Chipless Rfid Market Report

Published Date: 31 January 2026 | Report Code: chipless-rfid

Chipless Rfid Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Chipless RFID market, covering market size, regional insights, industry dynamics and future forecasts from 2023 to 2033.

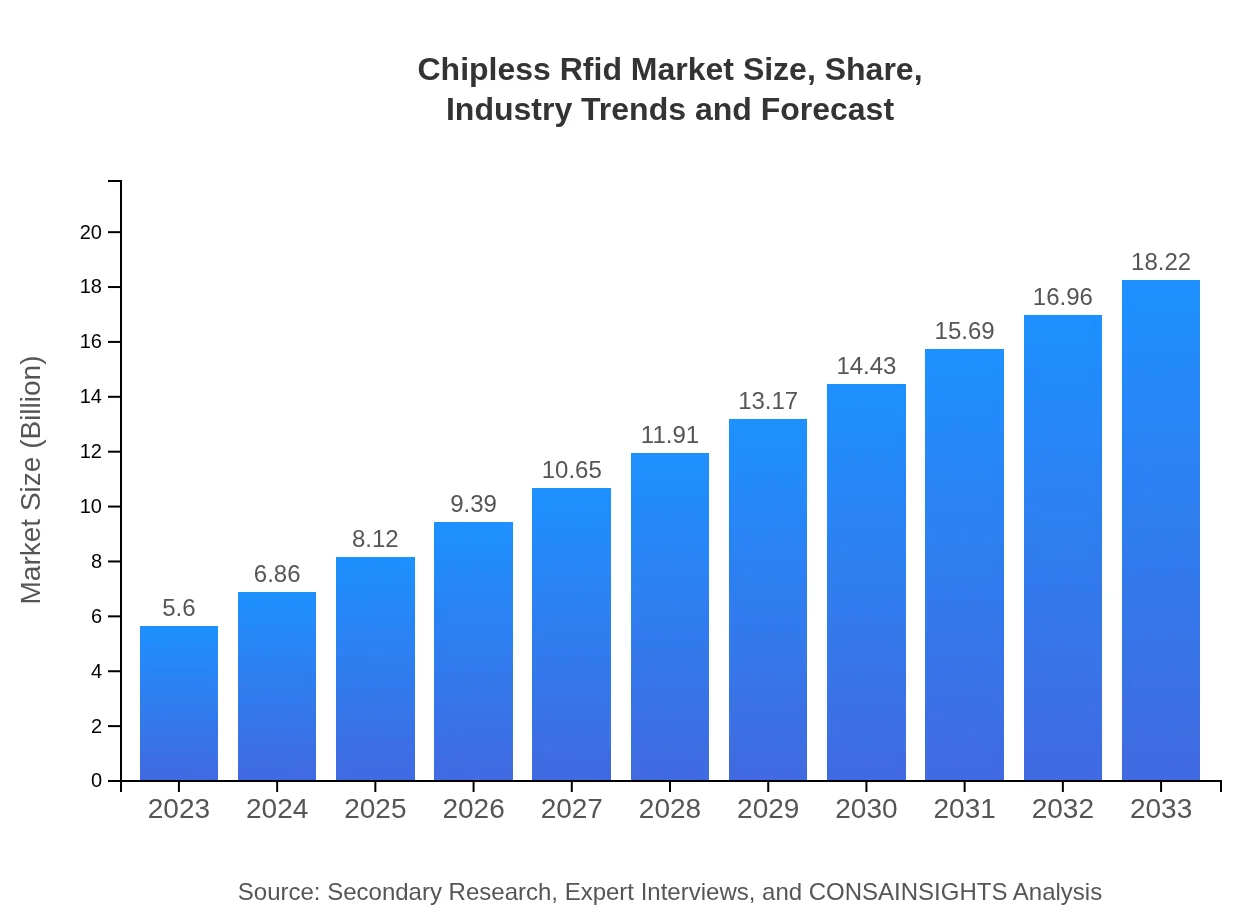

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $18.22 Billion |

| Top Companies | Impinj, Inc., Alien Technology Corp., SATO Holdings Corporation, Zebra Technologies |

| Last Modified Date | 31 January 2026 |

Chipless RFID Market Overview

Customize Chipless Rfid Market Report market research report

- ✔ Get in-depth analysis of Chipless Rfid market size, growth, and forecasts.

