Cardiovascular Drugs Market Report

Published Date: 31 January 2026 | Report Code: cardiovascular-drugs

Cardiovascular Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Cardiovascular Drugs market from 2023 to 2033, highlighting key trends, growth factors, and regional insights. It provides comprehensive data on market size, segmentation, leading players, and future forecasts.

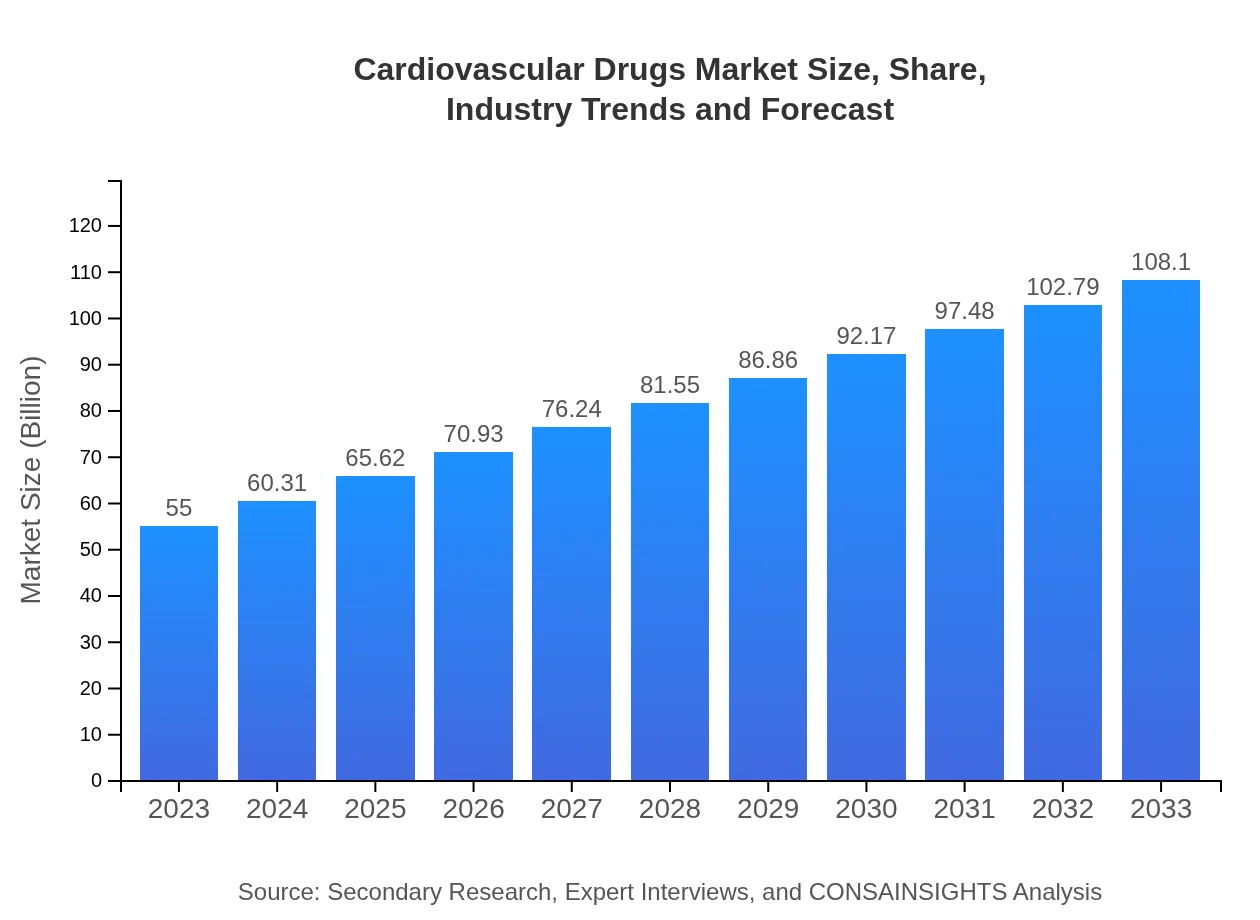

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $55.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $108.10 Billion |

| Top Companies | Pfizer Inc., Bristol-Myers Squibb, Novartis AG, AstraZeneca |

| Last Modified Date | 31 January 2026 |

Cardiovascular Drugs Market Overview

Customize Cardiovascular Drugs Market Report market research report

- ✔ Get in-depth analysis of Cardiovascular Drugs market size, growth, and forecasts.

