Cereal Bar Market Report

Published Date: 31 January 2026 | Report Code: cereal-bar

Cereal Bar Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the cereal bar market, exploring market size, growth rates, and industry trends from 2023 to 2033. Key insights and strategic recommendations are presented to guide stakeholders in navigating this evolving landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

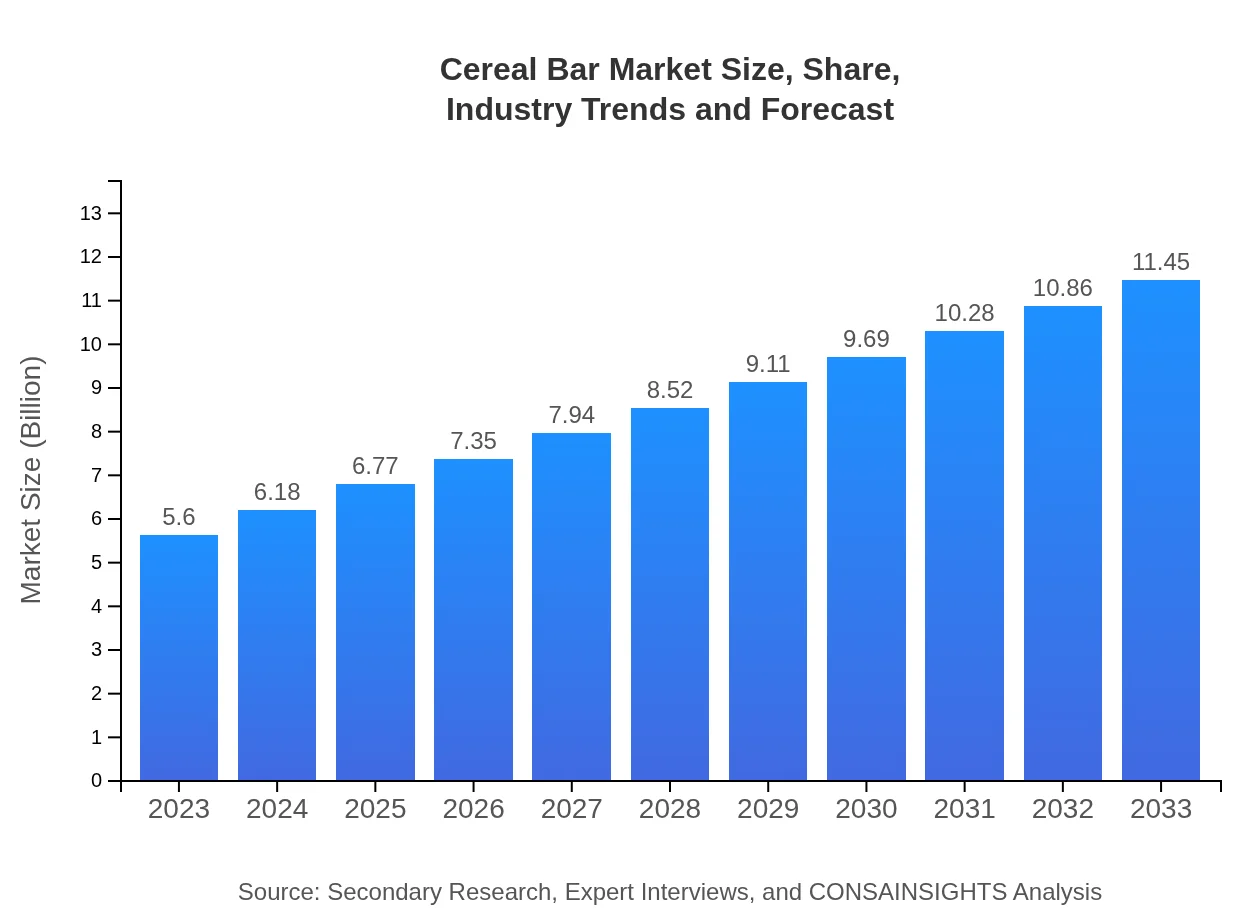

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | General Mills, Inc., Quaker Oats Company (PepsiCo), Kraft Heinz Company, Clif Bar & Company |

| Last Modified Date | 31 January 2026 |

Cereal Bar Market Overview

Customize Cereal Bar Market Report market research report

- ✔ Get in-depth analysis of Cereal Bar market size, growth, and forecasts.

