Cereal Ingredients Market Report

Published Date: 31 January 2026 | Report Code: cereal-ingredients

Cereal Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Cereal Ingredients market, providing insights into market dynamics, forecasts from 2023 to 2033, and comprehensive data on market trends, segmentation, and regional analyses.

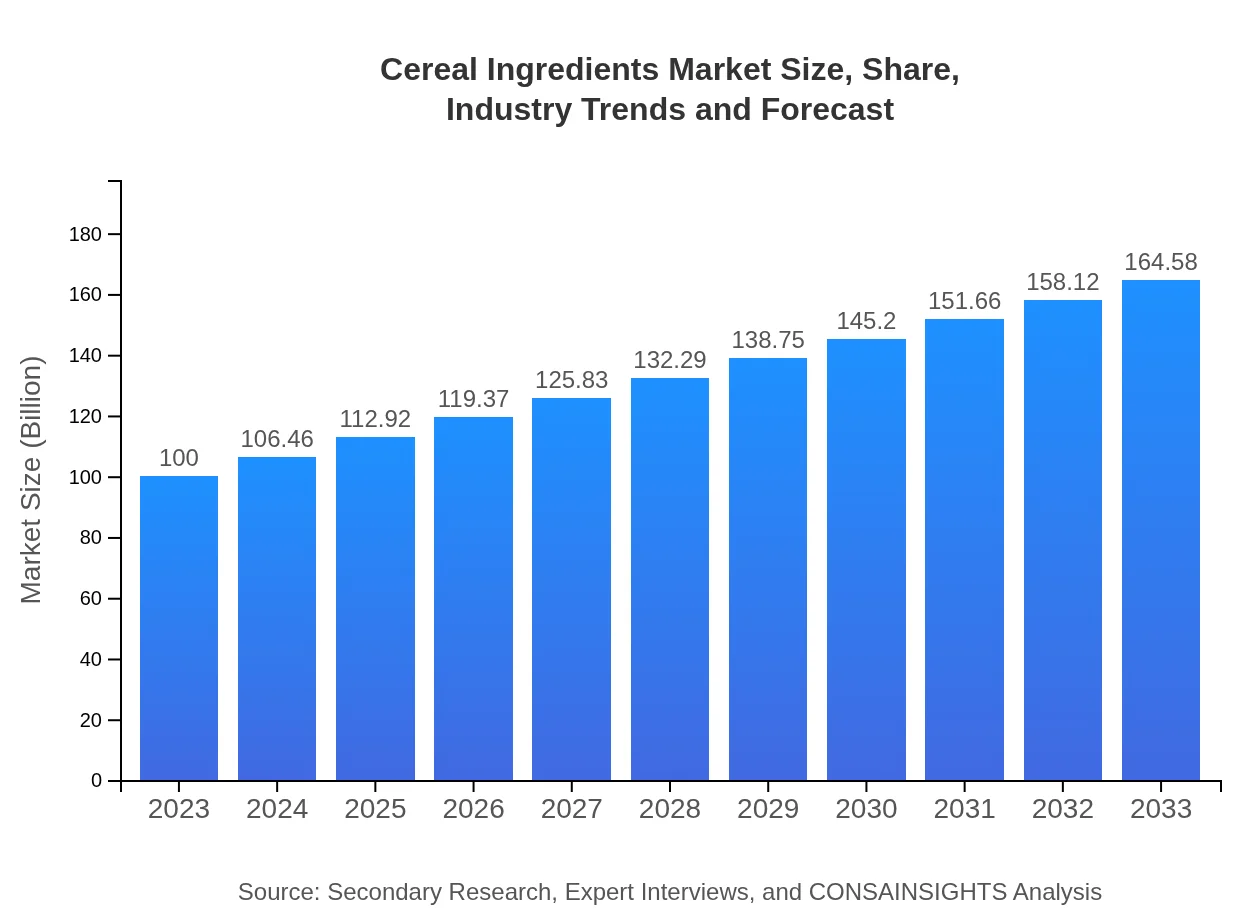

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | General Mills, Kraft Heinz, Kellogg Company, PepsiCo, Post Holdings |

| Last Modified Date | 31 January 2026 |

Cereal Ingredients Market Overview

Customize Cereal Ingredients Market Report market research report

- ✔ Get in-depth analysis of Cereal Ingredients market size, growth, and forecasts.

