Cat Food Market Report

Published Date: 31 January 2026 | Report Code: cat-food

Cat Food Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the Cat Food market, offering insights into market dynamics, trends, and forecasts from 2023 to 2033. It includes market size, segmentation analysis, regional insights, technology impact, and profiles of leading companies in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

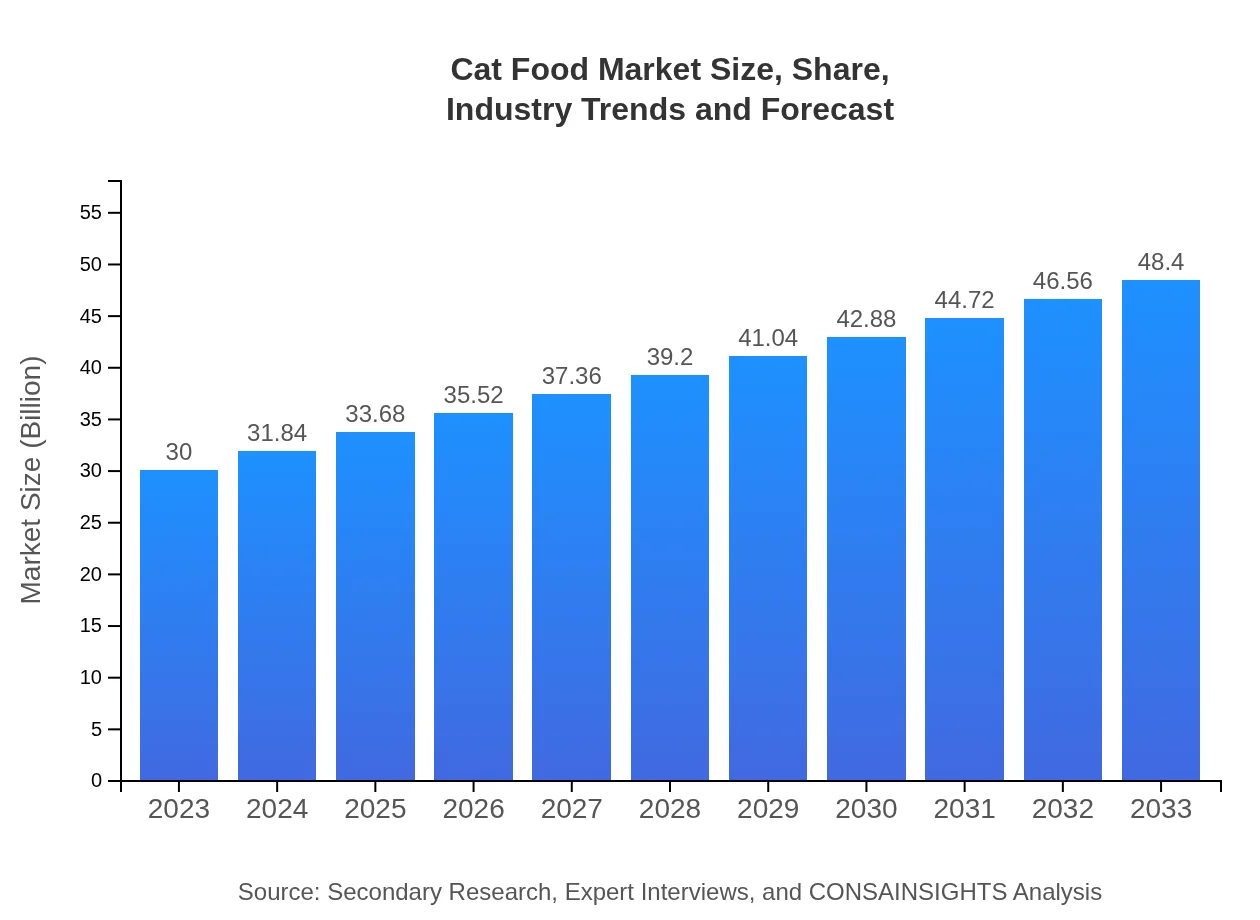

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $48.40 Billion |

| Top Companies | Nestle Purina PetCare, Mars Petcare, Hill's Pet Nutrition, Blue Buffalo, Royal Canin |

| Last Modified Date | 31 January 2026 |

Cat Food Market Overview

Customize Cat Food Market Report market research report

- ✔ Get in-depth analysis of Cat Food market size, growth, and forecasts.

