Case Packers Market Report

Published Date: 22 January 2026 | Report Code: case-packers

Case Packers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Case Packers market, detailing current trends, segmentation, and future projections from 2023 to 2033. Key insights include market size, growth rates, technology advancements, and industry dynamics relevant to stakeholders.

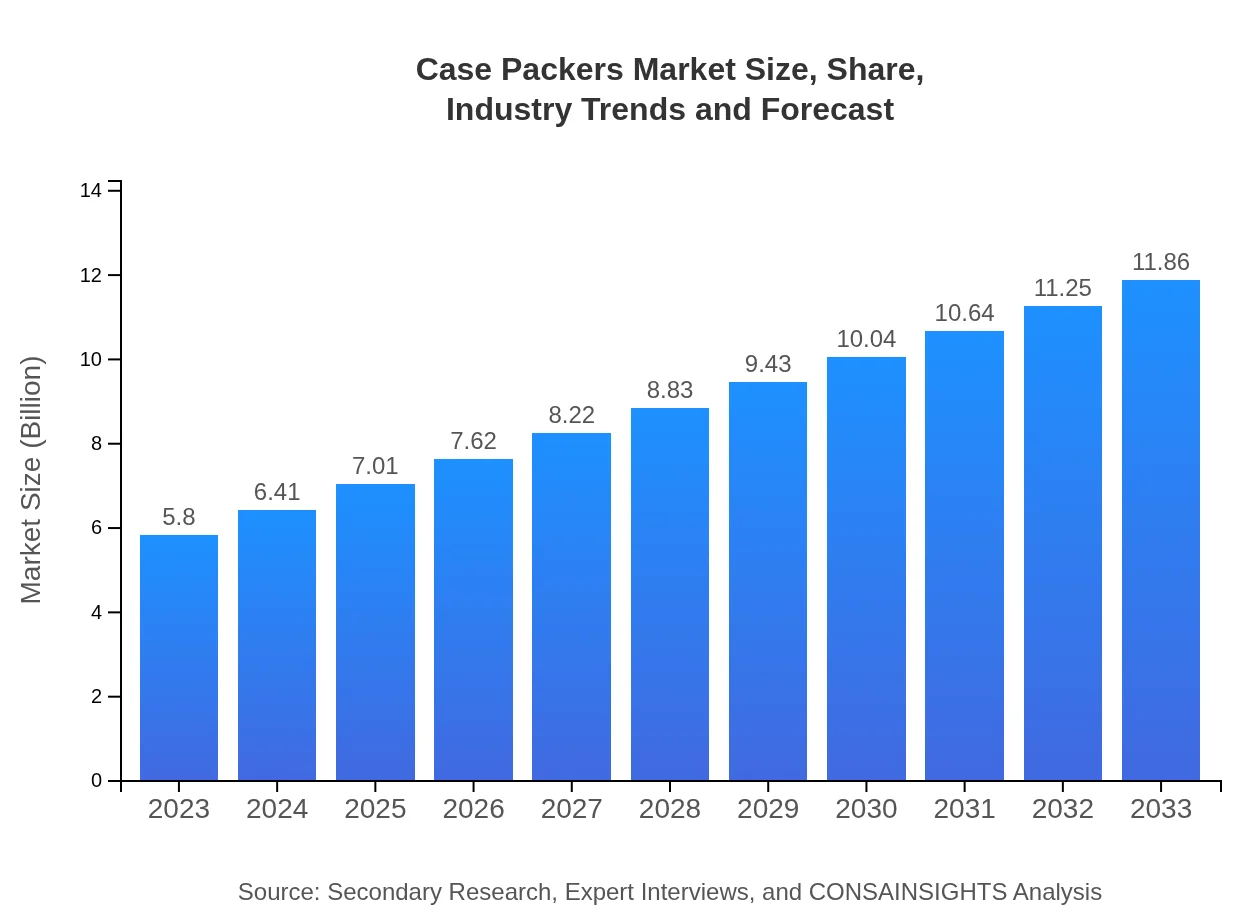

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.86 Billion |

| Top Companies | Krones AG, Tetra Pak International S.A., Schneider Packaging Equipment Co., Inc., Marchesini Group S.p.A., I.M.A. Industria Macchine Automatiche S.p.A. |

| Last Modified Date | 22 January 2026 |

Case Packers Market Overview

Customize Case Packers Market Report market research report

- ✔ Get in-depth analysis of Case Packers market size, growth, and forecasts.

