Chemical Biological- Radiological And Nuclear Security Market Report

Published Date: 03 February 2026 | Report Code: chemical-biological--radiological-and-nuclear-security

Chemical Biological- Radiological And Nuclear Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Chemical Biological, Radiological, and Nuclear (CBRN) security market, including market trends, segmentation, regional analysis, and forecasts from 2023 to 2033.

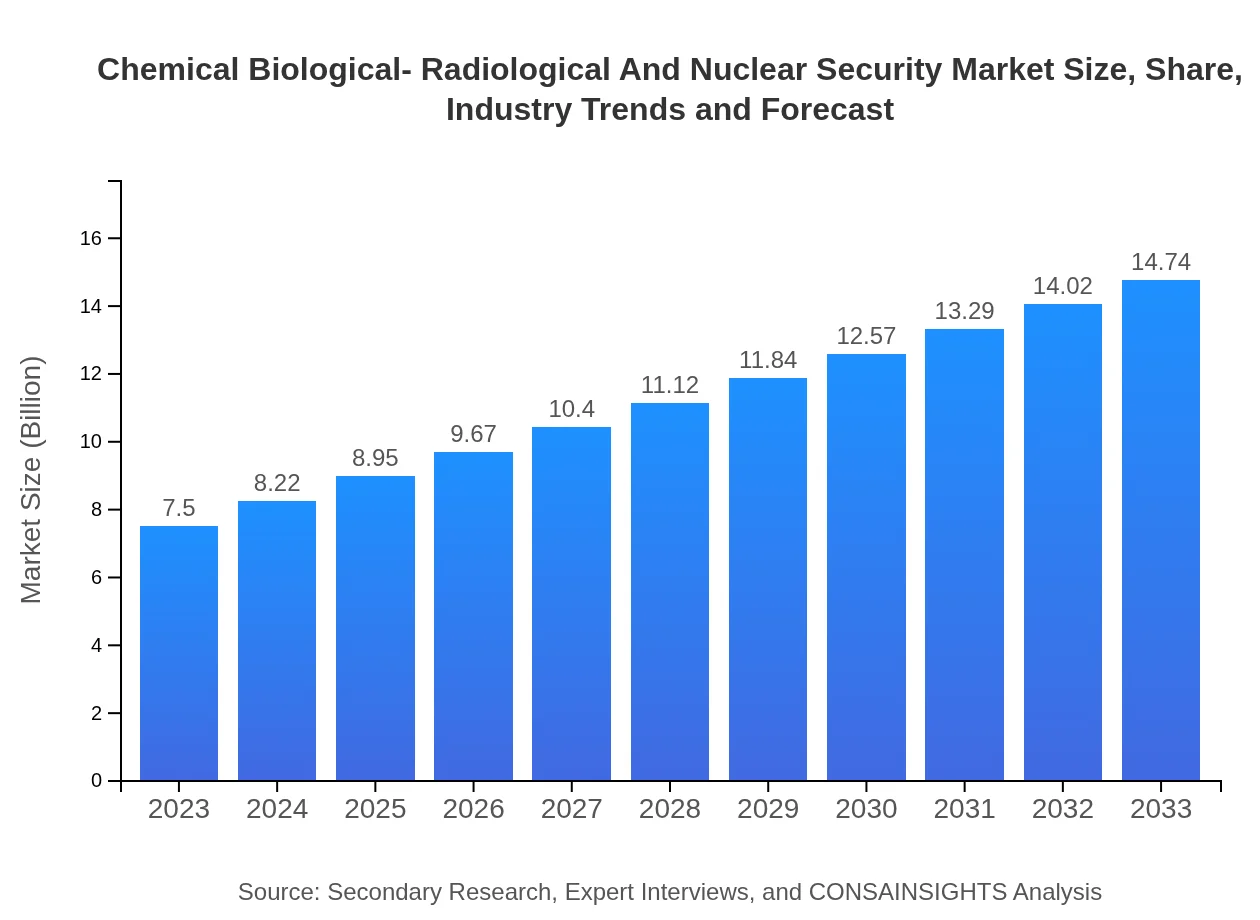

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.74 Billion |

| Top Companies | Smiths Detection, FLIR Systems, L3Harris Technologies, Chemring Group, Thermo Fisher Scientific |

| Last Modified Date | 03 February 2026 |

Chemical Biological- Radiological And Nuclear Security Market Overview

Customize Chemical Biological- Radiological And Nuclear Security Market Report market research report

- ✔ Get in-depth analysis of Chemical Biological- Radiological And Nuclear Security market size, growth, and forecasts.