- ✔ Understand Cardiovascular Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiovascular Drugs

What is the Market Size & CAGR of Cardiovascular Drugs market in 2023?

Cardiovascular Drugs Industry Analysis

Cardiovascular Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiovascular Drugs Market Analysis Report by Region

Europe Cardiovascular Drugs Market Report:

The European market is currently at $13.21 billion, with projections indicating a growth to $25.97 billion by 2033. With strong regulatory frameworks and a high standard of healthcare, Europe is expected to continue leading advancements in cardiovascular drug development.Asia Pacific Cardiovascular Drugs Market Report:

In the Asia Pacific region, the market for cardiovascular drugs was valued at $11.98 billion in 2023, projected to reach $23.54 billion by 2033. The growth is driven by increasing healthcare investments, expanding insurance coverage, and a rising geriatric population, necessitating more extensive cardiovascular disease management.North America Cardiovascular Drugs Market Report:

North America holds the largest share of the market, valued at $20.88 billion in 2023, anticipated to grow to $41.03 billion by 2033. High prevalence of cardiovascular diseases, substantial R&D investments by pharmaceutical companies, and advanced healthcare systems contribute to this market strength.South America Cardiovascular Drugs Market Report:

The South American cardiovascular drugs market is smaller, valued at $4.66 billion in 2023 and expected to grow to $9.17 billion by 2033. This growth is supported by improving health infrastructure and increasing awareness of cardiovascular health, although economic limitations present challenges.Middle East & Africa Cardiovascular Drugs Market Report:

The Middle East and Africa region is valued at $4.27 billion in 2023, with estimates reaching $8.39 billion by 2033. The growing focus on improving healthcare services and rising awareness regarding cardiovascular diseases is likely to boost market growth in this region.Tell us your focus area and get a customized research report.

