Ceramic Tiles Market Report

Published Date: 22 January 2026 | Report Code: ceramic-tiles

Ceramic Tiles Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Ceramic Tiles market, including insights into market size, trends, and growth forecasts from 2023 to 2033.

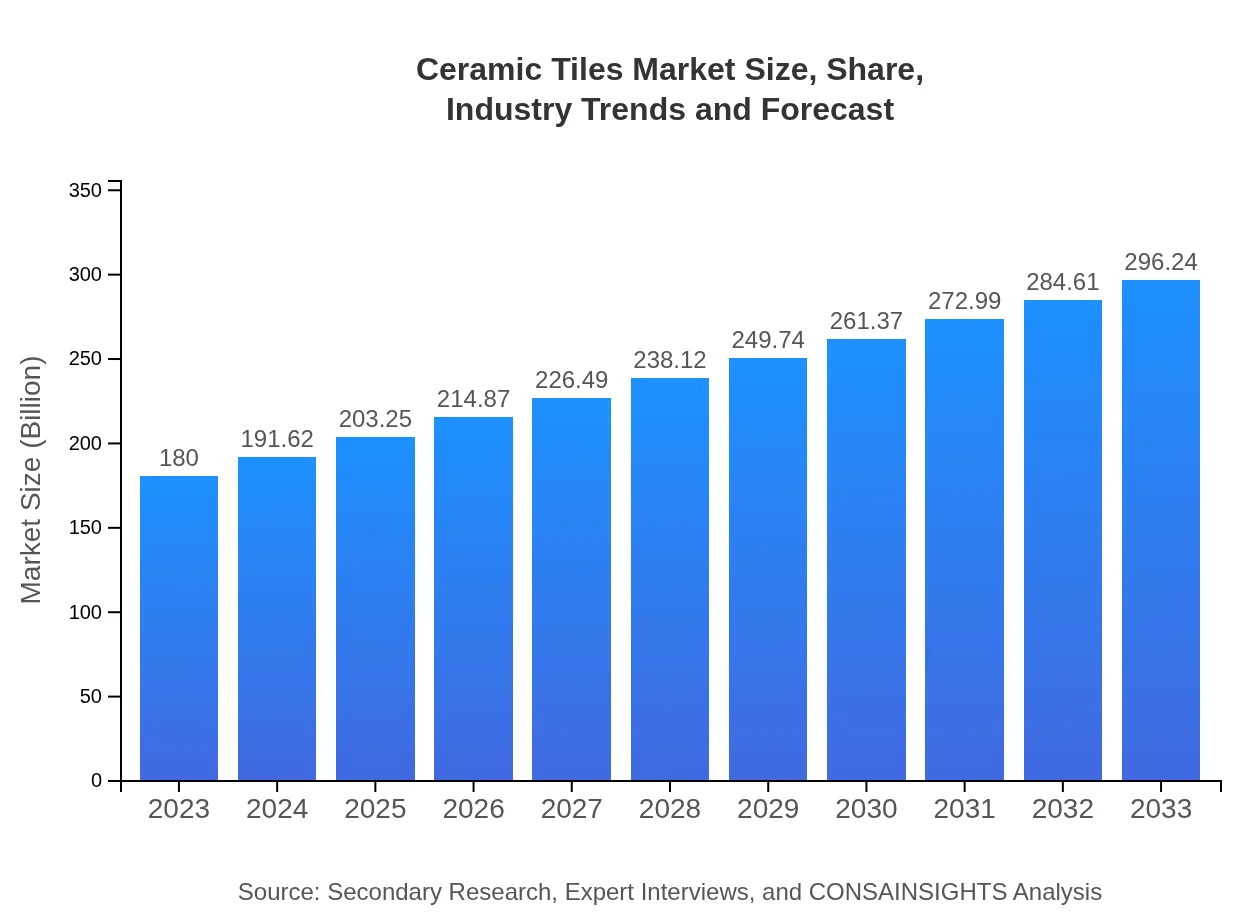

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $180.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $296.24 Billion |

| Top Companies | Mohawk Industries, Inc., Grupo Lamosa, Somany Ceramics Ltd., Johnson Tiles |

| Last Modified Date | 22 January 2026 |

Ceramic Tiles Market Overview

Customize Ceramic Tiles Market Report market research report

- ✔ Get in-depth analysis of Ceramic Tiles market size, growth, and forecasts.

