Cash Flow Market Report

Published Date: 31 January 2026 | Report Code: cash-flow

Cash Flow Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cash Flow market, including insights into market dynamics, size, trends, regional performance, industry analysis, and forecasts from 2023 to 2033.

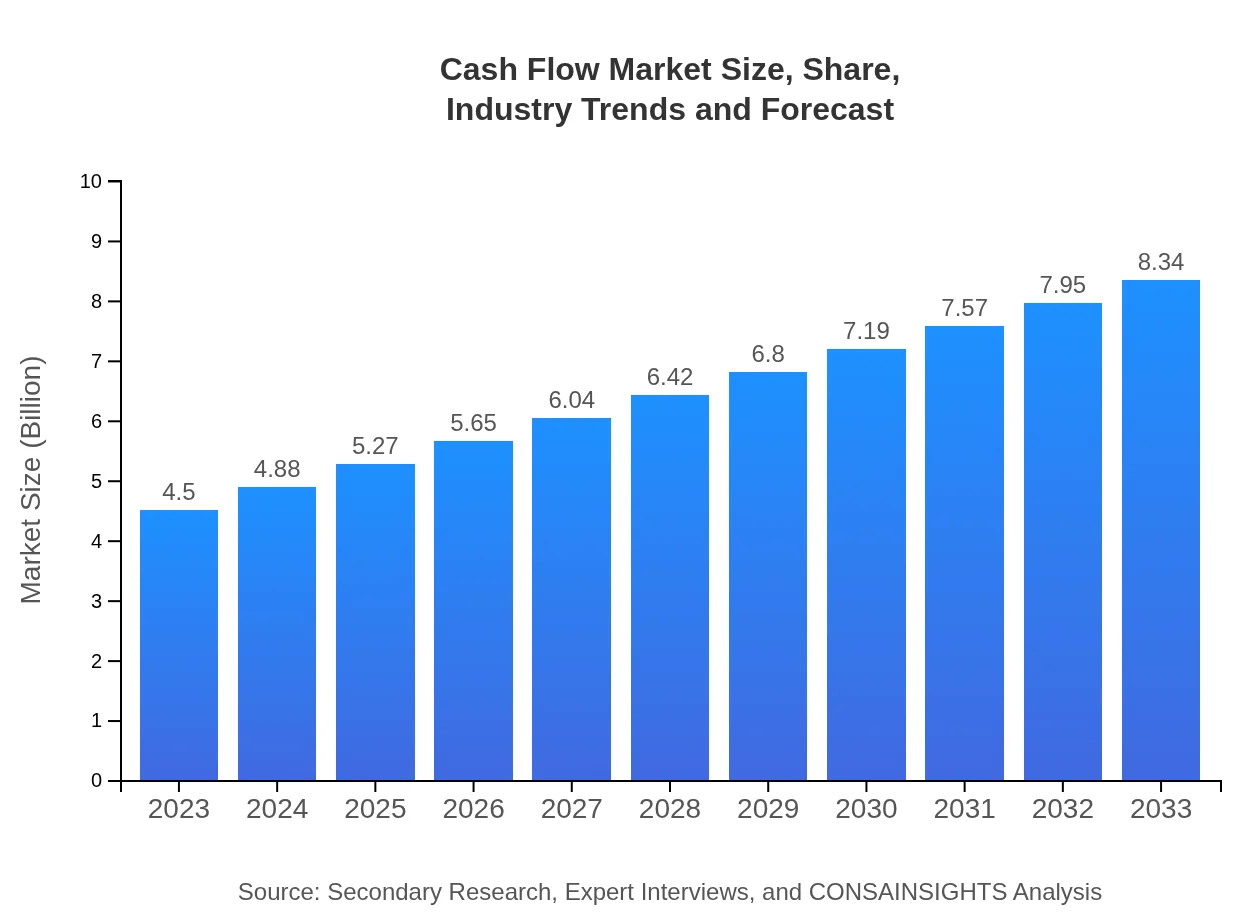

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $8.34 Billion |

| Top Companies | Oracle Financial Services, SAP SE, BlackLine, Float, Intuit QuickBooks |

| Last Modified Date | 31 January 2026 |

Cash Flow Market Overview

Customize Cash Flow Market Report market research report

- ✔ Get in-depth analysis of Cash Flow market size, growth, and forecasts.