- ✔ Understand Cereal Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cereal Ingredients

What is the Market Size & CAGR of Cereal Ingredients market in 2023-2033?

Cereal Ingredients Industry Analysis

Cereal Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cereal Ingredients Market Analysis Report by Region

Europe Cereal Ingredients Market Report:

Europe's Cereal Ingredients market is anticipated to grow from $28.43 billion in 2023 to $46.79 billion by 2033, influenced by stringent regulations on food quality and increasing consumer preference for organic products. The UK and Germany are at the forefront, engaging consumers with innovative formulations and health-oriented marketing strategies.Asia Pacific Cereal Ingredients Market Report:

The Cereal Ingredients market in the Asia Pacific region was valued at $18.60 billion in 2023 and is expected to reach $30.61 billion by 2033. This rapid growth is fueled by increasing urbanization, dietary changes among consumers, and an expanding middle class seeking convenient and healthier food options. Countries like China and India remain pivotal in driving market trends, supported by evolving consumer tastes and preferences.North America Cereal Ingredients Market Report:

North America, significant in the global landscape, holds a market size of $38.36 billion in 2023, expected to surge to $63.13 billion by 2033. The demand for functional foods and a growing inclination towards snack-based diets are key drivers. Major players in the U.S. are focusing on clean-label products that resonate with health-conscious consumers.South America Cereal Ingredients Market Report:

In South America, the market for Cereal Ingredients is projected to grow from $4.04 billion in 2023 to $6.65 billion by 2033. A growing population and shifts towards healthier eating habits are propelling this growth. Brazil and Argentina are leading contributors, with innovations in local cereals and grains better positioning them in the market.Middle East & Africa Cereal Ingredients Market Report:

In the Middle East and Africa, the market for Cereal Ingredients is expected to expand from $10.57 billion in 2023 to $17.40 billion by 2033. Increased focus on nutrition and rising levels of income are contributing to the growth pattern, with an emphasis on sustainable agriculture practices as regional consumers become more health-aware.Tell us your focus area and get a customized research report.

