Chatbot Market Report

Published Date: 31 January 2026 | Report Code: chatbot

Chatbot Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the chatbot market covering key insights, current trends, and forecasts from 2023 to 2033. It delves into market size, growth rates, industry challenges, and segmentation for informed decision-making.

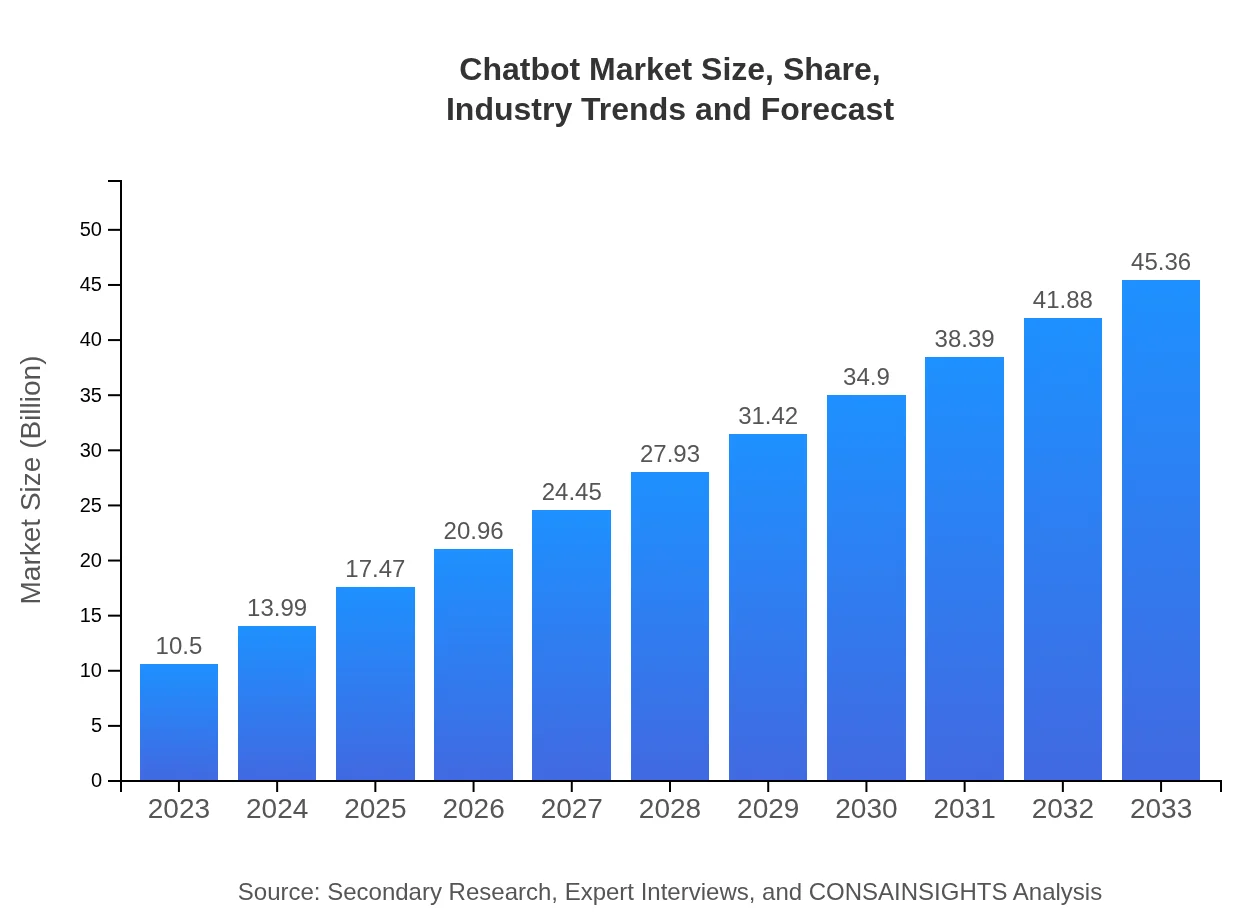

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $45.36 Billion |

| Top Companies | Salesforce, Google, IBM, Microsoft, LivePerson |

| Last Modified Date | 31 January 2026 |

Chatbot Market Overview

Customize Chatbot Market Report market research report

- ✔ Get in-depth analysis of Chatbot market size, growth, and forecasts.

