Cardiac Prosthetic Devices Market Report

Published Date: 31 January 2026 | Report Code: cardiac-prosthetic-devices

Cardiac Prosthetic Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cardiac Prosthetic Devices market, highlighting trends, growth factors, and forecasts for the period 2023-2033. Key insights include market size, segmentation, regional analysis, and competitive landscape, offering stakeholders a detailed overview for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

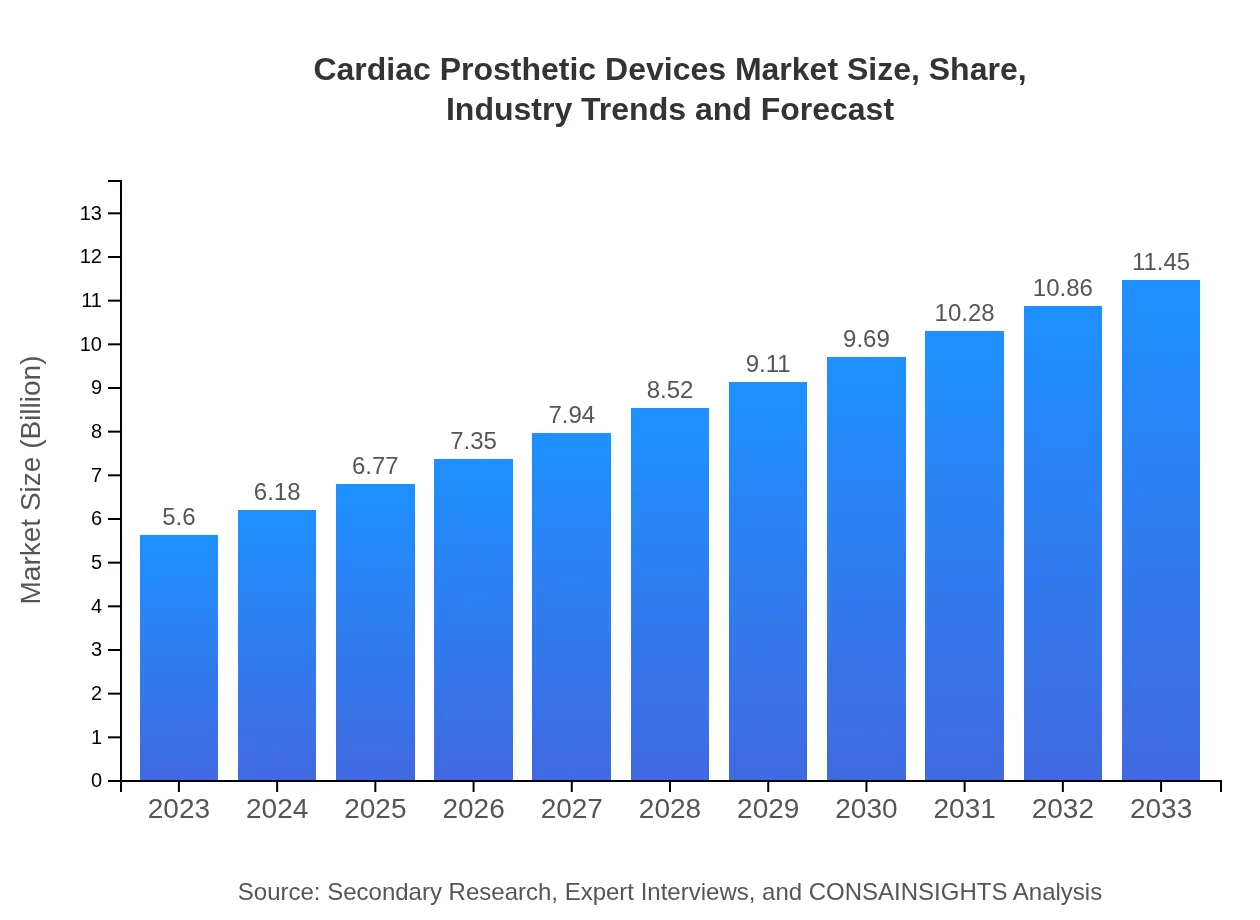

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Medtronic , Boston Scientific, Abbott Laboratories, AngioDynamics, Edwards Lifesciences |

| Last Modified Date | 31 January 2026 |

Cardiac Prosthetic Devices Market Overview

Customize Cardiac Prosthetic Devices Market Report market research report

- ✔ Get in-depth analysis of Cardiac Prosthetic Devices market size, growth, and forecasts.

