Cargo Handling Equipment Market Report

Published Date: 22 January 2026 | Report Code: cargo-handling-equipment

Cargo Handling Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Cargo Handling Equipment market, covering market size, segmentation, regional insights, and future trends from 2023 to 2033.

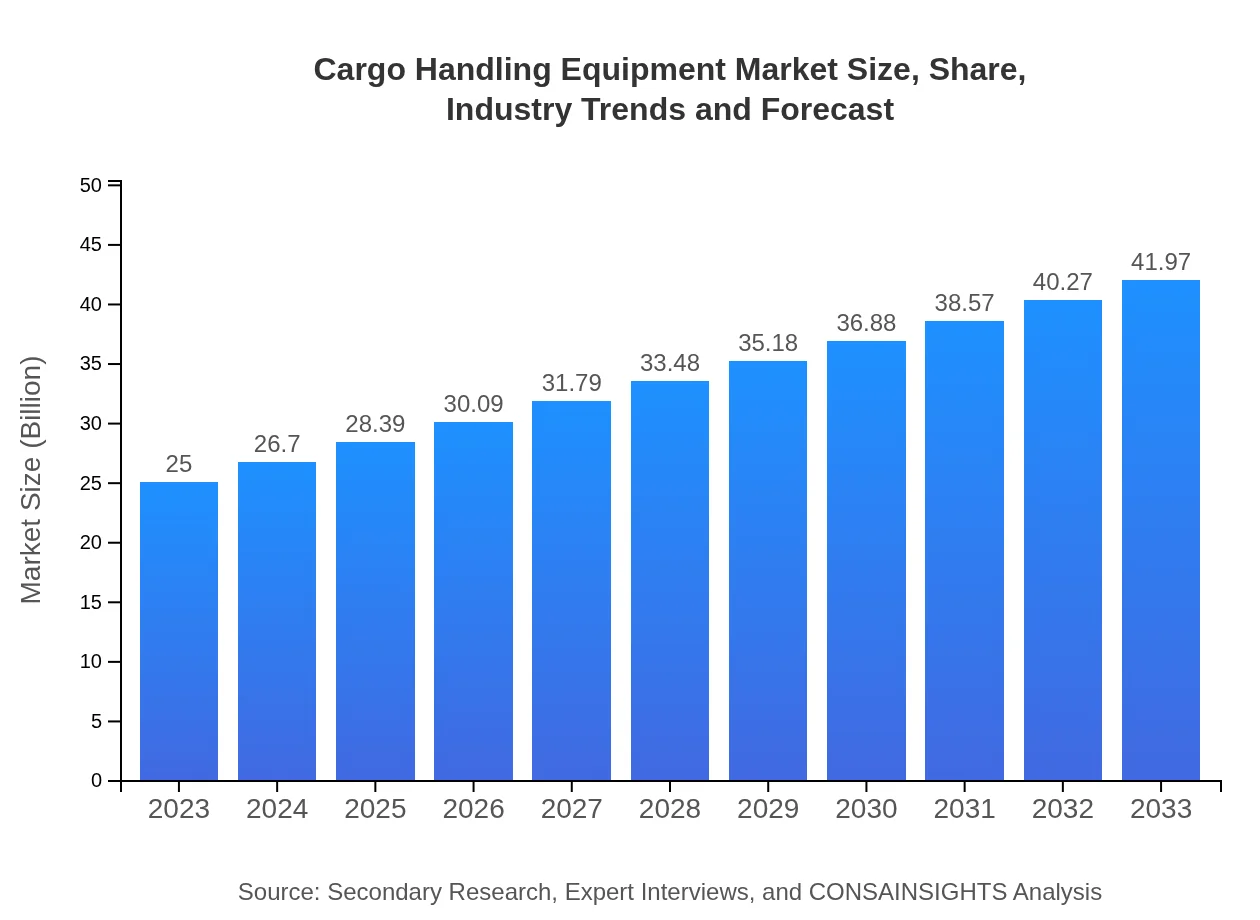

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $41.97 Billion |

| Top Companies | Konecranes, Hyster-Yale Materials Handling, Caterpillar Inc., Crown Equipment Corporation, Toyota Material Handling |

| Last Modified Date | 22 January 2026 |

Cargo Handling Equipment Market Overview

Customize Cargo Handling Equipment Market Report market research report

- ✔ Get in-depth analysis of Cargo Handling Equipment market size, growth, and forecasts.

