Carrier Screening Market Report

Published Date: 31 January 2026 | Report Code: carrier-screening

Carrier Screening Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report covers the Carrier Screening market, detailing current trends, market size, growth forecasts, and regional analysis from 2023 to 2033. Insights include key segments, technological advancements, and competitive landscape assessments.

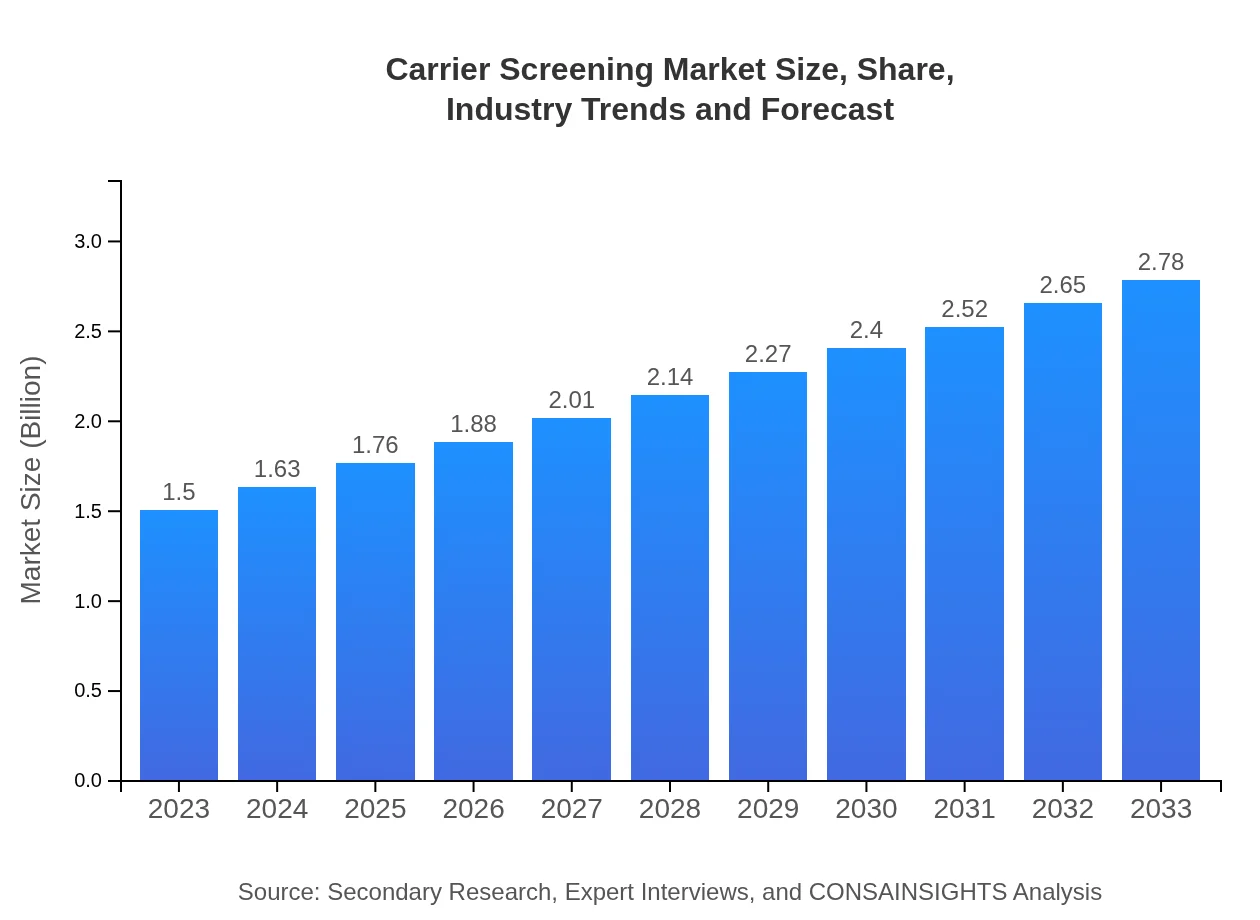

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Invitae Corporation, Myriad Genetics, Inc., GeneDx, Fulgent Genetics |

| Last Modified Date | 31 January 2026 |

Carrier Screening Market Overview

Customize Carrier Screening Market Report market research report

- ✔ Get in-depth analysis of Carrier Screening market size, growth, and forecasts.

