Cardiovascular Monitoring Diagnostic Devices Market Report

Published Date: 31 January 2026 | Report Code: cardiovascular-monitoring-diagnostic-devices

Cardiovascular Monitoring Diagnostic Devices Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Cardiovascular Monitoring Diagnostic Devices market, encompassing current trends, future forecasts, and detailed insights from 2023 to 2033.

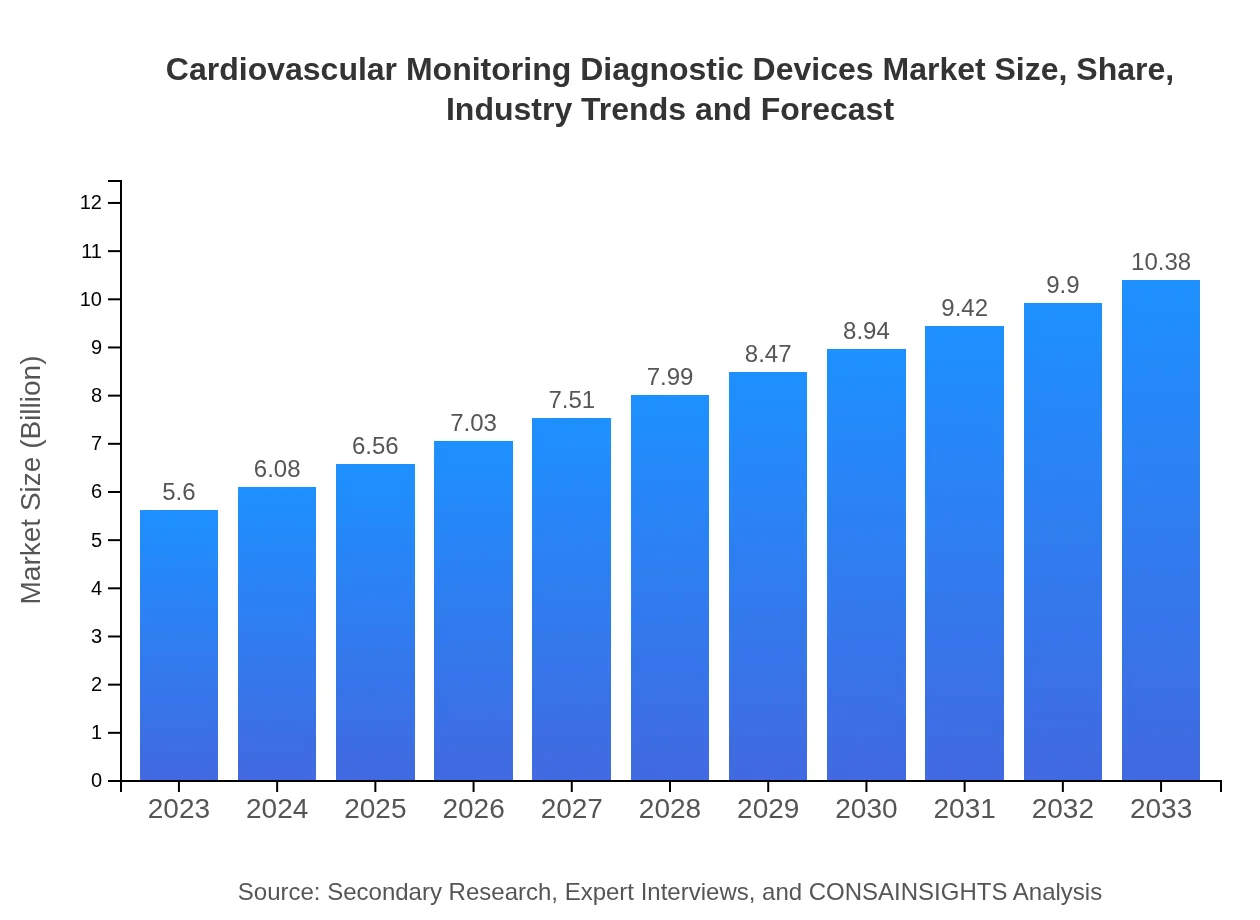

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Medtronic , Philips Healthcare, GE Healthcare, Abbott Laboratories, Boston Scientific |

| Last Modified Date | 31 January 2026 |

Cardiovascular Monitoring Diagnostic Devices Market Overview

Customize Cardiovascular Monitoring Diagnostic Devices Market Report market research report

- ✔ Get in-depth analysis of Cardiovascular Monitoring Diagnostic Devices market size, growth, and forecasts.