- ✔ Understand Chatbot's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chatbot

What is the Market Size & CAGR of Chatbot market in 2023?

Chatbot Industry Analysis

Chatbot Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chatbot Market Analysis Report by Region

Europe Chatbot Market Report:

The European chatbot market, valued at $2.56 billion in 2023, is expected to reach $11.06 billion by 2033. The proliferation of AI technology and increasing regulatory pressures to improve customer service are central factors fueling market growth in this region.Asia Pacific Chatbot Market Report:

In the Asia Pacific region, the chatbot market is expected to grow from $2.23 billion in 2023 to $9.62 billion by 2033. A surge in digital transformation initiatives across countries like China and India is a primary driver. Additionally, the rising adoption of chatbot solutions in e-commerce and healthcare sectors underscores the market's growth potential.North America Chatbot Market Report:

North America is anticipated to dominate the chatbot market, with growth from $4.04 billion in 2023 to $17.47 billion by 2033. The region's advanced technological infrastructure, investment in AI, and high adoption rate of automation technologies in industries like finance and retail are pivotal to this growth.South America Chatbot Market Report:

The South American chatbot market is projected to grow from $0.32 billion in 2023 to $1.40 billion by 2033, reflecting a growing interest in AI technology. As businesses in Brazil and Argentina adopt digital customer engagement strategies, the demand for chatbots is expected to rise.Middle East & Africa Chatbot Market Report:

The Middle East and Africa chatbot market is projected to grow from $1.35 billion in 2023 to $5.81 billion by 2033. The increasing digitization of businesses and a focus on enhancing customer experiences in sectors such as telecommunications and hospitality drive the adoption of chatbot technology.Tell us your focus area and get a customized research report.