- ✔ Understand Case Packers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Case Packers

What is the Market Size & CAGR of Case Packers market in 2023?

Case Packers Industry Analysis

Case Packers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Case Packers Market Analysis Report by Region

Europe Case Packers Market Report:

Europe's market size is estimated to grow from $1.61 billion in 2023 to $3.29 billion by 2033, with significant investments in sustainability initiatives and advanced packaging technologies.Asia Pacific Case Packers Market Report:

The Asia Pacific region exhibits strong growth, with the market size anticipated to rise from $1.26 billion in 2023 to $2.58 billion by 2033, driven by the increasing industrialization and expanding retail sectors in countries like China and India.North America Case Packers Market Report:

North America dominates the market with an anticipated increase from $1.94 billion in 2023 to $3.96 billion by 2033. This growth is attributed to high technological adoption rates and the presence of key industry players that drive innovations.South America Case Packers Market Report:

In South America, the Case Packers market is projected to grow steadily, from $0.35 billion in 2023 to $0.71 billion by 2033, largely fueled by rising consumer demand for packaged goods and improvements in logistics.Middle East & Africa Case Packers Market Report:

The Case Packers market in the Middle East and Africa is expected to increase from $0.64 billion in 2023 to $1.31 billion by 2033, supported by infrastructural developments and the growing retail sector.Tell us your focus area and get a customized research report.