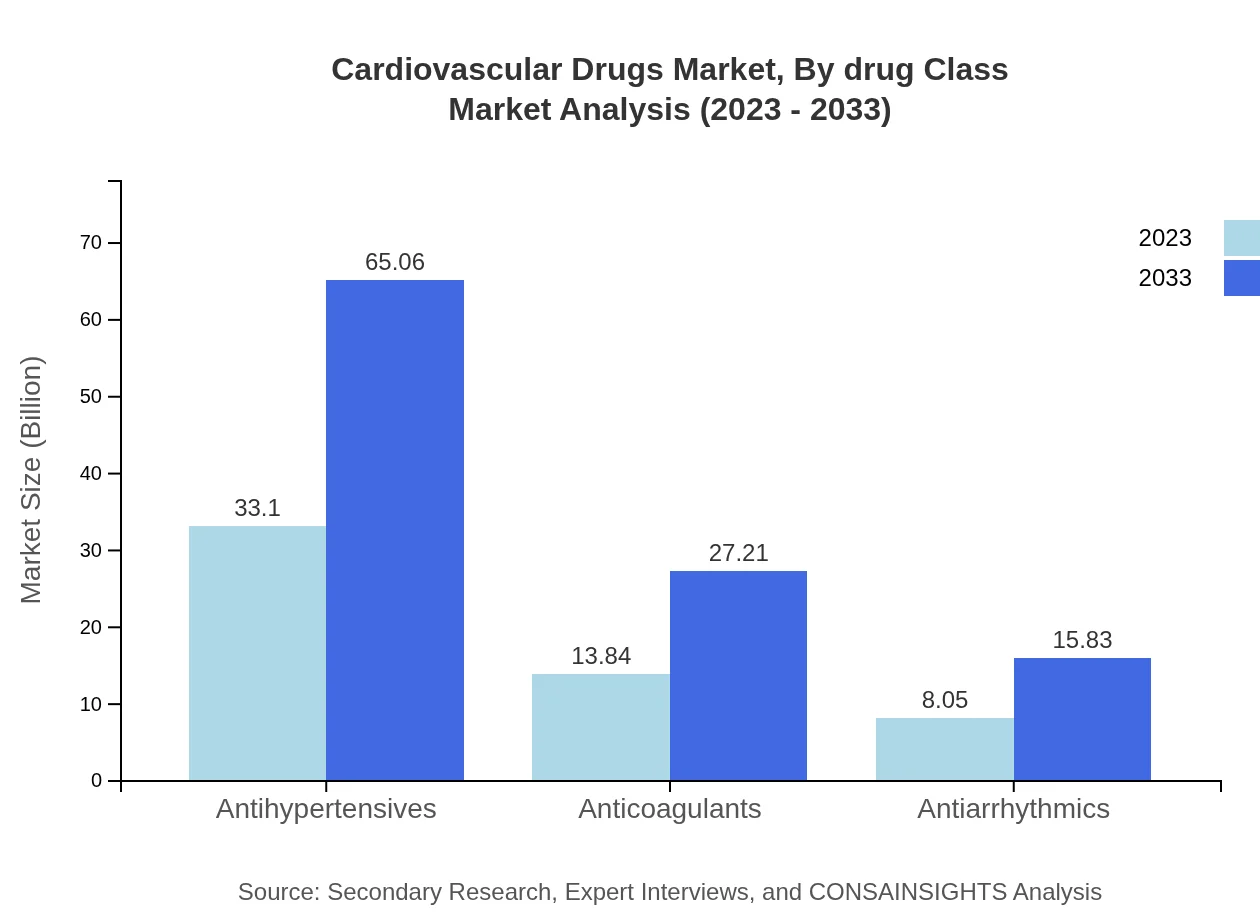

Cardiovascular Drugs Market Analysis By Drug Class

The cardiovascular drugs market segment by drug class is dominated by antihypertensives, projected to grow from $33.10 billion in 2023 to $65.06 billion by 2033, capturing 60.19% market share. Anticoagulants will double their market size from $13.84 billion to $27.21 billion, commanding a share of 25.17%, while antiarrhythmics will rise from $8.05 billion to $15.83 billion, holding 14.64%.