- ✔ Understand Cat Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cat Food

What is the Market Size & CAGR of Cat Food market in 2023?

Cat Food Industry Analysis

Cat Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cat Food Market Analysis Report by Region

Europe Cat Food Market Report:

Europe experiences a strong Cat Food market, valued at approximately $9.27 billion in 2023, increasing to $14.96 billion by 2033. The demand for natural and high-quality pet food products is rising, along with a focus on sustainability practices in manufacturing and packaging.Asia Pacific Cat Food Market Report:

In the Asia Pacific region, the Cat Food market was valued at approximately $5.05 billion in 2023 and is expected to grow to about $8.15 billion by 2033. The region's growth is driven by rising disposable incomes, urbanization, and an increasing pet adoption rate. As a result, companies are launching localized products tailored to regional preferences.North America Cat Food Market Report:

North America holds a significant share of the Cat Food market at a valuation of $11.68 billion in 2023, with projections of reaching $18.85 billion by 2033. A high level of pet ownership, coupled with trends favoring premium and specialized products, drives robust growth in this key market.South America Cat Food Market Report:

For South America, the market size is around $1.20 billion in 2023, growing to $1.93 billion by 2033. Economic improvements and a growing awareness of pet nutrition are major factors driving market growth. Innovations in product offerings are also contributing to a more competitive landscape in this region.Middle East & Africa Cat Food Market Report:

The Middle East and Africa represent a smaller yet growing market, valued at $2.80 billion in 2023, expected to rise to $4.52 billion by 2033. Increasing urbanization, changing lifestyles, and greater awareness of animal nutrition are key trends contributing to the growth of this market.Tell us your focus area and get a customized research report.