- ✔ Understand Ceramic Tiles's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ceramic Tiles

What is the Market Size & CAGR of Ceramic Tiles market in 2023?

Ceramic Tiles Industry Analysis

Ceramic Tiles Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ceramic Tiles Market Analysis Report by Region

Europe Ceramic Tiles Market Report:

The European ceramic tiles market is anticipated to be 55.01 million square meters in 2023, projected to expand to 90.53 million square meters by 2033. Key drivers include refurbishments, innovations in design, and an increasing number of eco-friendly products.Asia Pacific Ceramic Tiles Market Report:

In the Asia Pacific region, the ceramic tiles market for 2023 is valued at 35.19 million square meters, with projections of growth to 57.91 million square meters by 2033. This growth is primarily driven by rapid urbanization, an expanding middle class, and a surge in construction activities across countries like China and India.North America Ceramic Tiles Market Report:

In North America, the market for ceramic tiles is estimated at 59.00 million square meters in 2023, with expectations to reach 97.11 million square meters by 2033. Factors driving this growth include a robust construction market and heightened consumer interest in sustainable building materials.South America Ceramic Tiles Market Report:

The South American ceramic tiles market is expected to be 15.12 million square meters in 2023 and is anticipated to grow to 24.88 million square meters by 2033. Increased home improvement initiatives and a growing preference for ceramic tiles in both residential and commercial applications are contributing factors.Middle East & Africa Ceramic Tiles Market Report:

The Middle East and Africa segment presents a market size of 15.68 million square meters in 2023, expected to grow to 25.80 million square meters by 2033. This growth trajectory is supported by infrastructural investments and an increasing demand for luxury goods.Tell us your focus area and get a customized research report.