- ✔ Understand Cargo Handling Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cargo Handling Equipment

What is the Market Size & CAGR of Cargo Handling Equipment market in 2023?

Cargo Handling Equipment Industry Analysis

Cargo Handling Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cargo Handling Equipment Market Analysis Report by Region

Europe Cargo Handling Equipment Market Report:

In Europe, the market is estimated at USD 6.73 billion in 2023, with expectations to grow to USD 11.30 billion by 2033. Increased emphasis on sustainability and efficiency in logistics operations is shaping the demand for innovative cargo handling technologies.Asia Pacific Cargo Handling Equipment Market Report:

The Asia Pacific region is projected to witness significant growth, with a market size of USD 5.24 billion in 2023, expanding to USD 8.80 billion by 2033. This growth is driven by rapidly developing economies, increasing infrastructure investments, and rising industrial activities.North America Cargo Handling Equipment Market Report:

North America retains a substantial market presence, recording USD 8.50 billion in 2023 and expected to reach USD 14.26 billion by 2033. The solid growth is supported by state-of-the-art technological advancements and the rising demand for automated cargo solutions.South America Cargo Handling Equipment Market Report:

The South American market for Cargo Handling Equipment was valued at USD 2.35 billion in 2023, with a projected increase to USD 3.94 billion by 2033. Growth in this region is propelled by the expansion of logistics services and regional trade agreements aimed at enhancing supply chains.Middle East & Africa Cargo Handling Equipment Market Report:

The Middle East and Africa market stands at USD 2.18 billion in 2023, projected to grow to USD 3.66 billion by 2033. Economic diversification efforts and infrastructure development initiatives in this region are key contributors to market growth.Tell us your focus area and get a customized research report.

