Cataract Surgery Devices Market Report

Published Date: 31 January 2026 | Report Code: cataract-surgery-devices

Cataract Surgery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the cataract surgery devices market, covering current trends, industry forecasts, and key insights from 2023 to 2033, specifically focusing on market size, capacity, and segmentation.

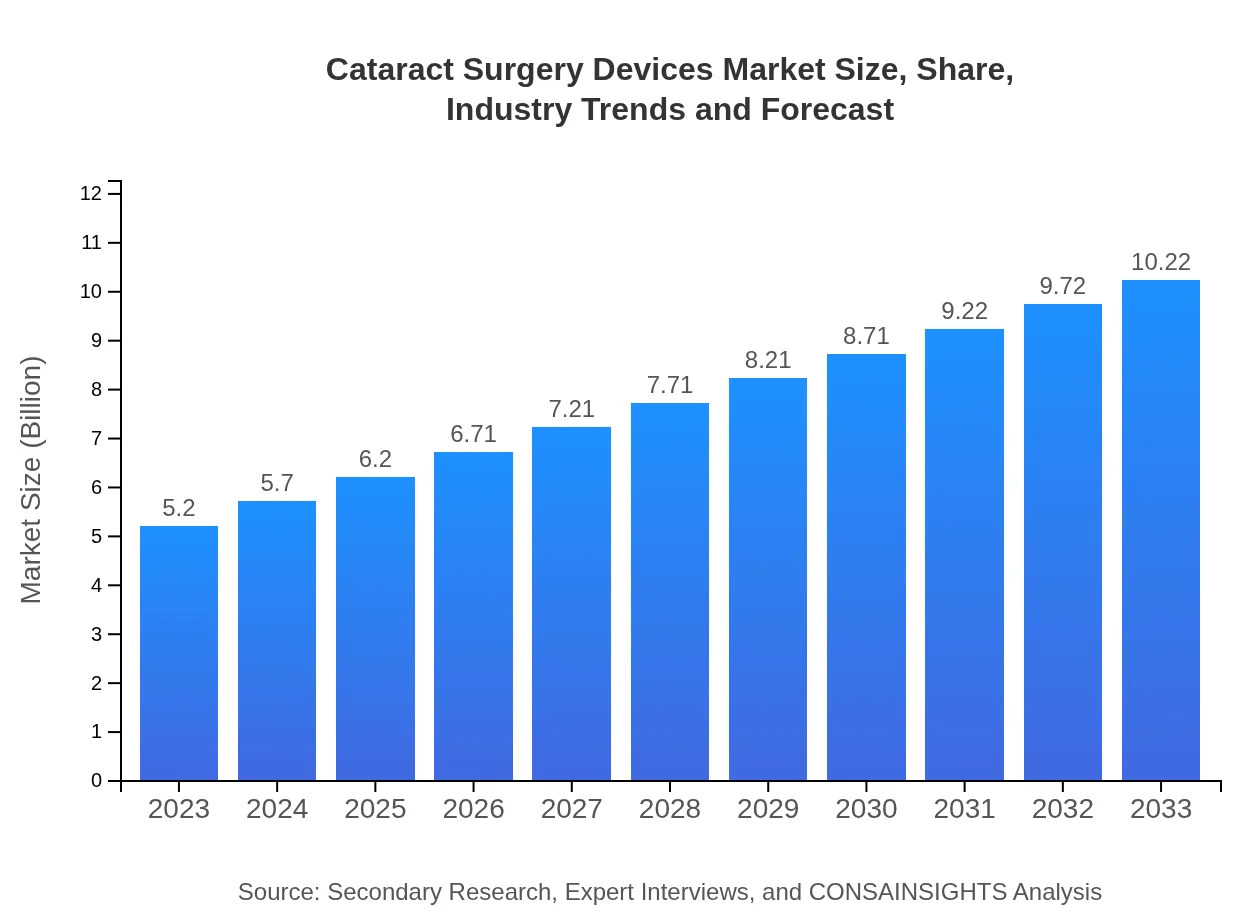

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Johnson & Johnson Vision, Alcon Inc., Bausch Health Companies Inc. |

| Last Modified Date | 31 January 2026 |

Cataract Surgery Devices Market Overview

Customize Cataract Surgery Devices Market Report market research report

- ✔ Get in-depth analysis of Cataract Surgery Devices market size, growth, and forecasts.