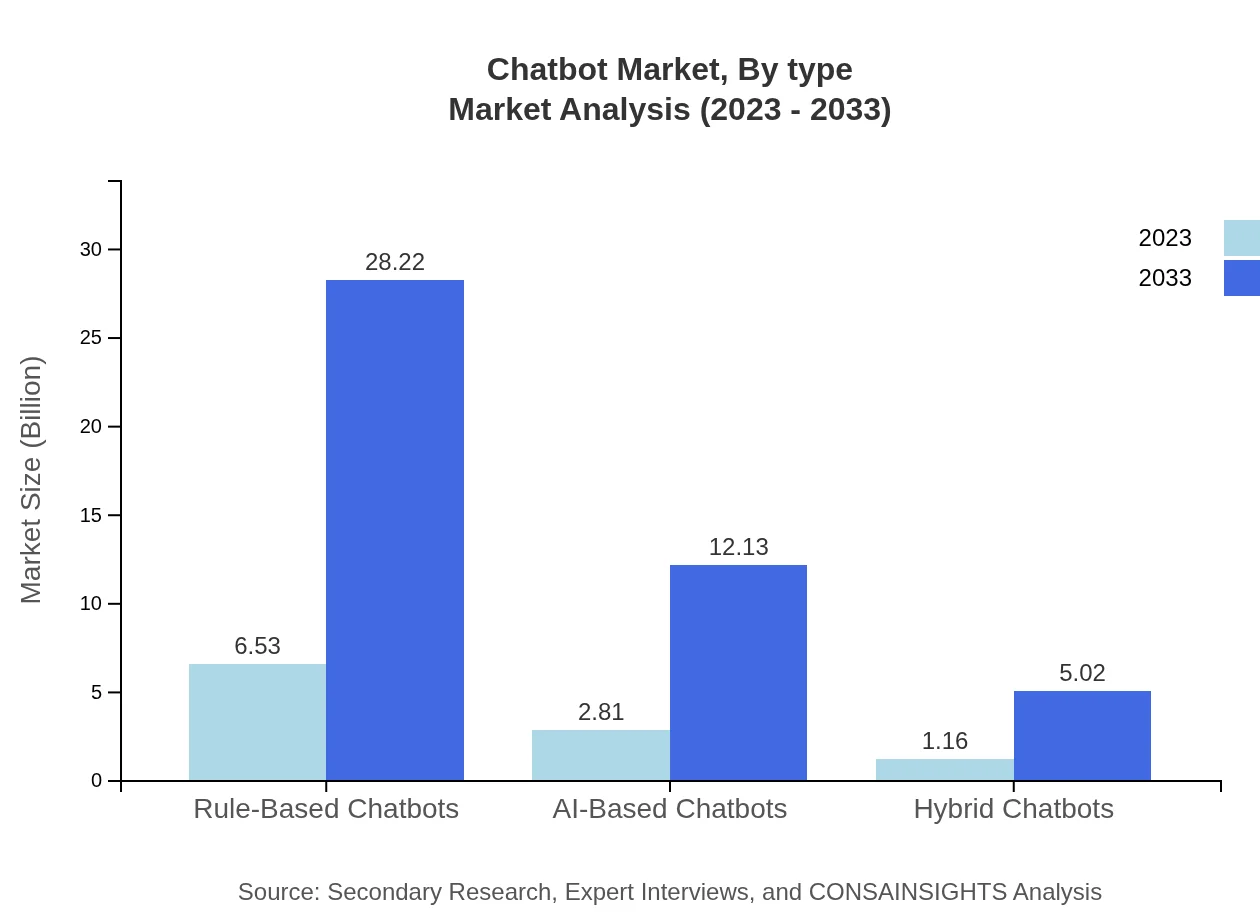

Chatbot Market Analysis By Type

The chatbot market is segmented by type into Rule-Based Chatbots, AI-Based Chatbots, and Hybrid Chatbots. Rule-based chatbots dominate the market with a size of $6.53 billion in 2023, expanding to $28.22 billion by 2033, retaining a share of 62.2%. AI-based chatbots, valued at $2.81 billion in 2023, are forecasted to grow to $12.13 billion, with a market share of 26.74%. Meanwhile, hybrid chatbots are expected to grow from $1.16 billion to $5.02 billion, maintaining an 11.06% share.

