Cardiovascular Devices Market Report

Published Date: 31 January 2026 | Report Code: cardiovascular-devices

Cardiovascular Devices Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Cardiovascular Devices market, offering insights into market size, trends, and future forecasts from 2023 to 2033, along with a thorough analysis of industry dynamics and regional variances.

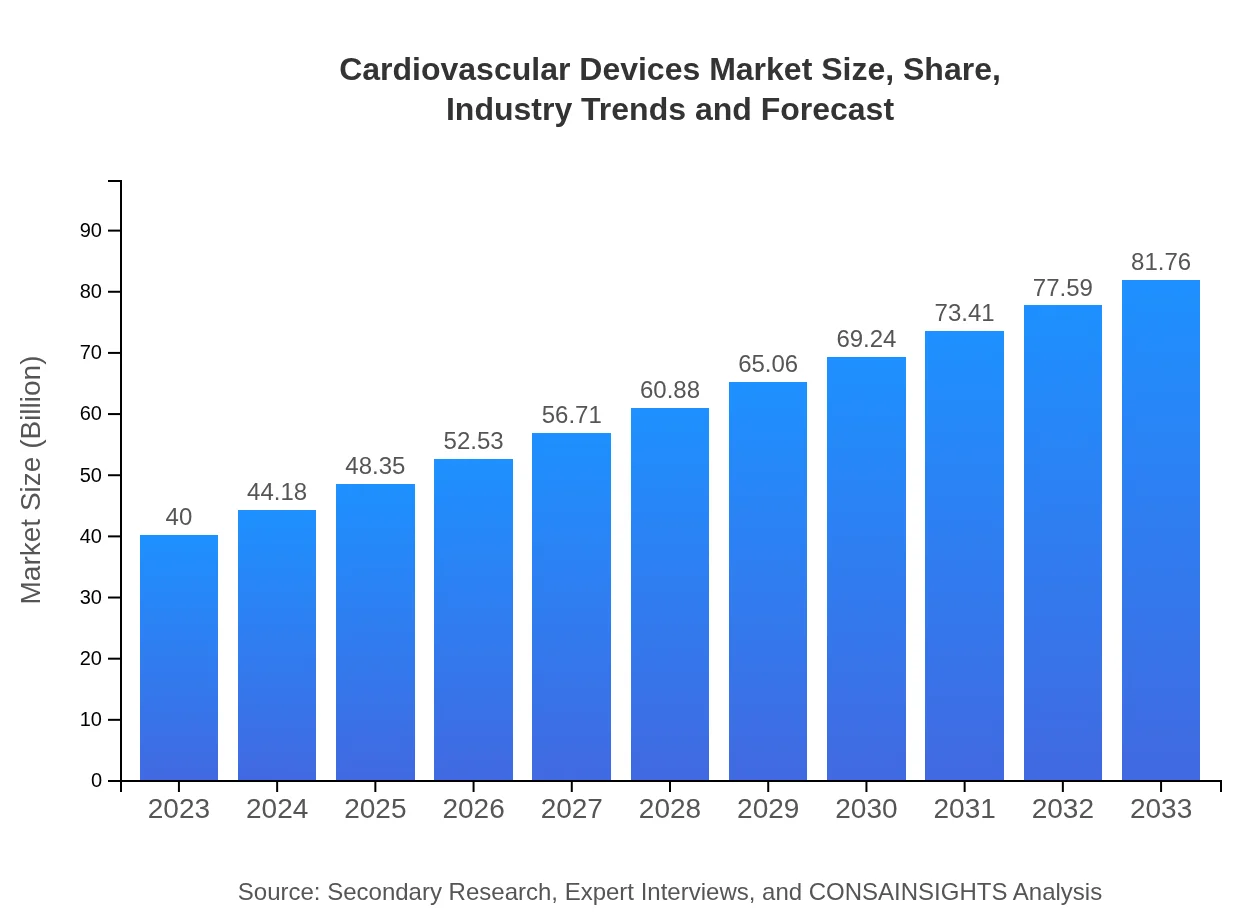

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $40.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $81.76 Billion |

| Top Companies | Medtronic , Boston Scientific, Abbott Laboratories, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Cardiovascular Devices Market Overview

Customize Cardiovascular Devices Market Report market research report

- ✔ Get in-depth analysis of Cardiovascular Devices market size, growth, and forecasts.

