Casein And Caseinates Market Report

Published Date: 31 January 2026 | Report Code: casein-and-caseinates

Casein And Caseinates Market Size, Share, Industry Trends and Forecast to 2033

This report provides an analysis of the Casein and Caseinates market, including market size, growth trends, industry dynamics, and forecasts from 2023 to 2033. Key insights about regional performances and market segmentation will also be discussed.

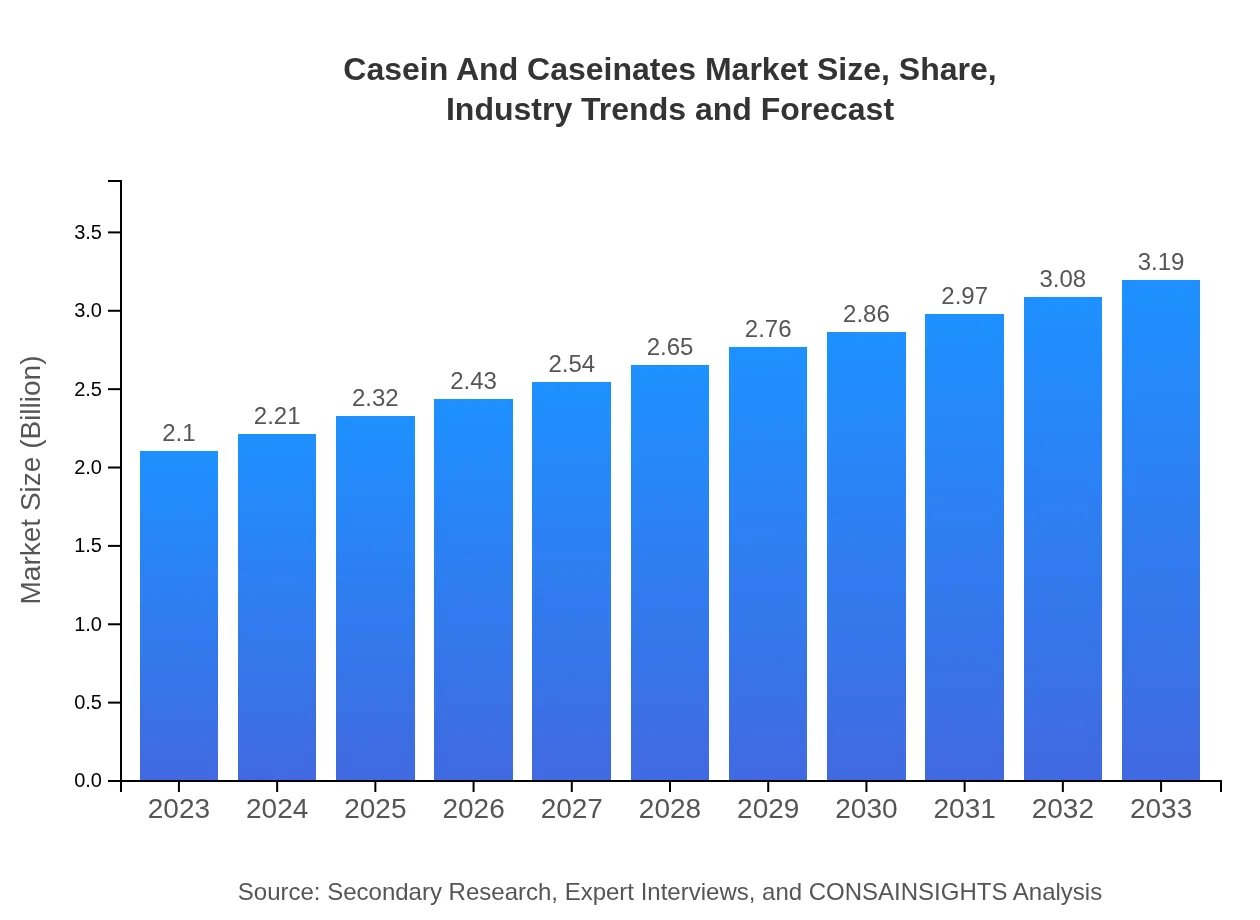

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $3.19 Billion |

| Top Companies | FrieslandCampina, Dairy Farmers of America, Arla Foods, Nestlé |

| Last Modified Date | 31 January 2026 |

Casein And Caseinates Market Overview

Customize Casein And Caseinates Market Report market research report

- ✔ Get in-depth analysis of Casein And Caseinates market size, growth, and forecasts.