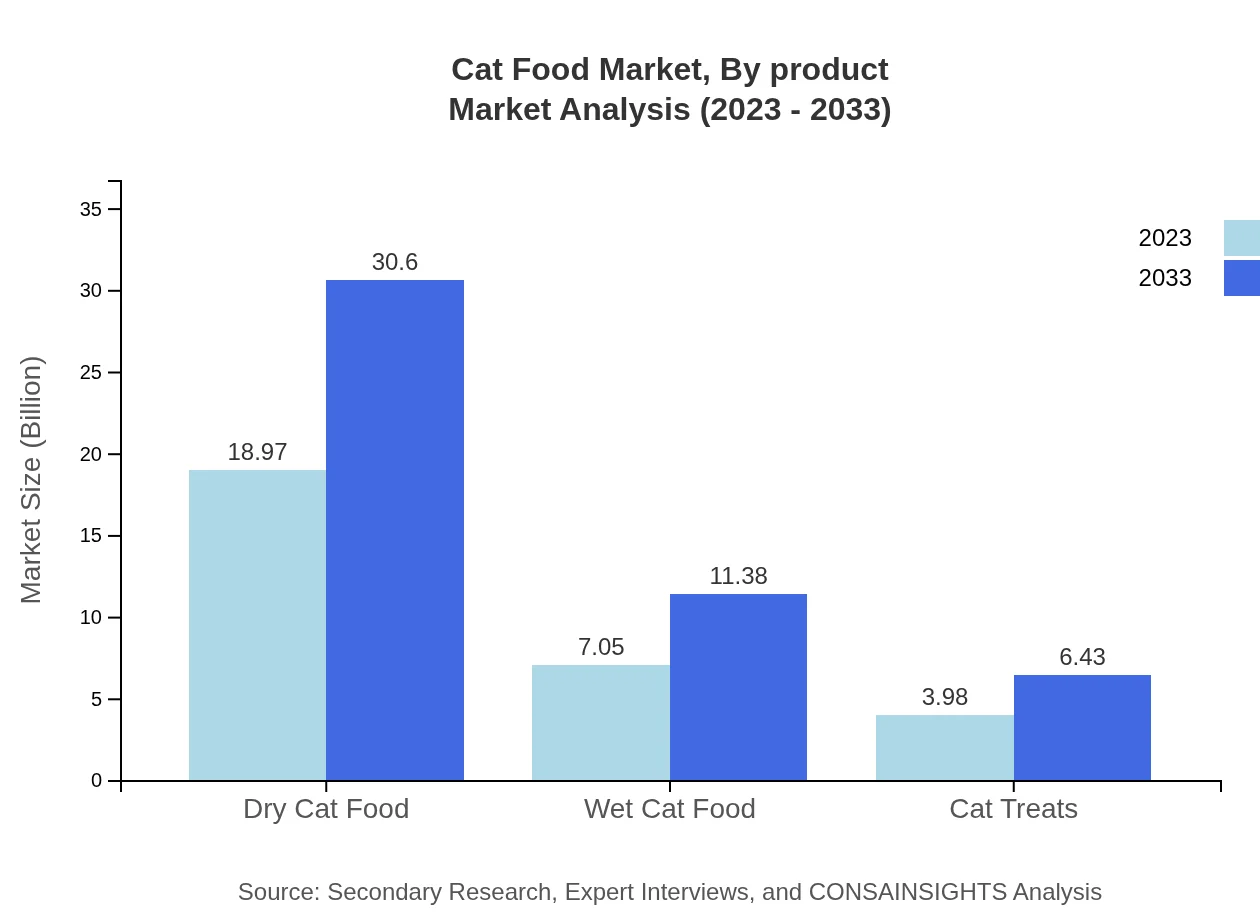

Cat Food Market Analysis By Product

The cat food market is frequently segmented into dry cat food, wet cat food, and treats. In 2023, dry food dominates the market with a size of $18.97 billion, representing 63.22% of the total market share. The dry food segment maintains its popularity, while wet food, valued at $7.05 billion (23.5% share), and treats at $3.98 billion (13.28% share) are also significant parts of the market. Growth in these segments is expected to continue as pet owners seek diversity in their pets' diets.

