Ceramic Fiber Market Report

Published Date: 22 January 2026 | Report Code: ceramic-fiber

Ceramic Fiber Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Ceramic Fiber market, analyzing its size, growth trends, regional performance, and industry dynamics from 2023 to 2033.

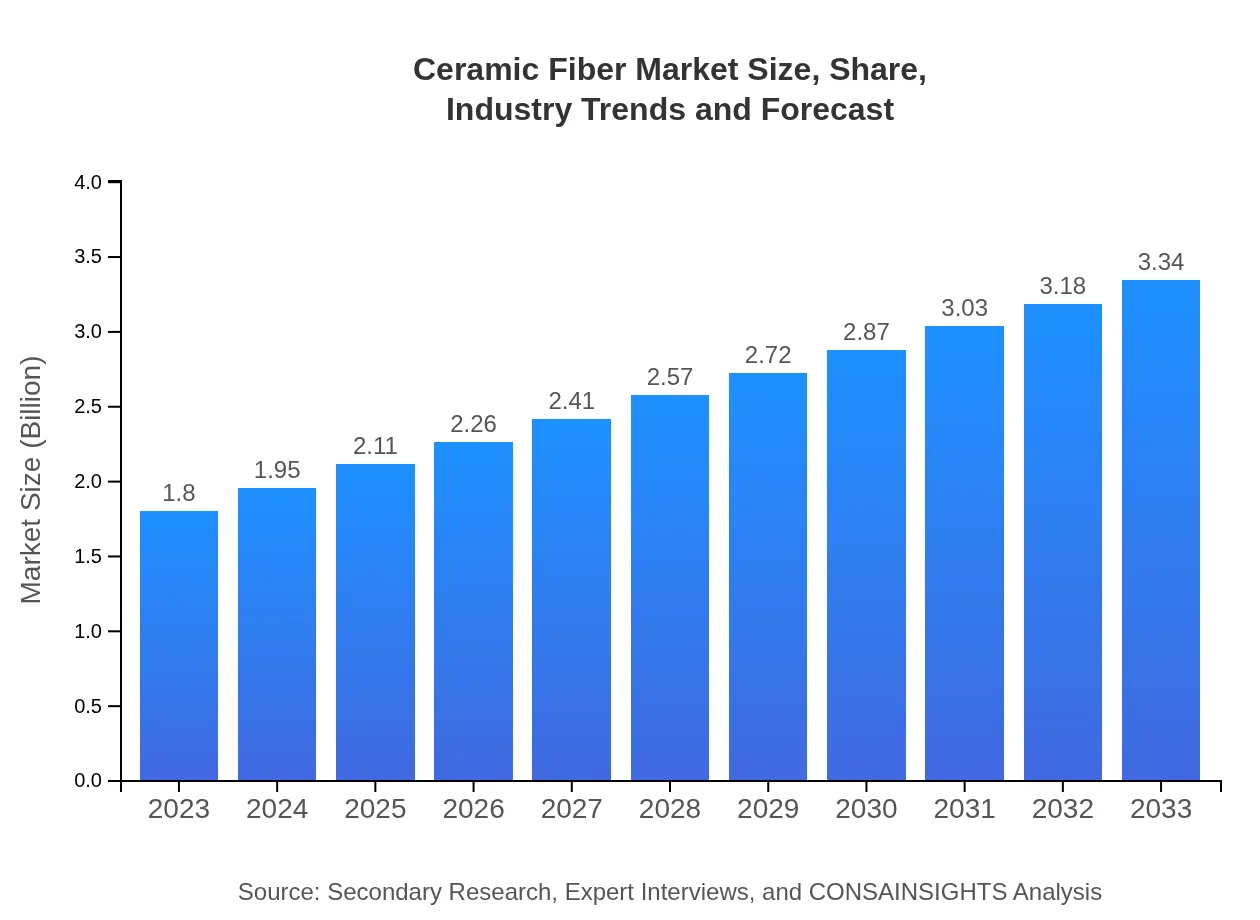

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Morgan Thermal Ceramics, Unifrax, Shin-Etsu Chemical Co., Ltd. |

| Last Modified Date | 22 January 2026 |

Ceramic Fiber Market Overview

Customize Ceramic Fiber Market Report market research report

- ✔ Get in-depth analysis of Ceramic Fiber market size, growth, and forecasts.