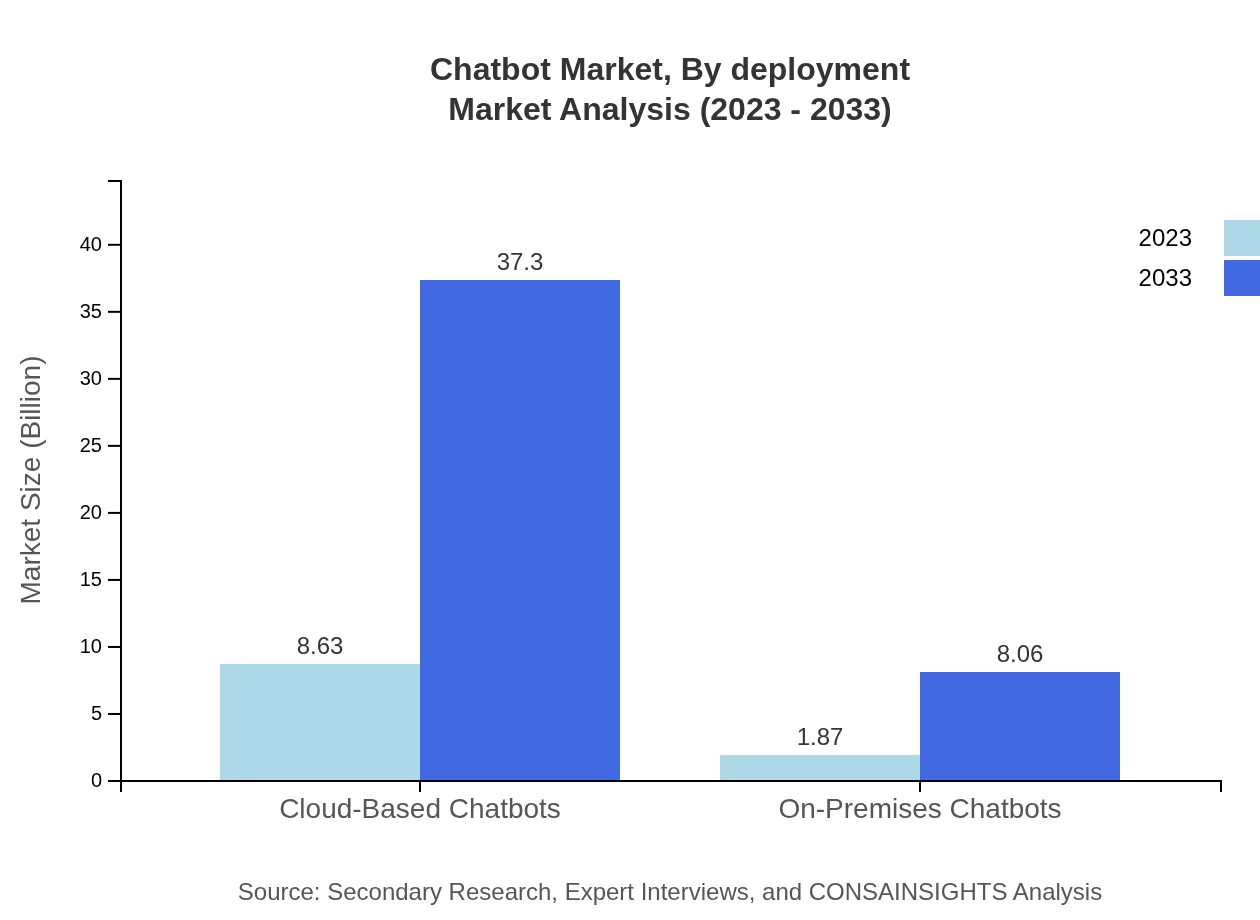

Chatbot Market Analysis By Deployment

The deployment segment includes Cloud-Based and On-Premises chatbots. Cloud-Based Chatbots are leading this segment, valued at $8.63 billion in 2023 and projected to grow to $37.30 billion by 2033, holding a substantial market share of 82.23%. On-Premises Chatbots account for $1.87 billion in 2023, expected to expand to $8.06 billion, with a share of 17.77%.