- ✔ Understand Cardiovascular Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiovascular Devices

What is the Market Size & CAGR of Cardiovascular Devices market in 2023?

Cardiovascular Devices Industry Analysis

Cardiovascular Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

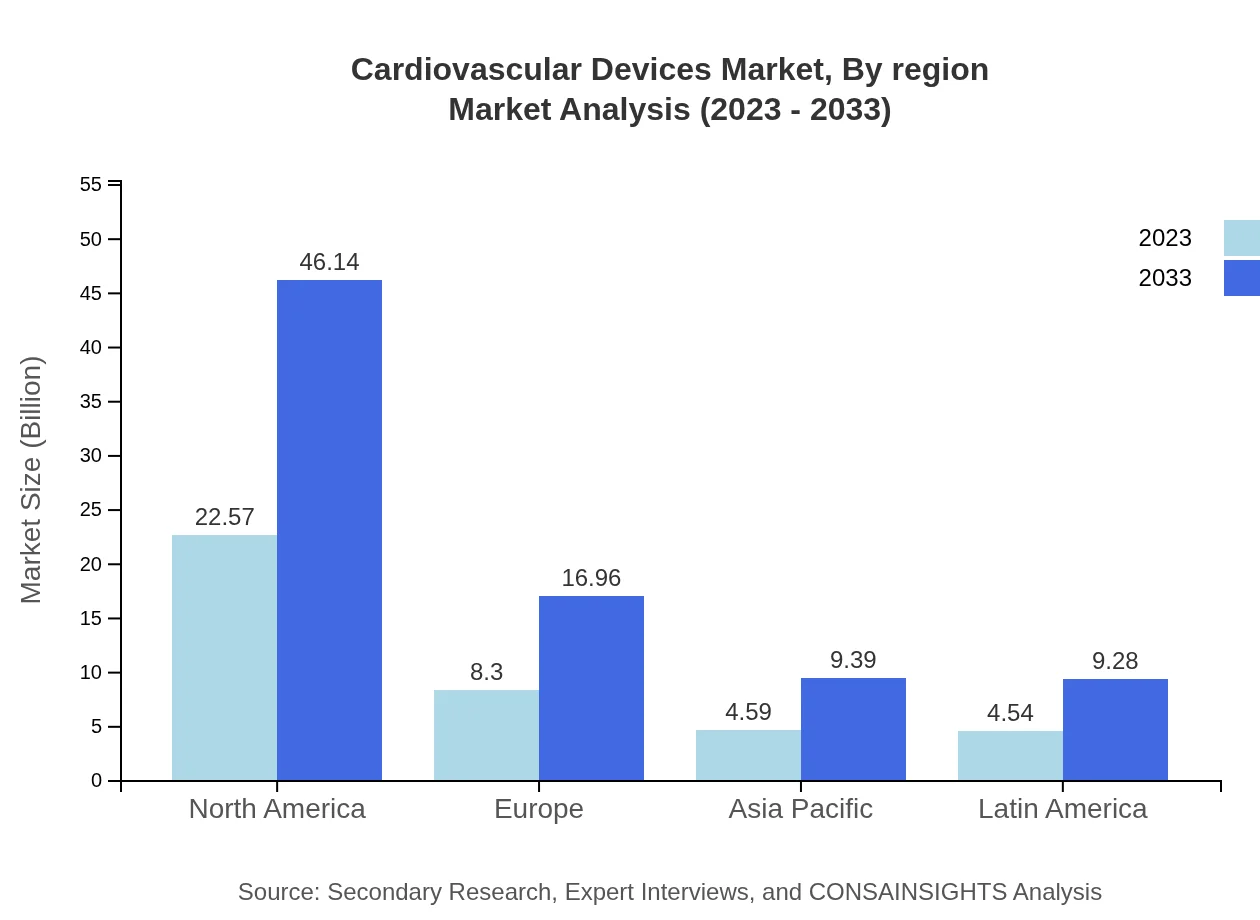

Cardiovascular Devices Market Analysis Report by Region

Europe Cardiovascular Devices Market Report:

The European market is positioned for steady growth, expanding from $12.60 billion in 2023 to $25.75 billion by 2033. Europe benefits from strong regulatory frameworks and initiatives aimed at enhancing healthcare access, coupled with high demand for innovative medical devices.Asia Pacific Cardiovascular Devices Market Report:

The Asia Pacific region is expected to grow significantly, with the market size projected to increase from $7.10 billion in 2023 to $14.51 billion by 2033. Rising healthcare awareness and government initiatives supporting medical advancements contribute to this growth. Additionally, increasing disposable incomes and an aging population robustly support demand for cardiovascular devices in this region.North America Cardiovascular Devices Market Report:

North America holds the largest share of the market, with sizes expected to grow from $15.03 billion in 2023 to $30.73 billion by 2033. Factors such as advanced healthcare infrastructure, high health care expenditure, and increasing prevalence of chronic diseases support continuous growth in this region.South America Cardiovascular Devices Market Report:

In South America, the market for cardiovascular devices is projected to grow from $1.31 billion in 2023 to $2.68 billion by 2033. The growth is driven by improving healthcare infrastructure, rising prevalence of cardiovascular diseases, and increased investments in medical technologies.Middle East & Africa Cardiovascular Devices Market Report:

The Middle East and Africa market is projected to grow from $3.96 billion in 2023 to $8.10 billion by 2033. Despite challenges in healthcare accessibility, growing investments in healthcare sectors and increased collaborations with international healthcare providers are facilitating market growth.Tell us your focus area and get a customized research report.