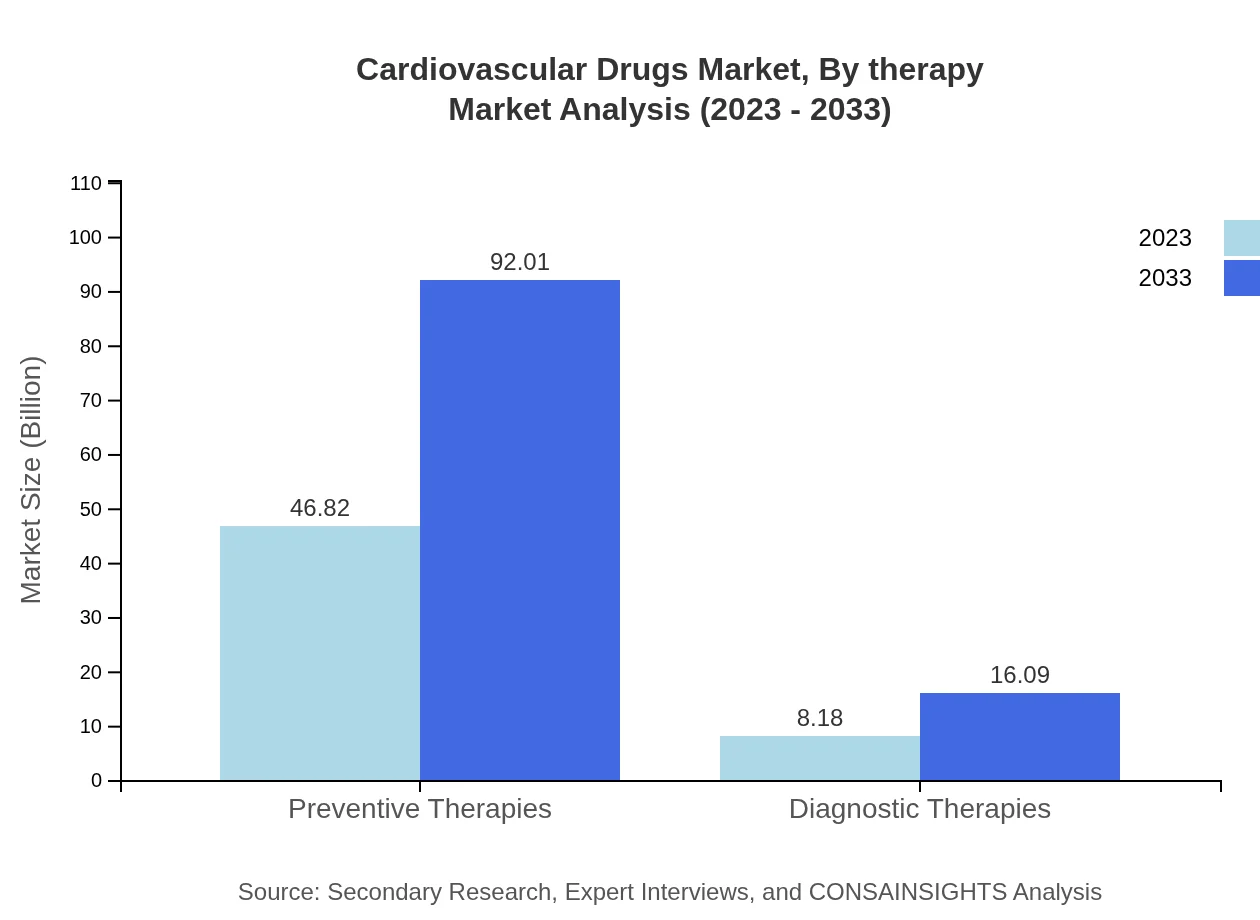

Cardiovascular Drugs Market Analysis By Therapy

The therapy distribution in the cardiovascular drugs market shows preventive therapies leading with a size of $46.82 billion in 2023 and expected to reach $92.01 billion in 2033, holding over 85% market share. Diagnostic therapies hold a smaller footprint, expanding from $8.18 billion to $16.09 billion at a 14.88% share.