- ✔ Understand Ceramic Fiber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ceramic Fiber

What is the Market Size & CAGR of the Ceramic Fiber market in 2023?

Ceramic Fiber Industry Analysis

Ceramic Fiber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ceramic Fiber Market Analysis Report by Region

Europe Ceramic Fiber Market Report:

In Europe, the expected market growth is significant, increasing from USD 0.52 billion in 2023 to USD 0.96 billion by 2033. The European market benefits from stringent regulations on energy efficiency and environmental sustainability, boosting the demand for ceramic fibers in industrial applications and leading to innovation in product offerings.Asia Pacific Ceramic Fiber Market Report:

The Asia Pacific region, with a market size of USD 0.35 billion in 2023 projected to grow to USD 0.65 billion by 2033, is driven by expanding industrial activities in countries like China and India. The rising steel production and increased expenditure on infrastructure are critical factors fuelling this growth. Additionally, the region's commitment to energy efficiency and pollution reduction is prompting businesses to invest in advanced insulation solutions.North America Ceramic Fiber Market Report:

North America stands as a pivotal market, with a size of USD 0.61 billion in 2023 projected to reach USD 1.14 billion by 2033. The demand is propelled by the United States’ aerospace and automotive industries, which emphasize high-performance insulation materials. The push towards green initiatives and energy-saving technologies further enhances market potential.South America Ceramic Fiber Market Report:

In South America, the ceramic fiber market is currently valued at USD 0.12 billion in 2023, expected to rise to USD 0.23 billion by 2033. The market growth is supported by developments in construction and manufacturing sectors, along with a focus on sustainable construction practices. The region is witnessing increased government initiatives aimed at improving infrastructural facilities.Middle East & Africa Ceramic Fiber Market Report:

The Middle East and Africa ceramic fiber market, valued at USD 0.20 billion in 2023 and projected to grow to USD 0.36 billion by 2033, is driven by industrial growth and increasing utilization of high-temperature insulation applications in oil and gas sectors. Investments in renewable energy infrastructures also contribute to the demand for ceramic fibers.Tell us your focus area and get a customized research report.