- ✔ Understand Casein And Caseinates's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Casein And Caseinates

What is the Market Size & CAGR of Casein And Caseinates market in 2023?

Casein And Caseinates Industry Analysis

Casein And Caseinates Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Casein And Caseinates Market Analysis Report by Region

Europe Casein And Caseinates Market Report:

The European market is set to grow from USD 0.55 billion in 2023 to USD 0.83 billion by 2033. Increased demand for dairy proteins in food products and expanding applications for caseinates in the nutraceuticals sector are key drivers.Asia Pacific Casein And Caseinates Market Report:

In the Asia-Pacific region, the market is projected to grow from USD 0.40 billion in 2023 to USD 0.61 billion by 2033. The increase is attributed to rising dairy consumption and rapid urbanization, leading to higher demand for protein-rich products. Additionally, the growth of the food processing industry in countries like China and India is significantly contributing to market expansion.North America Casein And Caseinates Market Report:

North America represents a significant share of the Casein and Caseinates market, with an expected increase from USD 0.81 billion in 2023 to USD 1.23 billion by 2033. The rise is fueled by heightened consumer interest in protein supplementation and the prevalence of fitness trends. Major American firms are actively innovating new products to capture market share.South America Casein And Caseinates Market Report:

The South American market for Casein and Caseinates is expected to grow from USD 0.13 billion in 2023 to USD 0.19 billion by 2033. This growth is supported by an increasing focus on nutritional supplements and functional foods, driven by a growing health-conscious consumer base.Middle East & Africa Casein And Caseinates Market Report:

In the Middle East and Africa, the market is expected to rise from USD 0.22 billion in 2023 to USD 0.33 billion by 2033. The region is witnessing an increase in health-conscious consumers, which is driving demand for cases and caseinates in various food applications.Tell us your focus area and get a customized research report.