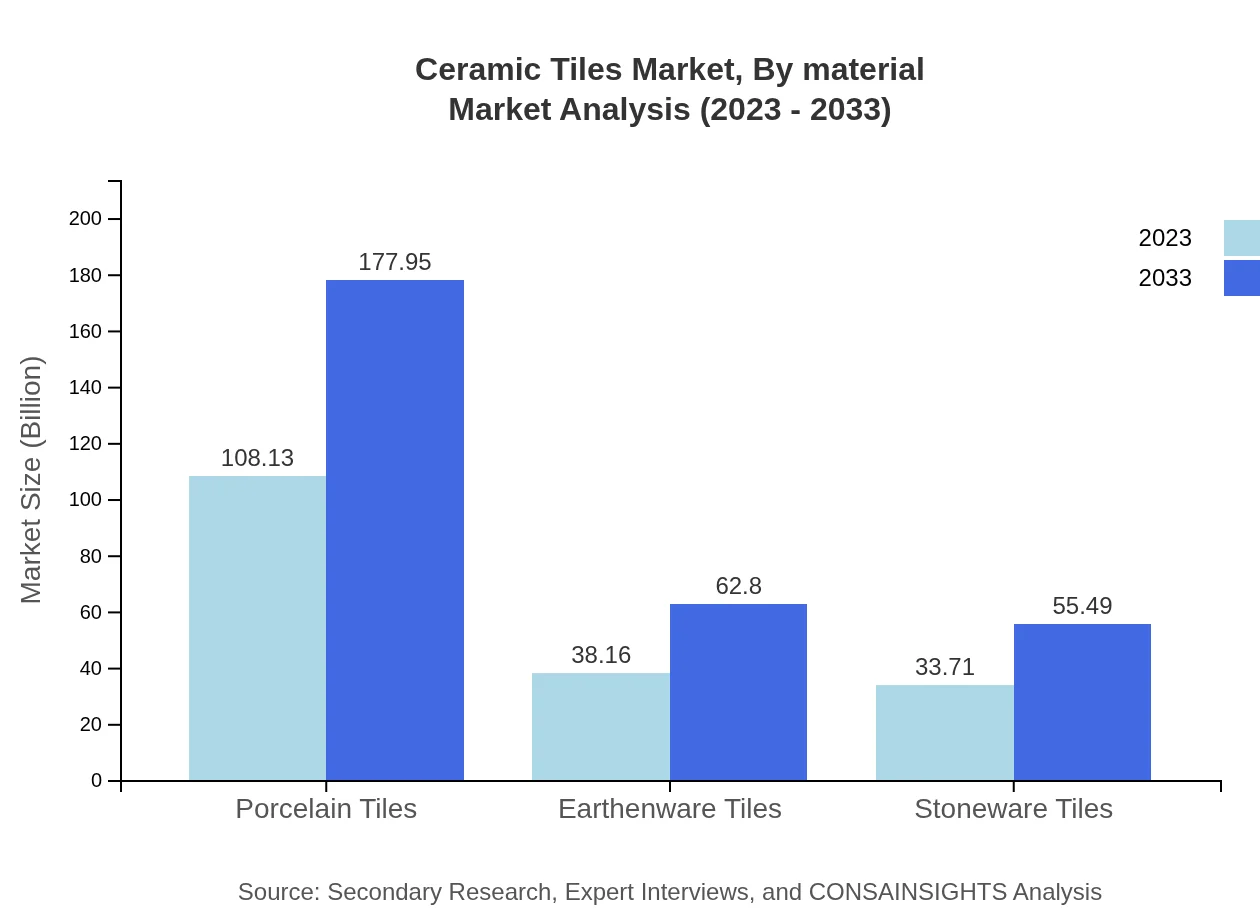

Ceramic Tiles Market Analysis By Material

The market segmentation by material types indicates that porcelain tiles dominate, with sizes of 108.13 million square meters in 2023, increasing to 177.95 million square meters by 2033. Earthenware and stoneware tiles follow, representing significant shares due to their versatility and cost-effectiveness.