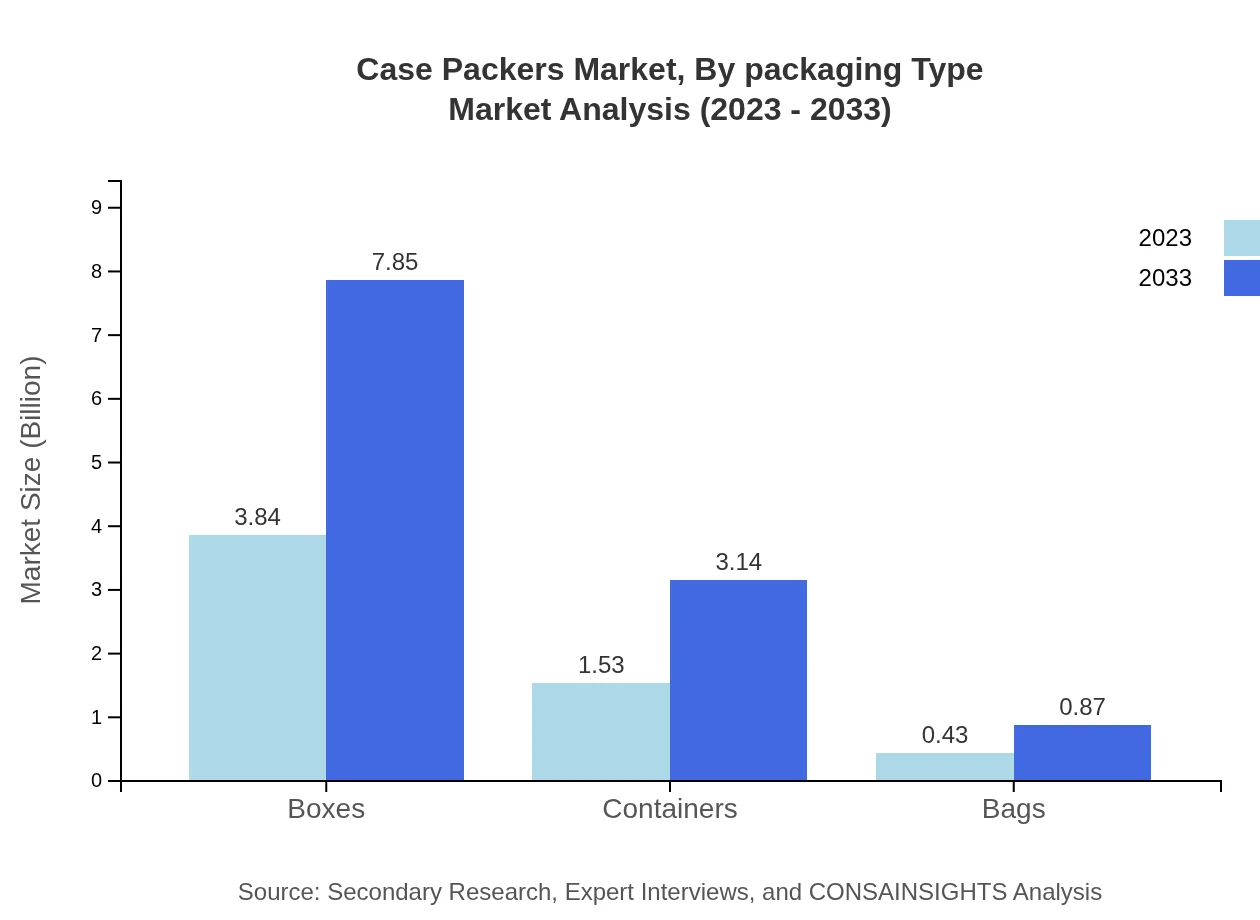

Case Packers Market Analysis By Packaging Type

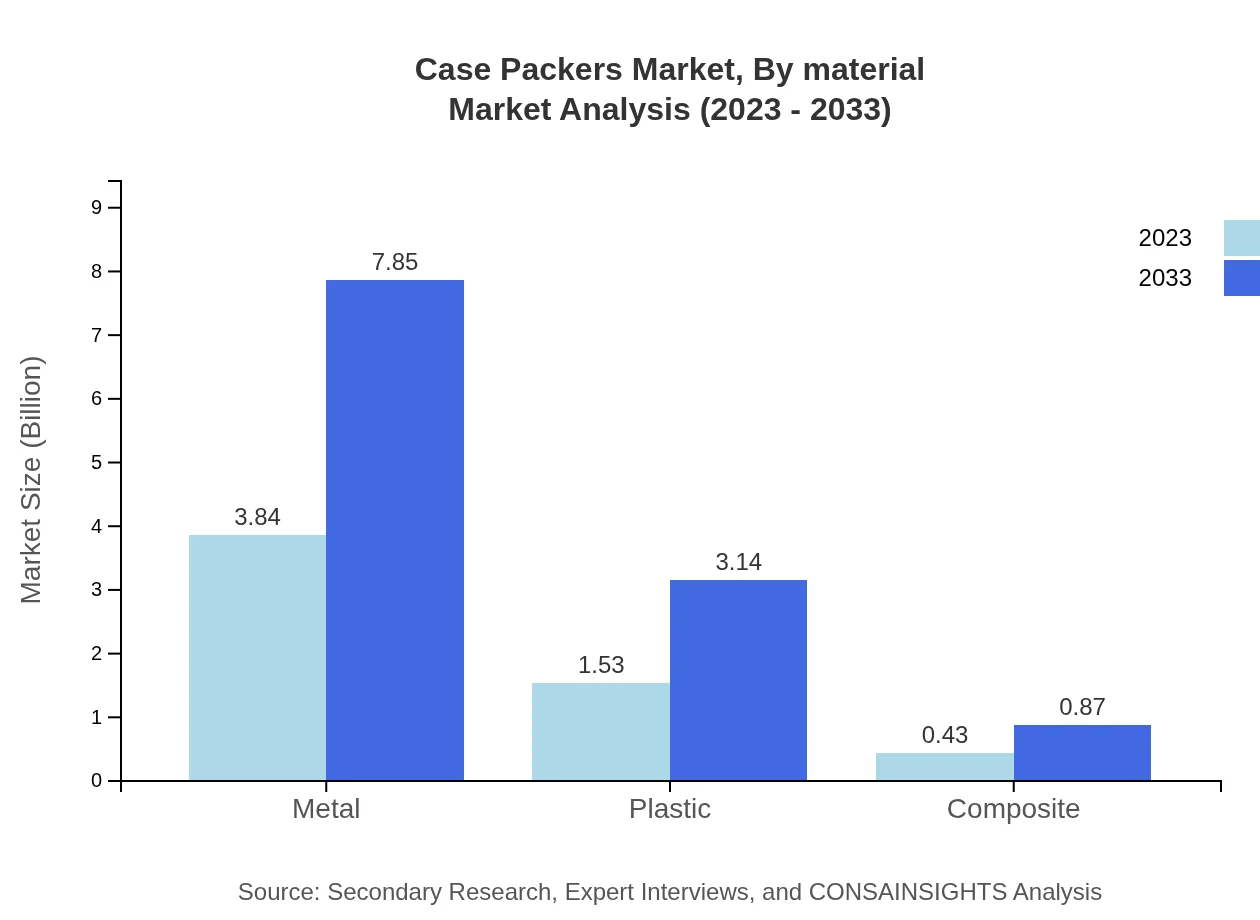

In 2023, the Metal packaging segment leads the market at $3.84 billion, anticipated to grow to $7.85 billion by 2033, holding a significant market share of 66.17%. Plastic packaging, although smaller at $1.53 billion currently, is set to expand to $3.14 billion by 2033, capturing 26.46%. Composite packaging is a niche market projected to grow modestly from $0.43 billion to $0.87 billion while maintaining a 7.37% share.

