Cattle Feed And Feed Additives Market Report

Published Date: 02 February 2026 | Report Code: cattle-feed-and-feed-additives

Cattle Feed And Feed Additives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cattle Feed and Feed Additives market, including current trends, market size, growth forecasts (2023 - 2033), and regional insights, aimed at stakeholders seeking to understand this evolving industry.

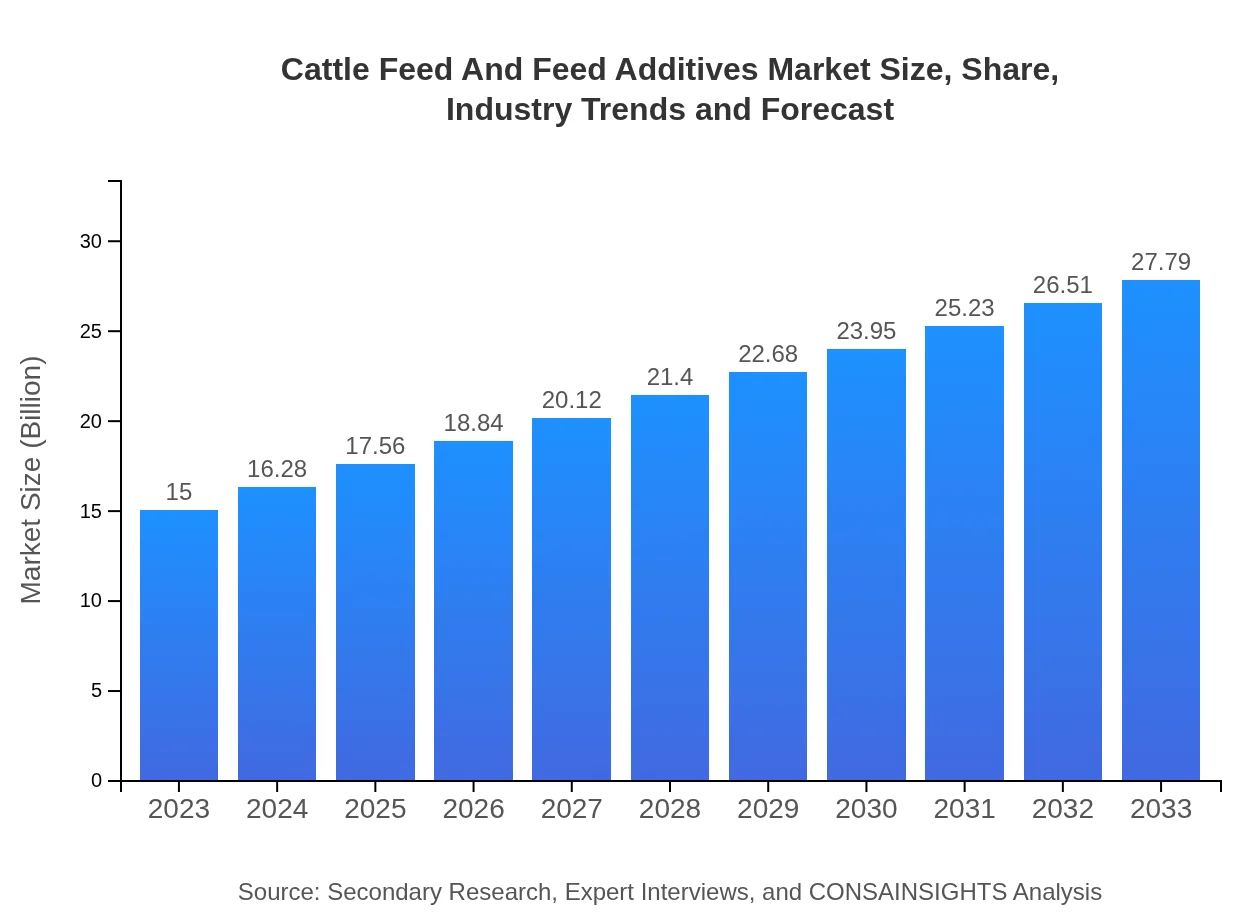

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Cargill, Inc., Archer Daniels Midland Company, Alltech, Inc., BASF SE |

| Last Modified Date | 02 February 2026 |

Cattle Feed And Feed Additives Market Overview

Customize Cattle Feed And Feed Additives Market Report market research report

- ✔ Get in-depth analysis of Cattle Feed And Feed Additives market size, growth, and forecasts.