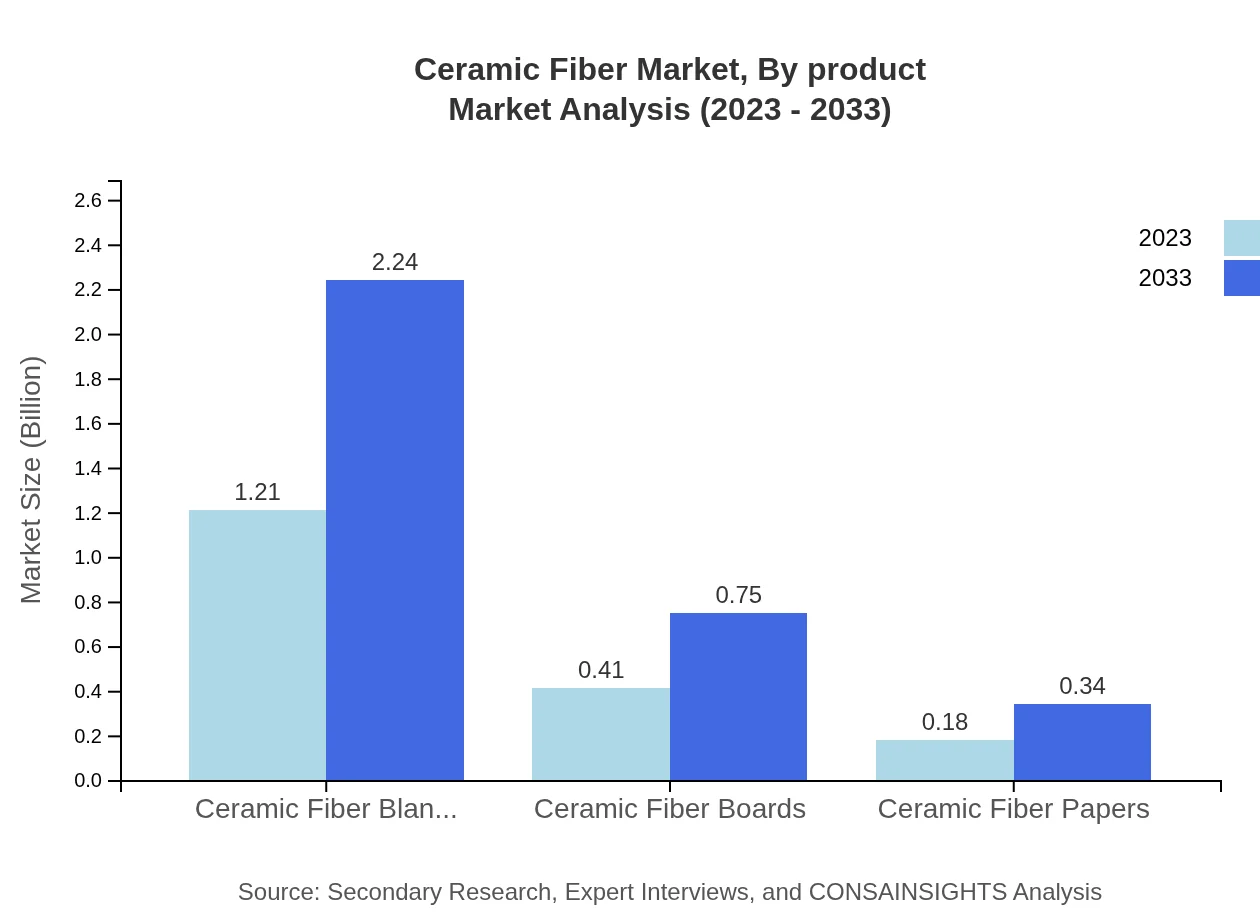

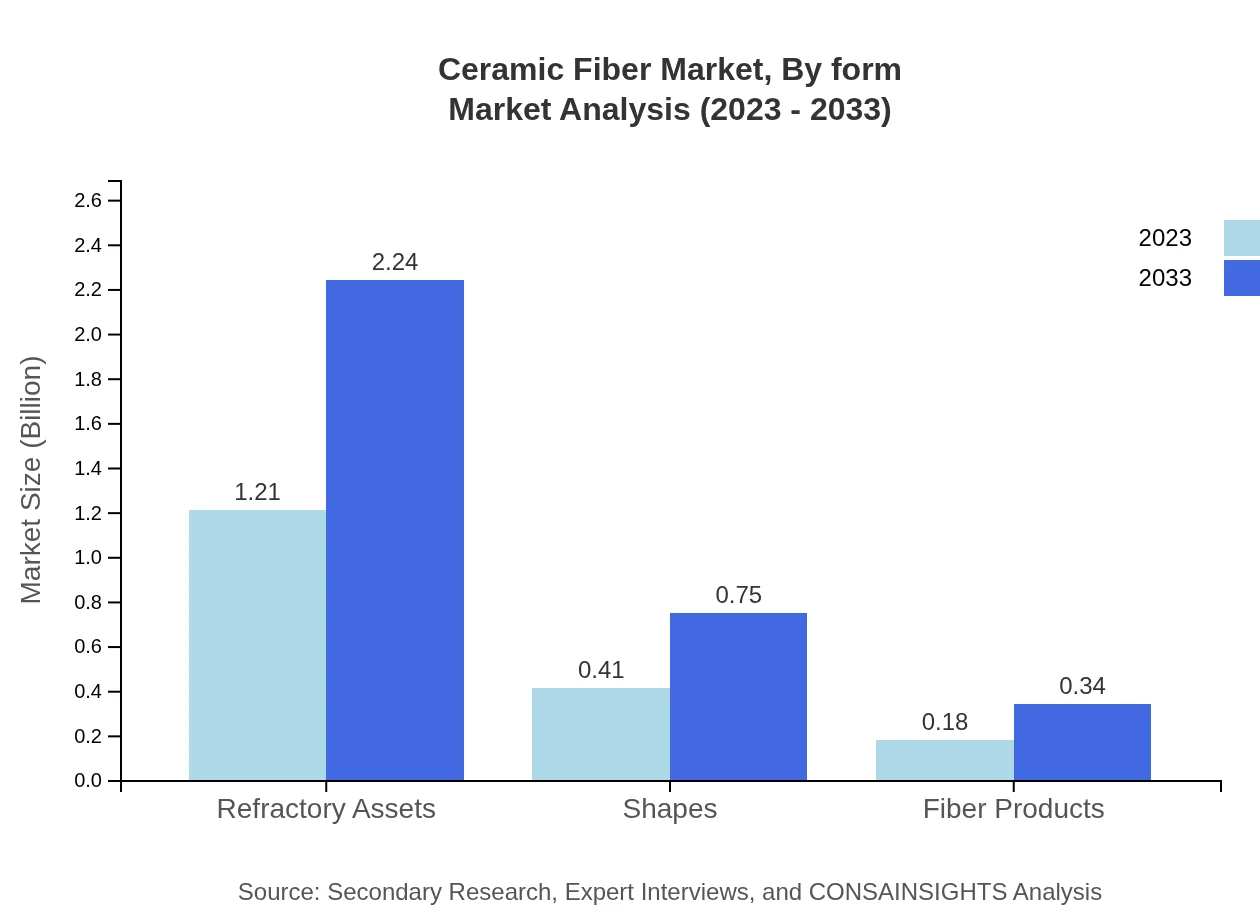

Ceramic Fiber Market Analysis By Product

The product segment of the Ceramic Fiber market includes ceramic fiber blankets, boards, and papers. Ceramic fiber blankets dominate the market, with a size of USD 1.21 billion in 2023 projected to grow to USD 2.24 billion by 2033, holding a significant share of 67.3%. Boards and papers are also critical, with current market sizes of USD 0.41 billion and USD 0.18 billion respectively and similar growth rates, driven by their widespread applications in thermal insulation in various industries.