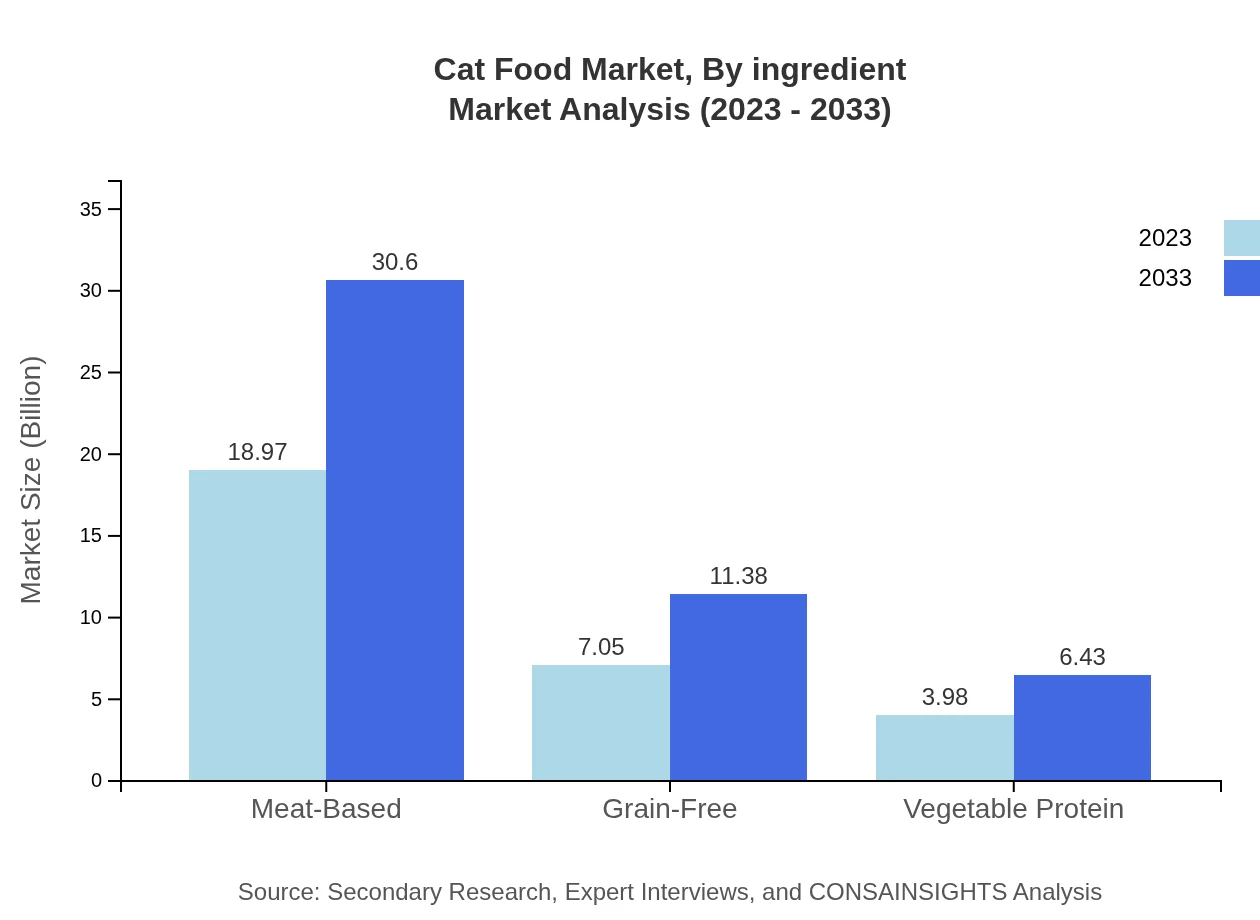

Cat Food Market Analysis By Ingredient

The market can be analyzed by ingredient types, primarily meat-based, grain-free, and vegetable protein formulations. The meat-based segment was valued at $18.97 billion in 2023, covering 63.22% of the market share. Grain-free products and vegetable protein options also serve unique dietary needs, with respective sizes of $7.05 billion and $3.98 billion, indicating a growing trend towards premium and health-conscious ingredients.

