Cargo Inspection Market Report

Published Date: 22 January 2026 | Report Code: cargo-inspection

Cargo Inspection Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cargo Inspection market, covering insights on market size, growth forecast, technological advancements, and regional dynamics from 2023 to 2033.

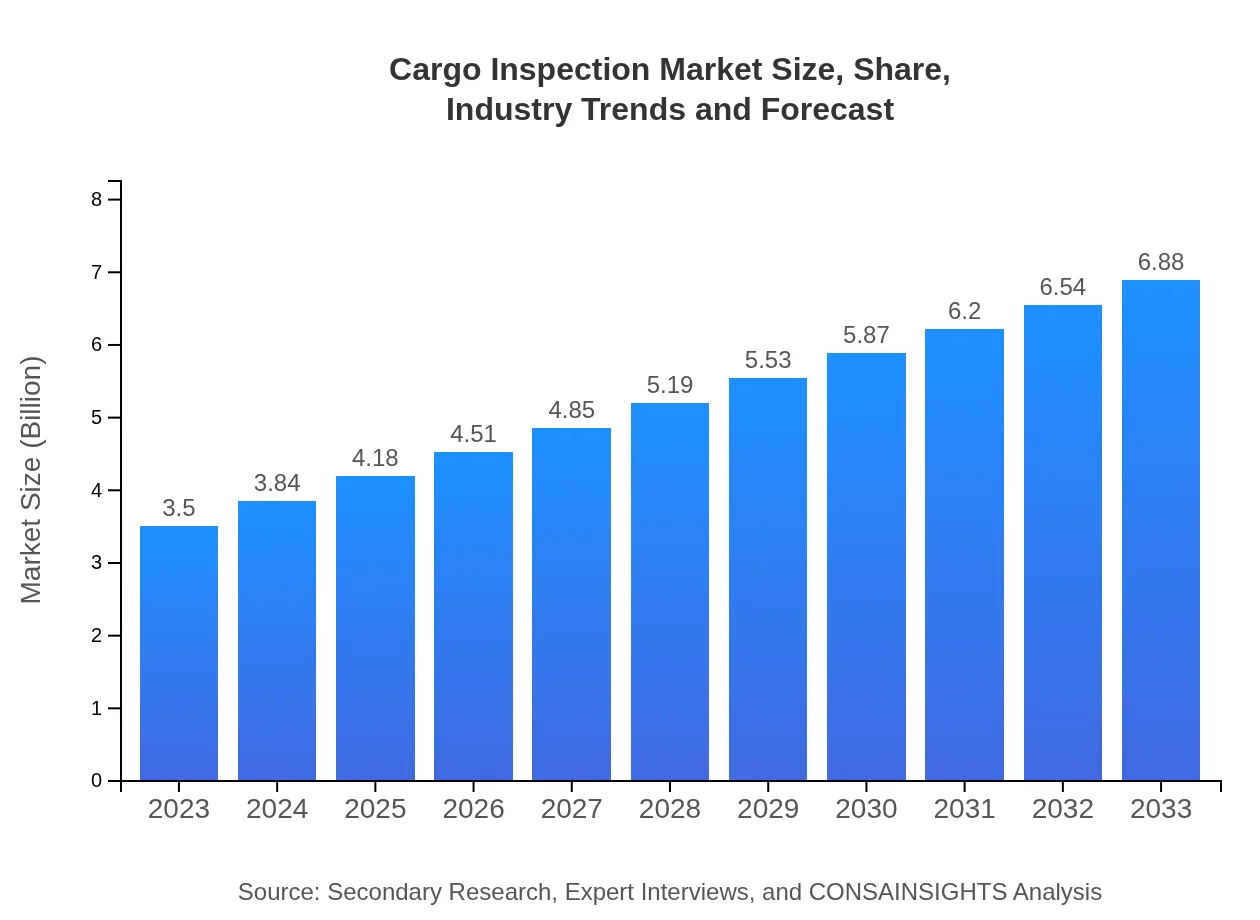

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Bureau Veritas, SGS S.A., Intertek Group plc, DHL Supply Chain, TUV Rheinland |

| Last Modified Date | 22 January 2026 |

Cargo Inspection Market Overview

Customize Cargo Inspection Market Report market research report

- ✔ Get in-depth analysis of Cargo Inspection market size, growth, and forecasts.