- ✔ Understand Cereal Bar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cereal Bar

What is the Market Size & CAGR of Cereal Bar market in 2023?

Cereal Bar Industry Analysis

Cereal Bar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cereal Bar Market Analysis Report by Region

Europe Cereal Bar Market Report:

The European cereal bar market is anticipated to grow from $1.58 billion in 2023 to $3.23 billion by 2033. Increasing health awareness, along with a rising demand for organic and gluten-free products, is stimulating market growth. The diverse consumer base across European countries presents numerous opportunities for brands to explore niche markets.Asia Pacific Cereal Bar Market Report:

In the Asia Pacific region, the cereal bar market was valued at approximately $1.07 billion in 2023, projected to grow to $2.19 billion by 2033. The increase in the health-conscious population, coupled with a shift towards convenient snacking options, is driving market growth. Rising disposable incomes and urbanization in countries like China and India are also contributing to the demand for cereal bars.North America Cereal Bar Market Report:

North America is a significant market for cereal bars, valued at $1.97 billion in 2023 and projected to climb to $4.03 billion by 2033. The popularity of healthy snacks is driving innovation and sales, with consumers keen on protein-enriched and low-sugar options. Prominent brands are continuously launching new flavors to cater to evolving tastes.South America Cereal Bar Market Report:

The South American market for cereal bars is smaller, estimated at $0.37 billion in 2023, with expectations to reach $0.77 billion by 2033. Health trends are gradually influencing consumer purchasing decisions, but growth remains moderate due to lower penetration of health-focused products compared to more developed regions.Middle East & Africa Cereal Bar Market Report:

In the Middle East and Africa, the market was valued at $0.61 billion in 2023, with projections to reach $1.24 billion by 2033. The growing trend of health and fitness among the younger population is driving the demand for nutritious snacking options. Urbanization and lifestyle changes further contribute to the growing consumption of cereal bars in the region.Tell us your focus area and get a customized research report.

