Central Bank Digital Currencies

Published Date: 24 January 2026 | Report Code: central-bank-digital-currencies

Central Bank Digital Currencies Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Central Bank Digital Currencies (CBDCs) market from 2024 to 2033. It covers market trends, size forecasts, regional insights, technological advancements, and key industry players, offering valuable insights for stakeholders in the financial sector.

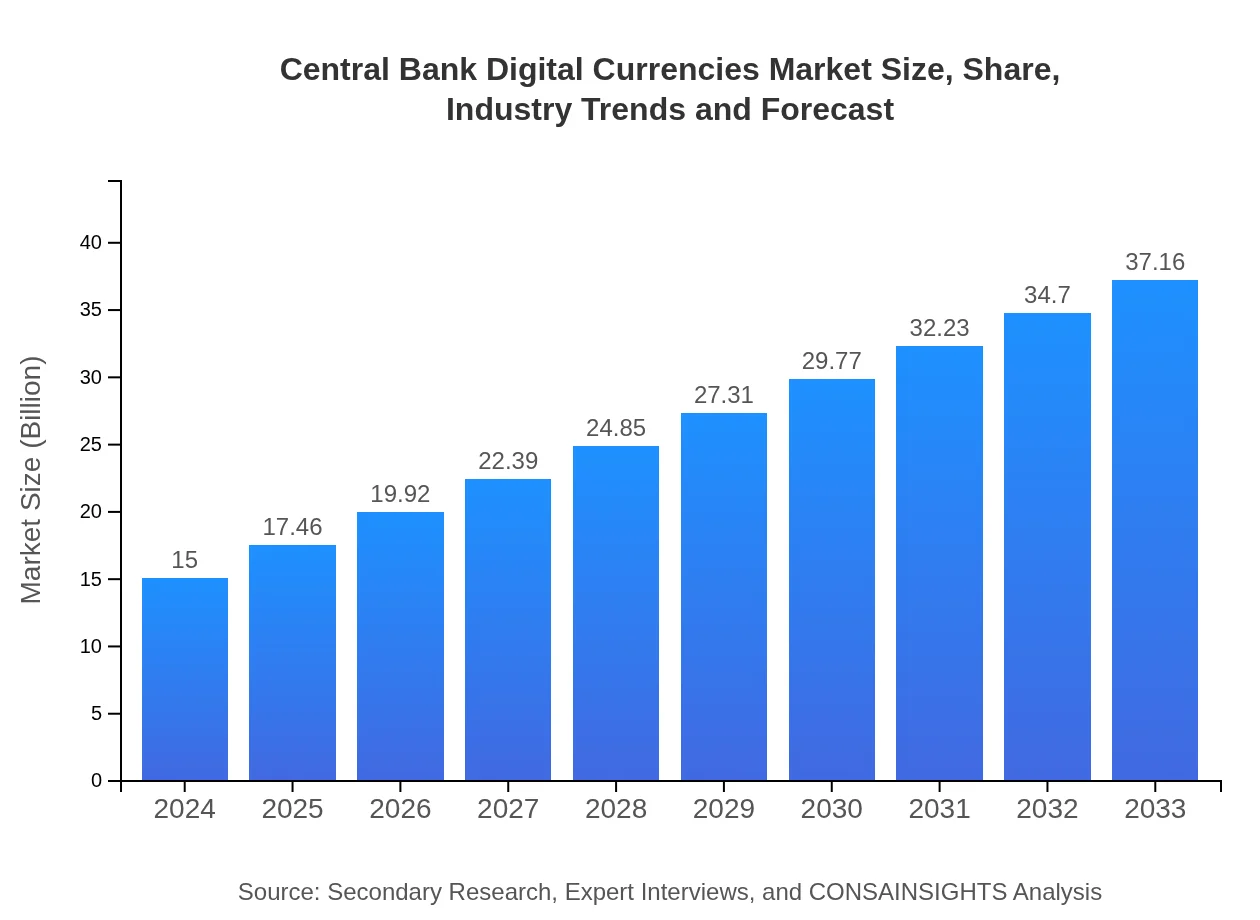

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $15.00 Billion |

| CAGR (2024-2033) | 10.2% |

| 2033 Market Size | $37.16 Billion |

| Top Companies | The People’s Bank of China, European Central Bank, Federal Reserve, Bank of England, Central Bank of Nigeria |

| Last Modified Date | 24 January 2026 |

Central Bank Digital Currencies Market Overview

Customize Central Bank Digital Currencies market research report

- ✔ Get in-depth analysis of Central Bank Digital Currencies market size, growth, and forecasts.

