Cardiac Pacemakers Market Report

Published Date: 31 January 2026 | Report Code: cardiac-pacemakers

Cardiac Pacemakers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the cardiac pacemakers market, covering essential trends, market size, forecasts from 2023 to 2033, and insights into regional dynamics and key players within the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

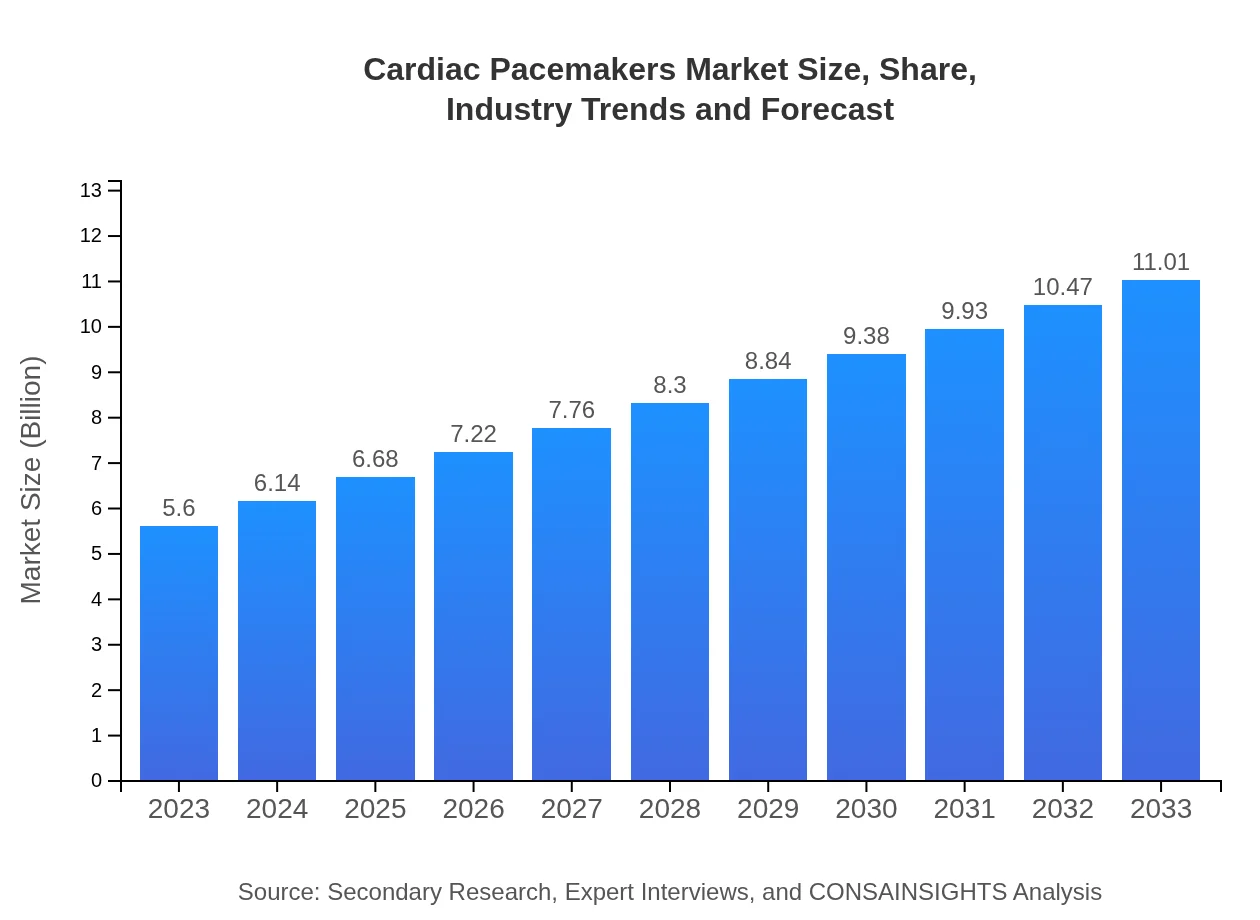

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Boston Scientific, BIOTRONIK, St. Jude Medical |

| Last Modified Date | 31 January 2026 |

Cardiac Pacemakers Market Overview

Customize Cardiac Pacemakers Market Report market research report

- ✔ Get in-depth analysis of Cardiac Pacemakers market size, growth, and forecasts.

