Chocolate Market Report

Published Date: 31 January 2026 | Report Code: chocolate

Chocolate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the chocolate market, covering market size, growth trends, segmentation, regional insights, and forecasts from 2023 to 2033. It offers critical insights for stakeholders to make informed decisions in a rapidly evolving industry.

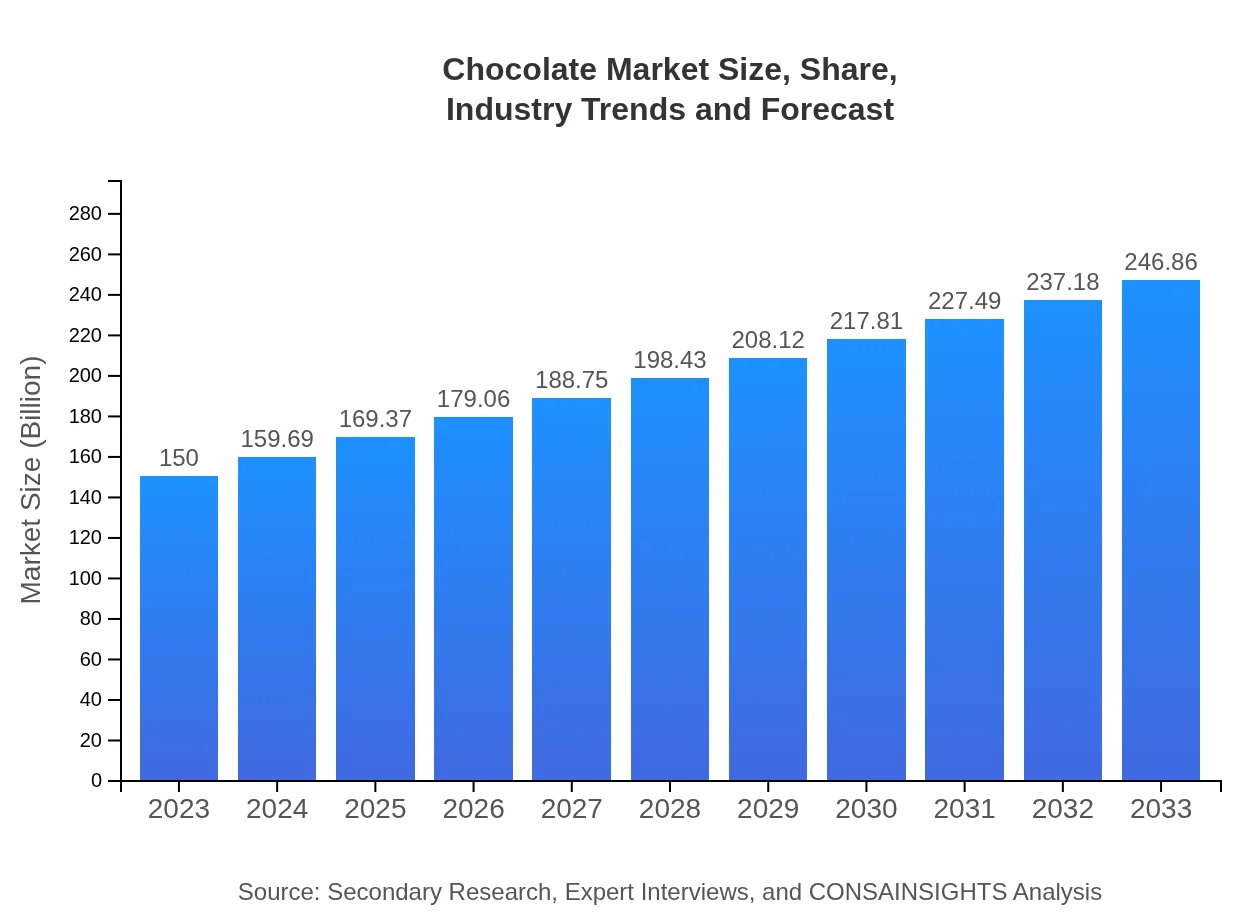

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $150.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $246.86 Billion |

| Top Companies | Mondelez International, Nestle , Mars, Incorporated, Ferrero Group |

| Last Modified Date | 31 January 2026 |

Chocolate Market Overview

Customize Chocolate Market Report market research report

- ✔ Get in-depth analysis of Chocolate market size, growth, and forecasts.

