Chemical Silage Additives Market Report

Published Date: 31 January 2026 | Report Code: chemical-silage-additives

Chemical Silage Additives Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Chemical Silage Additives market, detailing its current state and future growth projections from 2023 to 2033, including insights on market size, trends, and competitive landscape.

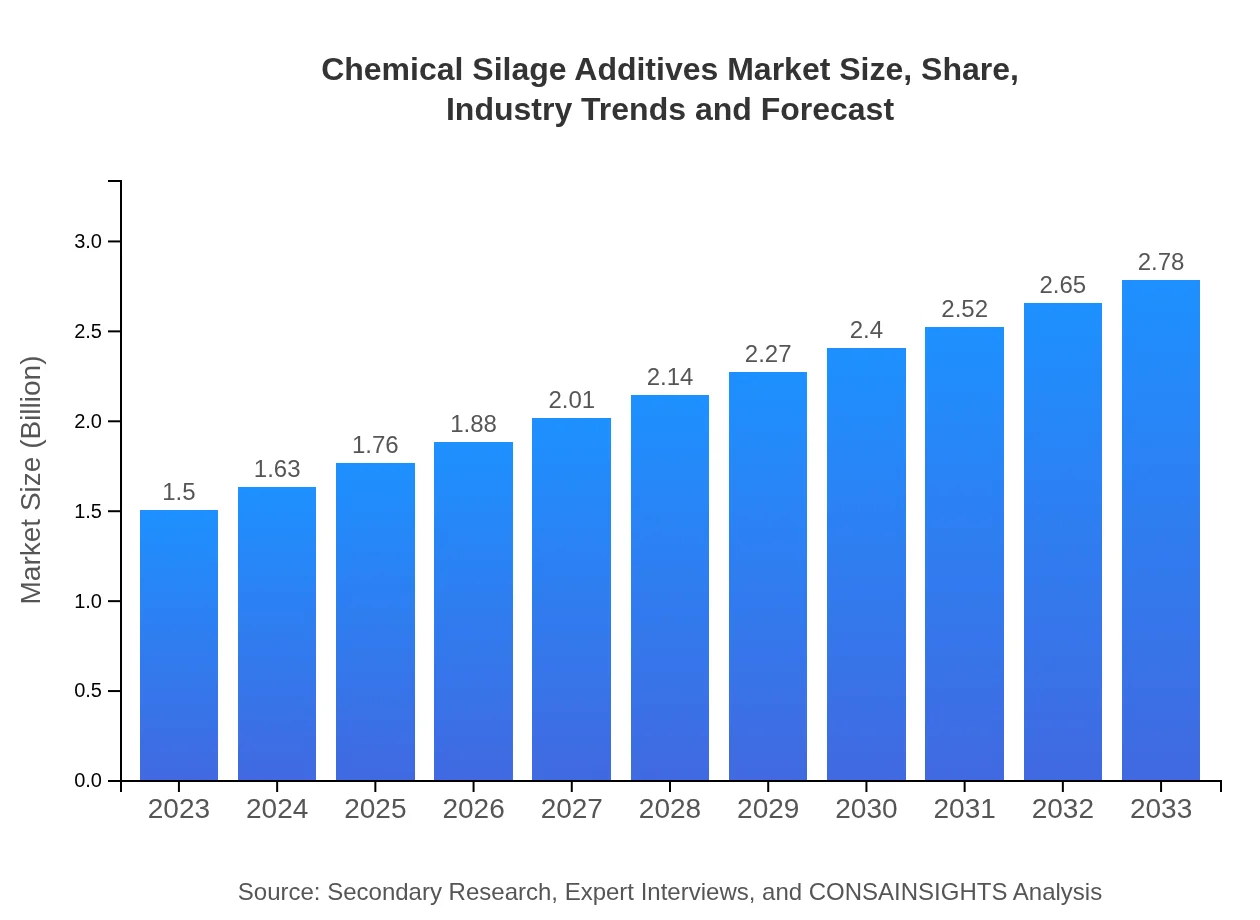

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Cargill, Inc., Alltech, Inc., BASF SE, Quality Silage Products, Inc. |

| Last Modified Date | 31 January 2026 |

Chemical Silage Additives Market Overview

Customize Chemical Silage Additives Market Report market research report

- ✔ Get in-depth analysis of Chemical Silage Additives market size, growth, and forecasts.

