Cell Analysis Instruments Market Report

Published Date: 31 January 2026 | Report Code: cell-analysis-instruments

Cell Analysis Instruments Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the Cell Analysis Instruments market from 2023 to 2033, covering market size, growth rates, trends, and comprehensive analyses by region and product type, supported by data-driven forecasts and company profiles.

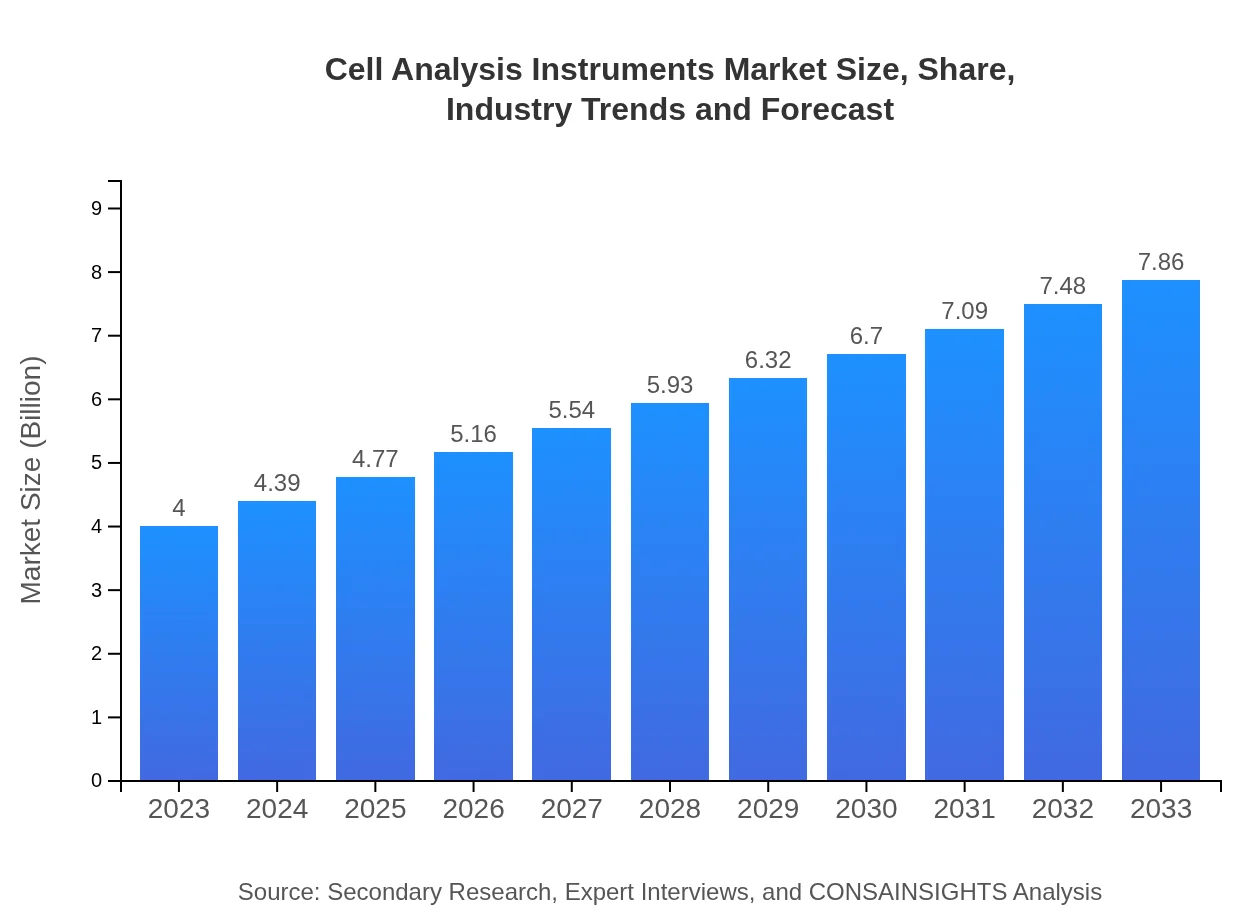

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $7.86 Billion |

| Top Companies | Thermo Fisher Scientific, BD Biosciences, Merck KGaA, Beckman Coulter, Agilent Technologies |

| Last Modified Date | 31 January 2026 |

Cell Analysis Instruments Market Overview

Customize Cell Analysis Instruments Market Report market research report

- ✔ Get in-depth analysis of Cell Analysis Instruments market size, growth, and forecasts.