- ✔ Understand Cargo Inspection's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cargo Inspection

What is the Market Size & CAGR of Cargo Inspection market in 2023?

Cargo Inspection Industry Analysis

Cargo Inspection Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cargo Inspection Market Analysis Report by Region

Europe Cargo Inspection Market Report:

The European market is estimated to grow from 1.03 billion USD in 2023 to 2.02 billion USD by 2033. Strict regulatory frameworks and a robust logistics industry are driving demand for comprehensive cargo inspections, with significant investments in automation and safety protocols.Asia Pacific Cargo Inspection Market Report:

In Asia Pacific, the Cargo Inspection market is projected to grow from 0.70 billion USD in 2023 to 1.37 billion USD by 2033. Countries like China and India are leading this growth due to rapid industrialization and increasing international trade. Investment in port infrastructure and regulation improvements are enhancing inspection capabilities.North America Cargo Inspection Market Report:

North America, specifically the USA, is anticipated to expand from 1.25 billion USD in 2023 to 2.45 billion USD in 2033. The region's emphasis on safety regulations and technological advancements in inspection processes are contributing to this growth, particularly across transportation and manufacturing sectors.South America Cargo Inspection Market Report:

The South American market is expected to see growth from 0.16 billion USD in 2023 to 0.31 billion USD by 2033. Emerging markets like Brazil are focusing on improving their logistics frameworks, driving demand for efficient cargo inspection systems to ensure compliance with international standards.Middle East & Africa Cargo Inspection Market Report:

Middle East and Africa's Cargo Inspection market is projected to grow from 0.37 billion USD in 2023 to 0.73 billion USD by 2033. The growth is supported by increased trade activities and investments in technology to modernize inspection methods amid rising safety concerns.Tell us your focus area and get a customized research report.