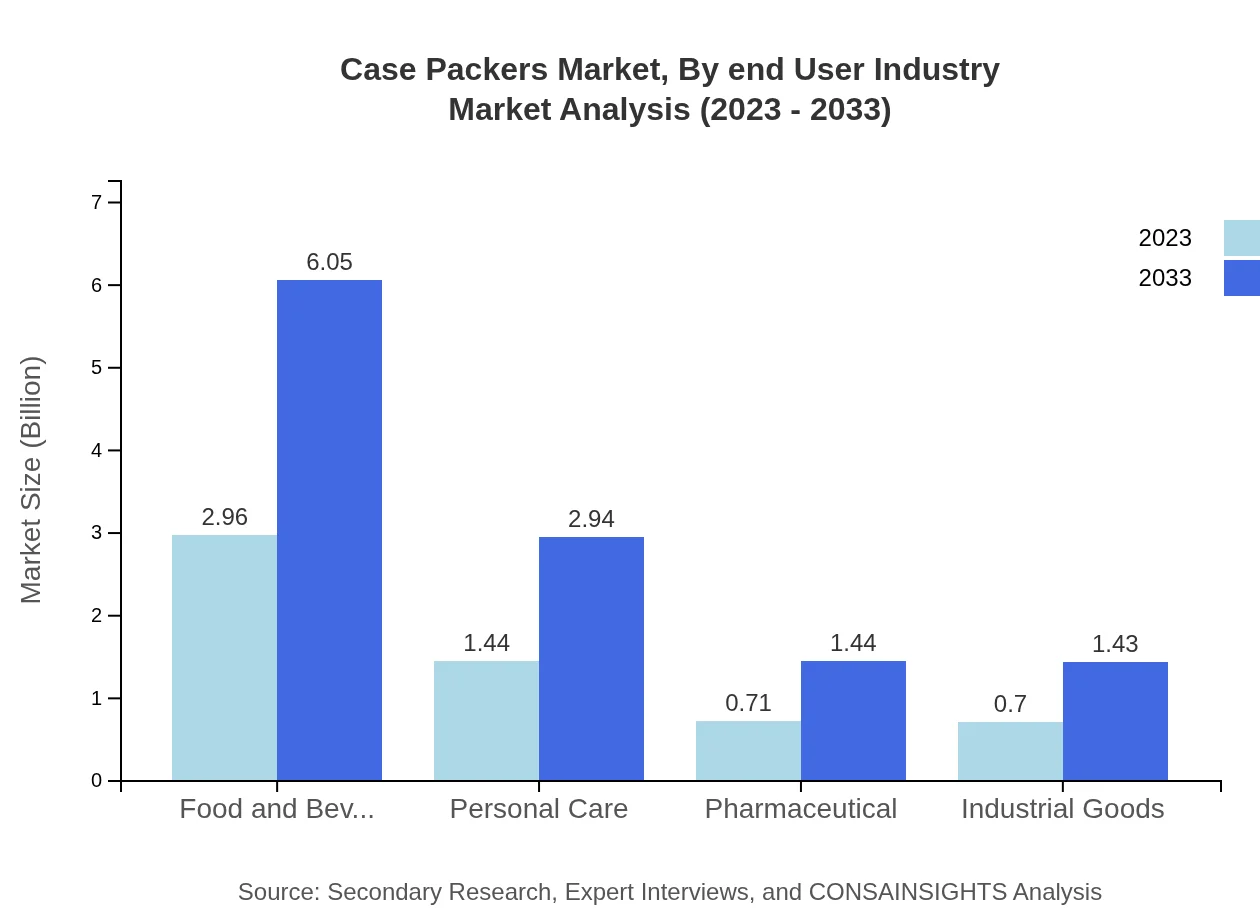

Case Packers Market Analysis By End User Industry

The Food and Beverage sector is the leading end-user, with a market share of 51.01%, increasing from $2.96 billion in 2023 to $6.05 billion by 2033. Personal Care follows with 24.8% share, translating to a growth from $1.44 billion to $2.94 billion during the same period. Pharmaceutical packaging constitutes a crucial segment as well, growing from $0.71 billion to $1.44 billion with a 12.17% market share.