- ✔ Understand Chemical Biological- Radiological And Nuclear Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chemical Biological- Radiological And Nuclear Security

What is the Market Size & CAGR of Chemical Biological- Radiological And Nuclear Security market in 2023 & 2033?

Chemical Biological- Radiological And Nuclear Security Industry Analysis

Chemical Biological- Radiological And Nuclear Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chemical Biological- Radiological And Nuclear Security Market Analysis Report by Region

Europe Chemical Biological- Radiological And Nuclear Security Market Report:

Europe is forecasted to see growth from $2.83 billion in 2023 to $5.56 billion by 2033, due to stringent regulations regarding public safety and investments in technology.Asia Pacific Chemical Biological- Radiological And Nuclear Security Market Report:

The Asia Pacific region, valued at $1.38 billion in 2023, is anticipated to grow to approximately $2.70 billion by 2033, driven by expanding defense budgets and rising awareness of biological threats.North America Chemical Biological- Radiological And Nuclear Security Market Report:

North America holds a significant market share, with a value of $2.42 billion in 2023, expected to grow to $4.76 billion by 2033, supported by substantial funding for public safety and disaster response initiatives.South America Chemical Biological- Radiological And Nuclear Security Market Report:

In South America, the market is projected to grow from $0.67 billion in 2023 to $1.31 billion by 2033 due to increased investment in border security and combating drug trafficking.Middle East & Africa Chemical Biological- Radiological And Nuclear Security Market Report:

The market in the Middle East and Africa region is small but growing, moving from $0.21 billion in 2023 to $0.41 billion by 2033, as countries enhance their preparedness against CBRN threats.Tell us your focus area and get a customized research report.