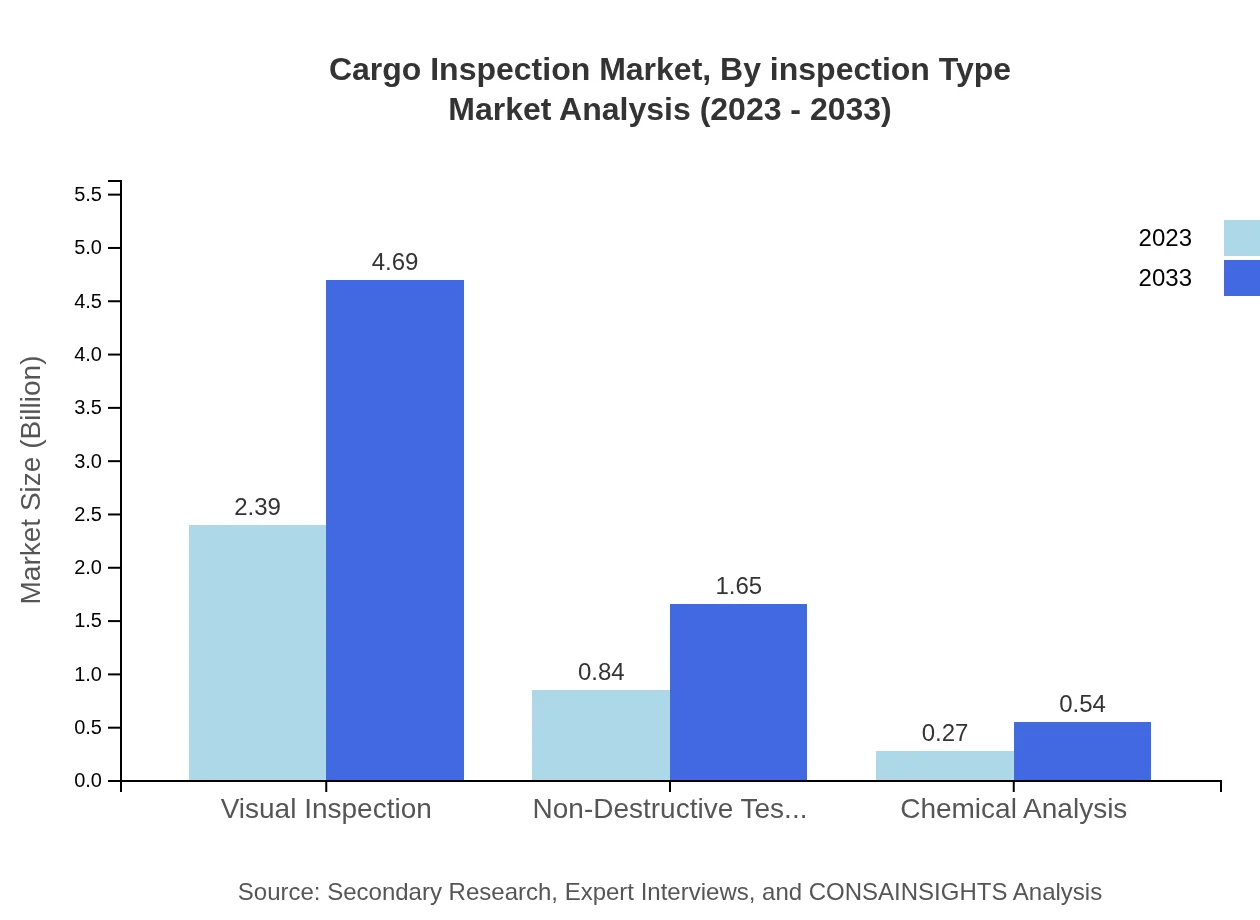

Cargo Inspection Market Analysis By Inspection Type

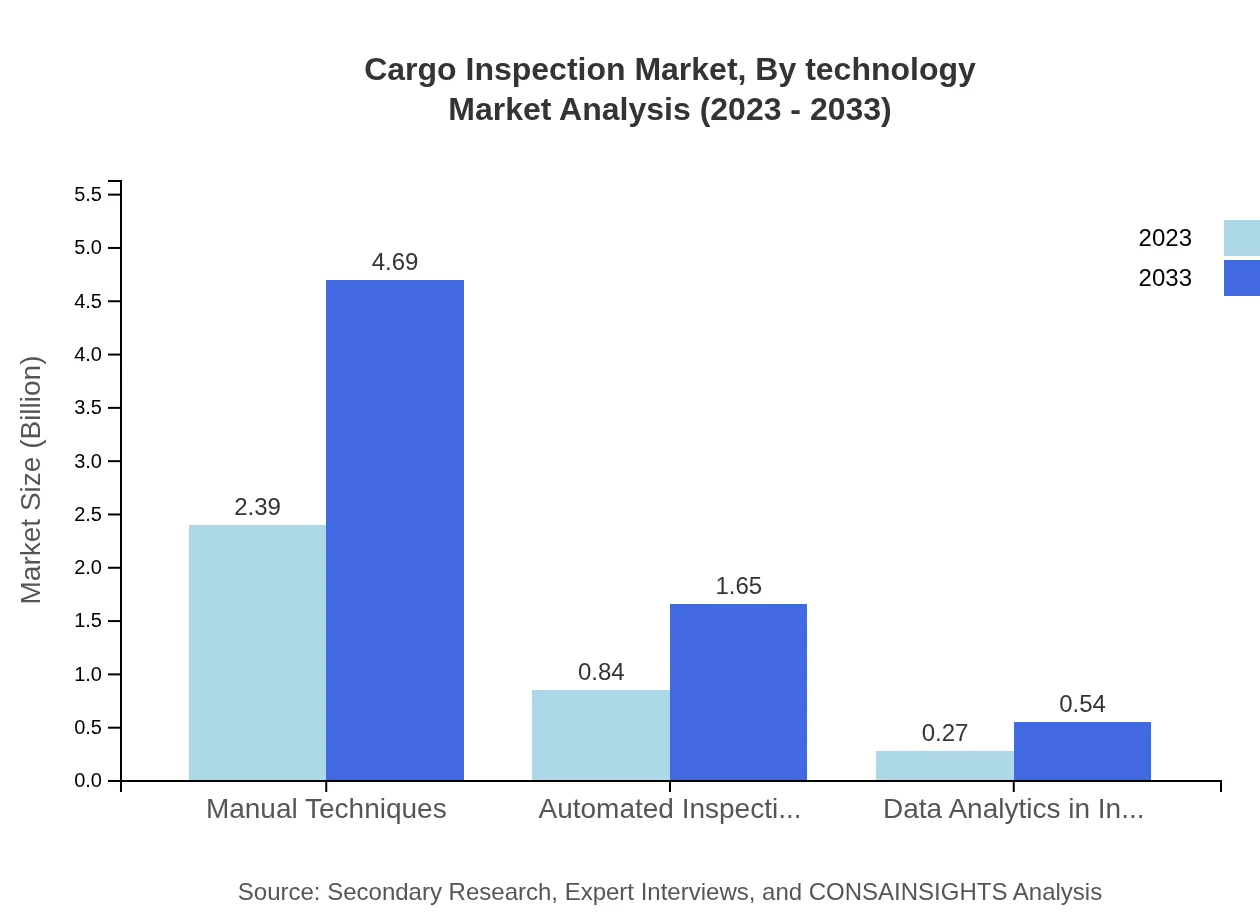

In terms of inspection type, the manual techniques segment dominates the market, valued at 2.39 billion USD in 2023 and projected to reach 4.69 billion USD by 2033, accounting for 68.15% share. Automated Inspection Systems and Non-Destructive Testing (NDT) are gaining traction, predicted to grow to 1.65 billion USD and 1.65 billion USD respectively by 2033, highlighting a shift toward technological advancements.

