Celiac Disease Drugs Market Report

Published Date: 31 January 2026 | Report Code: celiac-disease-drugs

Celiac Disease Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Celiac Disease Drugs market, covering insights into market size, trends, and forecasts from 2023 to 2033. It delves into industry dynamics, segmentation, regional perspectives, and major players shaping the market landscape.

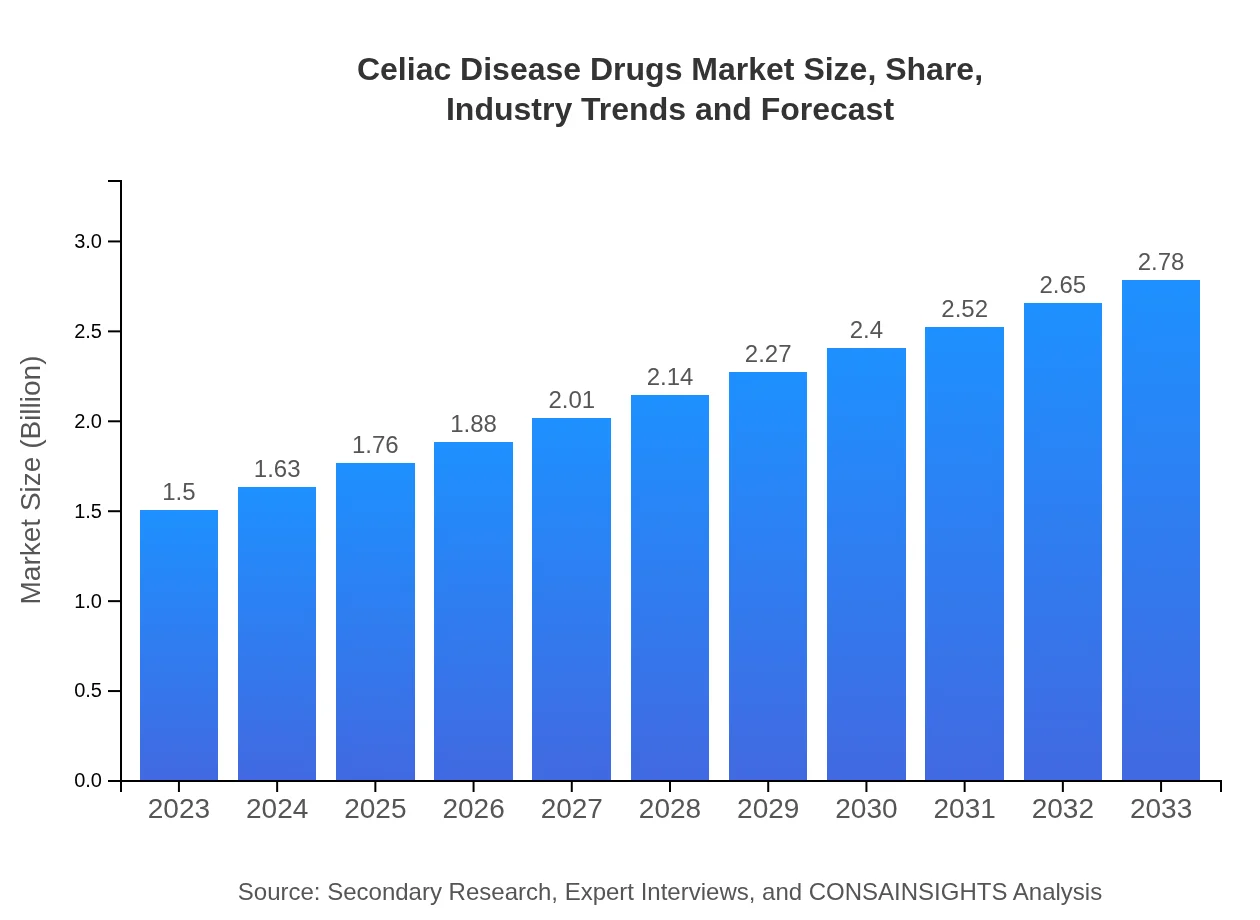

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Glutenase Pharma, Celiac Therapeutics, NutriHealth Inc., Pharmazyme Ltd. |

| Last Modified Date | 31 January 2026 |

Celiac Disease Drugs Market Overview

Customize Celiac Disease Drugs Market Report market research report

- ✔ Get in-depth analysis of Celiac Disease Drugs market size, growth, and forecasts.

