Ceramic Coatings Market Report

Published Date: 03 February 2026 | Report Code: ceramic-coatings

Ceramic Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the global Ceramic Coatings market, providing valuable insights from 2023 to 2033. It covers market size, growth prospects, segmentation, regional analysis, key players, and emerging trends impacting the industry.

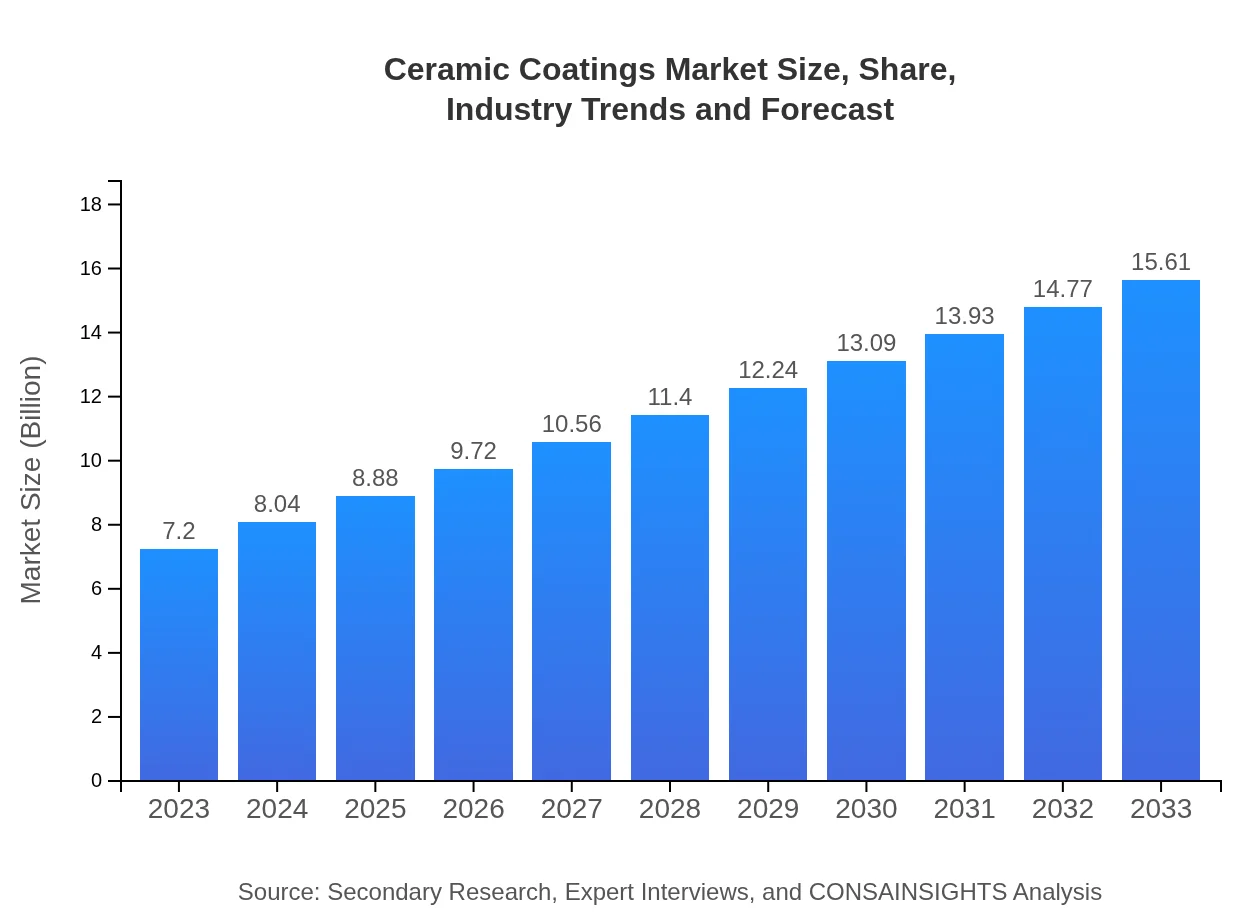

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $15.61 Billion |

| Top Companies | Saint-Gobain, PPG Industries, AkzoNobel, Hempel |

| Last Modified Date | 03 February 2026 |

Ceramic Coatings Market Overview

Customize Ceramic Coatings Market Report market research report

- ✔ Get in-depth analysis of Ceramic Coatings market size, growth, and forecasts.

