Chilled Processed Food Market Report

Published Date: 31 January 2026 | Report Code: chilled-processed-food

Chilled Processed Food Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Chilled Processed Food market from 2023 to 2033, covering market size, growth trajectories, segmentation, regional insights, and key trends affecting the industry.

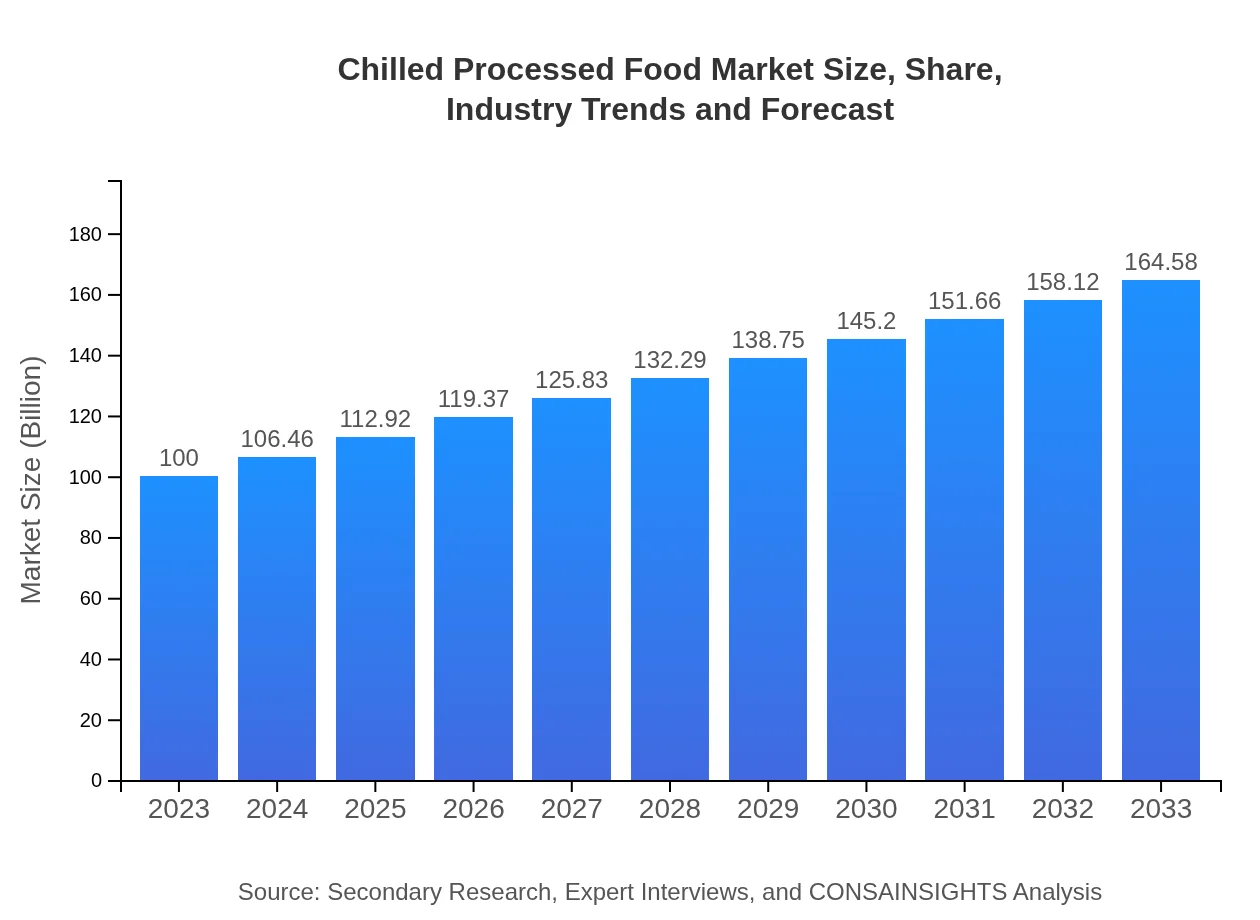

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Nestlé, Unilever, Tyson Foods, Kraft Heinz Company, Danone |

| Last Modified Date | 31 January 2026 |

Chilled Processed Food Market Overview

Customize Chilled Processed Food Market Report market research report

- ✔ Get in-depth analysis of Chilled Processed Food market size, growth, and forecasts.