- ✔ Understand Cardiac Pacemakers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiac Pacemakers

What is the Market Size & CAGR of Cardiac Pacemakers market in 2023?

Cardiac Pacemakers Industry Analysis

Cardiac Pacemakers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiac Pacemakers Market Analysis Report by Region

Europe Cardiac Pacemakers Market Report:

Europe's cardiac pacemakers market is forecasted to increase from USD 1.48 billion in 2023 to USD 2.90 billion by 2033, supported by an advanced healthcare system and increasing awareness about cardiac conditions.Asia Pacific Cardiac Pacemakers Market Report:

In the Asia Pacific region, the cardiac pacemakers market is projected to grow from USD 1.08 billion in 2023 to USD 2.13 billion by 2033, reflecting a significant rise driven by increasing healthcare expenditure and rising awareness about cardiac health.North America Cardiac Pacemakers Market Report:

North America, currently the largest market, is anticipated to grow from USD 2.15 billion in 2023 to USD 4.23 billion by 2033, fueled by high healthcare spending, advanced technology adoption, and a strong regulatory framework.South America Cardiac Pacemakers Market Report:

In South America, the market is expected to expand from USD 0.55 billion in 2023 to USD 1.09 billion by 2033, primarily due to an aging population and growing access to advanced medical technologies.Middle East & Africa Cardiac Pacemakers Market Report:

The Middle East and Africa region will likely see growth from USD 0.33 billion in 2023 to USD 0.66 billion by 2033, driven by improving healthcare infrastructure and rising disposable incomes.Tell us your focus area and get a customized research report.

