Chemical Mechanical Polishing Market Report

Published Date: 31 January 2026 | Report Code: chemical-mechanical-polishing

Chemical Mechanical Polishing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Chemical Mechanical Polishing market from 2023 to 2033. It covers market size, growth forecasts, regional insights, segmentation analysis, and trends influencing the industry.

| Metric | Value |

|---|---|

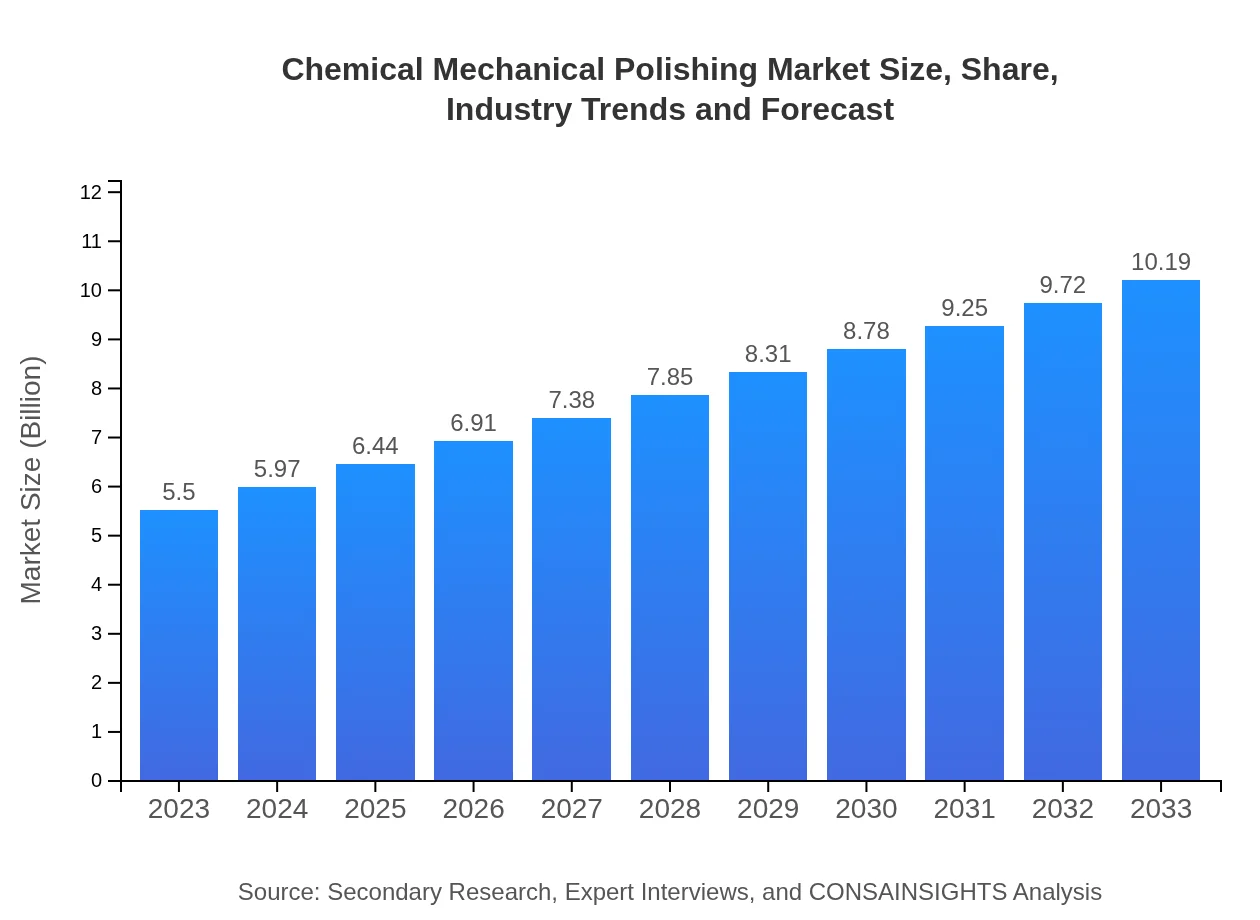

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.19 Billion |

| Top Companies | Applied Materials, Inc., Cabot Microelectronics Corporation, LAM Research Corporation, KMG Chemicals, Inc. |

| Last Modified Date | 31 January 2026 |

Chemical Mechanical Polishing Market Overview

Customize Chemical Mechanical Polishing Market Report market research report

- ✔ Get in-depth analysis of Chemical Mechanical Polishing market size, growth, and forecasts.