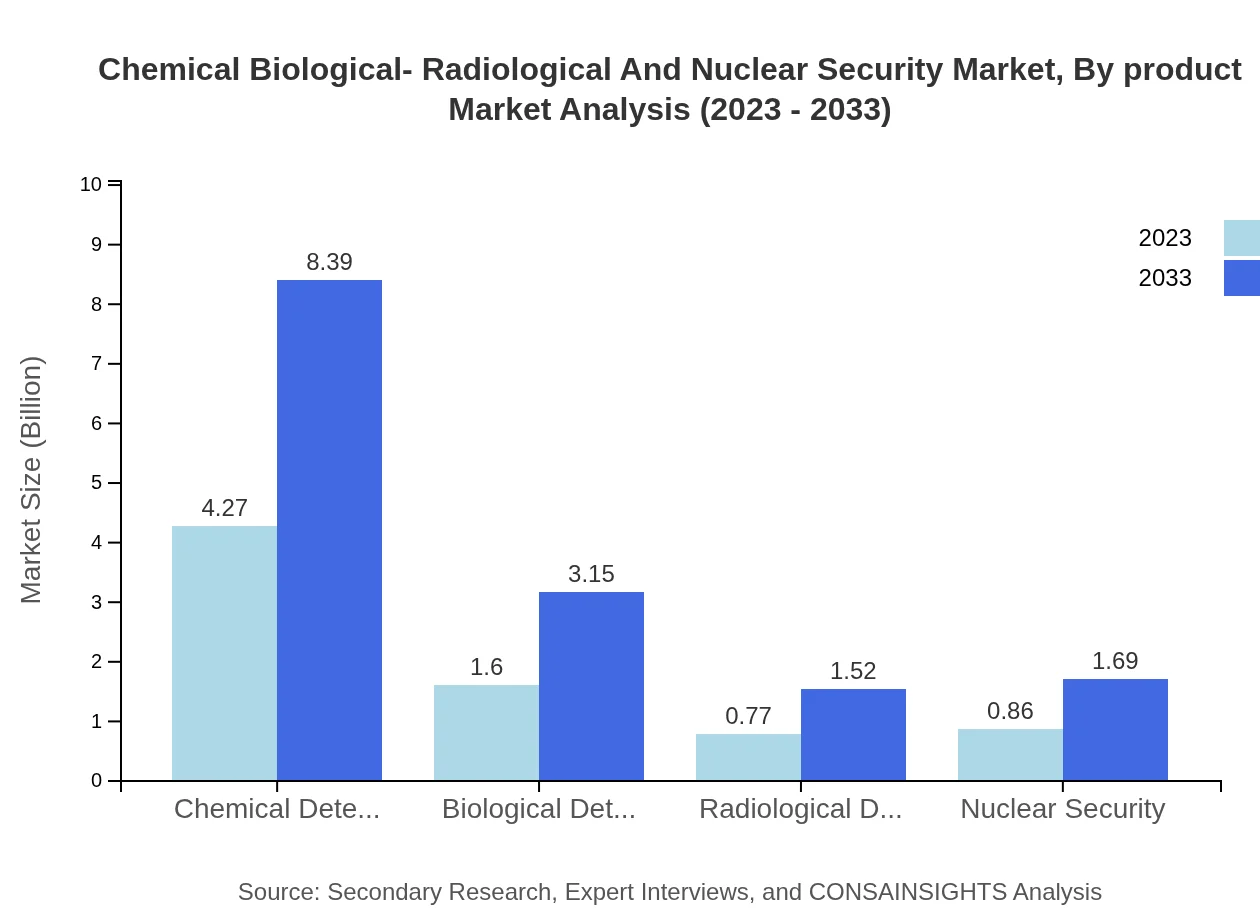

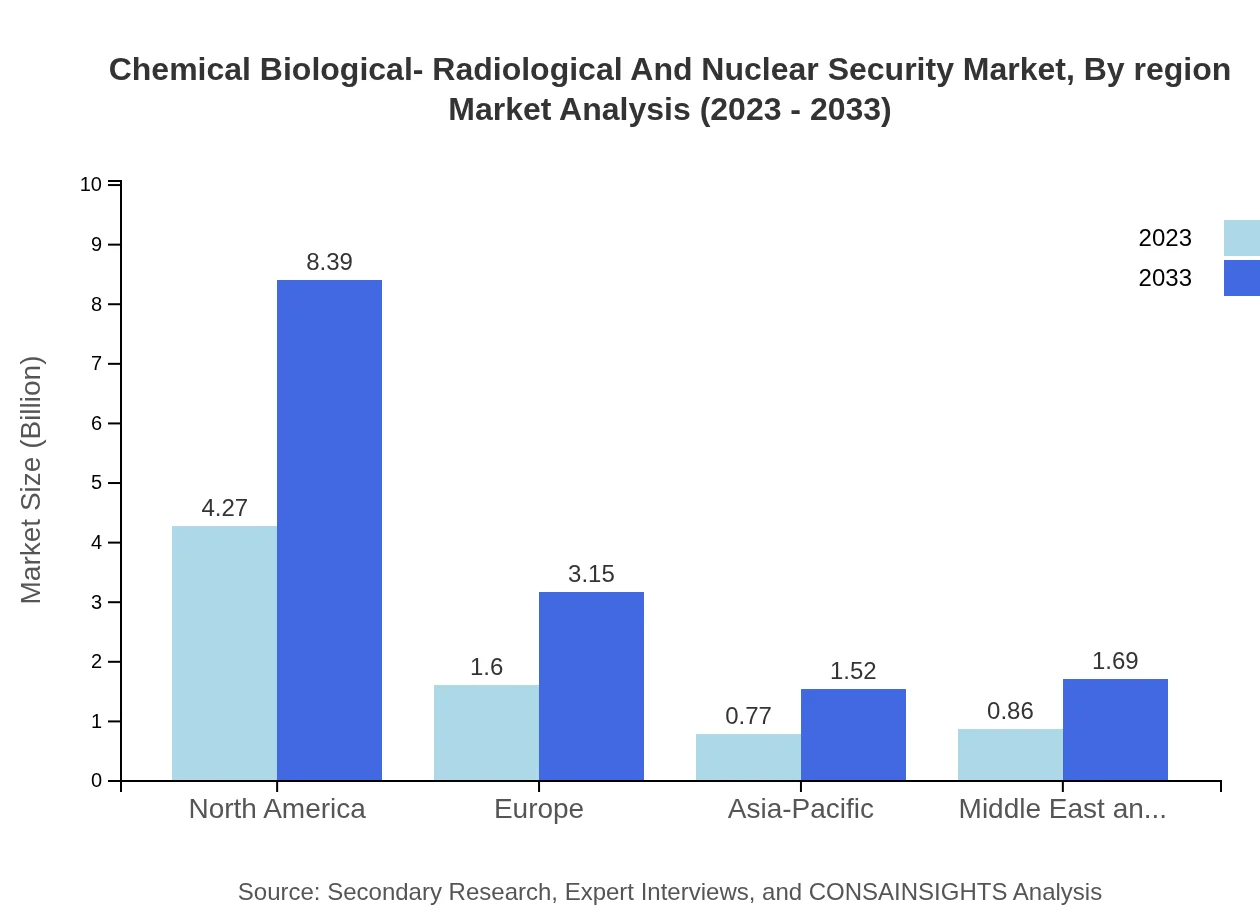

Chemical Biological- Radiological And Nuclear Security Market Analysis By Product

The product segmentation showcases that chemical detection systems dominate the market with a size of $4.27 billion in 2023, expected to increase to $8.39 billion by 2033. Biological detection systems are significant too, with values projected to rise from $1.60 billion to $3.15 billion. Radiological systems represent a vital segment growing from $0.77 billion to $1.52 billion, and nuclear security systems are anticipated to grow from $0.86 billion to $1.69 billion.