- ✔ Understand Celiac Disease Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Celiac Disease Drugs

What is the Market Size & CAGR of Celiac Disease Drugs market in 2023?

Celiac Disease Drugs Industry Analysis

Celiac Disease Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Celiac Disease Drugs Market Analysis Report by Region

Europe Celiac Disease Drugs Market Report:

Europe's Celiac Disease Drugs market was valued at $0.43 billion in 2023, with expectations to grow to $0.80 billion by 2033. Increased awareness and stringent health policies toward gluten management are contributing to the rising market conditions across European countries.Asia Pacific Celiac Disease Drugs Market Report:

In 2023, the Celiac Disease Drugs market in the Asia Pacific region was valued at $0.29 billion and is projected to reach $0.53 billion by 2033. The growing awareness of celiac disease and increased healthcare accessibility are driving market growth in this region. Furthermore, rising incidences of gluten intolerance are prompting the development of specialized healthcare solutions.North America Celiac Disease Drugs Market Report:

In North America, the Celiac Disease Drugs market reached $0.54 billion in 2023 and is expected to grow to $1.01 billion by 2033. The robust healthcare infrastructure, high prevalence of diagnosed cases, and significant investments in research and development are key factors driving market growth in this region.South America Celiac Disease Drugs Market Report:

The South American market for Celiac Disease Drugs was valued at $0.15 billion in 2023, with projections estimating growth to $0.27 billion by 2033. Increased adoption of gluten-free diets along with greater awareness regarding celiac disease is anticipated to propel the market in this region.Middle East & Africa Celiac Disease Drugs Market Report:

The Celiac Disease Drugs market in the Middle East and Africa was $0.09 billion in 2023 and is projected to increase to $0.17 billion by 2033. The market is motivated by rising health concerns related to gluten intolerance and progressive healthcare policies leading to better access to treatment options.Tell us your focus area and get a customized research report.