- ✔ Understand Chipless Rfid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chipless Rfid

What is the Market Size & CAGR of Chipless Rfid market in 2023?

Chipless RFID Industry Analysis

Chipless RFID Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chipless RFID Market Analysis Report by Region

Europe Chipless Rfid Market Report:

Europe has a projected market value of $1.88 billion in 2023, with aspirations of reaching $6.12 billion by 2033. European countries are at the forefront of adopting RFID solutions for inventory management, driven by stringent regulations regarding tracking systems in supply chains.Asia Pacific Chipless Rfid Market Report:

In the Asia Pacific region, the Chipless RFID market size in 2023 is estimated at $1.07 billion, projected to grow to $3.47 billion by 2033. The growth is largely driven by increasing manufacturing activities, rising demand for smart retail solutions, and supportive government initiatives promoting technology adoption.North America Chipless Rfid Market Report:

In North America, the Chipless RFID market is estimated to be worth $1.81 billion in 2023, expected to escalate to $5.89 billion by 2033. The region leads in technology adoption, propelled by significant investments in retail and healthcare sectors, as well as advancements in technology infrastructure.South America Chipless Rfid Market Report:

The South American market size for Chipless RFID in 2023 stands at $0.26 billion, with an expected increase to $0.85 billion by 2033. The region's growth is supported by increasing investments in logistics and supply chain management technologies, alongside growing consumption of consumer goods.Middle East & Africa Chipless Rfid Market Report:

The Middle East and Africa region is anticipated to achieve a market size of $0.58 billion in 2023, growing to $1.89 billion by 2033. The growth potential is supported by increasing investment in smart city initiatives, logistics enhancements, and greater adoption of automated technology.Tell us your focus area and get a customized research report.