- ✔ Understand Chemical Silage Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chemical Silage Additives

What is the Market Size & CAGR of Chemical Silage Additives market in 2023?

Chemical Silage Additives Industry Analysis

Chemical Silage Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chemical Silage Additives Market Analysis Report by Region

Europe Chemical Silage Additives Market Report:

The European market for Chemical Silage Additives is estimated at $0.45 billion in 2023, anticipated to grow to $0.83 billion by 2033. Stringent regulations regarding animal health and nutrition drive the adoption of high-quality additives in the livestock and feed industries.Asia Pacific Chemical Silage Additives Market Report:

In 2023, the market size for Chemical Silage Additives in the Asia Pacific region is approximately $0.27 billion, projected to grow to $0.50 billion by 2033. Rapid population growth and increasing meat consumption are significant drivers of this growth, along with a rising emphasis on enhancing livestock feed quality.North America Chemical Silage Additives Market Report:

North America holds the largest market size for Chemical Silage Additives, valued at $0.57 billion in 2023, with projections reaching $1.05 billion by 2033. The growth is supported by high dairy and beef production rates and the increasing preference for effective feeding solutions among livestock producers.South America Chemical Silage Additives Market Report:

The South America region has a market size of $0.14 billion in 2023, expected to expand to $0.26 billion by 2033. The robust agricultural practices in countries like Brazil and Argentina significantly contribute to the demand for chemical silage additives.Middle East & Africa Chemical Silage Additives Market Report:

The market size for Chemical Silage Additives in the Middle East and Africa is projected at $0.07 billion in 2023, with expectations to grow to $0.14 billion by 2033. Several agricultural initiatives and support for enhancing food security are stimulating growth in this region.Tell us your focus area and get a customized research report.