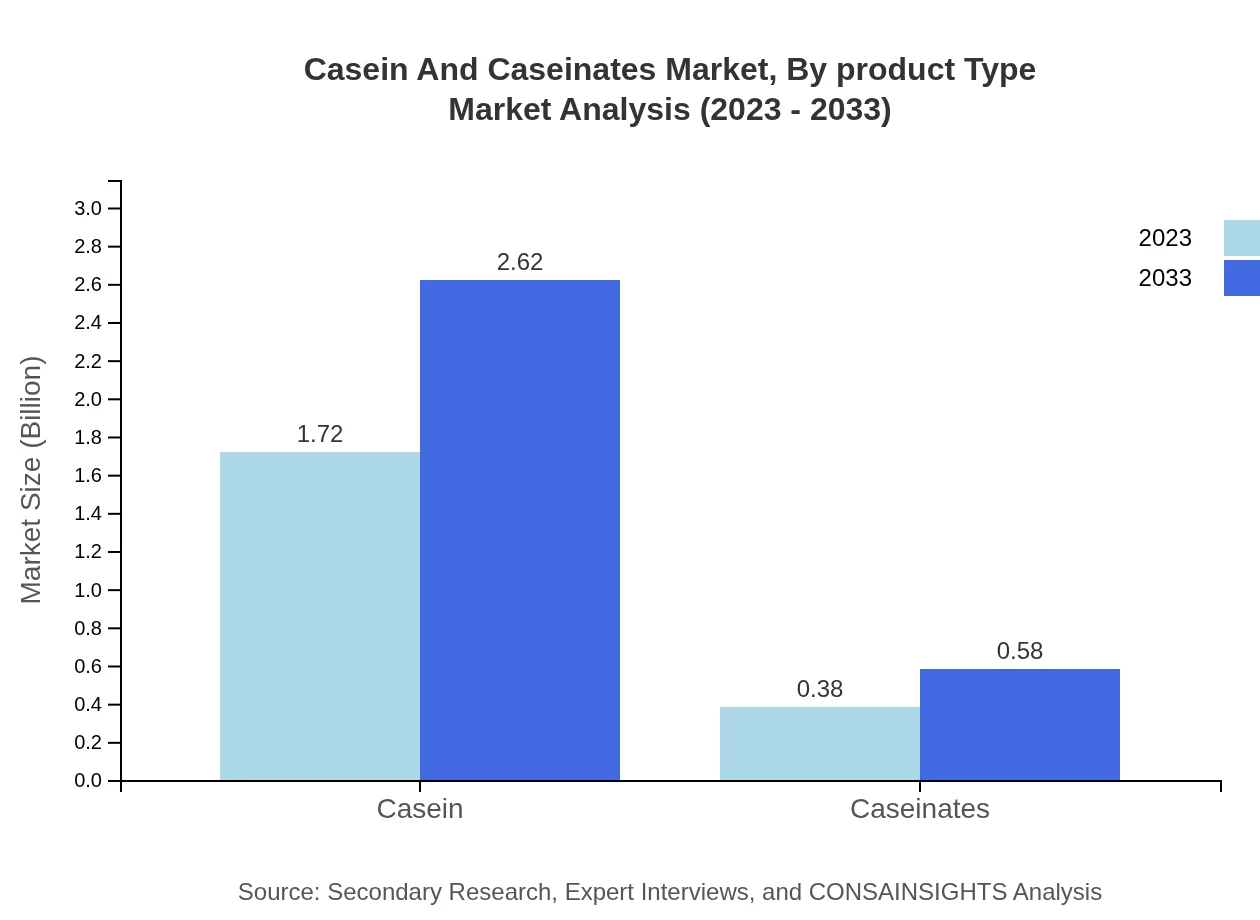

Casein And Caseinates Market Analysis By Product Type

In 2023, the powder form of casein dominates the market with a size of USD 1.72 billion, while caseinates account for USD 0.38 billion. Both subsectors are expected to experience growth driven by their applications in food and beverage.