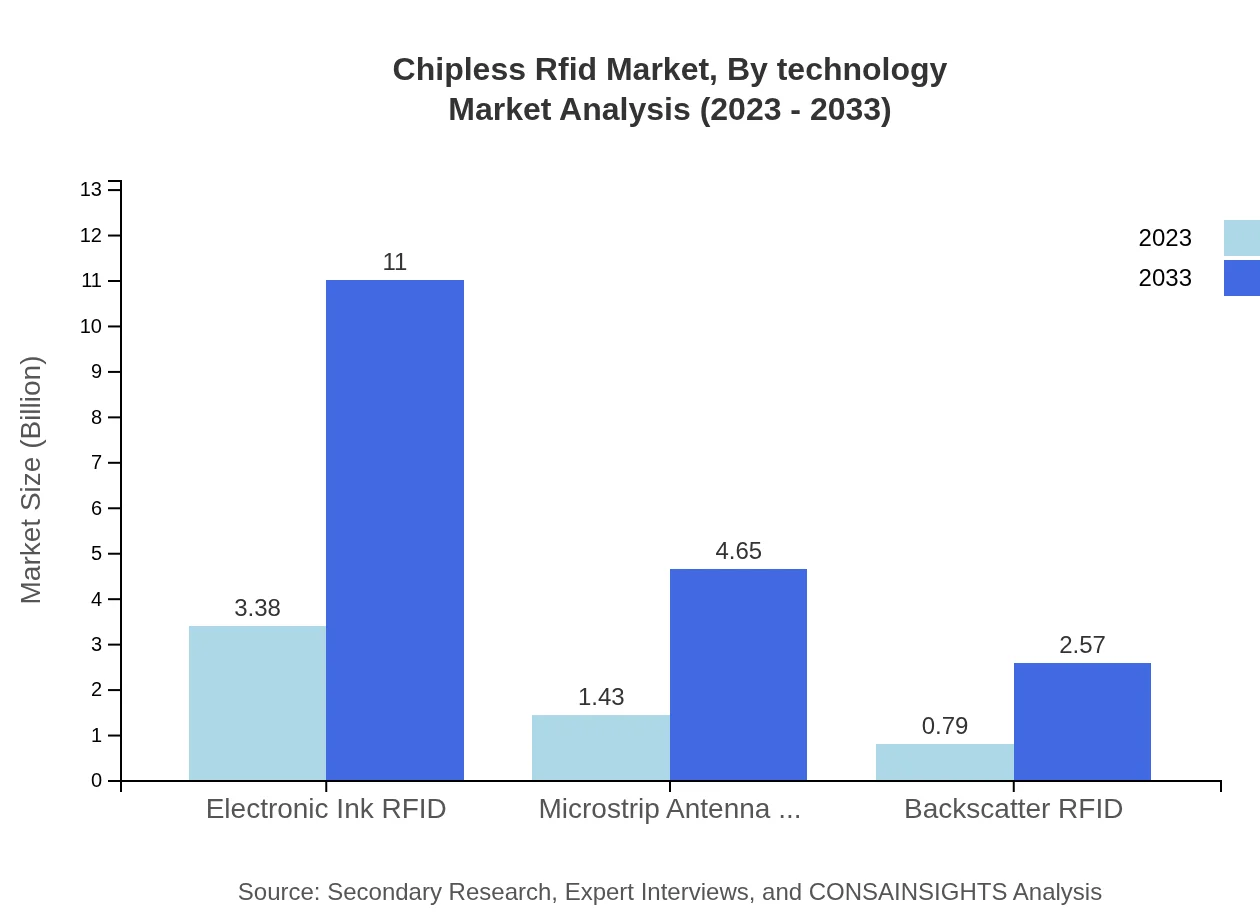

Chipless Rfid Market Analysis By Technology

The segment includes technologies such as backscatter RFID, electronic ink RFID, and microstrip antennas. Backscatter RFID shows the highest growth potential due to increasing interest in low-cost, mass-market applications, while electronic ink RFID offers innovative solutions for dynamic pricing and tagging.