- ✔ Understand Chemical Mechanical Polishing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chemical Mechanical Polishing

What is the Market Size & CAGR of Chemical Mechanical Polishing market in 2023?

Chemical Mechanical Polishing Industry Analysis

Chemical Mechanical Polishing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chemical Mechanical Polishing Market Analysis Report by Region

Europe Chemical Mechanical Polishing Market Report:

The European Chemical Mechanical Polishing market stands at approximately $1.53 billion in 2023, projected to grow to $2.83 billion by 2033. Factors contributing to this growth include the increasing demand for more advanced semiconductor technologies and strict regulations pushing for high precision in manufacturing processes, specific to the automotive and telecommunications industries.Asia Pacific Chemical Mechanical Polishing Market Report:

In 2023, the Asia Pacific Chemical Mechanical Polishing market is valued at around $1.03 billion, expected to grow to $1.91 billion by 2033. This substantial growth is driven largely by the booming semiconductor industry in countries like Taiwan, South Korea, and China, which are expanding their production capabilities to meet global demand. The increasing investment in research and development, as well as the proliferation of consumer electronics, fuels the regional market further.North America Chemical Mechanical Polishing Market Report:

North America holds a prominent position in the Chemical Mechanical Polishing market with a valuation of $2.12 billion in 2023, anticipated to increase to $3.93 billion by 2033. Major technological innovations and a strong base of semiconductor manufacturing in the U.S. are significant drivers, alongside growing demand for advanced electronic devices and data centers that require high-quality polishing solutions.South America Chemical Mechanical Polishing Market Report:

The South American market for Chemical Mechanical Polishing is currently valued at $0.34 billion in 2023 and is forecasted to rise to $0.62 billion by 2033. Growth in this region is slower compared to others, but is supported by increasing local manufacturing capabilities, particularly in electronics and automotive segments as countries attempt to diversify their economies and reduce reliance on imports.Middle East & Africa Chemical Mechanical Polishing Market Report:

The Chemical Mechanical Polishing market in the Middle East and Africa is valued at approximately $0.48 billion in 2023, and is expected to grow to $0.90 billion by 2033. The growth is primarily driven by emerging demand from the electronics sector as local companies expand their production capacities. Investments in technology and infrastructure also play critical roles in enhancing market growth.Tell us your focus area and get a customized research report.