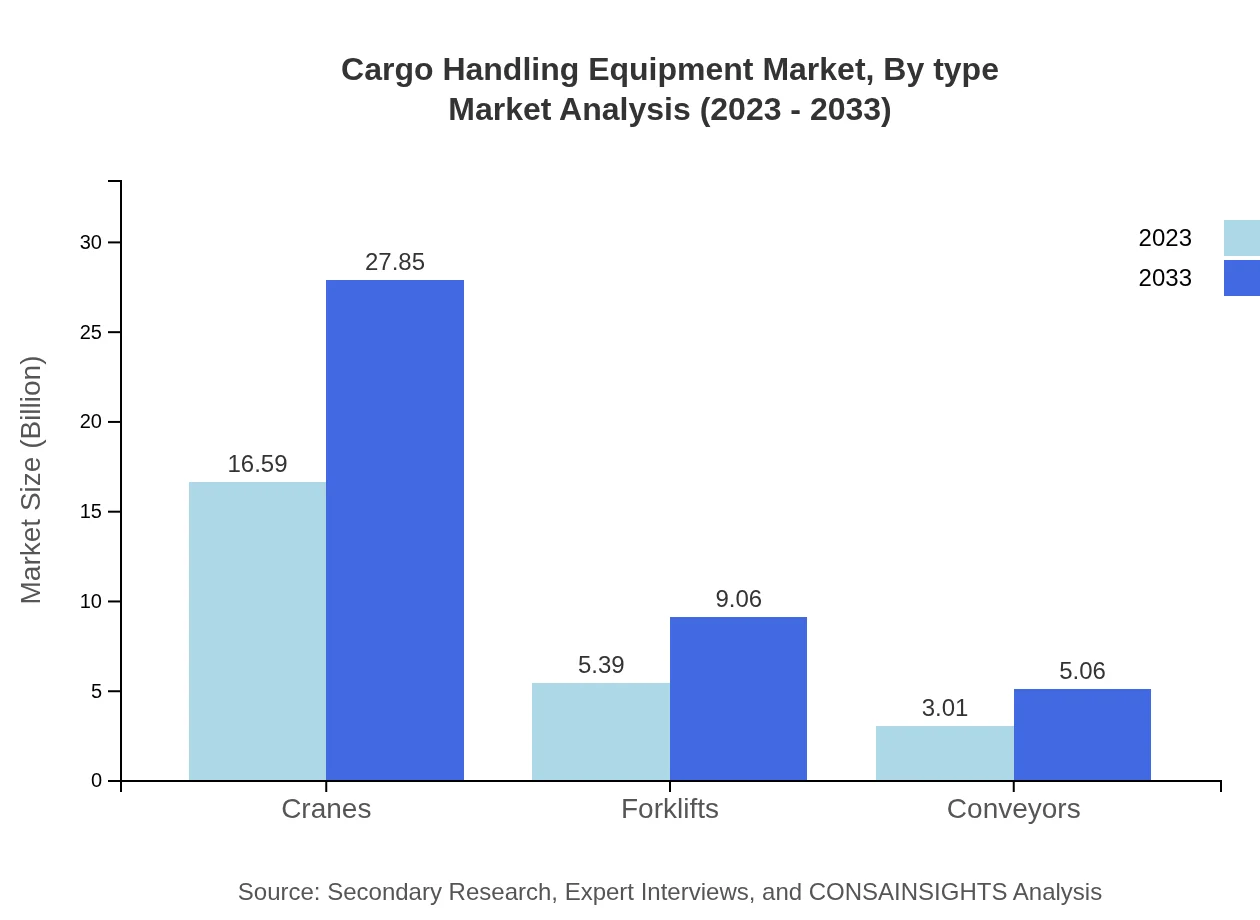

Cargo Handling Equipment Market Analysis By Type

The Cargo Handling Equipment market by type reveals cranes dominate the segment with an estimated size of USD 16.59 billion in 2023, projected to reach USD 27.85 billion by 2033. Forklifts follow, reflecting a size of USD 5.39 billion in 2023 and expected to grow to USD 9.06 billion by 2033. Conveyors and other technologies are also critical, reflecting the growing need for specialized cargo management solutions.

