Chip Scale Package Led Market Report

Published Date: 31 January 2026 | Report Code: chip-scale-package-led

Chip Scale Package Led Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Chip Scale Package LED market from 2023 to 2033, covering market trends, regional dynamics, product segmentation, and major industry players to offer valuable insights for stakeholders and investors.

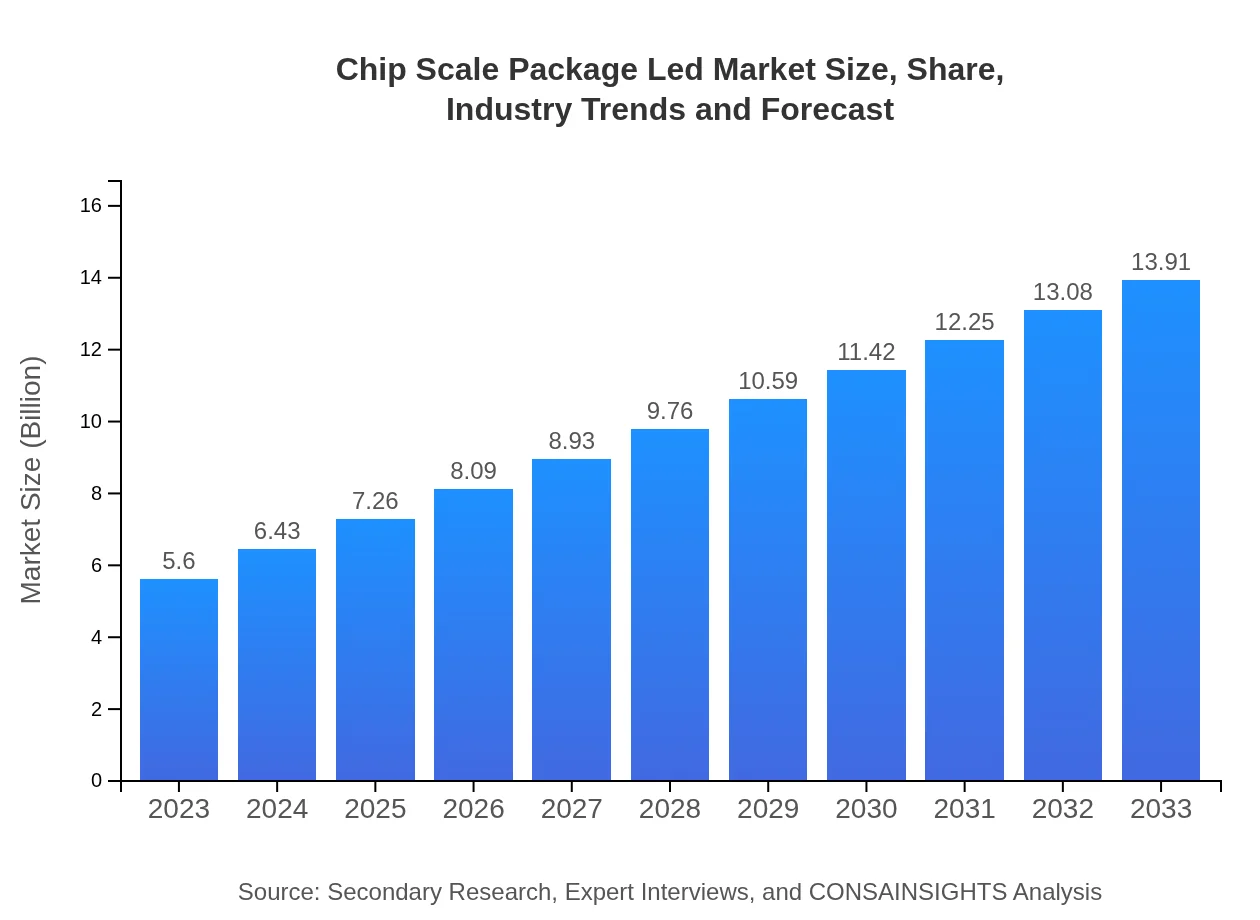

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Nichia Corporation, Osram Opto Semiconductors, Samsung Electronics |

| Last Modified Date | 31 January 2026 |

Chip Scale Package Led Market Overview

Customize Chip Scale Package Led Market Report market research report

- ✔ Get in-depth analysis of Chip Scale Package Led market size, growth, and forecasts.