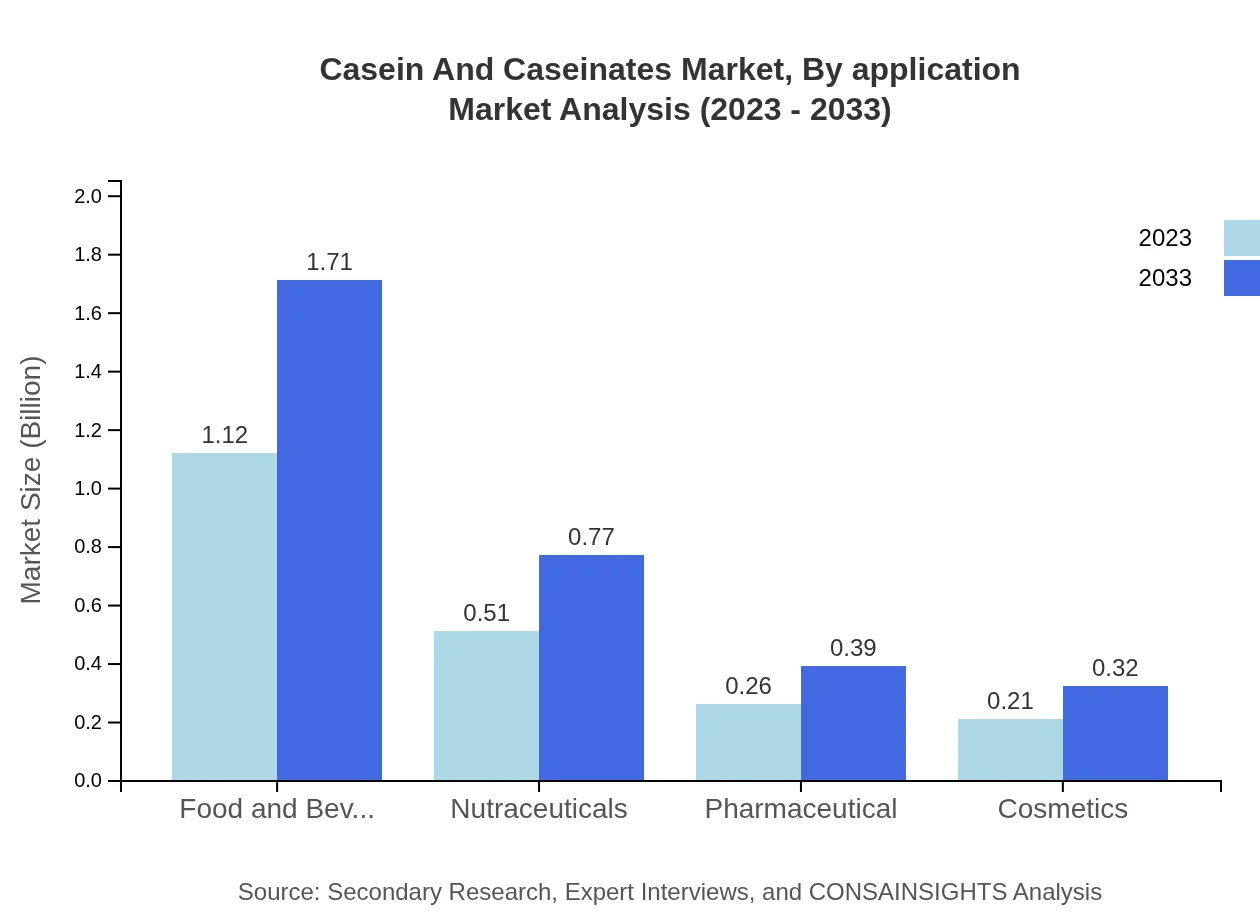

Casein And Caseinates Market Analysis By Application

The food and beverage sector is the largest segment, representing 53.53% of the market share in 2023. Nutraceutical applications are also noteworthy, with a 24.11% share, reflecting growing interest in health and wellness.