- ✔ Understand Chocolate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chocolate

What is the Market Size & CAGR of Chocolate market in 2023?

Chocolate Industry Analysis

Chocolate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chocolate Market Analysis Report by Region

Europe Chocolate Market Report:

Europe remains a dominant market for chocolate, expected to grow from $44.86 billion in 2023 to $73.84 billion by 2033, driven by established consumption patterns and innovation in chocolate products.Asia Pacific Chocolate Market Report:

In the Asia Pacific region, the chocolate market is expected to grow from $28.32 billion in 2023 to $46.61 billion by 2033, fueled by urbanization, rising disposable incomes, and the growing popularity of chocolate products among younger populations.North America Chocolate Market Report:

North America is expected to see robust growth from $54.82 billion in 2023 to $90.23 billion by 2033 due to strong brand loyalty and premiumization trends, with a notable increase in demand for gourmet and artisanal chocolates.South America Chocolate Market Report:

The South American chocolate market will expand from $14.41 billion in 2023 to $23.72 billion by 2033, propelled by increased cacao production capabilities and rising chocolate consumption trends, particularly in Brazil and Argentina.Middle East & Africa Chocolate Market Report:

The Middle East and Africa market is projected to rise from $7.57 billion in 2023 to $12.47 billion by 2033, supported by an increasing middle-class population and expanding retail environments.Tell us your focus area and get a customized research report.