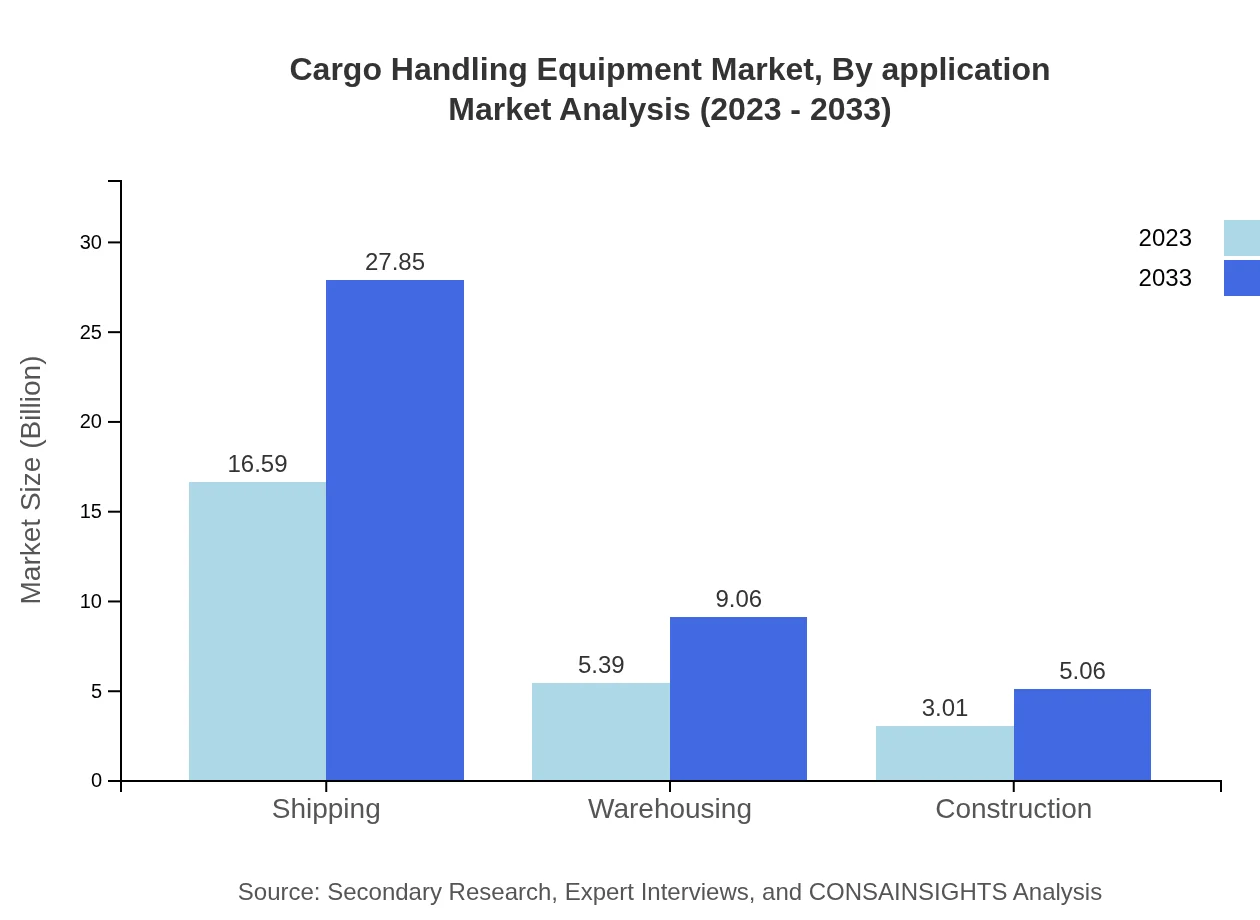

Cargo Handling Equipment Market Analysis By Application

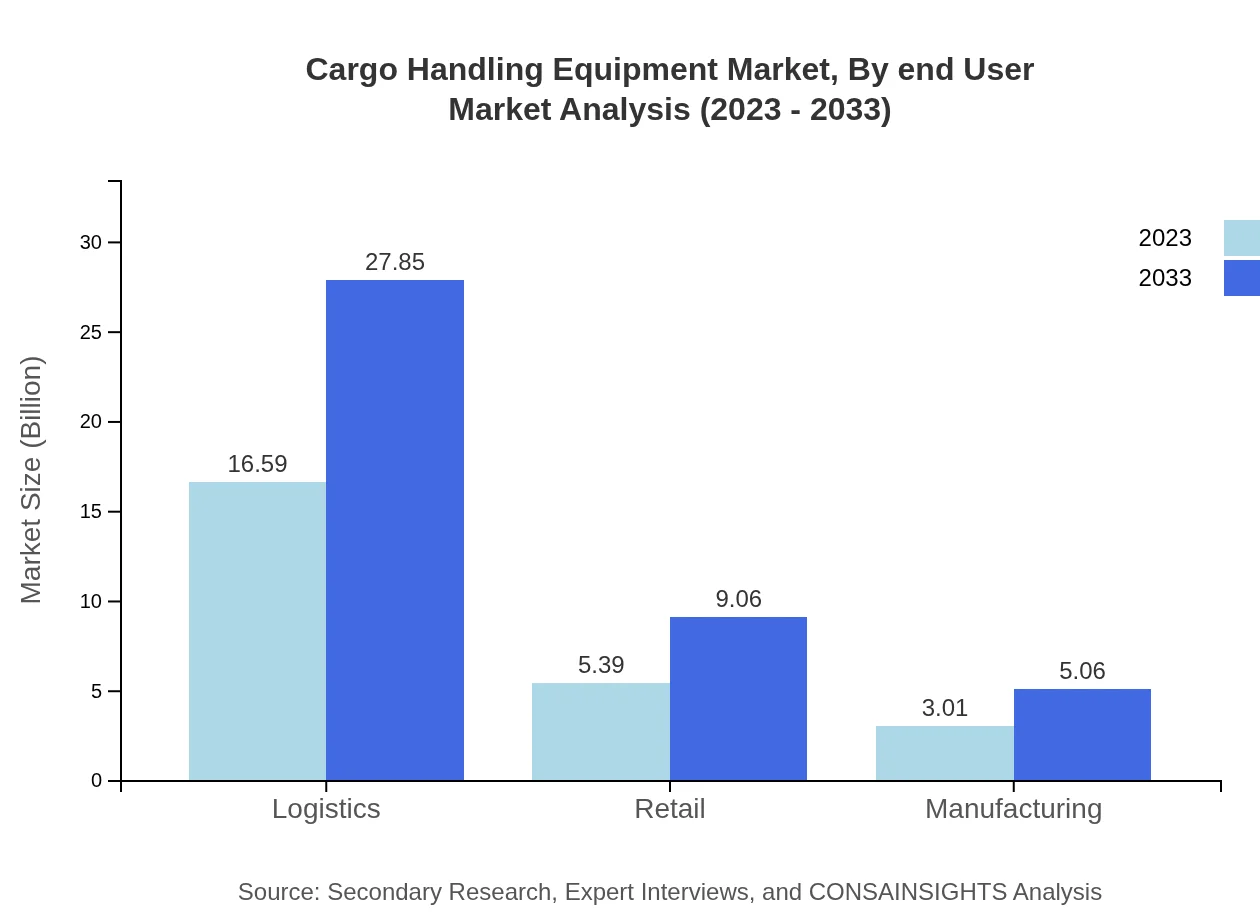

By application, the logistics sector represents the largest share of the Cargo Handling Equipment market, valued at USD 16.59 billion in 2023. Retail applications show a substantial presence with expected market growth from USD 5.39 billion to USD 9.06 billion by 2033. Manufacturing and shipping are also significant, emphasizing the importance of cargo handling across various industries.

