Chromatography Accessories And Consumables Market Report

Published Date: 31 January 2026 | Report Code: chromatography-accessories-and-consumables

Chromatography Accessories And Consumables Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Chromatography Accessories And Consumables market, including size estimates, growth forecasts, and trends from 2023 to 2033. It explores market dynamics, regional insights, product segmentation, and key players enhancing this vital industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

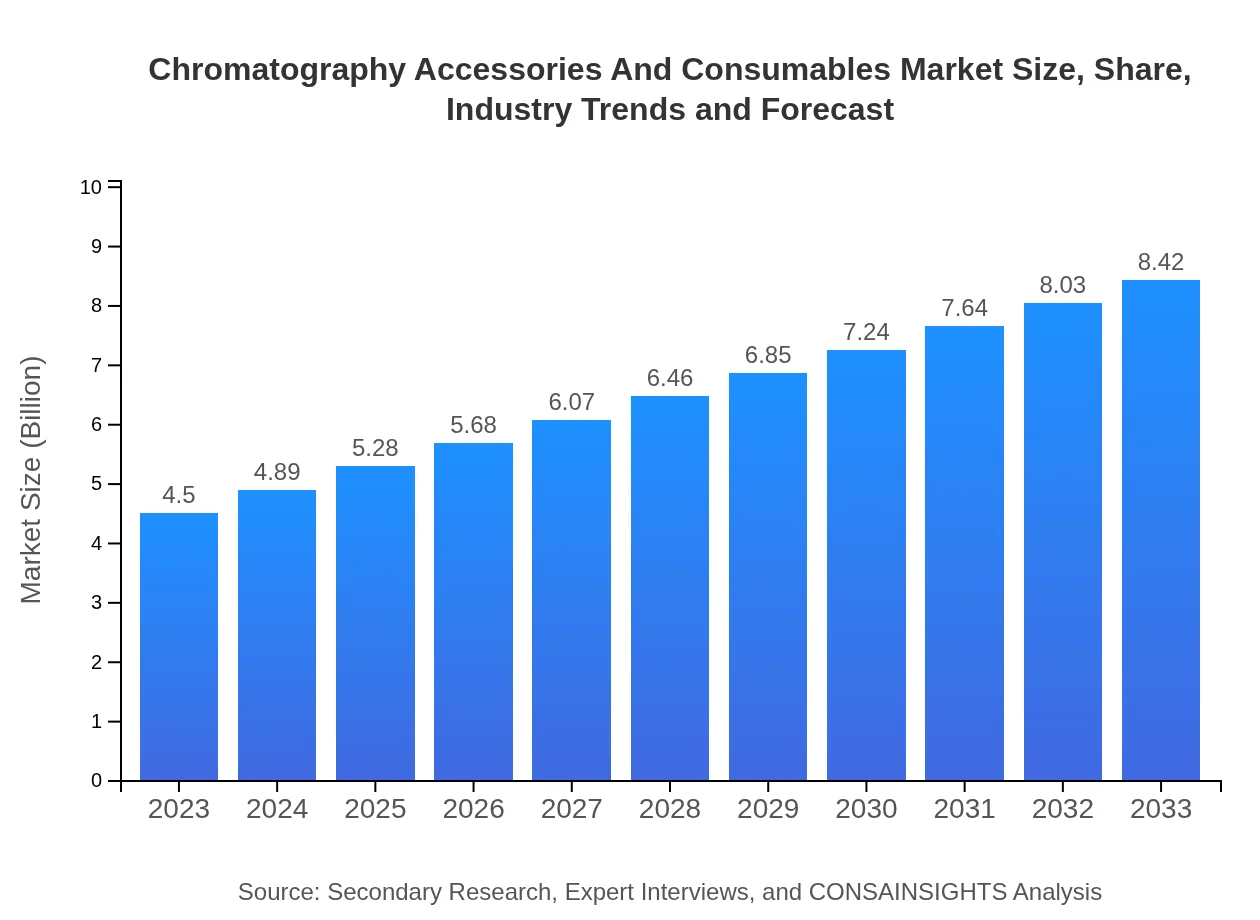

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $8.42 Billion |

| Top Companies | Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Waters Corporation, PerkinElmer Inc. |

| Last Modified Date | 31 January 2026 |

Chromatography Accessories And Consumables Market Overview

Customize Chromatography Accessories And Consumables Market Report market research report

- ✔ Get in-depth analysis of Chromatography Accessories And Consumables market size, growth, and forecasts.

- ✔ Understand Chromatography Accessories And Consumables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chromatography Accessories And Consumables

What is the Market Size & CAGR of Chromatography Accessories And Consumables market in 2023?