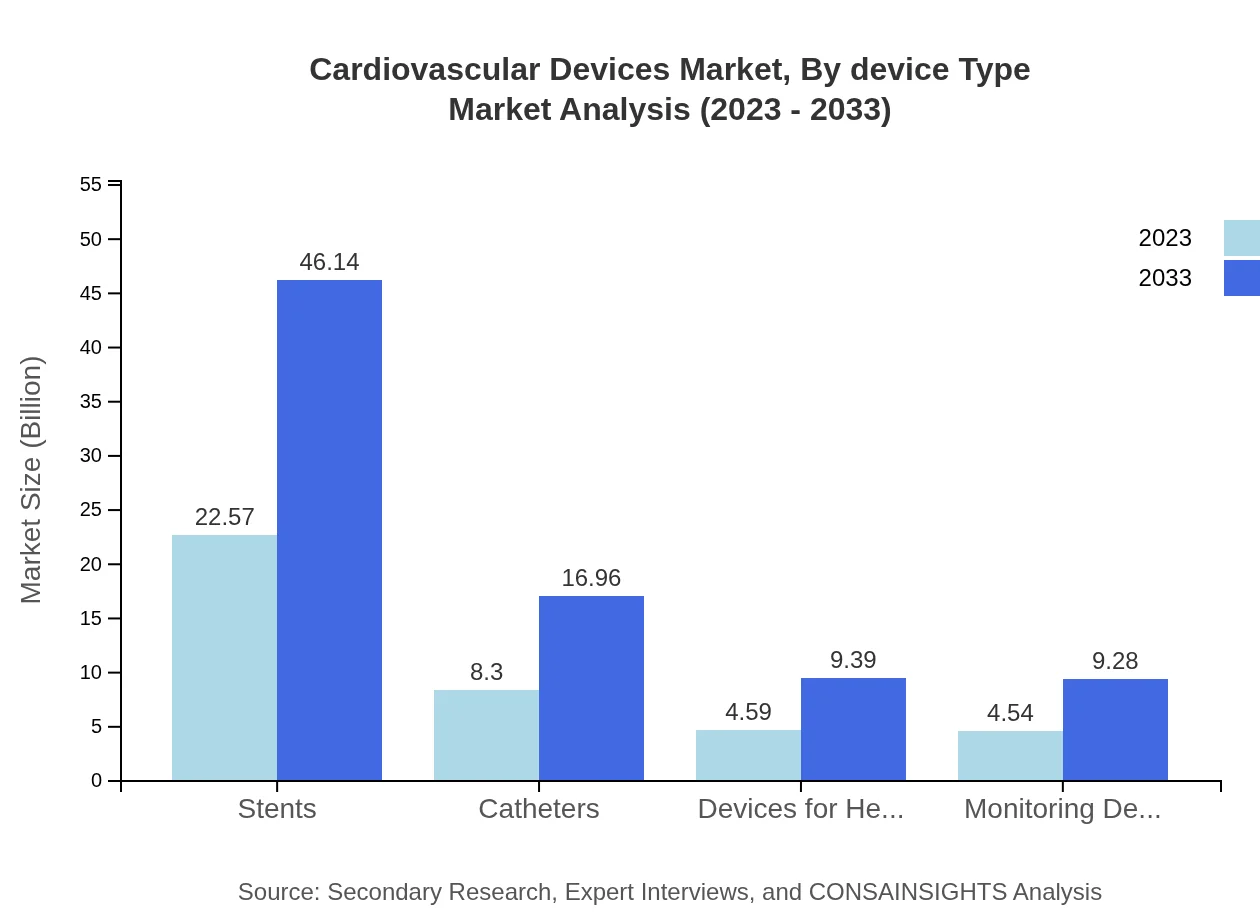

Cardiovascular Devices Market Analysis By Device Type

The analysis indicates that stents and catheters dominate the market, with stents constituting a market size of $22.57 billion in 2023, expanding to $46.14 billion by 2033. Catheters follow closely, with sizes growing from $8.30 billion in 2023 to $16.96 billion by 2033. Other product categories such as monitoring devices and heart valve devices are also witnessing significant growth.