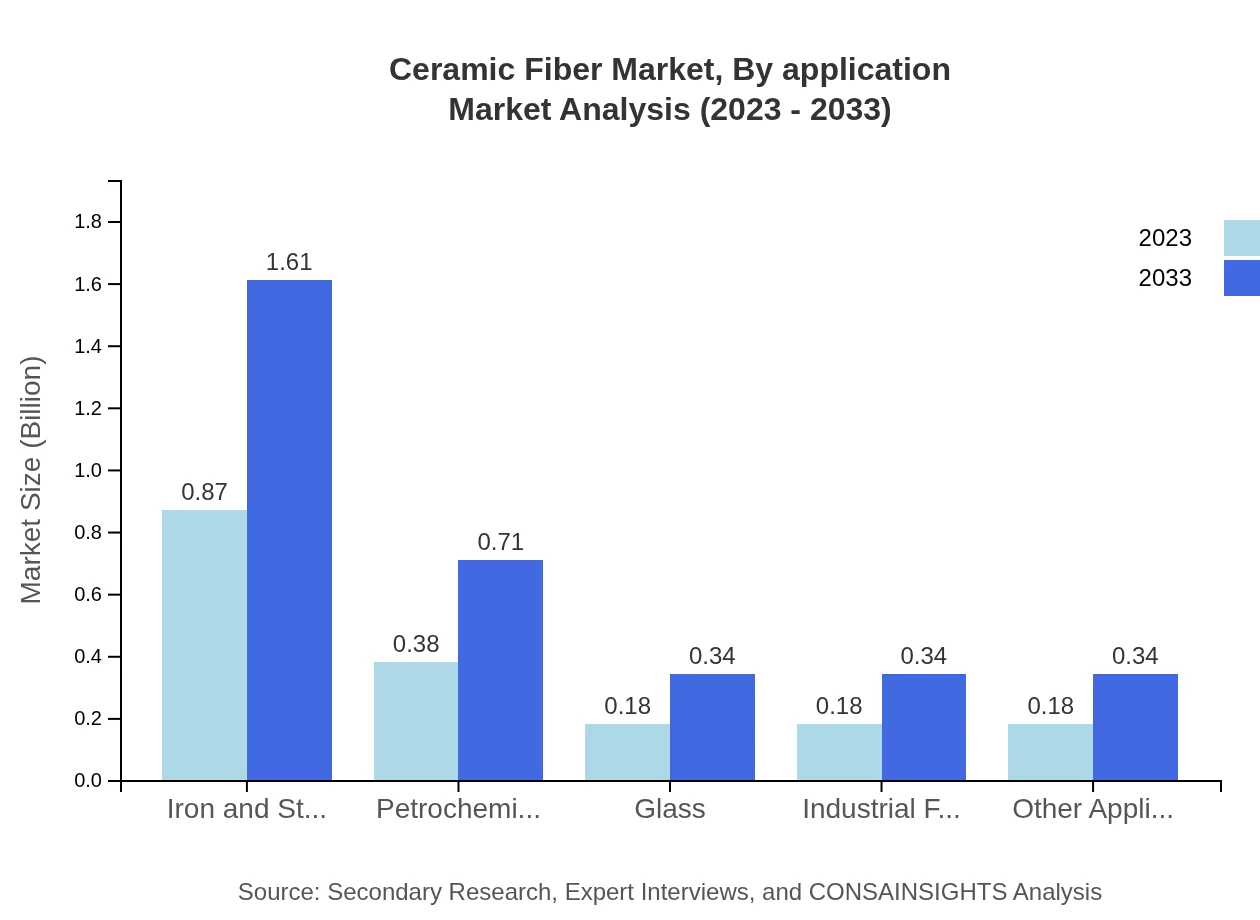

Ceramic Fiber Market Analysis By Application

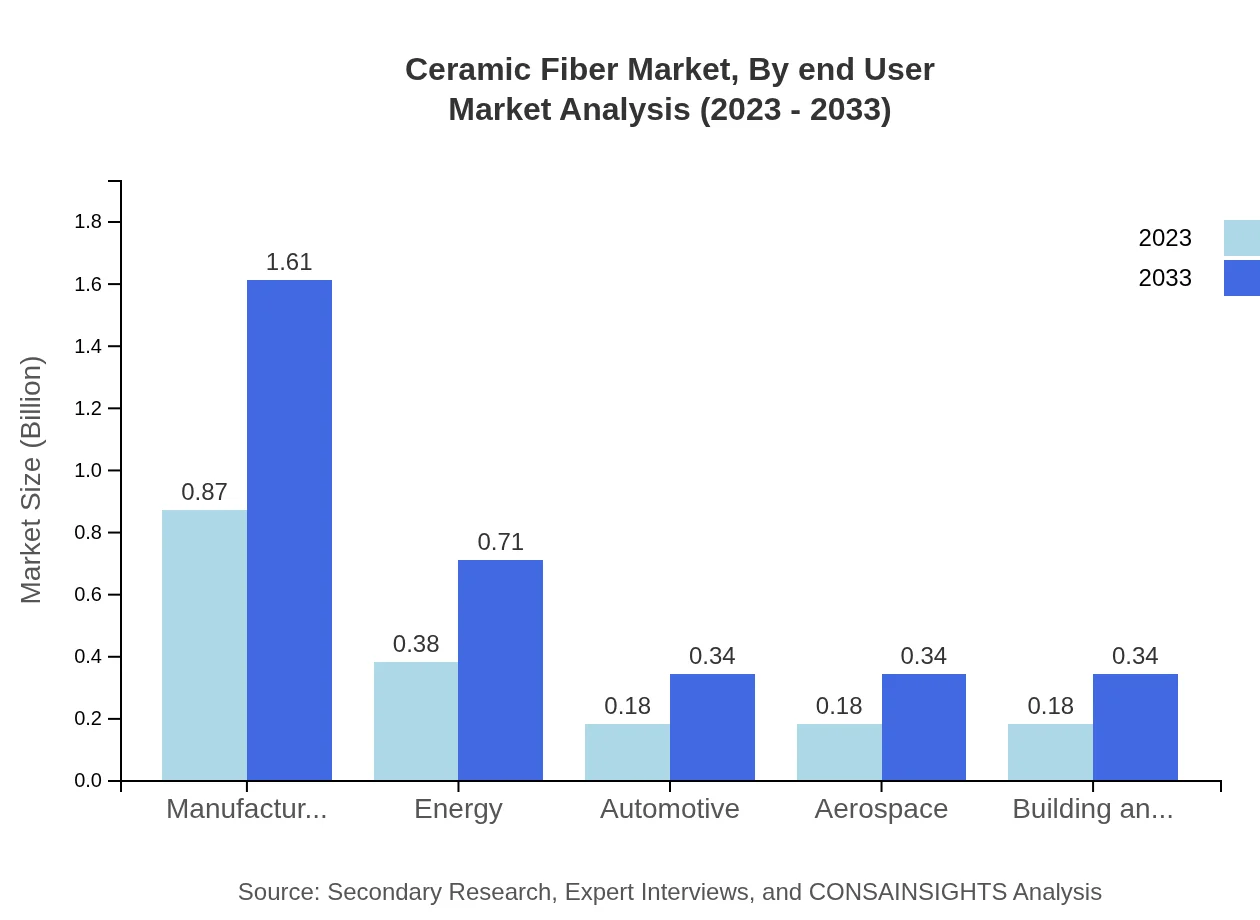

The application segment encompasses industries such as manufacturing, energy, automotive, aerospace, and building construction. Manufacturing leads with a size of USD 0.87 billion in 2023, predicted to reach USD 1.61 billion by 2033, capturing 48.15% of the market share. The energy sector follows closely, reflecting increasing shifts towards cleaner energy solutions.

Ceramic Fiber Market Analysis By End User

The end-user segment includes industries like iron and steel, petrochemical, aerospace, automotive, and industrial furnaces. The iron and steel industry represents a substantial share, accounting for USD 0.87 billion in 2023, with a forecast to grow to USD 1.61 billion by 2033. The automotive and aerospace sectors are also on the rise, driven by demands for lightweight, robust materials.

Ceramic Fiber Market Analysis By Form

The form segment is categorized into wet and dry processes of ceramic fiber production. The wet process dominates the market, accounting for USD 1.21 billion in 2023, expected to increase to USD 2.24 billion by 2033. In contrast, the dry process is valued at USD 0.41 billion in 2023, with growth projections indicating a market size of USD 0.75 billion by 2033.