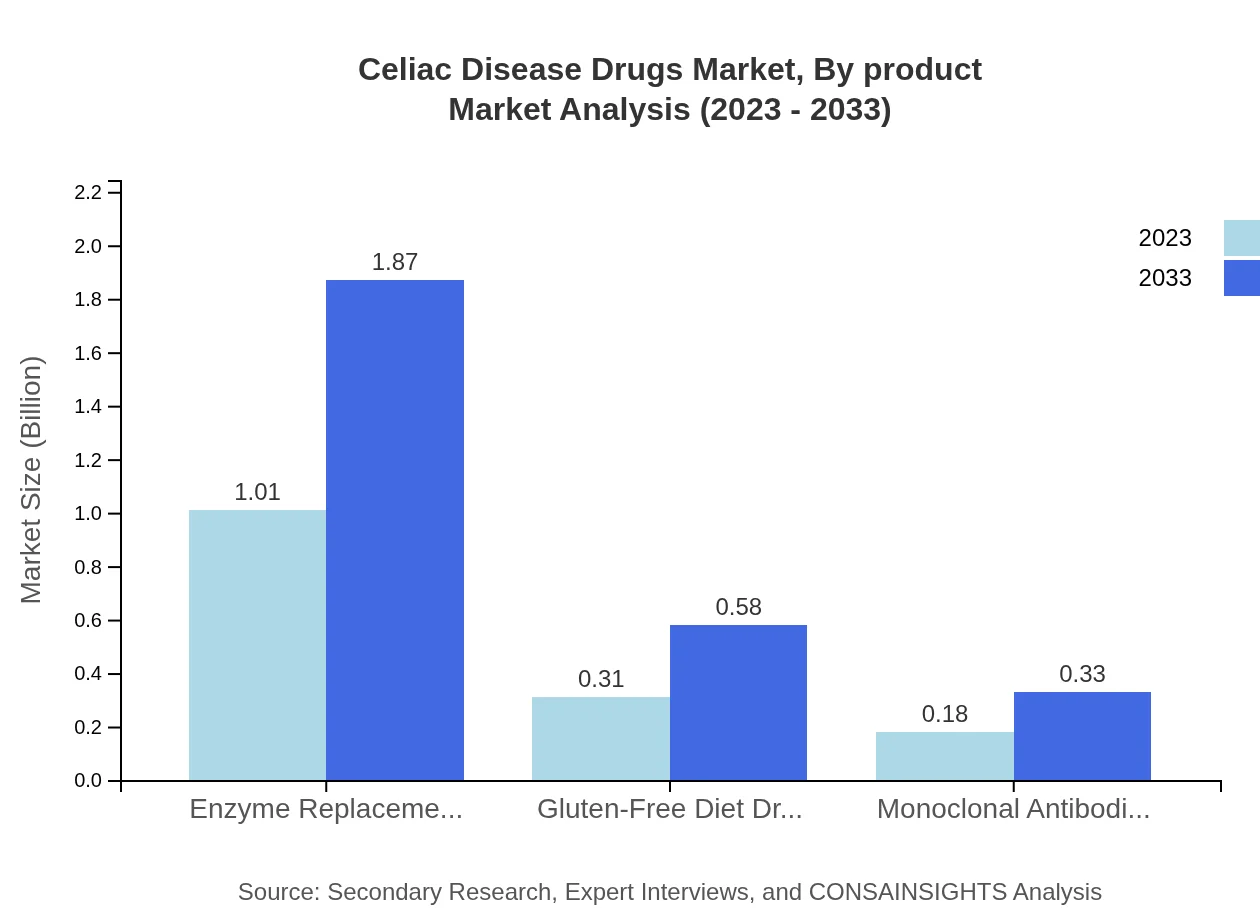

Celiac Disease Drugs Market Analysis By Product

By product analysis reveals that enzyme replacement therapies lead the market with a size of $1.01 billion in 2023, projected to grow to $1.87 billion by 2033. Other categories, including gluten-free diet drugs and monoclonal antibodies, are gaining traction, with sizes of $0.31 billion and $0.18 billion in 2023, expected to grow to $0.58 billion and $0.33 billion respectively.