- ✔ Understand Central Bank Digital Currencies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Central Bank Digital Currencies

What is the Market Size & CAGR of Central Bank Digital Currencies market in 2024?

Central Bank Digital Currencies Industry Analysis

Central Bank Digital Currencies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Central Bank Digital Currencies Market Analysis Report by Region

Europe Central Bank Digital Currencies:

In Europe, the market is forecasted to expand from $4.46 billion in 2024 to $11.06 billion by 2033. The European Central Bank is investigating the digital euro, emphasizing consumer protection and stable pricing mechanisms as priority objectives.Asia Pacific Central Bank Digital Currencies:

In Asia Pacific, the CBDCs market is expected to reach $3.28 billion in 2024 and grow substantially to $8.12 billion by 2033. Countries like China and Singapore lead in digital currency initiatives, focusing on enhancing cross-border transactions and financial inclusivity.North America Central Bank Digital Currencies:

North America is anticipated to see a substantial market growth from $5.00 billion in 2024 to $12.40 billion in 2033. The United States Federal Reserve is actively exploring digital currency frameworks, motivated by innovative fintech developments.South America Central Bank Digital Currencies:

The South American CBDCs market, while still nascent, is projected to show significant growth from $0.48 billion in 2024 to $1.18 billion by 2033. With economies facing inflationary pressures, governments are exploring CBDCs as stable alternatives to cryptocurrencies.Middle East & Africa Central Bank Digital Currencies:

The Middle East and Africa market is expected to grow from $1.78 billion in 2024 to $4.40 billion by 2033. Countries such as Nigeria and South Africa are intensifying efforts to leverage CBDCs for economic stabilization and to enhance financial inclusion.Tell us your focus area and get a customized research report.