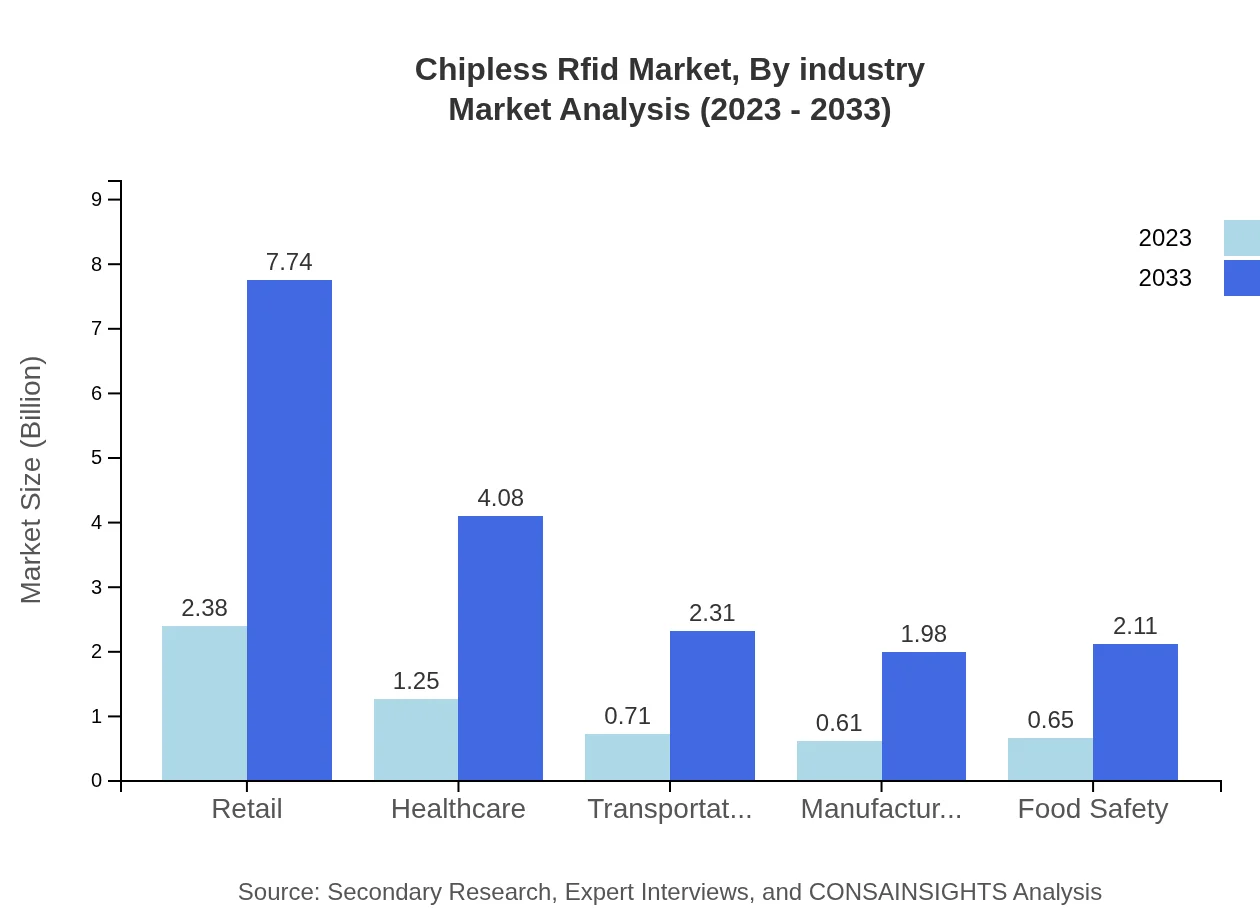

Chipless Rfid Market Analysis By Industry

Retail remains the largest segment, expected to reach $7.74 billion by 2033, due to ongoing efforts in loss prevention and inventory efficiency. The healthcare sector is gaining momentum, with a market estimate of $4.08 billion by 2033, following the adoption of RFID for asset and medication tracking.