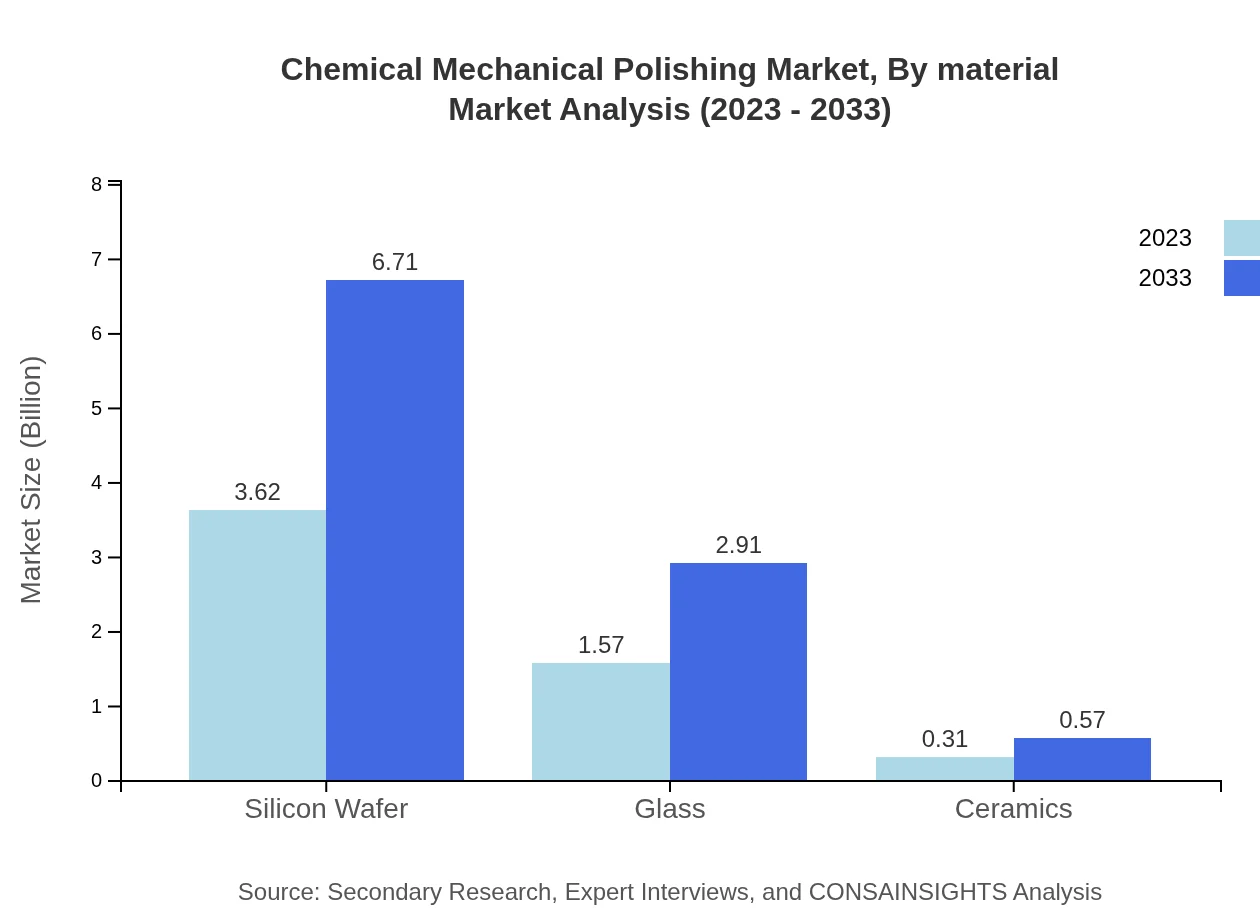

Chemical Mechanical Polishing Market Analysis By Material

Analyzing the material segment of the Chemical Mechanical Polishing market reveals that silicon wafer dominates with a market size of approximately $3.62 billion in 2023, expected to grow to $6.71 billion by 2033. Followed by glass and ceramics which hold significant portions of the market share, driven by growing applications in electronics and automotive sectors, emphasizing precision and quality drive.