- ✔ Understand Carrier Screening's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Carrier Screening

What is the Market Size & CAGR of Carrier Screening market in 2023?

Carrier Screening Industry Analysis

Carrier Screening Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Carrier Screening Market Analysis Report by Region

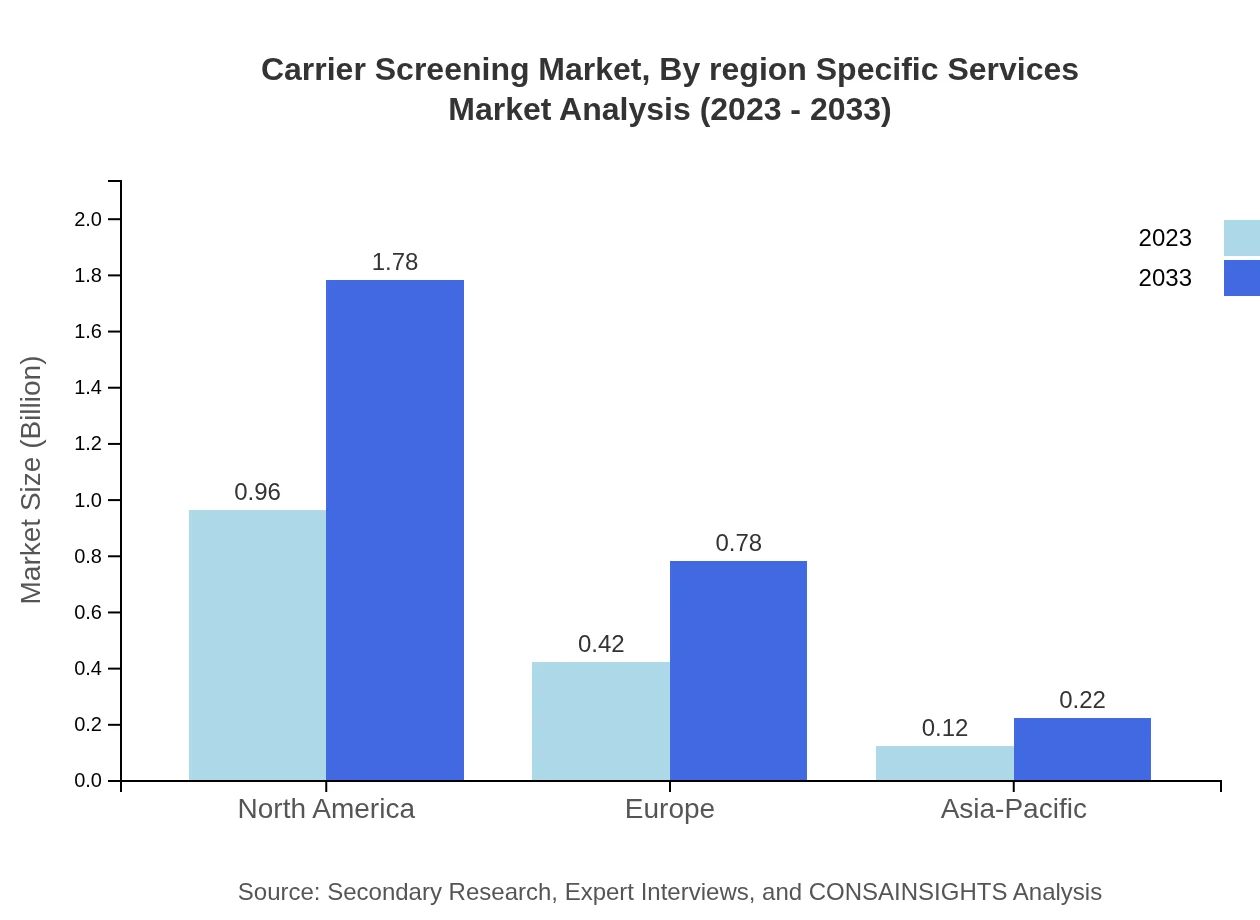

Europe Carrier Screening Market Report:

The European market is expected to grow from $0.44 billion in 2023 to $0.81 billion by 2033. The region benefits from strong regulatory standards, growing awareness of genetic disorders, and increased integration of genetic testing into prenatal and reproductive care services.Asia Pacific Carrier Screening Market Report:

The Asia Pacific region is expected to show significant growth, with market estimates rising from $0.31 billion in 2023 to $0.58 billion by 2033. This is driven by increasing healthcare access, rising awareness of genetic testing, and government initiatives promoting preventive healthcare.North America Carrier Screening Market Report:

North America is currently the largest market for carrier screening, projected to expand from $0.50 billion in 2023 to $0.93 billion by 2033. The high adoption rate of screening tests, alongside robust healthcare frameworks and insurance coverage, significantly contributes to this growth.South America Carrier Screening Market Report:

In South America, market growth is anticipated from $0.12 billion in 2023 to $0.23 billion by 2033. Increasing investments in healthcare infrastructure and a growing emphasis on genetic diseases among local populations are key growth factors.Middle East & Africa Carrier Screening Market Report:

In the Middle East and Africa, the market is projected to grow from $0.12 billion in 2023 to $0.22 billion by 2033, driven by improvements in healthcare access and rising awareness of genetic testing amid increasing incidences of genetic disorders.Tell us your focus area and get a customized research report.