- ✔ Understand Chip Scale Package Led's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chip Scale Package Led

What is the Market Size & CAGR of Chip Scale Package Led market in 2033?

Chip Scale Package Led Industry Analysis

Chip Scale Package Led Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chip Scale Package Led Market Analysis Report by Region

Europe Chip Scale Package Led Market Report:

The European market for Chip Scale Packages is projected to expand from USD 1.38 billion in 2023 to USD 3.43 billion by 2033. Regulatory frameworks aimed at reducing greenhouse gas emissions and the growing adoption of LED lighting solutions in smart cities significantly contribute to this growth.Asia Pacific Chip Scale Package Led Market Report:

In the Asia Pacific region, the Chip Scale Package LED market was valued at USD 1.08 billion in 2023, with projections to reach USD 2.68 billion by 2033. This growth can be attributed to the rapid industrialization, expanding urban population, and increasing infrastructural developments in countries like China and India, which are driving the demand for advanced LED lighting solutions.North America Chip Scale Package Led Market Report:

North America is anticipated to witness substantial growth, with the Chip Scale Package LED market increasing from USD 1.91 billion in 2023 to USD 4.75 billion by 2033. The heightened emphasis on energy conservation and advancements in LED technology are driving this momentum within key markets such as the United States and Canada.South America Chip Scale Package Led Market Report:

The market in South America is expected to grow from USD 0.55 billion in 2023 to USD 1.37 billion by 2033. The shift towards energy-efficient lighting and government initiatives promoting sustainable technologies are key factors propelling the market forward in this region.Middle East & Africa Chip Scale Package Led Market Report:

The Middle East and Africa region is expected to see a growth in the Chip Scale Package LED market from USD 0.68 billion in 2023 to USD 1.68 billion by 2033. Increasing investments in infrastructure and a rising focus on energy-efficient technologies are key drivers in this region.Tell us your focus area and get a customized research report.