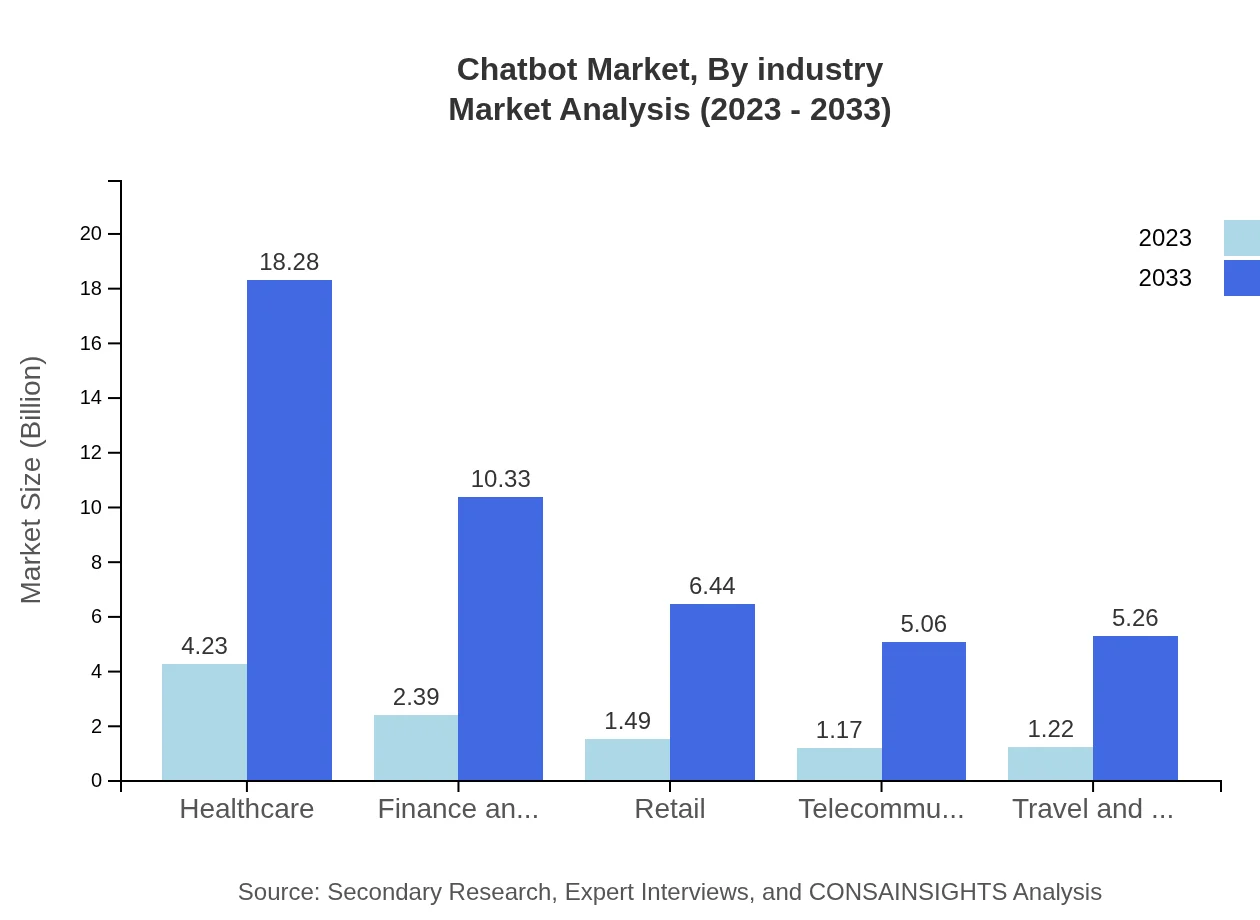

Chatbot Market Analysis By Industry

In terms of industry application, domains such as Healthcare, Finance and Banking, Retail, and Telecommunications are major contributors. The healthcare chatbot market is projected to grow from $4.23 billion in 2023 to $18.28 billion by 2033, capturing 40.29% of the market. The Finance and Banking segment is also significant, expected to grow from $2.39 billion to $10.33 billion, reflecting a share of 22.78%. Retail and Telecommunications sectors are expected to develop significantly as well.