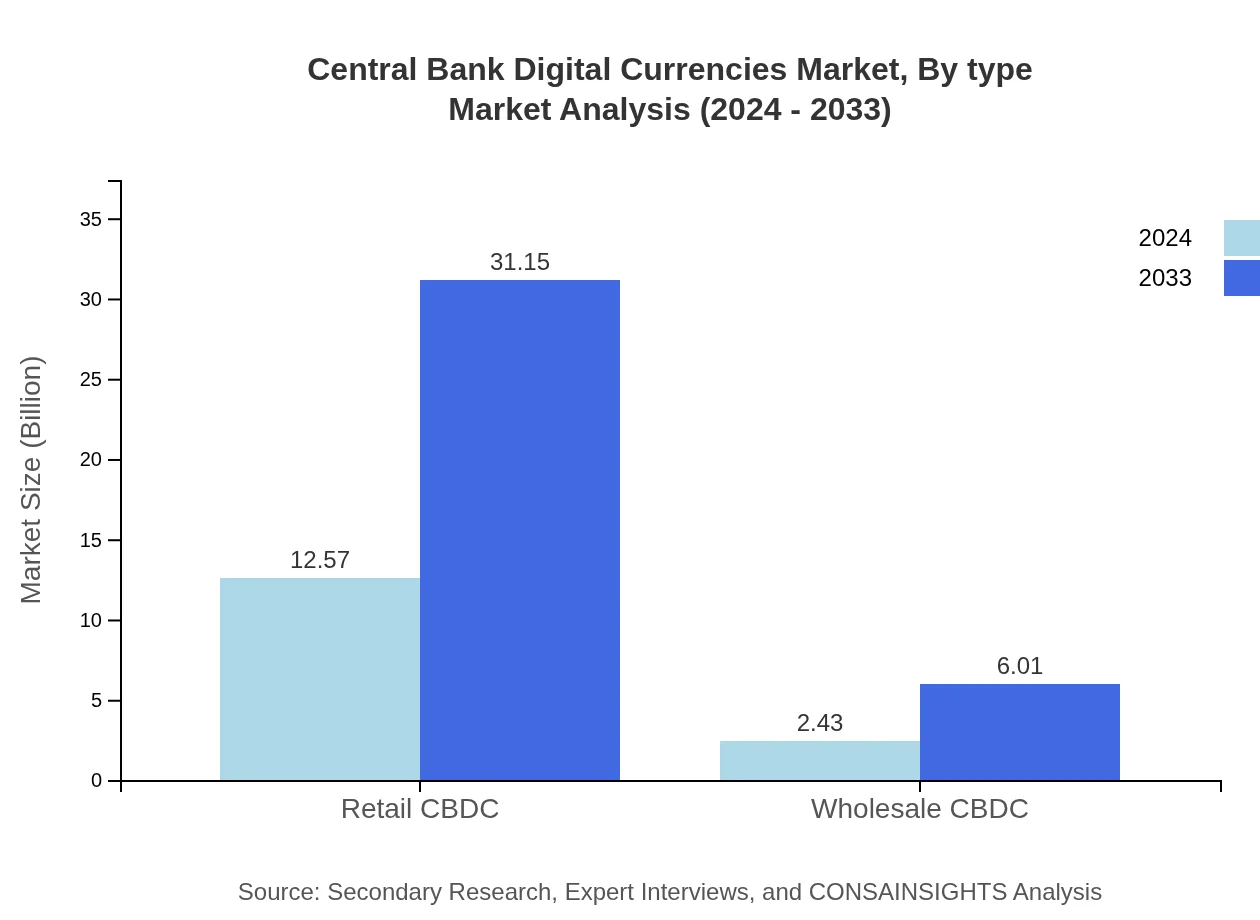

Central Bank Digital Currencies Market Analysis By Type

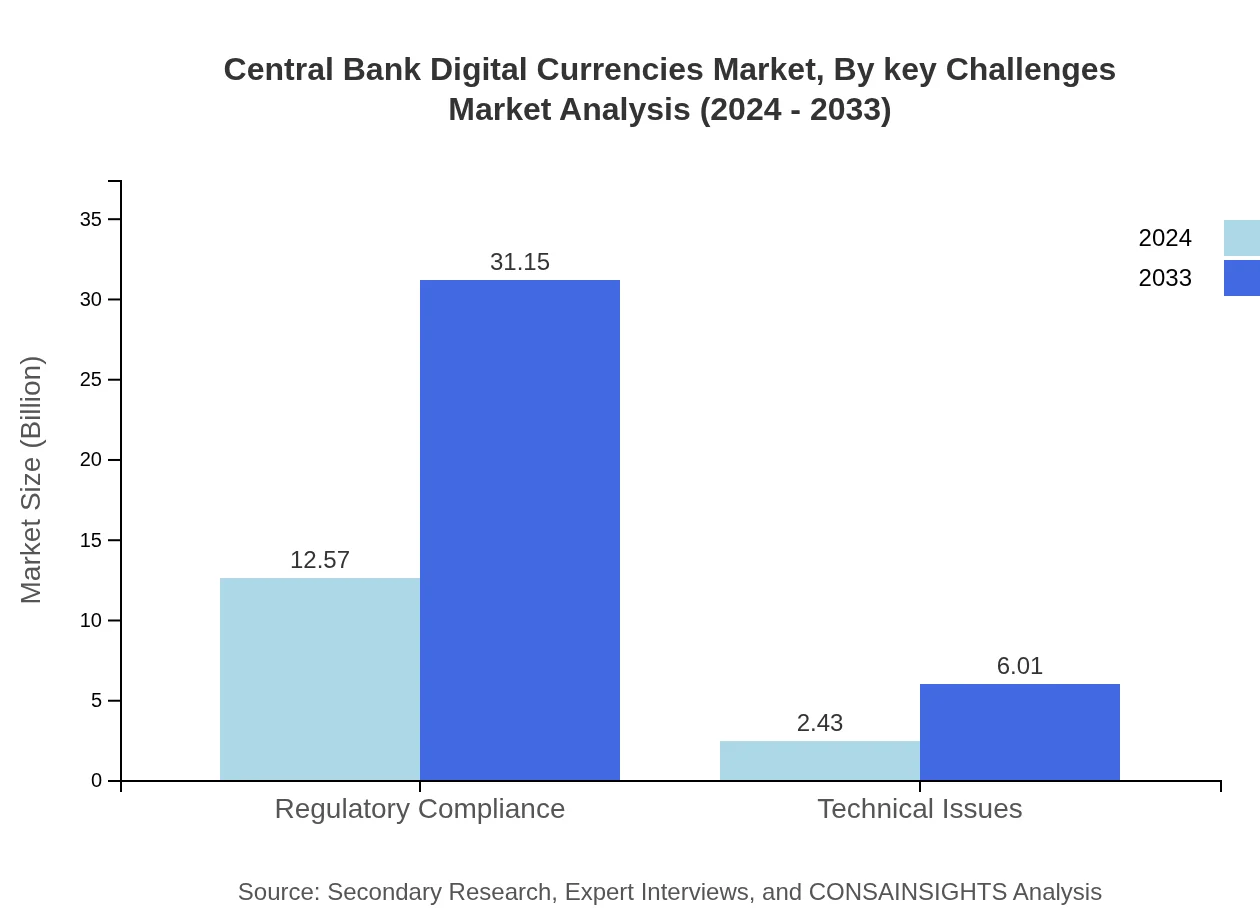

The Retail CBDC segment is projected to dominate the market with a size of $12.57 billion in 2024, growing to $31.15 billion by 2033, capturing 83.82% share throughout the period. Conversely, the Wholesale CBDC segment, while smaller, is expected to grow from $2.43 billion to $6.01 billion, maintaining a market share of 16.18%.