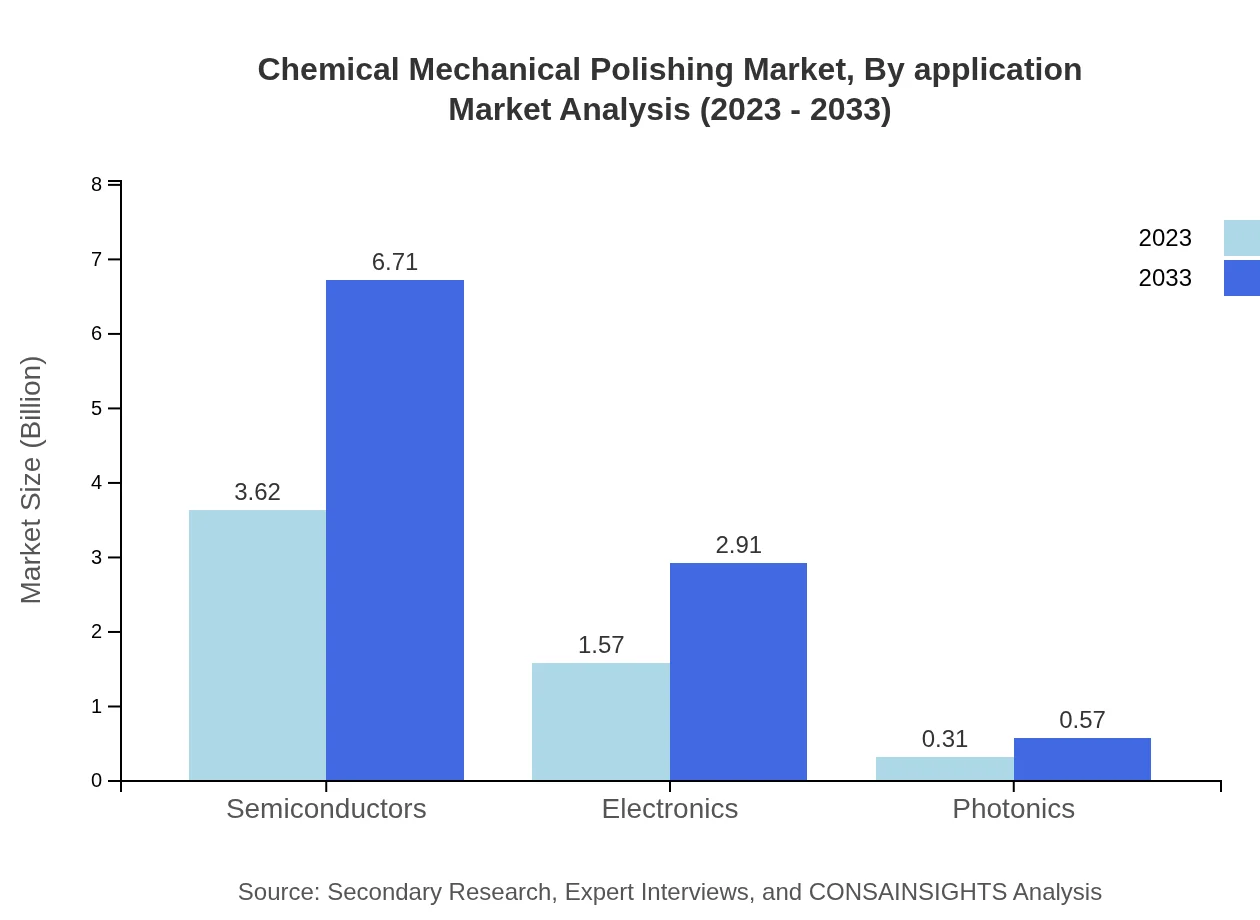

Chemical Mechanical Polishing Market Analysis By Application

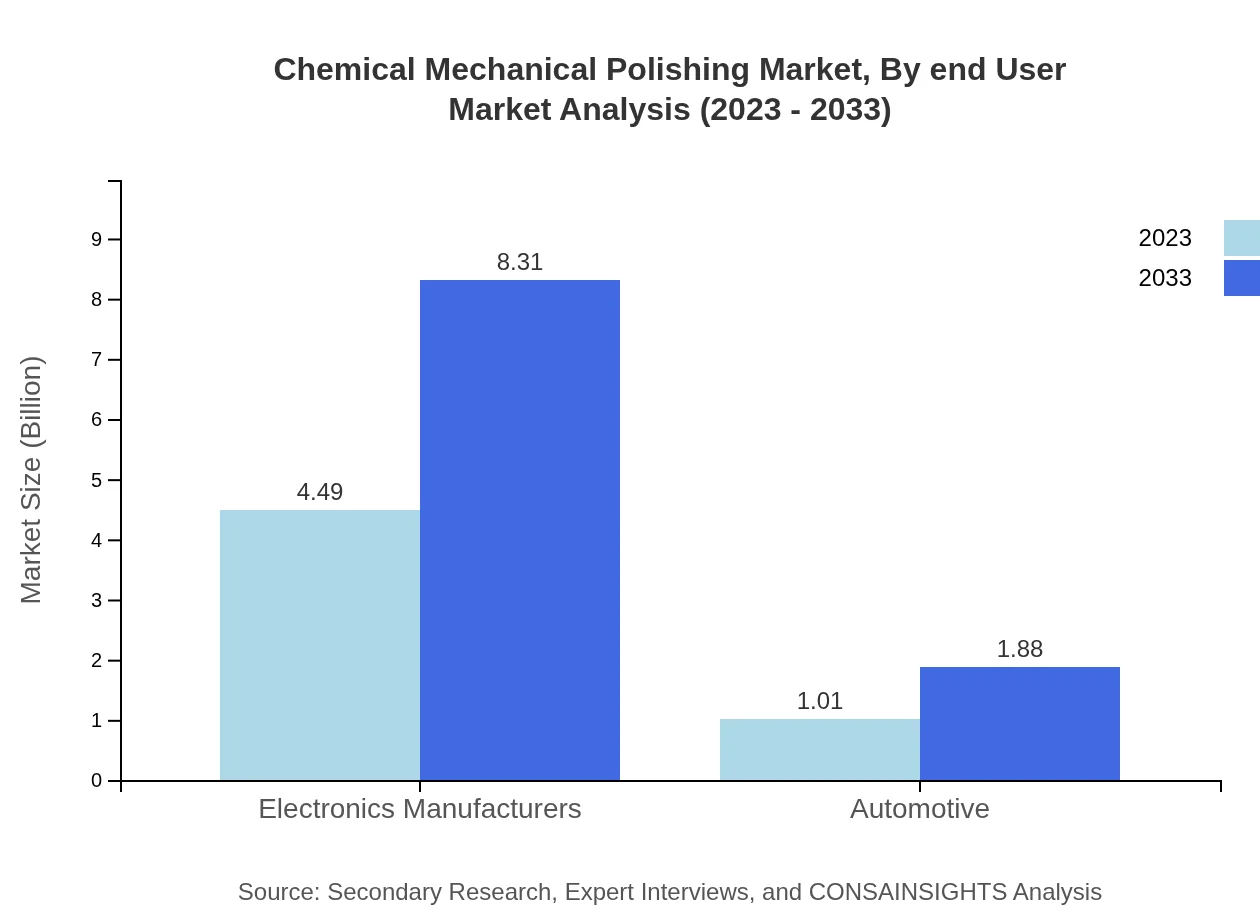

The applications segment shows robust growth trends in electronics manufacturing, holding a size of approximately $4.49 billion in 2023, which is projected to increase to $8.31 billion by 2033. This aligns with the boom in consumer electronics and the burgeoning demand for high-tech devices. The automotive sector is also significant in this regard, with growth from $1.01 billion in 2023 to $1.88 billion by 2033, reflecting the automotive industry's increasing reliance on advanced technologies.