- ✔ Understand Cardiovascular Monitoring Diagnostic Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cardiovascular Monitoring Diagnostic Devices

What is the Market Size & CAGR of Cardiovascular Monitoring Diagnostic Devices market in 2023 and 2033?

Cardiovascular Monitoring Diagnostic Devices Industry Analysis

Cardiovascular Monitoring Diagnostic Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cardiovascular Monitoring Diagnostic Devices Market Analysis Report by Region

Europe Cardiovascular Monitoring Diagnostic Devices Market Report:

The European market is anticipated to expand from $1.35 billion in 2023 to $2.50 billion by 2033. Factors such as supportive regulatory frameworks, high healthcare expenditure, and increasing health awareness drive the growth of cardiovascular monitoring devices across Europe.Asia Pacific Cardiovascular Monitoring Diagnostic Devices Market Report:

The Asia Pacific region's market for cardiovascular monitoring devices is projected to grow from $1.15 billion in 2023 to $2.14 billion in 2033. This growth is driven by rising healthcare spending, improving healthcare infrastructure, and increasing awareness regarding cardiovascular diseases in countries like India and China.North America Cardiovascular Monitoring Diagnostic Devices Market Report:

North America dominated the market in 2023 with a valuation of $1.84 billion and is forecasted to reach $3.41 billion by 2033. High prevalence of heart diseases, advanced healthcare systems, and substantial investments in technological advancements contribute to this significant growth.South America Cardiovascular Monitoring Diagnostic Devices Market Report:

In South America, the market is expected to rise from $0.53 billion in 2023 to $0.99 billion by 2033. Growth is attributed to increasing healthcare investments and a rise in the aging population, leading to higher incidences of cardiovascular disorders.Middle East & Africa Cardiovascular Monitoring Diagnostic Devices Market Report:

The Middle East and Africa region is expected to witness growth from $0.73 billion in 2023 to $1.35 billion by 2033. Improving healthcare facilities, government initiatives to improve public health, and rising awareness of cardiovascular diseases increase market penetration in this region.Tell us your focus area and get a customized research report.