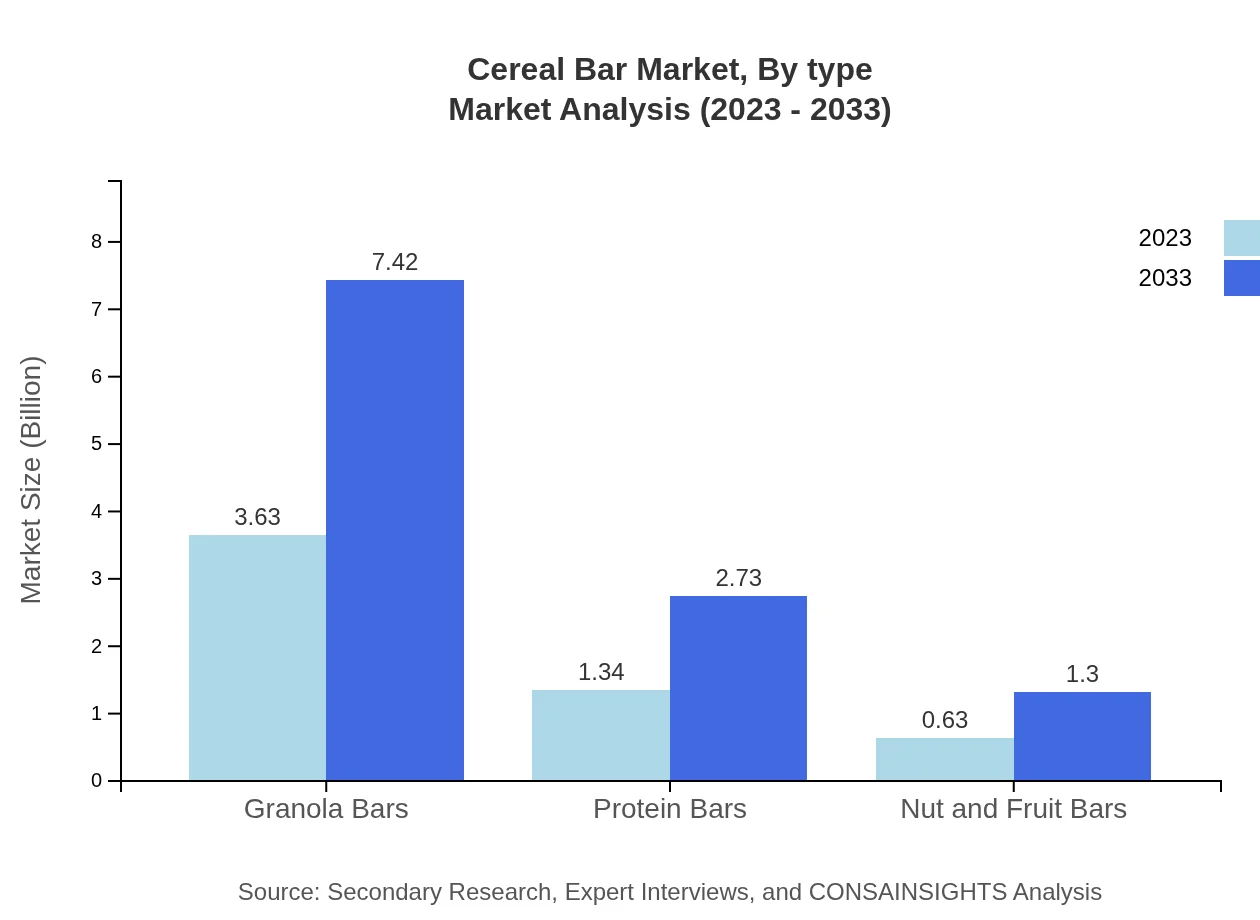

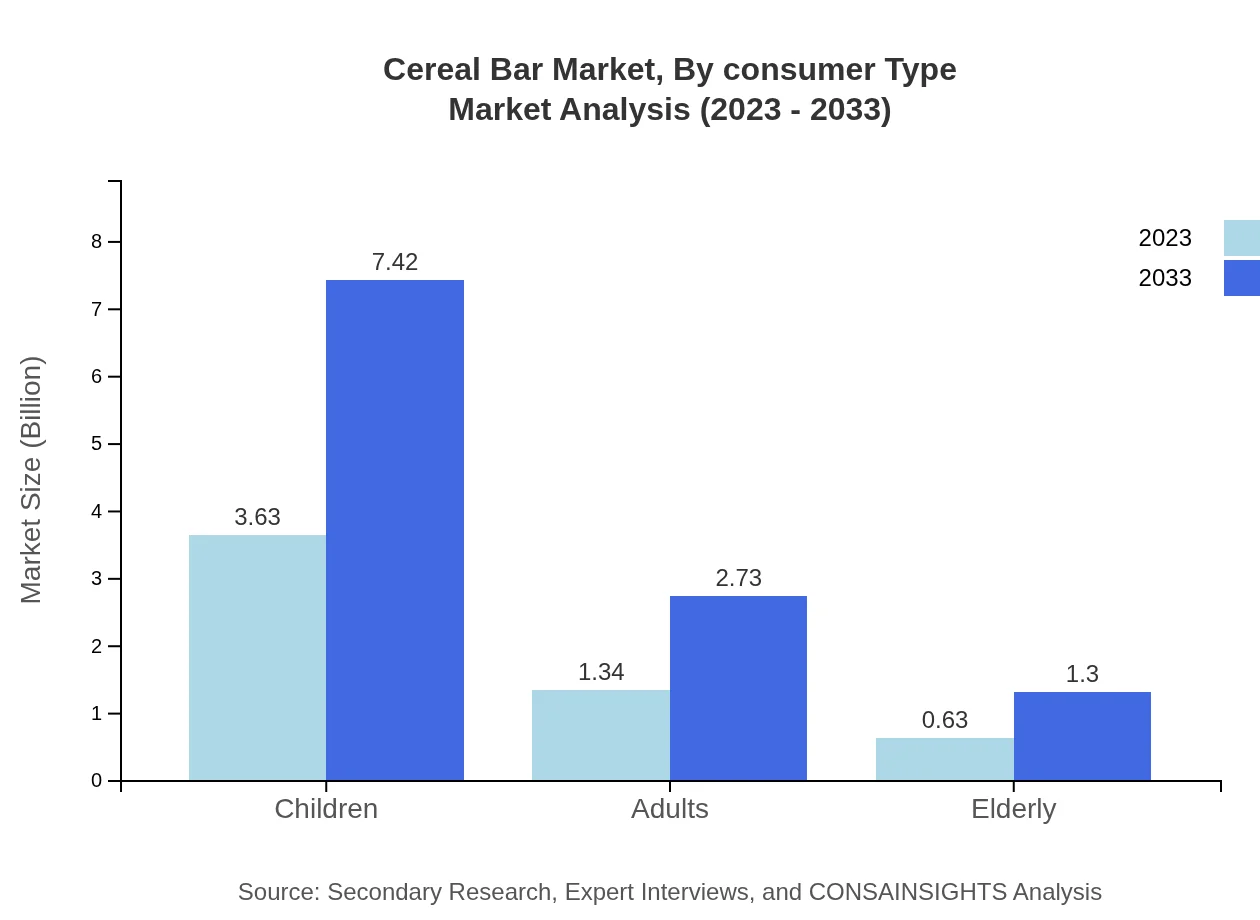

Cereal Bar Market Analysis By Type

The cereal bar market consists predominantly of granola bars, which have been the primary product type, holding a market size of approximately $3.63 billion in 2023 set to double to $7.42 billion by 2033. Protein bars follow, estimated at $1.34 billion in 2023, with growth to $2.73 billion projected. Nut and fruit bars, with a market size of $0.63 billion in 2023, are also gaining popularity, expected to reach $1.30 billion by 2033.