- ✔ Understand Cell Analysis Instruments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cell Analysis Instruments

What is the Market Size & CAGR of Cell Analysis Instruments market in 2023 and 2033?

Cell Analysis Instruments Industry Analysis

Cell Analysis Instruments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cell Analysis Instruments Market Analysis Report by Region

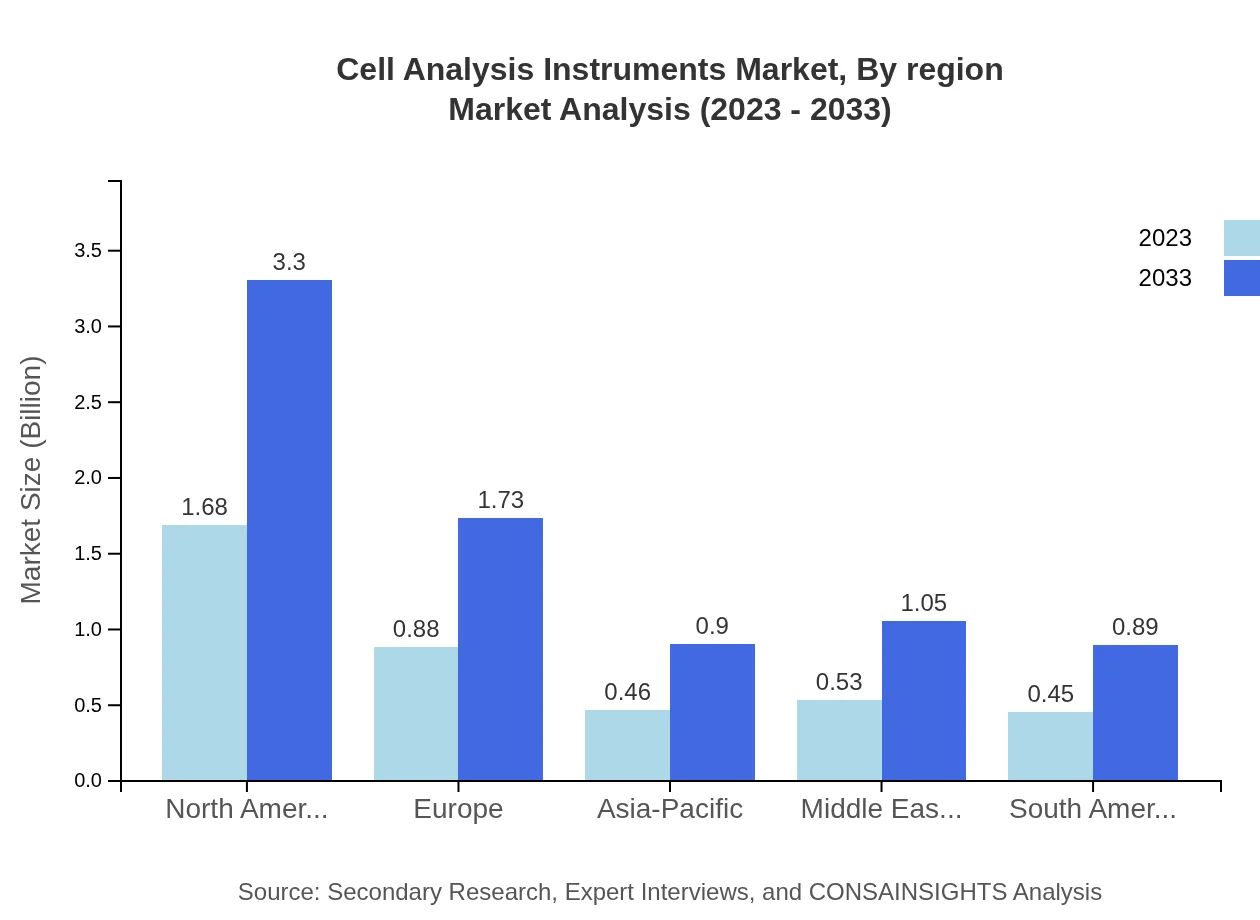

Europe Cell Analysis Instruments Market Report:

The European market is also experiencing notable growth, expanding from $1.04 billion in 2023 to $2.04 billion by 2033. Increasing partnerships between academic institutions and industry players focused on research and development in life sciences catalyze market demand.Asia Pacific Cell Analysis Instruments Market Report:

The Asia Pacific region is anticipated to witness significant growth, with a market size expected to increase from $0.79 billion in 2023 to $1.56 billion by 2033. This growth is driven by enhancing healthcare infrastructure, rising investments in biotechnology research, and a growing prevalence of diseases requiring advanced diagnostic tools.North America Cell Analysis Instruments Market Report:

North America is one of the largest markets for Cell Analysis Instruments, expected to grow from $1.42 billion in 2023 to $2.78 billion by 2033. The presence of major market players, strong investment in research, and the high prevalence of chronic diseases significantly contribute to this region's growth.South America Cell Analysis Instruments Market Report:

South America is projected to grow from $0.26 billion in 2023 to $0.51 billion by 2033. The rising demand for advanced cell analysis technologies in research and clinical laboratories across the region is propelling the market expansion, supported by increased healthcare expenditures.Middle East & Africa Cell Analysis Instruments Market Report:

In the Middle East and Africa, the market is set to rise from $0.49 billion in 2023 to $0.97 billion by 2033. Improvement in healthcare access and the augmentation of research initiatives in biotechnology are enhancing the demand for cell analysis instruments.Tell us your focus area and get a customized research report.