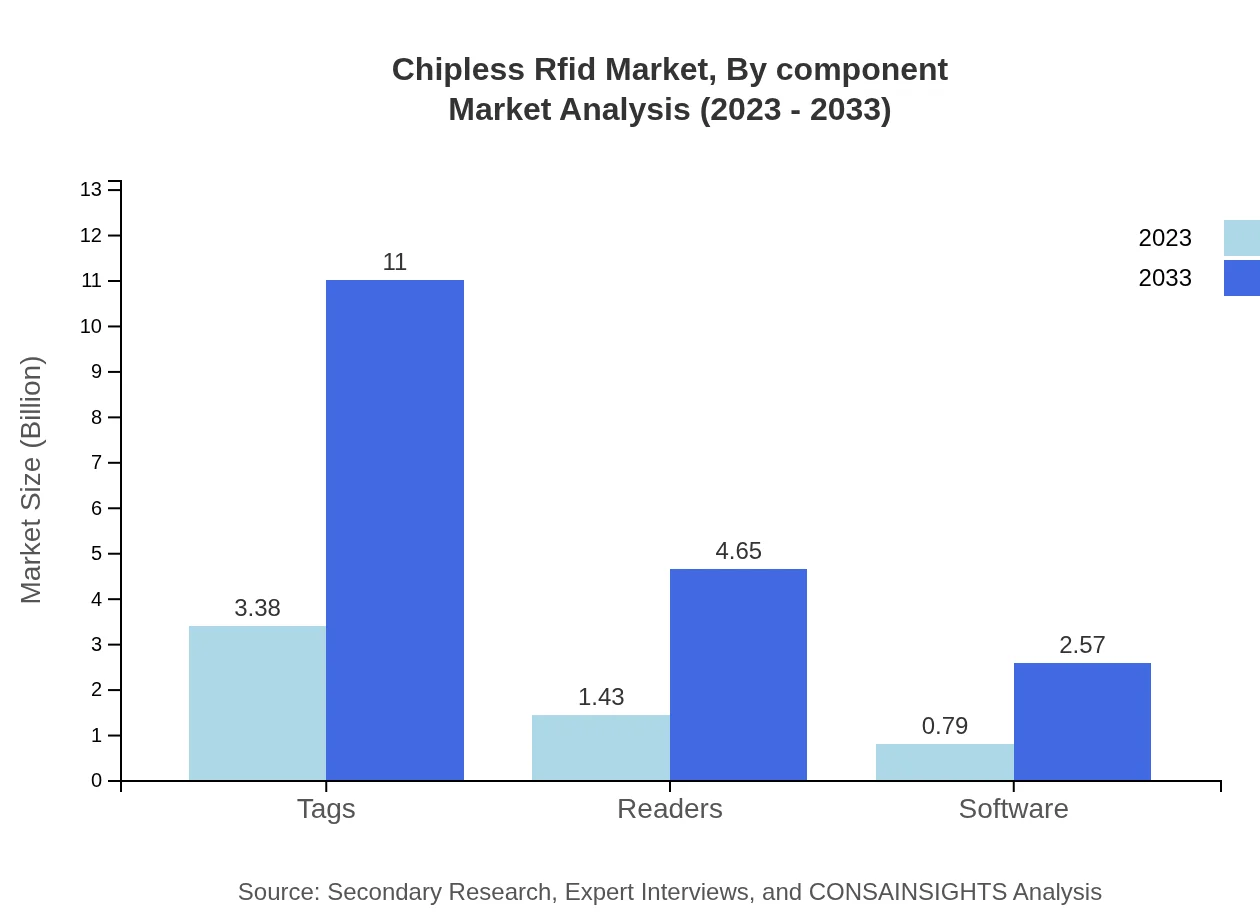

Chipless Rfid Market Analysis By Component

Components of the chipless RFID market include tags, readers, software, and services. Tags dominate the market share, driven by the growing demand for cost-effective solutions in various applications, along with readers and software that support the infrastructure.