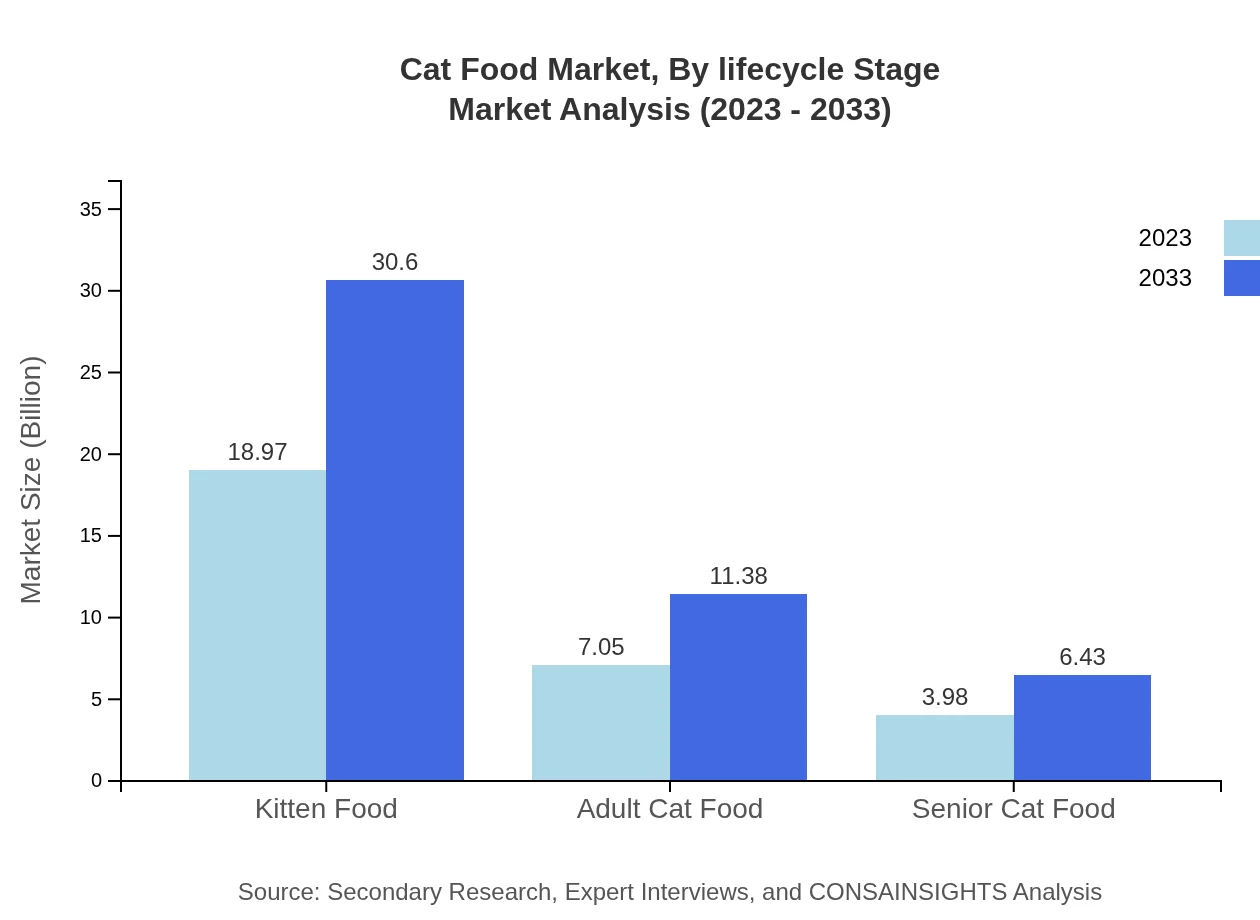

Cat Food Market Analysis By Lifecycle Stage

Cat food is further categorized by lifecycle stages: kitten food, adult cat food, and senior cat food. Kitten food commands a leading market share, reflective of growing kitten adoption rates, valued at $18.97 billion (63.22% share) in 2023. Adult cat food accounts for $7.05 billion (23.5% share) and senior cat food at $3.98 billion (13.28% share). This segmentation highlights the tailored nutritional needs of different cat demographics.