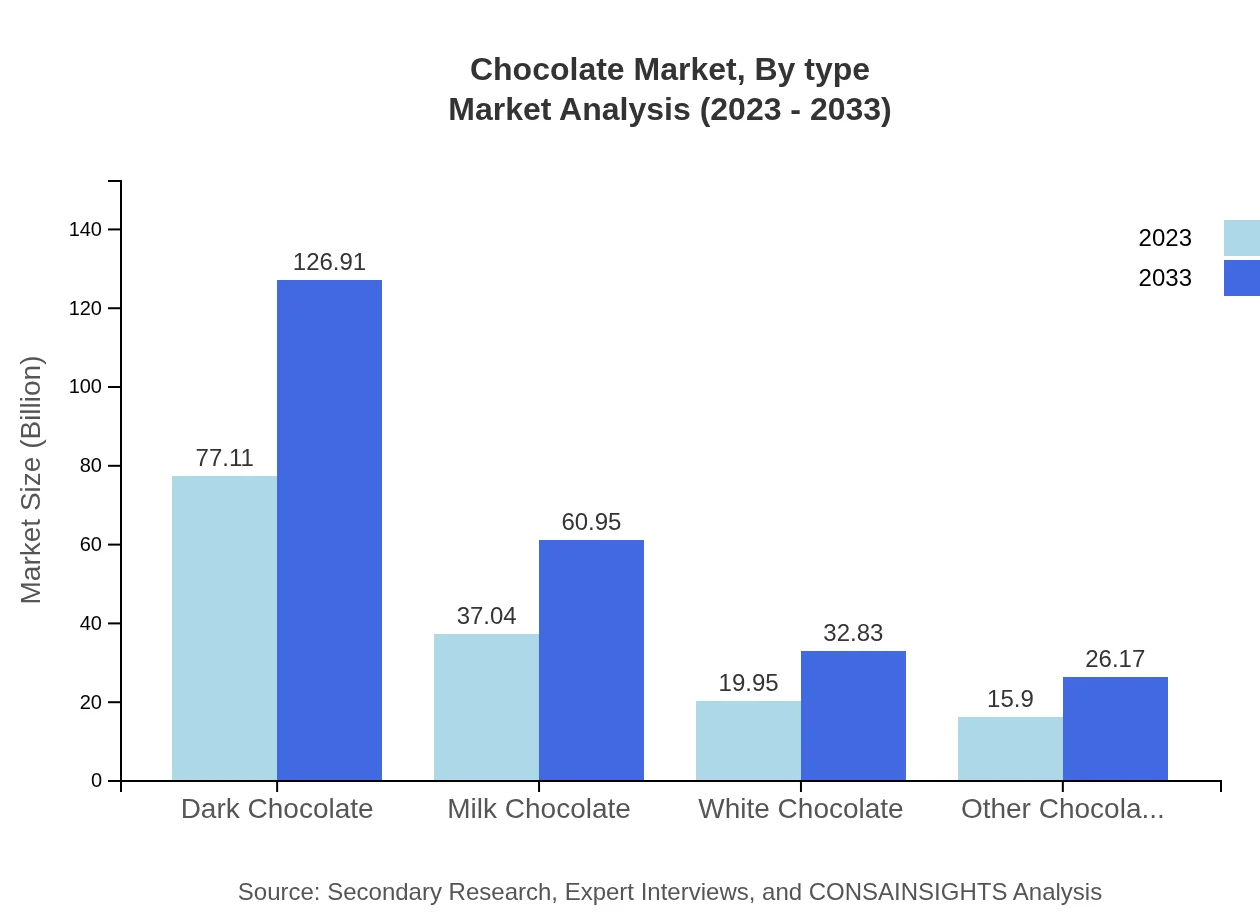

Chocolate Market Analysis By Type

The chocolate market can be divided into four key product types: Dark Chocolate, Milk Chocolate, White Chocolate, and Other Chocolate Types. Dark Chocolate is projected to grow from $77.11 billion in 2023 to $126.91 billion by 2033, while Milk Chocolate is expected to rise from $37.04 billion to $60.95 billion in the same period. White Chocolate and Other types will also see increases, reflecting changing consumer tastes towards flavor diversity.