- ✔ Understand Cattle Feed And Feed Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cattle Feed And Feed Additives

What is the Market Size & CAGR of Cattle Feed And Feed Additives market in 2023 and 2033?

Cattle Feed And Feed Additives Industry Analysis

Cattle Feed And Feed Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cattle Feed And Feed Additives Market Analysis Report by Region

Europe Cattle Feed And Feed Additives Market Report:

Europe currently has a market valuation of USD 4.64 billion in 2023, anticipated to reach USD 8.60 billion by 2033. The European market is characterized by stringent food safety regulations and high consumption of organic feed, prompting a shift towards specialty and premium products.Asia Pacific Cattle Feed And Feed Additives Market Report:

In 2023, the Asia Pacific region holds a market size of USD 2.97 billion, expected to grow to USD 5.50 billion by 2033. This growth is driven by increased livestock production and rising demand for dairy products, particularly in countries like India and China. The region is focusing on sustainable feed practices and technological innovations to enhance production efficiency.North America Cattle Feed And Feed Additives Market Report:

North America recorded a market size of USD 4.82 billion in 2023, expected to reach USD 8.92 billion by 2033. The U.S. is a major contributor, driving demand for both conventional and specialty feed due to a growing emphasis on the quality of meat products and dairy exports.South America Cattle Feed And Feed Additives Market Report:

The South American market in 2023 is valued at USD 0.71 billion, projected to expand to USD 1.31 billion by 2033. Brazil and Argentina are leading countries, with growth fueled by rising meat exports and increasing investment in livestock health and nutrition.Middle East & Africa Cattle Feed And Feed Additives Market Report:

In the Middle East and Africa, the market is reported at USD 1.87 billion in 2023, likely to grow to USD 3.46 billion by 2033. The region is experiencing growth in dairy and beef production, influenced by increasing domestic consumption and investments in livestock infrastructure.Tell us your focus area and get a customized research report.