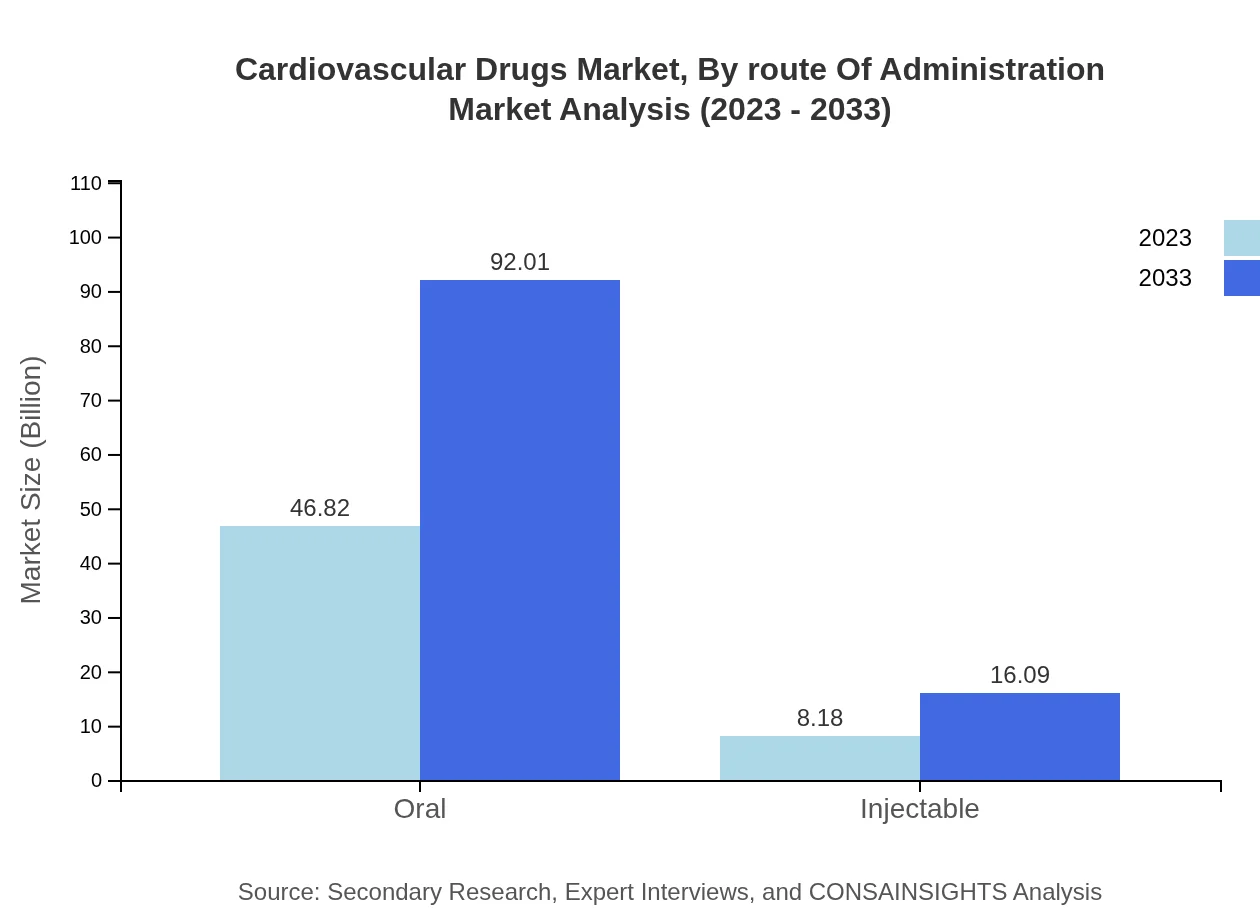

Cardiovascular Drugs Market Analysis By Route Of Administration

Oral administration dominates the market at $46.82 billion in 2023 with a forecasted growth to $92.01 billion by 2033, maintaining an 85.12% share. Injectable routes represent a smaller yet growing segment, moving from $8.18 billion to $16.09 billion, securing a 14.88% share.