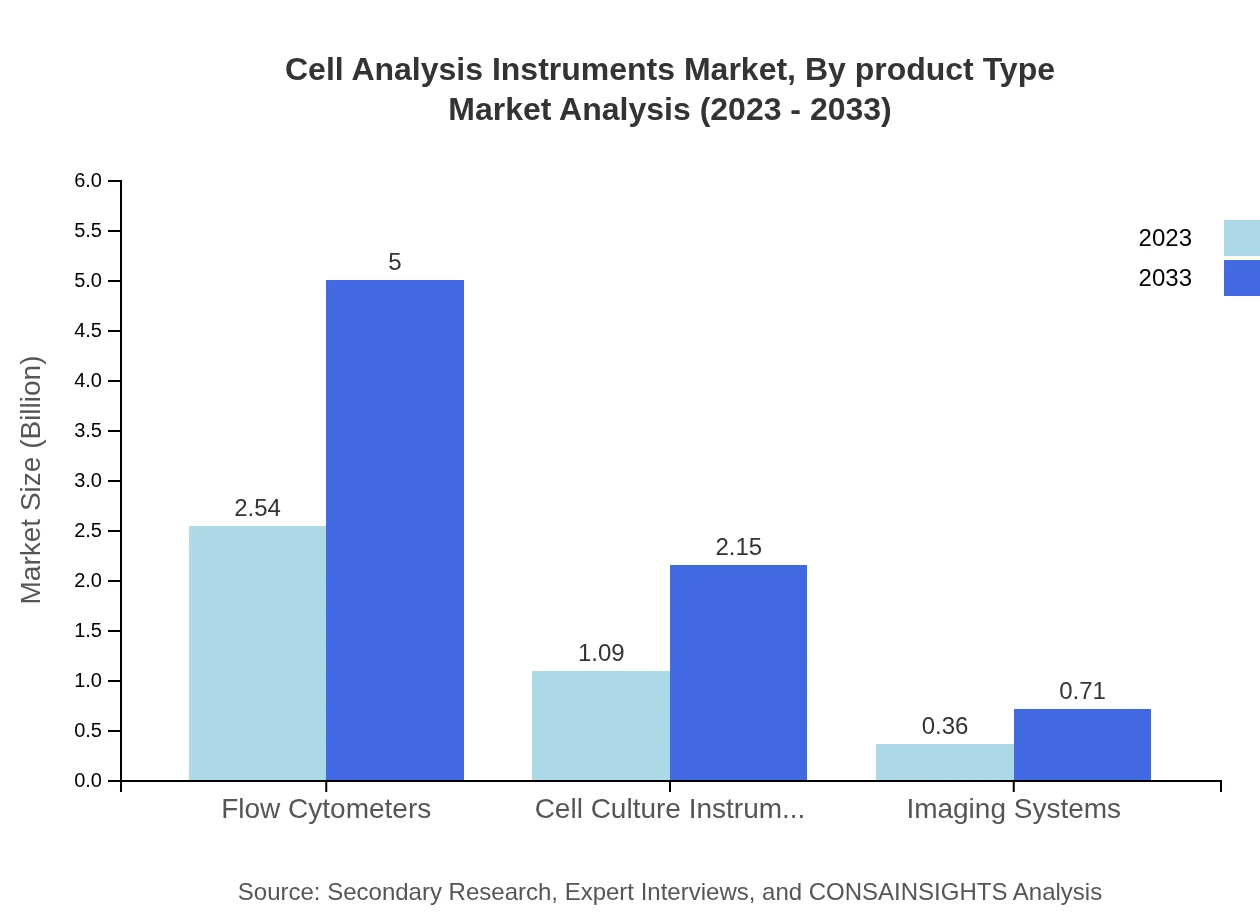

Cell Analysis Instruments Market Analysis By Product Type

The product types such as Flow Cytometers, which hold a market share of 63.61% in 2023, and are expected to maintain this dominance, supported by their wide application in cell biology. Other significant segments include Mass Cytometry (27.34%) and High-Content Screening (9.05%), contributing notably to the advancements in the analysis of intracellular components and cell behaviors.

