Cardiology Information System Market Report

Published Date: 31 January 2026 | Report Code: cardiology-information-system

Cardiology Information System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cardiology Information System market, offering insights on market size, growth forecasts, segmentation, industry analysis, and regional trends from 2023 to 2033.

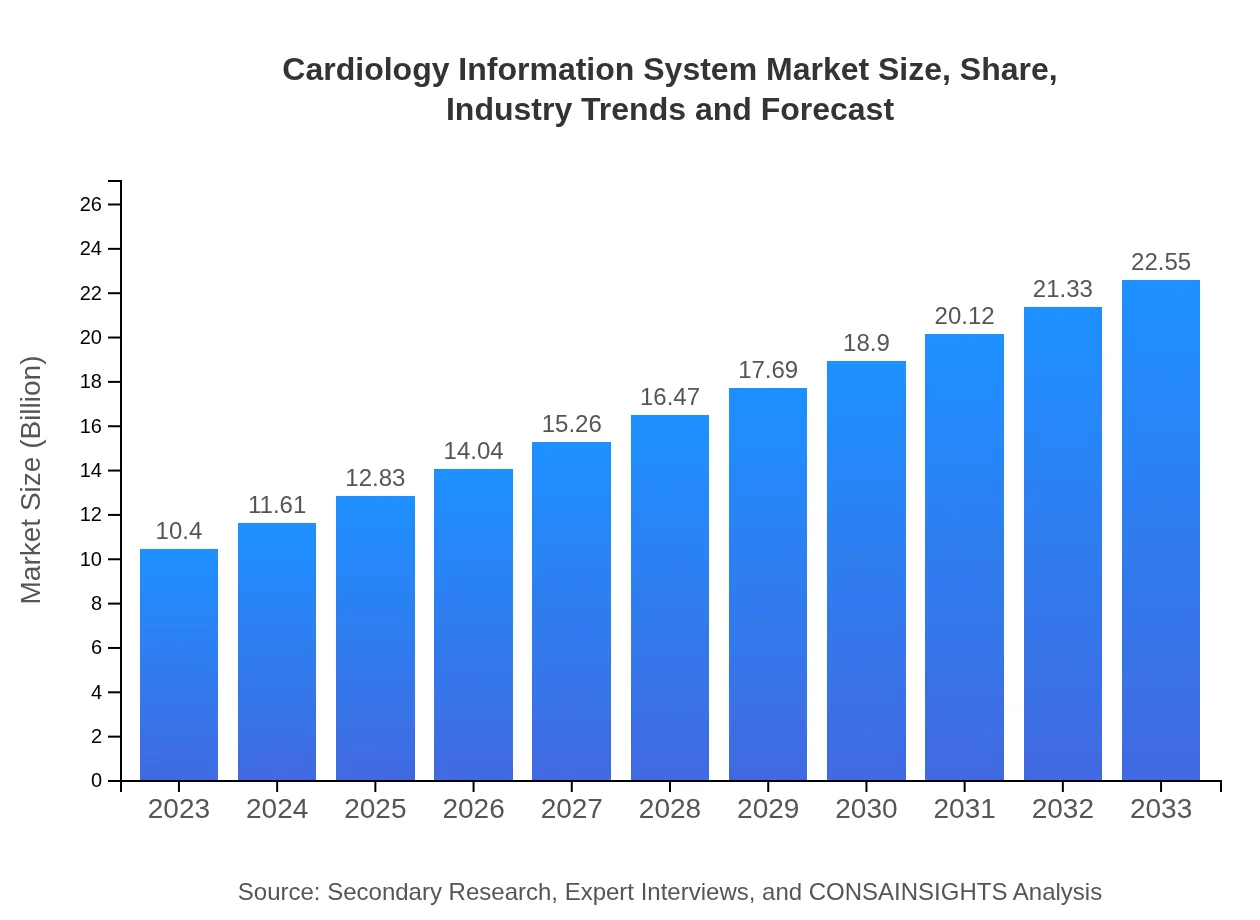

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.40 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.55 Billion |

| Top Companies | Cerner Corporation, McKesson Corporation, Allscripts Healthcare Solutions, Philips Healthcare, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Cardiology Information System Market Overview

Customize Cardiology Information System Market Report market research report

- ✔ Get in-depth analysis of Cardiology Information System market size, growth, and forecasts.