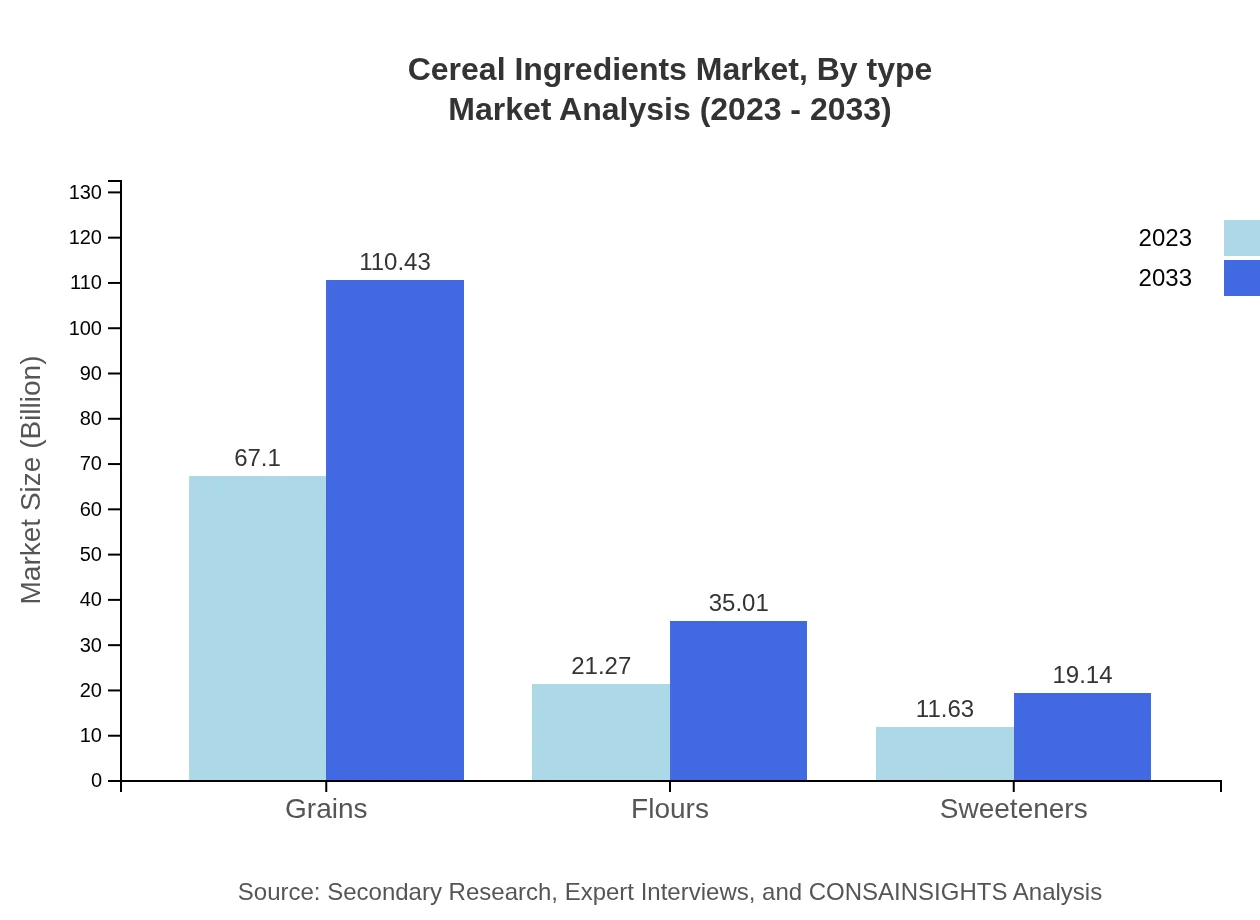

Cereal Ingredients Market Analysis By Type

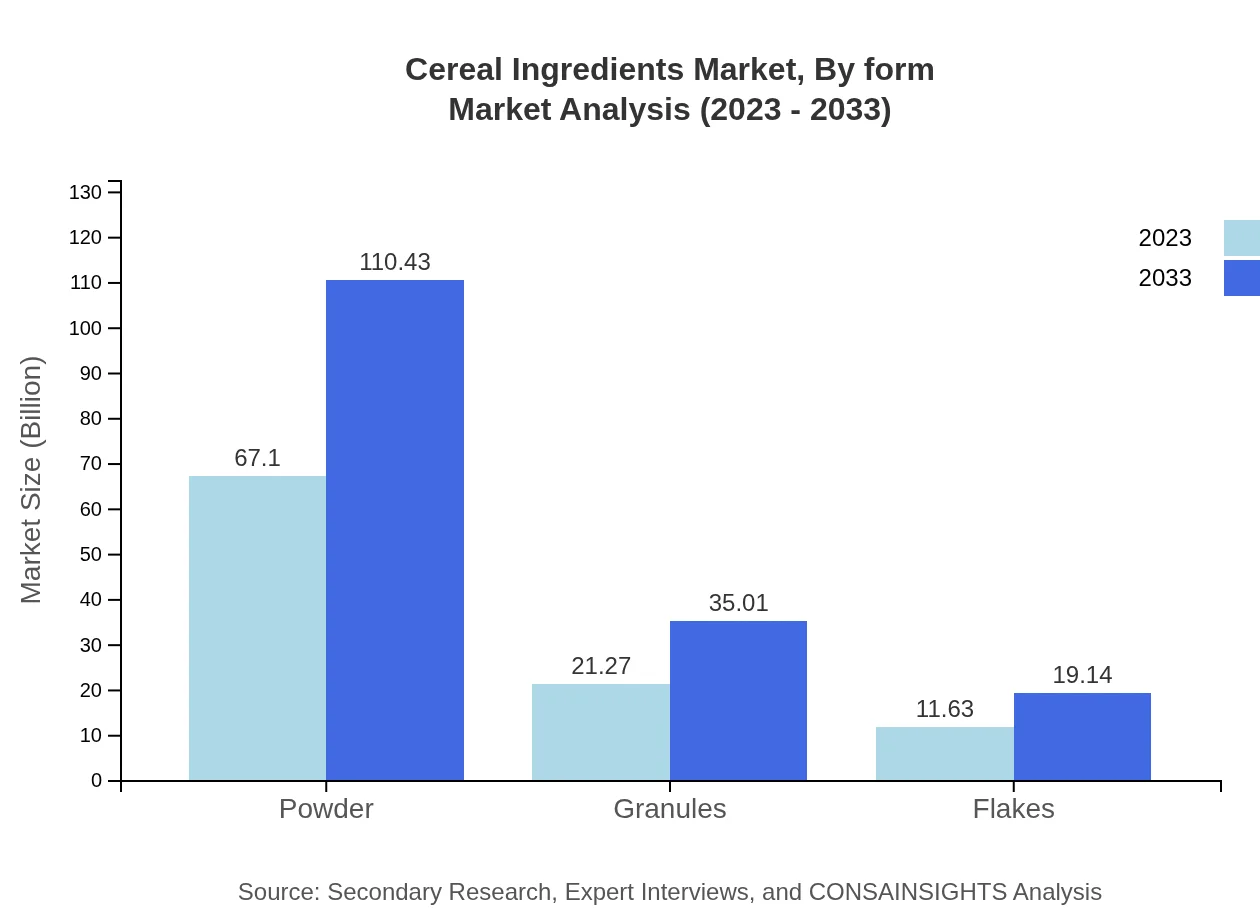

The types of Cereal Ingredients are primarily categorized as Powders, Granules, Flakes, and others. The Powder segment dominates with a market size of $67.10 billion in 2023, projected to reach $110.43 billion by 2033, reflecting a robust share of 67.1%. Granules follow with a size of $21.27 billion in 2023, expected to grow significantly to $35.01 billion. Flakes, albeit smaller with $11.63 billion currently, will also see proportional gains in the coming years, showcasing the diversity in consumer tastes.