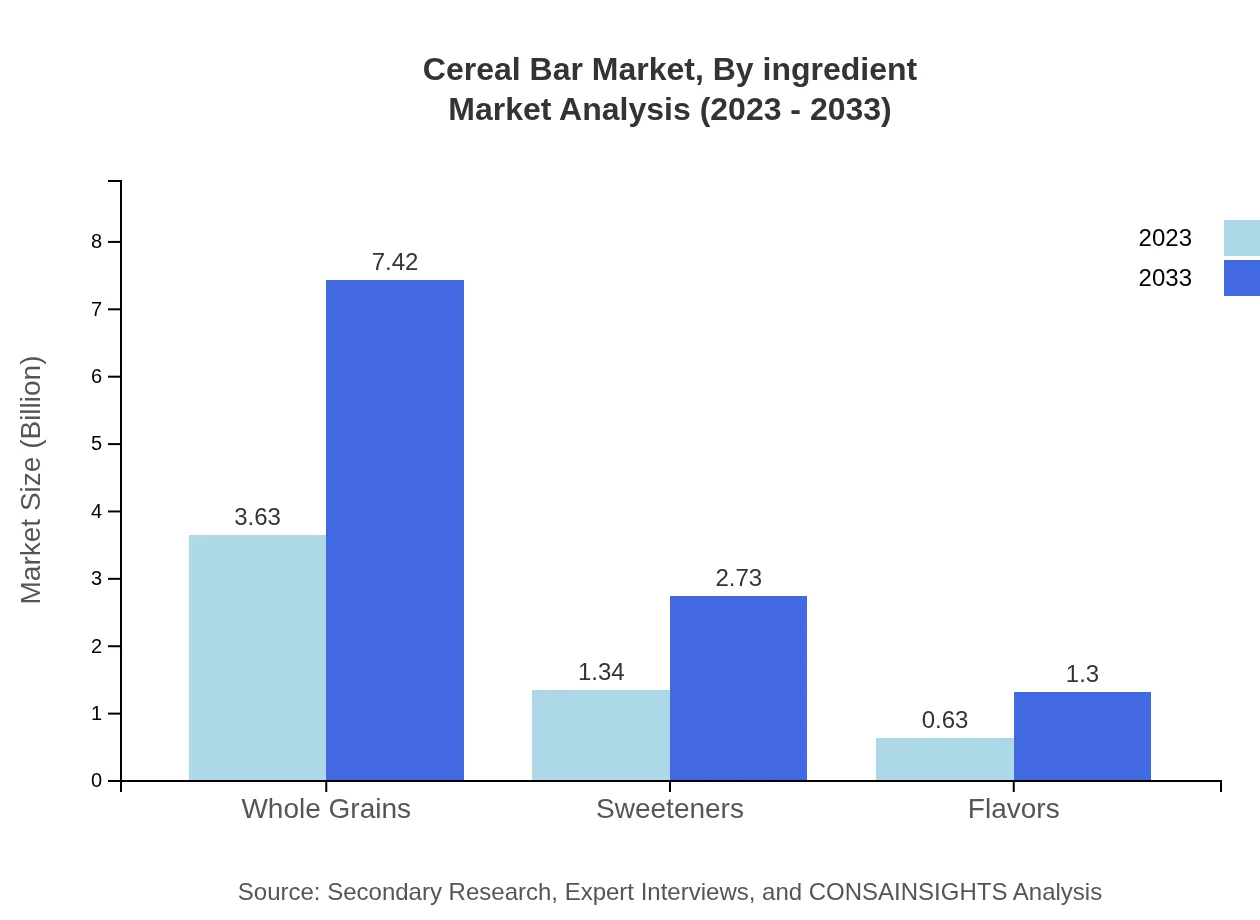

Cereal Bar Market Analysis By Ingredient

The key ingredient segments in the cereal bar market include granola, protein, and whole grains. Granola remains the preferred ingredient, with a market share of 64.81% in 2023 and projected to maintain this share through 2033. Protein content is also significant, represented by a share of 23.86% in 2023. Nut and seed ingredients contribute to the unique flavor profiles that resonate with consumers looking for nutritious snacks.