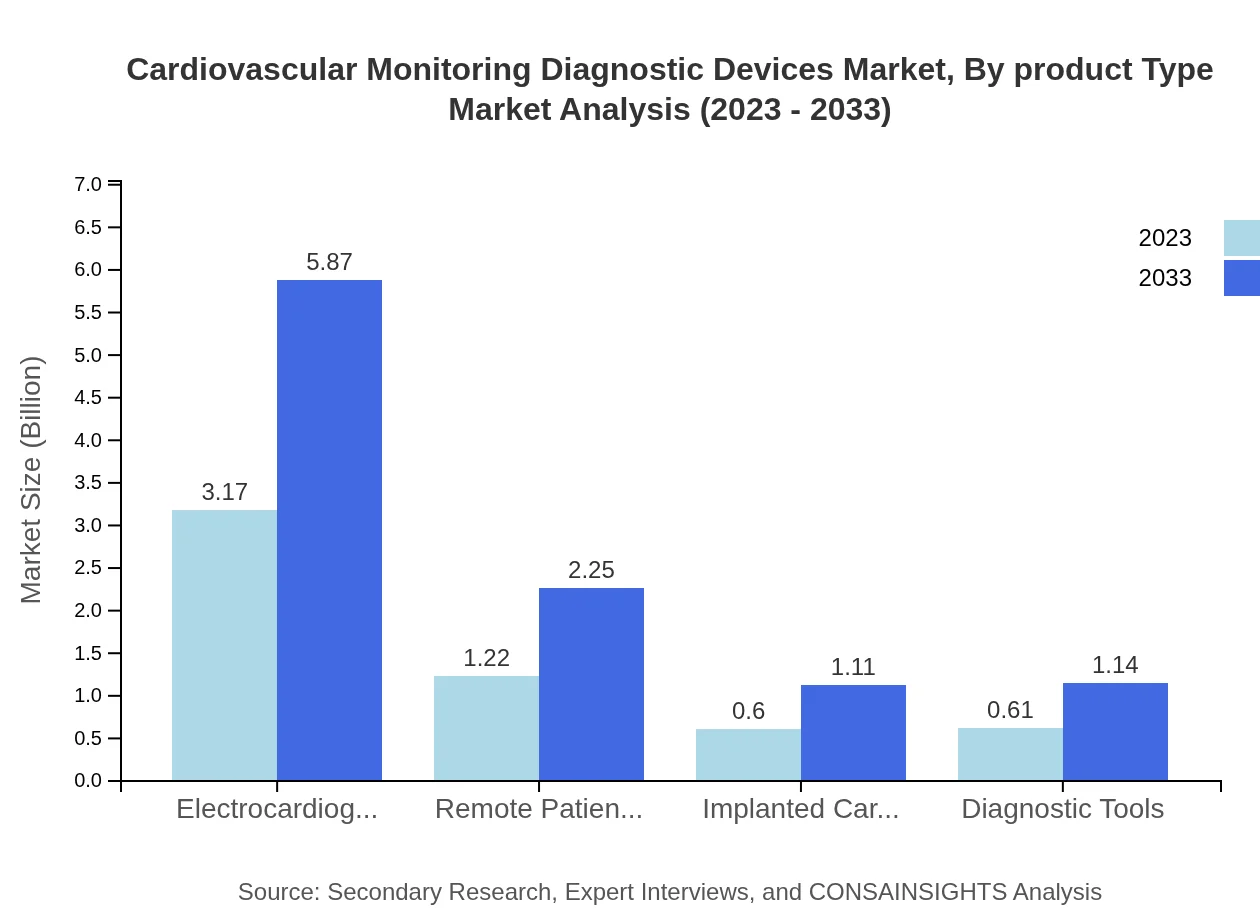

Cardiovascular Monitoring Diagnostic Devices Market Analysis By Product Type

The product type segment includes various devices critical for monitoring cardiovascular health. In 2023, the market is valued at $4.80 billion with a significant share attributed to Electrocardiogram (ECG) devices (56.57%) while growth toward advanced diagnostic tools increases the focus on preventive care.