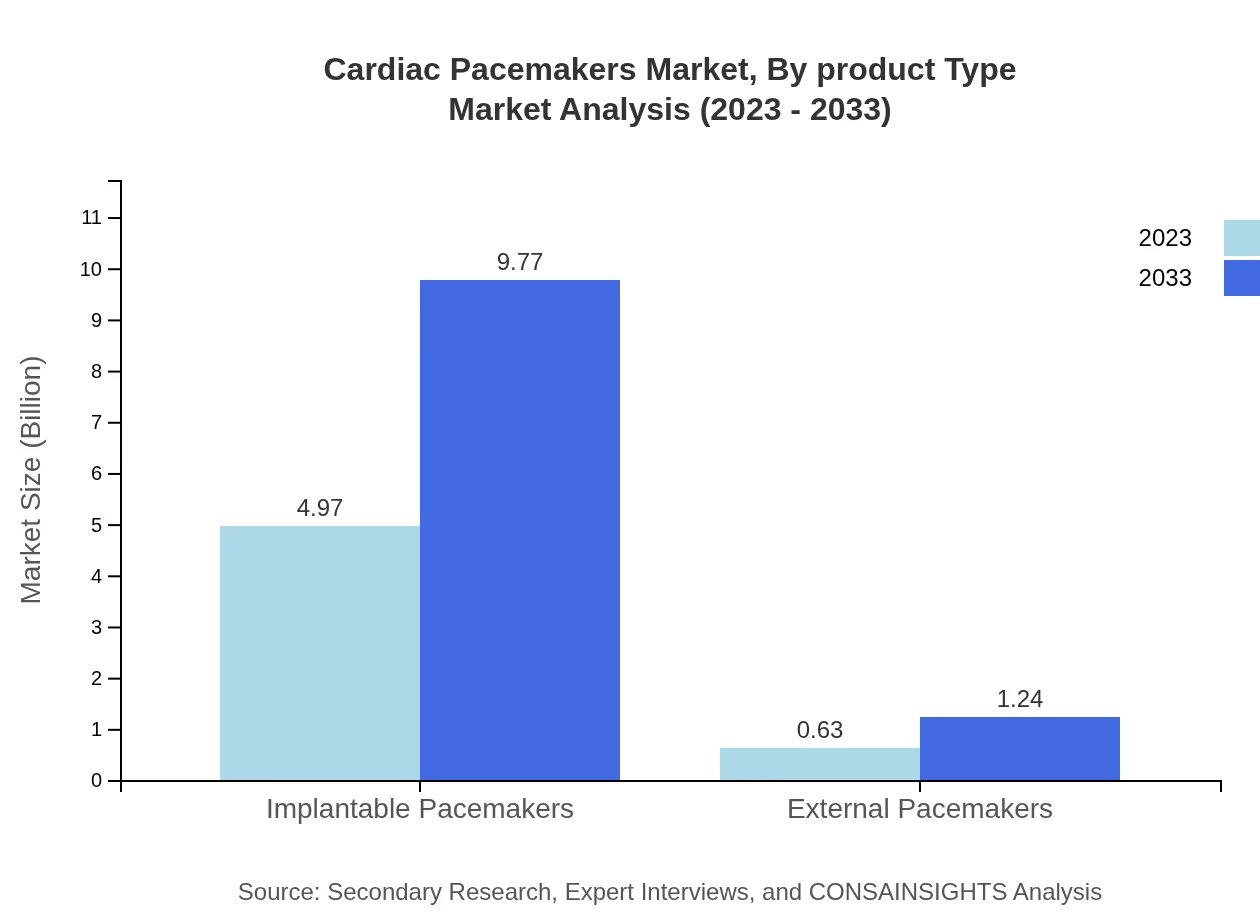

Cardiac Pacemakers Market Analysis By Product Type

The market for cardiac pacemakers is dominated by implantable devices, which accounted for approximately 88.76% share in 2023 and is projected to maintain this lead with a size of USD 9.77 billion by 2033. Conventional pacemakers, while still significant, are facing competition from smart and biophysical alternatives. These newer technologies address specific conditions such as heart failure and arrhythmias while enhancing patient comfort and monitoring.