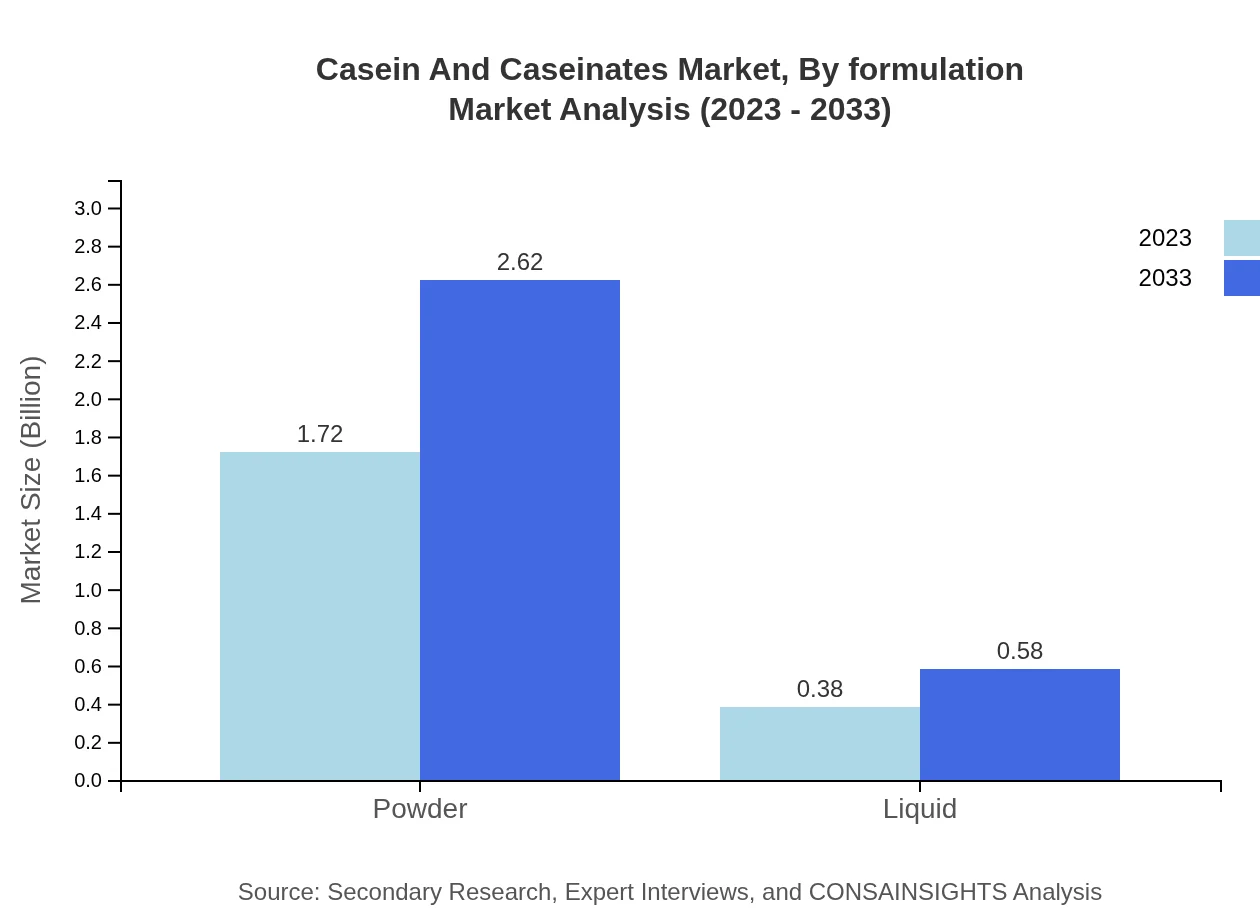

Casein And Caseinates Market Analysis By Formulation

The casein market is largely dominated by powder formulation, accounting for 81.96% of the segment in 2023. Liquid formulations, while smaller, serve niche markets and are projected to grow as demand for convenience products increases.