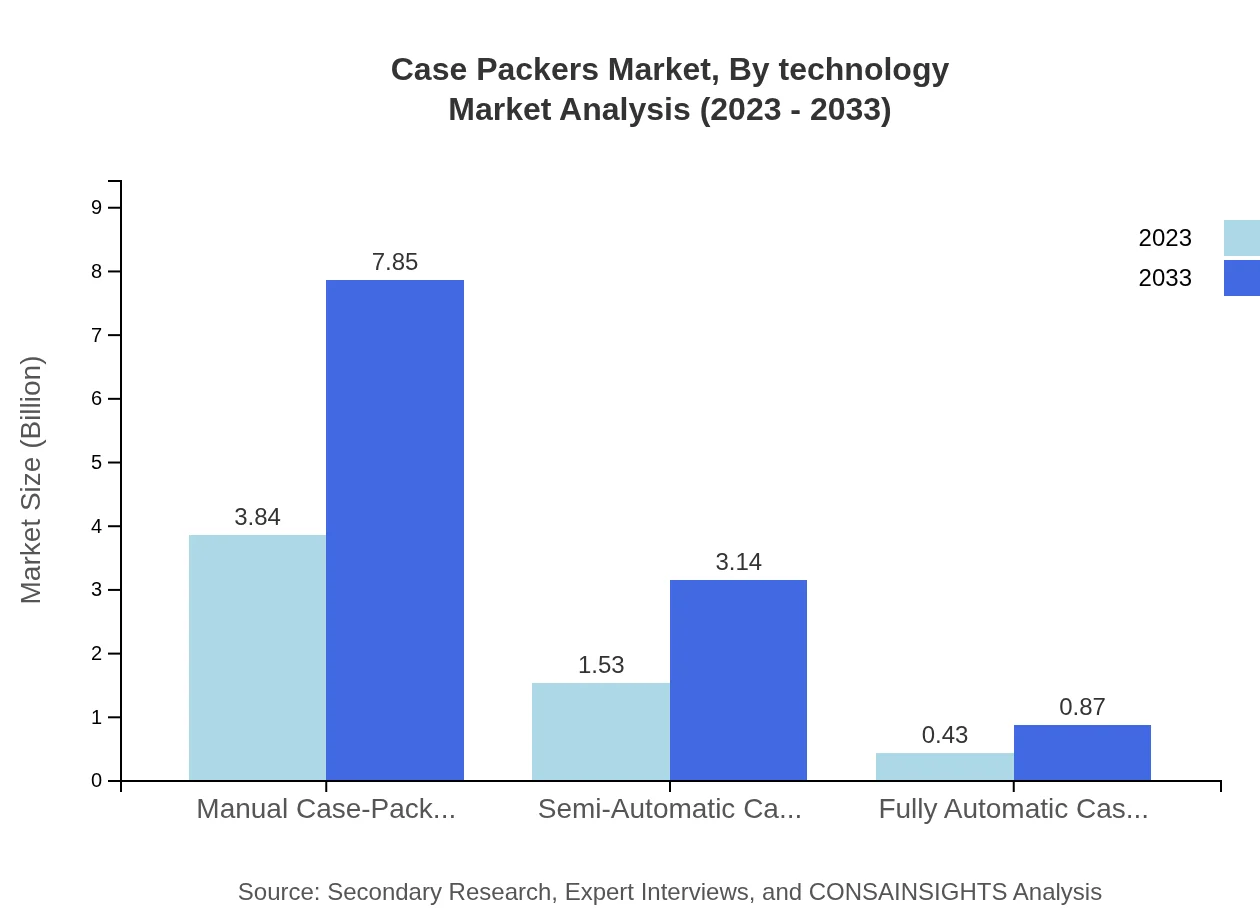

Case Packers Market Analysis By Technology

The market is divided between Manual, Semi-Automatic, and Fully Automatic Case-Packers. Manual Case-Packers dominate with a share of 66.17% and a projected growth from $3.84 billion to $7.85 billion. Semi-Automatic Case-Packers follow, maintaining a 26.46% share, expanding to $3.14 billion by 2033. Fully Automatic Case-Packers are projected to grow from $0.43 billion to $0.87 billion, remaining at 7.37% share.