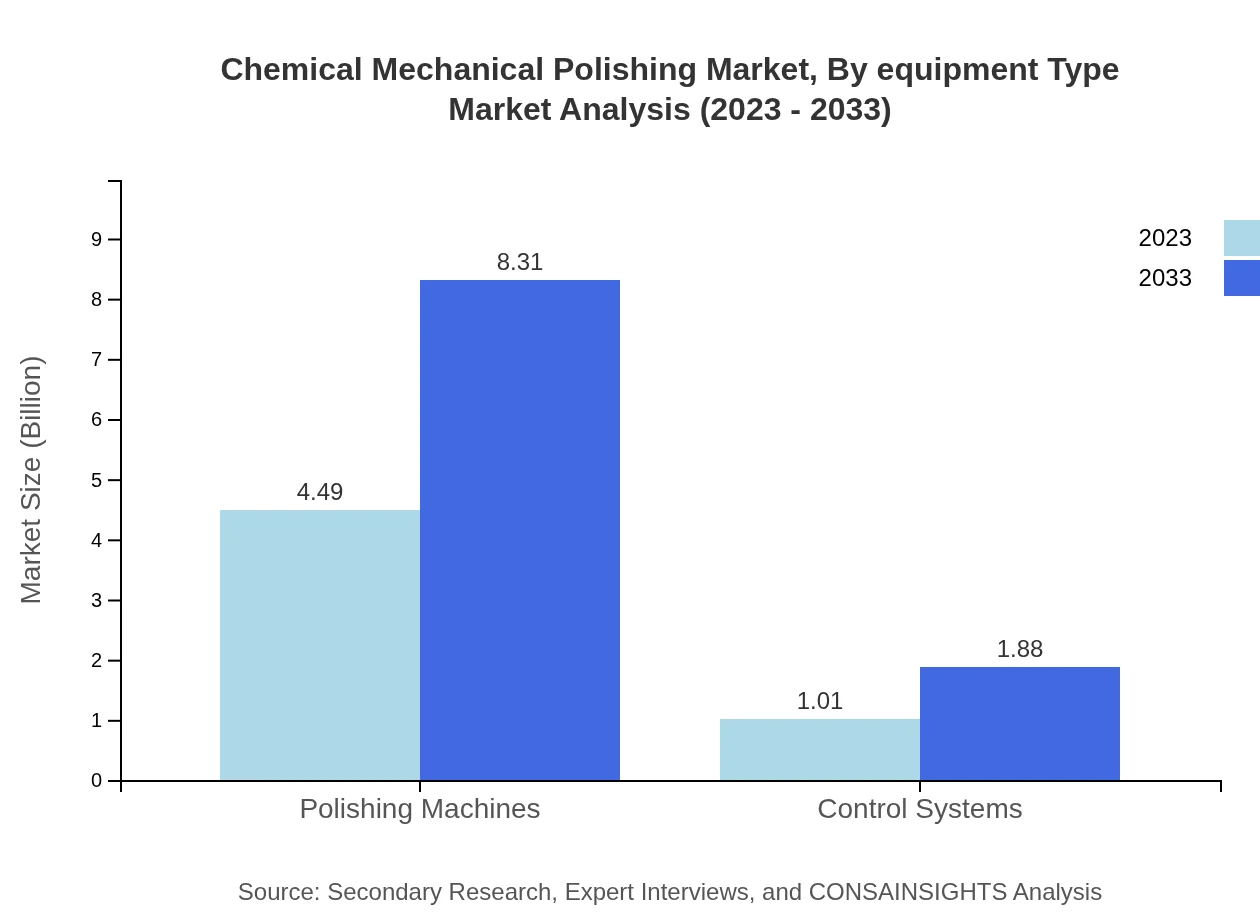

Chemical Mechanical Polishing Market Analysis By Equipment Type

In equipment type, polishing machines lead with a notable market size of $4.49 billion in 2023, set to reach $8.31 billion by 2033. This is indicative of larger investments geared towards innovative CMP machinery that are enhancing production capacity and efficiency in manufacturing environments.