- ✔ Understand Cardiac Prosthetic Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiac Prosthetic Devices

What is the Market Size & CAGR of Cardiac Prosthetic Devices market in 2023 and 2033?

Cardiac Prosthetic Devices Industry Analysis

Cardiac Prosthetic Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiac Prosthetic Devices Market Analysis Report by Region

Europe Cardiac Prosthetic Devices Market Report:

In Europe, the market is projected to grow from $1.91 billion in 2023 to $3.91 billion by 2033. The increase is driven by technological advancements in device manufacturing, alongside supportive regulatory environments and patient access to innovative therapies.Asia Pacific Cardiac Prosthetic Devices Market Report:

In the Asia Pacific region, the Cardiac Prosthetic Devices market is forecasted to grow from $1.06 billion in 2023 to $2.16 billion by 2033. Factors driving this growth include a rapidly increasing patient population and improving healthcare infrastructure, alongside greater awareness of cardiovascular health.North America Cardiac Prosthetic Devices Market Report:

North America is currently the largest market for Cardiac Prosthetic Devices with a valuation of $1.80 billion in 2023, expected to reach $3.67 billion by 2033. The dominance of this region is attributed to advanced healthcare facilities and robust R&D initiatives.South America Cardiac Prosthetic Devices Market Report:

The South American market, valued at $0.54 billion in 2023, is predicted to expand to $1.1 billion by 2033. Growth drivers include rising disposable incomes and an increasing burden of cardiovascular diseases, which compel investment in healthcare solutions.Middle East & Africa Cardiac Prosthetic Devices Market Report:

The Middle East and Africa region's market is smaller, valued at $0.30 billion in 2023, expected to rise to $0.61 billion by 2033. However, growth is driven by increasing healthcare investments and rising cardiovascular disease cases.Tell us your focus area and get a customized research report.