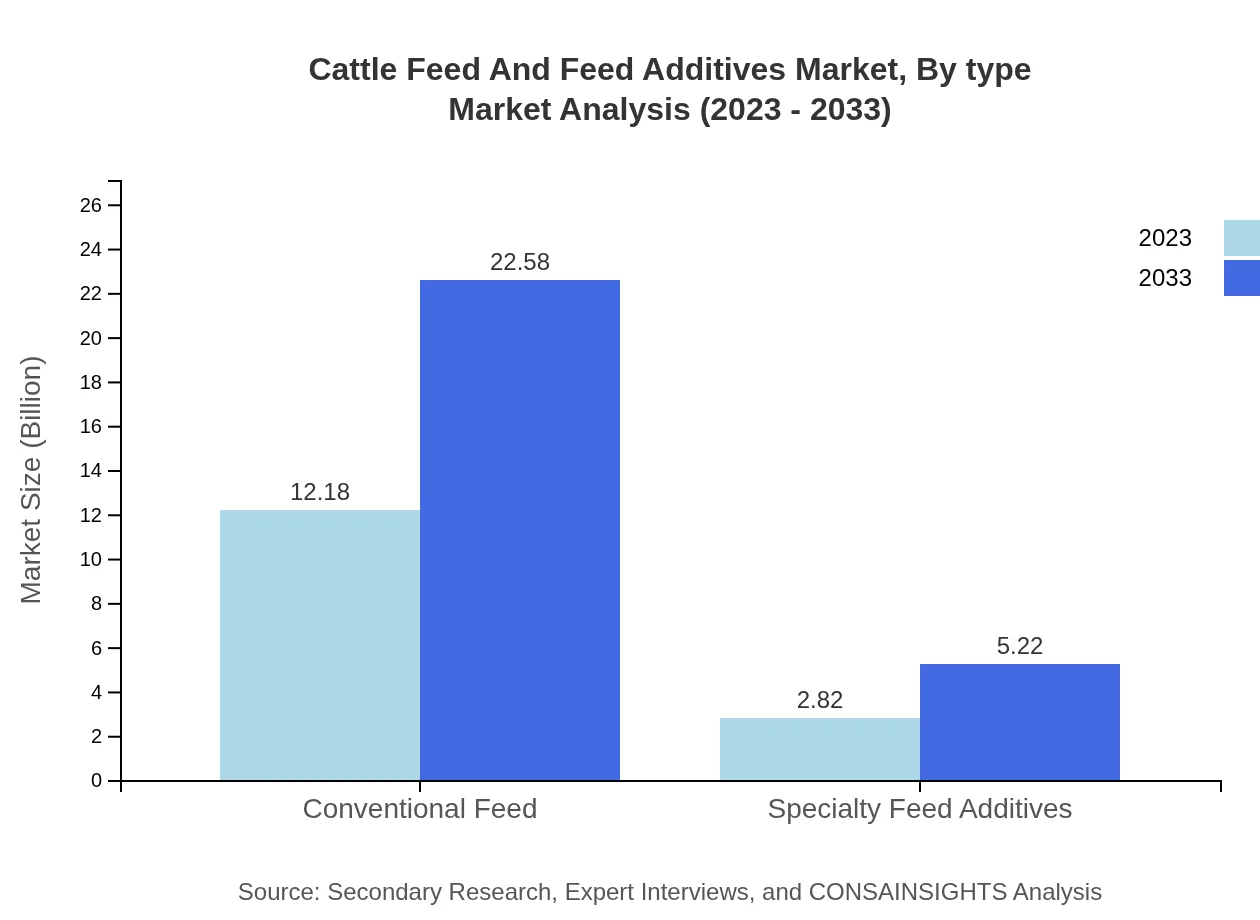

Cattle Feed And Feed Additives Market Analysis By Type

The demand for conventional feed is substantial, with a market size of USD 12.18 billion in 2023, projected to grow to USD 22.58 billion by 2033, maintaining an 81.23% market share. Specialty feed additives also play a crucial role, valued at USD 2.82 billion in 2023 and expected to reach USD 5.22 billion by 2033, holding an 18.77% share.