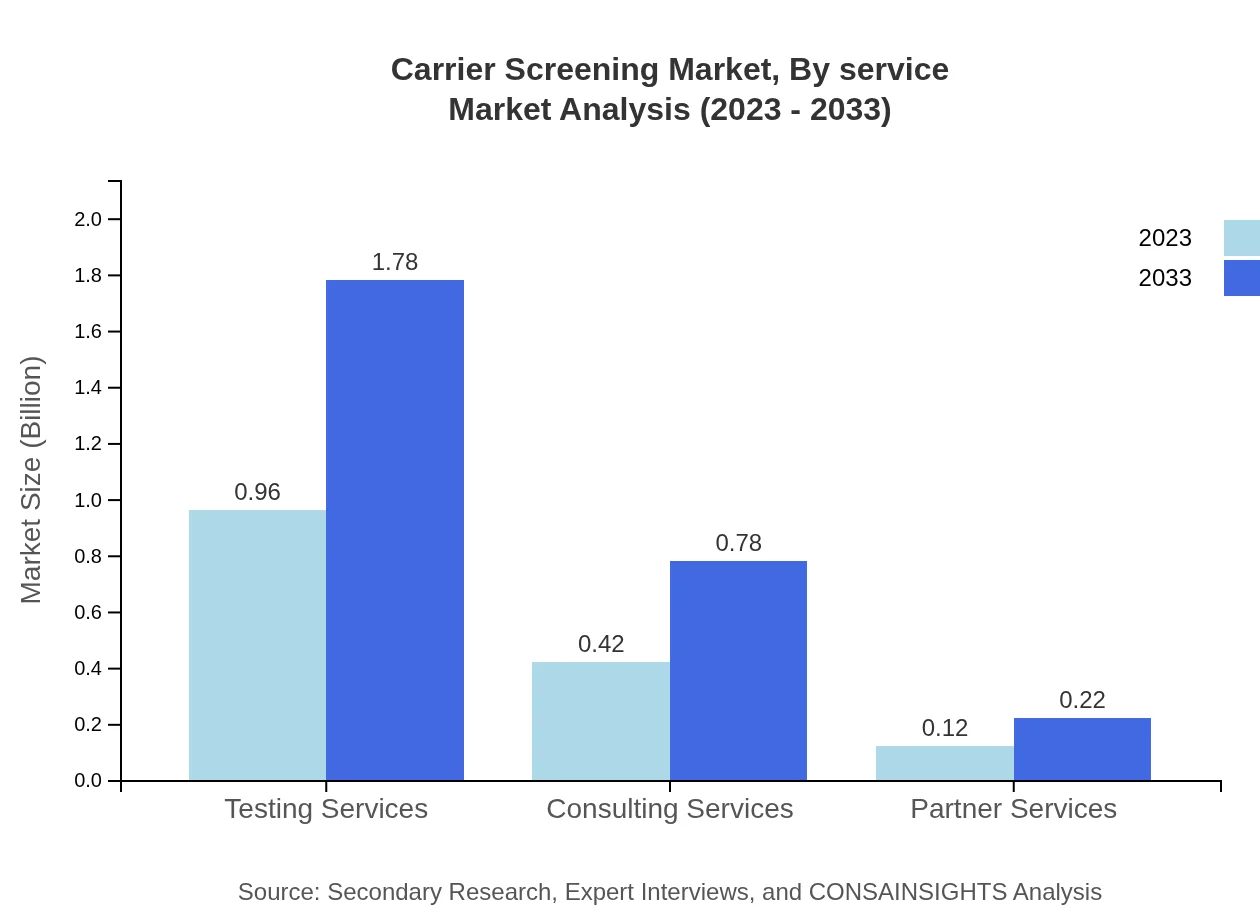

Carrier Screening Market Analysis By Service

The Carrier Screening market based on services includes Testing Services, Consulting Services, and Partner Services. Testing Services dominate the market, valued at $0.96 billion in 2023 and expected to reach $1.78 billion by 2033, capturing 63.99% market share. Consulting Services are projected to grow from $0.42 billion to $0.78 billion, holding 28.09% market share as healthcare providers increasingly offer genetic counseling.