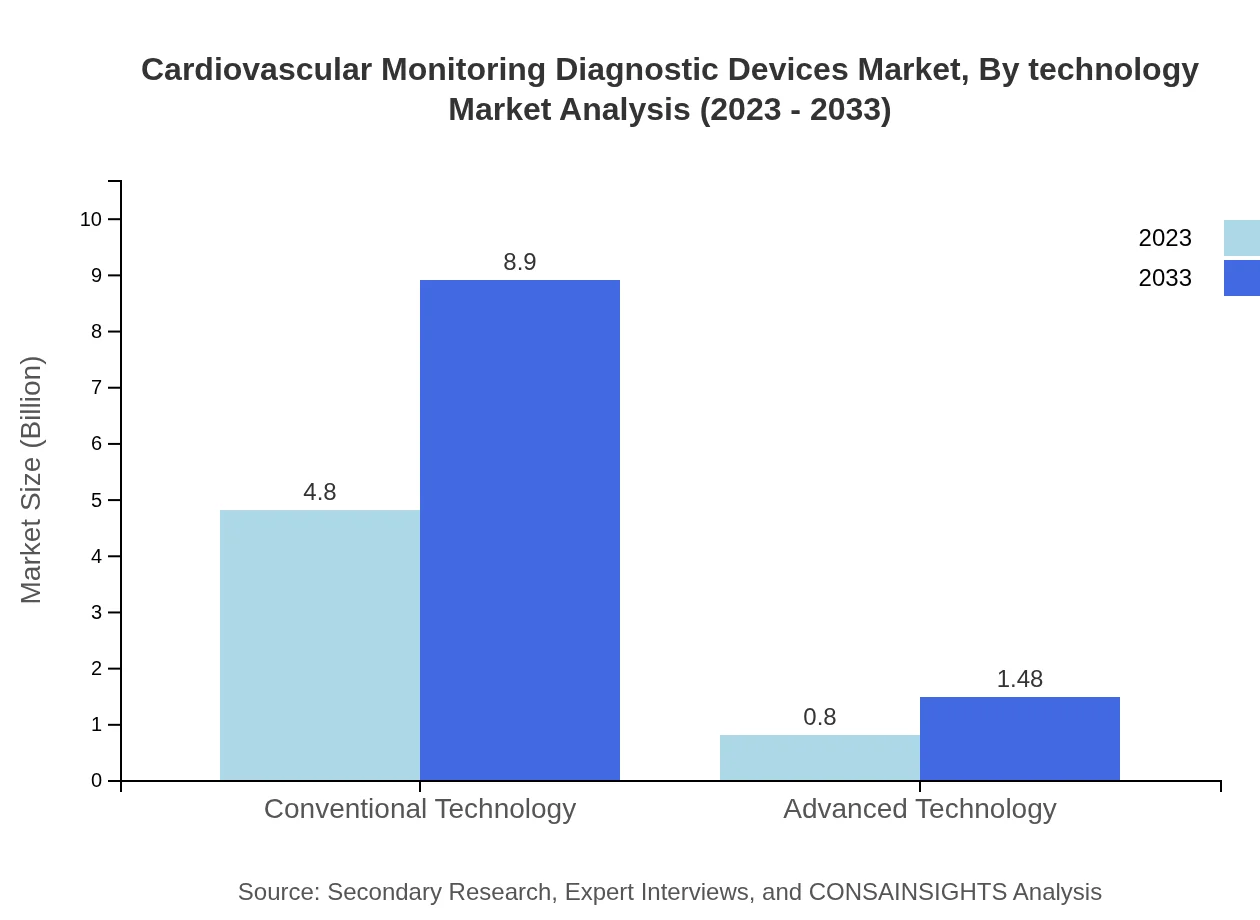

Cardiovascular Monitoring Diagnostic Devices Market Analysis By Technology

The market is classified into conventional and advanced technologies. Conventional technologies dominate with an 85.74% share, reflecting their established use in healthcare. Advanced technologies, however, are rapidly evolving, with an expected growth to a $1.48 billion market size by 2033, driven by innovations and increasing demand for home monitoring solutions.