- ✔ Understand Ceramic Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ceramic Coatings

What is the Market Size & CAGR of Ceramic Coatings market in 2023?

Ceramic Coatings Industry Analysis

Ceramic Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ceramic Coatings Market Analysis Report by Region

Europe Ceramic Coatings Market Report:

Europe's Ceramic Coatings market is valued at $2.03 billion in 2023, anticipated to reach $4.40 billion by 2033. Factors like stringent environmental regulations and a focus on sustainable solutions are propelling market growth, particularly in sectors like automotive and aerospace.Asia Pacific Ceramic Coatings Market Report:

The Asia Pacific region holds a significant share of the Ceramic Coatings market, with a value of $1.41 billion in 2023, expected to grow to $3.05 billion by 2033. Rapid industrial growth, particularly in countries like China and India, along with increasing automotive production, drives this growth. Major investments in aerospace and electronics sectors further strengthen the market position.North America Ceramic Coatings Market Report:

North America exhibits a robust Ceramic Coatings market valued at $2.68 billion in 2023, with expectations of growth to $5.80 billion by 2033. The presence of key aerospace and automotive manufacturers, coupled with advancements in coating technologies, drives demand for high-performance ceramic coatings in this region.South America Ceramic Coatings Market Report:

In South America, the market size for Ceramic Coatings is estimated at $0.32 billion in 2023, projected to reach $0.70 billion by 2033. The market is slowly developing due to rising automotive production and construction activities, although it faces challenges from economic fluctuations and trade barriers.Middle East & Africa Ceramic Coatings Market Report:

The Middle East and Africa market size for Ceramic Coatings stands at $0.76 billion in 2023 and is expected to grow to $1.64 billion by 2033. The region is seeing investments in infrastructure and industrial expansion, especially in oil and gas, which helps drive the demand for protective coatings.Tell us your focus area and get a customized research report.