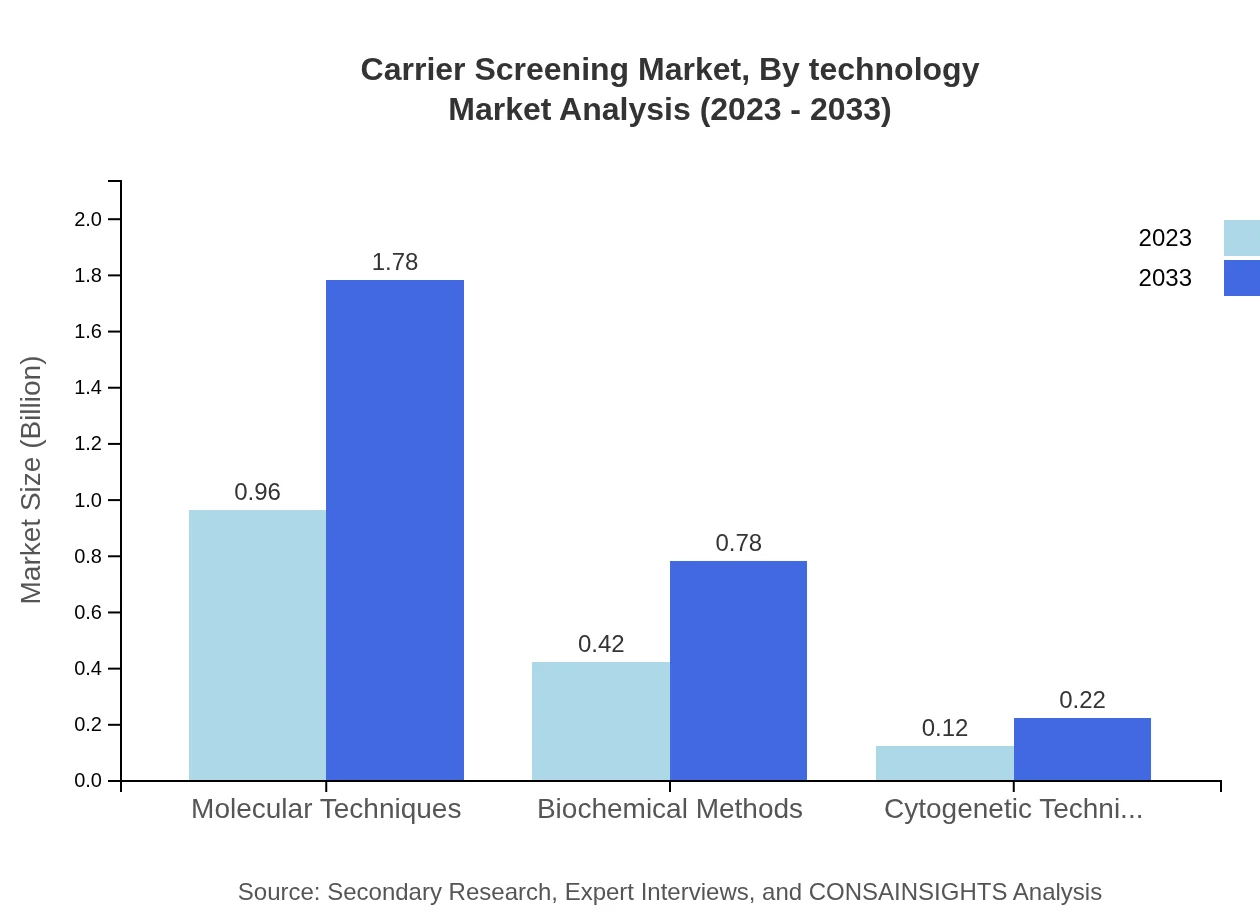

Carrier Screening Market Analysis By Technology

Carrier Screening utilizes various technologies, including Molecular Techniques, Biochemical Methods, and Cytogenetic Techniques. Molecular Techniques lead the market with a size of $0.96 billion in 2023 and a forecasted growth to $1.78 billion by 2033, capturing a 63.99% share. Biochemical Methods and Cytogenetic Techniques follow, enhancing capabilities in screening and diagnosis.