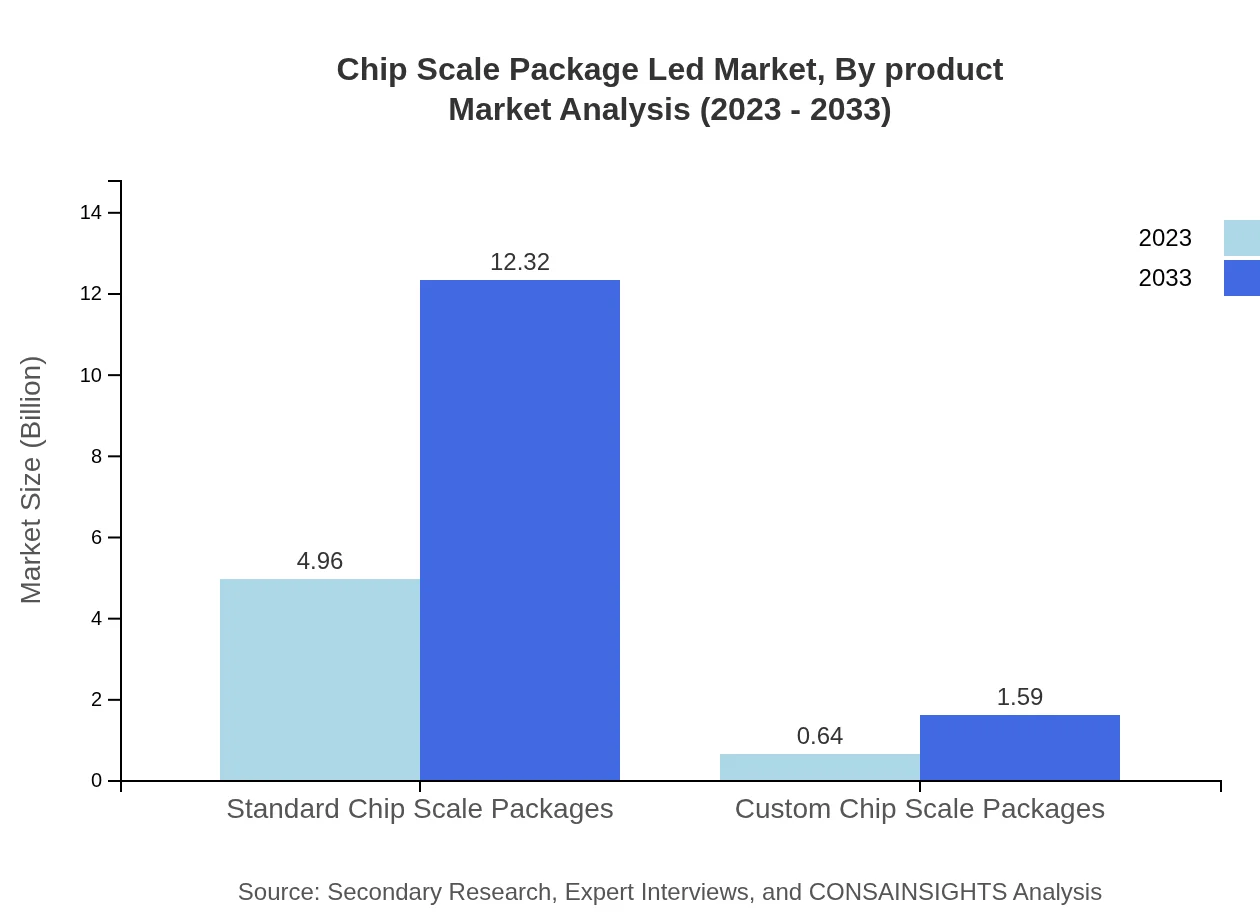

Chip Scale Package Led Market Analysis By Product

The Chip Scale Package LED market is categorized into standard and custom packages. In 2023, standard chip scale packages comprise the dominant market segment, valued at USD 4.96 billion, anticipated to grow to USD 12.32 billion by 2033. Conversely, custom chip scale packages, initially valued at USD 0.64 billion in 2023, are projected to grow to USD 1.59 billion by 2033, indicating a shift towards tailored solutions for specific applications.