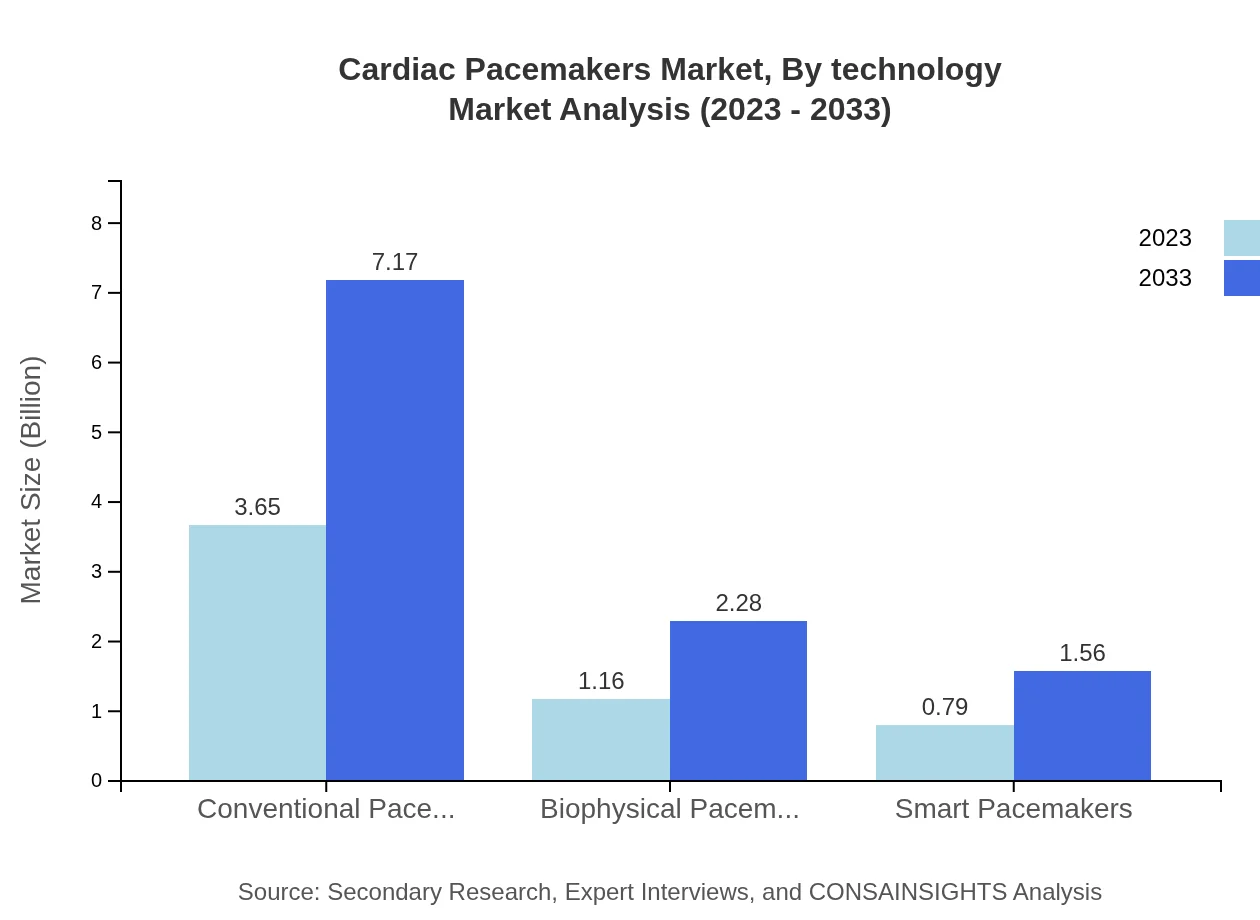

Cardiac Pacemakers Market Analysis By Technology

The technology segment reveals a competitive landscape between conventional pacemakers, which have sustained a presence in clinical practice, and the emerging biophysical and smart pacemakers that leverage connectivity features for real-time monitoring. The biophysical segment is expected to expand its market size from USD 1.16 billion in 2023 to USD 2.28 billion by 2033, showcasing the shift towards personalized medicine in cardiac care.