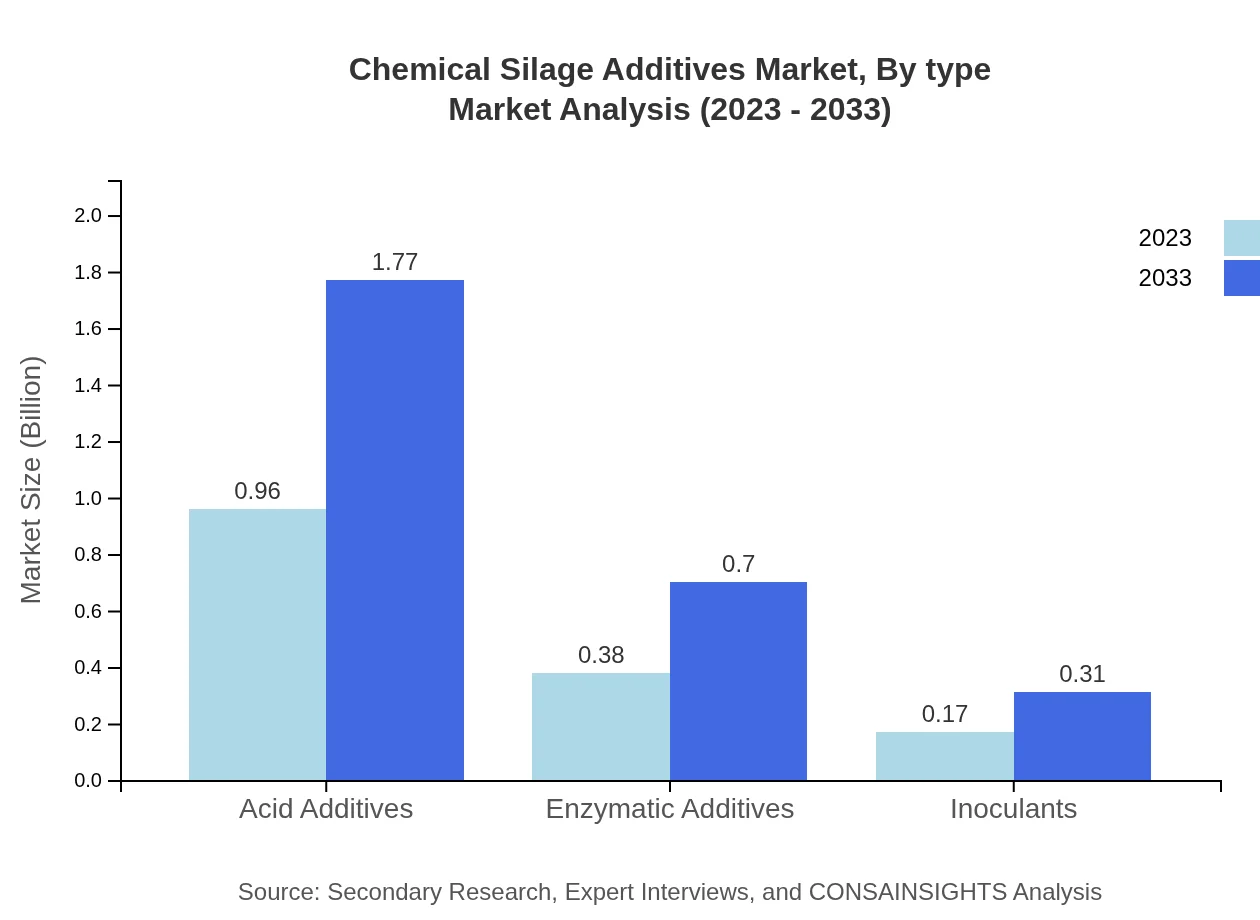

Chemical Silage Additives Market Analysis By Type

The market is dominated by *Acid Additives*, accounting for a significant market share of 63.67% in 2023 and consistent growth to reach the same share by 2033. Enzymatic additives and inoculants are also critical, providing a combined market share of 63.67% with growth projections indicating similar trends over the next decade.