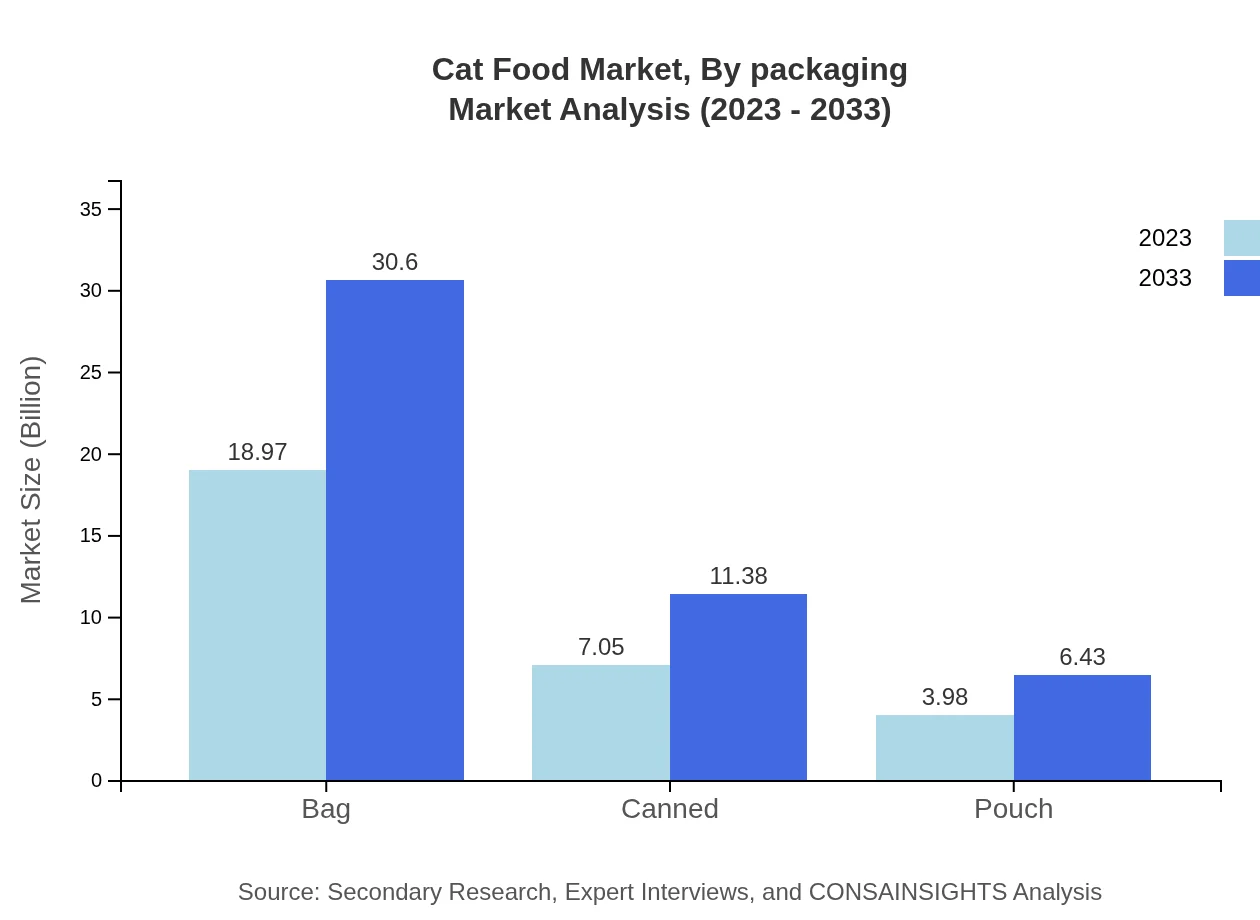

Cat Food Market Analysis By Packaging

The packaging segment is essential, with products available in bags, cans, and pouches. Bagged products had a market size of $18.97 billion in 2023 (63.22% share), while canned foods totaled approximately $7.05 billion (23.5%), and pouches reached $3.98 billion (13.28%). Convenience and freshness drive consumer preferences for particular packaging types.