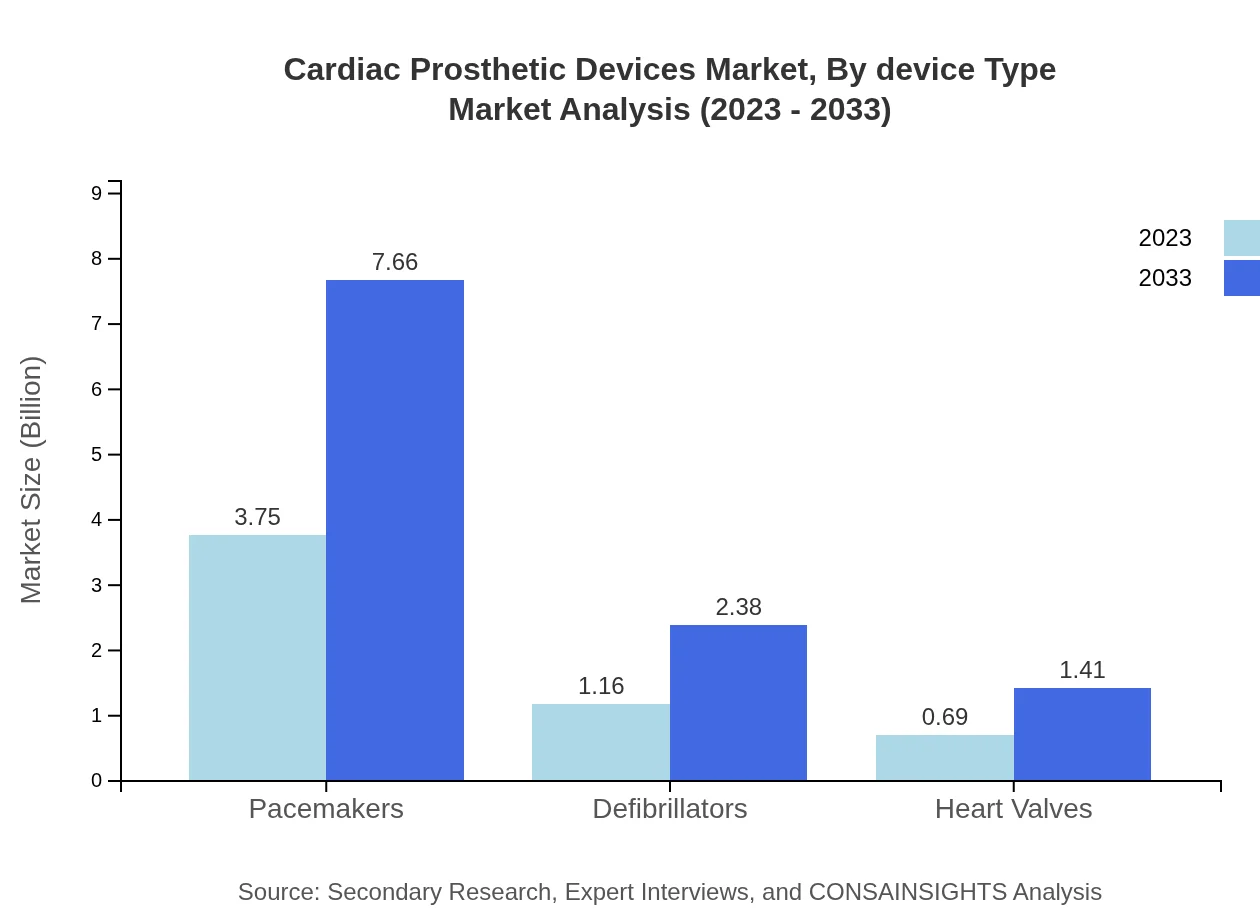

Cardiac Prosthetic Devices Market Analysis By Device Type

The Cardiac Prosthetic Devices market by device type includes significant segments such as pacemakers, defibrillators, and heart valves. Pacemakers held a market size of $3.75 billion in 2023, projected to grow to $7.66 billion by 2033, reflecting their critical role in arrhythmia management. Defibrillators, valued at $1.16 billion in 2023, are expected to reach $2.38 billion, indicating a growing acceptance of automated devices in emergency care.