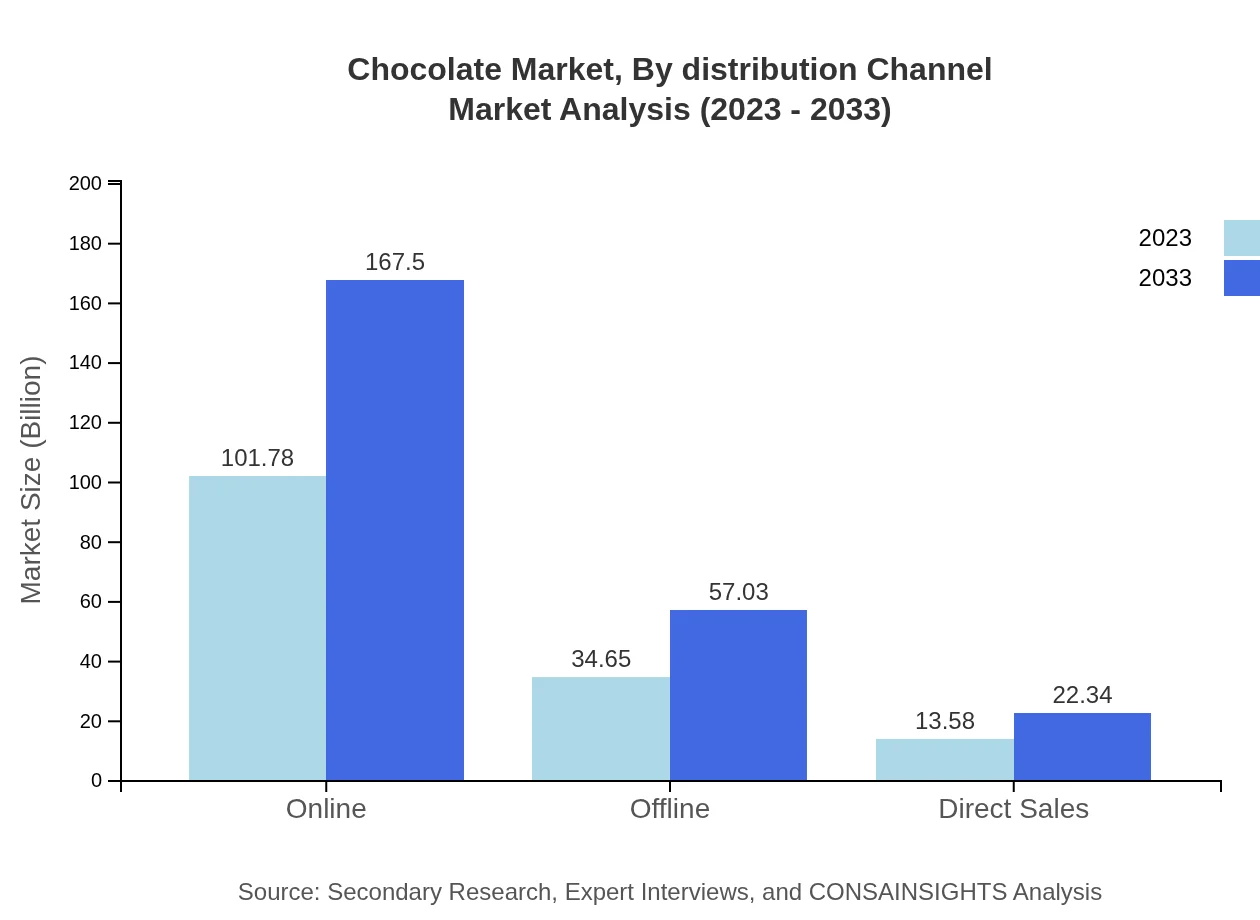

Chocolate Market Analysis By Distribution Channel

The chocolate market distribution channels are significant for understanding product reach. The Food Service sector dominates the distribution landscape, growing from $101.78 billion in 2023 to $167.50 billion by 2033. Online sales channels are gaining traction alongside traditional retail, with expectations for substantial growth driven by e-commerce trends and convenience.