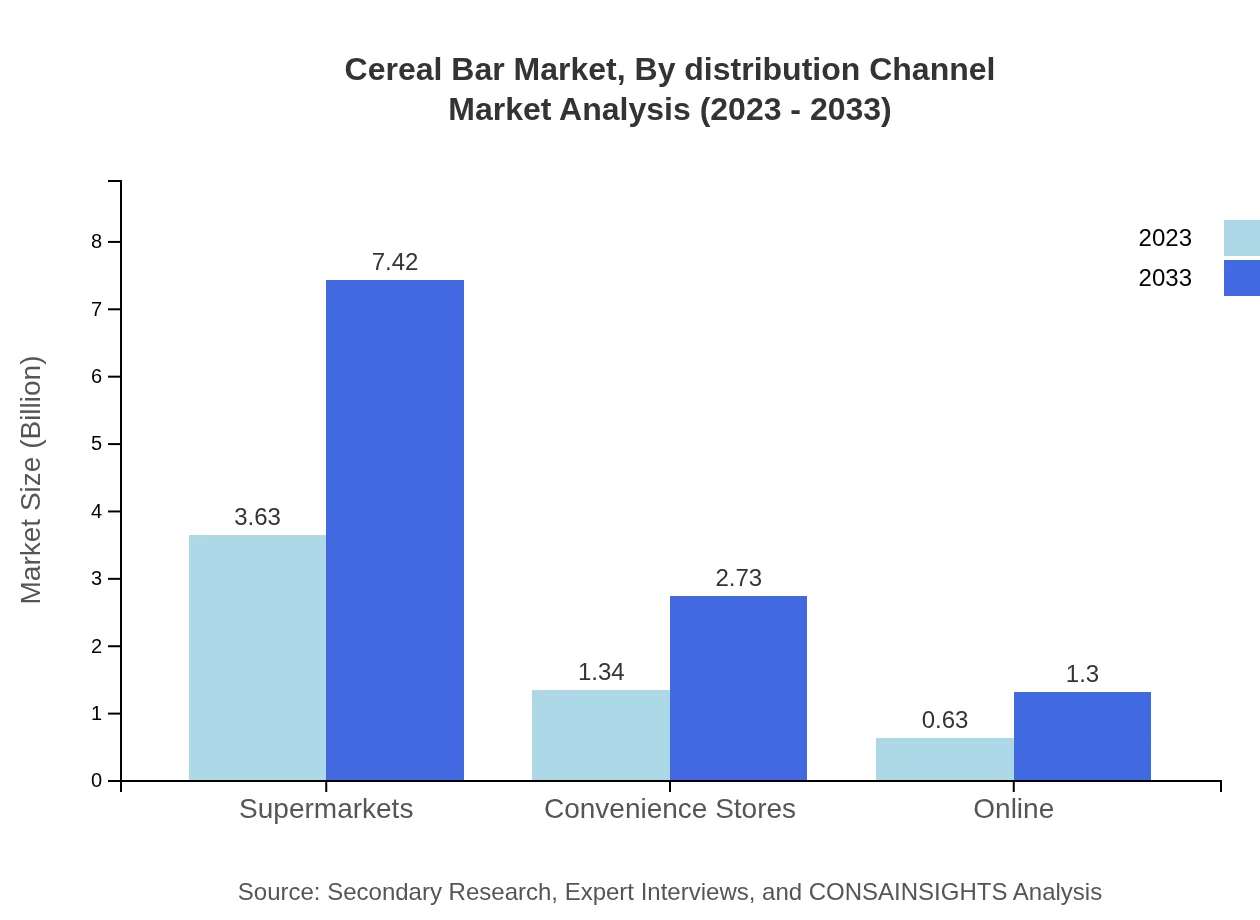

Cereal Bar Market Analysis By Distribution Channel

Key distribution channels for the cereal bar market include supermarkets, convenience stores, and online platforms. Supermarkets dominate the distribution landscape with a market share of 64.81% in 2023. Convenience stores, with 23.86%, and online platforms at 11.33% are also growing in importance as consumer preferences shift towards convenient shopping options.

Cereal Bar Market Analysis By Consumer Type

The consumer type segmentation highlights significant demand from children, adults, and the elderly. Children’s products account for 64.81% of the market share in 2023, while adults represent about 23.86%. The elderly demographic, often looking for convenient nutrition, shows a growing interest in cereal bars, comprising an 11.33% share and expected to expand.