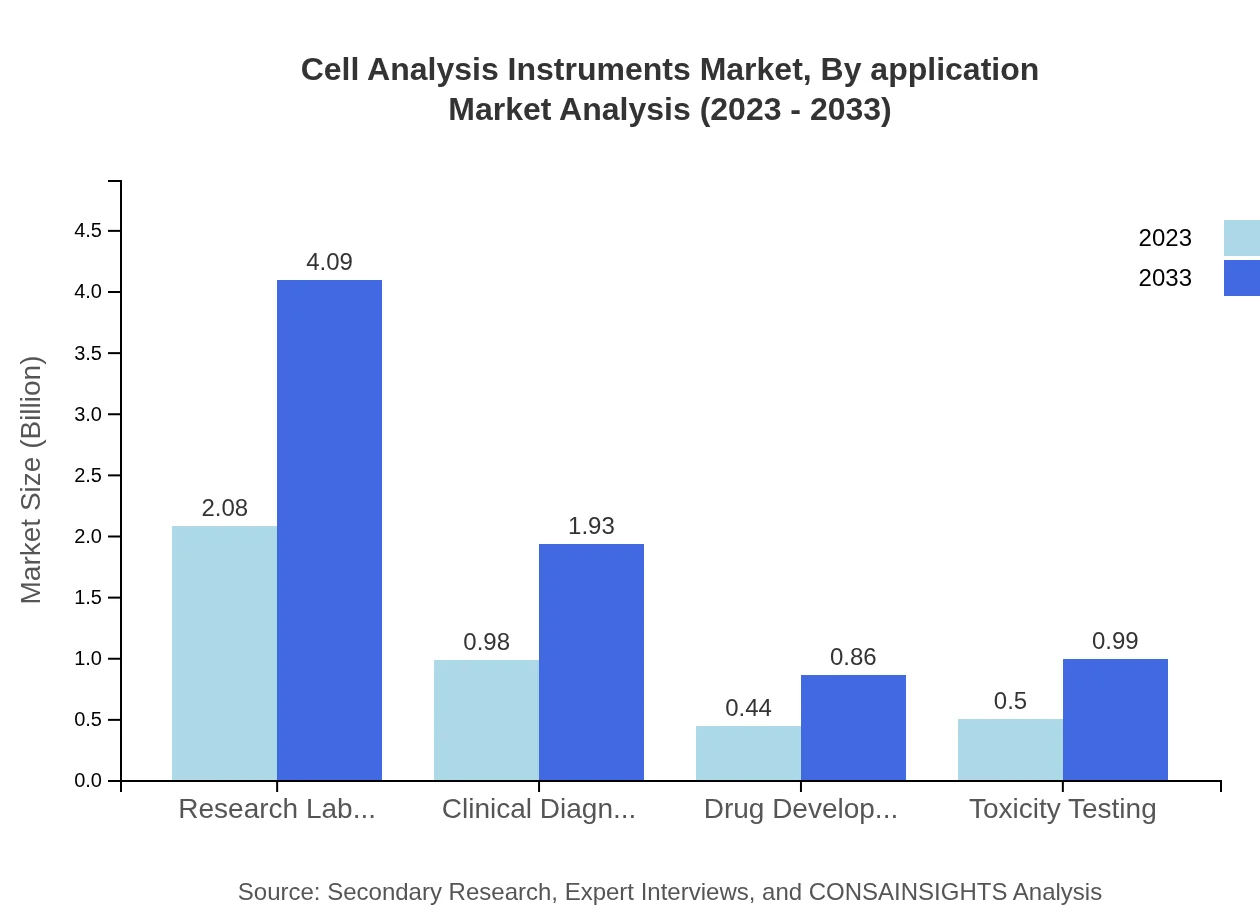

Cell Analysis Instruments Market Analysis By Application

Applications such as clinical diagnostics, pharmaceutical research, and academic studies are integral to market dynamics. The clinical diagnostics segment represents 24.49% of the market in 2023, with projections indicating steady growth as personalized medicine becomes more prevalent.