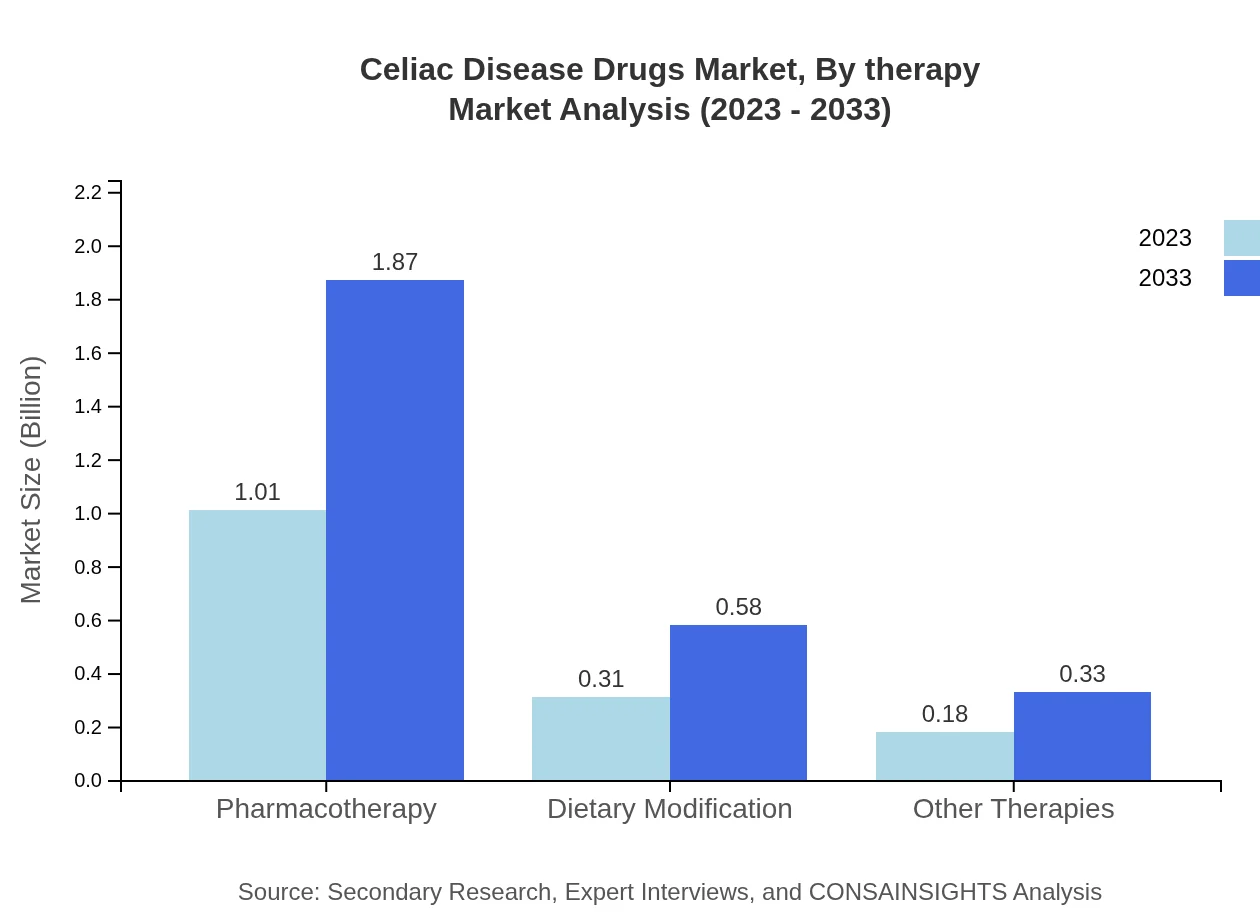

Celiac Disease Drugs Market Analysis By Therapy

The pharmacotherapy segment dominates the market with a size of $1.01 billion in 2023, set to expand to $1.87 billion by 2033. Dietary modification and gluten-free diet therapies complement the market with substantial shares, indicating a preference for comprehensive management strategies among patients.