- ✔ Understand Chilled Processed Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chilled Processed Food

What is the Market Size & CAGR of Chilled Processed Food market in 2023?

Chilled Processed Food Industry Analysis

Chilled Processed Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chilled Processed Food Market Analysis Report by Region

Europe Chilled Processed Food Market Report:

In Europe, the chilled processed food market is valued at $26.71 billion in 2023 and is anticipated to reach $43.96 billion by 2033. The region is experiencing demand for organic and sustainably sourced products, fostering innovation among manufacturers. The trend towards plant-based diets is also becoming significant, with an increasing number of companies launching vegan and vegetarian chilled options.Asia Pacific Chilled Processed Food Market Report:

In 2023, the Asia Pacific Chilled Processed Food market is valued at approximately $20.37 billion and is projected to reach $33.52 billion by 2033. The region is characterized by a growing middle class, increased disposable income, and a rising trend toward urbanization, prompting higher demand for convenient food options. The expansion of modern retail formats and aggressive marketing by food brands are also driving market growth.North America Chilled Processed Food Market Report:

North America's Chilled Processed Food market is currently valued at $35.93 billion, with projections to reach $59.13 billion by 2033. The region leads globally in the consumption of chilled products due to established supply chains, widespread retail infrastructure, and evolving consumer preference for convenience and health-oriented products. The strong presence of major food manufacturers and innovative product launches also drive this growth.South America Chilled Processed Food Market Report:

The South American market for Chilled Processed Food is estimated at $4.19 billion in 2023, expected to grow to $6.90 billion by 2033. This growth is supported by increasing consumer awareness regarding food quality and the rise of health-conscious eating habits. Emerging market players are focusing on introducing innovative flavors and products tailored to local preferences.Middle East & Africa Chilled Processed Food Market Report:

The Middle East and Africa Chilled Processed Food market is valued at $12.80 billion in 2023, expected to grow to $21.07 billion by 2033. Economic diversification in these regions is boosting the food sector, with growing expatriate populations increasing demand for diverse chilled products. Additionally, improved logistics and cold chain infrastructure are enhancing distribution capabilities.Tell us your focus area and get a customized research report.