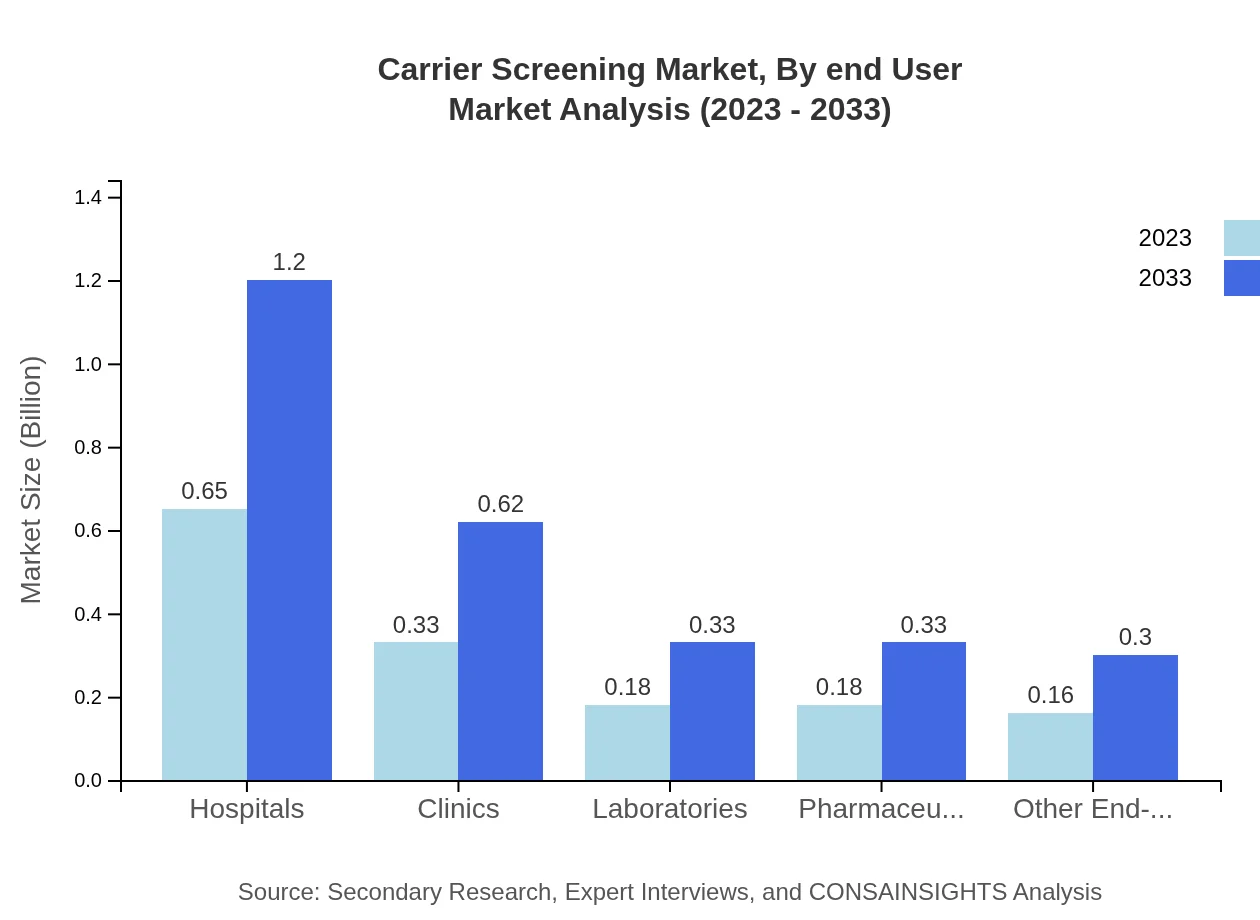

Carrier Screening Market Analysis By End User

The end-user segmentation includes Hospitals, Clinics, Laboratories, Pharmaceutical Companies, and Other End-Users. Hospitals account for a significant share, valued at $0.65 billion in 2023, set to reach $1.20 billion by 2033. Clinics and laboratories are notable contributors, improving carrier screening accessibility and diagnostic precision.