- ✔ Understand Cardiology Information System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiology Information System

What is the Market Size & CAGR of Cardiology Information System market in 2023?

Cardiology Information System Industry Analysis

Cardiology Information System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiology Information System Market Analysis Report by Region

Europe Cardiology Information System Market Report:

The European Cardiology Information System market is forecasted to grow from $3.00 billion in 2023 to $6.49 billion by 2033. Factors contributing to this growth include an aging population, increased healthcare spending, and a strong focus on preventive care and patient-centered approaches. Additionally, regulatory frameworks promoting digital health are enhancing the adoption of innovative CIS solutions.Asia Pacific Cardiology Information System Market Report:

The Asia Pacific region is witnessing rapid growth in the Cardiology Information System market, projected to expand from $2.29 billion in 2023 to $4.96 billion by 2033. The growing population base, increasing health awareness, and rising investments in healthcare infrastructure fuel this growth. Moreover, government initiatives aimed at improving cardiac care are further catalyzing the adoption of CIS solutions.North America Cardiology Information System Market Report:

North America continues to lead in the Cardiology Information System market, with a projected market size increase from $3.45 billion in 2023 to $7.48 billion by 2033. The region's growth is supported by an advanced healthcare system, high adoption rates of digital health technologies, and increasing patient data management requirements. The competitive landscape is dominated by key industry players investing heavily in research and innovation.South America Cardiology Information System Market Report:

In South America, the market size for Cardiology Information Systems is expected to grow from $0.69 billion in 2023 to $1.50 billion by 2033. Factors such as increasing cardiovascular disease prevalence and government-funded healthcare initiatives are driving demand. However, challenges related to healthcare infrastructure and funding may impact growth rates in certain regions.Middle East & Africa Cardiology Information System Market Report:

The Cardiology Information System market in the Middle East and Africa is anticipated to expand from $0.98 billion in 2023 to $2.11 billion by 2033, reflecting increasing investments in healthcare infrastructure and growing awareness about cardiovascular diseases. However, diverse healthcare systems and economic disparities across countries may pose challenges to market growth.Tell us your focus area and get a customized research report.