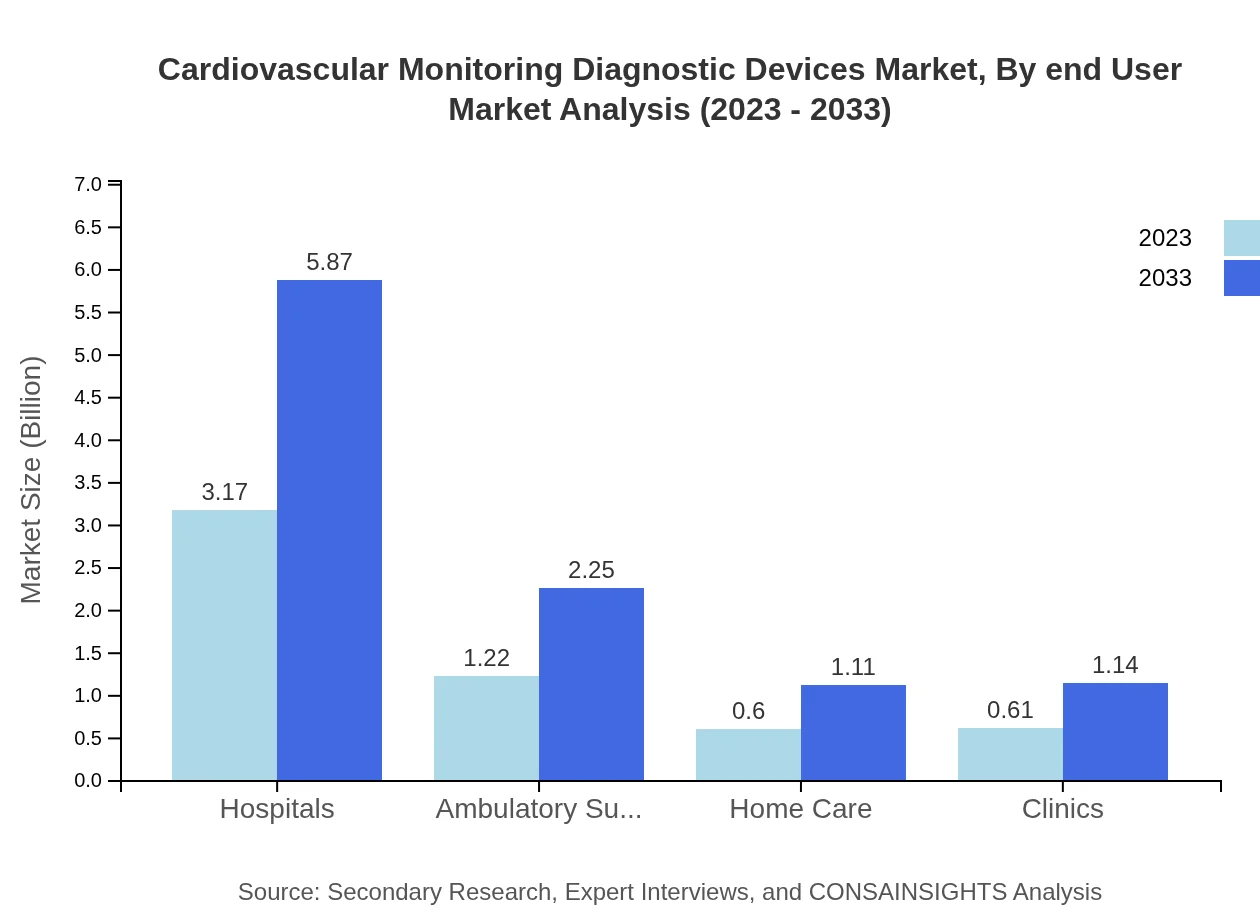

Cardiovascular Monitoring Diagnostic Devices Market Analysis By End User

The end-user segment shows hospitals as the largest market share holder (56.57%), growing from $3.17 billion in 2023 to $5.87 billion in 2033. Other notable segments include ambulatory surgery centers and clinics, which are also experiencing increased demand for cardiovascular monitoring devices as part of comprehensive patient care.