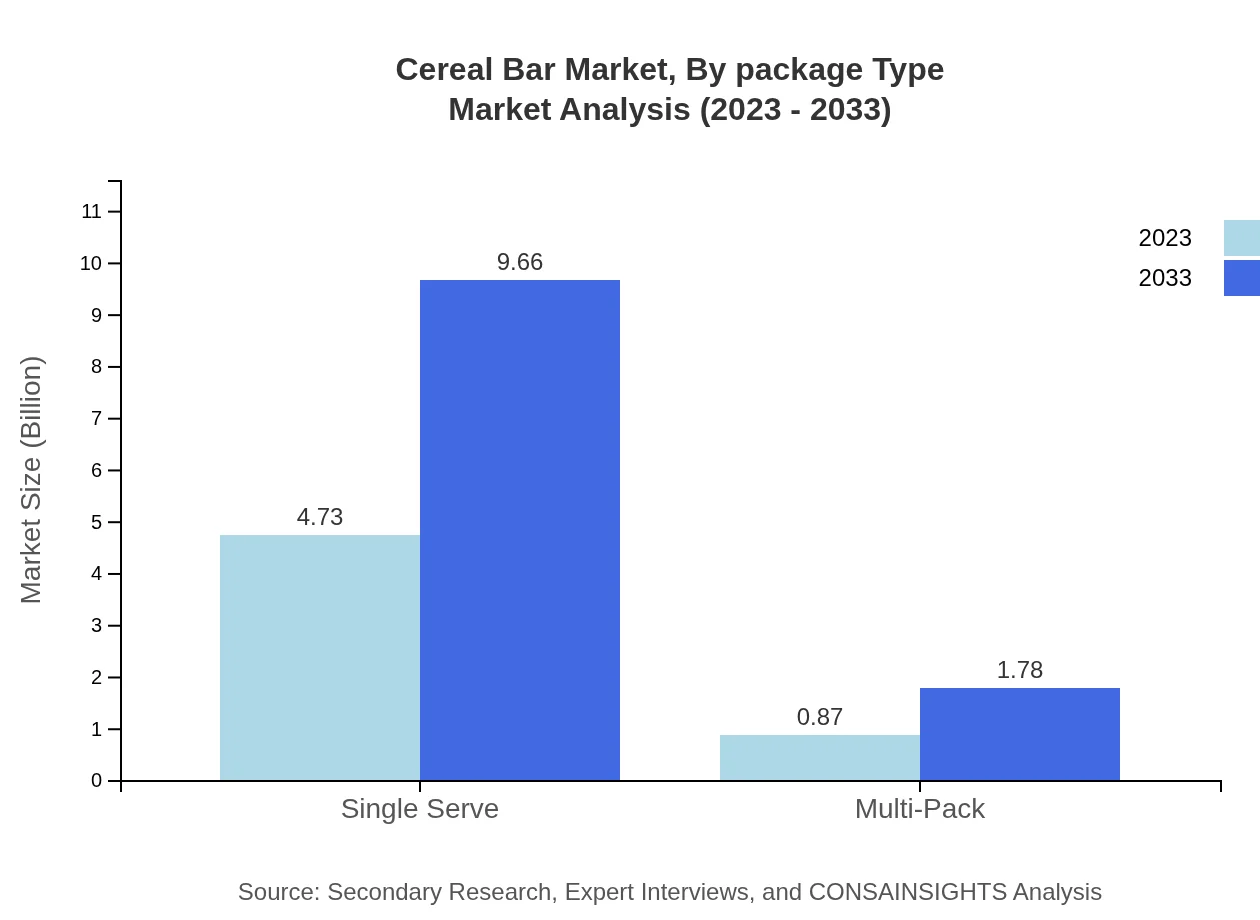

Cereal Bar Market Analysis By Package Type

Package type segmentation is another critical aspect of the cereal bar market. Single-serve packaging dominates the market with an 84.41% share in 2023, reflecting consumer demand for convenient, ready-to-eat products. Multi-pack options represent a smaller share at 15.59%, attracting families and bulk-buy consumers.

Cereal Bar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cereal Bar Industry

General Mills, Inc.:

General Mills is a leading manufacturer of cereal bars, known for its wide portfolio including brands like Nature Valley and Larabar, which emphasize wholesome ingredients and convenience.Quaker Oats Company (PepsiCo):

Quaker Oats offers a variety of popular cereal bars, including Quaker Chewy Bars, focusing on sweet and savory flavors suitable for all ages.Kraft Heinz Company:

Kraft Heinz has established itself in the cereal bar market with its Nutri-Grain brand, appealing to health-conscious consumers looking for nutritious snack options.Clif Bar & Company:

Clif Bar specializes in organic and energy bars, promoting healthy, active lifestyles and aligning with growing consumer trends toward organic and plant-based snacks.We're grateful to work with incredible clients.

FAQs

What is the market size of cereal Bar?

The global cereal bar market was valued at approximately $5.6 billion in 2023 and is expected to grow at a CAGR of 7.2%, likely reaching significant figures by 2033.

What are the key market players or companies in this cereal Bar industry?

Key players in the cereal bar industry include major brands like Kellogg’s, Nature Valley, and KIND, which dominate the market through a variety of product offerings and strong distribution channels.

What are the primary factors driving the growth in the cereal bar industry?

Growth in the cereal bar market is driven by increasing health consciousness, demand for on-the-go snacks, and rising investments in innovative flavors and formulations targeting diverse consumer segments.

Which region is the fastest Growing in the cereal Bar?

The Asia Pacific region is projected to be the fastest-growing in the cereal bar market, with growth anticipated from $1.07 billion in 2023 to $2.19 billion by 2033.

Does ConsaInsights provide customized market report data for the cereal Bar industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications, catering to specific needs within the cereal bar industry.

What deliverables can I expect from this cereal Bar market research project?

From this market research project, you can expect comprehensive reports, market forecasts, competitor analysis, and insights into consumer preferences within the cereal bar landscape.

What are the market trends of cereal Bar?

Current market trends in the cereal bar industry include a rise in demand for healthier ingredients, innovative flavors, and targeted products like protein bars for fitness enthusiasts.