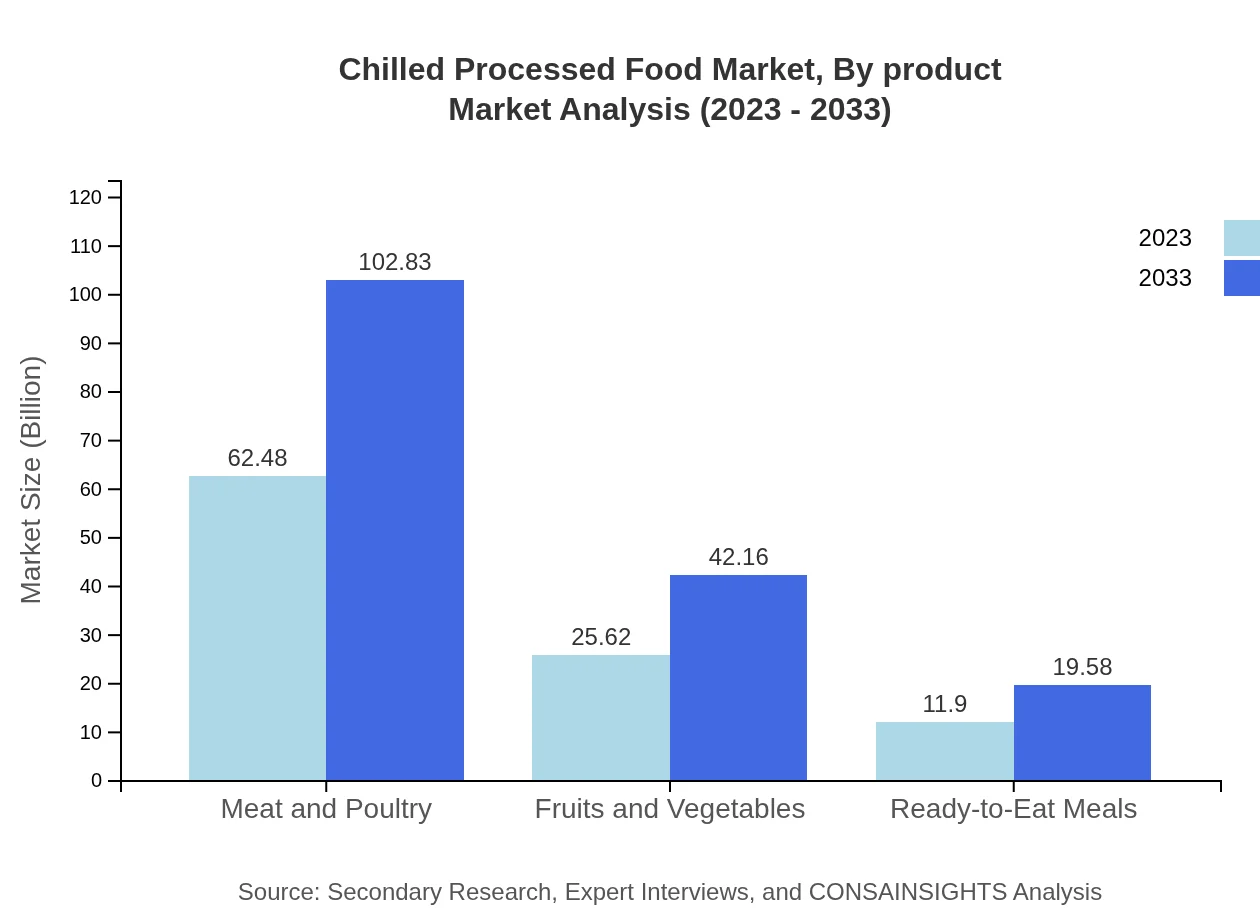

Chilled Processed Food Market Analysis By Product

The segment of meat and poultry is the largest in the Chilled Processed Food market, estimated at $62.48 billion in 2023 and forecasts to grow to $102.83 billion in 2033. Fruits and vegetables represent a significant share as well, with a market size of $25.62 billion in 2023, projected to reach $42.16 billion by 2033. Additionally, ready-to-eat meals are gaining traction due to rising demand for convenience, currently valued at $11.90 billion but expected to grow to $19.58 billion in the next decade.