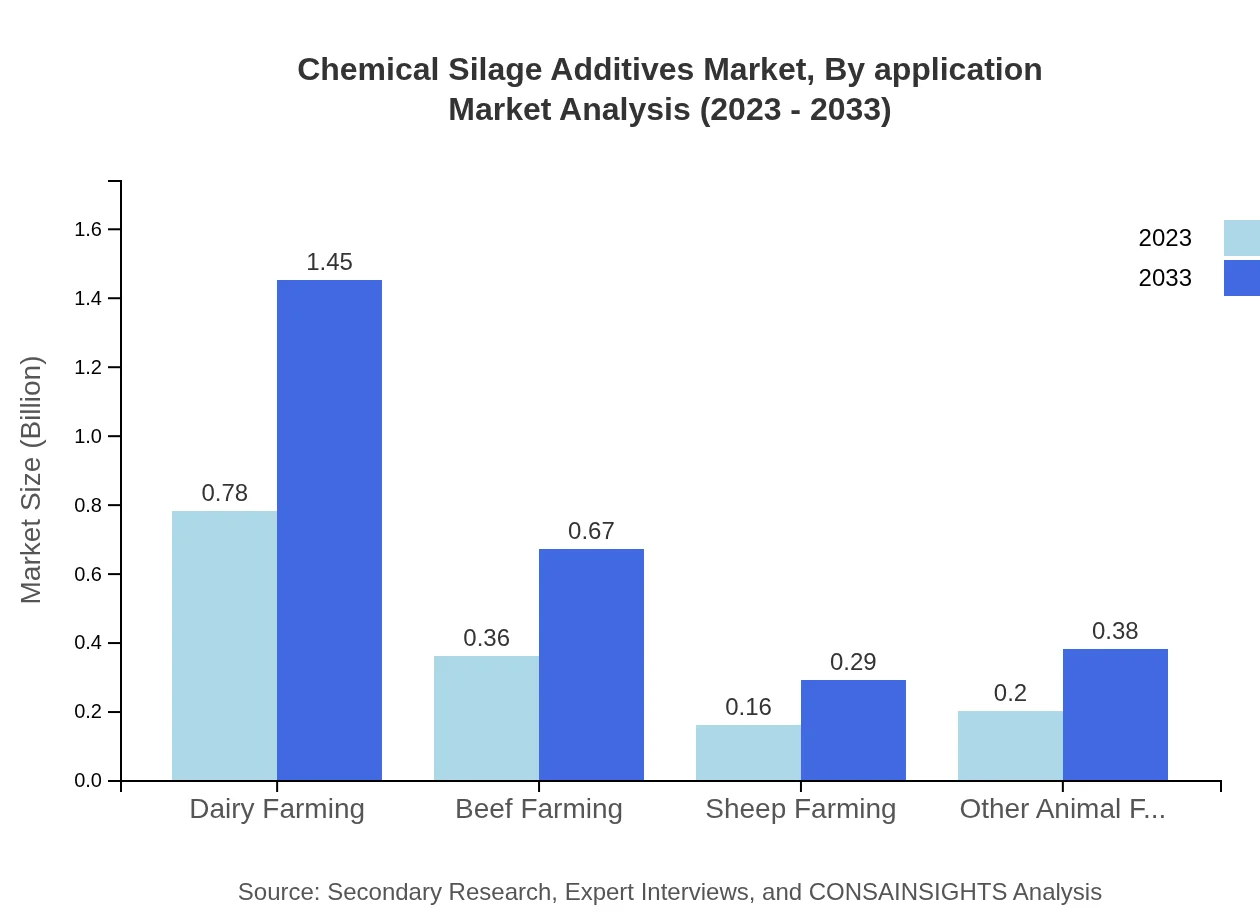

Chemical Silage Additives Market Analysis By Application

Dairy farming leads the market with a share of 52% in 2023, expected to maintain growth to 2033. Other applications, including beef farming and sheep farming, contribute 23.99% and 10.42% respectively, indicating a strong reliance on silage in meeting livestock nutritional needs.