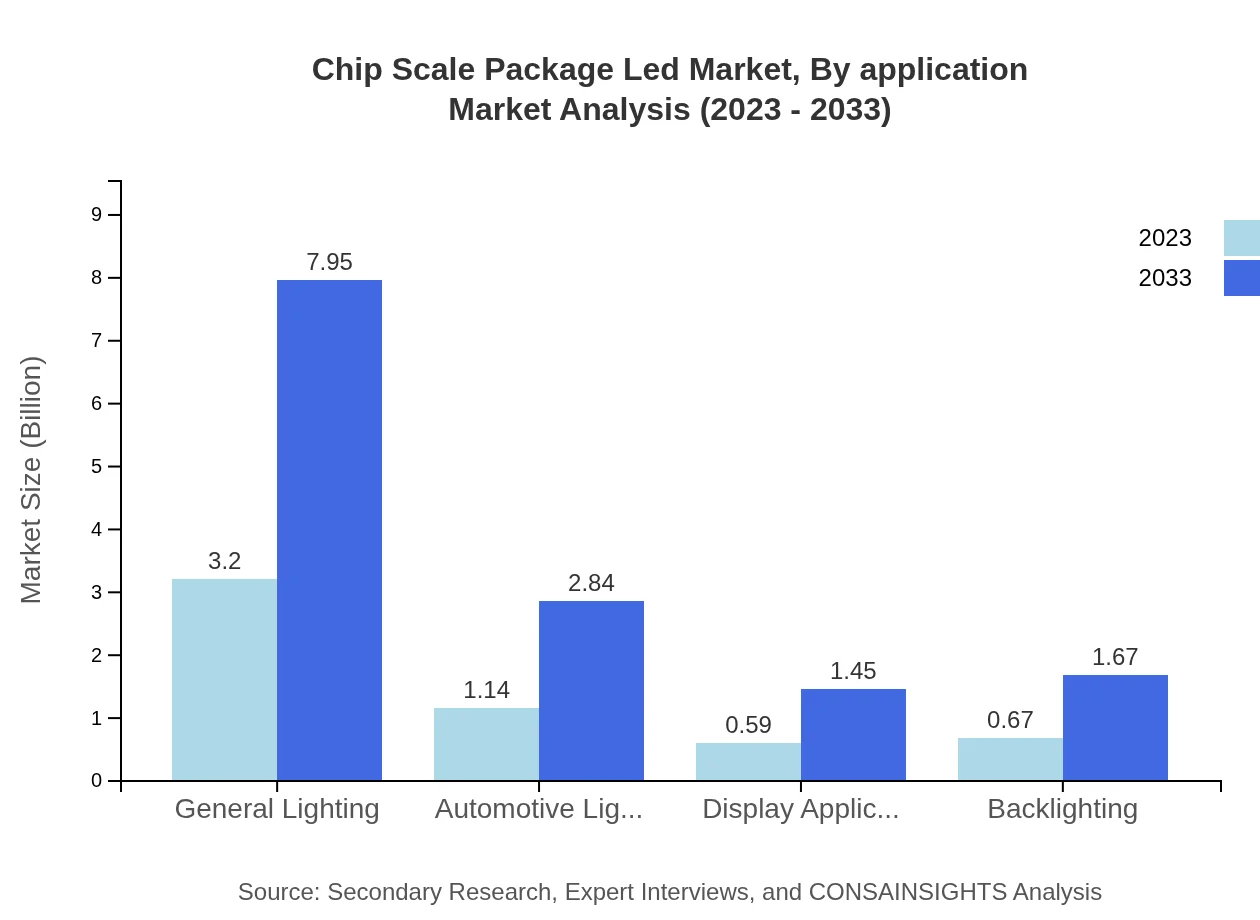

Chip Scale Package Led Market Analysis By Application

The major applications for Chip Scale Package LEDs include general lighting, automotive lighting, display applications, and backlighting. In 2023, the general lighting segment is valued at USD 3.20 billion, expected to rise to USD 7.95 billion by 2033. Automotive lighting, initially worth USD 1.14 billion in 2023, is expected to grow to USD 2.84 billion due to the increasing demand for energy-efficient vehicles.