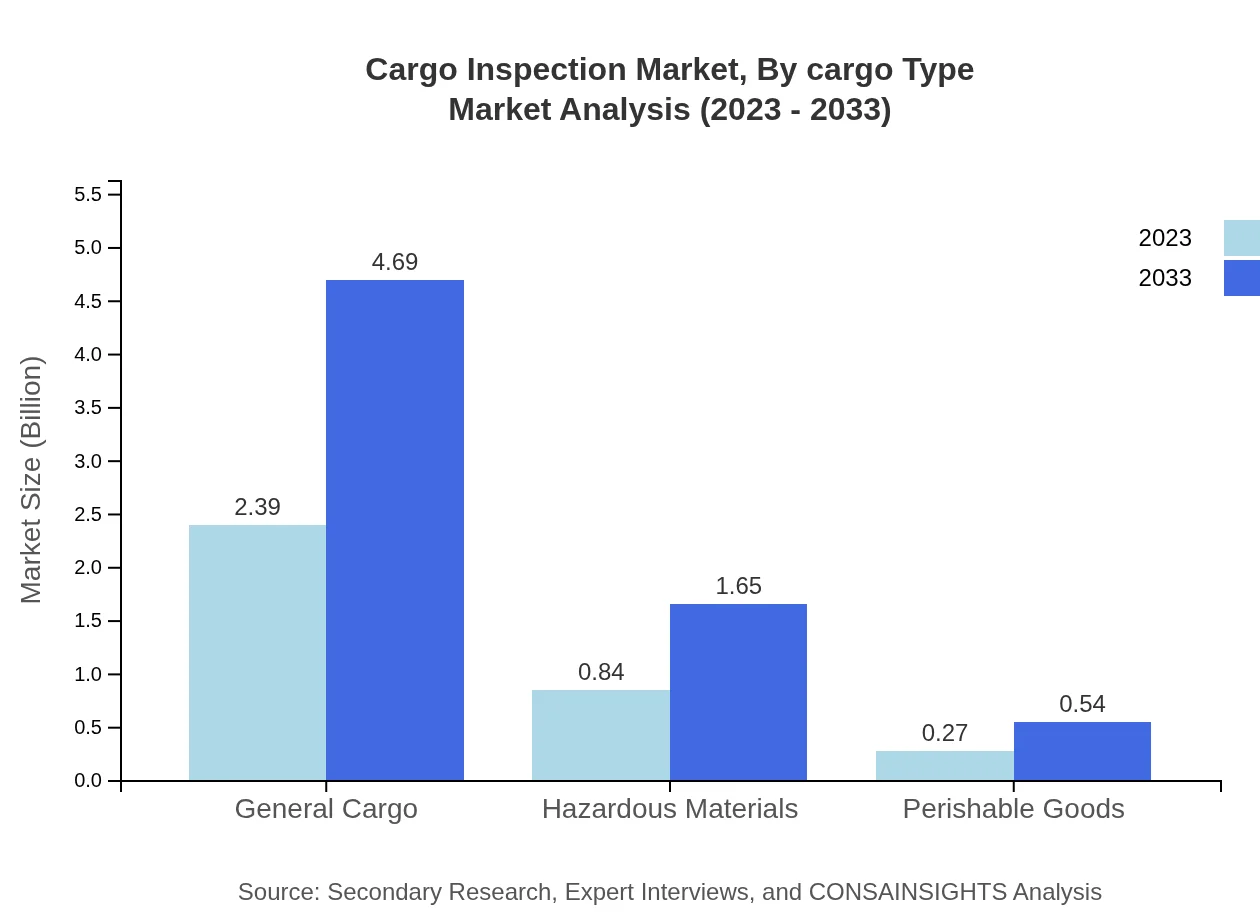

Cargo Inspection Market Analysis By Cargo Type

The General Cargo segment represents the largest share in the market, reaching 2.39 billion USD in 2023 and expected to grow to 4.69 billion USD by 2033. Hazardous Materials and Perishable Goods are also important segments, with their respective market values projected to reach 1.65 billion USD and 0.54 billion USD by 2033, emphasizing the diverse needs for cargo inspection.

Cargo Inspection Market Analysis By Technology

The use of Data Analytics in Inspection is emerging, growing from 0.27 billion USD in 2023 to 0.54 billion USD by 2033, showcasing an increasing preference for data-driven decision-making processes. Visual Inspection remains significant, reflecting traditional practices that still hold relevance in the current market landscape.