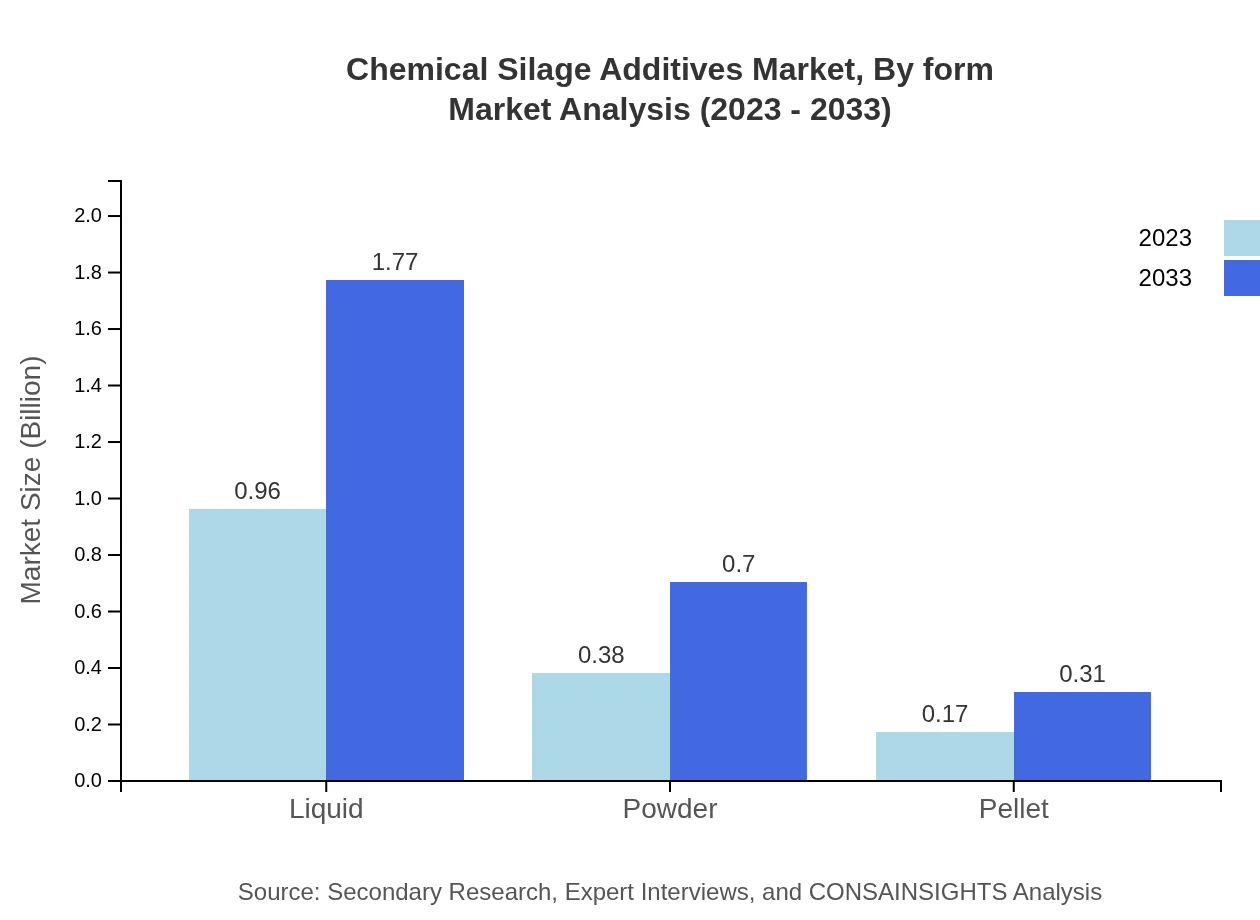

Chemical Silage Additives Market Analysis By Form

The liquid form of additives is dominant, holding 63.67% of the market share in 2023, which is projected to remain stable over the next decade. Powder and pellet forms are also essential, representing 25.26% and 11.07% respectively, providing diverse options for farmers in silage preparation.