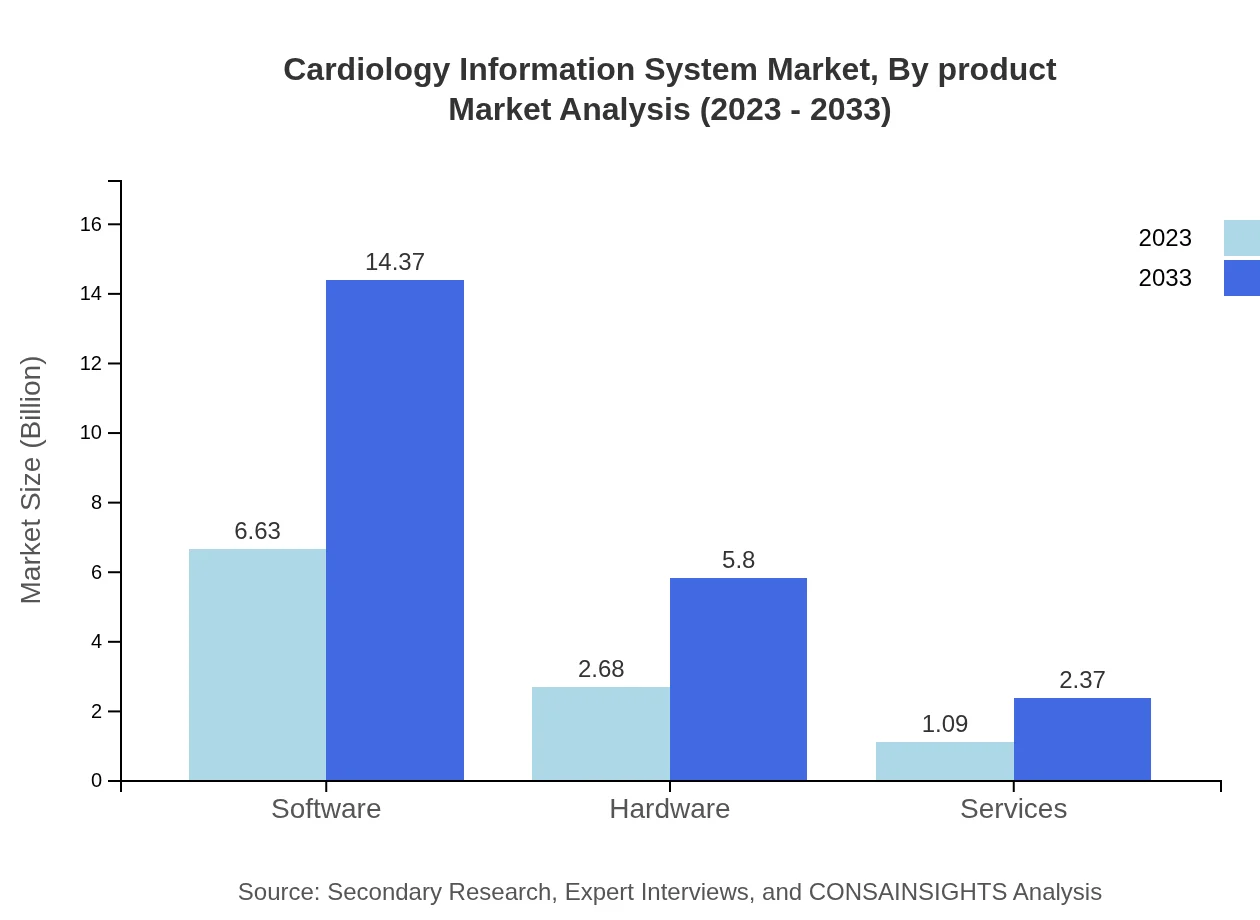

Cardiology Information System Market Analysis By Product

The software segment significantly dominates the Cardiology Information System market due to its critical role in data management and patient care. The market size for software is expected to rise from $6.63 billion in 2023 to $14.37 billion by 2033, representing a growing share of 63.75% throughout the period. Hardware and services also contribute to the market but at a slower pace, with hardware projected to grow from $2.68 billion to $5.80 billion, representing 25.73% of the total share.