- ✔ Understand Cash Flow's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cash Flow

What is the Market Size & CAGR of Cash Flow market in 2023?

Cash Flow Industry Analysis

Cash Flow Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cash Flow Market Analysis Report by Region

Europe Cash Flow Market Report:

In 2023, Europe's Cash Flow market is worth 1.10 billion, growing to 2.04 billion by 2033. The emphasis on regulatory compliance and sustainability in financial practices fosters innovations in cash flow management, with organizations adopting advanced technologies to stay competitive in a rapidly evolving market.Asia Pacific Cash Flow Market Report:

In 2023, the Cash Flow market in the Asia Pacific region is valued at 0.88 billion, with projections to grow to 1.62 billion by 2033. The region is experiencing rapid digitalization, with businesses leveraging technology to manage cash flows and streamline operations. Increasing SME participation in the financial ecosystem and government initiatives to promote financial literacy are expected to contribute to this growth.North America Cash Flow Market Report:

North America shows a significantly larger market valuation of 1.57 billion in 2023, expected to rise to 2.92 billion by 2033. The region leads in cash management innovations, heavily investing in fintech solutions and platforms that enhance cash analytics and forecasting.South America Cash Flow Market Report:

The market in South America is valued at 0.35 billion in 2023 and is projected to reach 0.64 billion by 2033. Economic challenges and fluctuations in currency demand effective cash management strategies, with many businesses adopting digital solutions to enhance their cash flow visibility and efficiency.Middle East & Africa Cash Flow Market Report:

The MEA region's Cash Flow market is valued at 0.60 billion in 2023 and is anticipated to increase to 1.12 billion by 2033. A growing banking sector and the rising number of startups are driving demand for effective cash management solutions to ensure financial stability.Tell us your focus area and get a customized research report.