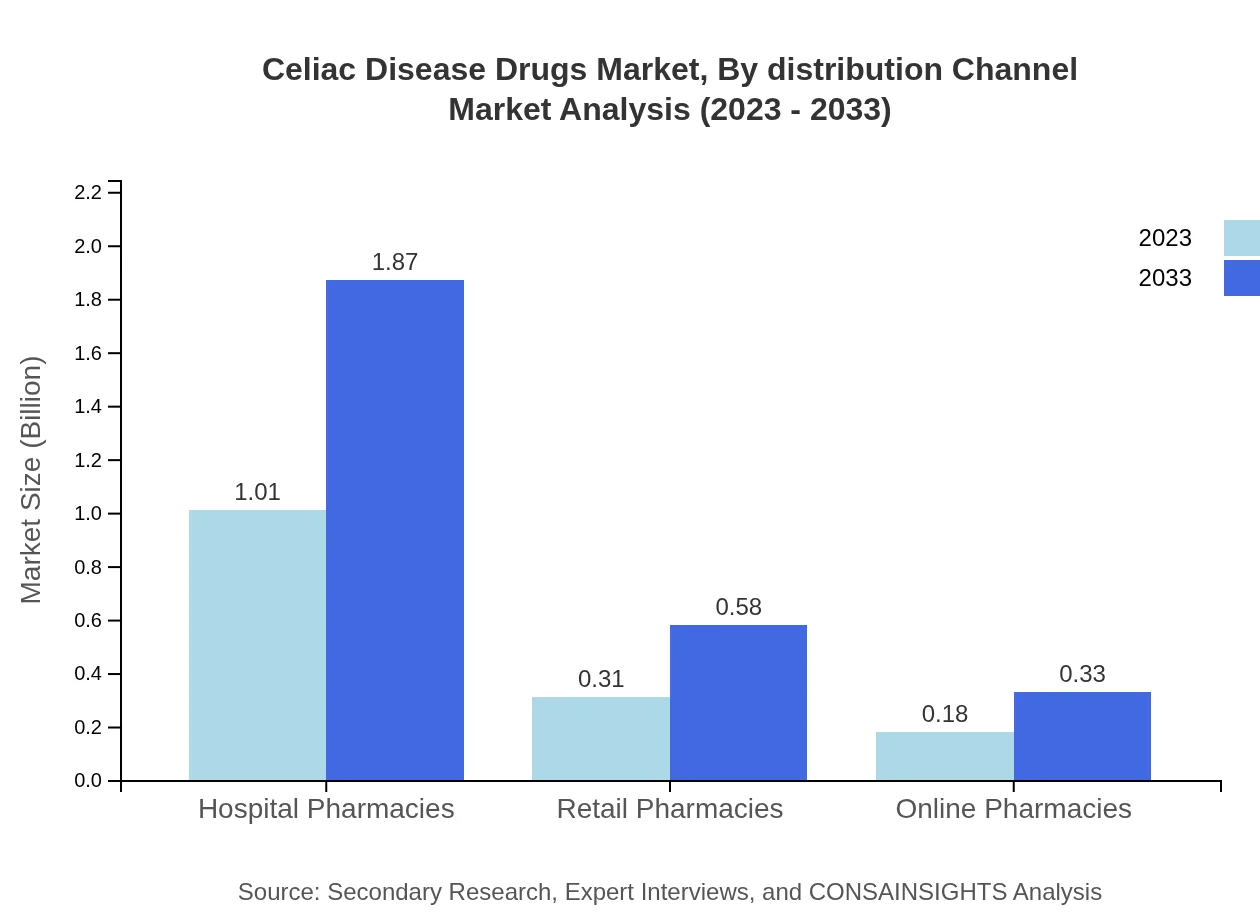

Celiac Disease Drugs Market Analysis By Distribution Channel

Hospital pharmacies lead in distribution with a size of $1.01 billion in 2023. Retail and online pharmacies are also significant channels, with sizes of $0.31 billion and $0.18 billion, respectively, reflecting evolving consumer purchasing behaviors.