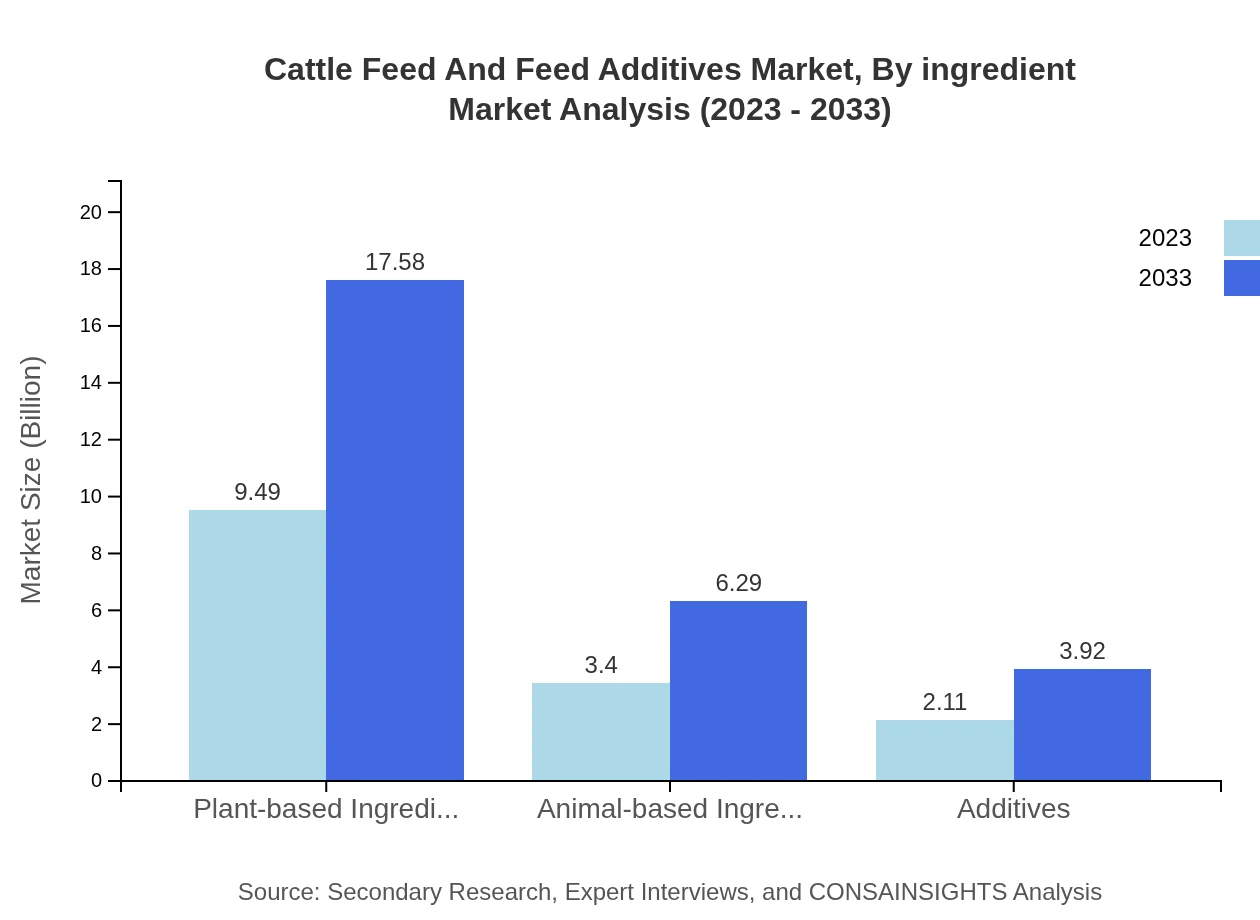

Cattle Feed And Feed Additives Market Analysis By Ingredient

Plant-based ingredients dominate the market, with a size of USD 9.49 billion in 2023, projected to reach USD 17.58 billion by 2033, representing a 63.26% market share. In contrast, animal-based ingredients are valued at USD 3.40 billion in 2023 and forecasted to grow to USD 6.29 billion by 2033, accounting for 22.65% share.