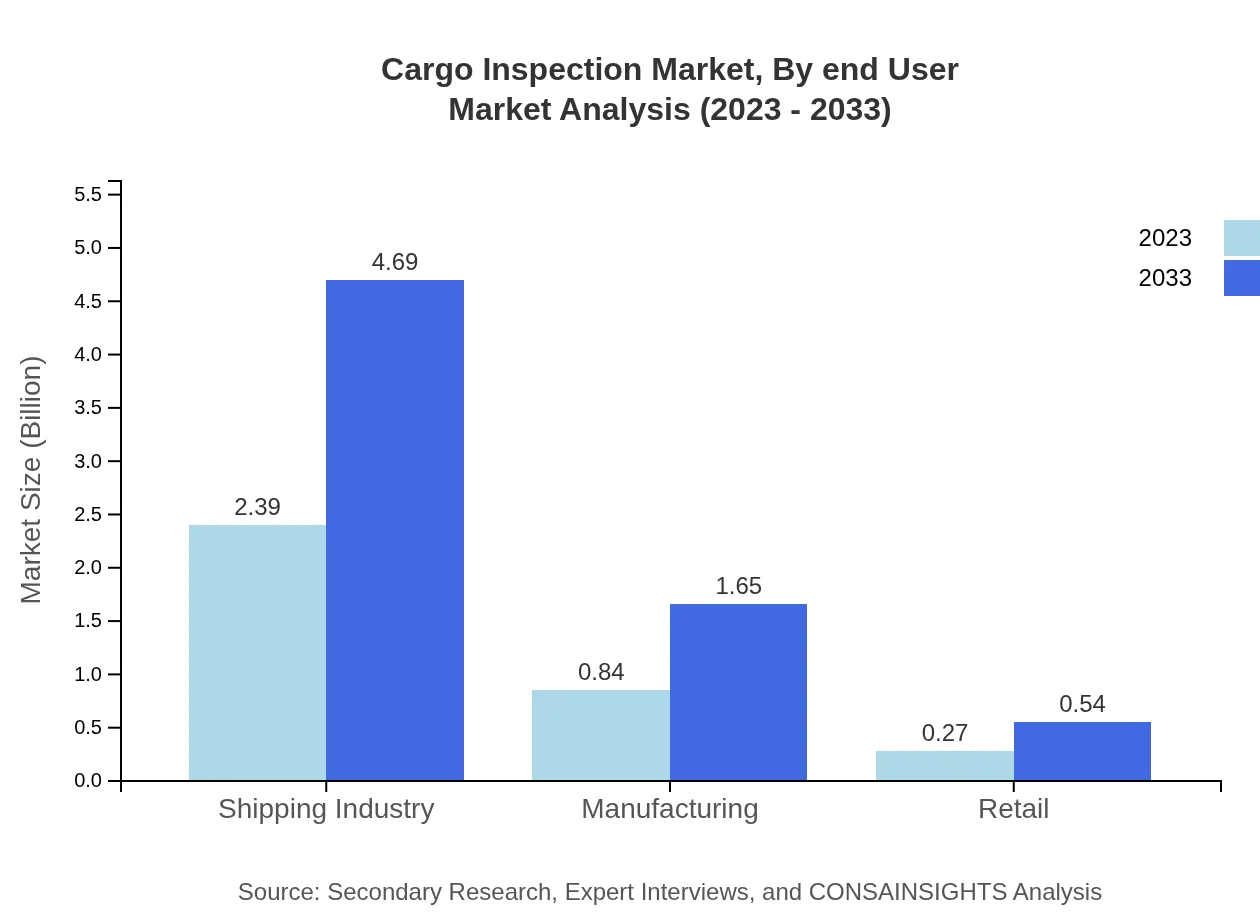

Cargo Inspection Market Analysis By End User

The Shipping Industry serves as the primary end-user of Cargo Inspection services, holding a market size of 2.39 billion USD in 2023, expected to double to 4.69 billion USD by 2033. Other industries, including Manufacturing and Retail, are also significant, reflecting broader adoption of inspection protocols across multiple sectors.

Cargo Inspection Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cargo Inspection Industry

Bureau Veritas:

A global leader in testing, inspection, and certification services, Bureau Veritas plays a crucial role in cargo inspection through comprehensive solutions that ensure compliance with safety standards.SGS S.A.:

SGS is recognized for its extensive inspection services across various industries, providing accurate and reliable cargo inspections to enhance safety and operational efficiency.Intertek Group plc:

Intertek specializes in quality assurance and safety, offering a range of inspection services that support cargo safety and regulatory compliance.DHL Supply Chain:

DHL has established a reputation for logistics excellence, integrating cargo inspection into their service offerings to enhance supply chain integrity and security.TUV Rheinland:

TUV Rheinland provides global assurance and safety solutions, contributing to cargo inspection through rigorous compliance and risk assessments.We're grateful to work with incredible clients.

FAQs

What is the market size of cargo Inspection?

The global cargo inspection market is projected to reach $3.5 billion by 2033, growing at a CAGR of 6.8% from 2023 to 2033. This growth reflects the increasing demand for robust cargo security and regulatory compliance.

What are the key market players or companies in this cargo inspection industry?

Key players in the cargo inspection industry include SGS, Bureau Veritas, Intertek, and ALS Limited. These companies provide various inspection, verification, testing, and certification services across the global logistics sector.

What are the primary factors driving the growth in the cargo inspection industry?

The growth of the cargo inspection industry is driven by regulatory compliance, global trade expansion, and increased emphasis on supply chain security. Additionally, advancements in technology, such as automated inspection systems, fuel further growth.

Which region is the fastest Growing in the cargo inspection market?

North America is currently the fastest-growing region in the cargo inspection market, expected to grow from $1.25 billion in 2023 to $2.45 billion by 2033. Following closely are Europe and Asia Pacific, with substantial growth rates.

Does ConsaInsights provide customized market report data for the cargo inspection industry?

Yes, ConsaInsights offers customized market report data tailored to client needs for the cargo inspection industry. This flexibility allows businesses to access critical insights and data specific to their operational requirements and market focus.

What deliverables can I expect from this cargo inspection market research project?

Deliverables from the cargo inspection market research project include detailed market analysis, regional breakdowns, competitive assessments, and trend reports, providing comprehensive insights into market dynamics and opportunities.

What are the market trends of cargo inspection?

Market trends in cargo inspection include a rise in automated inspection solutions, the integration of data analytics for enhanced decision-making, and a growing emphasis on environmental safety, reflecting shifts in consumer and regulatory expectations.