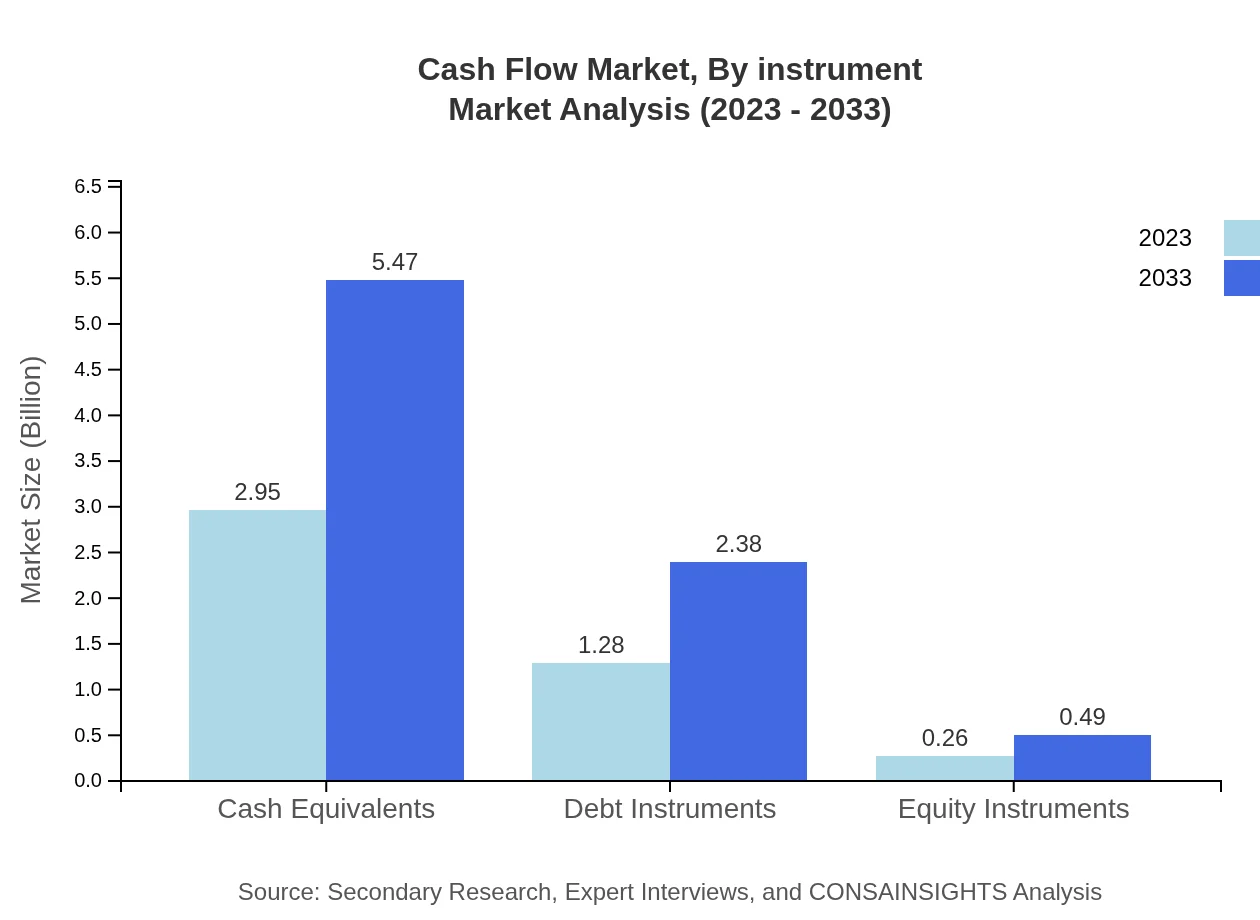

Cash Flow Market Analysis By Instrument

In 2023, Cash Equivalents dominate the market with a size of 2.95 billion, maintaining a 65.58% share and expected to grow to 5.47 billion by 2033. Debt Instruments follow with 1.28 billion in size and a 28.55% share, projected to reach 2.38 billion. Equity Instruments hold a smaller segment with 0.26 billion, showing growth to 0.49 billion. This indicates a critical shift towards liquidity management as businesses prioritize cash equivalents while using debt instruments for financial leverage.