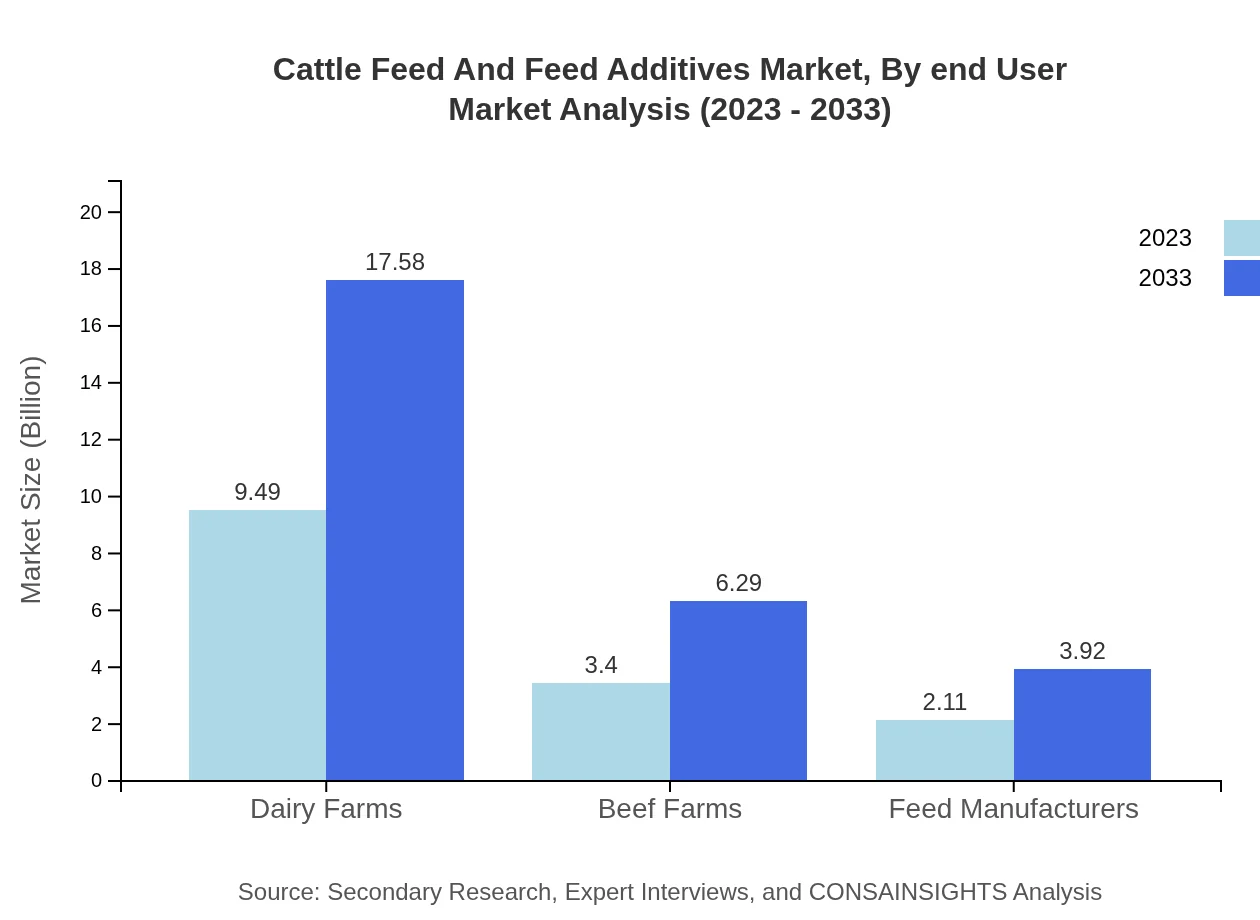

Cattle Feed And Feed Additives Market Analysis By End User

Dairy farms are the largest end-users, with a market size of USD 9.49 billion in 2023, expected to rise to USD 17.58 billion by 2033, capturing a 63.26% share. Beef farms have a market value of USD 3.40 billion in 2023, projected to expand to USD 6.29 billion by 2033, holding a 22.65% share.