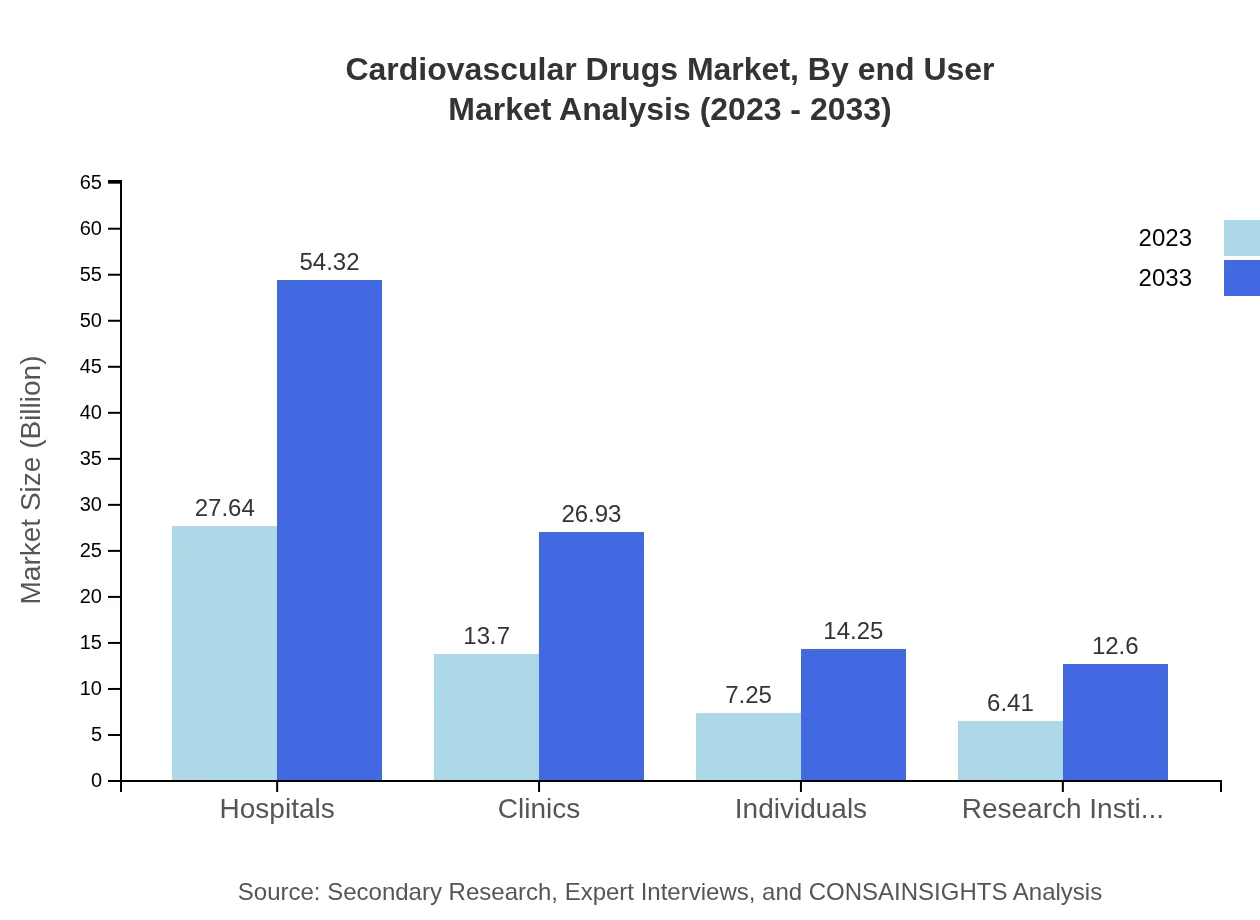

Cardiovascular Drugs Market Analysis By End User

Hospitals represent the largest end-user segment, with market size expected to grow from $27.64 billion in 2023 to $54.32 billion in 2033 (50.25% share). Clinics and individuals follow, with sizes projected at $13.70 billion to $26.93 billion and $7.25 billion to $14.25 billion, respectively.