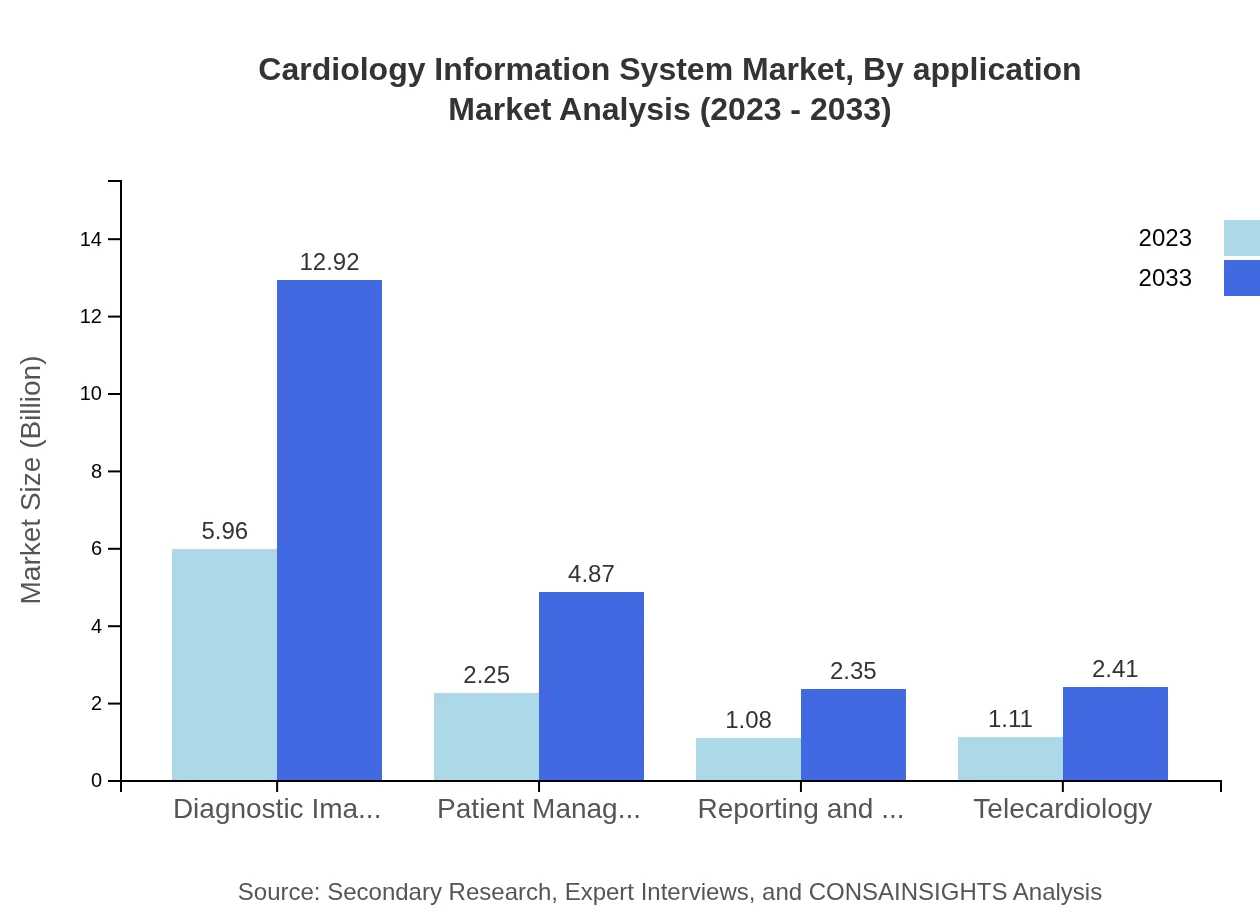

Cardiology Information System Market Analysis By Application

Applications of Cardiology Information Systems vary widely but primarily focus on diagnostic imaging, patient management, reporting and documentation, and telecardiology. As the healthcare sector moves towards more integrated solutions, the significance of these applications will increase, leading to a market forecast of considerable growth across all key applications.