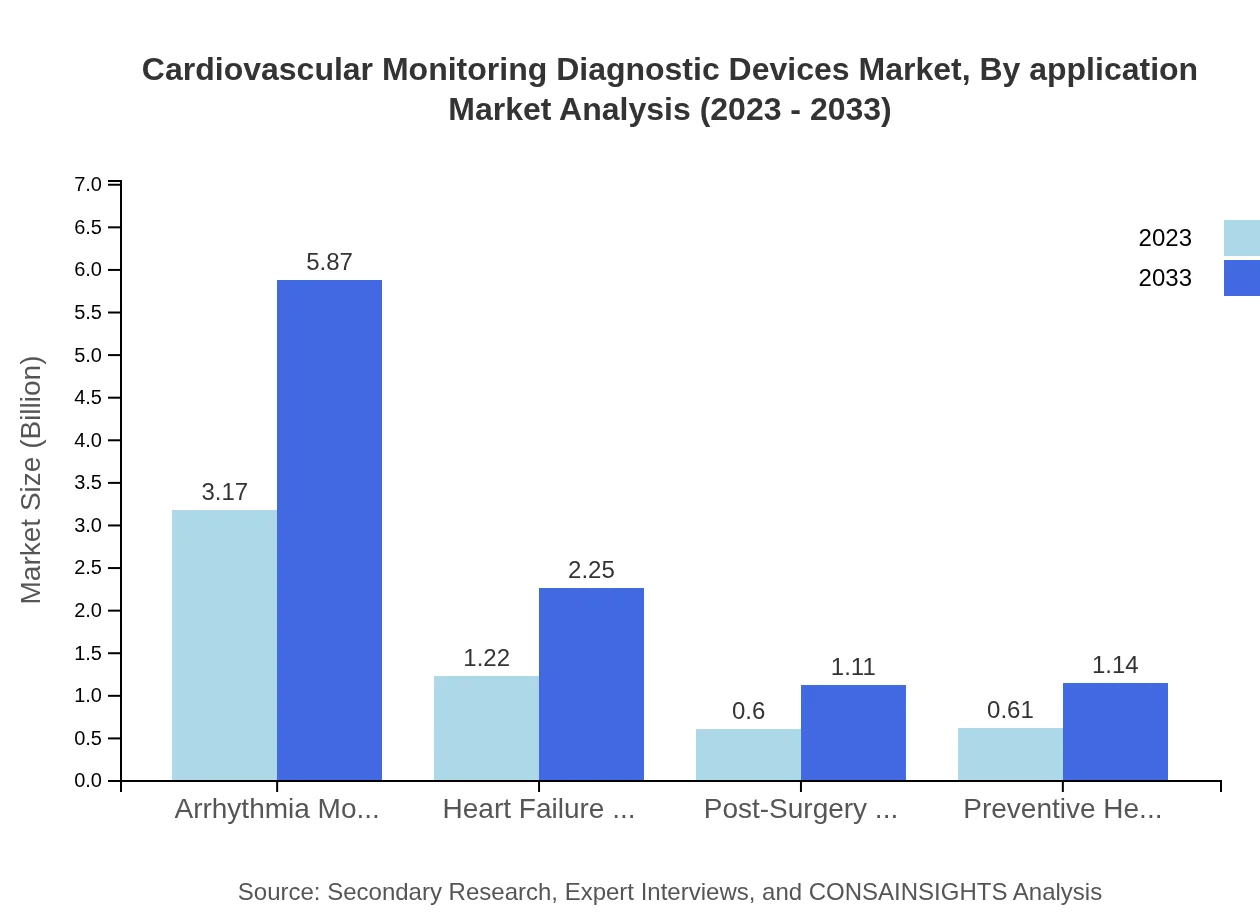

Cardiovascular Monitoring Diagnostic Devices Market Analysis By Application

Applications include arrhythmia monitoring, heart failure management, and preventive healthcare, collectively valued at $5.57 billion in 2023. Each application is witnessing rapid growth with advancements tailored toward elevating patient monitoring standards and enhancing treatment outcomes.