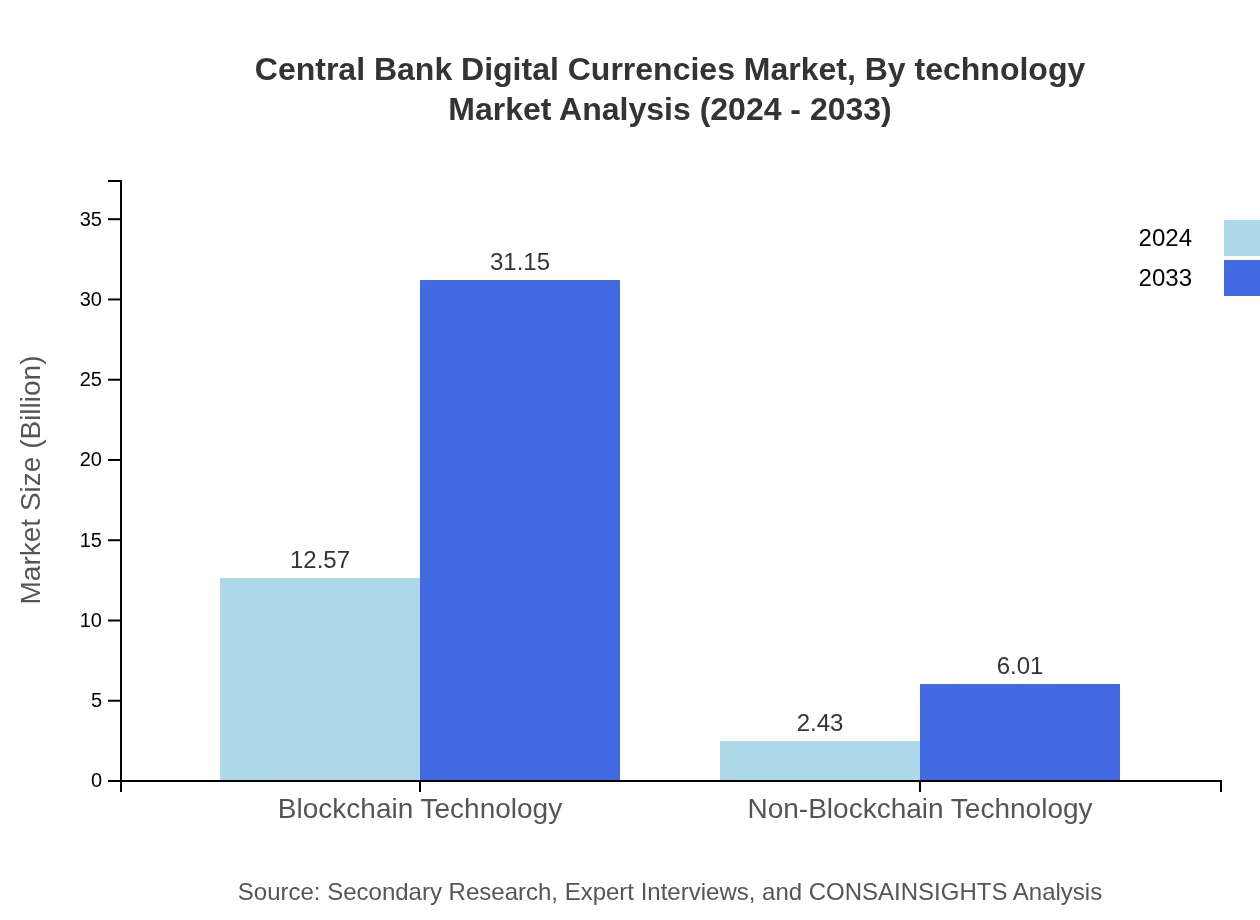

Central Bank Digital Currencies Market Analysis By Technology

The CBDC market by technology is experiencing dynamic shifts. Blockchain technology is anticipated to hold a leading position, with a market size growing from $12.57 billion in 2024 to $31.15 billion by 2033, maintaining an 83.82% share. Non-blockchain technology, however, is projected to increase from $2.43 billion to $6.01 billion, accommodating 16.18% share.