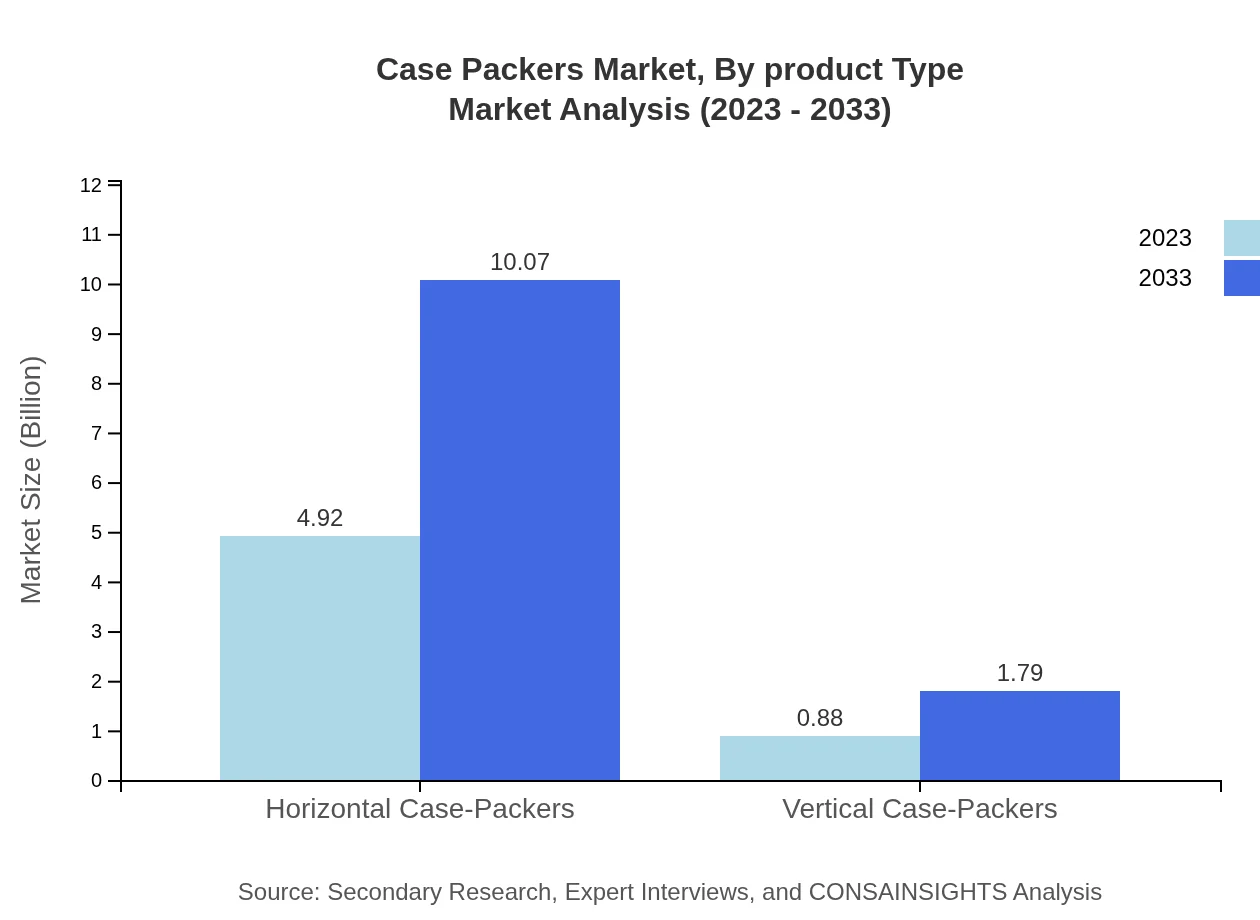

Case Packers Market Analysis By Product Type

The horizontal case packers account for the largest market share of 84.9%, growing from $4.92 billion to $10.07 billion. Vertical case packers represent a smaller segment, expanding from $0.88 billion to $1.79 billion, holding 15.1% share.

Case Packers Market Analysis By Material

Boxes and Containers are significant, with boxes growing from $3.84 billion to $7.85 billion (66.17% market share), and containers expanding from $1.53 billion to $3.14 billion (26.46% share). Bags represent a much smaller share, from $0.43 billion to $0.87 billion, maintaining 7.37% share.

Case Packers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Case Packers Industry

Krones AG:

Krones AG is a leading manufacturer of packaging and bottling machinery, offering advanced automation solutions that enhance efficiency and quality in the packaging process.Tetra Pak International S.A.:

Specializing in food packaging, Tetra Pak provides innovative packaging solutions with a commitment to sustainability, significantly impacting the case packing market.Schneider Packaging Equipment Co., Inc.:

Schneider provides automated packaging solutions with an emphasis on operational efficiency and customization, contributing extensively to the Case Packers market.Marchesini Group S.p.A.:

Known for their advanced technological innovations in pharmaceutical packaging, Marchesini Group expands its reach into several industries through flexible case packing solutions.I.M.A. Industria Macchine Automatiche S.p.A.:

I.M.A. is a global leader in automatic machines for packaging, consistently innovating in the case packing process and expanding its market presence.We're grateful to work with incredible clients.

FAQs

What is the market size of case Packers?

The global case-packers market is valued at approximately $5.8 billion in 2023. It is projected to grow at a CAGR of 7.2%, reaching significant market size by 2033, reflecting a strong demand for automated packing solutions.

What are the key market players or companies in this case Packers industry?

Key players in the case-packers industry include renowned manufacturers that specialize in packing equipment and automated solutions, driving innovation and market growth. Their influence shapes competitive dynamics and fosters advancements in technology and efficiency.

What are the primary factors driving the growth in the case Packers industry?

Factors driving growth in the case-packers industry include the rise in e-commerce, increased demand for packaged goods, automation in manufacturing processes, and advancements in packaging technology that enhance efficiency and reduce operational costs.

Which region is the fastest Growing in the case Packers market?

The Asia Pacific region is the fastest-growing market for case-packers, with market size expected to grow from $1.26 billion in 2023 to $2.58 billion by 2033. This growth is driven by increasing industrialization and demand for packaged products.

Does ConsaInsights provide customized market report data for the case Packers industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the case-packers industry, ensuring relevant insights and strategic guidance based on individual business requirements and market conditions.

What deliverables can I expect from this case Packers market research project?

Deliverables from the case-packers market research project typically include comprehensive market analysis reports, trend insights, competitor assessments, financial projections, regional breakdowns, and valuable strategic recommendations for informed decision-making.

What are the market trends of case Packers?

Current trends in the case-packers market include a shift towards automated and semi-automated packaging systems, increased use of eco-friendly materials in packaging, and enhanced client demand for versatile packing solutions to satisfy diverse product requirements.