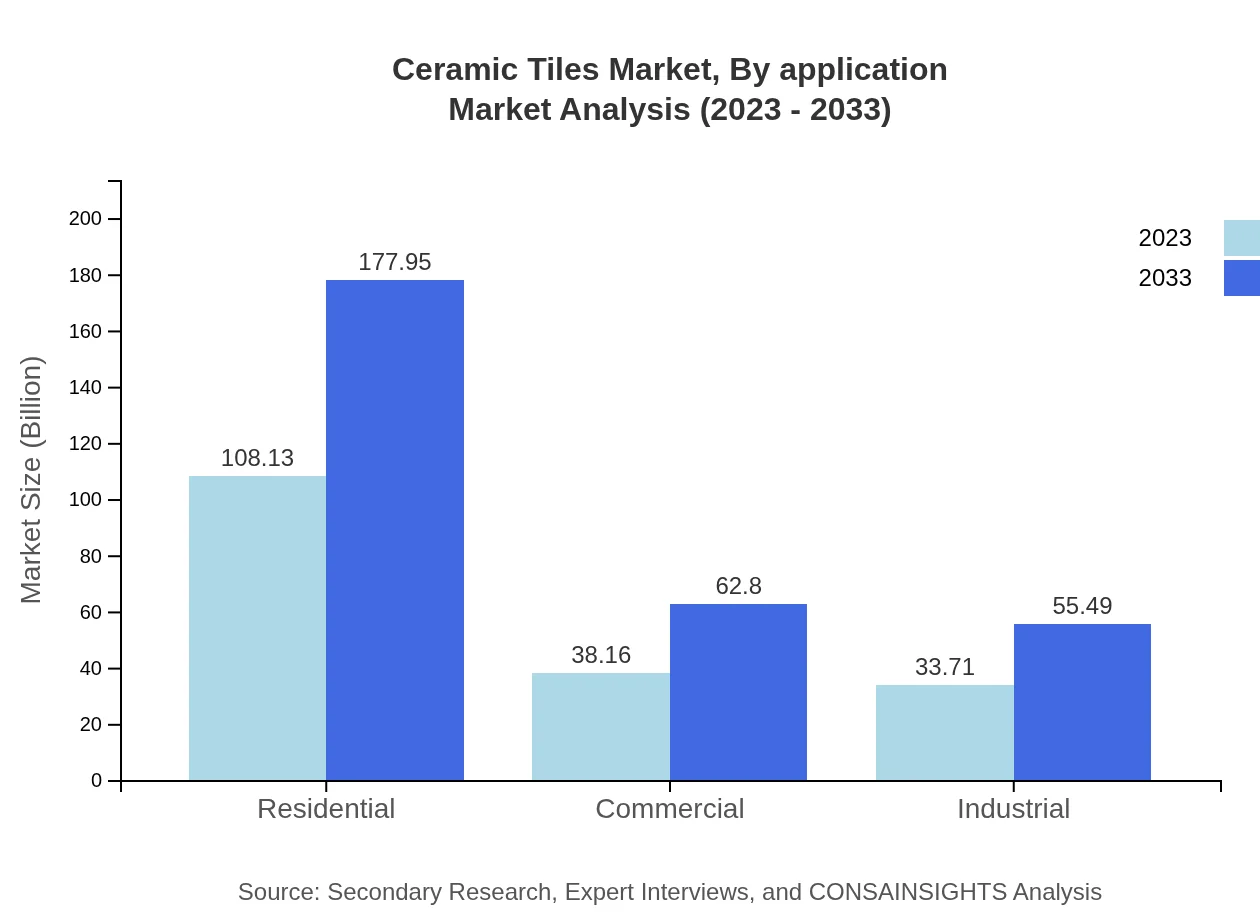

Ceramic Tiles Market Analysis By Application

Segmenting the market by application, residential tiles have a strong lead with 108.13 million square meters in 2023, forecasted to grow to 177.95 million square meters by 2033. Commercial usage accounts for 38.16 million square meters, anticipated to increase to 62.80 million square meters due to growing retail and hospitality sectors.