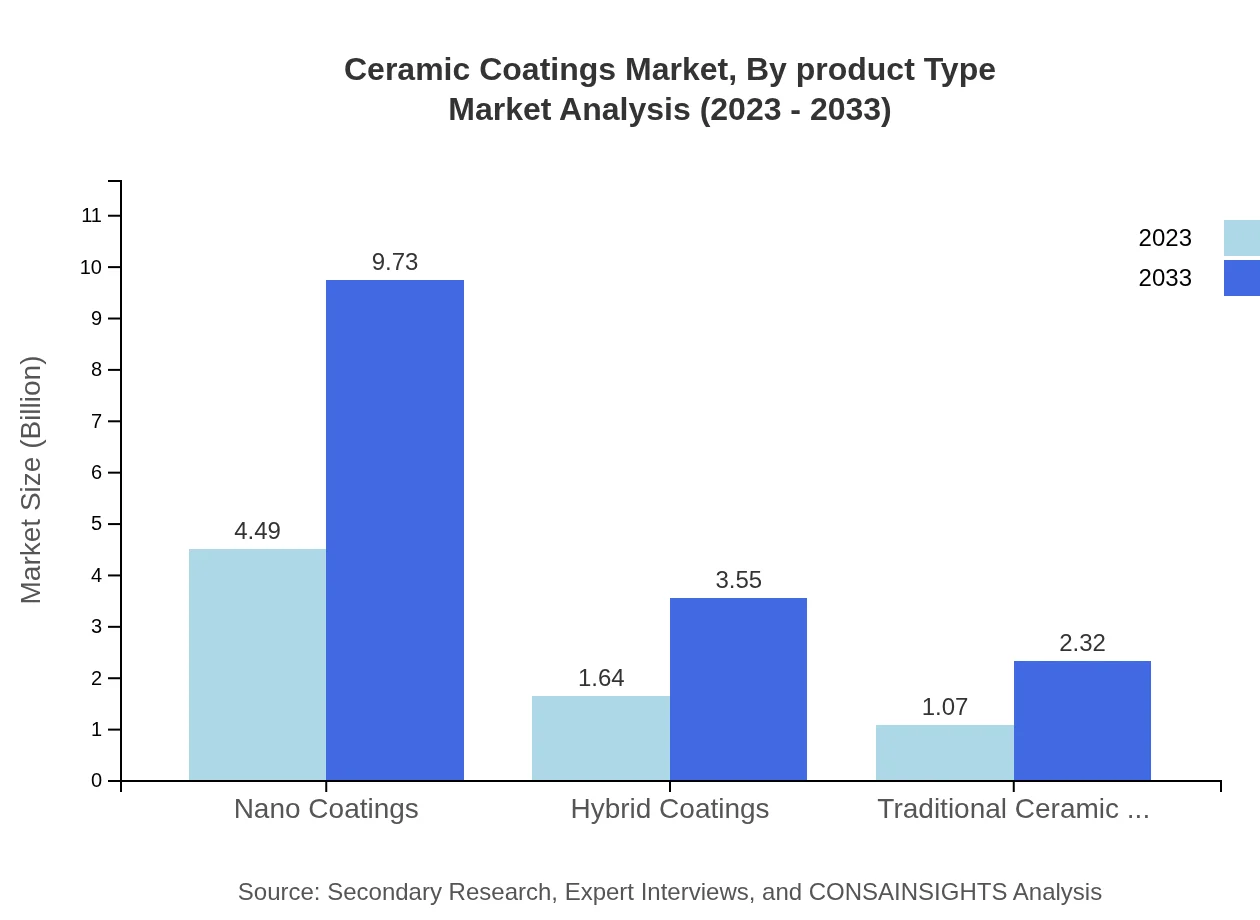

Ceramic Coatings Market Analysis By Product Type

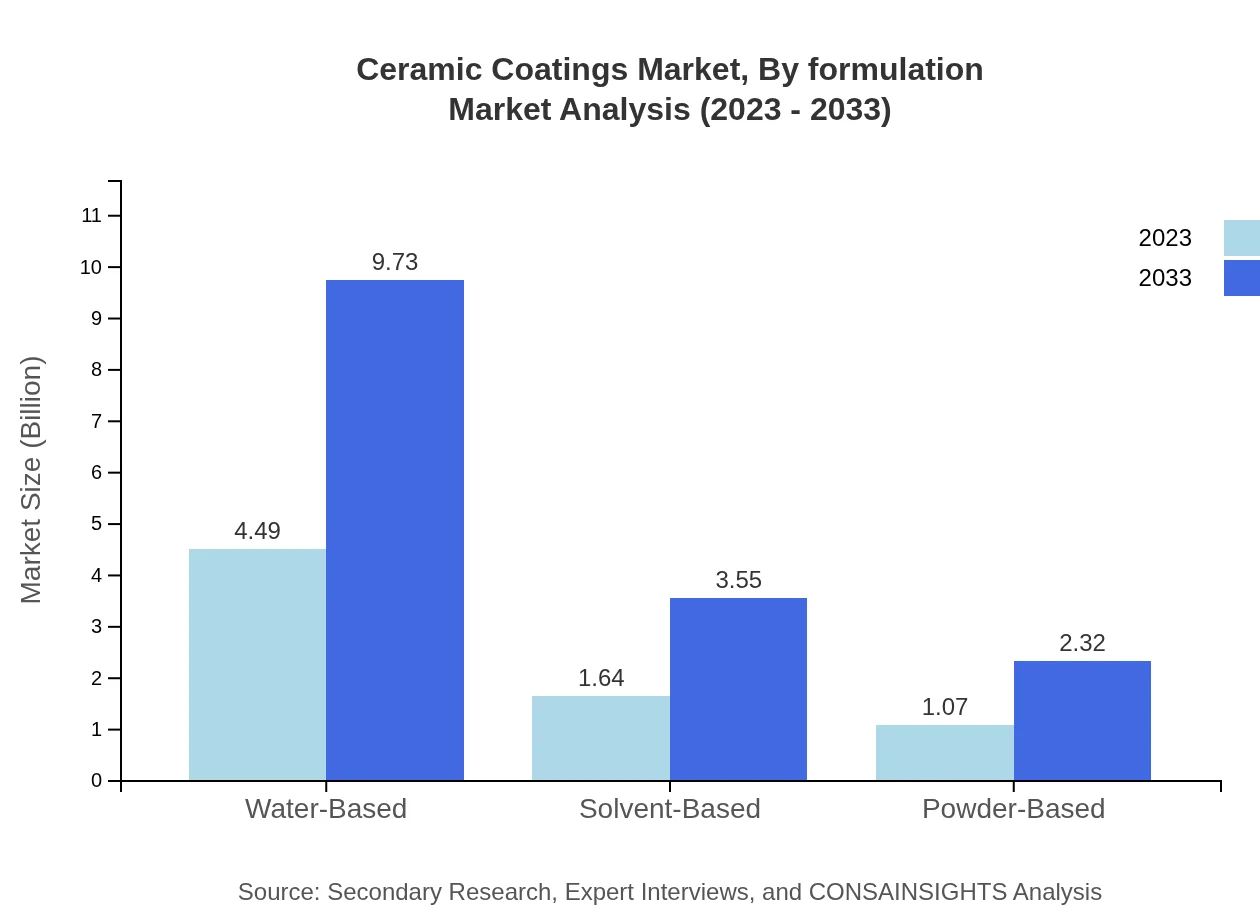

The Ceramic Coatings market can be categorized into various product types, with the following key segments: - **Water-Based Coatings** account for a significant share, valued at $4.49 billion in 2023, expected to rise to $9.73 billion by 2033, due to their eco-friendly characteristics and ease of application. - **Solvent-Based Coatings** are projected to grow from $1.64 billion in 2023 to $3.55 billion by 2033, favored for their superior performance in various industrial applications. - **Powder-Based Coatings** hold a market size of $1.07 billion in 2023, expected to reach $2.32 billion by 2033.