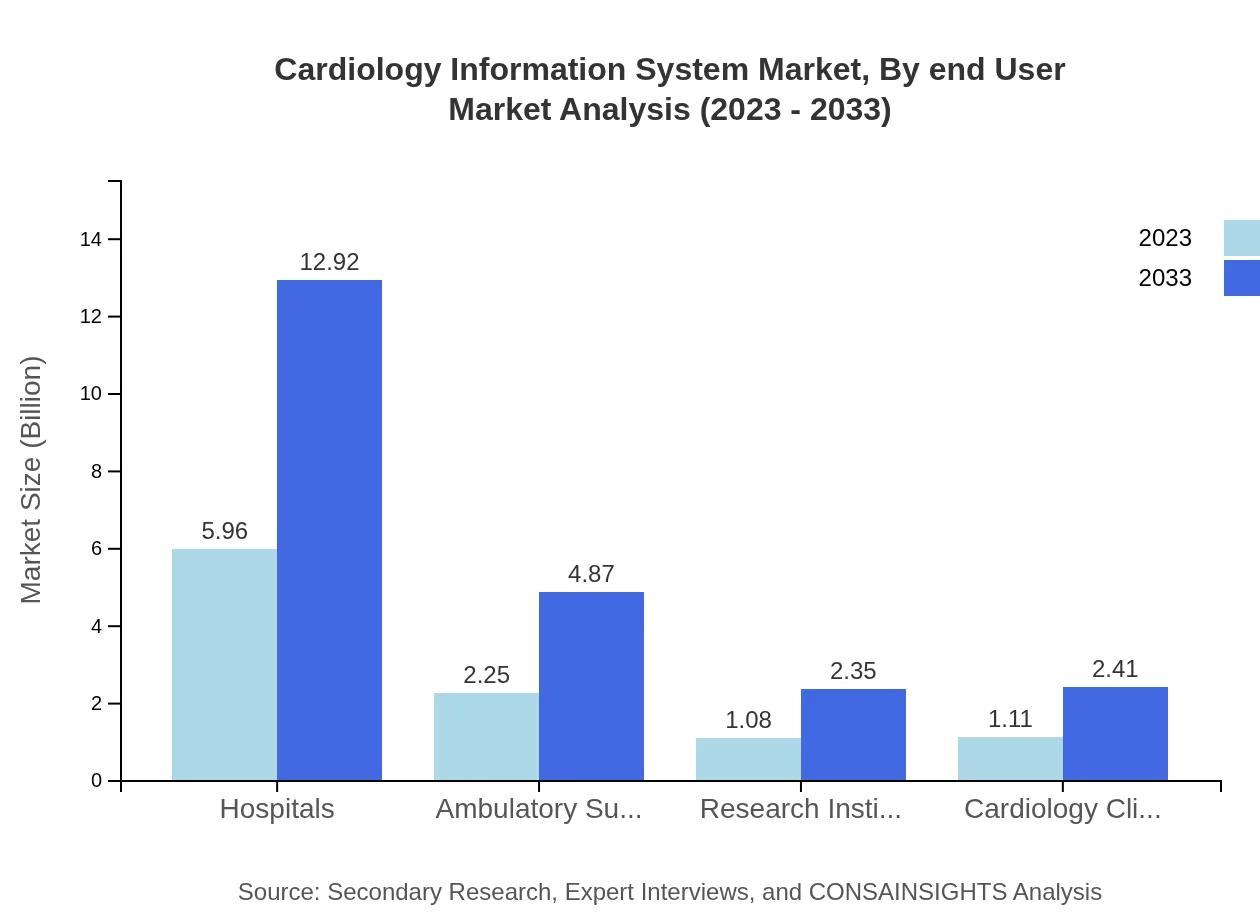

Cardiology Information System Market Analysis By End User

The end-user segment is predominantly led by hospitals, which hold a market share of 57.32%. The projected growth for hospitals in this segment is from $5.96 billion in 2023 to $12.92 billion by 2033. Other significant end-users include ambulatory surgical centers and cardiology clinics, reflecting a diverse requirement for CIS based on the type of care provided.