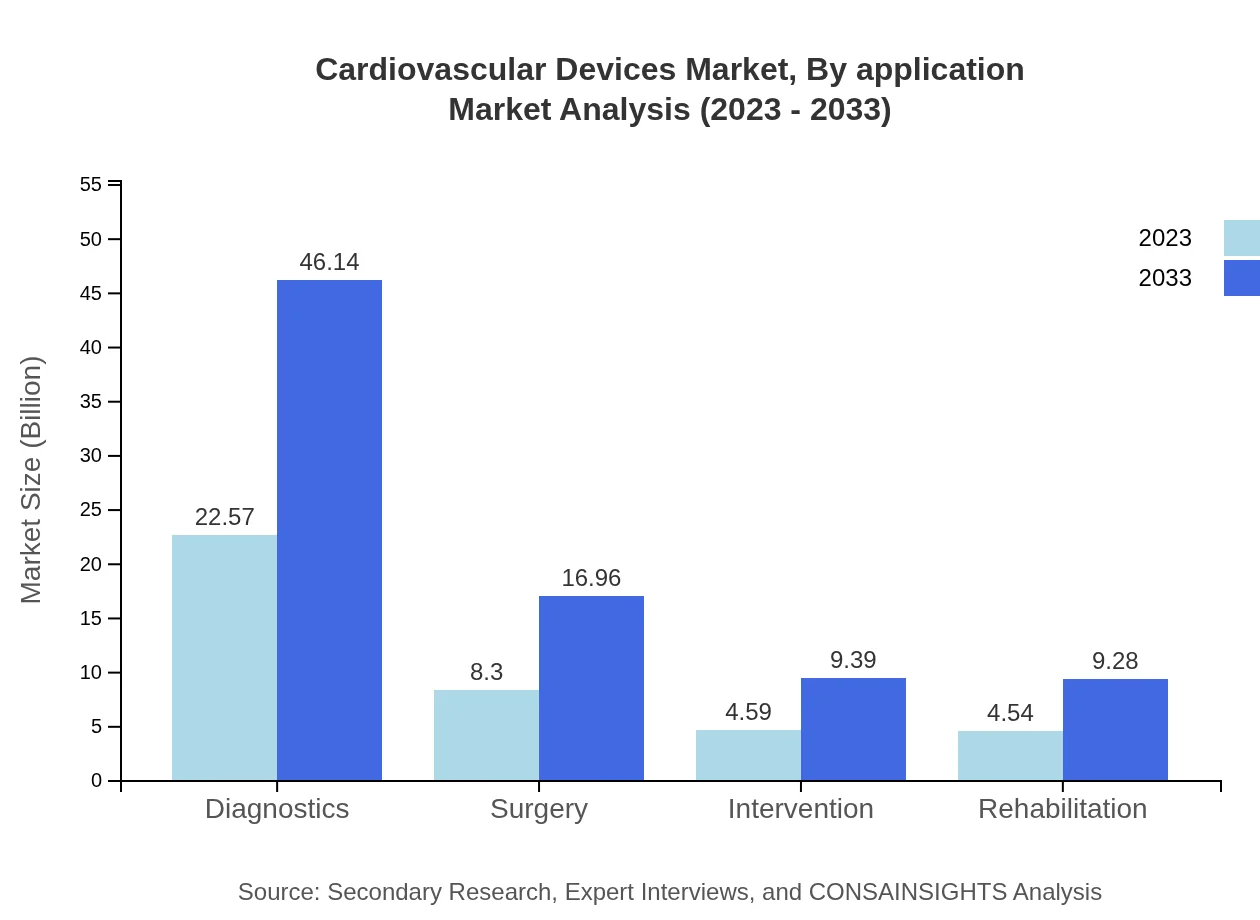

Cardiovascular Devices Market Analysis By Application

Diagnostics currently dominates the application segment, accounting for $22.57 billion in 2023 and expected to reach $46.14 billion by 2033. Surgical interventions also present substantial growth, with application in surgeries expanding from $8.30 billion to $16.96 billion over the same period. Interventional and rehabilitation applications are gaining attention as demand for holistic patient care rises.