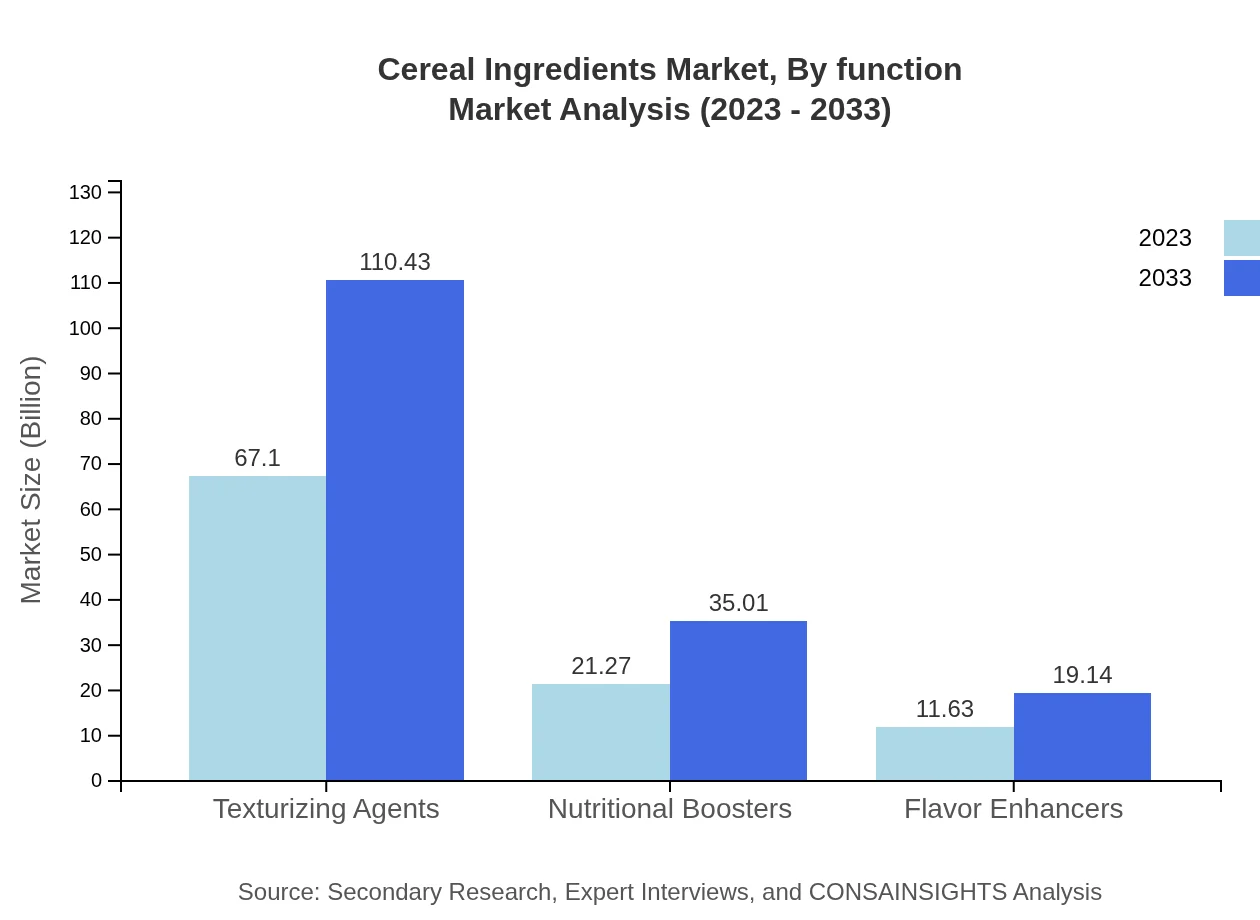

Cereal Ingredients Market Analysis By Function

The functions of Cereal Ingredients primarily include Texturizing Agents, Nutritional Boosters, and Flavor Enhancers. Texturizing Agents are the largest segment, capturing $67.10 billion in size and projecting a similar market share. Nutritional Boosters are important for their growing role in enhancing food products, currently valued at $21.27 billion with a promising future. Flavor Enhancers also hold a niche market share of $11.63 billion, primarily for engaging taste in various food products.

