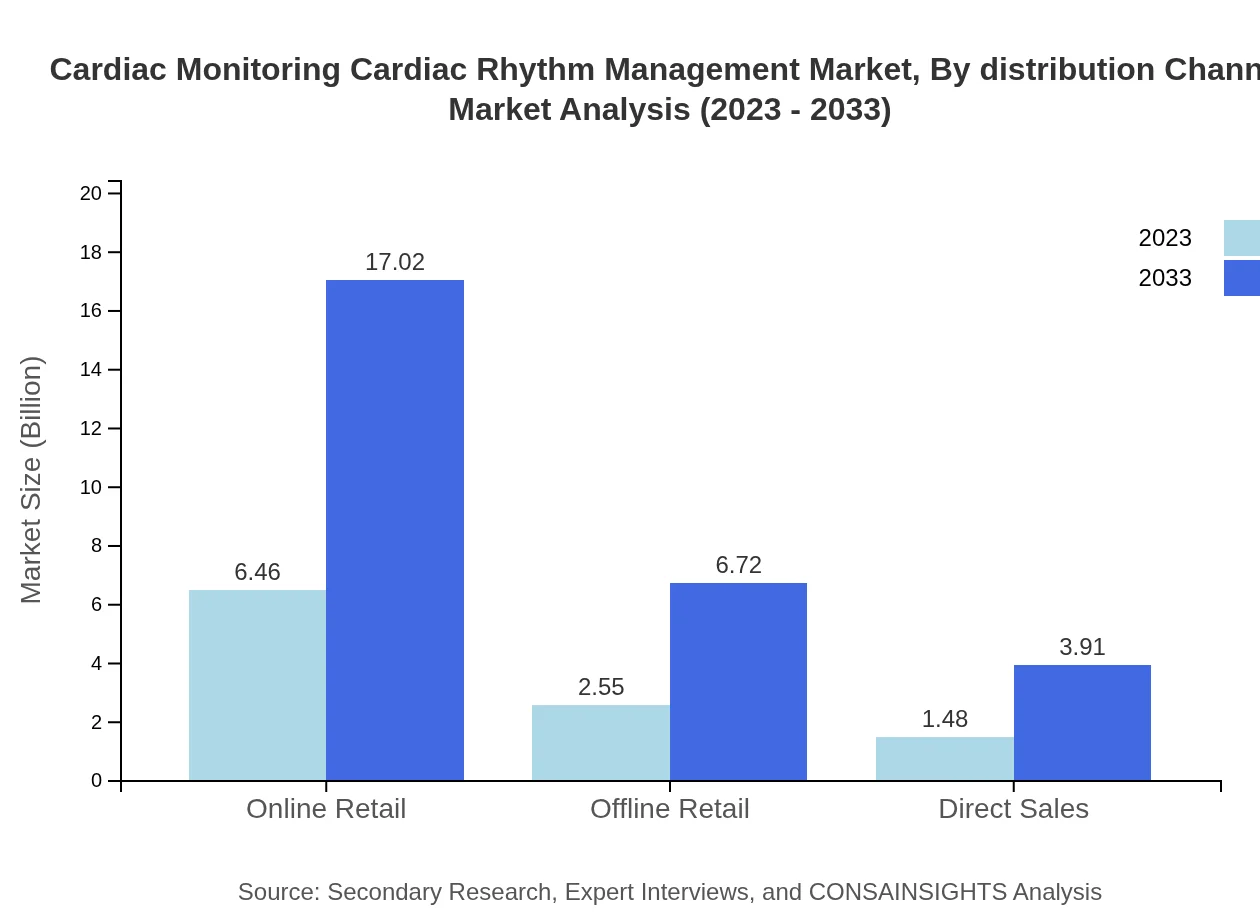

Cardiac Monitoring Cardiac Rhythm Management Market Analysis By Distribution Channel

Distribution channels include Online Retail, Offline Retail, and Direct Sales. Online retail is anticipated to grow from USD 6.46 billion in 2023 to USD 17.02 billion by 2033, emphasizing the trend towards e-commerce in healthcare.

Cardiac Monitoring Cardiac Rhythm Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiac Monitoring Cardiac Rhythm Management Industry

Medtronic :

Medtronic is a global leader in medical technology, providing innovative solutions in cardiac monitoring and rhythm management devices. Their extensive product portfolio includes a variety of implantable devices and management software.Abbott Laboratories:

Abbott is a key player in the cardiac space, focusing on advanced technologies for heart monitoring, including implantable cardiac devices and cardiac rhythm management solutions. Their commitment to innovation has driven significant market presence.Philips Healthcare:

Philips is recognized for its comprehensive range of cardiac monitoring solutions, from diagnostic imaging to patient monitoring technologies. Their emphasis on integrated healthcare solutions positions them as a frontrunner in the industry.Boston Scientific:

Boston Scientific specializes in less invasive medical solutions, including devices for cardiac rhythm management and advanced monitoring technologies. Their innovative approach addresses the evolving needs of patients with heart conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiac Monitoring Cardiac Rhythm Management?

The global market size for cardiac monitoring and cardiac rhythm management is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 9.8% from its current valuation.

What are the key market players or companies in this cardiac Monitoring Cardiac Rhythm Management industry?

Key players in the cardiac monitoring and rhythm management industry include leading medical technology companies such as Medtronic, Abbott Laboratories, and Boston Scientific, which focus on developing innovative cardiac devices and monitoring solutions.

What are the primary factors driving the growth in the cardiac Monitoring Cardiac Rhythm Management industry?

The growth in this industry is driven by rising prevalence of cardiac diseases, advancements in wearable technology, and increased public awareness of cardiovascular health, along with improved healthcare expenditure.

Which region is the fastest Growing in the cardiac Monitoring Cardiac Rhythm Management?

The Asia Pacific region is emerging as the fastest-growing market, with projections showing an increase from $1.86 billion in 2023 to $4.89 billion by 2033, driven by a growing population and rising healthcare investments.

Does ConsaInsights provide customized market report data for the cardiac Monitoring Cardiac Rhythm Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, which can help clients focus on niche areas within the cardiac monitoring and rhythm management industry for targeted insights.

What deliverables can I expect from this cardiac Monitoring Cardiac Rhythm Management market research project?

Deliverables from this market research project include comprehensive market reports, detailed trend analysis, competitive landscape evaluations, segmentation insights, and forecasts for growth through 2033.

What are the market trends of cardiac Monitoring Cardiac Rhythm Management?

Current trends in the cardiac monitoring and rhythm management market include the increasing adoption of remote patient monitoring technologies, a shift toward home healthcare, and advancements in implantable devices and wearable health technologies.