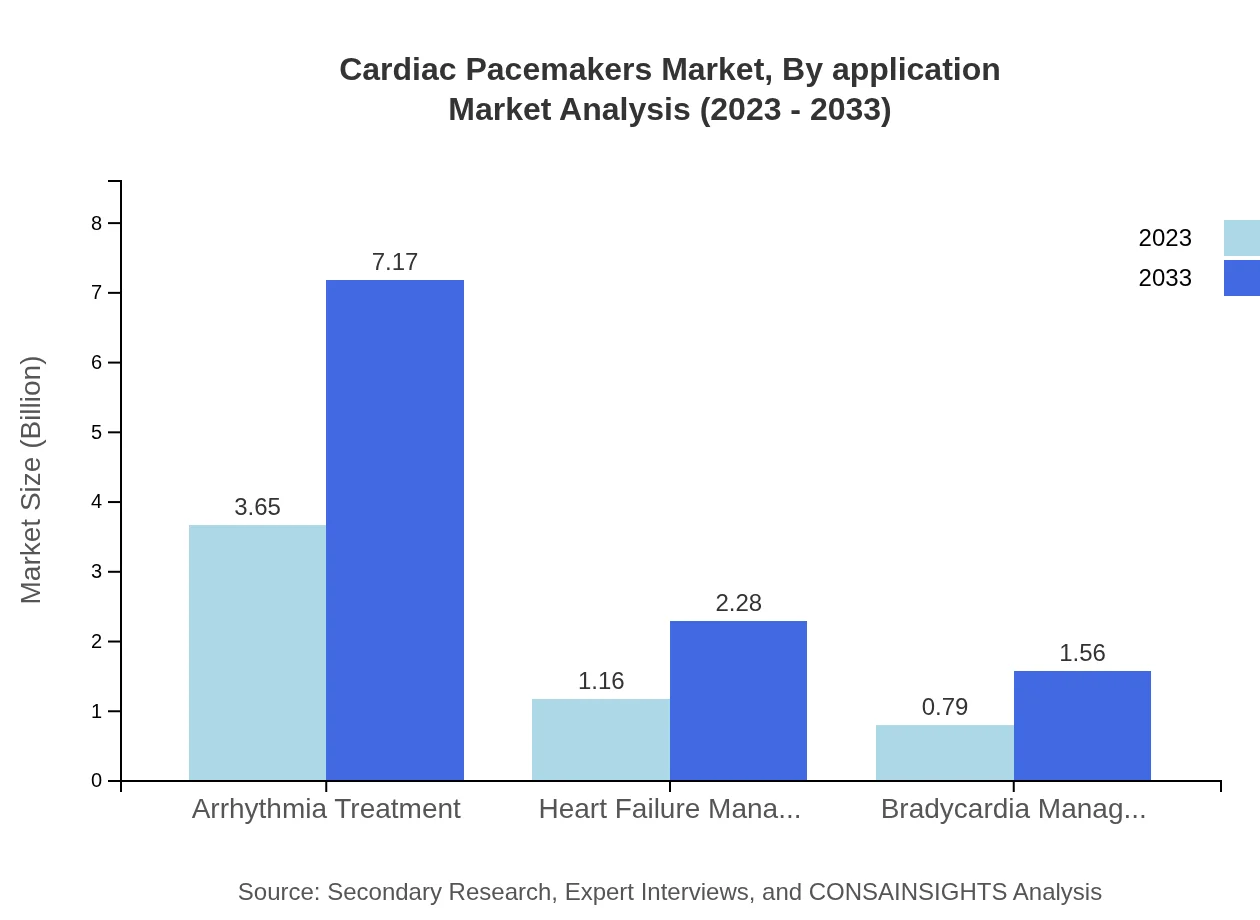

Cardiac Pacemakers Market Analysis By Application

The application segments show arrhythmia treatment holding a crucial share of the market (65.12% in 2023) and projected to sustain this figure over the next decade. Heart failure management and bradycardia management are also gaining traction, indicating a diversified need for cardiac assistance devices in various patient profiles.