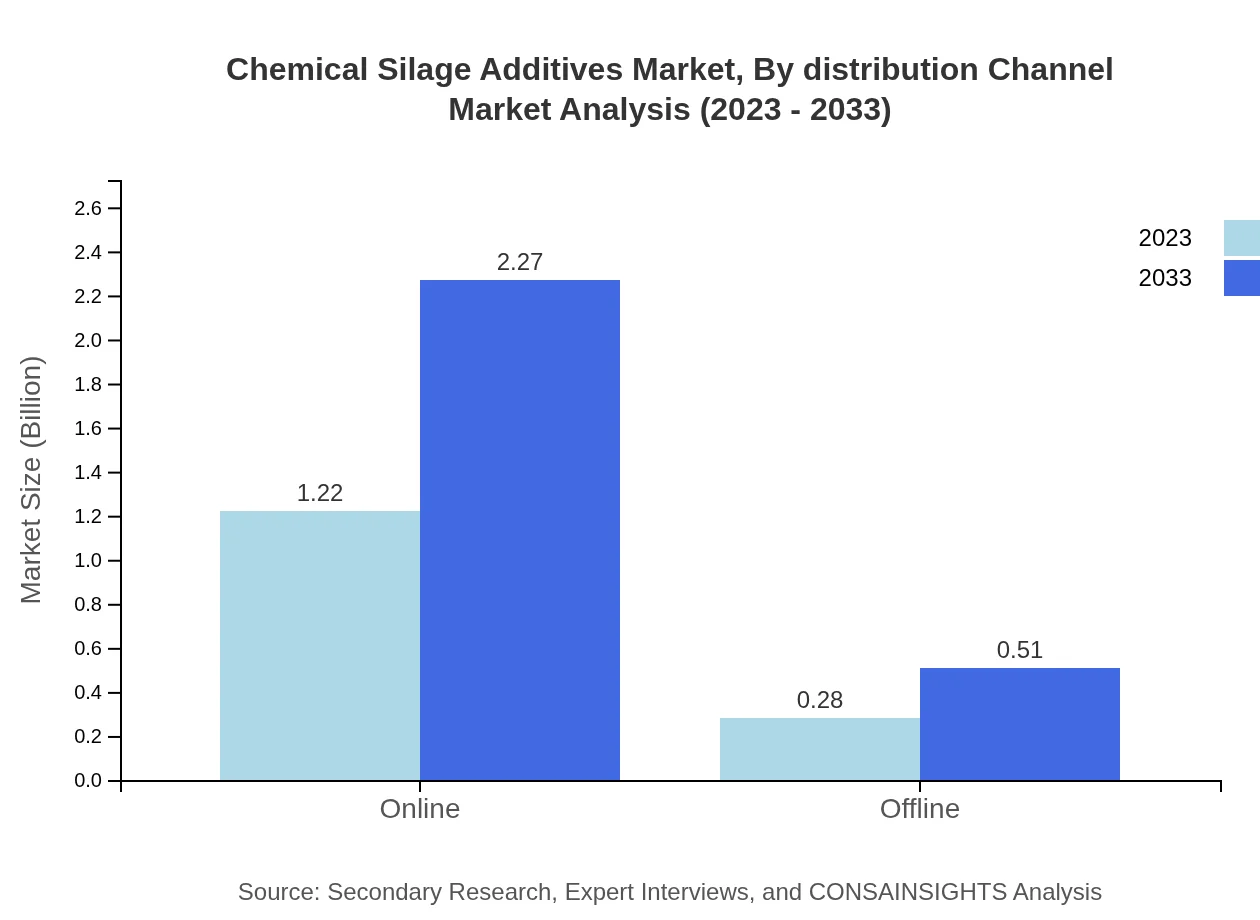

Chemical Silage Additives Market Analysis By Distribution Channel

Sales channels for Chemical Silage Additives include online and offline methods. The online channel leads with a market share of 81.61% in 2023, expected to rise to 81.61% by 2033, driven by increased convenience and availability of products. Offline sales account for 18.39%.