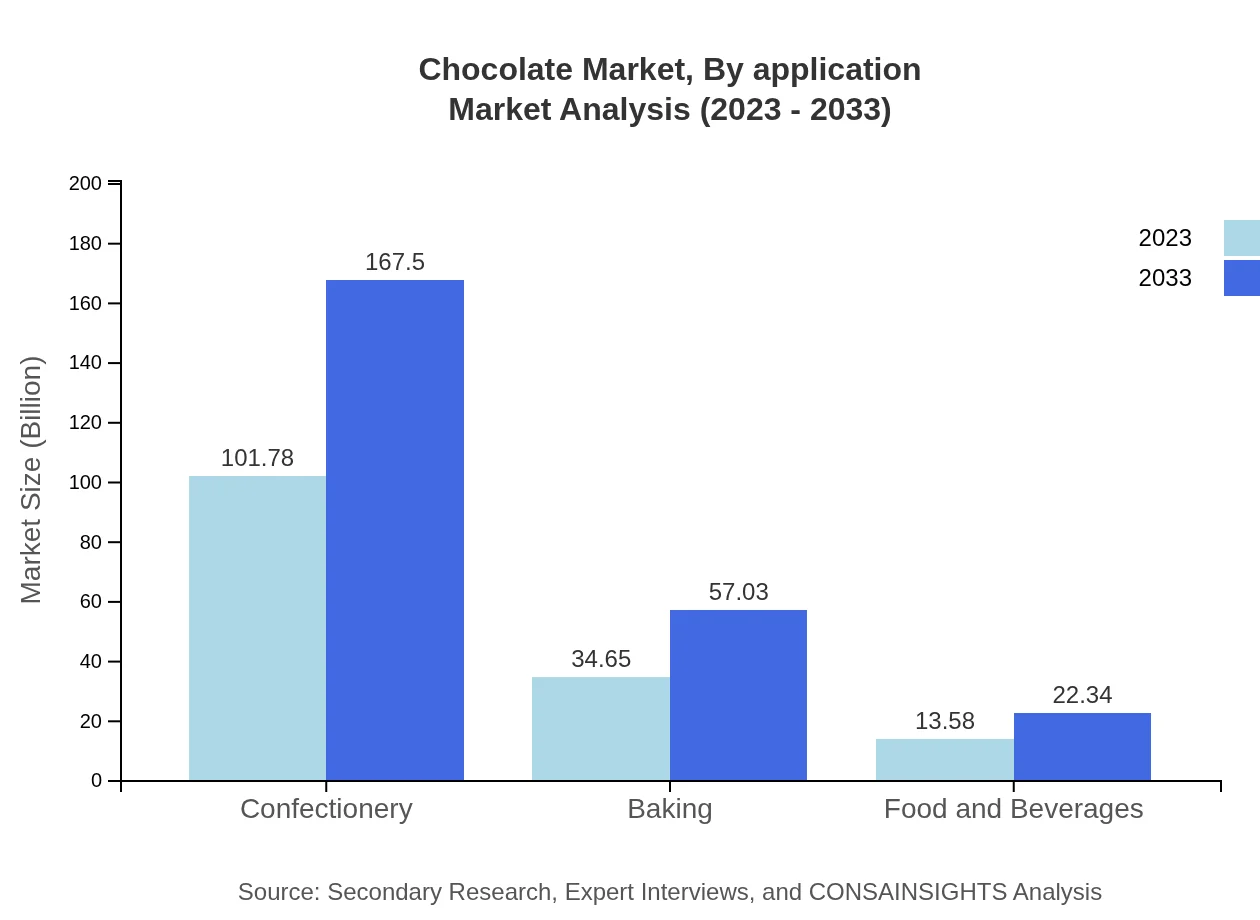

Chocolate Market Analysis By Application

Applications in the chocolate market include Confectionery, Baking, Food & Beverages, each showcasing distinct growth dynamics. Confectionery represents a major segment, with current revenue at $101.78 billion projected to reach $167.50 billion by 2033. The Baking application segment is also gaining popularity, fueled by trends towards baking at home and the rise of artisanal baking.