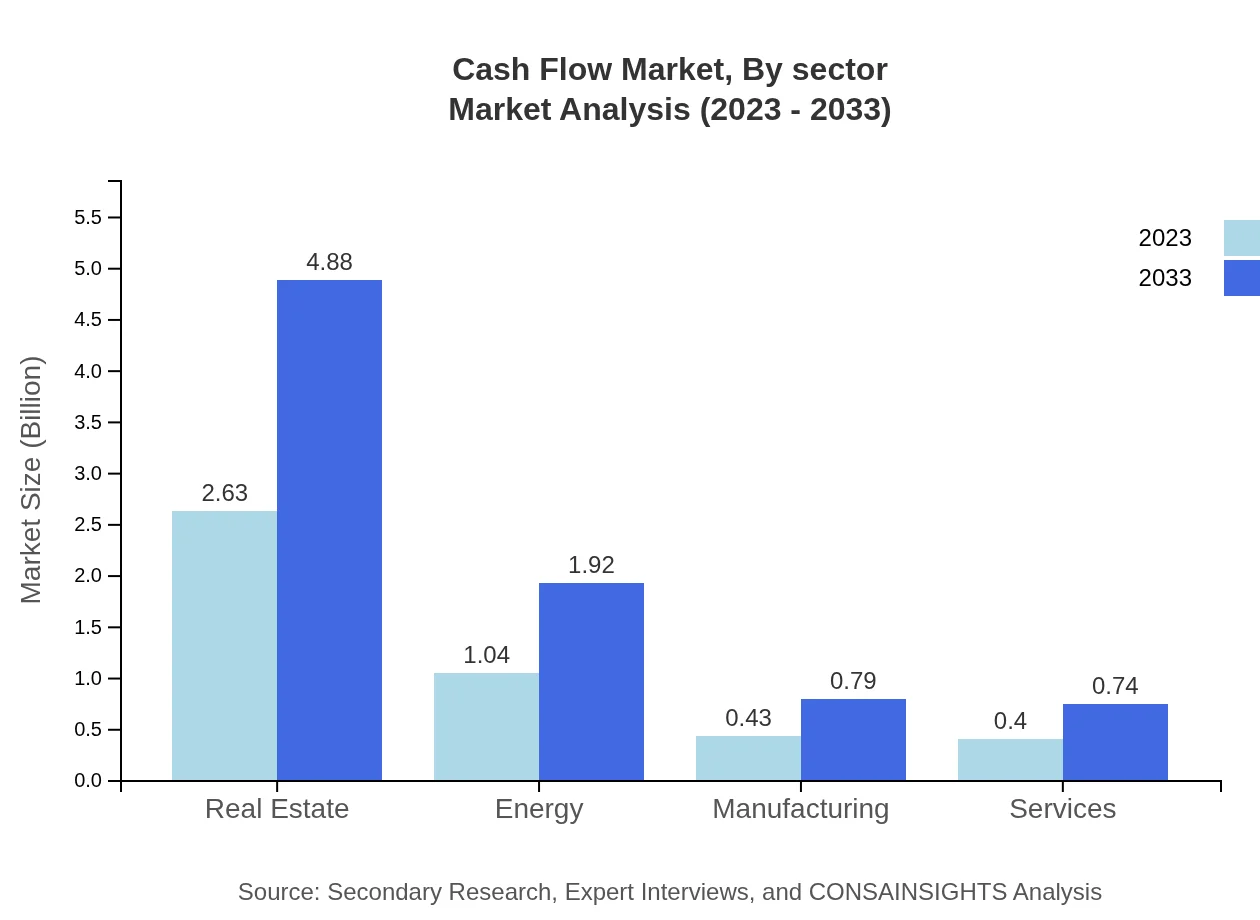

Cash Flow Market Analysis By Sector

The Real Estate sector accounts for the largest segment with a market size of 2.63 billion in 2023, projected to grow to 4.88 billion by 2033, maintaining a 58.52% market share. Energy and Manufacturing sectors contribute 1.04 billion and 0.43 billion respectively in 2023, with significant growth forecasted as industries become more aware of cash flow impacts on operational efficiency.