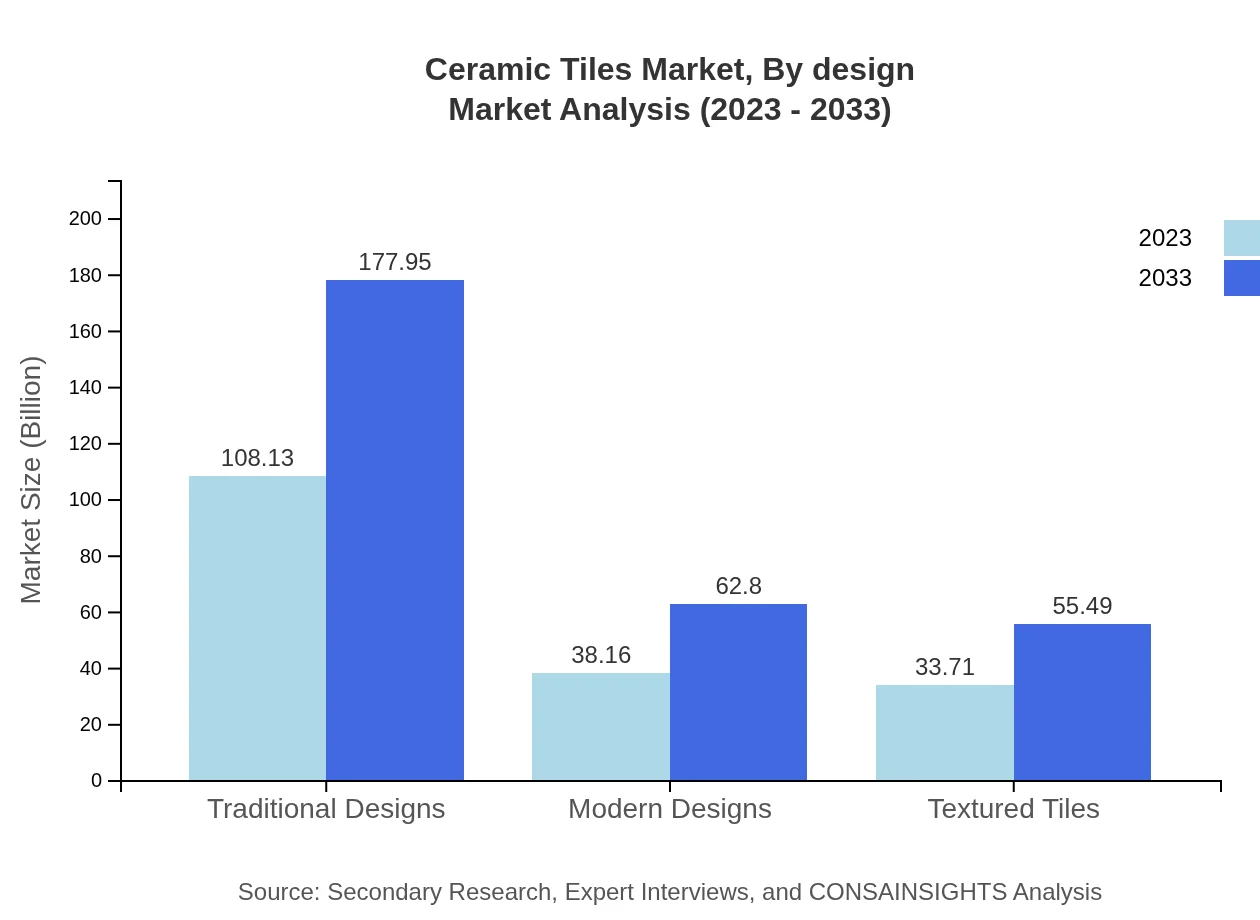

Ceramic Tiles Market Analysis By Design

In terms of design style, traditional designs maintain a significant market share, projected at 60.07% in 2023, reflecting consumer preferences for classic aesthetics. Modern designs are capturing 21.2% of the market, growing increasingly popular among younger demographic groups for contemporary spaces.