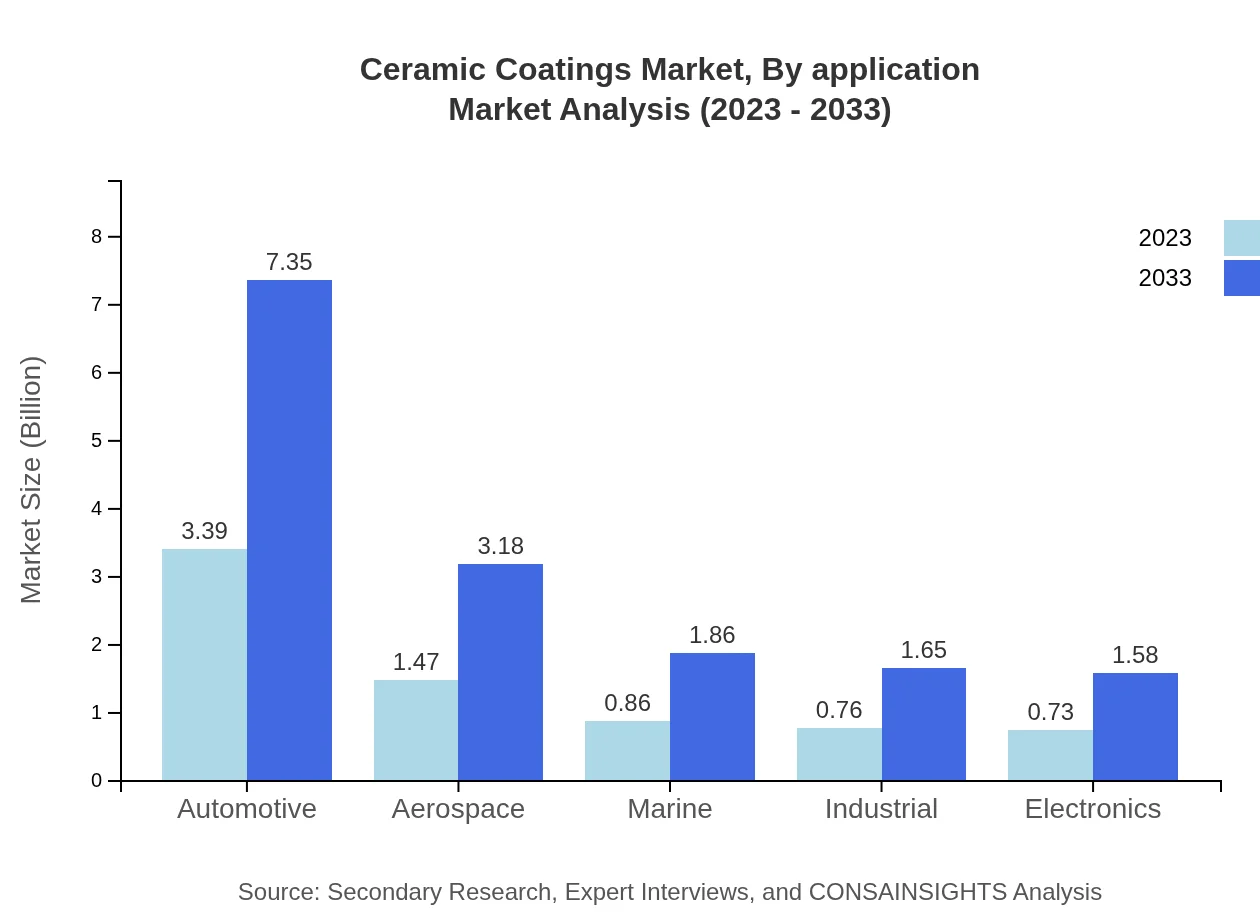

Ceramic Coatings Market Analysis By Application

Applications within the Ceramic Coatings market are diverse: - **Automotive Manufacturing** dominates the sector, valued at $3.39 billion in 2023 with projections of $7.35 billion by 2033 due to increased demand for performance enhancements. - **Aerospace** and **Marine Operators** also significantly contribute, with market sizes of $1.47 billion and $0.86 billion respectively in 2023. - The **Electronics** segment is experiencing growth, forecasted to rise from $0.76 billion in 2023 to $1.65 billion by 2033.