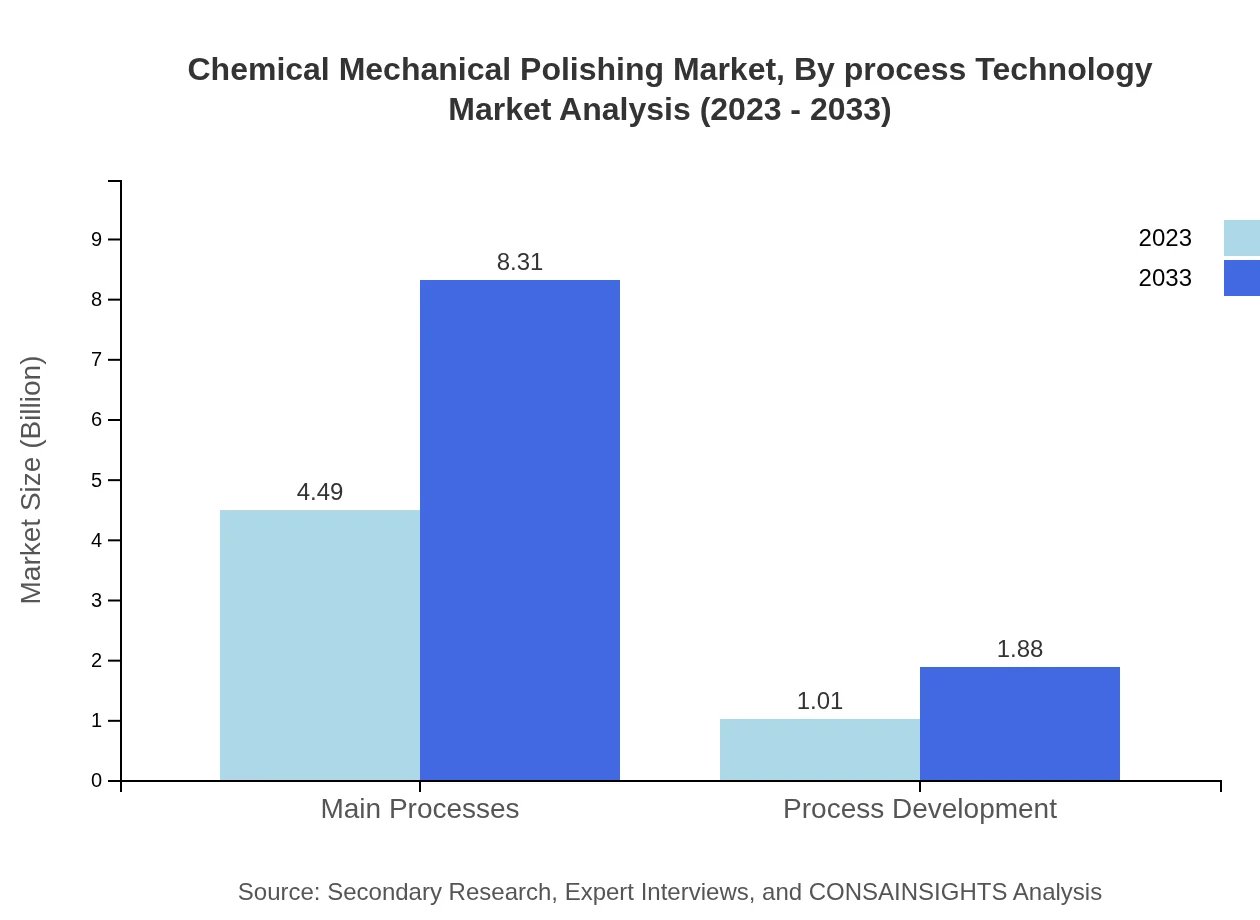

Chemical Mechanical Polishing Market Analysis By Process Technology

The process technology segment is evolving with developments in automation and AI integration, positioned to advance CMP processes. Main processes hold a significant market share, indicating the persistent importance of established CMP methodologies while highlighting opportunities for new efficiencies.

Chemical Mechanical Polishing Market Analysis By End User

Looking at the end-user segment, semiconductor manufacturers represent a crucial area with substantial growth. The demand from electronics manufacturers stands strong with a market size of about $4.49 billion in 2023, poised to grow as technology advances and new products enter market cycles.

Chemical Mechanical Polishing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chemical Mechanical Polishing Industry

Applied Materials, Inc.:

A leading provider of materials engineering solutions, Applied Materials is known for its innovative CMP systems that enhance chip performance and chip maker productivity.Cabot Microelectronics Corporation:

Specializes in the development and manufacturing of advanced CMP slurries. Cabot Microelectronics is recognized for its high-quality and customized products that cater to specific fabrication needs.LAM Research Corporation:

Provides a comprehensive range of semiconductor manufacturing equipment, including systems for CMP applications. Renowned for its technological advancements and operational excellence.KMG Chemicals, Inc.:

Known for its focus on the specialty chemicals sector, KMG manufactures and supplies high-performance CMP slurries and related products tailored for the semiconductor industry.We're grateful to work with incredible clients.

FAQs

What is the market size of chemical Mechanical Polishing?

The chemical-mechanical polishing market is projected to reach USD 5.5 billion by 2033, growing at a CAGR of 6.2% from its 2023 value. This growth reflects the increasing demand for advanced semiconductor and electronic components.

What are the key market players or companies in the chemical Mechanical Polishing industry?

Key players in the chemical-mechanical polishing industry include major semiconductor manufacturers and precision polishing equipment suppliers. Their innovations and market strategies significantly impact the competitive landscape and growth dynamics of the sector.

What are the primary factors driving the growth in the chemical Mechanical Polishing industry?

The growth in the chemical-mechanical polishing industry is primarily driven by advancements in semiconductor manufacturing technologies, increasing demand for high-performance electronics, and the need for precision in surface finishing across various sectors.

Which region is the fastest Growing in the chemical Mechanical Polishing market?

North America is the fastest-growing region in the chemical-mechanical polishing market, with a projected increase from USD 2.12 billion in 2023 to USD 3.93 billion by 2033, attributed to its strong electronics manufacturing base.

Does ConsaInsights provide customized market report data for the chemical Mechanical Polishing industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the chemical-mechanical polishing industry, helping clients gain insights that are aligned with their strategic objectives and market needs.

What deliverables can I expect from this chemical Mechanical Polishing market research project?

Deliverables include comprehensive market analysis, regional insights, competitive landscape evaluation, and detailed segment performance assessments, providing a holistic view of the chemical-mechanical polishing market trends.

What are the market trends of chemical Mechanical Polishing?

Market trends include increasing automation in polishing processes, a shift towards eco-friendly polishing solutions, and the growth of smart manufacturing technologies, all indicating a transformative phase in the chemical-mechanical polishing industry.