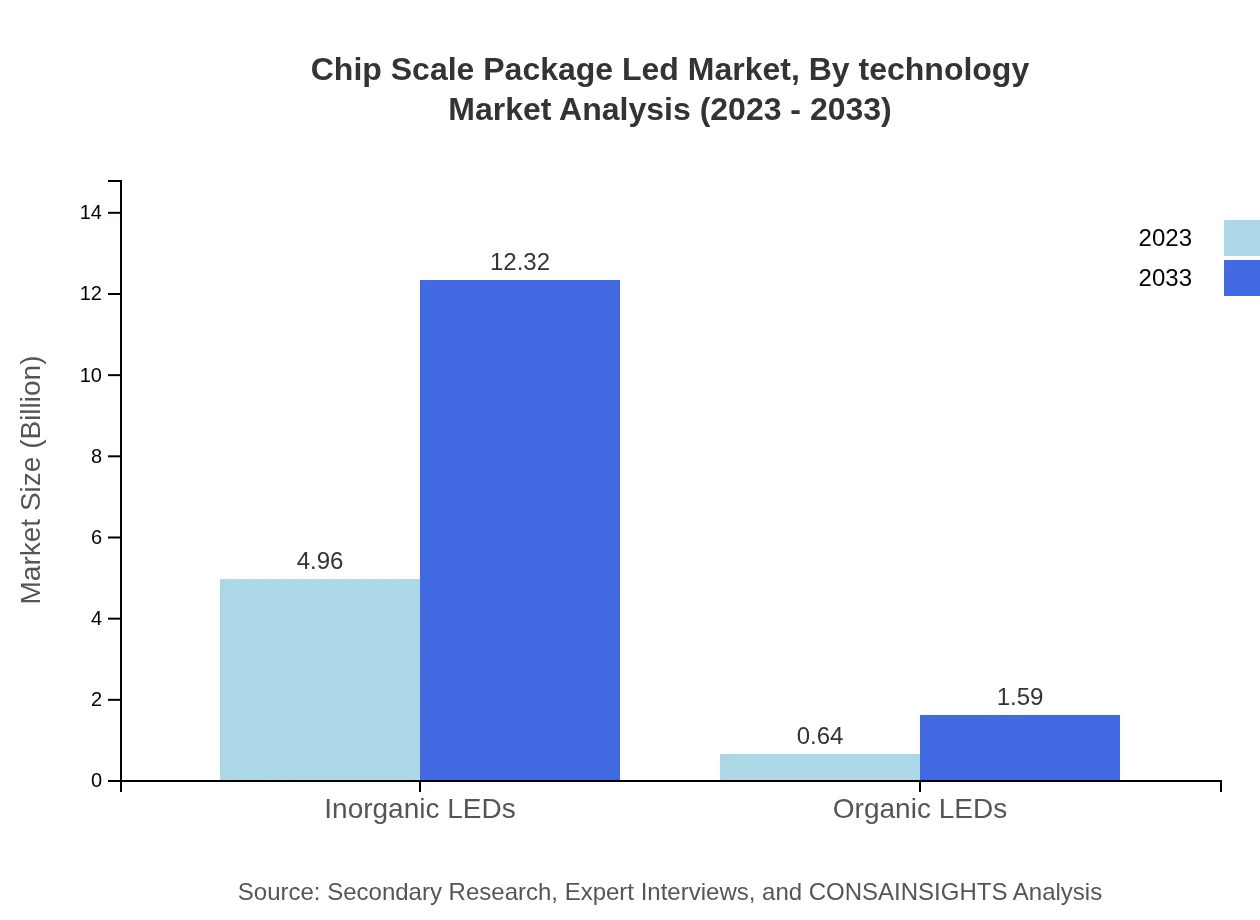

Chip Scale Package Led Market Analysis By Technology

In terms of technology, the market is primarily divided into inorganic and organic LEDs. Inorganic LEDs dominate the market, representing a size of USD 4.96 billion in 2023, projected to grow to USD 12.32 billion by 2033. Organic LEDs, although smaller in market size, are forecasted to grow from USD 0.64 billion in 2023 to USD 1.59 billion as manufacturers explore flexible and innovative lighting solutions.