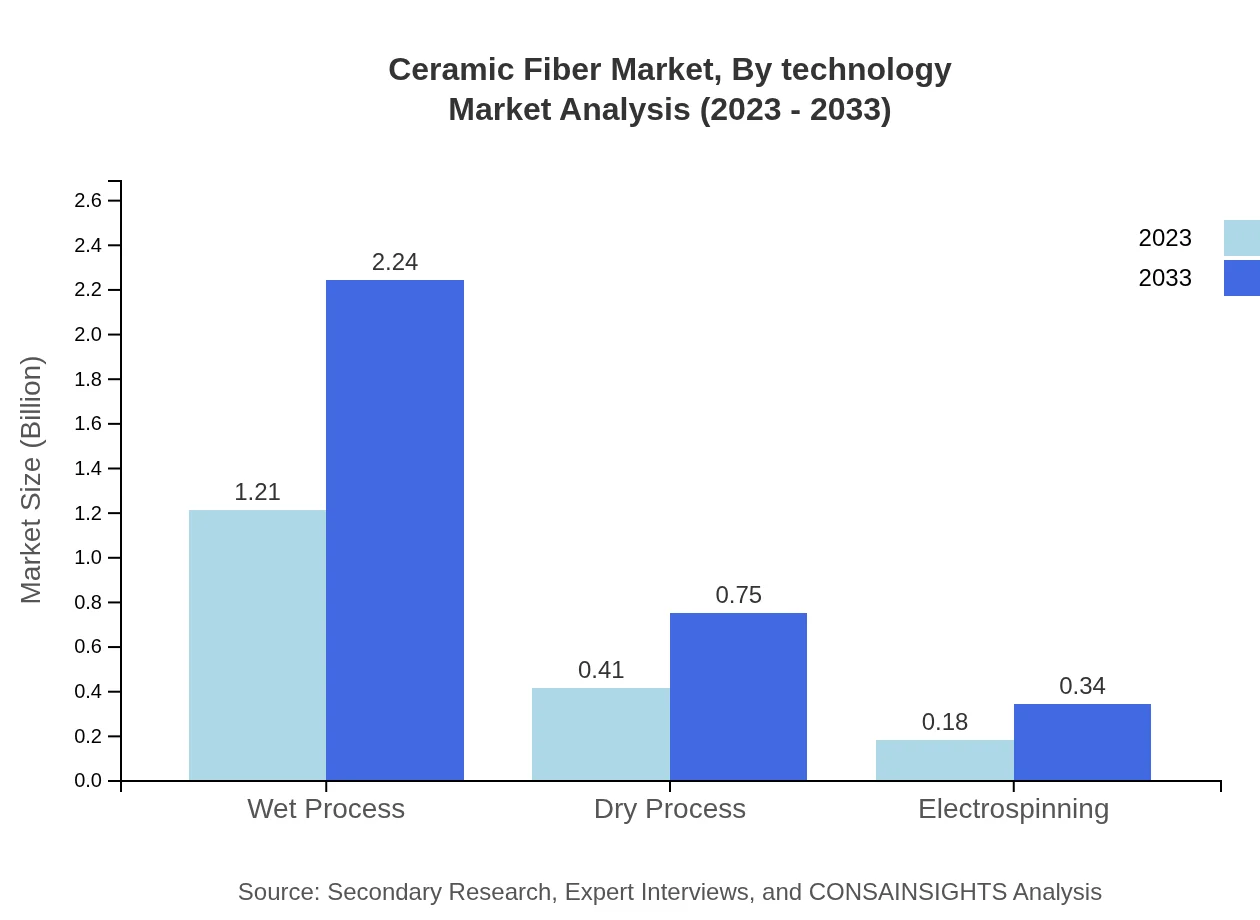

Ceramic Fiber Market Analysis By Technology

The technology segment includes traditional manufacturing methods and innovations such as electrospinning. Traditional methods dominate, although advancements in processes are gaining traction. The electrospinning technology segment currently holds a market size of USD 0.18 billion in 2023, with expectations to reach USD 0.34 billion by 2033, catering to niche applications requiring high-performance fibers.

Ceramic Fiber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ceramic Fiber Industry

Morgan Thermal Ceramics:

A leading supplier of thermal management and insulation materials, Morgan Thermal Ceramics specializes in supplying high-performance ceramic fiber products for a wide range of applications, including industrial insulation.Unifrax:

Unifrax is recognized for its innovative ceramic fiber insulation materials and provides solutions primarily for the industrial, energy, and transportation sectors, focusing on enhancing efficiency and sustainability.Shin-Etsu Chemical Co., Ltd.:

A major player in the market, Shin-Etsu specializes in high-performance ceramic fiber materials, contributing significantly to advancements in aerospace, automotive, and industrial insulation applications.We're grateful to work with incredible clients.

FAQs

What is the market size of ceramic Fiber?

The ceramic fiber market is valued at approximately $1.8 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching significant market milestones in the coming years.

What are the key market players or companies in the ceramic Fiber industry?

Key players in the ceramic fiber industry include established companies such as Morgan Thermal Ceramics, Unifrax, 3M, and others, which specialize in high-performance insulation and materials for various applications.

What are the primary factors driving the growth in the ceramic Fiber industry?

Growth in the ceramic fiber industry is driven by increasing demand in end-use sectors such as manufacturing, energy, and automotive, alongside the advancement of technology in insulation materials.

Which region is the fastest Growing in the ceramic Fiber market?

North America is the fastest-growing region in the ceramic fiber market, projected to grow from $0.61 billion in 2023 to $1.14 billion by 2033, reflecting a strong market demand for diverse applications.

Does ConsaInsights provide customized market report data for the ceramic Fiber industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the ceramic-fiber industry, ensuring clients receive actionable insights and analytics.

What deliverables can I expect from this ceramic Fiber market research project?

Deliverables include comprehensive market analysis, trend assessments, forecasts, competitive landscape evaluations, and insights into regional and segment-specific performance.

What are the market trends of ceramic Fiber?

Current trends in the ceramic fiber market highlight advancements in manufacturing processes, a shift toward eco-friendly products, and a rise in applications in sectors like aerospace and construction.