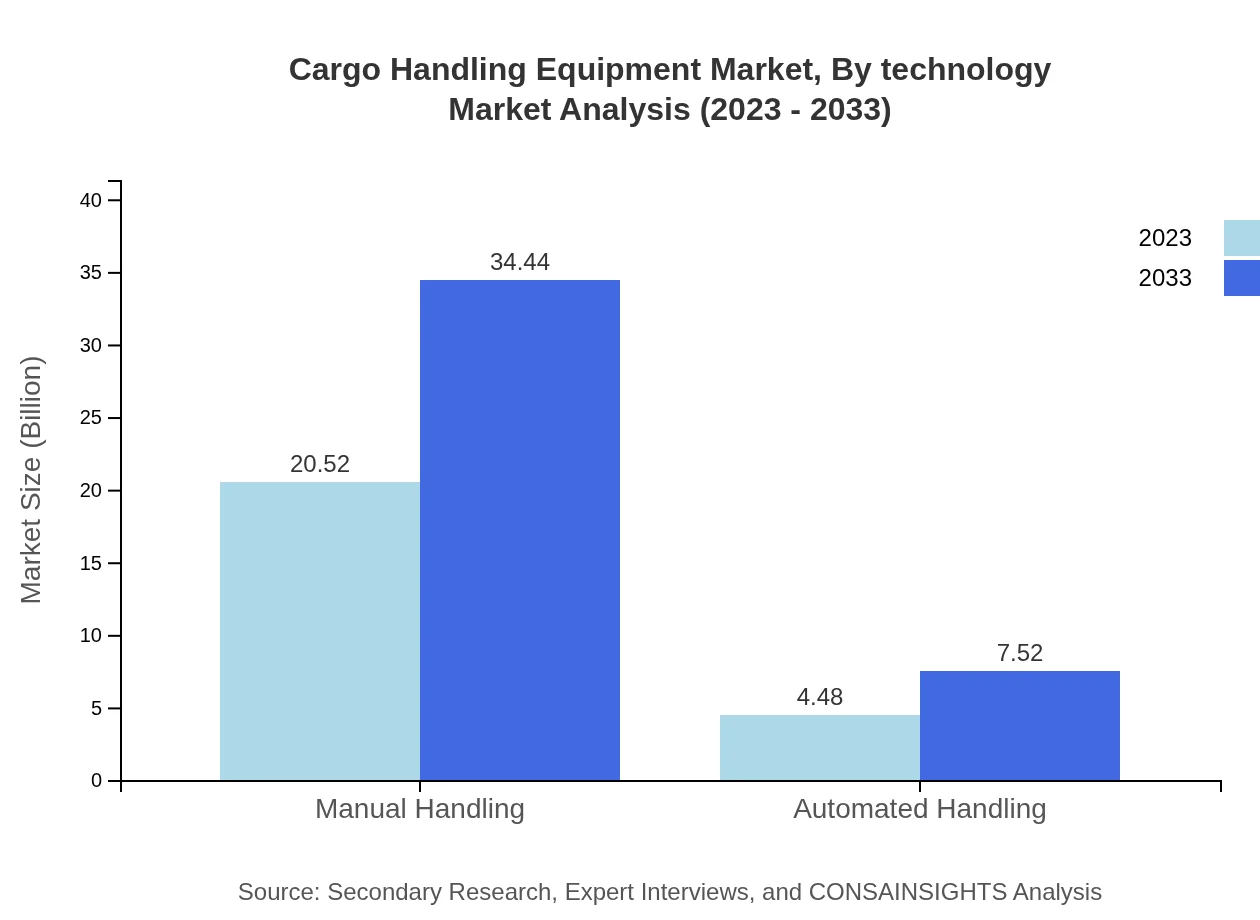

Cargo Handling Equipment Market Analysis By Technology

Innovations in technology are reshaping the Cargo Handling Equipment market, with manual handling still accounting for 82.07% of size in 2023. However, automated handling is steadily gaining market share, expected to grow from USD 4.48 billion in 2023 to USD 7.52 billion by 2033, reflecting a shift towards automation and increased efficiency in cargo operations.

Cargo Handling Equipment Market Analysis By End User

End-users of Cargo Handling Equipment include sectors such as shipping, warehousing, and retail, with significant contributions from manufacturing as well. These sectors emphasize the need for efficient cargo operations, predicting continued growth influenced by infrastructural advancements, particularly in emerging economies.