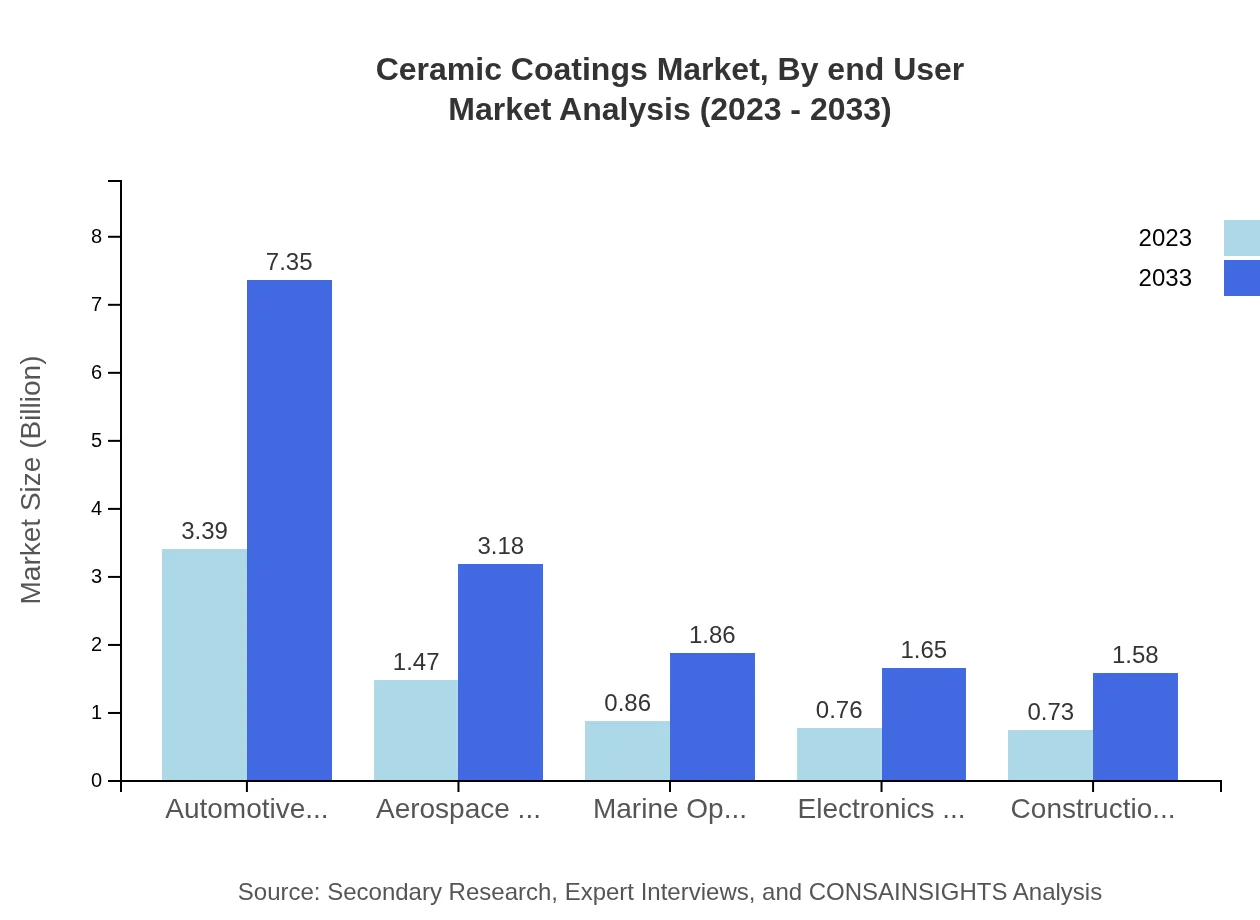

Ceramic Coatings Market Analysis By End User

In the end-user segment, key industries include: - **Aerospace** and **Automotive** being the largest consumers, collectively accounting for substantial market shares, driven by enhanced requirements for durability and safety in applications. - The **Marine** and **Industrial** manufacturing sectors are also important, each valued at $0.86 billion and $0.76 billion in 2023 respectively, projected for growth in upcoming years.