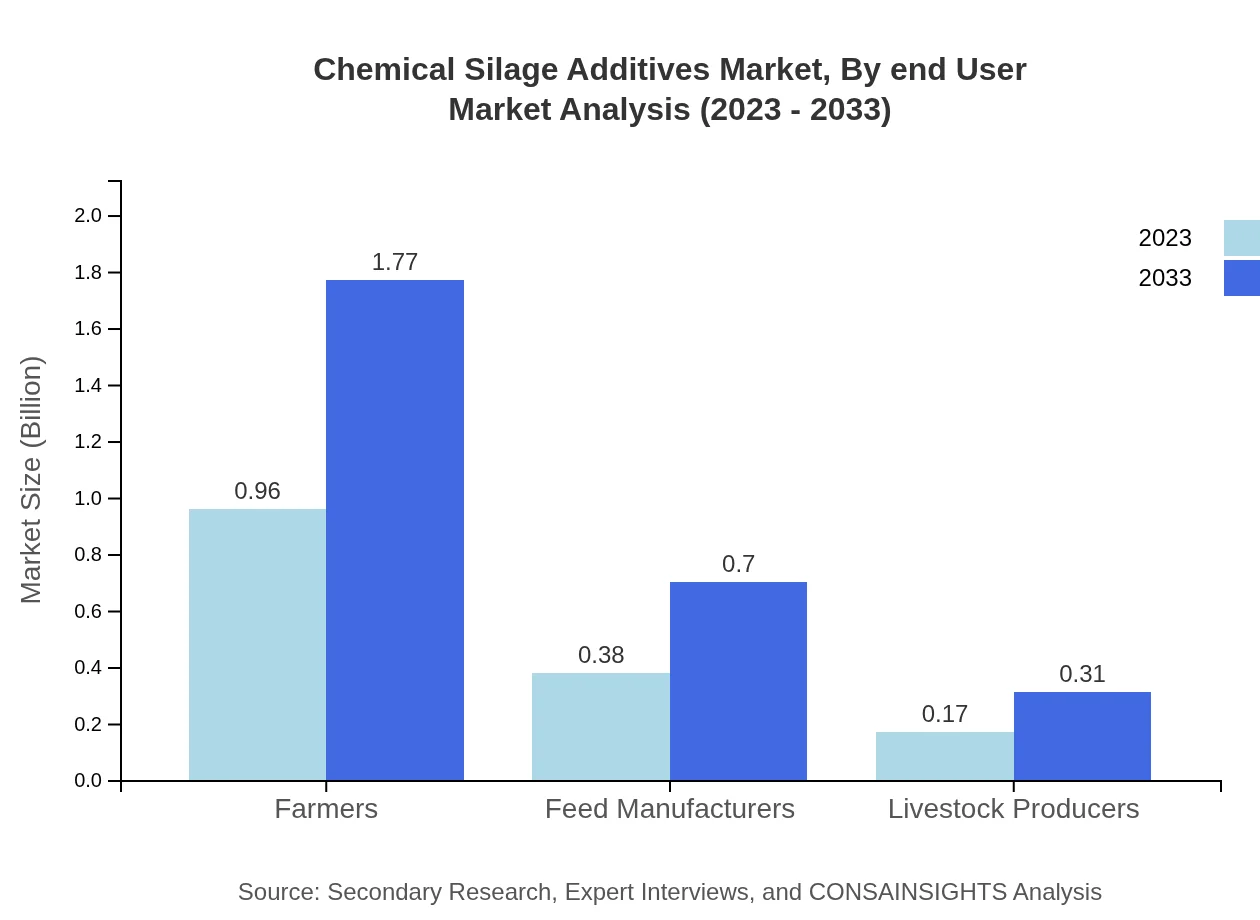

Chemical Silage Additives Market Analysis By End User

Farmers dominate the Chemical Silage Additives market with a significant share of 63.67% in 2023. Feed manufacturers follow with 25.26%, and livestock producers account for 11.07%, highlighting the importance of these additives for various stakeholders in the agricultural sector.

Chemical Silage Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chemical Silage Additives Industry

Cargill, Inc.:

Cargill is a global leader in food and agriculture, providing tailored silage additives that enhance fermentation and improve feed efficiency. Their innovative solutions help farmers optimize livestock nutrition.Alltech, Inc.:

Alltech specializes in animal nutrition and health, offering a range of silage additives that support fermentation processes and improve nutritional value, solidifying their presence in the market.BASF SE:

BASF is a leading chemical company providing sustainable and efficient silage additives that help improve feed quality and promote livestock health.Quality Silage Products, Inc.:

Quality Silage Products is dedicated to developing advanced solutions for improving silage preservation to enhance livestock feeding, driving productivity and profitability for farmers.We're grateful to work with incredible clients.

FAQs

What is the market size of chemical silage additives?

The chemical silage additives market is estimated to reach $1.5 billion by 2033, growing at a CAGR of 6.2%. This growth reflects increasing demand for quality feed preservation solutions across the agricultural sector.

What are the key market players or companies in this chemical silage additives industry?

Major players in the chemical silage additives market include Agroferm, BASF SE, DuPont, and Addcon Group. These companies are known for their innovative products and strong market presence, which significantly contribute to sector growth.

What are the primary factors driving the growth in the chemical silage additives industry?

Key growth drivers for the chemical silage additives market include rising demand for livestock feed, increased awareness about silage quality, and advancements in production technologies. Additionally, the push for sustainable agriculture practices also supports market expansion.

Which region is the fastest Growing in the chemical silage additives?

North America is anticipated to be the fastest-growing region in the chemical silage additives market, projected to grow from $0.57 billion in 2023 to $1.05 billion in 2033. This growth is attributed to a large livestock industry and increasing feed quality demands.

Does ConsaInsights provide customized market report data for the chemical silage additives industry?

Yes, ConsaInsights offers customizable market report data tailored to specific needs in the chemical silage additives industry. Clients can obtain insights based on unique parameters, ensuring relevance and applicability.

What deliverables can I expect from this chemical silage additives market research project?

The deliverables of the market research project on chemical silage additives include detailed reports, data analyses by region and segment, forecasts, and actionable insights to guide strategic decision-making in market entry or expansion.

What are the market trends of chemical silage additives?

Current trends in the chemical silage additives market include an increasing shift towards liquid additives, with a projected growth from $0.96 billion in 2023 to $1.77 billion in 2033. This trend underscores a preference for efficient application methods and convenience.