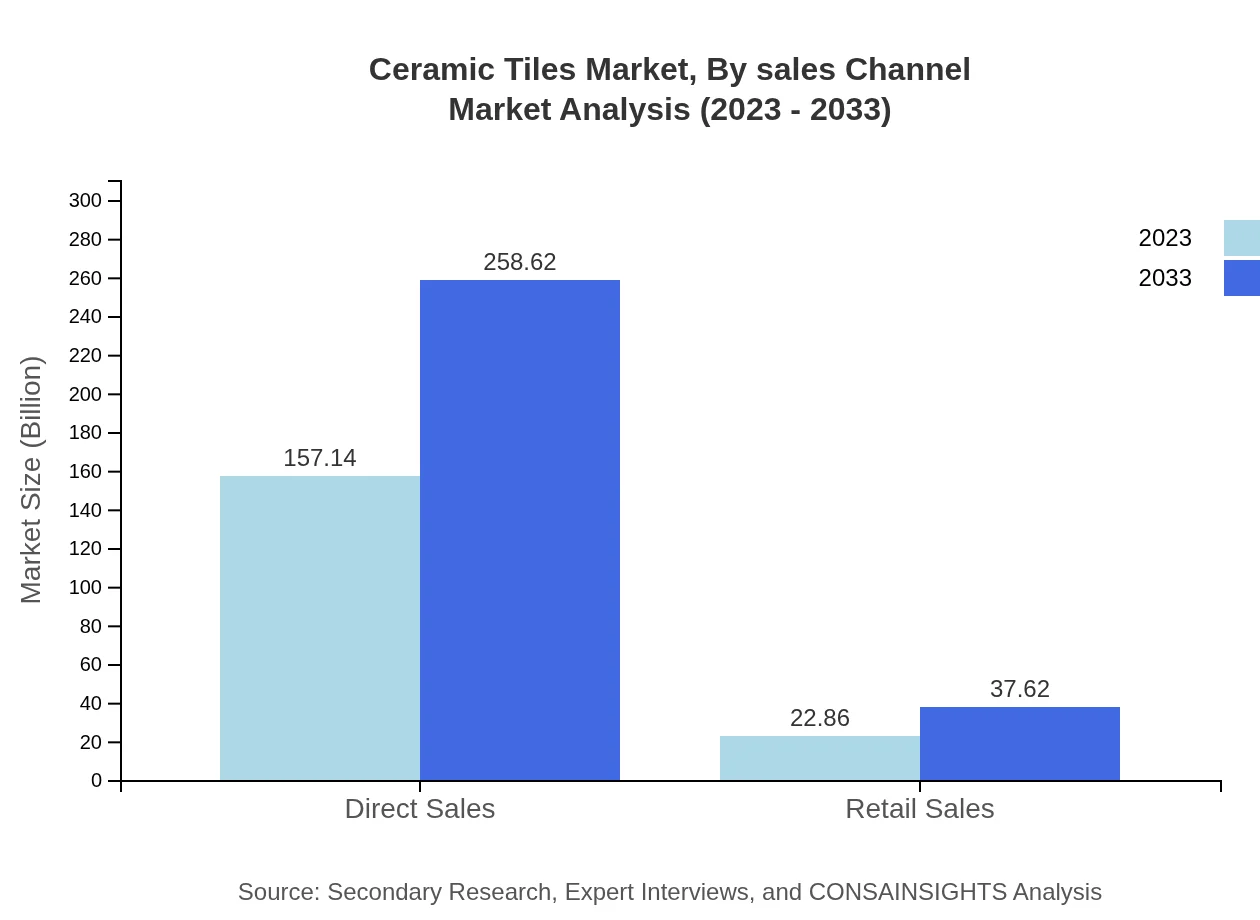

Ceramic Tiles Market Analysis By Sales Channel

Direct sales hold a major share at 157.14 million square meters in 2023, contrasting with retail sales estimated at 22.86 million square meters. Direct channels are gaining prominence thanks to strategic partnerships with contractors and builders.

Ceramic Tiles Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ceramic Tiles Industry

Mohawk Industries, Inc.:

Mohawk Industries, the largest flooring company in the world, provides a wide array of ceramic tiles known for their innovation and quality.Grupo Lamosa:

A leading tile manufacturer in Latin America, Grupo Lamosa focuses on high-quality ceramic products and has a strong presence in various market segments.Somany Ceramics Ltd.:

An established player in the Indian market, Somany manufactures a wide range of ceramic tiles, particularly known for their designs and affordability.Johnson Tiles:

A recognized name in tiling solutions in the UK with a strong emphasis on design and sustainability within their ceramic range.We're grateful to work with incredible clients.

FAQs

What is the market size of ceramic tiles?

As of 2023, the global ceramic tiles market is valued at approximately $180 billion, with a projected growth at a CAGR of 5% through 2033, indicating a robust demand for ceramic tiles across various sectors.

What are the key market players or companies in the ceramic tiles industry?

The ceramic tiles industry is dominated by several key players including Mohawk Industries, Grupo Lamosa, and RAK Ceramics. These companies have a significant market share and influence the direction of the industry with their innovative designs and products.

What are the primary factors driving the growth in the ceramic tiles industry?

Growth in the ceramic tiles industry is driven by urbanization, increasing construction activities, and a rise in consumer preference for aesthetically appealing flooring solutions. Additionally, technological advancements in tile manufacturing contribute significantly to this growth.

Which region is the fastest Growing in the ceramic tiles market?

The Asia Pacific region is the fastest-growing market for ceramic tiles, projected to grow from $35.19 billion in 2023 to $57.91 billion by 2033. This growth is fueled by rapid urbanization and increasing disposable incomes in countries like India and China.

Does ConsaInsights provide customized market report data for the ceramic tiles industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the ceramic tiles industry. Clients can obtain insights and data focusing on particular segments, regions, or trends to make informed business decisions.

What deliverables can I expect from this ceramic tiles market research project?

The deliverables from the ceramic tiles market research project may include detailed reports encompassing market size, trends, competitive analysis, segment performance, and tailored insights into consumer preferences, providing valuable information for strategic planning.

What are the market trends of the ceramic tiles market?

Current trends in the ceramic tiles market include a shift towards modern and textured designs, sustainability in production, and an increase in digital printing technology, influencing consumer choices and driving innovation in product offerings.