- ✔ Understand Cataract Surgery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cataract Surgery Devices

What is the Market Size & CAGR of Cataract Surgery Devices market in 2023?

Cataract Surgery Devices Industry Analysis

Cataract Surgery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cataract Surgery Devices Market Analysis Report by Region

Europe Cataract Surgery Devices Market Report:

Europe's market value is $1.43 billion in 2023, projected to reach $2.81 billion by 2033. The region benefits from strong regulatory frameworks, increased awareness about eye care, and substantial investments in healthcare technology.Asia Pacific Cataract Surgery Devices Market Report:

In the Asia Pacific, the cataract surgery devices market was valued at $0.99 billion in 2023 and is forecasted to reach $1.94 billion by 2033. Increasing healthcare investments and rising awareness about eye conditions are key growth drivers in this region. Countries like China and India are witnessing a surge in surgical volume due to the growing geriatric population.North America Cataract Surgery Devices Market Report:

North America represents the largest market for cataract surgery devices, valued at $2.00 billion in 2023, expecting to grow to $3.94 billion by 2033. Factors including high healthcare spending, advanced surgical technology, and a significant elderly demographic are propelling this market.South America Cataract Surgery Devices Market Report:

The South American market is valued at $0.45 billion in 2023, with projections of $0.89 billion by 2033. Brazil and Argentina are leading this growth as they improve healthcare infrastructure and access to ophthalmology services, despite facing economic challenges.Middle East & Africa Cataract Surgery Devices Market Report:

The Middle East and Africa market is relatively small, valued at $0.32 billion in 2023, with an anticipated growth to $0.64 billion by 2033. The market is supported by improving healthcare facilities and increased focus on eye health in emerging economies.Tell us your focus area and get a customized research report.