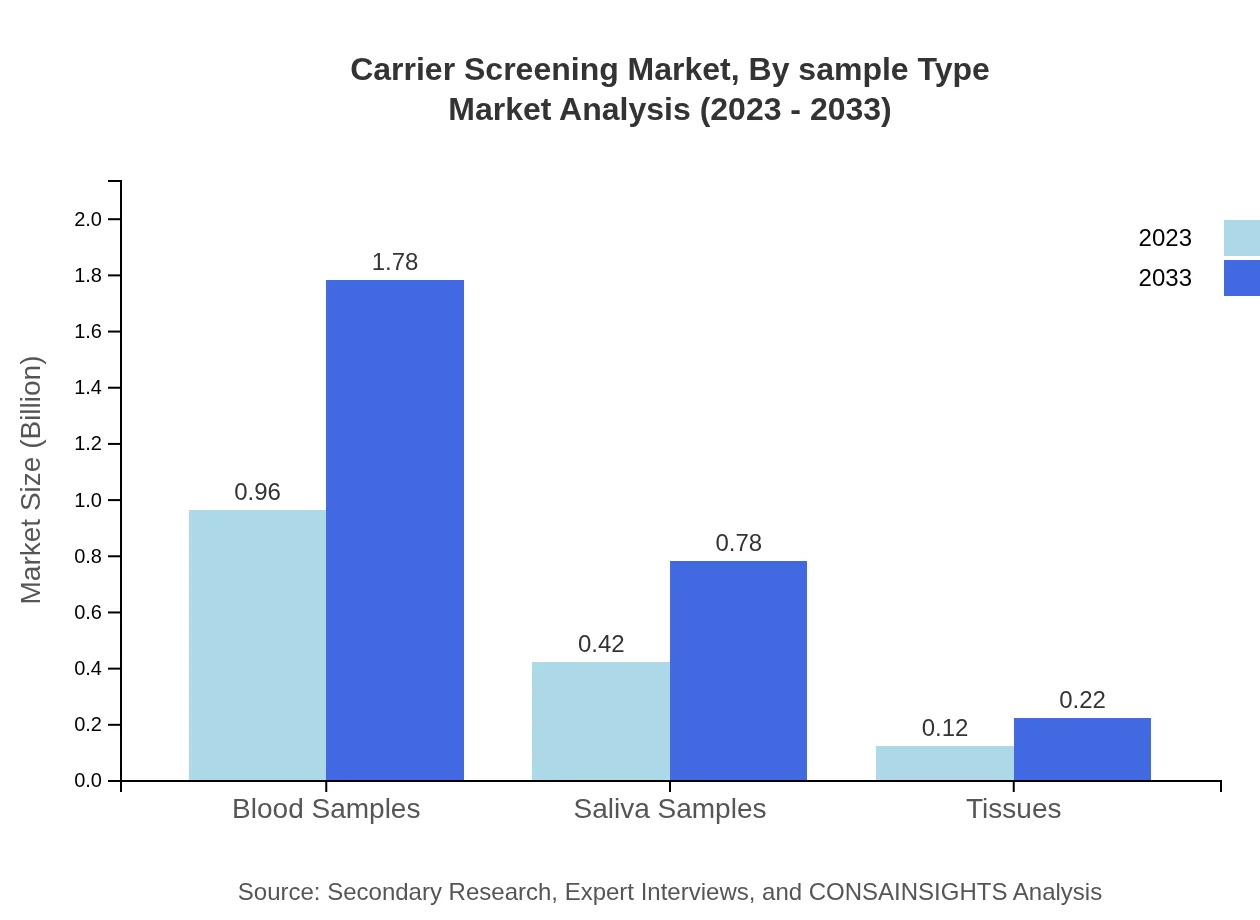

Carrier Screening Market Analysis By Sample Type

Carrier Screening utilizes various sample types including Blood Samples, Saliva Samples, and Tissues. Blood Samples dominate the segment, valued at $0.96 billion in 2023, with expectations to reach $1.78 billion by 2033, holding a 63.99% market share. Saliva Samples and Tissues are also emerging as viable options, broadening the accessibility of screening.

Carrier Screening Market Analysis By Region Specific Services

Region-specific services are crucial in driving the Carrier Screening market. North America showcases robust service offerings, while Europe emphasizes regulatory compliance and quality assurance in testing methodologies. Growing services in Asia Pacific and Latin America are expanding education and outreach efforts, essential for increasing carrier screening uptake.

Carrier Screening Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Carrier Screening Industry

Invitae Corporation:

A leader in genetic testing, Invitae Corporation offers a wide range of carrier screening tests to support informed reproductive decisions. Their technology integrates genomic data with high-quality clinical performance.Myriad Genetics, Inc.:

Myriad Genetics specializes in hereditary cancer tests and offers comprehensive carrier screening solutions focusing on women's health and reproductive health.GeneDx:

GeneDx provides advanced genetic testing services, including carrier screening for various conditions, emphasizing hereditary disorders and personalized medicine.Fulgent Genetics:

With a focus on diversity and comprehensive genomic testing services, Fulgent Genetics offers carrier screening solutions that cater to various clinical needs.We're grateful to work with incredible clients.

FAQs

What is the market size of carrier Screening?

The carrier screening market is projected to reach $1.5 billion by 2033, growing at a CAGR of 6.2% from the base year 2023. This growth is driven by advances in genetic testing technologies and increased awareness.

What are the key market players or companies in this carrier Screening industry?

Key players in the carrier screening market include leading laboratories and genetic testing companies that focus on innovative screening technologies to support precision medicine and personalized healthcare solutions.

What are the primary factors driving the growth in the carrier screening industry?

The growth of the carrier screening market is mainly driven by technological advancements in genetic testing, increasing prevalence of genetic disorders, health awareness, and demand for personalized healthcare services that leverage genomic data for better outcomes.

Which region is the fastest Growing in the carrier screening?

North America is forecasted to be the fastest-growing region in the carrier screening market, increasing from $0.50 billion in 2023 to $0.93 billion by 2033, representing significant growth opportunities in this sector.

Does ConsaInsights provide customized market report data for the carrier screening industry?

Yes, Consainsights offers customized market reports tailored to specific needs within the carrier screening industry, allowing clients to gain targeted insights and data to inform their strategic decisions.

What deliverables can I expect from this carrier screening market research project?

Deliverables may include comprehensive market analysis, growth forecasts, segment performance details, regional insights, competitive landscape evaluations, and actionable recommendations tailored for the carrier screening sector.

What are the market trends of carrier screening?

Current trends in the carrier screening market include increasing integration of advanced molecular techniques, growth in telehealth services, and rising consumer demand for genetic counseling, highlighting a shift towards personalized healthcare.