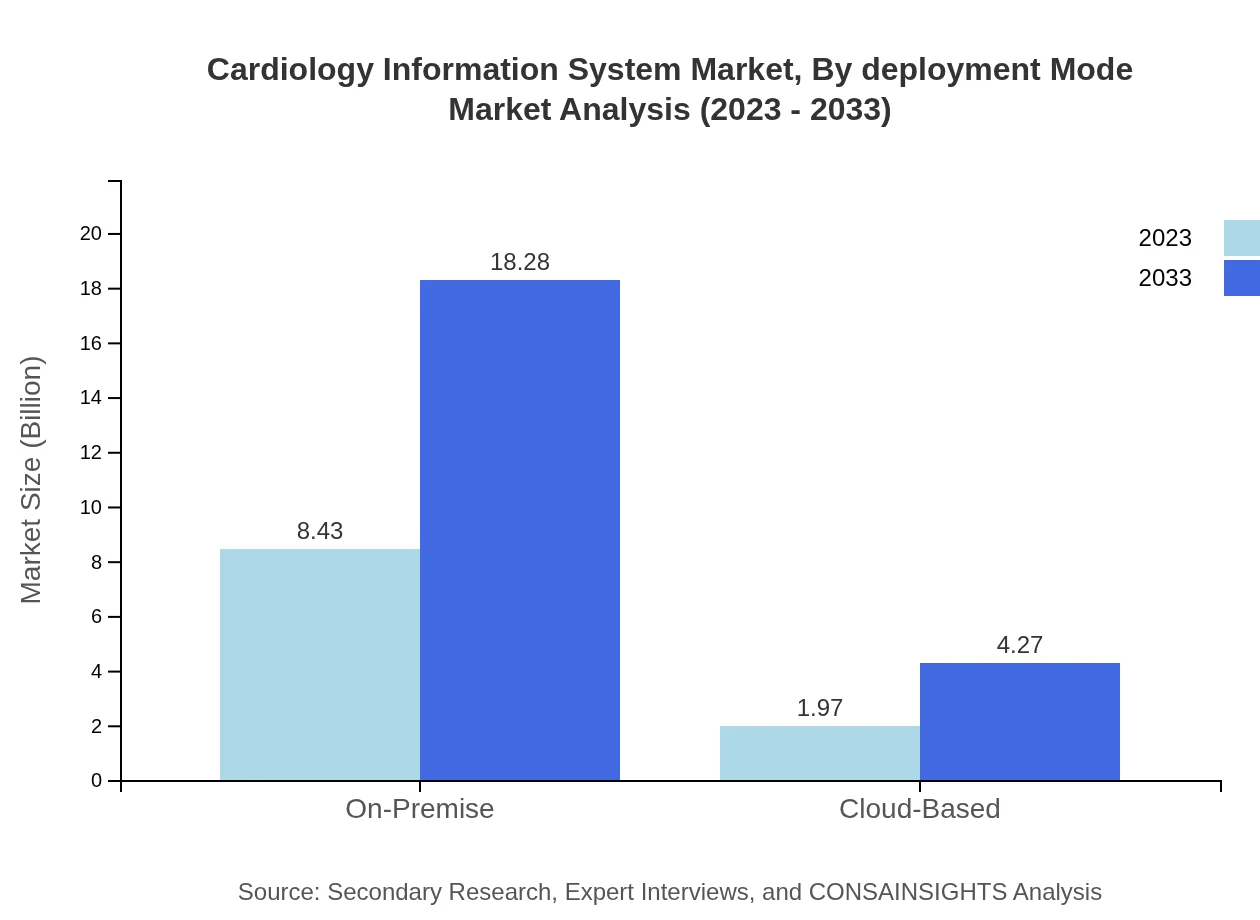

Cardiology Information System Market Analysis By Deployment Mode

Deployment modes are crucial in defining how Cardiology Information Systems are implemented. On-premise solutions maintain a prominent share of 81.06% dominating the market size of $8.43 billion in 2023. However, cloud-based systems are expected to gain traction, projected to rise from $1.97 billion in 2023 to $4.27 billion by 2033, representing a growing trend towards greater flexibility and scalability in healthcare IT.