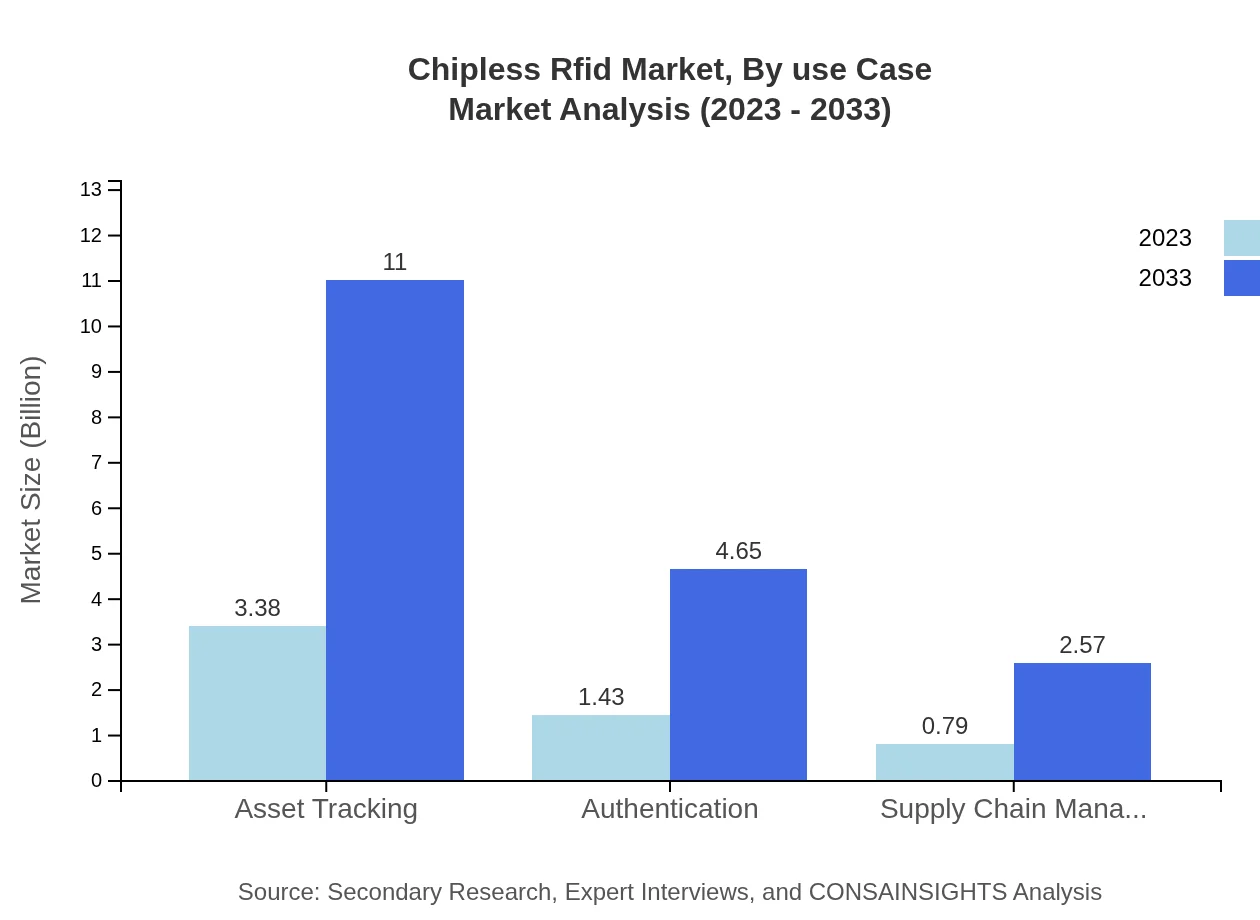

Chipless Rfid Market Analysis By Use Case

Key use cases include asset tracking, authentication, and supply chain management. The asset tracking segment is the largest, accounting for about 60.36% of the market share, driven by businesses aiming for enhanced operational efficiency.