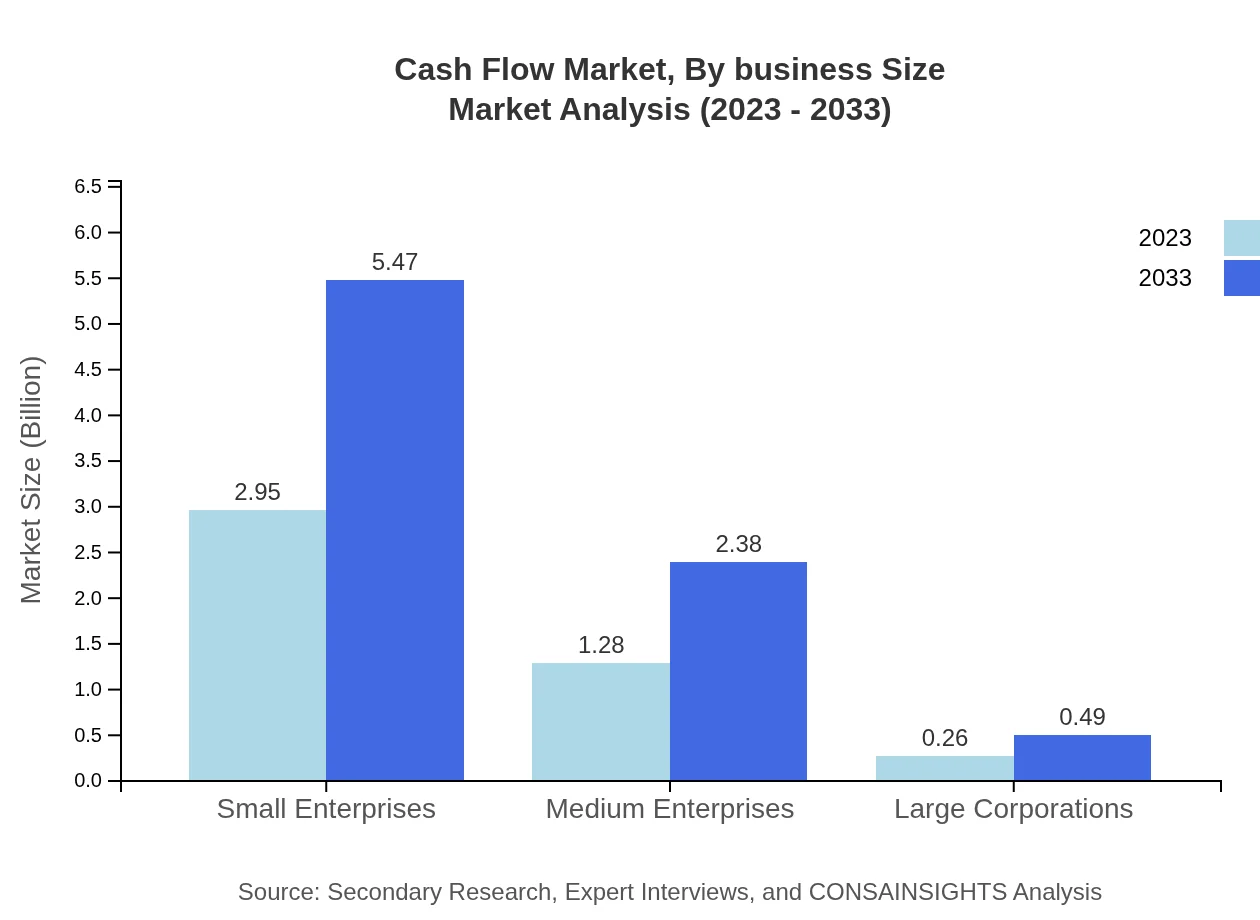

Cash Flow Market Analysis By Business Size

Small Enterprises show significant dominance in the Cash Flow market with a size of 2.95 billion in 2023 and retaining a share of 65.58%. Medium Enterprises follow with 1.28 billion and a share of 28.55%. Large Corporations represent a smaller segment with 0.26 billion, underlining the importance of cash flow management across different business sizes as financial resilience becomes crucial.