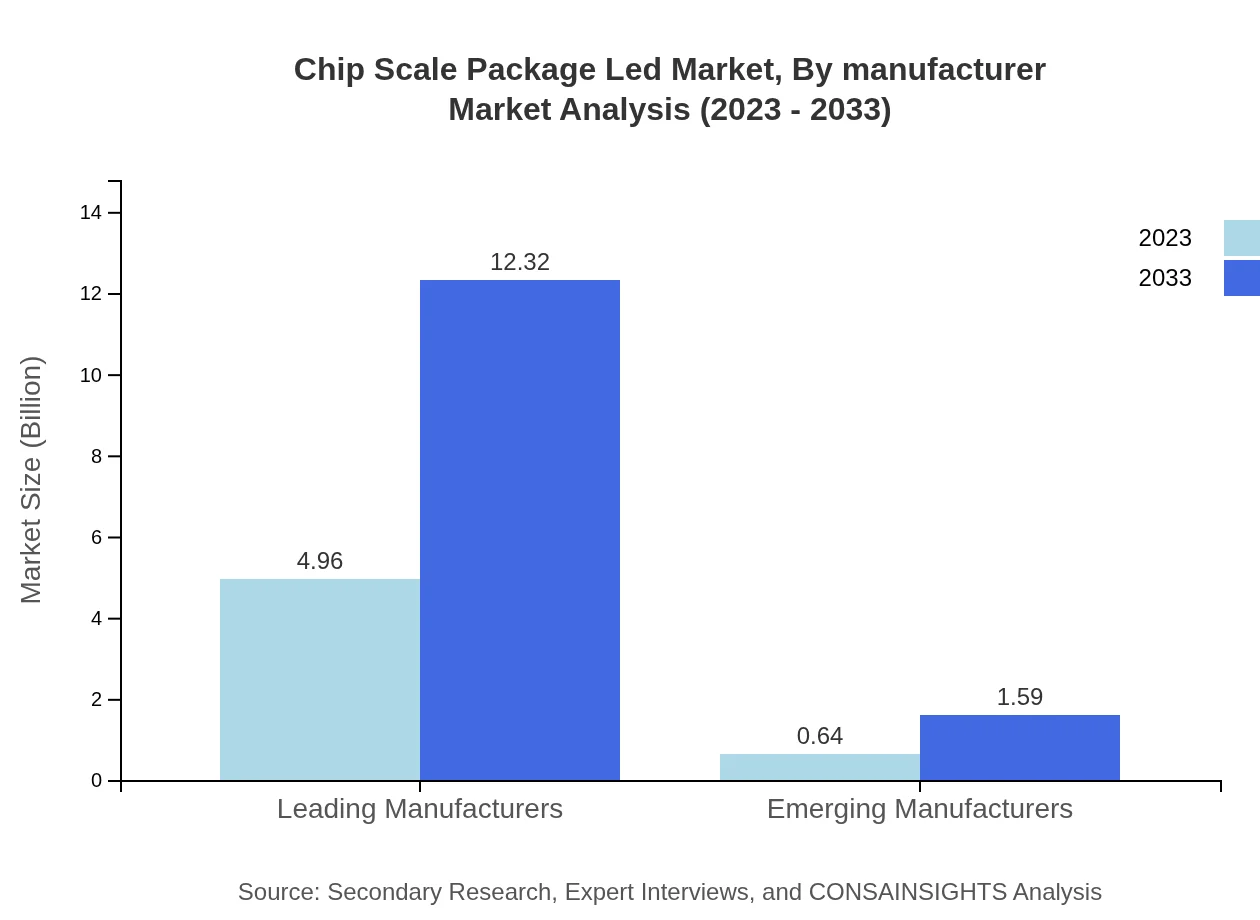

Chip Scale Package Led Market Analysis By Manufacturer

The Chip Scale Package LED market is influenced greatly by leading and emerging manufacturers. Leading manufacturers are projected to capture a market share of 88.55%, translating to a size of USD 4.96 billion in 2023, growing to USD 12.32 billion by 2033. Meanwhile, emerging manufacturers will hold an 11.45% share, indicating their growing influence in developing niche products.