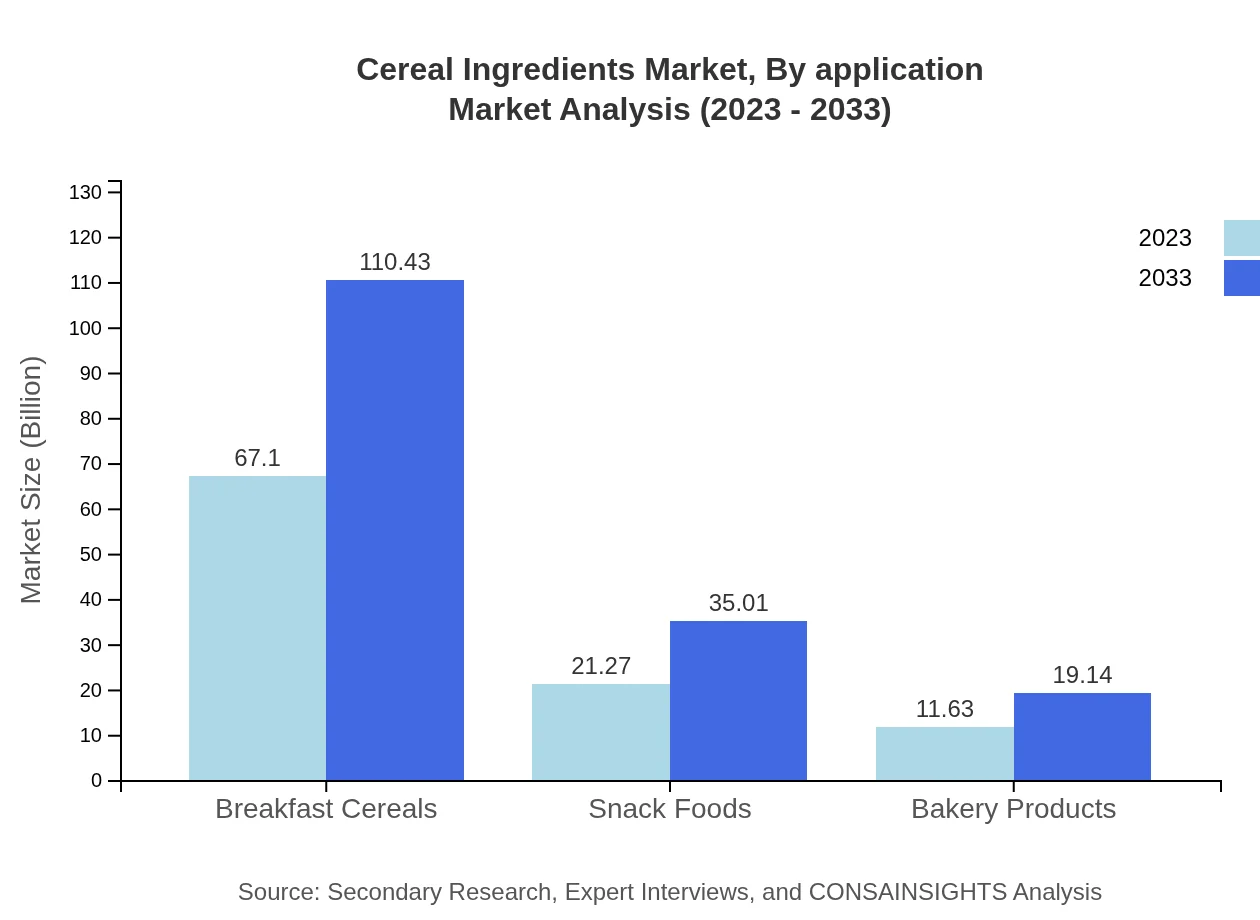

Cereal Ingredients Market Analysis By Application

Applications are foundational in defining the Cereal Ingredients Market. The Breakfast Cereals segment is leading with $67.10 billion in size. Snack Foods and Bakery Products segments are also gaining traction, estimated at $21.27 billion and $11.63 billion respectively. These segments serve a variety of consumer bases and are increasingly influenced by trends in health and convenience.