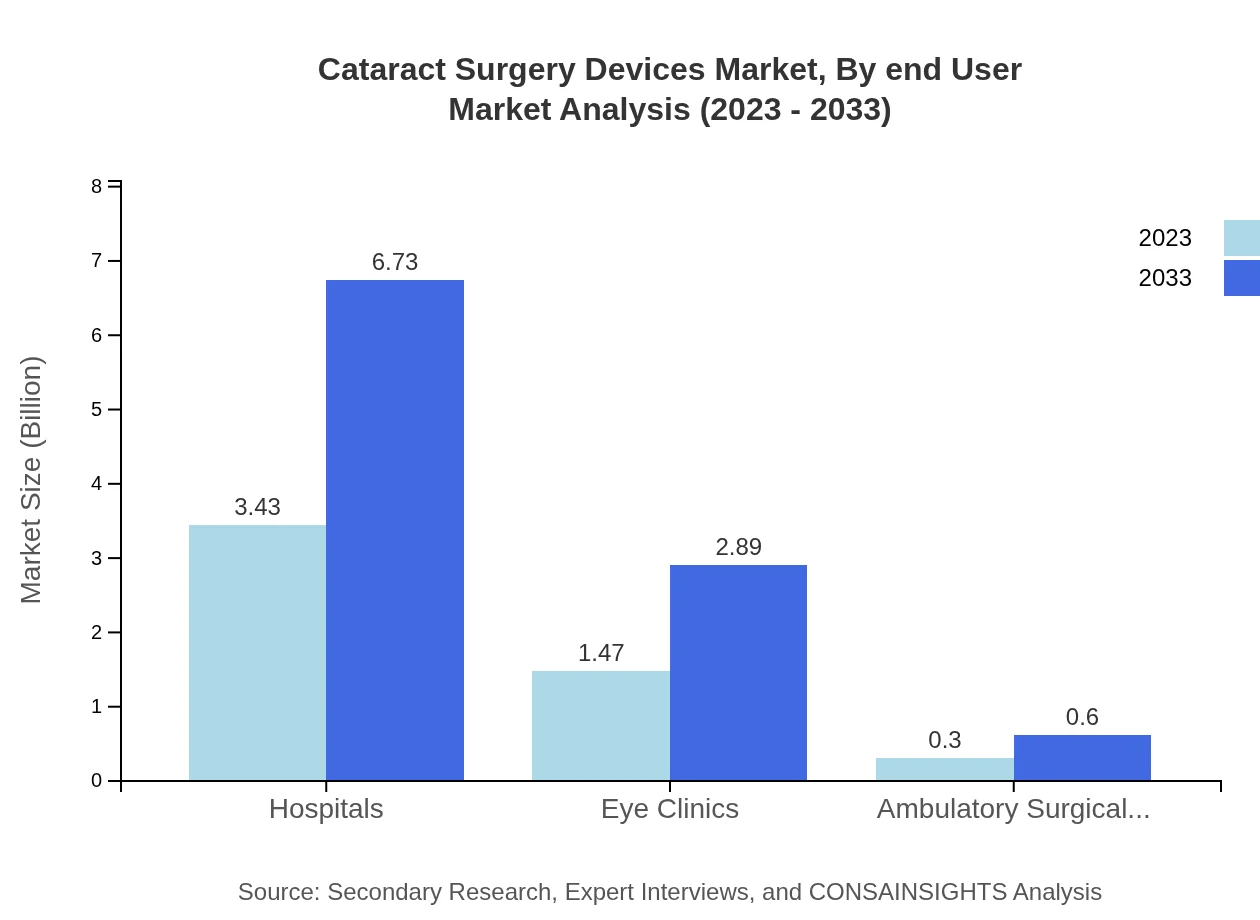

Cataract Surgery Devices Market Analysis By End User

The end-user segment is pivotal in defining the market dynamics. In 2023, the market size for hospitals is approximately $3.43 billion, holding a 65.87% market share. Eye clinics represent $1.47 billion, accounting for 28.29%, while ambulatory surgical centers contribute a smaller segment with $0.30 billion and 5.84% market share.