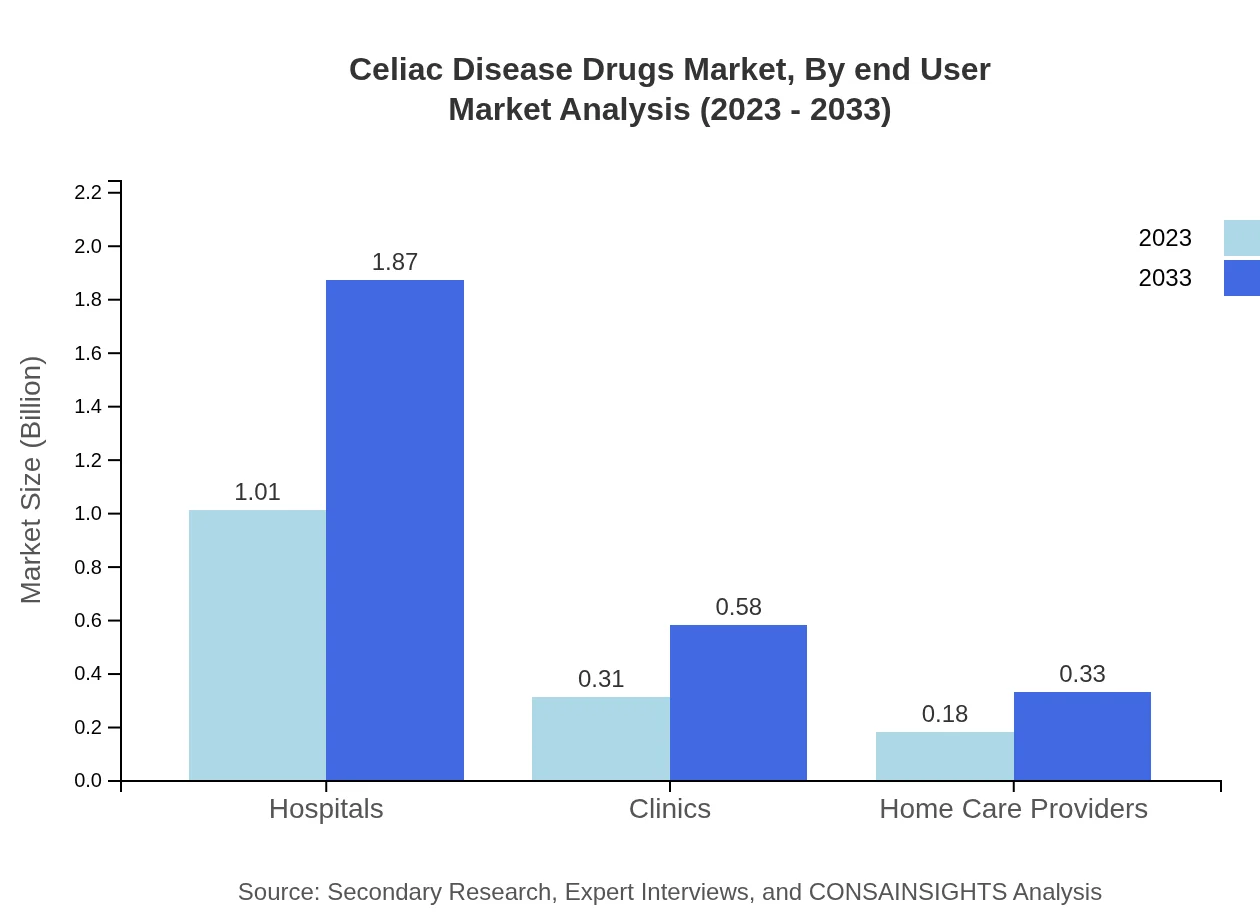

Celiac Disease Drugs Market Analysis By End User

Hospitals and clinics remain the primary end-users in the Celiac Disease Drugs market, with hospital-related sales projected at $1.01 billion in 2023. Home care providers and retail pharmacies are also contributing significantly to the overall market dynamics, indicating a shift towards home-based treatments.

Celiac Disease Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Celiac Disease Drugs Industry

Glutenase Pharma:

A leader in enzyme replacement therapy for gluten intolerance, known for its innovative products that help manage celiac disease symptoms.Celiac Therapeutics:

Specializes in biopharmaceuticals aimed at treating autoimmune diseases, with a strong focus on developing monoclonal antibodies for celiac disease.NutriHealth Inc.:

Pioneers in gluten-free diet products, providing a wide range of dietary solutions to support individuals with celiac disease.Pharmazyme Ltd.:

A biopharmaceutical company focusing on enzyme therapies, contributing to changing the treatment paradigms in celiac disease management.We're grateful to work with incredible clients.

FAQs

What is the market size of Celiac Disease Drugs?

The market size of Celiac Disease Drugs is estimated to reach $1.5 billion by 2033, growing at a CAGR of 6.2% from its current level. This growth reflects increased awareness and diagnosis of celiac disease.

What are the key market players or companies in the Celiac Disease Drugs industry?

Key players in the Celiac Disease Drugs market include leading pharmaceutical companies that specialize in gastrointestinal therapeutics. These companies are actively involved in research and the development of innovative solutions for celiac disease.

What are the primary factors driving the growth in the Celiac Disease Drugs industry?

The growth in the Celiac Disease Drugs industry is primarily driven by rising prevalence rates, advances in drug formulations, and increased awareness among healthcare providers and patients about the condition. Additionally, supportive regulatory frameworks are facilitating market expansion.

Which region is the fastest Growing in the Celiac Disease Drugs market?

The fastest-growing region in the Celiac Disease Drugs market is North America, expected to grow from $0.54 billion in 2023 to $1.01 billion by 2033. Europe also shows significant growth, projected to rise from $0.43 billion to $0.80 billion in the same period.

Does ConsaInsights provide customized market report data for the Celiac Disease Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to specific research needs in the Celiac Disease Drugs industry, ensuring clients receive relevant insights based on dynamic market conditions and trends.

What deliverables can I expect from this Celiac Disease Drugs market research project?

Deliverables from the Celiac Disease Drugs market research project include detailed market analysis reports, forecasts, competitive landscape assessments, and insights into market dynamics and key company strategies.

What are the market trends of Celiac Disease Drugs?

Current market trends in the Celiac Disease Drugs sector include a rise in enzyme replacement therapies, with market shares for pharmaceuticals focusing on gluten-free diet solutions, suggesting a shift towards more effective management options for patients.