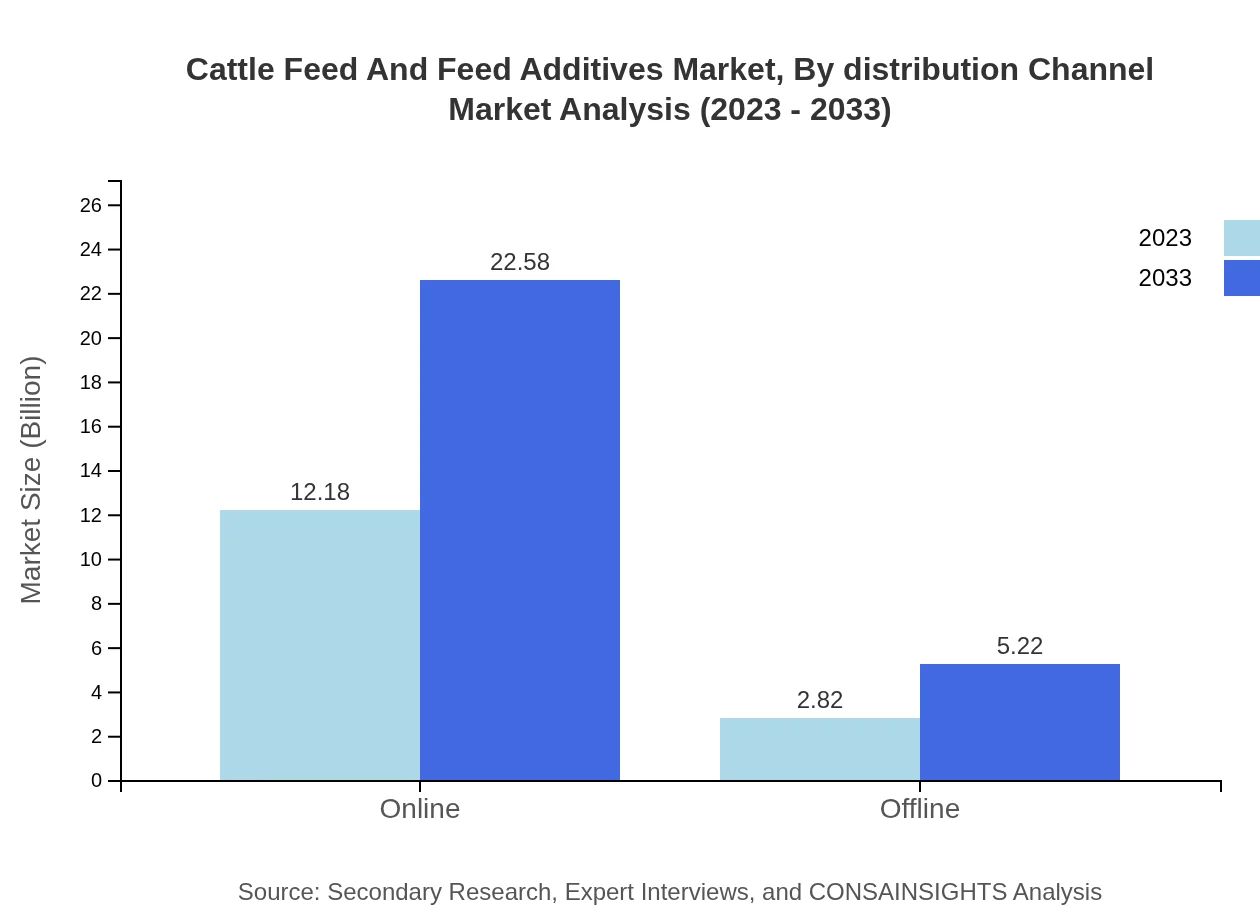

Cattle Feed And Feed Additives Market Analysis By Distribution Channel

The online distribution channel is expected to dominate, with a market size of USD 12.18 billion in 2023, anticipated to increase to USD 22.58 billion by 2033, maintaining an 81.23% market share. The offline channel has a smaller but growing presence, with a 2023 market size of USD 2.82 billion, projected to reach USD 5.22 billion by 2033, holding an 18.77% share.

Cattle Feed And Feed Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cattle Feed And Feed Additives Industry

Cargill, Inc.:

Cargill is a global leader in agribusiness, offering a wide range of nutritional products to raise livestock sustainably. Their innovative feed formulations help improve animal health and production efficiency.Archer Daniels Midland Company:

ADM is one of the largest agricultural processors and food ingredient providers globally, focusing on the innovation of feed additives that enhance livestock nutrition and health.Alltech, Inc.:

Alltech specializes in animal nutrition and health, providing advanced feed additives designed to improve animal performance while promoting overall farm sustainability.BASF SE:

BASF is a significant player in the livestock feed market, offering various additives that enhance feed efficiency and animal growth, thereby supporting the sustainable development of the livestock sector.We're grateful to work with incredible clients.

FAQs

What is the market size of cattle Feed And Feed Additives?

The global cattle feed and feed additives market is valued at approximately $15 billion in 2023, with a projected CAGR of 6.2% through 2033. This signifies robust growth opportunities within the sector, driven by rising meat demand globally.

What are the key market players or companies in the cattle Feed And Feed Additives industry?

Key players in the cattle feed and feed additives industry include Cargill, Archer Daniels Midland Company, Alltech, BASF, and Nutreco. These companies are leading innovations, expanding product portfolios, and fostering sustainability within the cattle feed sector.

What are the primary factors driving the growth in the cattle Feed And Feed Additives industry?

Growth in the cattle feed industry is primarily driven by rising global meat consumption, increased emphasis on livestock health, and innovative feed formulations. Additionally, the growing adoption of organic and specialty feed products is boosting market expansion.

Which region is the fastest Growing in the cattle Feed And Feed Additives market?

The Asia-Pacific region is poised to be the fastest-growing market segment for cattle feed and feed additives, with a market value increase from $2.97 billion in 2023 to $5.50 billion by 2033, reflecting increasing livestock production and demand.

Does ConsaInsights provide customized market report data for the cattle Feed And Feed Additives industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and goals of clients in the cattle feed and feed additives industry, ensuring relevant insights and strategic recommendations for market participants.

What deliverables can I expect from this cattle Feed And Feed Additives market research project?

Deliverables from the cattle feed and feed additives market research project include detailed reports with market size, growth trends, competitive landscape, forecasts, and comprehensive analysis of regional and segment-specific data facilitating informed decisions.

What are the market trends of cattle Feed And Feed Additives?

Current market trends in cattle feed and feed additives include increased demand for plant-based ingredients, growth in organic feed products, a shift towards sustainable practices, and technological advancements in feed formulations to enhance livestock productivity.