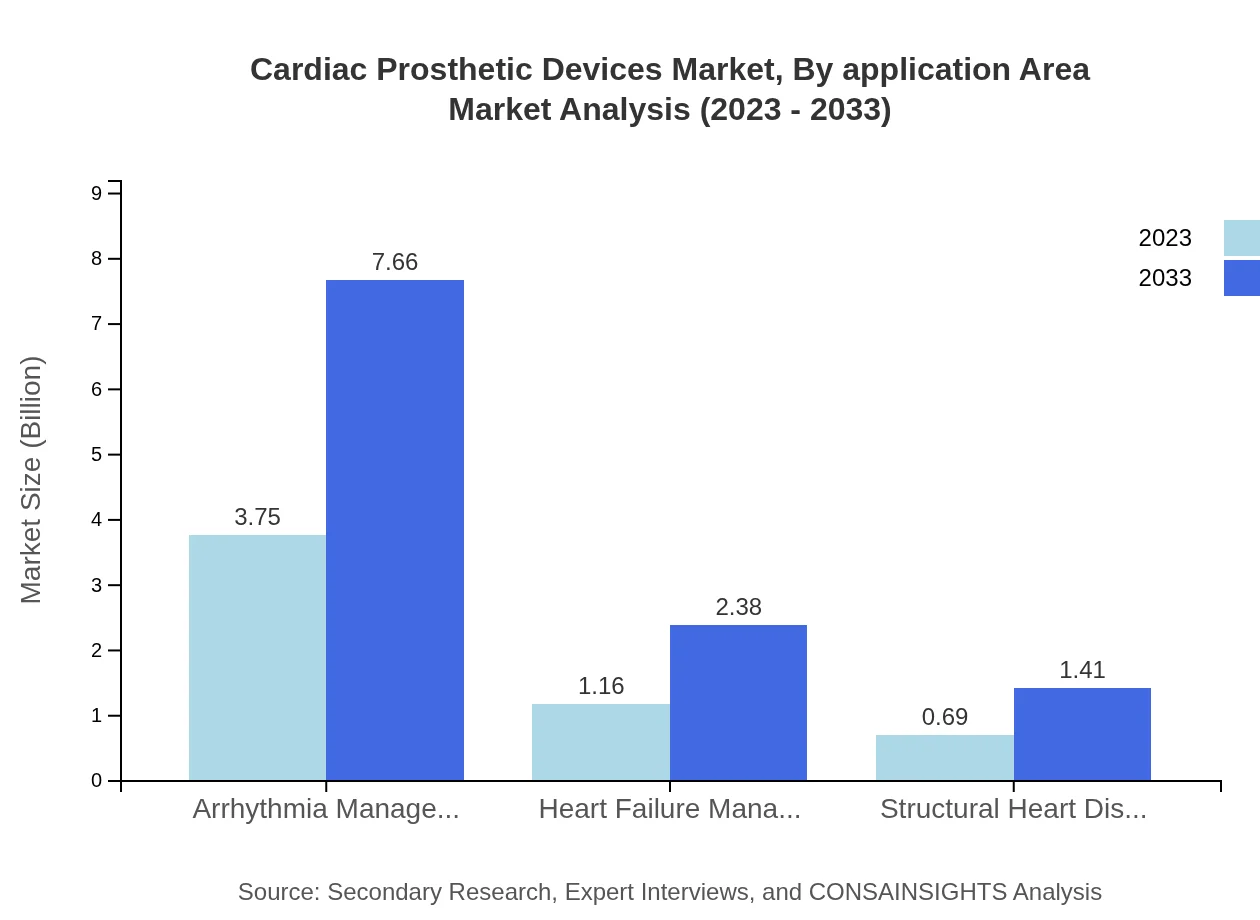

Cardiac Prosthetic Devices Market Analysis By Application Area

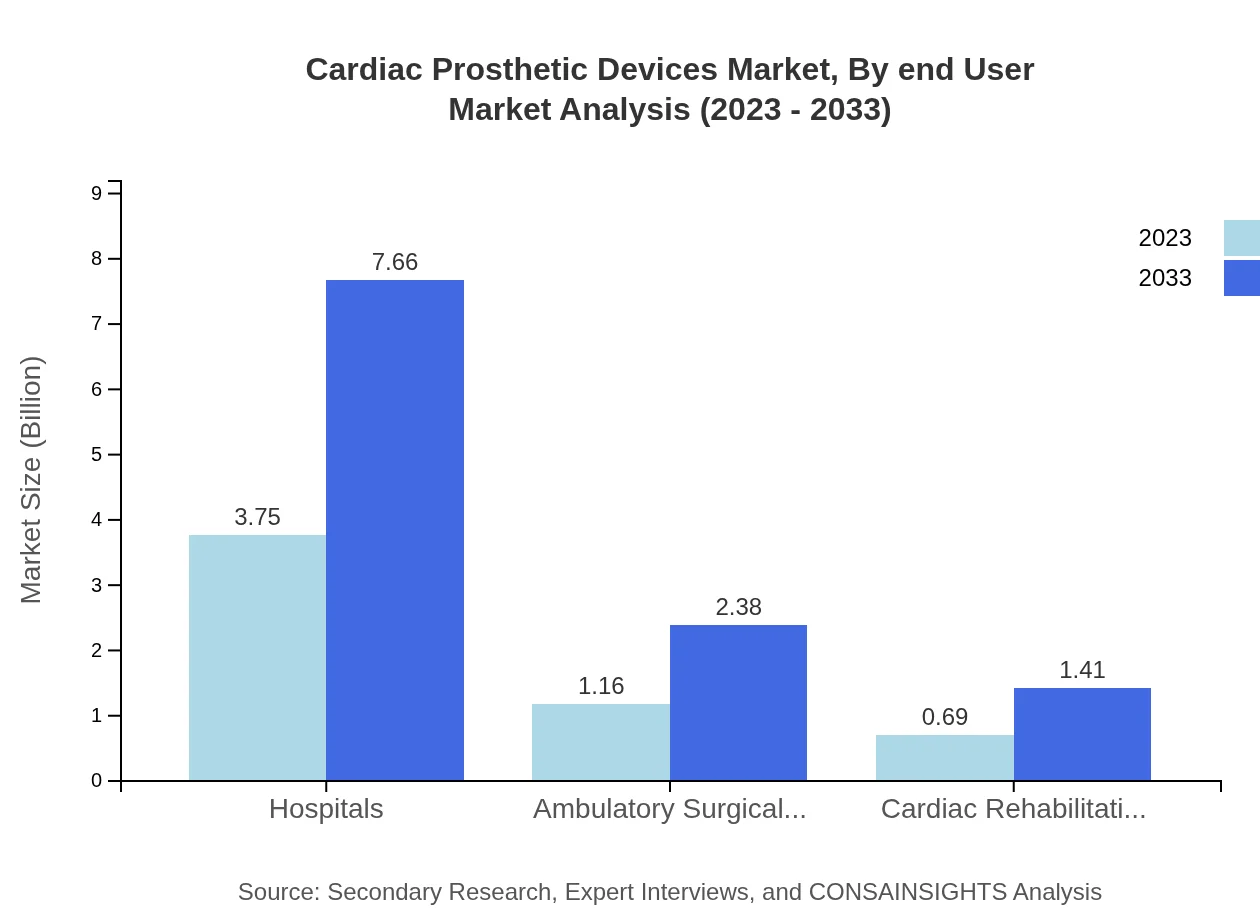

The application area segment includes Cardiac Rehabilitation Centers, Arrhythmia Management, and Heart Failure Management. Cardiac Rehabilitation Centers have a market size of $0.69 billion in 2023, projected to grow to $1.41 billion, emphasizing the increased focus on post-operative care and recovery. Arrhythmia Management similarly holds significance, with consistent market shares throughout the forecast period, highlighting sustained demand.