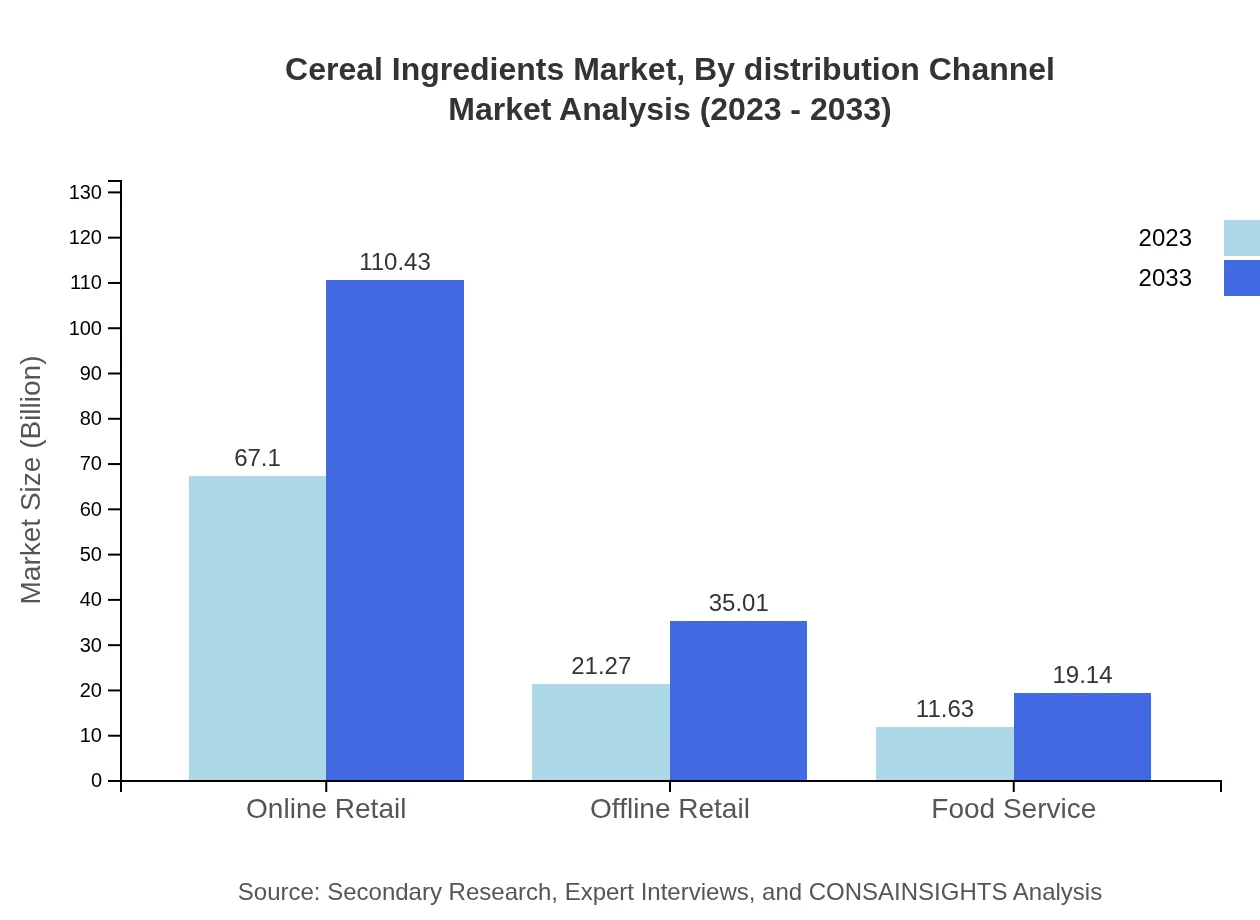

Cereal Ingredients Market Analysis By Distribution Channel

The distribution channels for Cereal Ingredients include Online Retail, Offline Retail, and Food Service. Online Retail currently leads by size with $67.10 billion and a steady share, supported by the shift towards e-commerce in food sales. Offline Retail and Food Service are also essential segments, valued at $21.27 billion and $11.63 billion respectively, demonstrating the multifaceted approach required to reach consumers effectively.

Cereal Ingredients Market Analysis By Form

In terms of form, Cereal Ingredients are mainly available as Powders, Granules, and Flakes. Each form contributes uniquely to food products. Powders dominate in versatility, Granules offer distinct textures, and Flakes cater to crispness preferences in snacks and cereals. The performance of these forms highlights the critical nature of consumer choice in product development.

Cereal Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cereal Ingredients Industry

General Mills:

A major player in the food industry known for its innovative cereal products, General Mills has embraced sustainability and health-conscious ingredients.Kraft Heinz:

With a strong portfolio in snacks and breakfast offerings, Kraft Heinz continually invests in R&D to cater to changing dietary trends.Kellogg Company:

Kellogg is a leader in breakfast cereals, committed to nutritional innovation and health-focused product development.PepsiCo:

PepsiCo's cereal brands are integral to its portfolio, aligning with health trends through reduced sugar options and fortified products.Post Holdings:

Specializing in consumer-packaged goods, Post Holdings focuses on expanding its cereal range, emphasizing whole grain and natural ingredients.We're grateful to work with incredible clients.

FAQs

What is the market size of cereal ingredients?

The global cereal ingredients market is currently valued at approximately $100 million, with a forecasted compound annual growth rate (CAGR) of 5% from 2023 to 2033, indicating promising growth prospects in the upcoming decade.

What are the key market players or companies in this cereal ingredients industry?

Prominent players in the cereal ingredients industry include major companies like Cargill, Archer Daniels Midland Company, and Bunge Limited. These organizations play significant roles in shaping market dynamics via innovative product development and sustainable practices.

What are the primary factors driving the growth in the cereal ingredients industry?

Key growth drivers include increasing demand for healthy breakfast choices, the rise in consumer health consciousness, and innovations in food production technologies that enable more efficient manufacturing and product diversification.

Which region is the fastest Growing in the cereal ingredients market?

The fastest-growing region is North America, with its market projected to grow from $38.36 million in 2023 to approximately $63.13 million by 2033. This growth is fueled by rising health awareness and demand for convenience foods.

Does ConsaInsights provide customized market report data for the cereal ingredients industry?

Yes, ConsaInsights offers tailored market reports for the cereal ingredients industry, allowing clients to specify their needs, ensuring that data and insights align with particular business objectives and market requirements.

What deliverables can I expect from this cereal ingredients market research project?

Deliverables include a comprehensive market analysis report, segmentation data, growth forecasts, competitive landscape assessments, and insights on regional trends, ensuring a holistic understanding of market dynamics.

What are the market trends of cereal ingredients?

Current trends in the cereal ingredients market highlight the growing adoption of natural ingredients and gluten-free products, increased online retailing, and innovations in flavors and textures, enhancing consumer engagement and experience.