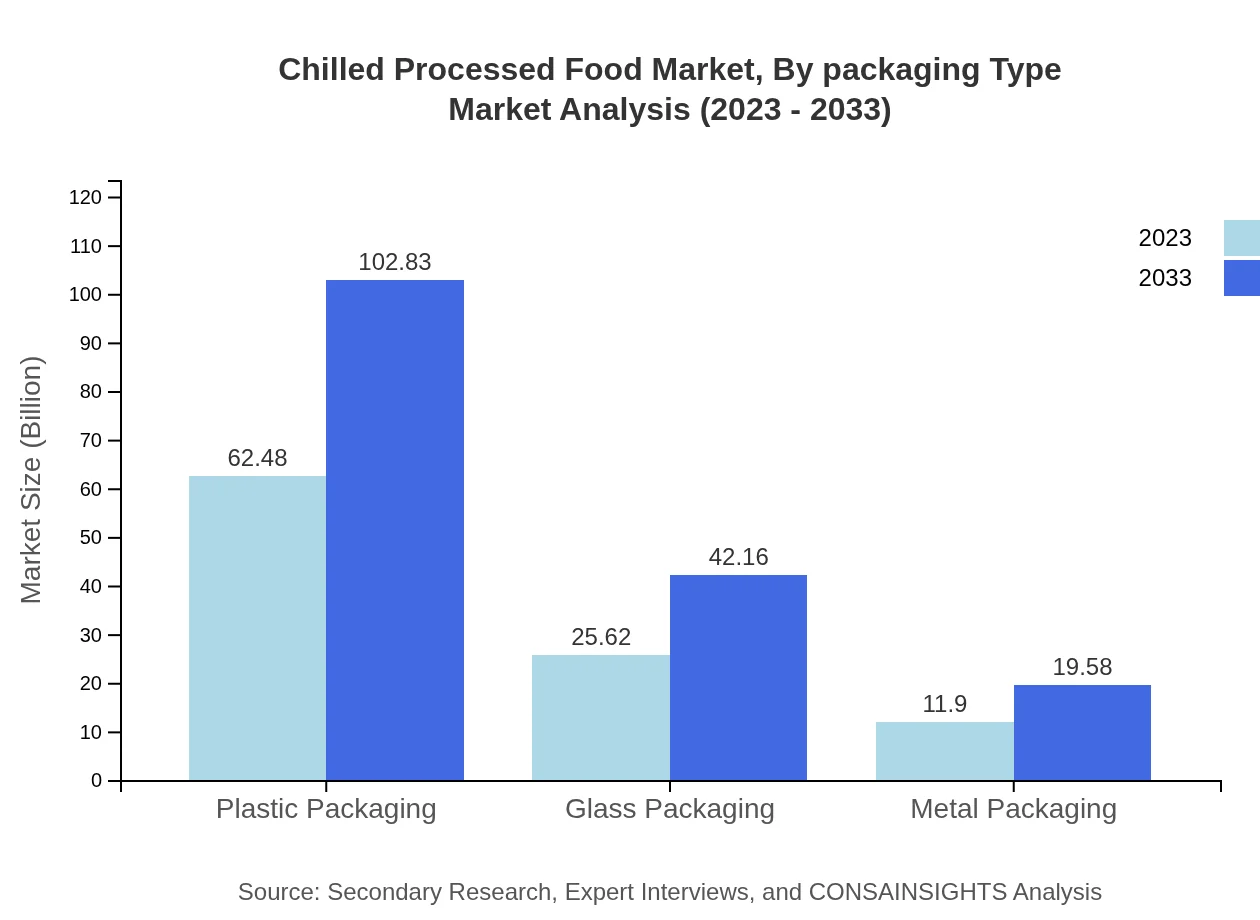

Chilled Processed Food Market Analysis By Packaging Type

The market for chilled processed food packaging is dominated by plastic, valued at $62.48 billion in 2023, which is expected to grow significantly. Glass packaging, valued at $25.62 billion, is gaining popularity for its environmentally friendly properties, while metal packaging remains essential for certain product types, at $11.90 billion in 2023.