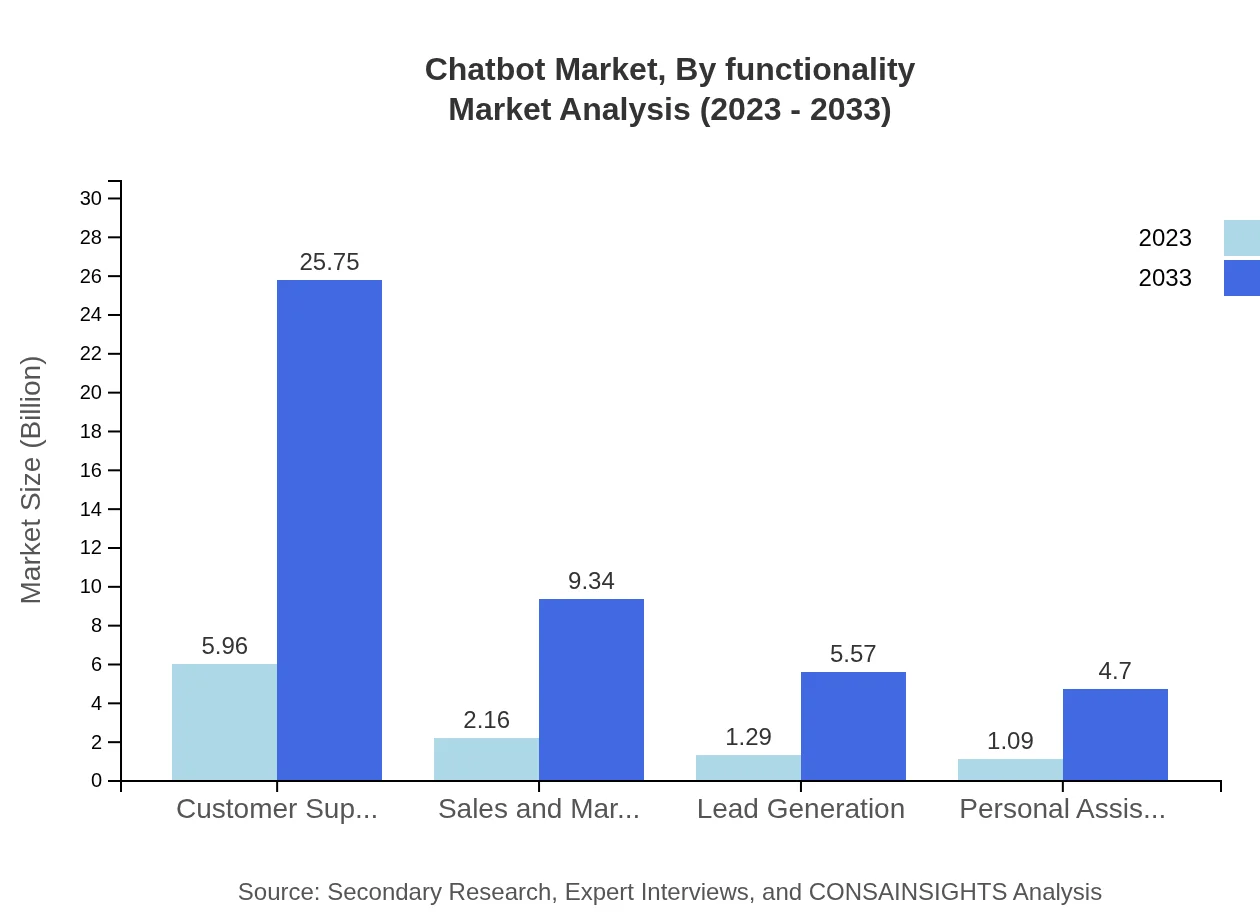

Chatbot Market Analysis By Functionality

Functionally, chatbots serve various purposes, including Customer Support, Sales and Marketing, Lead Generation, and Personal Assistance. The Customer Support segment is dominant, with growth projections from $5.96 billion in 2023 to $25.75 billion by 2033, holding a significant market share of 56.76%. Sales and Marketing functionalities are also growing, set to expand from $2.16 billion to $9.34 billion with a market share of 20.6%.