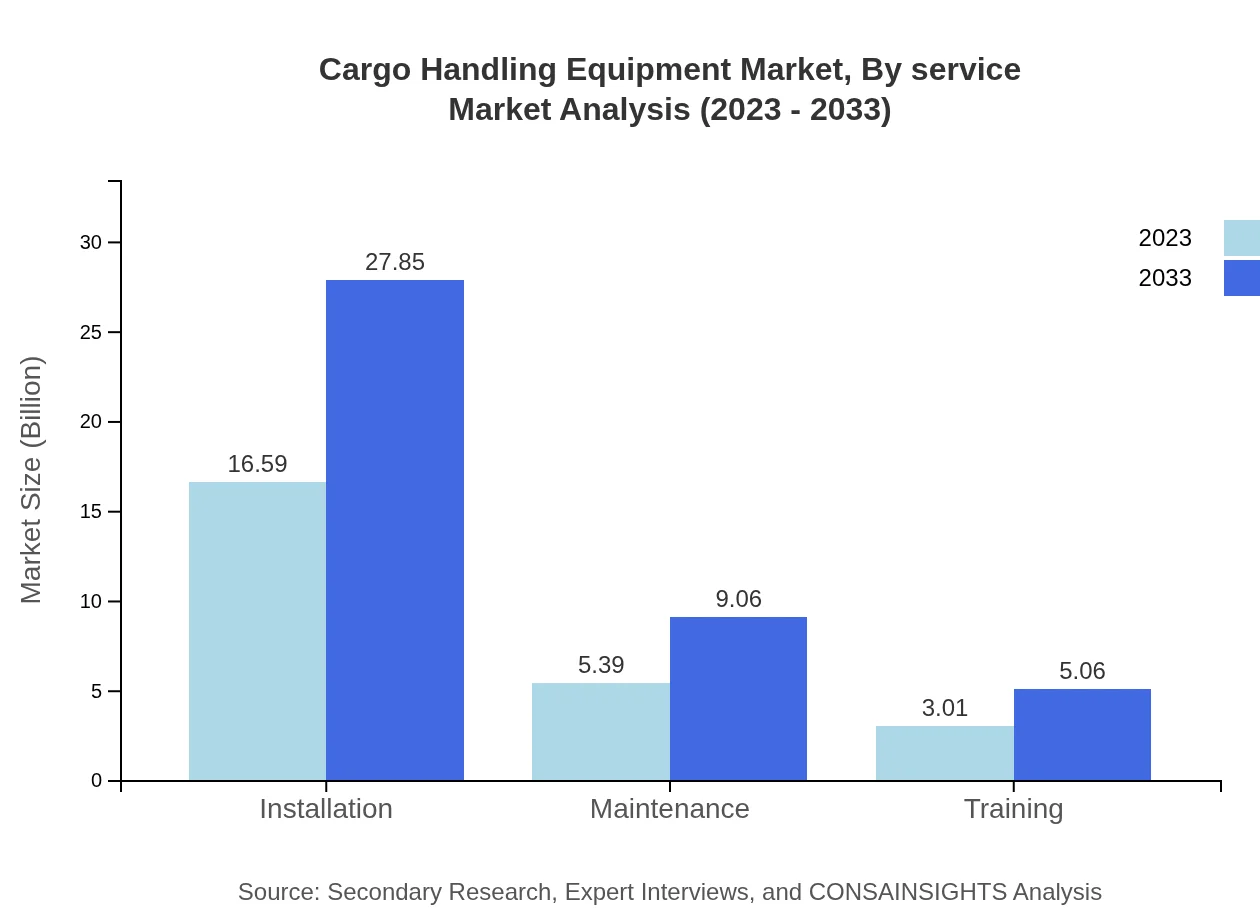

Cargo Handling Equipment Market Analysis By Service

Services including installation, maintenance, and training hold significant importance in the Cargo Handling Equipment market. With services valued at USD 16.59 billion in 2023 for installation and the same for logistics, companies are increasingly looking at end-to-end solutions that integrate high-quality service offerings.

Cargo Handling Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cargo Handling Equipment Industry

Konecranes:

A global leader in lifting solutions, Konecranes provides innovative equipment and services tailored for material handling. Their focus on safety, efficiency, and sustainability sets them apart in the industry.Hyster-Yale Materials Handling:

Hyster-Yale is recognized for its advanced forklifts and cargo handling solutions. Their extensive product range and commitment to customer service enhance operational efficiency across various sectors.Caterpillar Inc.:

Caterpillar offers comprehensive cargo handling solutions including cranes and other heavy machinery. Their strong global presence is bolstered by innovative technology and reliability.Crown Equipment Corporation:

Crown is a prominent player in the electric forklift market, focusing on energy efficiency and operator comfort, resulting in increased productivity in cargo handling.Toyota Material Handling:

Toyota has established itself as a leader in material handling equipment, providing high-performance forklifts and automated solutions that cater to the evolving needs of industries globally.We're grateful to work with incredible clients.

FAQs

What is the market size of cargo Handling Equipment?

The global cargo-handling equipment market is valued at approximately $25 billion in 2023, with a projected CAGR of 5.2%. This growth signifies increasing demand for efficient cargo handling in various sectors, ensuring robust market expansion over the next decade.

What are the key market players or companies in the cargo Handling Equipment industry?

Key players in the cargo-handling equipment industry include established corporations such as KION Group AG, Toyota Industries Corporation, and Jungheinrich AG. These companies dominate the market due to their advanced technologies and strong distribution networks.

What are the primary factors driving the growth in the cargo Handling Equipment industry?

Major growth factors include the rising demand for automation in logistics, increased e-commerce activities, and ongoing infrastructure development projects globally. Additionally, advancements in technology and the need for improved safety in material handling contribute significantly to market growth.

Which region is the fastest Growing in the cargo Handling Equipment market?

North America is the fastest-growing region in the cargo-handling equipment market, expanding from $8.50 billion in 2023 to $14.26 billion by 2033. This growth is fueled by significant investments in logistics infrastructure and a booming e-commerce market.

Does ConsaInsights provide customized market report data for the cargo Handling Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the cargo-handling equipment industry. This enables stakeholders to gain insights that align closely with their strategic objectives.

What deliverables can I expect from this cargo Handling Equipment market research project?

Expect comprehensive deliverables including detailed market analysis, trend reports, segment insights, regional overviews, and competitive landscape assessments. These insights will be crucial for strategic planning and market positioning.

What are the market trends of cargo Handling Equipment?

Current trends in the cargo-handling equipment market include increased automation, the integration of IOT technologies in equipment management, a shift towards eco-friendly equipment, and growth in manual handling equipment due to labor shortages.