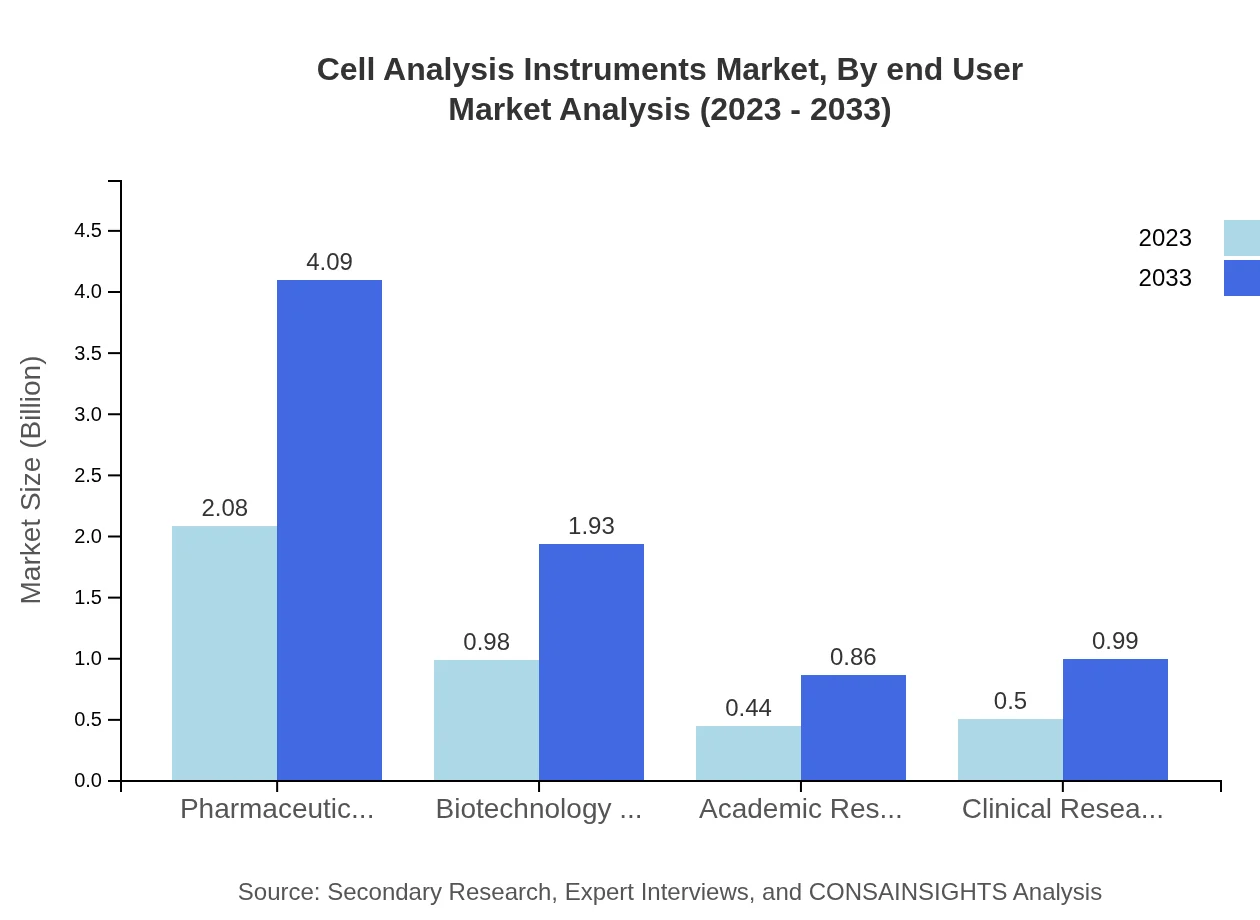

Cell Analysis Instruments Market Analysis By End User

Pharmaceutical companies dominate the market with a share of 52.03% in 2023, heavily investing in cell analysis instruments for drug development processes. Biotechnology firms (24.49%) and academic institutions (10.95%) also significantly contribute to the overall market demand.