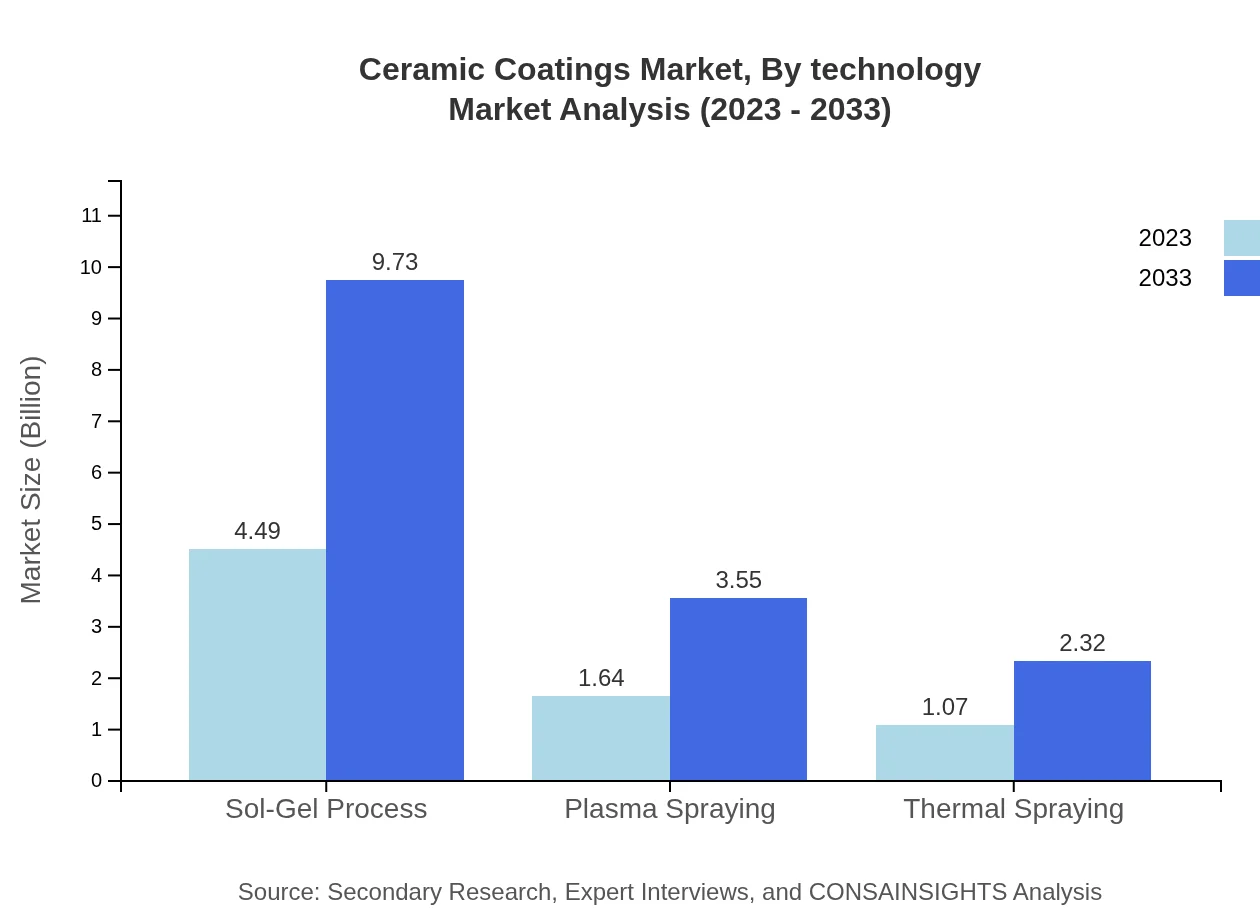

Ceramic Coatings Market Analysis By Technology

Key technologies in the Ceramic Coatings market include: - **Sol-Gel Process**: This dominates the technology segment, holding a leading market share at 62.37% in 2023. - **Plasma Spraying** and **Thermal Spraying** technologies also hold substantial market shares, with values of $1.64 billion and $1.07 billion respectively in 2023.

Ceramic Coatings Market Analysis By Formulation

The formulation of Ceramic Coatings plays a critical role in their performance. Key formulations include: - **Water-Based Coatings**, holding a substantial market share for their environmental compliance. - **Hybrid Coatings** and **Traditional Ceramic Coatings** are also popular, projecting steady growth rates in the future.

Ceramic Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ceramic Coatings Industry

Saint-Gobain:

A leading manufacturer of high-performance ceramic materials providing innovative solutions across various industries, significantly contributing to the growth of the Ceramic Coatings market.PPG Industries:

Renowned for its extensive coatings portfolio, PPG Industries specializes in aerospace and automotive coatings, playing a pivotal role in advancing ceramic technology.AkzoNobel:

A global company committed to sustainability, AkzoNobel offers a variety of ceramic coating solutions that enhance product efficiency and lifespan.Hempel:

With a strong emphasis on marine coatings, Hempel develops ceramic solutions tailored for harsh environments, bolstering industry standards.We're grateful to work with incredible clients.

FAQs

What is the market size of ceramic coatings?

The ceramic coatings market is valued at approximately $7.2 billion in 2023, with a compound annual growth rate (CAGR) of 7.8%. This market is projected to expand significantly over the next decade.

What are the key market players or companies in the ceramic coatings industry?

Key players include established companies like PPG Industries, BASF SE, AkzoNobel N.V., and Saint-Gobain, which drive innovations and uphold competitive dynamics in the ceramic coatings market.

What are the primary factors driving the growth in the ceramic coatings industry?

Growth in the ceramic coatings industry is primarily driven by their rising demand in automotive and aerospace sectors, increasing emphasis on surface durability, and advances in coating technologies enhancing their performance.

Which region is the fastest Growing in the ceramic coatings market?

Asia Pacific is currently the fastest-growing region, with the market projected to rise from $1.41 billion in 2023 to $3.05 billion by 2033, reflecting increasing industrial activities and demand.

Does ConsaInsights provide customized market report data for the ceramic coatings industry?

Yes, ConsaInsights offers tailored market report data, allowing clients to obtain specific insights and analytics that cater to individual business needs in the ceramic coatings industry.

What deliverables can I expect from this ceramic coatings market research project?

Expect comprehensive reports, including market analysis, trends, forecasts, competitive landscape, regional insights, and custom insights that enable informed decision-making in the ceramic coatings market.

What are the market trends of ceramic coatings?

Current trends include the adoption of environmentally friendly coatings, technological advancements in application processes, and a growing shift towards high-performance coatings in various sectors.