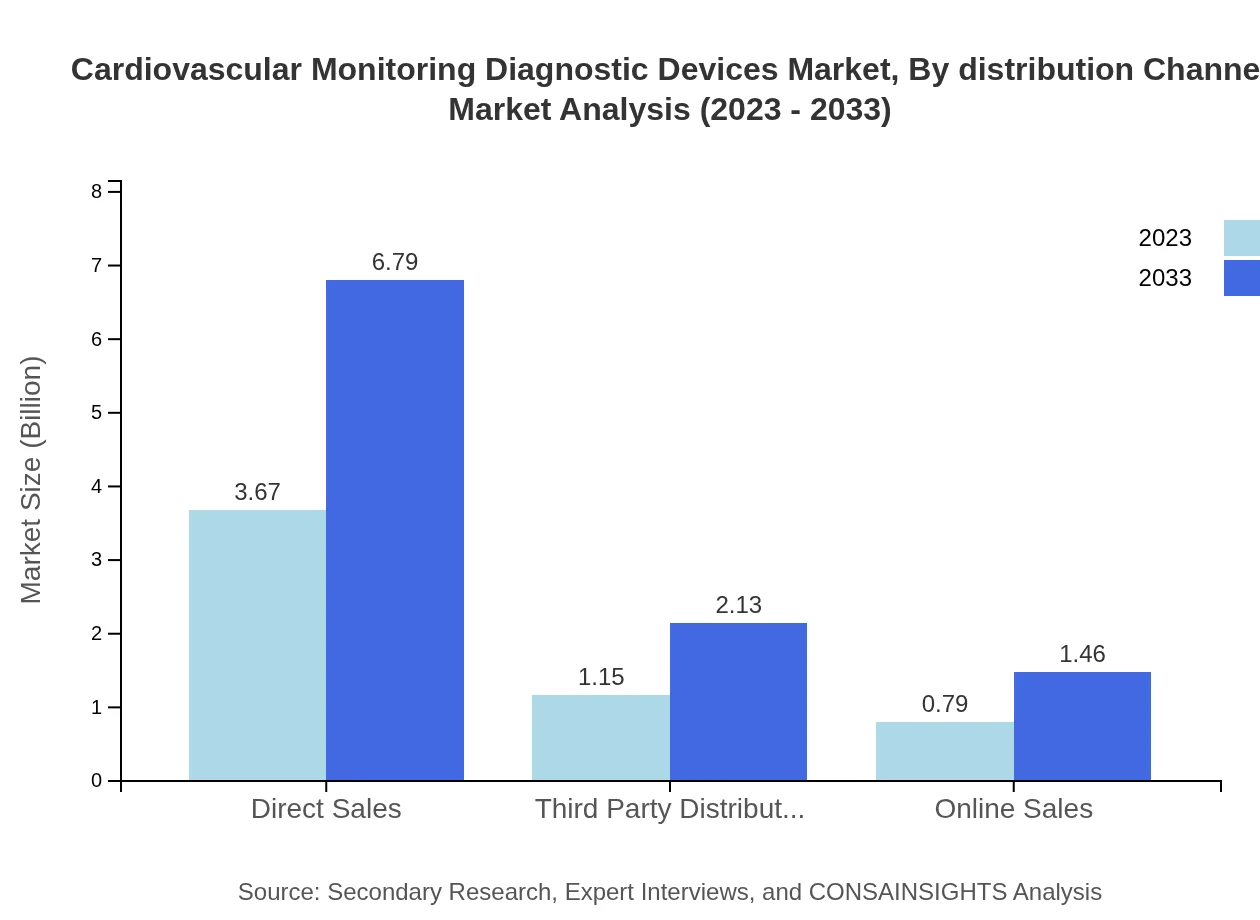

Cardiovascular Monitoring Diagnostic Devices Market Analysis By Distribution Channel

Market distribution channels include direct sales, online sales, and sales through third-party distributors. The direct sales channel leads with a market share of 65.45%, while online sales and distributors' channels are progressively gaining traction, reflecting the evolving dynamics of how devices are sold and distributed in today's marketplace.

Cardiovascular Monitoring Diagnostic Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cardiovascular Monitoring Diagnostic Devices Industry

Medtronic :

A leader in medical technology, Medtronic has been at the forefront of developing innovative cardiovascular monitoring devices, focusing on improving patient outcomes and access to care.Philips Healthcare:

Recognized for its advanced imaging and monitoring technologies, Philips enhances cardiovascular diagnostics through innovative solutions aimed at streamlining medical workflows.GE Healthcare:

GE Healthcare is known for its extensive lineup of cardiovascular monitoring equipment, emphasizing data integration and advanced analytics to support healthcare providers.Abbott Laboratories:

With a focus on implantable devices and diagnostics, Abbott Laboratories specializes in innovative products that promote effective cardiac health management.Boston Scientific:

Boston Scientific develops devices and solutions that cater to both inpatient and outpatient cardiovascular care, driving improvements in healthcare outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of cardiovascular Monitoring Diagnostic Devices?

The cardiovascular monitoring diagnostic devices market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.2%. This growth highlights the increasing demand for innovative healthcare solutions in monitoring cardiovascular health.

What are the key market players or companies in this cardiovascular Monitoring Diagnostic Devices industry?

Key market players include renowned companies like Medtronic, Abbott Laboratories, and Philips Healthcare. These companies lead the development of advanced cardiovascular monitoring technologies, contributing to enhanced patient outcomes and driving market growth.

What are the primary factors driving the growth in the cardiovascular Monitoring Diagnostic Devices industry?

Growth drivers include the rising prevalence of cardiovascular diseases, technological advancements in monitoring devices, and an increasing focus on preventive healthcare. Additionally, the aging population and rising healthcare expenditure further fuel market expansion.

Which region is the fastest Growing in the cardiovascular Monitoring Diagnostic Devices?

The Asia-Pacific region is the fastest-growing for cardiovascular monitoring diagnostic devices, with a market size projected to grow from $1.15 billion in 2023 to $2.14 billion by 2033, reflecting a strong demand for advanced healthcare technology in this region.

Does ConsaInsights provide customized market report data for the cardiovascular Monitoring Diagnostic Devices industry?

Yes, ConsaInsights offers customized market report data tailored to the cardiovascular monitoring diagnostic devices industry. This includes in-depth analysis to meet specific client needs, ensuring comprehensive insights for strategic decision-making.

What deliverables can I expect from this cardiovascular Monitoring Diagnostic Devices market research project?

From this market research project, you can expect detailed reports, analysis of key trends, competitive landscape assessments, and projections for market size across various segments, regions, and technologies relevant to cardiovascular monitoring devices.

What are the market trends of cardiovascular Monitoring Diagnostic Devices?

Current market trends include a shift towards homecare solutions, increased integration of AI in diagnostics, and a growing emphasis on telemedicine. These trends highlight the evolving landscape of cardiovascular monitoring, aimed at enhancing accessibility and patient care.