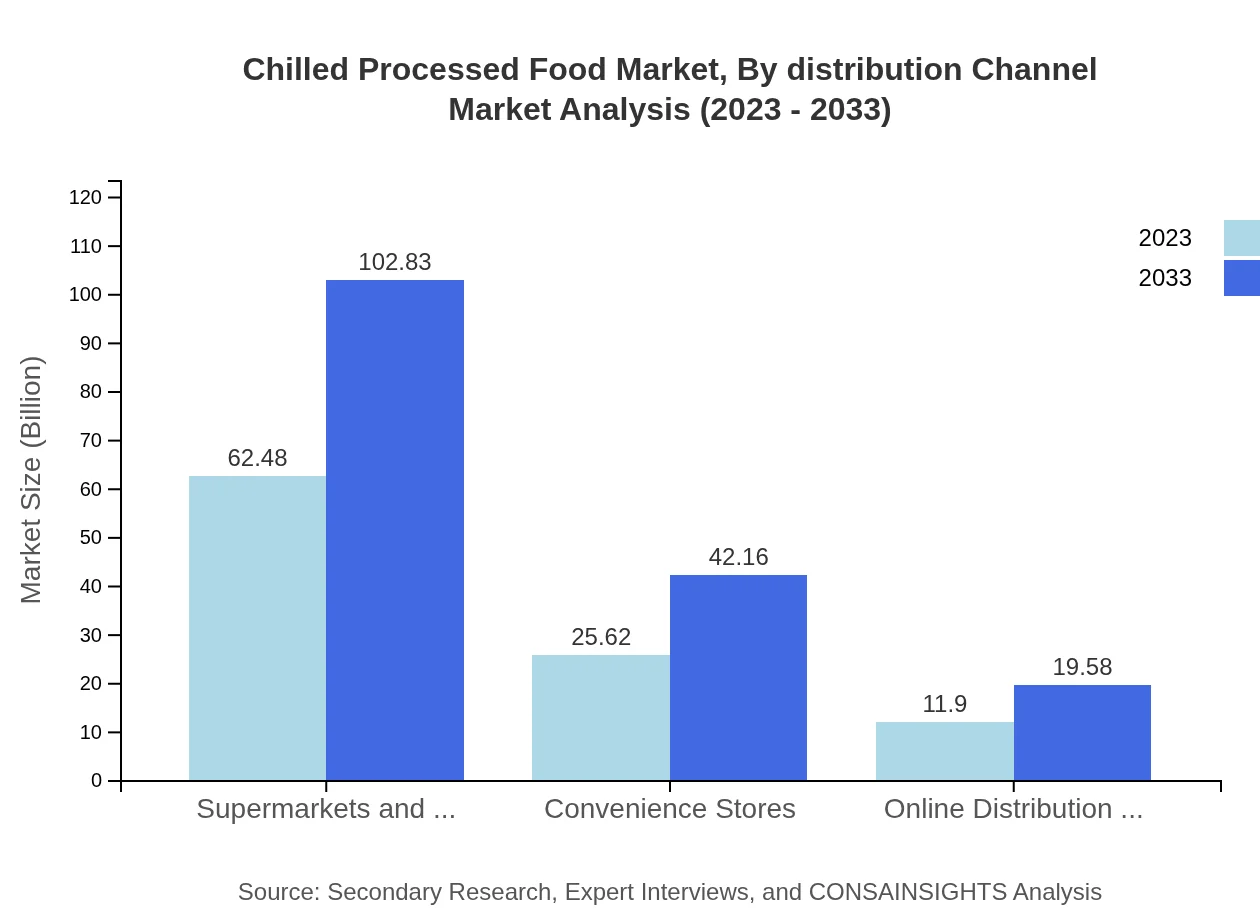

Chilled Processed Food Market Analysis By Distribution Channel

Supermarkets and hypermarkets dominate the distribution channel for chilled processed foods, valued at $62.48 billion in 2023. Convenience stores are also significant, projected at $25.62 billion, driven by changing shopping habits. Online distribution channels, while currently at $11.90 billion, are witnessing rapid growth as digital grocery shopping becomes increasingly popular.