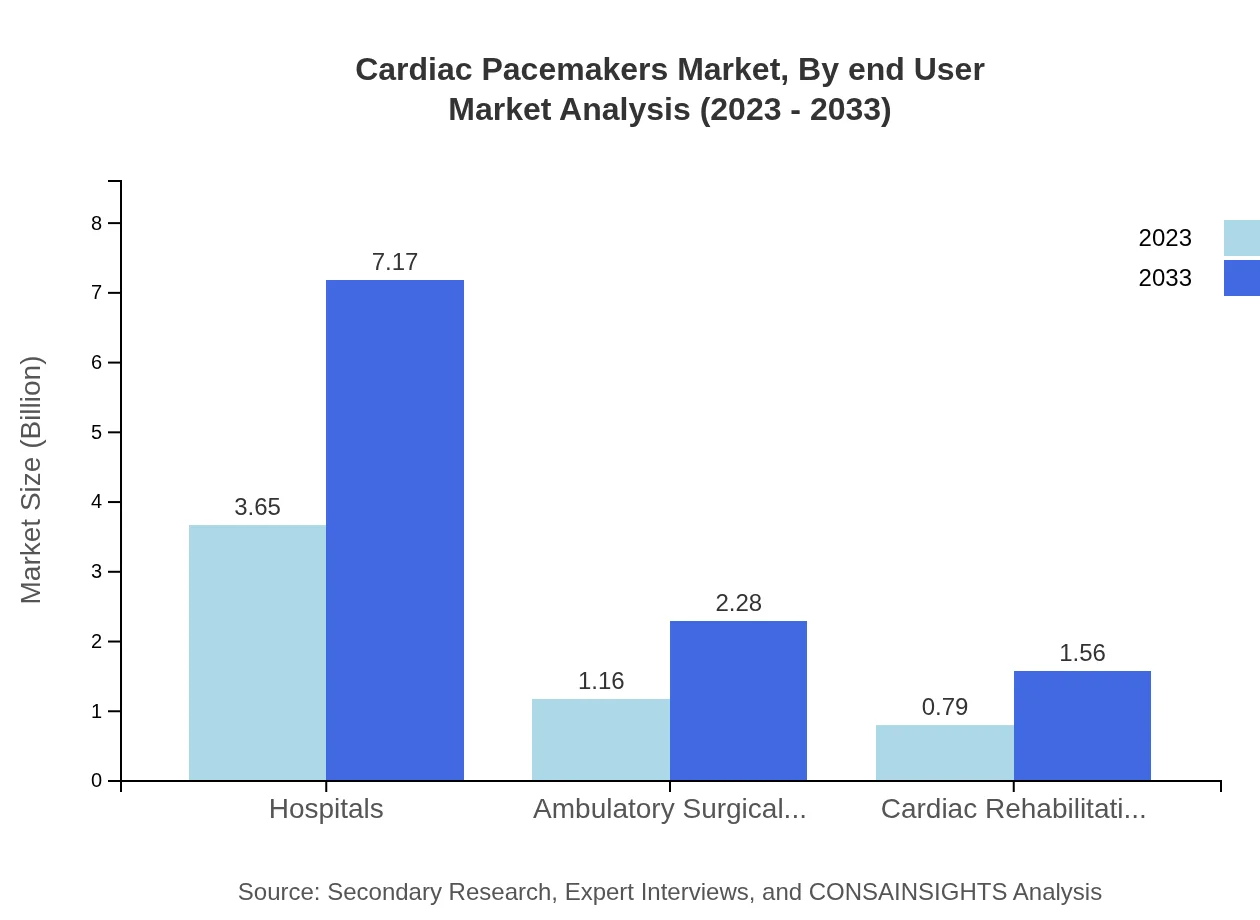

Cardiac Pacemakers Market Analysis By End User

End-user analysis reveals hospitals as the primary setting for pacemaker implantation, maintaining a significant market share. They accounted for approximately 65.12% of the overall market in 2023, expected to remain stable, while outpatient surgical centers are emerging as a viable alternative due to rising patient preference for less invasive procedures.

Cardiac Pacemakers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiac Pacemakers Industry

Medtronic :

A leader in medical technology, Medtronic offers a broad range of pacemakers, emphasizing innovation and patient-care solutions globally.Abbott Laboratories:

Abbott is well-known for developing advanced cardiac devices, including pacemakers that seamlessly integrate technology for improved patient outcomes.Boston Scientific:

Boston Scientific specializes in interventional medical solutions, providing innovative devices aimed at improving heart health.BIOTRONIK:

A global leader, BIOTRONIK is recognized for its pioneering efforts in pacemaker technology and remote monitoring solutions.St. Jude Medical:

Now part of Abbott, St. Jude Medical has a broad portfolio of advanced cardiac rhythm management devices including pacemakers that emphasize reliability and effectiveness in treatment.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiac Pacemakers?

The global cardiac pacemakers market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033. This growth reflects increasing adoption due to rising cardiovascular diseases and technological advancements in pacemaker devices.

What are the key market players or companies in the cardiac Pacemakers industry?

Key players in the cardiac pacemakers market include major companies such as Medtronic, Boston Scientific, Abbott Laboratories, Biotronik, and Sorin Group. Their advanced technologies and extensive product portfolios significantly influence market dynamics.

What are the primary factors driving the growth in the cardiac Pacemakers industry?

Growth in the cardiac pacemakers market is mainly driven by factors like increasing prevalence of cardiac arrhythmias, technological innovations in pacemaker design, a growing aging population, and heightened awareness regarding cardiac health.

Which region is the fastest Growing in the cardiac Pacemakers?

The Asia Pacific region is emerging as the fastest-growing market for cardiac pacemakers, expected to grow from $1.08 billion in 2023 to $2.13 billion by 2033. Factors include improved healthcare infrastructure and increased patient access to medical devices.

Does ConsaInsights provide customized market report data for the cardiac Pacemakers industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the cardiac pacemakers industry. Clients can receive specific insights based on market dynamics, trends, and competitive analysis.

What deliverables can I expect from this cardiac Pacemakers market research project?

Deliverables from the cardiac pacemakers market research project include comprehensive reports, market analysis, segmentation data, trend forecasts, competitive landscape evaluations, and actionable insights tailored to your strategic objectives.

What are the market trends of cardiac Pacemakers?

Market trends in cardiac pacemakers show an increase in demand for smart pacemakers and biophysical pacemakers, driven by technological advancements. The shift towards minimally invasive procedures and outpatient care is also prominent.