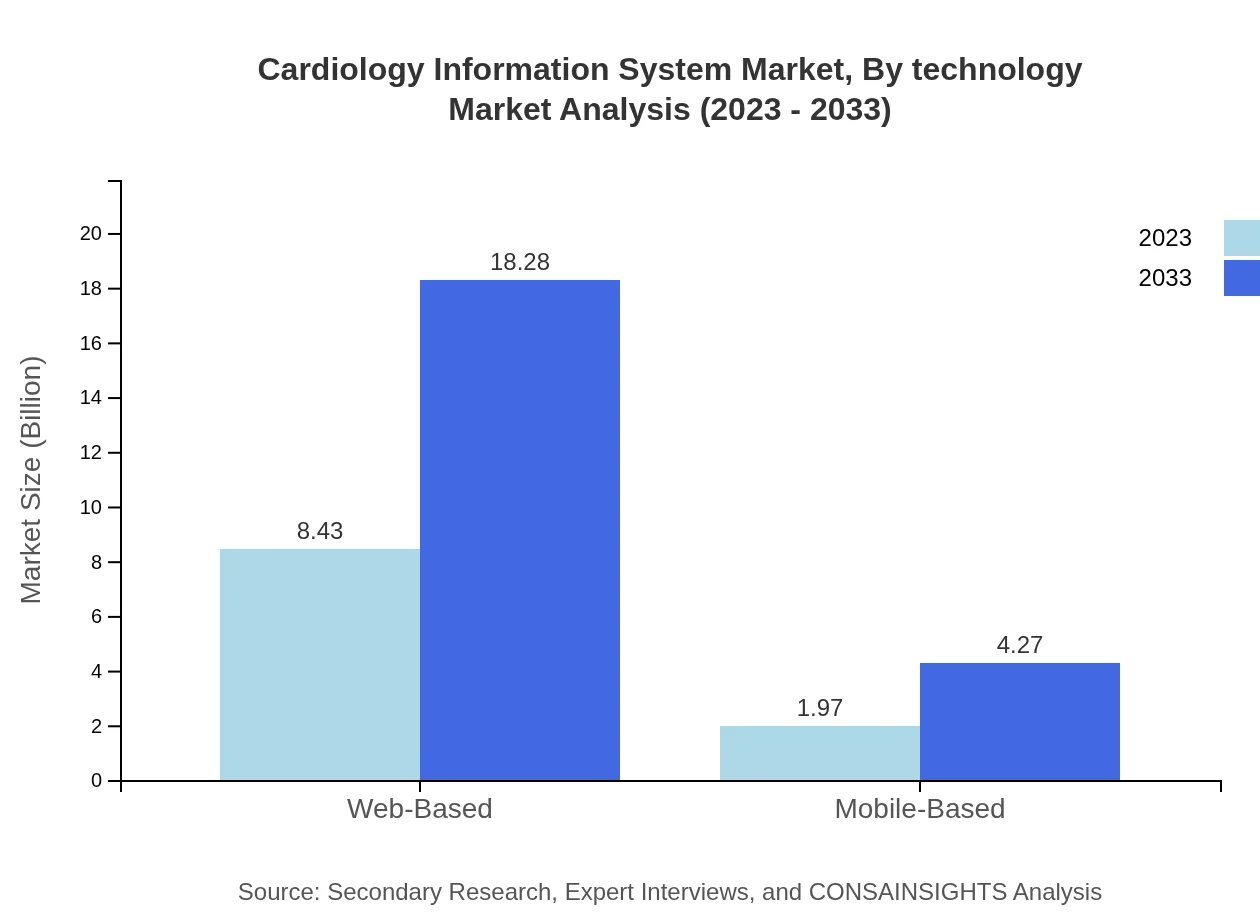

Cardiology Information System Market Analysis By Technology

Technological trends within Cardiology Information Systems are evolving rapidly. From advanced data analytics and AI-driven diagnostics to telemedicine and integrated electronic health records (EHR), the incorporation of these technologies is reshaping patient care delivery. The market for web-based solutions is set to grow significantly, moving from a market size of $8.43 billion to $18.28 billion by 2033, indicating a strong trend towards online accessibility and real-time data usage in cardiology practices.

Cardiology Information System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiology Information System Industry

Cerner Corporation:

A leading provider of health information technology solutions, Cerner specializes in software for data management and clinical applications to enhance patient care and operational efficiencies.McKesson Corporation:

McKesson offers integrated solutions designed to improve healthcare delivery, focusing on software and analytics solutions aimed at streamlining hospital operations and patient management.Allscripts Healthcare Solutions:

Allscripts provides software solutions tailored to enhance clinical communication and the management of cardiovascular health data for better outcomes.Philips Healthcare:

Known for its advanced diagnostic imaging solutions, Philips Healthcare specializes in innovative technologies that support cardiology practices and improve patient management.GE Healthcare:

GE Healthcare focuses on delivering healthcare solutions, including cardiology informatics and imaging technologies, to enhance clinical workflows.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiology Information System?

The cardiology information system market is valued at $10.4 billion in 2023 and projected to grow at a CAGR of 7.8% through 2033. This growth indicates an increasing demand for advanced cardiac care solutions across healthcare settings.

What are the key market players or companies in this cardiology Information System industry?

Key players in the cardiology information system market include Epic Systems Corporation, Allscripts Healthcare Solutions, Philips Healthcare, Siemens Healthineers, and GE Healthcare. These companies lead the sector by offering innovative cardiology software and services.

What are the primary factors driving the growth in the cardiology Information System industry?

Growth drivers in the cardiology information system industry include the rise in cardiovascular diseases, increasing healthcare IT investments, regulatory compliance demands, and advancements in cardiology diagnostics and treatment technologies enhancing patient care.

Which region is the fastest Growing in the cardiology Information System?

The fastest-growing region in the cardiology information system market is North America, projected to expand from $3.45 billion in 2023 to $7.48 billion by 2033, highlighting significant investment in advanced healthcare technologies.

Does ConsaInsights provide customized market report data for the cardiology Information System industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications in the cardiology information system industry, allowing for in-depth analysis of market trends, competitive landscapes, and regional insights.

What deliverables can I expect from this cardiology Information System market research project?

Deliverables from the cardiology information system market research project include comprehensive market analysis, competitive intelligence reports, segment breakdowns, regional insights, and actionable recommendations for stakeholders in the healthcare industry.

What are the market trends of cardiology Information System?

Current market trends in cardiology information systems include increased adoption of telecardiology, integration of AI technologies for diagnostics, and a shift towards cloud-based solutions enhancing data accessibility and patient management capabilities.