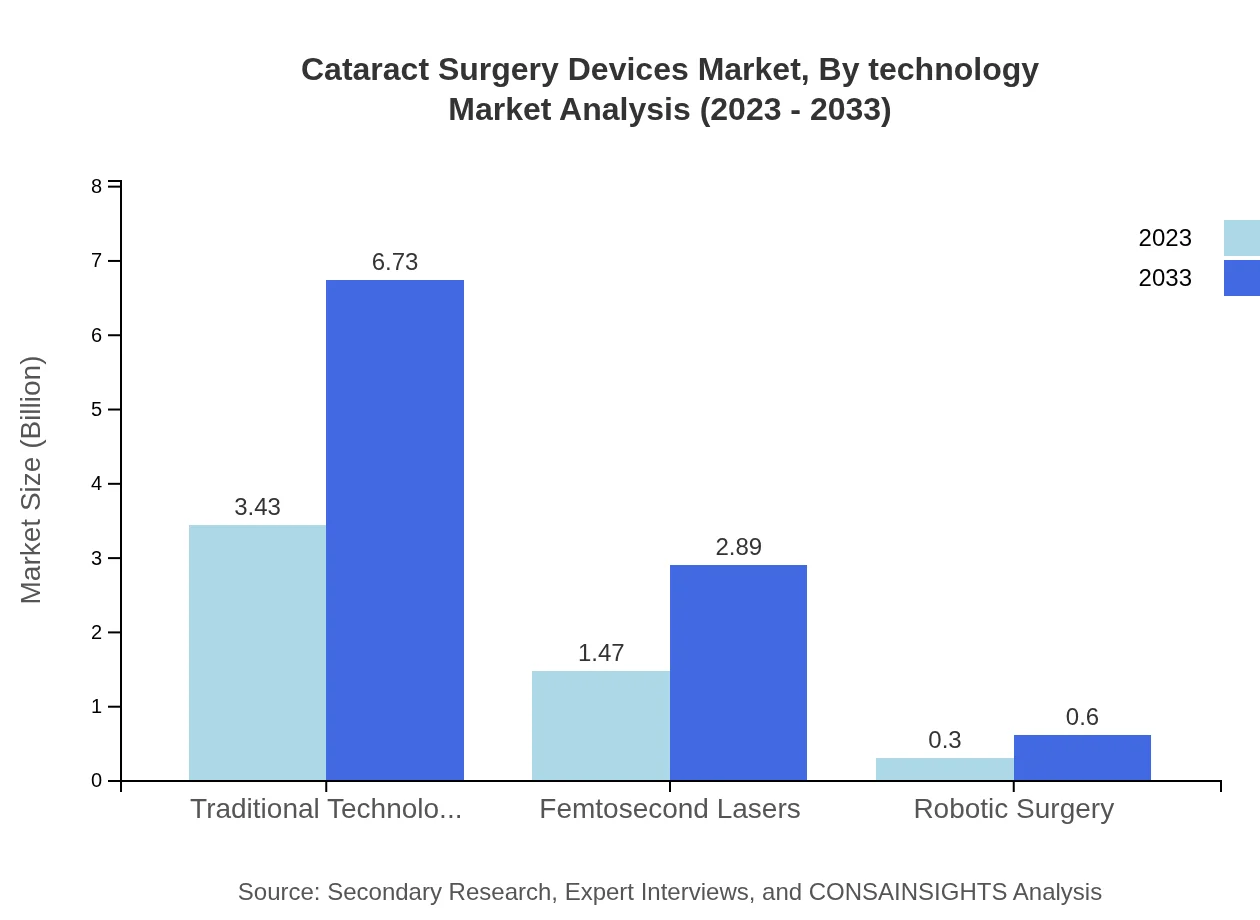

Cataract Surgery Devices Market Analysis By Technology

The technology segment is critical in shaping the cataract surgery devices market. Traditional technology holds a substantial share of 65.87%, with a market size of $3.43 billion in 2023. Femtosecond lasers follow at 28.29%, valued at $1.47 billion, and robotic surgery is emerging but accounts for a smaller share at 5.84%, with $0.30 billion.

Cataract Surgery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cataract Surgery Devices Industry

Johnson & Johnson Vision:

A leading player in the ophthalmology market, Johnson & Johnson Vision provides innovative intraocular lenses and surgical instruments, playing a significant role in advancing cataract surgery technology.Alcon Inc.:

Alcon is renowned for its comprehensive range of eye care products, including cataract surgery devices, and is recognized for pioneering advancements in surgical instruments and intraocular lenses.Bausch Health Companies Inc.:

Bausch Health is a global company specializing in a variety of ophthalmic products, including cataract surgery devices, focusing on enhancing surgical outcomes and patient safety.We're grateful to work with incredible clients.

FAQs

What is the market size of cataract surgery devices?

In 2023, the cataract surgery devices market is valued at approximately $5.2 billion, with a projected CAGR of 6.8% until 2033. This growth is indicative of the increasing demand for advanced surgical solutions globally.

What are the key market players or companies in the cataract surgery devices industry?

Key players in the cataract surgery devices market include notable manufacturers and healthcare providers focusing on innovative surgical technologies and improved patient outcomes, establishing a significant competitive landscape driving the industry forward.

What are the primary factors driving the growth in the cataract surgery devices industry?

The growth in the cataract surgery devices industry is driven by an aging population, rising prevalence of cataracts, technological advancements in surgical procedures, and increasing healthcare expenditure, leading to greater accessibility and efficiency in cataract surgeries.

Which region is the fastest Growing in the cataract surgery devices market?

North America is the fastest-growing region in the cataract surgery devices market, with projected growth from $2.00 billion in 2023 to $3.94 billion by 2033, reflecting strategic investments and advancements in surgical techniques.

Does ConsaInsights provide customized market report data for the cataract surgery devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cataract surgery devices industry, allowing stakeholders to gain insights aligned with their strategic goals and operational requirements.

What deliverables can I expect from this cataract surgery devices market research project?

Expect comprehensive market analysis, detailed segmentation reports, competitive landscape evaluations, regional market data, and actionable insights aimed at informing strategic decisions in the cataract surgery devices market.

What are the market trends of cataract surgery devices?

Current trends in the cataract surgery devices market include the adoption of minimally invasive techniques, increased utilization of femtosecond lasers, and advancements in intraocular lenses, reflecting ongoing innovations shaping the future of cataract surgeries.