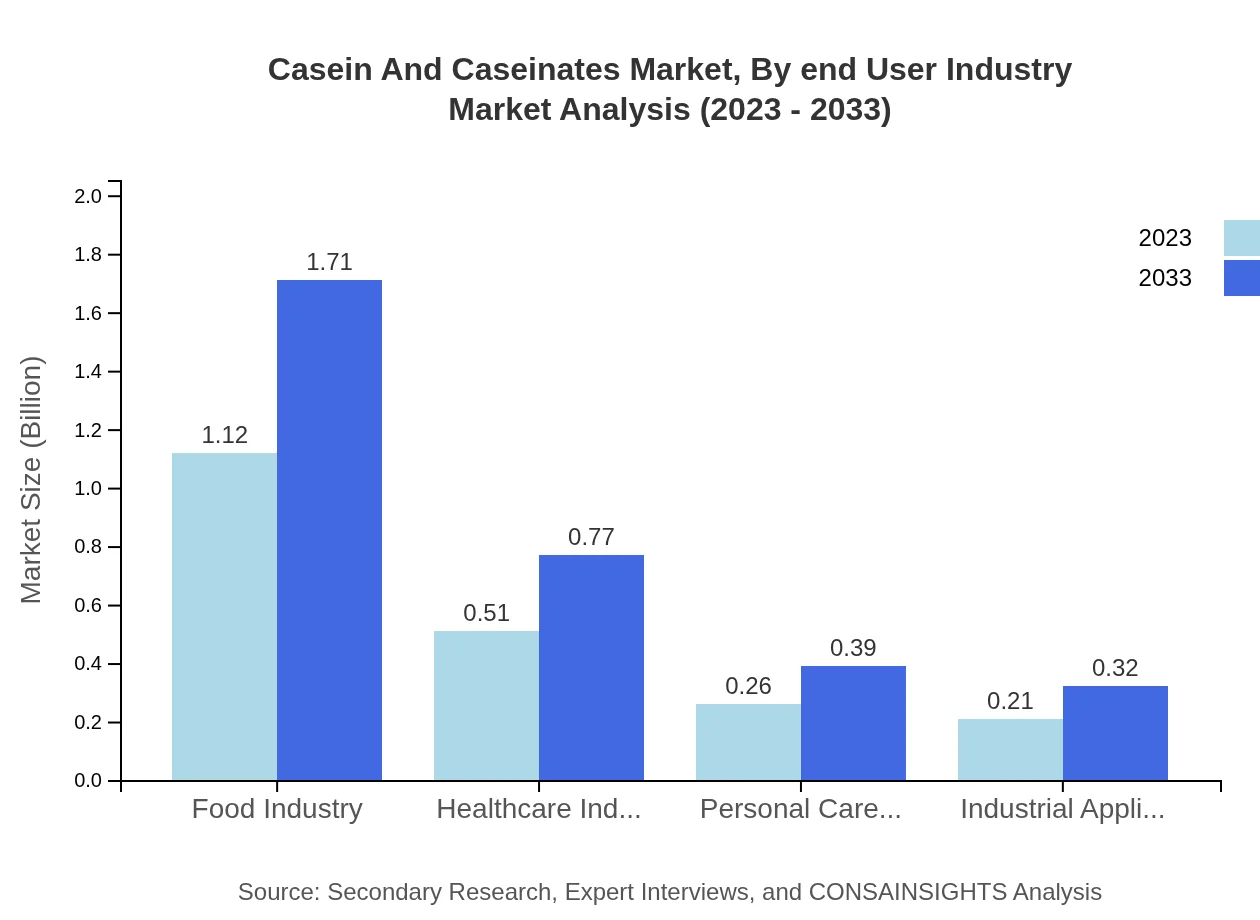

Casein And Caseinates Market Analysis By End User Industry

The food industry holds a significant portion of the market at 53.53%, while healthcare and personal care industries contribute 24.11% and 12.24%, respectively, showcasing the diverse applications of casein and caseinates across sectors.

Casein And Caseinates Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Casein And Caseinates Industry

FrieslandCampina:

FrieslandCampina is a leading global dairy cooperative, recognized for its quality dairy products and commitment to sustainability and innovation in the casein market.Dairy Farmers of America:

Dairy Farmers of America is one of the largest dairy cooperatives in the USA, involved in the production of casein and caseinates, providing high-quality dairy ingredients to both domestic and international markets.Arla Foods:

Arla Foods, a cooperative based in Denmark, is renowned for its dairy innovations. The company invests significantly in R&D to develop premium casein and caseinates suited for various applications.Nestlé:

Nestlé is a global health and nutrition leader, leveraging its expertise in the dairy sector to produce casein and caseinates tailored for infant nutrition and health-enhancing products.We're grateful to work with incredible clients.

FAQs

What is the market size of casein And Caseinates?

The global casein and caseinates market is valued at approximately $2.1 billion in 2023, with a projected CAGR of 4.2% from 2023 to 2033, indicating steady growth. Key segments include food and beverage, nutraceuticals, and pharmaceuticals.

What are the key market players or companies in this casein And Caseinates industry?

Key players in the casein and caseinates market include companies such as Fonterra Co-operative Group, Vreugdenhil Dairy Foods, and Dairy Farmers of America. These companies are significant contributors to the global supply and innovation in the industry.

What are the primary factors driving the growth in the casein And Caseinates industry?

Growth in the casein and caseinates market is driven by increasing demand in food and beverage sectors, rising health-conscious consumer behavior, and advancements in nutraceutical formulations. These factors collectively support the market's positive trajectory.

Which region is the fastest Growing in the casein And Caseinates?

The fastest-growing region for the casein and caseinates market is North America, projected to expand from $0.81 billion in 2023 to $1.23 billion in 2033. Europe also shows strong growth potential, particularly in dairy product applications.

Does ConsaInsights provide customized market report data for the casein And Caseinates industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the casein and caseinates industry. Clients can receive insights specific to market segments, regions, and growth forecasts.

What deliverables can I expect from this casein And Caseinates market research project?

Deliverables from the casein and caseinates market research project will include comprehensive market analysis, segmentation data, competitive landscape, and trends. Additionally, a detailed report will outline forecasts and strategic recommendations.

What are the market trends of casein And Caseinates?

Market trends in the casein and caseinates industry include increased demand for plant-based alternatives, growth in health-focused food innovations, and the expansion of personalized nutrition. These trends indicate evolving consumer preferences in the sector.