Chromatography Accessories And Consumables Industry Analysis

Chromatography Accessories And Consumables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chromatography Accessories And Consumables Market Analysis Report by Region

Europe Chromatography Accessories And Consumables Market Report:

In Europe, the market is characterized by a high level of research activity and regulatory compliance, valued at $1.17 billion in 2023 and forecasted to reach $2.19 billion by 2033. The region benefits from strong governmental support for research initiatives, particularly in Germany, France, and the UK, driving substantial investment in chromatography technologies.Asia Pacific Chromatography Accessories And Consumables Market Report:

In 2023, the Asia Pacific market is valued at approximately $0.88 billion, expecting to grow to $1.65 billion by 2033, driven by increasing pharmaceutical manufacturing and research activities in countries like China and India. Heightened awareness of advanced analytical techniques among laboratories and research institutions is further expected to fuel market expansion.North America Chromatography Accessories And Consumables Market Report:

North America is predicted to experience robust growth, with market values anticipated to rise from $1.61 billion in 2023 to $3.01 billion by 2033. The presence of advanced research facilities and a highly regulated environment for pharmaceuticals creates a conducive landscape for chromatography applications, further supporting market scalability.South America Chromatography Accessories And Consumables Market Report:

The South American market is projected to increase from $0.38 billion in 2023 to $0.72 billion by 2033. Growing investments in biotechnology and pharmaceuticals are fostering the demand for chromatography products across this region. Brazil and Argentina represent significant contributors to this growth, given their developing healthcare sectors.Middle East & Africa Chromatography Accessories And Consumables Market Report:

The Middle East and Africa market is anticipated to grow from $0.45 billion in 2023 to $0.85 billion by 2033. Factors supporting this growth include increasing research and development activities and the establishment of modern laboratories, particularly in the United Arab Emirates and South Africa.Tell us your focus area and get a customized research report.