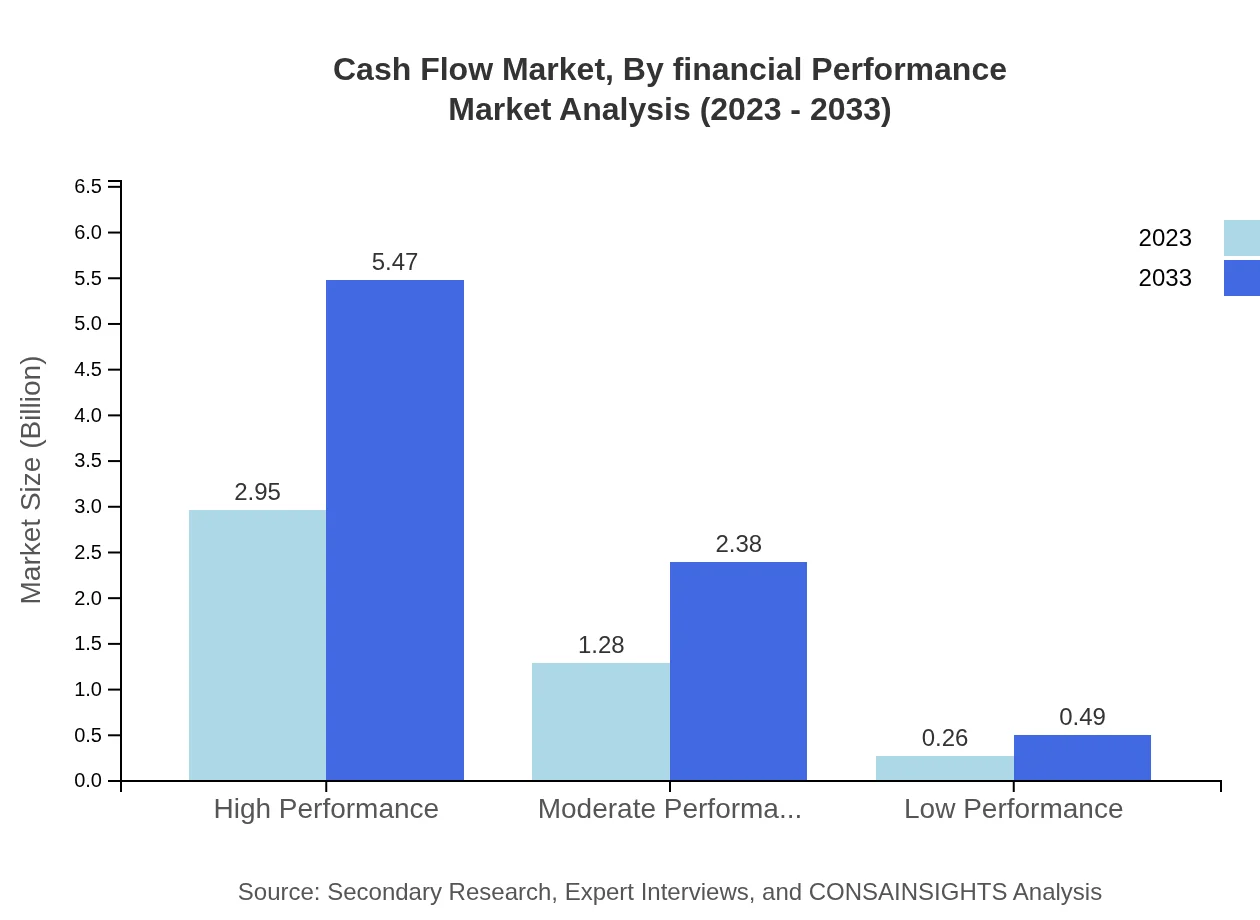

Cash Flow Market Analysis By Financial Performance

High Performance businesses capture a majority with a size of 2.95 billion and a share of 65.58% in 2023, projected to grow effectively over the next decade. Moderate Performance firms yield 1.28 billion with a stable market share, while Low Performance entities show potential growth from 0.26 billion, reflecting the need for effective cash management strategies for financial health.

Cash Flow Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cash Flow Industry

Oracle Financial Services:

Oracle provides a comprehensive suite of financial management tools that help businesses manage cash flows efficiently, utilizing advanced analytics and cloud-based solutions.SAP SE:

SAP offers integrated cash management solutions designed to assist organizations in optimizing their cash flow status through real-time insights and predictive analytics.BlackLine:

BlackLine specializes in finance automation solutions that streamline cash management processes, enhancing accuracy and transparency in accounting.Float:

Float is a cash flow forecasting tool helping businesses manage liquidity with predictive analytics and real-time tracking, targeted towards small and medium enterprises.Intuit QuickBooks:

QuickBooks offers accounting and cash flow management solutions primarily for SMEs, enabling users to maintain clear visibility over their cash positions.We're grateful to work with incredible clients.

FAQs

What is the market size of Cash Flow?

The global cash flow market is valued at approximately $4.5 billion in 2023, with a projected CAGR of 6.2%, indicating robust growth potential through 2033.

What are the key market players or companies in the Cash Flow industry?

Prominent companies in the cash flow industry include global financial institutions, fintech firms, and traditional banks, which are innovating to enhance cash flow management solutions.

What are the primary factors driving the growth in the Cash Flow industry?

Key drivers include increased digitalization of financial services, rising demand for effective cash flow management tools, and the growing complexity of global business operations.

Which region is the fastest Growing in the Cash Flow?

Asia Pacific is the fastest-growing region in the cash flow market, projected to expand from $0.88 billion in 2023 to $1.62 billion by 2033, reflecting a strong CAGR.

Does ConsaInsights provide customized market report data for the Cash Flow industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cash flow industry, enabling clients to make informed decisions.

What deliverables can I expect from this Cash Flow market research project?

Deliverables include comprehensive market analysis, regional insights, segmentation data, competitor profiling, and future market trend forecasts.

What are the market trends of Cash Flow?

Current trends in the cash flow market include the adoption of AI in cash management, increased focus on real-time analytics, and the integration of blockchain technology for transparency.