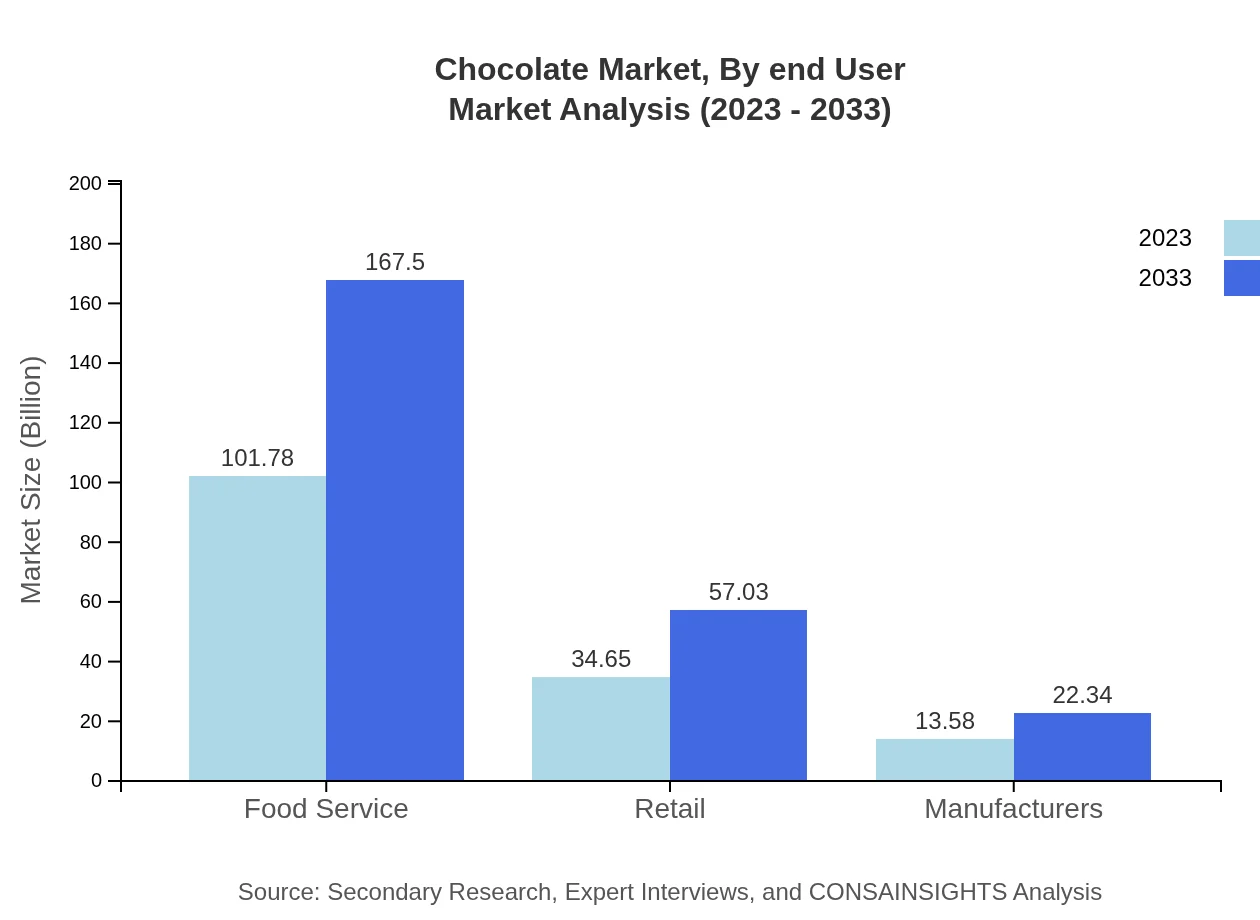

Chocolate Market Analysis By End User

The end-user segmentation reflects the diverse applications of chocolate. The primary consumers include households, food service providers, and manufacturers. The steady growth and innovation in foodservice offerings will continue to drive demand, supported by increasing consumer interest in gourmet experiences.

Chocolate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chocolate Industry

Mondelez International:

A leading global snacking company known for its brands like Cadbury, Toblerone, and Milka, Mondelez focuses on innovation and premium offerings to satisfy diverse consumer preferences.Nestle :

Nestle is a prominent player in the chocolate market, known for its wide range of chocolate products across various segments, moving towards healthier alternatives.Mars, Incorporated:

Mars is one of the largest chocolate manufacturers worldwide, known for popular brands like Mars, Snickers, and M&M’s, focusing on sustainability and ethical sourcing.Ferrero Group:

Ferrero is recognized for its premium brands such as Ferrero Rocher and Nutella, emphasizing quality and consumer satisfaction in its operations.We're grateful to work with incredible clients.

FAQs

What is the market size of chocolate?

The global chocolate market is valued at approximately $150 billion in 2023, with a projected CAGR of 5% from 2023 to 2033, indicating robust growth driven by consumer demand and product innovation.

What are the key market players or companies in this chocolate industry?

Key players in the chocolate market include Nestlé, Mars, Mondelez International, Ferrero, and Hershey, each contributing significantly to market growth through innovative products and expansion strategies.

What are the primary factors driving the growth in the chocolate industry?

Growth in the chocolate market is driven by rising consumer preferences for premium chocolates, increasing health consciousness leading to demand for dark chocolate, and expanding distribution channels across online and retail platforms.

Which region is the fastest Growing in the chocolate market?

The Asia Pacific region is the fastest-growing market for chocolate, projected to grow from $28.32 billion in 2023 to $46.61 billion by 2033, attributed to changing consumer lifestyles and increasing disposable income.

Does ConsaInsights provide customized market report data for the chocolate industry?

Yes, ConsaInsights offers customized market report data on the chocolate industry, enabling businesses to gain tailored insights specific to their market interests and competitive landscape.

What deliverables can I expect from this chocolate market research project?

Deliverables from the chocolate market research project typically include comprehensive market analysis, competitive landscape assessment, consumer insights, and detailed segmentation reports to guide strategic decision-making.

What are the market trends of chocolate?

Current trends in the chocolate market include a surge in demand for organic and fair-trade options, the popularity of flavored chocolates, and an increasing focus on sustainability and ethical sourcing.