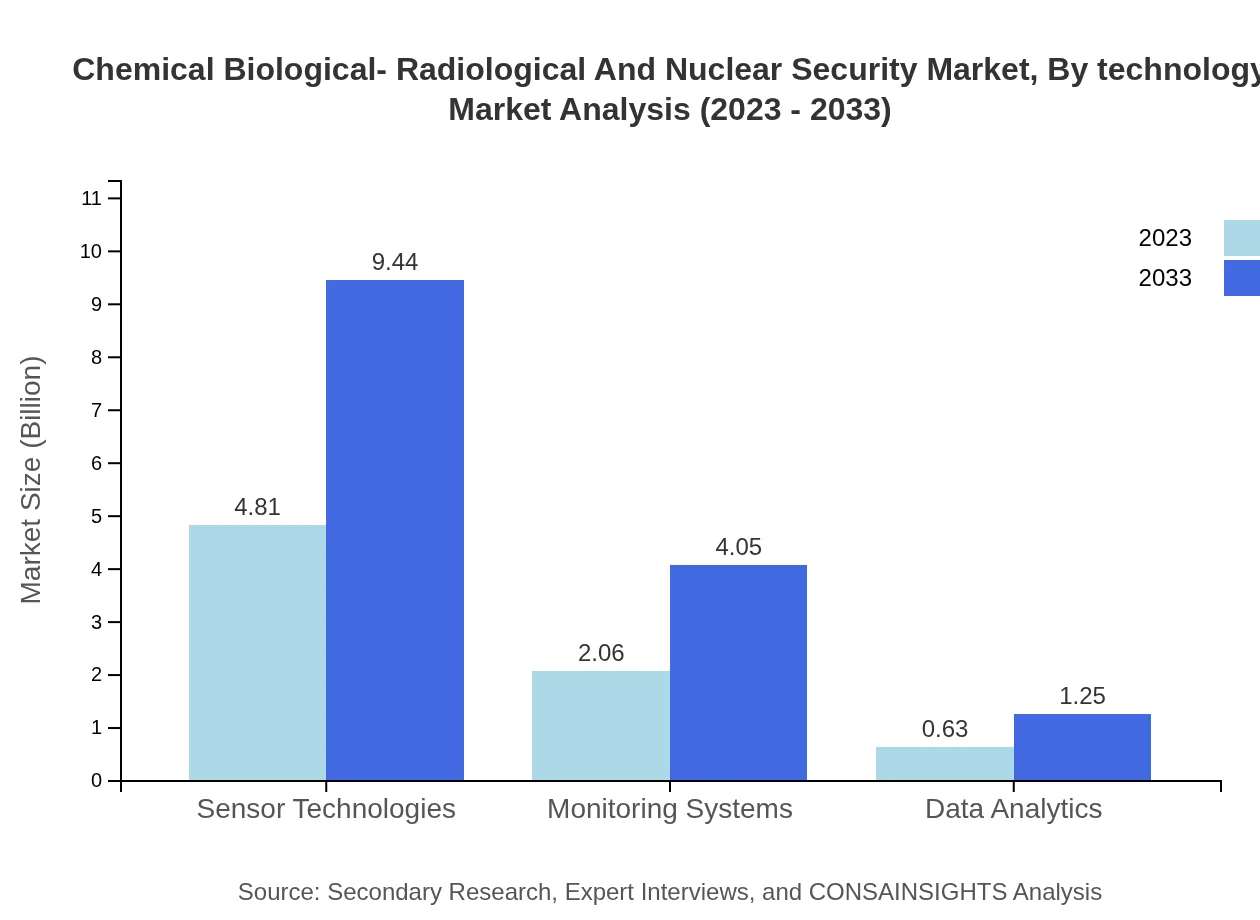

Chemical Biological- Radiological And Nuclear Security Market Analysis By Technology

Sensor technologies account for the largest share of the market, growing from $4.81 billion in 2023 to $9.44 billion in 2033, showcasing the demand for real-time data. Monitoring systems are expected to expand their presence as well, from $2.06 billion to $4.05 billion. Data analytics technologies will also grow from $0.63 billion to $1.25 billion, emphasizing the importance of analyzing vast amounts of security data.