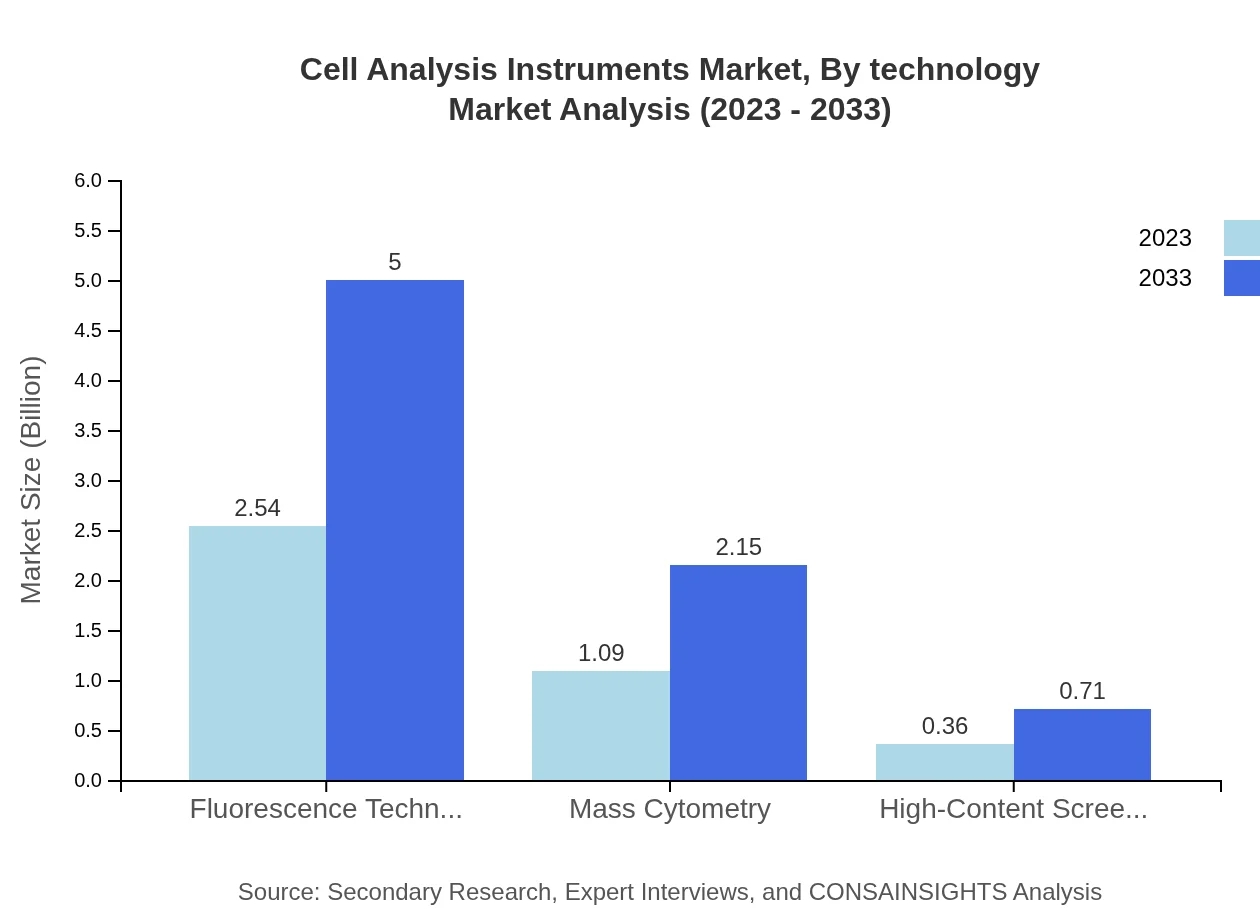

Cell Analysis Instruments Market Analysis By Technology

Technological advancements in areas such as fluorescence technology continue to lead the market, representing 63.61% share in 2023. Innovations in automation and workflow efficiency are driving the adoption of advanced technologies in laboratories.

Cell Analysis Instruments Market Analysis By Region

Regional segmentation illustrates varying growth trajectories. North America and Europe hold significant shares while Asia-Pacific and Latin America show rapid growth potential, driven by improved research capabilities and healthcare infrastructure investments.

Cell Analysis Instruments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cell Analysis Instruments Industry

Thermo Fisher Scientific:

A global leader in serving science, Thermo Fisher offers innovative technologies and solutions for cell analysis, playing a pivotal role in the development of cutting-edge instruments and reagents.BD Biosciences:

Specializing in immunology and cell analysis, BD Biosciences leads with its flow cytometry solutions that are widely adopted in clinical and research laboratories worldwide.Merck KGaA:

Merck provides a range of cell analysis instruments and reagents, aiding scientists in various applications, from cancer research to drug development.Beckman Coulter:

Beckman Coulter is known for its advancements in cell counting and flow cytometry technology, offering high-quality solutions tailored for both research and clinical diagnostics.Agilent Technologies:

Agilent delivers precise analytical solutions, including innovative technologies used in cell analysis within pharmaceutical, biotech, and academic sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of cell Analysis Instruments?

The global cell analysis instruments market is projected to reach approximately $4 billion by 2033, growing at a CAGR of 6.8%. This growth is attributed to increasing demand for advanced analytical tools in biological research and clinical diagnostics.

What are the key market players or companies in this cell Analysis Instruments industry?

Key players in the cell analysis instruments market include leading manufacturers such as Thermo Fisher Scientific, Merck KGaA, BD Biosciences, and Siemens Healthineers, which dominate the market through innovation and expanded product lines.

What are the primary factors driving the growth in the cell Analysis Instruments industry?

The growth in the cell analysis instruments industry is primarily driven by advancements in technology, increased funding for life sciences research, rising prevalence of chronic diseases, and greater emphasis on personalized medicine, boosting demand for these instruments.

Which region is the fastest Growing in the cell Analysis Instruments?

Among regions, Europe is expected to be the fastest-growing market for cell analysis instruments from 2023 to 2033, with growth projections increasing from $1.04 billion to $2.04 billion, driven by research initiatives and healthcare spending.

Does ConsaInsights provide customized market report data for the cell Analysis Instruments industry?

Yes, ConsaInsights offers customized market report data for the cell-analysis instruments industry, allowing clients to tailor insights and analysis according to specific business needs and market dynamics.

What deliverables can I expect from this cell Analysis Instruments market research project?

Deliverables from the cell analysis instruments market research project typically include comprehensive reports, market forecasts, competitive analysis, and insights on trends and opportunities, tailored to client requirements.

What are the market trends of cell Analysis Instruments?

Current trends in the cell analysis instruments market include increasing adoption of high-content screening technologies, growth in fluorescence-based techniques, and a shift towards integrated systems that enhance analysis efficiency.