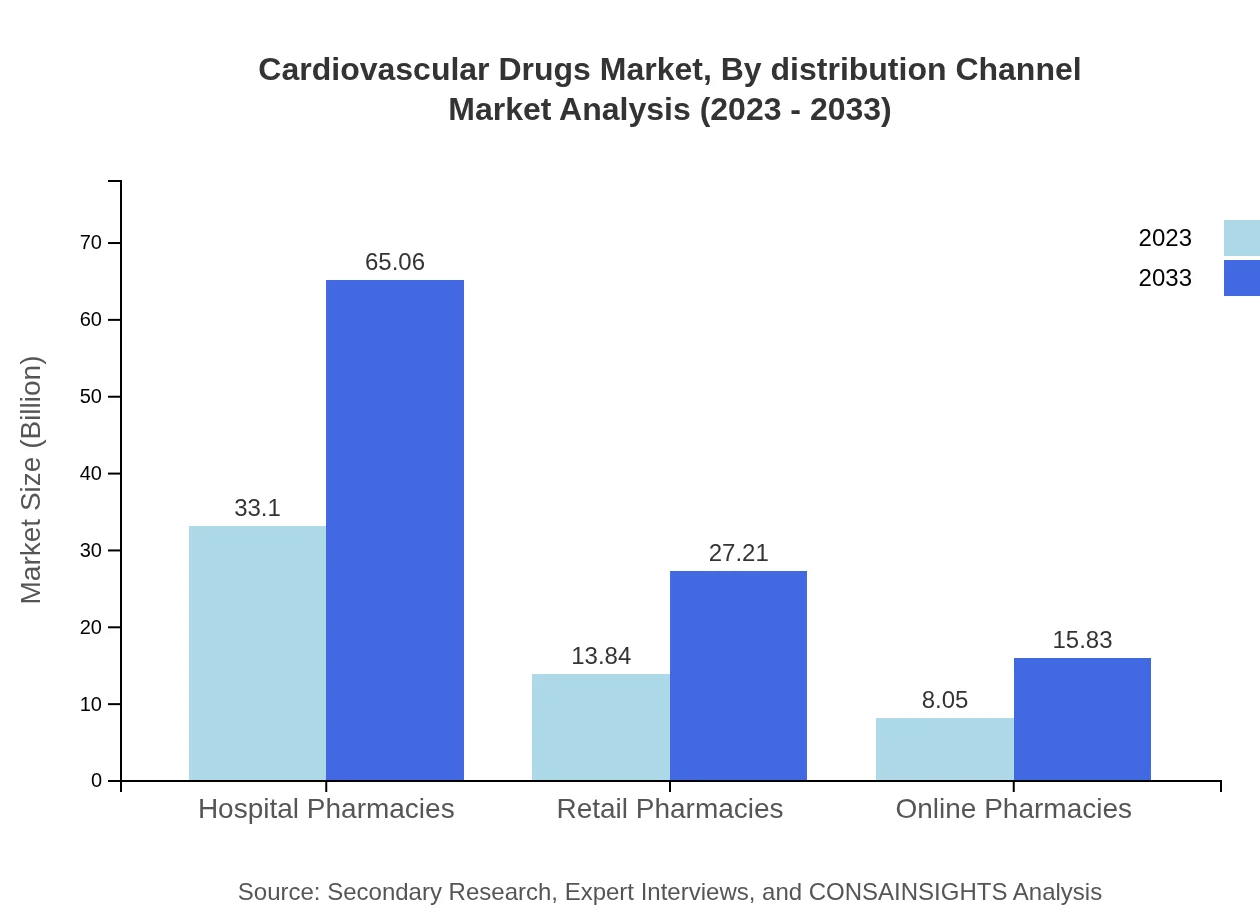

Cardiovascular Drugs Market Analysis By Distribution Channel

Hospital pharmacies lead this segment, growing from $33.10 billion in 2023 to $65.06 billion in 2033, maintaining a 60.19% share. Retail pharmacies and online pharmacies also play vital roles, projected to grow significantly from $13.84 billion to $27.21 billion and $8.05 billion to $15.83 billion.

Cardiovascular Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiovascular Drugs Industry

Pfizer Inc.:

Pfizer is a global leader in the pharmaceutical industry, offering a wide range of cardiovascular medications with a focus on innovation and patient access.Bristol-Myers Squibb:

Known for its groundbreaking therapies, Bristol-Myers Squibb specializes in cardiology and offers a portfolio that addresses various cardiovascular disorders.Novartis AG:

Novartis focuses on developing innovative cardiovascular solutions, contributing significantly to market advancements and patient care.AstraZeneca:

AstraZeneca offers a robust portfolio of cardiovascular drugs, emphasizing research and development to innovate new treatments for heart diseases.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiovascular drugs?

The global cardiovascular drugs market is valued at $55 billion in 2023, with a projected CAGR of 6.8% through to 2033. This indicates a significant growth potential in the sector, reflecting the rising demand for cardiovascular treatments globally.

What are the key market players or companies in the cardiovascular drugs industry?

Key market players in the cardiovascular drugs industry include major pharmaceutical companies such as Pfizer, Merck, Sanofi, AstraZeneca, and Novartis. These companies drive innovation and market dynamics, offering a range of cardiovascular therapeutic solutions.

What are the primary factors driving the growth in the cardiovascular drugs industry?

Primary growth factors include the increasing incidence of cardiovascular diseases due to aging populations, urbanization, lifestyle changes, and technological advancements in drug development. Additionally, growing awareness and preventive health measures contribute to market expansion.

Which region is the fastest Growing in the cardiovascular drugs market?

The fastest-growing region in the cardiovascular drugs market is North America, projected to grow from $20.88 billion in 2023 to $41.03 billion by 2033. This growth is driven by demand for innovative therapies and advanced healthcare infrastructure.

Does ConsaInsights provide customized market report data for the cardiovascular drugs industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cardiovascular drugs industry. Clients can request detailed insights focusing on market size, growth projections, and competitive analyses.

What deliverables can I expect from this cardiovascular drugs market research project?

Deliverables from our cardiovascular drugs market research include comprehensive reports, market sizing, competitive landscape analysis, segment breakdowns, and projected growth rates. Additional insights into trends and strategic recommendations are also provided.

What are the market trends of cardiovascular drugs?

Current market trends in cardiovascular drugs involve a shift towards preventive therapies, with the preventive segment growing significantly from $46.82 billion in 2023 to $92.01 billion by 2033, reflecting the increasing focus on health management.