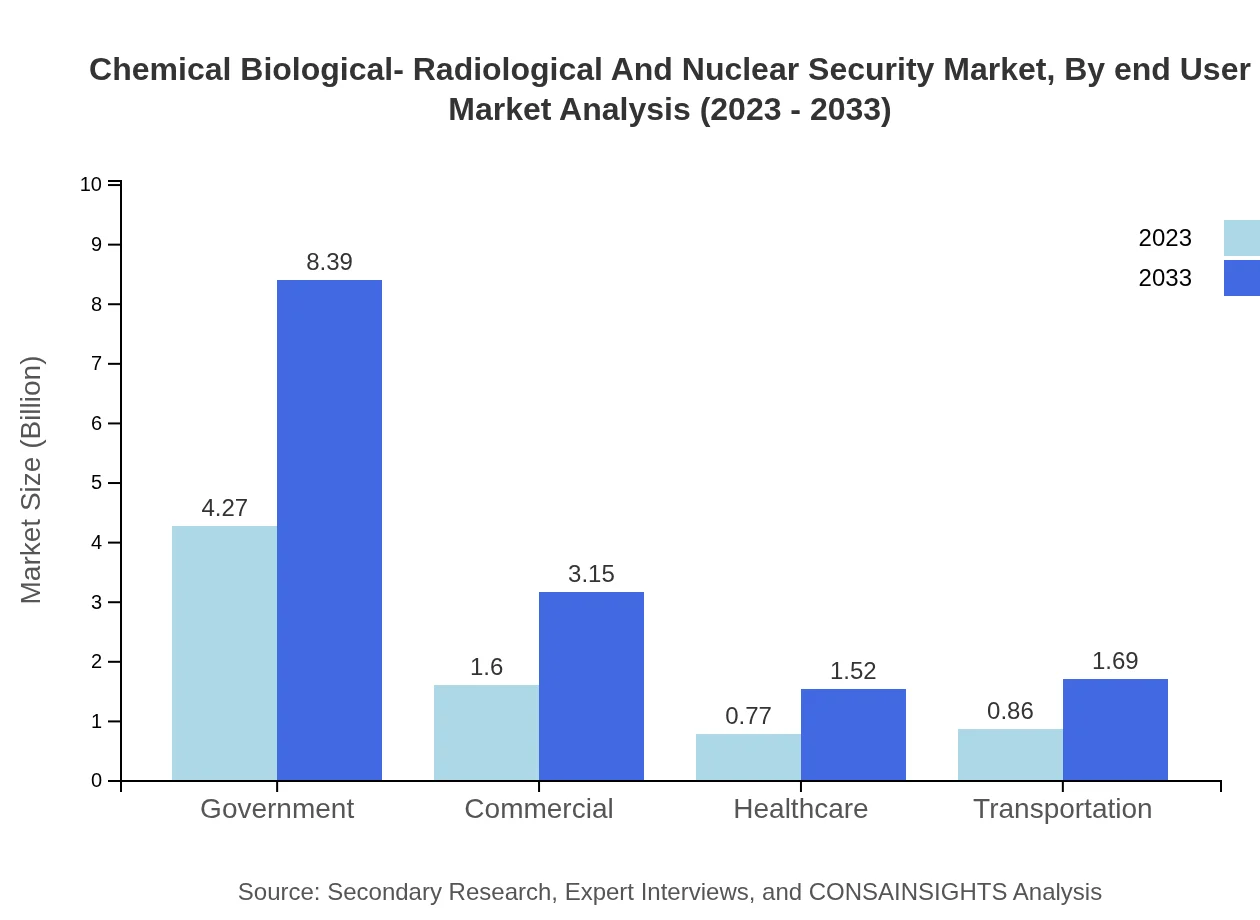

Chemical Biological- Radiological And Nuclear Security Market Analysis By End User

The government sector is leading the market, from $4.27 billion in 2023 to $8.39 billion by 2033, indicating robust public sector investments. The commercial sector and healthcare sector are also substantial, expanding from $1.60 billion to $3.15 billion, and $0.77 billion to $1.52 billion respectively. Transportation is crucial for market growth, increasing from $0.86 billion to $1.69 billion.

Chemical Biological- Radiological And Nuclear Security Market Analysis By Region

Regional dynamics show North America leading the market with a size of $4.27 billion in 2023, expected to maintain a share of 56.9% throughout the forecast. Europe's segment is expected to rise from $1.60 billion to $3.15 billion, preserving its share. The Asia-Pacific market is growing but will only reach around 21.34% share, emphasizing opportunities for growth in these emerging markets.

Chemical Biological- Radiological And Nuclear Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chemical Biological- Radiological And Nuclear Security Industry

Smiths Detection:

Leading provider of advanced security solutions, specializing in CBRN detection systems used across various sectors globally.FLIR Systems:

A key player offering innovative sensor technologies and surveillance systems focused on enhancing security measures against CBRN threats.L3Harris Technologies:

Renowned for its comprehensive defense solutions, including systems that protect against radiological and nuclear threats.Chemring Group:

Specializes in providing countermeasures to chemical and biological threats, focusing on research and innovative solutions.Thermo Fisher Scientific:

Develops and supplies innovative analytical instrumentation, particularly in the detection of chemical and biological agents.We're grateful to work with incredible clients.

FAQs

What is the market size of chemical Biological- Radiological And Nuclear security?

The global market size for Chemical Biological-Radiological and Nuclear Security is projected to reach $7.5 billion by 2033, growing at a CAGR of 6.8% from 2023, reflecting increasing demand for advanced security measures.

What are the key market players or companies in this chemical Biological- Radiological And Nuclear security industry?

Key players in the Chemical Biological-Radiological and Nuclear Security industry include companies engaged in sensor technologies, monitoring systems, and government agencies focused on national security, which drive innovations and implementations.

What are the primary factors driving the growth in the chemical Biological- Radiological And Nuclear security industry?

Growth in this industry is driven by rising global security concerns, advancements in detection technologies, increased government investment in defense, and the need for robust national security frameworks against chemical threats.

Which region is the fastest Growing in the chemical Biological- Radiological And Nuclear security?

The fastest-growing region for Chemical Biological-Radiological and Nuclear Security is Europe, with a market size increasing from $2.83 billion in 2023 to $5.56 billion by 2033, indicating significant investment and development in security measures.

Does ConsaInsights provide customized market report data for the chemical Biological- Radiological And Nuclear security industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the Chemical Biological-Radiological and Nuclear Security industry, allowing for focused insights and strategic recommendations.

What deliverables can I expect from this chemical Biological- Radiological And Nuclear security market research project?

Expect comprehensive deliverables including detailed market analysis, regional breakdowns, competitive landscape assessments, future growth predictions, and insights segmented by technology and applications relevant to Chemical Biological-Radiological and Nuclear Security.

What are the market trends of chemical Biological- Radiological And Nuclear security?

Current market trends include the adoption of advanced sensor technologies, increasing investments in cybersecurity for defense applications, growing awareness regarding safety from biological threats, and enhanced regulatory frameworks to address security challenges.