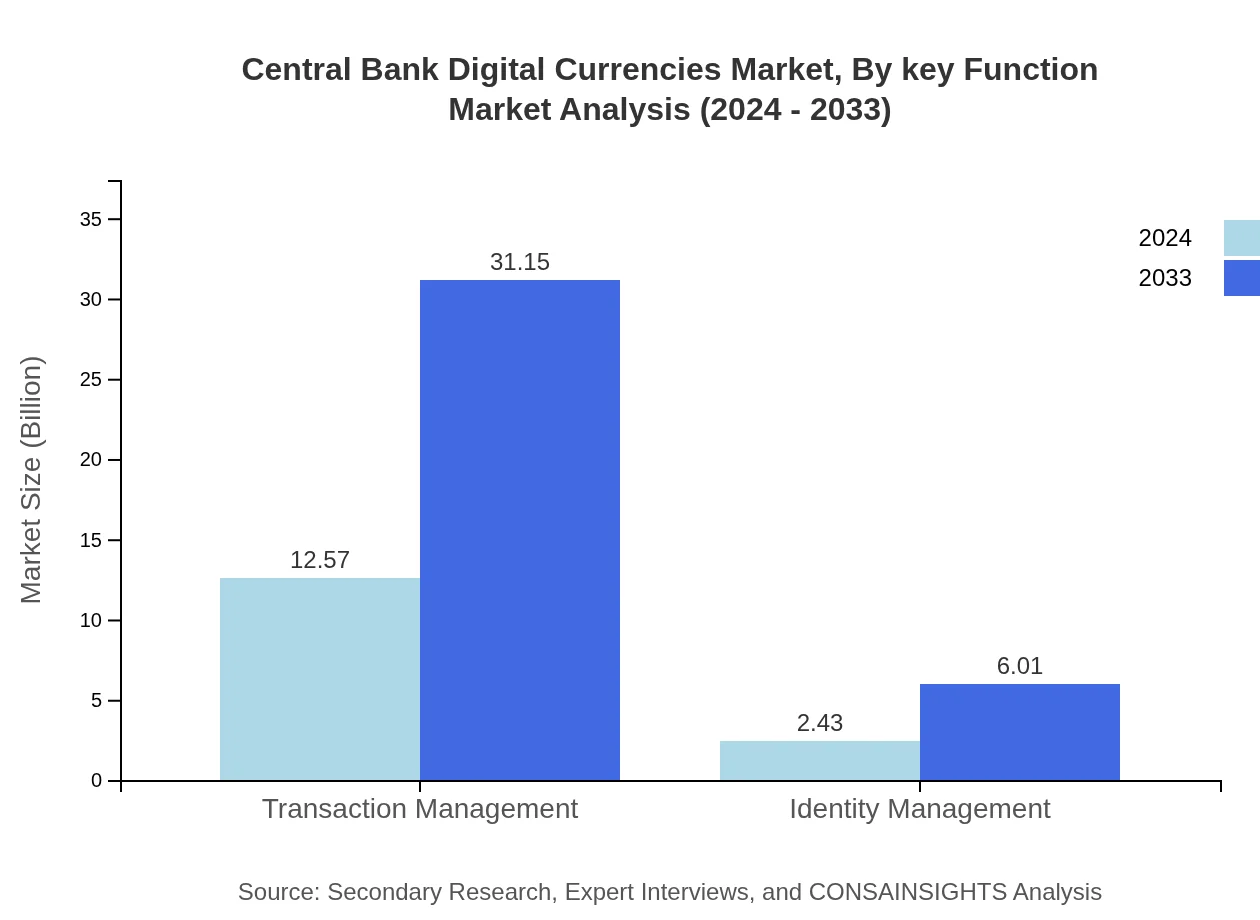

Central Bank Digital Currencies Market Analysis By Key Function

In terms of functionality, Transaction Management is set to dominate with a substantial size projected to grow from $12.57 billion to $31.15 billion, capturing an 83.82% market share. Identity Management and Regulatory Compliance will also gain ground but are expected to remain smaller segments, growing from $2.43 billion to $6.01 billion.