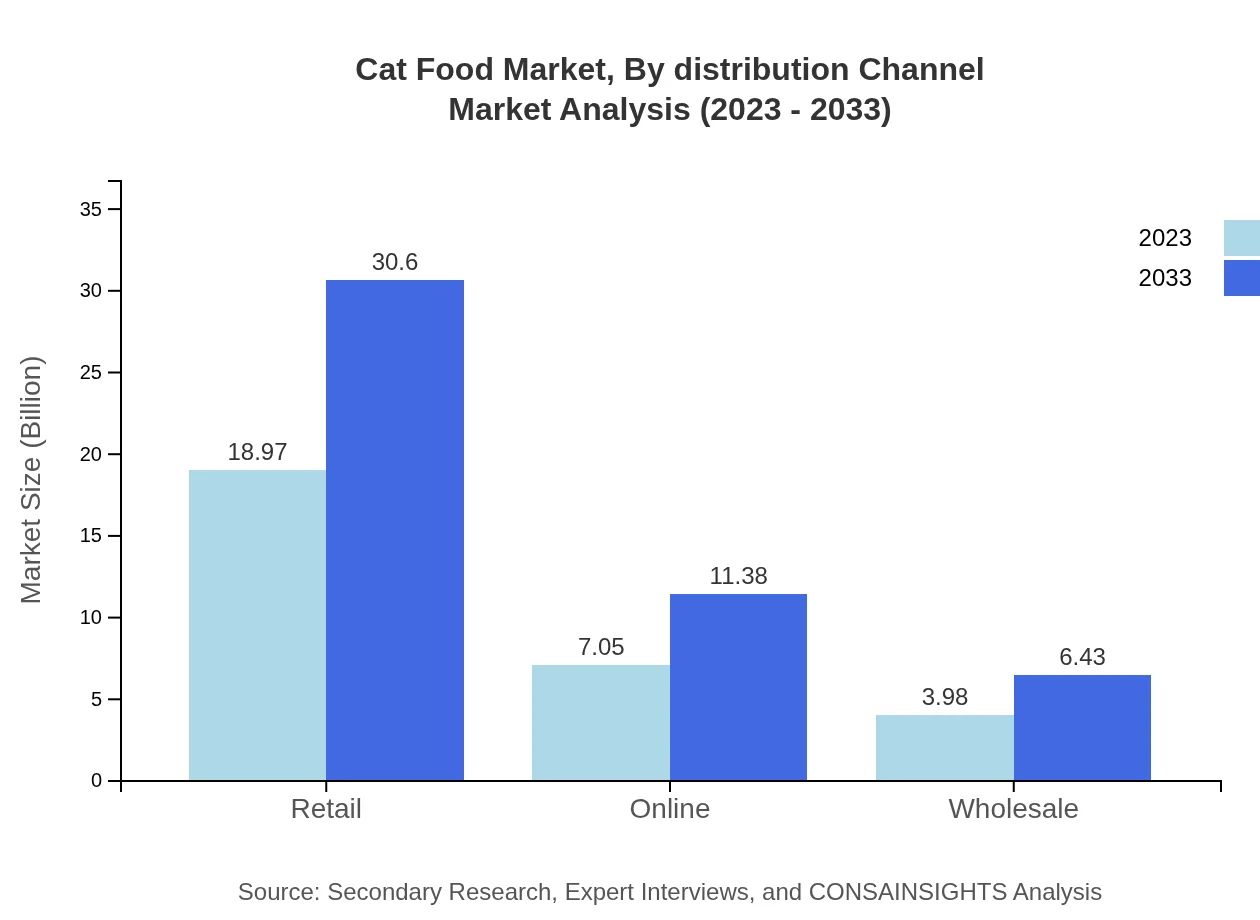

Cat Food Market Analysis By Distribution Channel

Distribution channels for cat food include retail, online, and wholesale. Retail remains dominant with a market size of $18.97 billion (63.22% share), whereas online channels grow increasingly relevant with a size of $7.05 billion (23.5% share), and wholesale accounts for $3.98 billion (13.28%). The shift towards online shopping reflects changing consumer behaviors in purchasing pet food.

Cat Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cat Food Industry

Nestle Purina PetCare:

A subsidiary of Nestlé, Purina is known for its popular cat food brands such as Friskies and Fancy Feast, focusing on nutritional science and product innovation.Mars Petcare:

Mars Petcare is one of the leading players in the pet food sector globally, with brands like Whiskas and Sheba, emphasizing premium ingredients and sustainability in production.Hill's Pet Nutrition:

A subsidiary of Colgate-Palmolive, Hill's offers health-focused products, particularly Science Diet and Prescription Diet, catering to specific dietary needs and veterinary recommendations.Blue Buffalo:

Known for its all-natural ingredients and holistic approach, Blue Buffalo caters to health-conscious pet owners, offering a variety of grain-free and holistic options.Royal Canin:

Royal Canin specializes in tailored nutrition solutions, offering breed-specific and age-specific diets, enhancing the overall health and well-being of pets.We're grateful to work with incredible clients.

FAQs

What is the market size of cat food?

The global cat food market is valued at approximately $30 billion in 2023, and is expected to grow at a CAGR of 4.8%. This growth indicates a strong and steady demand in the coming years.

What are the key market players or companies in the cat food industry?

Key players in the cat food industry include Mars Petcare, Nestlé Purina, Hill's Pet Nutrition, and Spectrum Brands. These companies dominate the market by offering a wide range of products across various segments.

What are the primary factors driving the growth in the cat food industry?

Growth in the cat food market is primarily driven by increasing pet ownership, rising awareness about pet nutrition, and a growing preference for premium pet food products that cater to specific dietary needs.

Which region is the fastest Growing in the cat food market?

The fastest-growing region in the cat food market is North America. With a market size projected to rise from $11.68 billion in 2023 to $18.85 billion by 2033, it showcases significant growth potential.

Does ConsaInsights provide customized market report data for the cat food industry?

Yes, ConsaInsights offers customized market report data for the cat food industry, catering to specific client needs and providing tailored insights that enhance strategic decision-making.

What deliverables can I expect from this cat food market research project?

From this market research project, you can expect comprehensive reports that include market size, segmentation analysis, competitive landscape, growth forecasts, and trend analysis pertinent to the cat food industry.

What are the market trends of cat food?

Current market trends in cat food include the increasing demand for grain-free options, meat-based diets, and premium treats. Additionally, online retailing is becoming a significant channel for distribution.