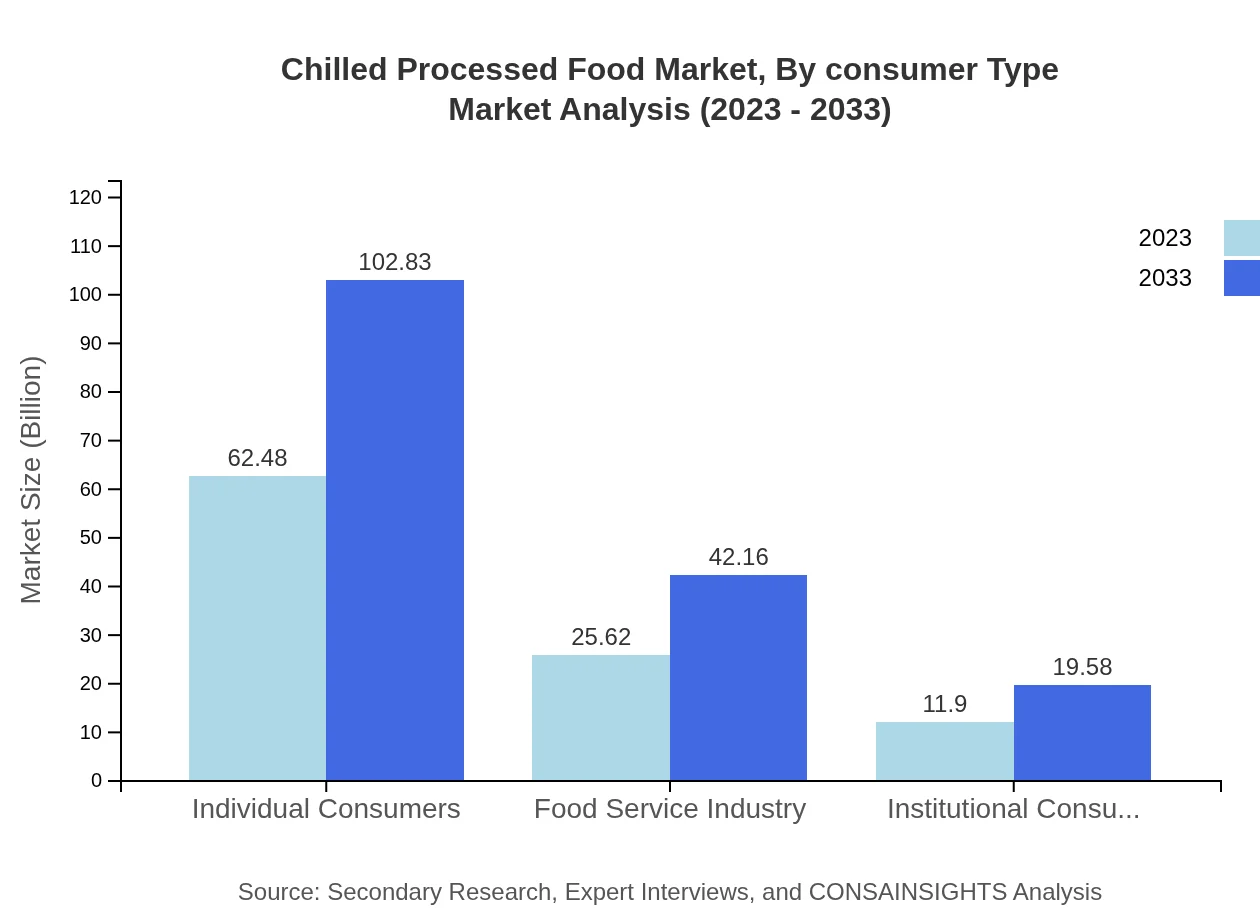

Chilled Processed Food Market Analysis By Consumer Type

Individual consumers dominate the market, valued at $62.48 billion in 2023, reflecting the growing trend of convenience among busy households. The food service industry and healthcare sectors, valued at $25.62 billion and $11.90 billion respectively, are also substantial contributors, catering to specific consumer needs.