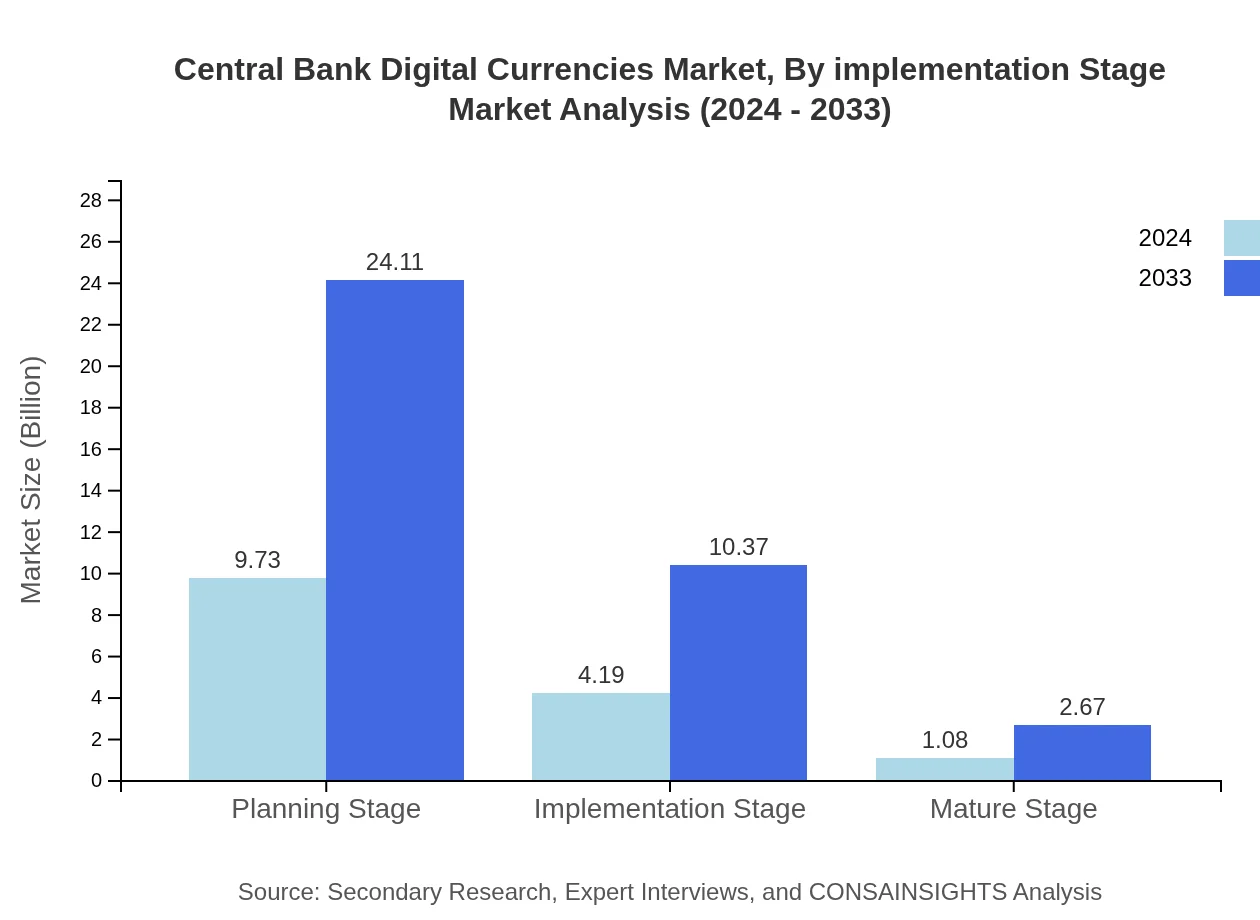

Central Bank Digital Currencies Market Analysis By Implementation Stage

The CBDC market is segmented into various implementation stages: Planning, Implementation, and Mature stages. The Planning Stage, valued at $9.73 billion in 2024, is projected to reach $24.11 billion by 2033 with a 64.89% share. Implementation and Mature stages, however, are expected to grow more slowly but progressively contribute to overall market growth.

Central Bank Digital Currencies Market Analysis By Key Challenges

Key challenges such as regulatory hurdles, technical issues, and public acceptance will influence market dynamics. Advocacy for regulatory frameworks and technological solutions to address concerns of privacy, security, and interoperability is critical as the scope for CBDCs widens.

Central Bank Digital Currencies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Central Bank Digital Currencies Industry

The People’s Bank of China:

Leading global efforts in CBDC adoption with the digital yuan initiative, focusing on reducing cash dependence and enhancing transaction efficiency.European Central Bank:

Spearheading the digital euro project to secure sovereignty over digital payments and streamline financial operations in the Eurozone.Federal Reserve:

Engaged in research on a digital dollar, emphasizing secure payment systems and reducing inefficient transaction costs.Bank of England:

Exploring the concept of a digital pound, assessing its benefits to the economy and the evolving payment landscape.Central Bank of Nigeria:

Making strides in digital currency implementation with the eNaira initiative to enhance financial inclusion and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of central Bank Digital Currencies?

The Central Bank Digital Currencies market is valued at $15 billion in 2024, with a remarkable CAGR of 10.2%. By 2033, the market is projected to expand significantly, showcasing increased adoption and integration into financial systems globally.

What are the key market players or companies in this central Bank Digital Currencies industry?

Key players in the Central Bank Digital Currencies industry include major central banks, fintech companies, and tech giants focusing on blockchain technology and cryptocurrency solutions, contributing to the development and implementation of digital currencies globally.

What are the primary factors driving the growth in the central bank digital currency industry?

Growth in the Central Bank Digital Currency industry is driven by advancements in technology, increasing demand for secure and efficient payment systems, economic digitalization, and the need for central banks to improve monetary policies and financial inclusion.

Which region is the fastest Growing in the central bank digital currency market?

The Asia Pacific region is the fastest-growing market for Central Bank Digital Currencies, with a projected market size of $3.28 billion in 2024 and $8.12 billion by 2033, driven by government initiatives and technological advancements.

Does ConsaInsights provide customized market report data for the central bank digital currencies industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Central Bank Digital Currencies industry, enabling stakeholders to make informed decisions based on detailed analytics and trends.

What deliverables can I expect from this central bank digital currency market research project?

Deliverables from the Central Bank Digital Currency market research include comprehensive market analysis, insights on trends, growth projections, segmentation details, and strategic recommendations to guide decision-making.

What are the market trends of central Bank Digital Currencies?

Current market trends in Central Bank Digital Currencies include increased collaboration between central banks and technology providers, rising interest in blockchain solutions, and an emphasis on regulatory frameworks to support digital currency initiatives.