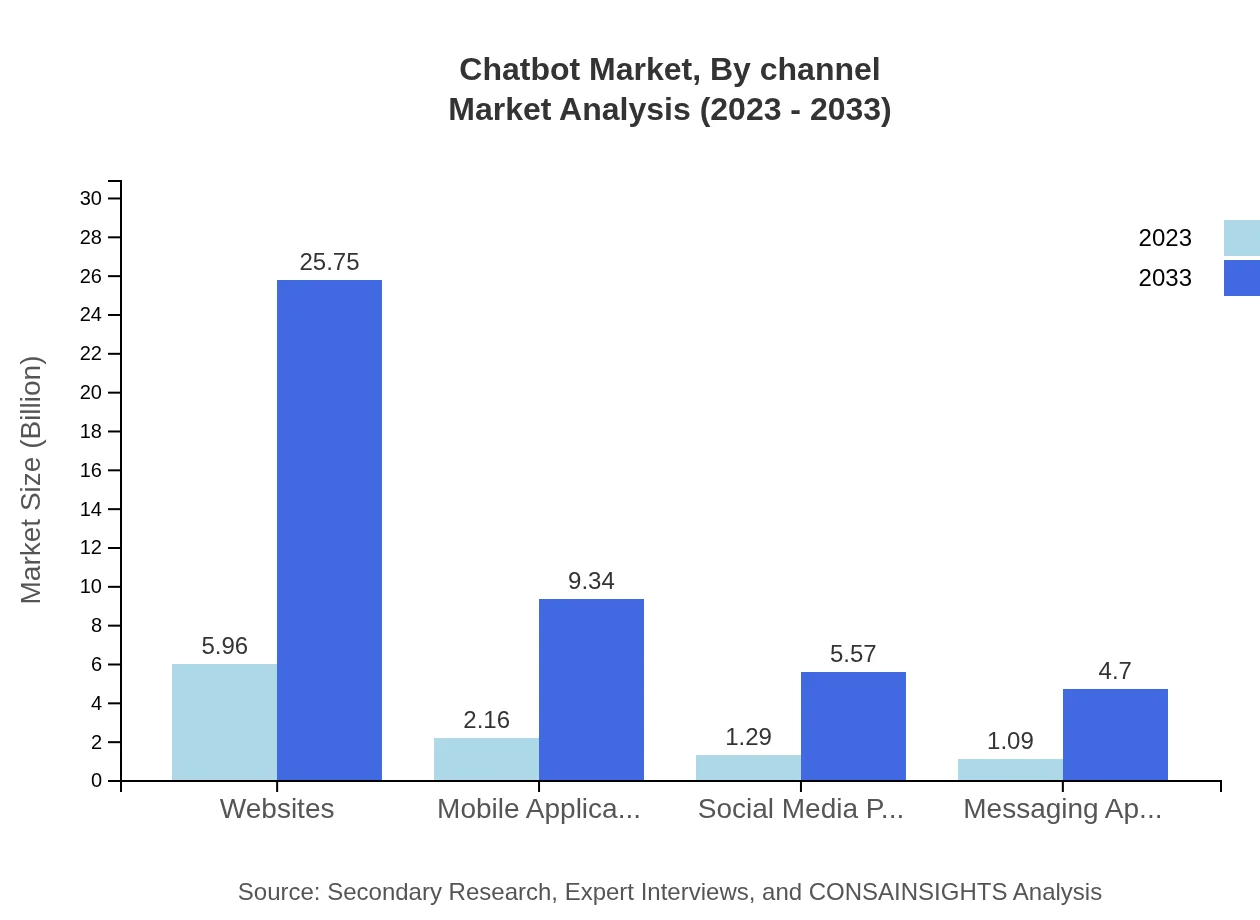

Chatbot Market Analysis By Channel

The channels segment includes Websites, Mobile Applications, Social Media Platforms, and Messaging Apps. Websites are significant, projected to grow from $5.96 billion to $25.75 billion, holding a 56.76% share in 2023. Mobile applications are anticipated to grow from $2.16 billion to $9.34 billion, while Messaging Applications will grow from $1.09 billion to $4.70 billion.

Chatbot Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chatbot Industry

Salesforce:

Salesforce provides cloud-based customer service solutions with integrated chatbots that enhance real-time customer interactions and automate responses.Google:

Google offers AI-driven chatbot technology, utilizing its natural language processing capabilities through Google Assistant to provide conversational assistance across various platforms.IBM:

IBM Watson is a prominent player in AI and chatbot solutions, offering customizable and scalable chatbot services for enterprises aiming to improve customer engagement and efficiency.Microsoft:

Microsoft provides a range of bot services integrated with Azure, allowing businesses to create intelligent conversational agents tailored to specific needs in different industries.LivePerson:

Specializing in customer engagement solutions, LivePerson develops advanced chatbots that enable businesses to connect with customers across multiple channels.We're grateful to work with incredible clients.

FAQs

What is the market size of chatbot?

The global chatbot market is valued at approximately $10.5 billion in 2023, with an impressive CAGR of 15%. By 2033, the market is projected to grow significantly, reflecting the increasing adoption of chatbot technologies.

What are the key market players or companies in this chatbot industry?

The chatbot industry features major players like Microsoft, IBM, Google, Amazon, and Facebook, among others, leading in both technology and market share, driving innovations that enhance user experiences and engagement.

What are the primary factors driving the growth in the chatbot industry?

Key drivers of growth in the chatbot industry include increased demand for customer service automation, advancements in AI technology, and growing preference for 24/7 support among consumers, enhancing business efficiency and user satisfaction.

Which region is the fastest Growing in the chatbot?

The fastest-growing region in the chatbot market is North America, expected to rise from $4.04 billion in 2023 to $17.47 billion by 2033. Europe and Asia Pacific also demonstrate significant growth in this sector.

Does ConsaInsights provide customized market report data for the chatbot industry?

Yes, ConsaInsights offers customized market report data, which caters to specific business needs and provides tailored insights that adapt to unique market challenges and opportunities within the chatbot industry.

What deliverables can I expect from this chatbot market research project?

From the chatbot market research project, you can expect detailed market analysis reports, segmentation data, competitive landscape insights, growth forecasts, and actionable recommendations suiting your strategic objectives.

What are the market trends of chatbot?

Current chatbot market trends include the shift towards AI-driven solutions, increased integration with messaging platforms, growing emphasis on multi-language support, and advancements in natural language processing technologies to enhance user interactions.