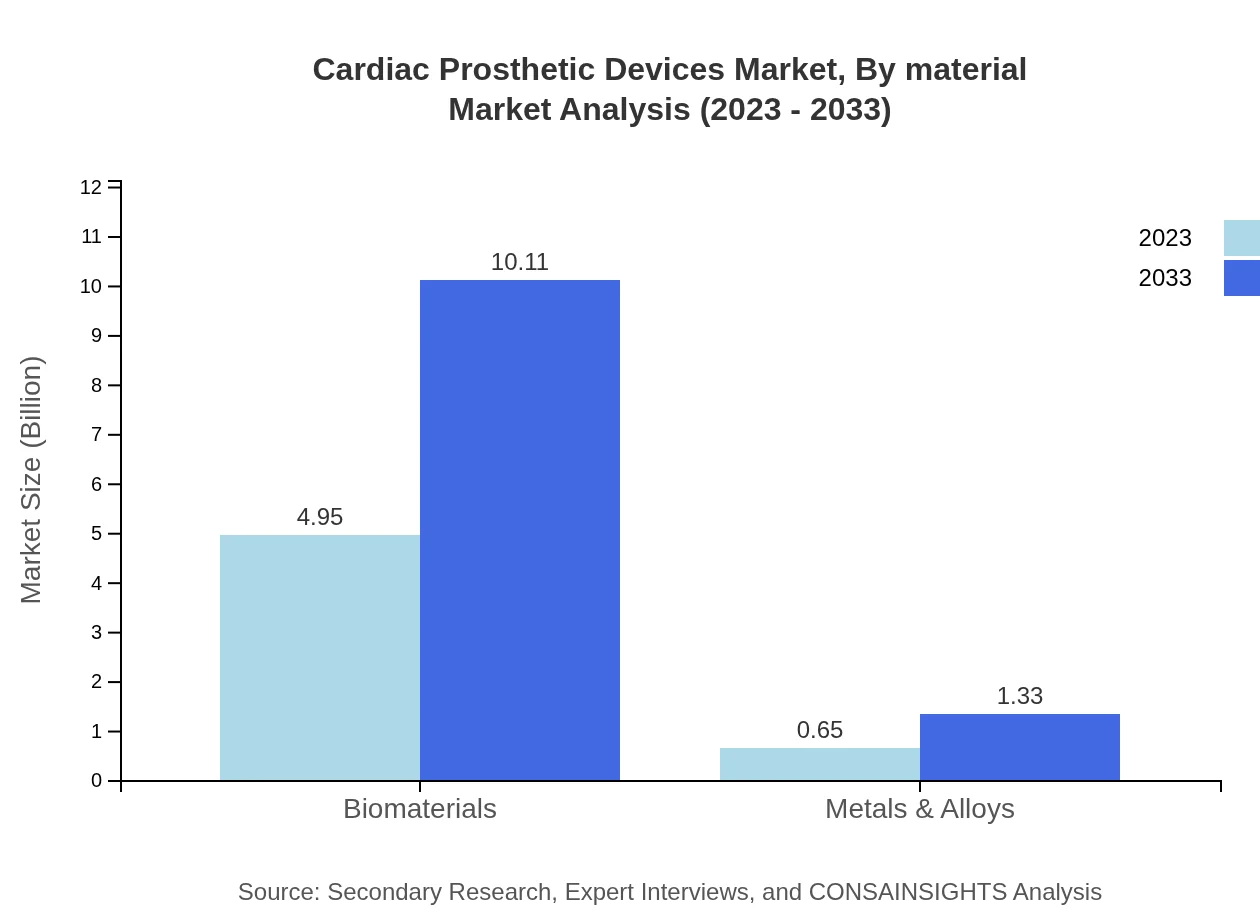

Cardiac Prosthetic Devices Market Analysis By Material

The material segment indicates a strong reliance on biomaterials, currently valued at $4.95 billion in 2023 and anticipated to reach $10.11 billion by 2033, which constitutes 88.34% of the segment share. Metals and alloys, though smaller at $0.65 billion in 2023, signify innovation in hard-to-replace components, projected to grow steadily.

Cardiac Prosthetic Devices Market Analysis By End User

In the end-user segment, hospitals are pivotal, with a market size of $3.75 billion in 2023 forecasted to grow to $7.66 billion. This reflects the higher patient turnover and advanced facilities in hospitals. Ambulatory surgical centers are also noteworthy, holding a market size of $1.16 billion, growing towards $2.38 billion, indicating shifts toward outpatient care.

Cardiac Prosthetic Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiac Prosthetic Devices Industry

Medtronic :

A pioneer in cardiac device technology, Medtronic is renowned for its innovative solutions in pacemakers, defibrillators, and heart valves, portraying a strong commitment to improving patients’ heart health globally.Boston Scientific:

Boston Scientific focuses on developing cutting-edge technologies for arrhythmia management, including advanced defibrillation systems and cardiac monitoring devices, leading to improved clinical outcomes.Abbott Laboratories:

Abbott is recognized for its contributions to heart valve prosthetics and transcatheter aortic valve implantation technology, providing revolutionary solutions that enhance patient care.AngioDynamics:

A company specializing in innovative medical devices, AngioDynamics excels in vascular access, oncology, and cardiac solutions, contributing significantly to the cardiac prosthetic landscape.Edwards Lifesciences:

Focused on critical care and surgical heart valve therapy, Edwards Lifesciences plays a vital role in improving heart function through advanced device technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiac Prosthetic Devices?

The cardiac prosthetic devices market is valued at approximately $5.6 billion in 2023 with a projected CAGR of 7.2% through 2033, indicating significant growth as technological advances improve patient outcomes.

What are the key market players or companies in this cardiac Prosthetic Devices industry?

Key players in the cardiac prosthetic devices market include Medtronic, Boston Scientific, Abbott, Edwards Lifesciences, and St. Jude Medical, which are recognized for their innovative products and market presence.

What are the primary factors driving the growth in the cardiac Prosthetic Devices industry?

The growth in the cardiac prosthetic devices industry is driven by rising prevalence of cardiovascular diseases, increasing aging population, and advancements in medical technology that enhance treatment efficacy.

Which region is the fastest Growing in the cardiac Prosthetic Devices?

The Asia Pacific region is the fastest-growing area for cardiac prosthetic devices, projected to grow from $1.06 billion in 2023 to $2.16 billion by 2033, boosted by increasing healthcare investments and expanding patient access.

Does ConsaInsights provide customized market report data for the cardiac Prosthetic Devices industry?

Yes, ConsaInsights offers customized market report data tailored to client needs, ensuring comprehensive and relevant insights that cater to specific interests within the cardiac prosthetic devices industry.

What deliverables can I expect from this cardiac Prosthetic Devices market research project?

Deliverables from a cardiac prosthetic devices market research project include detailed reports, market forecasts, trend analyses, competitive landscape assessments, and insights on regional and segment performance.

What are the market trends of cardiac Prosthetic Devices?

Current trends in the cardiac prosthetic devices market include increasing adoption of minimally invasive surgical techniques, advancements in AI and robotics in surgeries, and a surge in remote monitoring technologies for improved patient care.