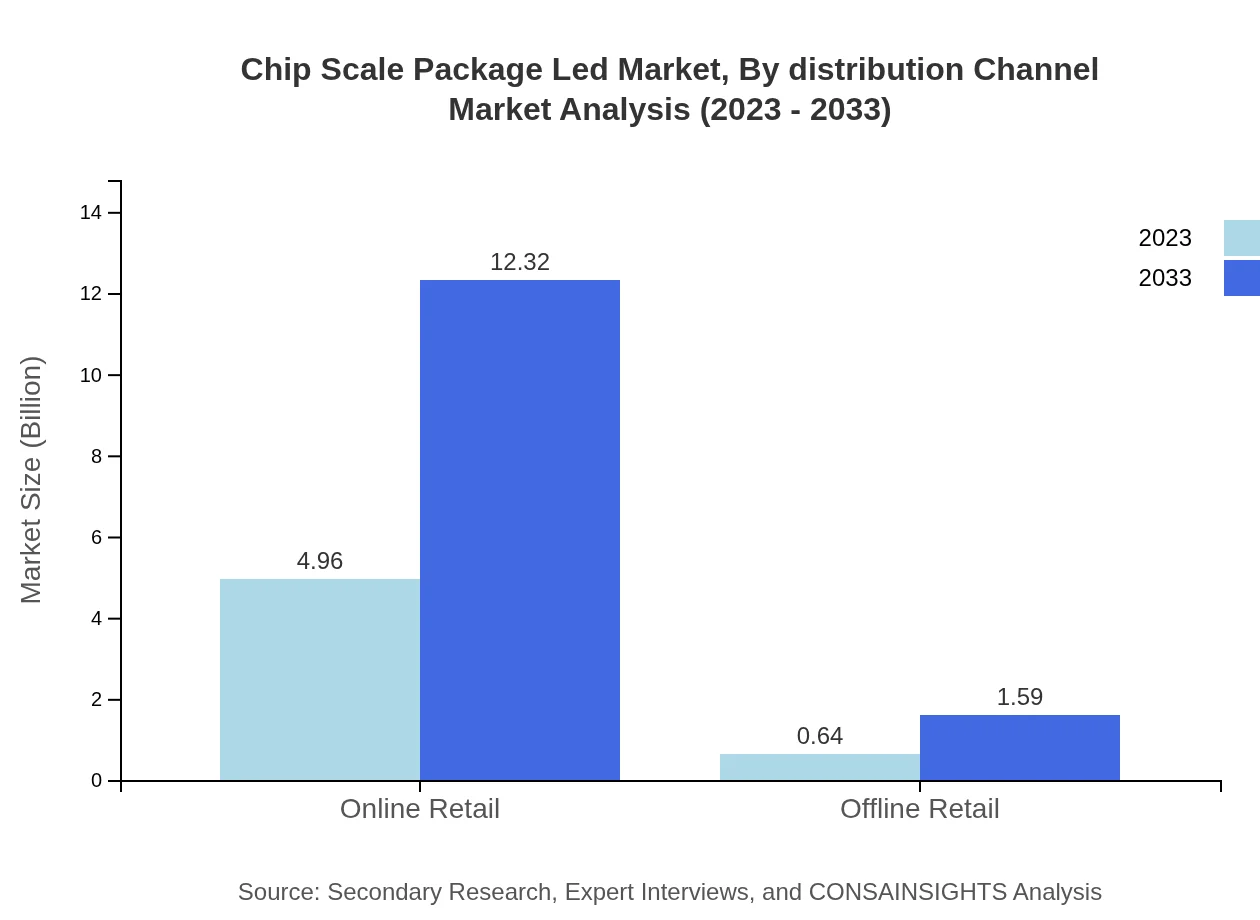

Chip Scale Package Led Market Analysis By Distribution Channel

Distribution channels for the Chip Scale Package LED market include online and offline retail. Online retail leads with an impressive market share of 88.55%, generating USD 4.96 billion in 2023, expected to grow to USD 12.32 billion by 2033. Conversely, offline retail, while smaller, is expected to expand significantly from USD 0.64 billion to USD 1.59 billion, as consumers seek tactile purchasing experiences.

Chip Scale Package Led Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chip Scale Package Led Industry

Nichia Corporation:

Nichia is a global leader in LED technology, known for its exceptional performance and energy-efficient products. The company has made significant investments in R&D to advance CSP LED technology and maintain its market dominance.Osram Opto Semiconductors:

As a prominent player in the lighting industry, Osram excels in developing innovative CSP LEDs. Their focus on sustainability and cutting-edge technologies drives their leadership position in the global market.Samsung Electronics:

Samsung Electronics continues to expand its portfolio of LED products, including Chip Scale Package solutions, through continuous innovation and strategic partnerships to enhance market presence.We're grateful to work with incredible clients.

FAQs

What is the market size of chip Scale Package Led?

The global chip-scale-package-led market is valued at approximately $5.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2% through 2033, indicating substantial growth opportunities in this technology.

What are the key market players or companies in this chip Scale Package Led industry?

Key players in the chip-scale-package-led industry include prominent manufacturers specializing in LED technology. Their ongoing innovations and partnerships drive advancements in product quality and application versatility, fostering competition and collaboration within the market.

What are the primary factors driving the growth in the chip Scale Package Led industry?

Growth in the chip-scale-package-led industry is driven by increasing demand for energy-efficient lighting solutions, advancements in LED technology, growing applications in automotive and general lighting, and rising consumer awareness of sustainable technologies.

Which region is the fastest Growing in the chip Scale Package Led?

The fastest-growing region in the chip-scale-package-led market is North America, projected to grow from $1.91 billion in 2023 to $4.75 billion by 2033. Europe also shows significant growth potential, expanding from $1.38 billion to $3.43 billion in the same period.

Does ConsaInsights provide customized market report data for the chip Scale Package Led industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the chip-scale-package-led industry. These reports are designed to provide insights relevant to particular market segments and regional focuses.

What deliverables can I expect from this chip Scale Package Led market research project?

Deliverables from the chip-scale-package-led market research project typically include comprehensive market analysis, detailed segment breakdowns, competitive landscape assessments, and strategic recommendations for market entry and expansion.

What are the market trends of chip Scale Package Led?

Current trends in the chip-scale-package-led market include increasing adoption of smart lighting solutions, integration of IoT technologies, expansion in automotive lighting applications, and growing preference for environmental sustainability in product development.