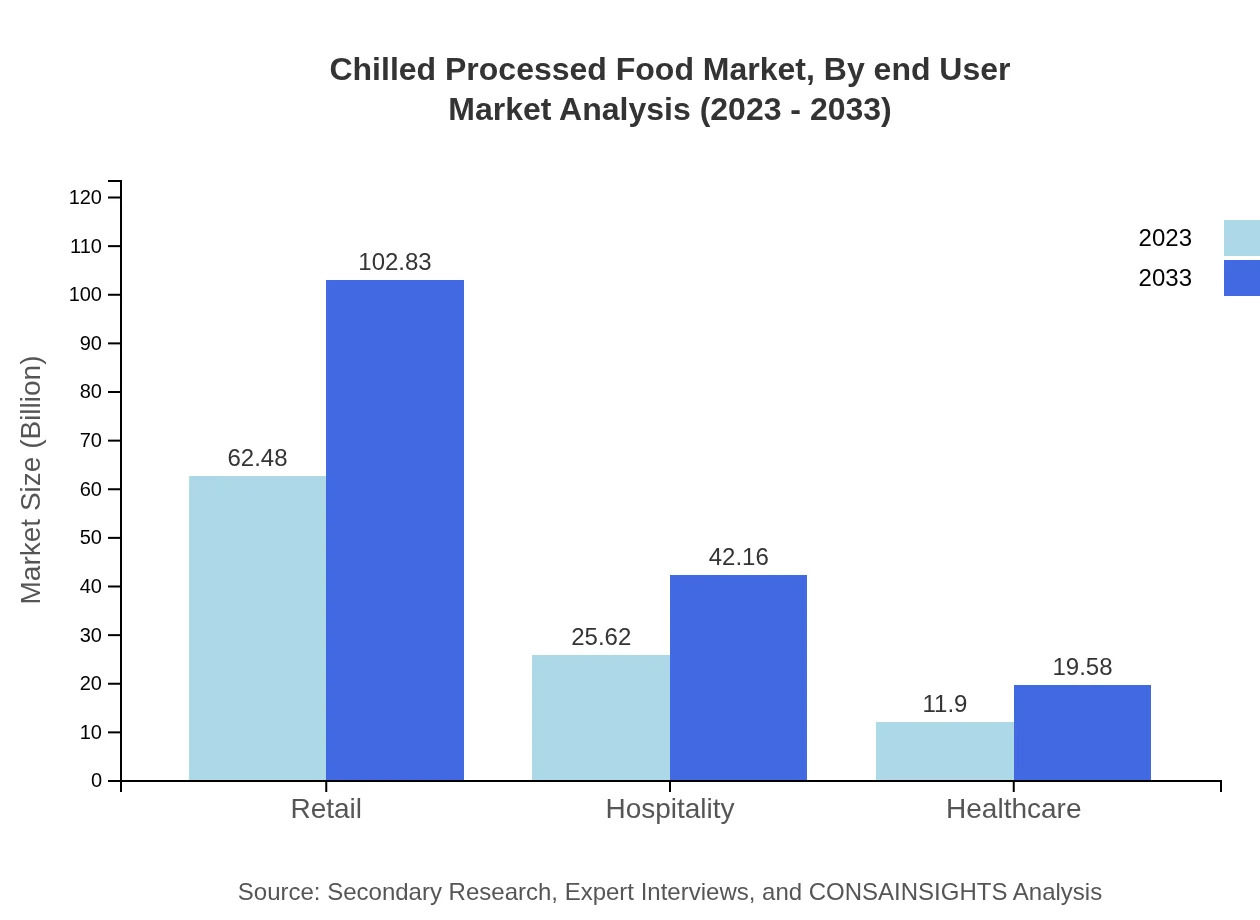

Chilled Processed Food Market Analysis By End User

The institutional consumer segment is crucial, valued at $11.90 billion in 2023. This includes hospitals, schools, and corporations relying on chilled foods for their meal services. The food service market, valued at $25.62 billion, represents significant growth opportunities given the increasing number of dining options available.

Chilled Processed Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chilled Processed Food Industry

Nestlé:

A leading global food and beverage company, Nestlé offers a range of chilled processed foods, focusing on nutrition, health, and wellness.Unilever:

Known for its diverse portfolio, Unilever caters to the chilled processed food market through many well-established brands, emphasizing sustainable sourcing and innovation.Tyson Foods:

As one of the largest meat producers, Tyson Foods provides a variety of chilled poultry and meat products, instrumental in the growth of the chilled processed food segment.Kraft Heinz Company:

A major player in the food industry, Kraft Heinz offers a comprehensive range of chilled products, focusing on quality and convenience.Danone:

Specializing in dairy and plant-based products, Danone is a significant competitor in the chilled processed food sector, promoting health-focused offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of chilled Processed Food?

The global chilled processed food market was valued at approximately $100 million in 2023 and is projected to grow at a CAGR of 5%, reaching significantly larger figures by 2033.

What are the key market players or companies in this chilled Processed Food industry?

Key players in the chilled processed food market include major manufacturers and brands involved in meat and poultry, fruits and vegetables, and ready-to-eat meal sectors, contributing to growth and innovation in this industry.

What are the primary factors driving the growth in the chilled Processed Food industry?

Growth in the chilled processed food industry is primarily driven by increasing consumer demand for convenience, changing lifestyles, and growth in food service sectors, alongside advancements in food preservation and processing technologies.

Which region is the fastest Growing in the chilled Processed Food?

The Asia Pacific region is among the fastest-growing markets for chilled processed food, projected to grow from $20.37 million in 2023 to $33.52 million by 2033, reflecting a significant annual increase.

Does ConsaInsights provide customized market report data for the chilled Processed Food industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the chilled processed food industry, ensuring clients receive insights relevant to their focus areas.

What deliverables can I expect from this chilled Processed Food market research project?

Deliverables from the chilled processed food market research project typically include detailed market analysis reports, forecasts, segment data, and insights on consumer trends and competitive landscape.

What are the market trends of chilled Processed Food?

Current trends in the chilled processed food market include increased demand for organic and healthy options, sustainability in packaging, and the rapid growth of online distribution channels, reflecting broader consumer shifts.