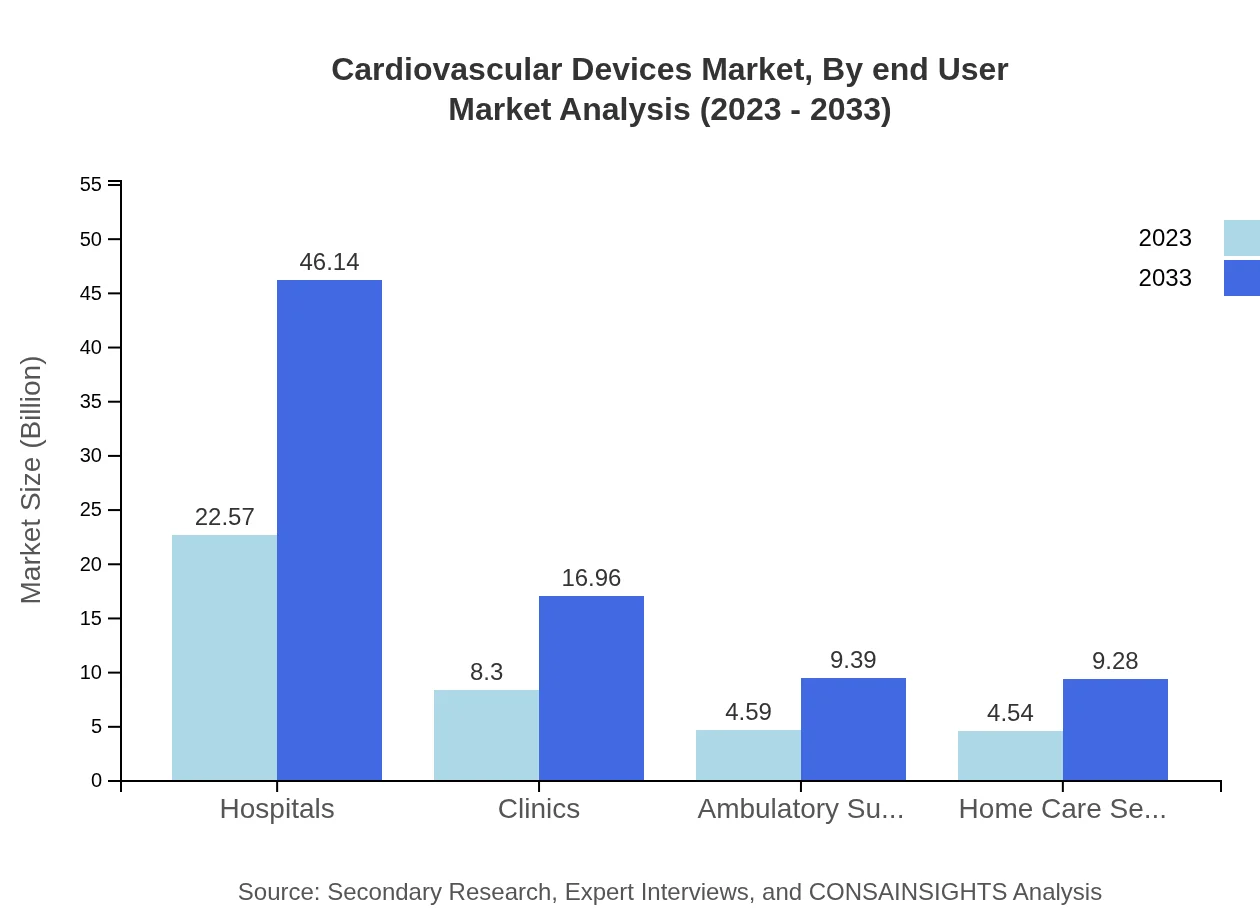

Cardiovascular Devices Market Analysis By End User

Hospitals remain the primary end-user segment, capturing a significant market share of $22.57 billion in 2023. This segment is expected to reach $46.14 billion by 2033. Clinics and ambulatory surgical centers are also increasingly utilizing cardiovascular devices, underscored by trends towards outpatient procedures.

Cardiovascular Devices Market Analysis By Region

Regionally, North America leads in size, with significant growth in Europe and the Asia Pacific presenting opportunities for expansion. The competitive landscape varies, with different market dynamics in emerging vs developed regions, emphasizing the necessity for localized strategies.

Cardiovascular Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiovascular Devices Industry

Medtronic :

A global leader in medical technology, Medtronic offers innovative devices for cardiac surgery and management, focusing on minimally invasive techniques.Boston Scientific:

Known for its advanced medical devices, Boston Scientific is heavily involved in the development of cardiovascular stents, catheters, and imaging systems.Abbott Laboratories:

Abbott provides a wide range of cardiovascular devices, focusing on heart valve replacements and cardiac imaging technologies.Johnson & Johnson:

Through its subsidiary Ethicon, Johnson & Johnson has a significant foothold in the cardiovascular devices market, particularly in the areas of surgical and interventional devices.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiovascular devices?

The global cardiovascular devices market is currently estimated at $40 billion, with a projected CAGR of 7.2% from 2023 to 2033. This reflects a growing demand for advanced diagnostic and therapeutic devices in cardiovascular care.

What are the key market players or companies in the cardiovascular devices industry?

Key players in the cardiovascular devices market include major companies like Medtronic, Abbott Laboratories, Boston Scientific, and Johnson & Johnson. These companies drive innovation through significant investment in research and product development.

What are the primary factors driving the growth in the cardiovascular devices industry?

The growth in the cardiovascular devices industry is driven by increasing incidence of cardiovascular diseases, technological advancements in device design and functionality, and a rising focus on preventive healthcare measures among the global population.

Which region is the fastest Growing in the cardiovascular devices market?

The fastest-growing region in the cardiovascular devices market is North America, expected to expand from $15.03 billion in 2023 to $30.73 billion by 2033, benefiting from technological innovations and robust healthcare infrastructure.

Does Consainsights provide customized market report data for the cardiovascular devices industry?

Yes, Consainsights offers customized market research reports tailored to specific client requirements, providing detailed insights into market trends, competitive analysis, and forecasts relevant to the cardiovascular devices industry.

What deliverables can I expect from this cardiovascular devices market research project?

Deliverables from the cardiovascular devices market research include comprehensive reports, detailed visualizations, market forecasts, competitive landscape analyses, and segment-specific insights to inform strategic decision-making.

What are the market trends of cardiovascular devices?

Current trends in the cardiovascular devices market include the increasing adoption of minimally invasive procedures, growing demand for home monitoring devices, and advancements in smart technologies that facilitate remote patient management.