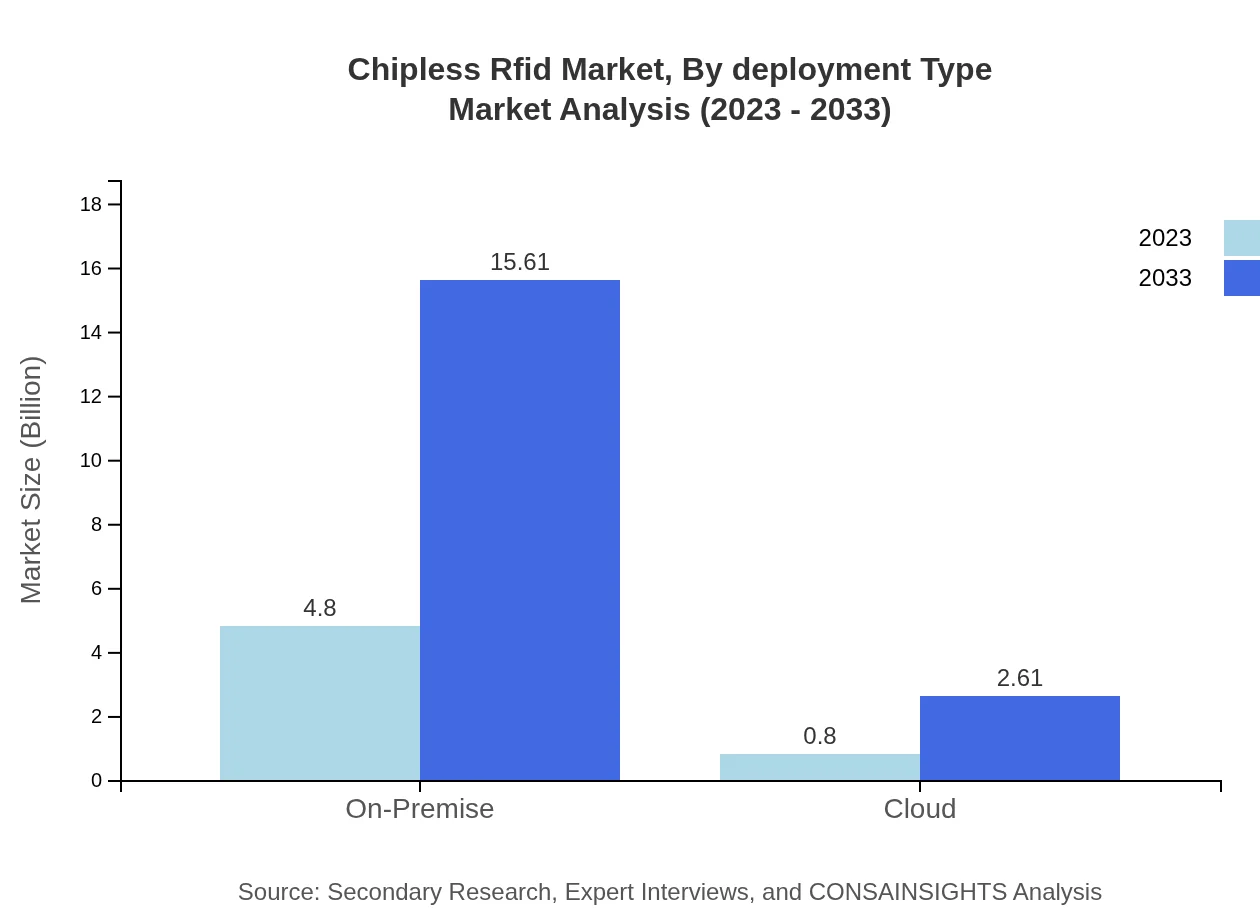

Chipless Rfid Market Analysis By Deployment Type

The market is split between on-premise and cloud-based deployment types. The on-premise deployment is preferred among enterprises prioritizing data security and control, while cloud solutions are gaining traction due to their scalability and cost-effectiveness.

Chipless Rfid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chipless Rfid Industry

Impinj, Inc.:

Impinj is a leading provider of RAIN RFID solutions, offering a comprehensive range of products that enhance RFID system performance and efficiency.Alien Technology Corp.:

Alien Technology is a pioneer in RFID technology, renowned for its innovative chipless solutions utilized across a multitude of applications globally.SATO Holdings Corporation:

SATO is renowned for its intelligent and innovative RFID solutions that help enhance operational management particularly in retail and healthcare sectors.Zebra Technologies:

Zebra Technologies specializes in solutions that give enterprise visibility into operations, including advanced RFID technology for asset and inventory management.We're grateful to work with incredible clients.

FAQs

What is the market size of chipless RFID?

The chipless RFID market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 12% through 2033, indicating significant market expansion over the next decade.

What are the key market players or companies in the chipless RFID industry?

Key players in the chipless RFID industry include major technology firms and startups specializing in RFID solutions, enhancing product applications in sectors such as retail, healthcare, and logistics.

What are the primary factors driving the growth in the chipless RFID industry?

Growth is driven by the increasing demand for inventory management, asset tracking, advancements in RFID technology, and the need for cost-effective solutions in sectors like retail and healthcare.

Which region is the fastest Growing in the chipless RFID market?

The Asia Pacific region is the fastest-growing market for chipless RFID, projected to reach $3.47 billion by 2033, growing from $1.07 billion in 2023 due to rising technological adoption and investment.

Does ConsaInsights provide customized market report data for the chipless RFID industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the chipless RFID industry, allowing clients to gain insights aligned with their strategic objectives.

What deliverables can I expect from this chipless RFID market research project?

Deliverables include comprehensive market analysis, segment data, competitive landscape assessments, growth forecasts, and tailored insights that support strategic decisions in the chipless RFID market.

What are the market trends of chipless RFID?

Market trends include the increasing adoption of IoT solutions, focus on sustainability through recyclable materials in RFID products, and growing investments in smart city projects driving chipless RFID innovations.