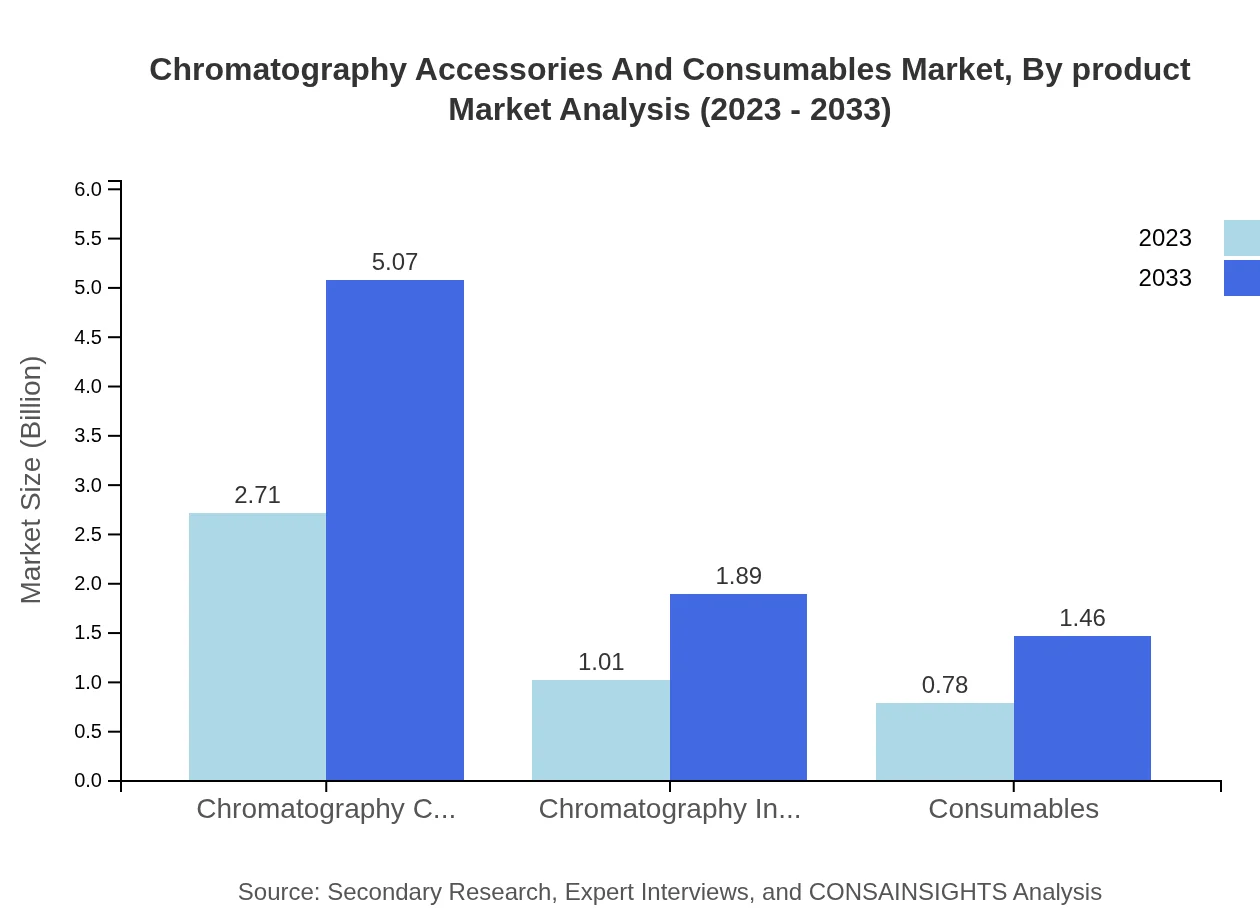

Chromatography Accessories And Consumables Market Analysis By Product

The segmentation by product includes chromatography columns, instruments, and various consumables. Chromatography columns dominate the market with a significant share, projected to grow from $2.71 billion in 2023 to $5.07 billion by 2033. This growth is driven by their essential role in various chromatographic processes.

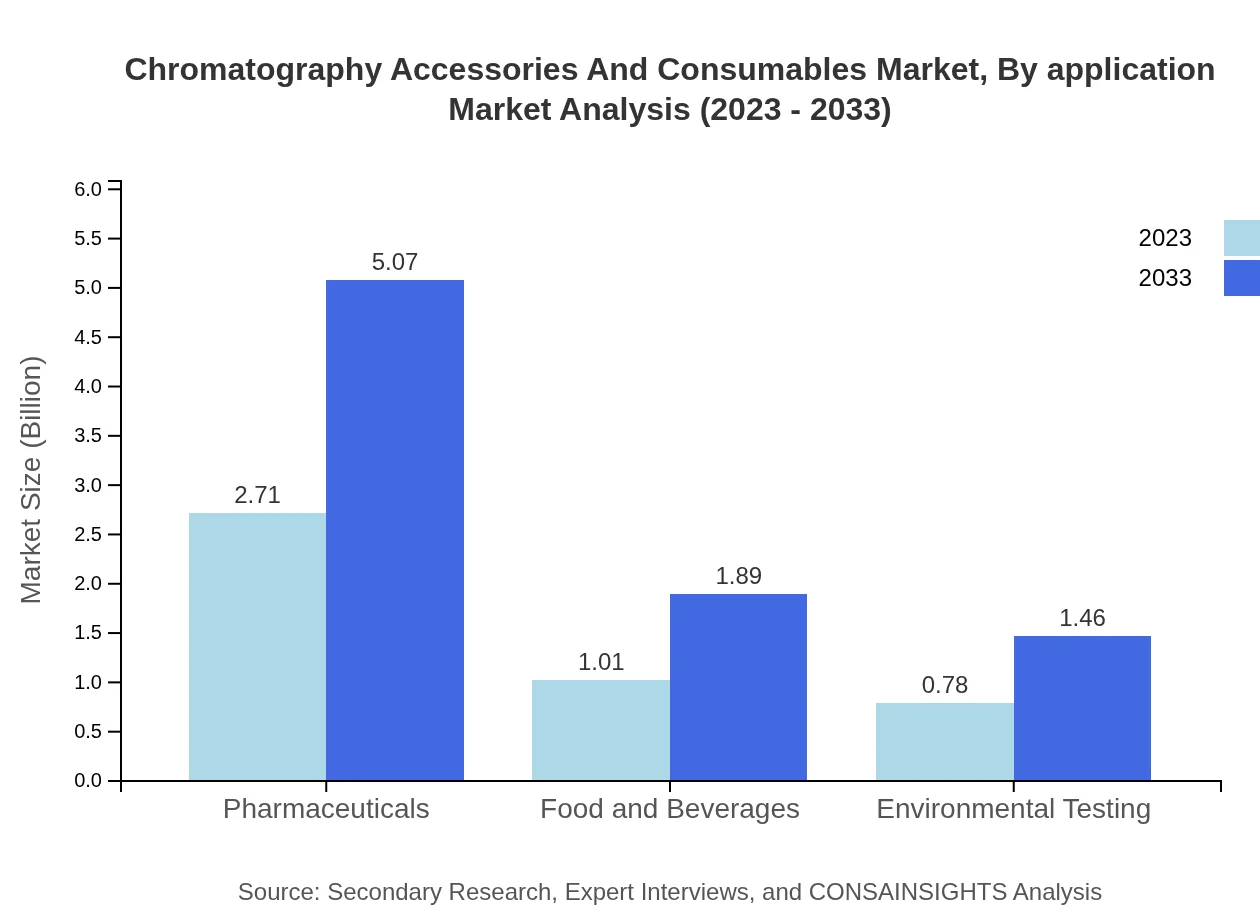

Chromatography Accessories And Consumables Market Analysis By Application

Applications of chromatography accessories span across pharmaceutical analysis, environmental testing, food safety testing, and clinical diagnostics. The pharmaceutical sector holds a prominent share, estimated at 60.24% as of 2023, largely attributed to stringent regulations requiring thorough analysis and testing of pharmaceutical products.

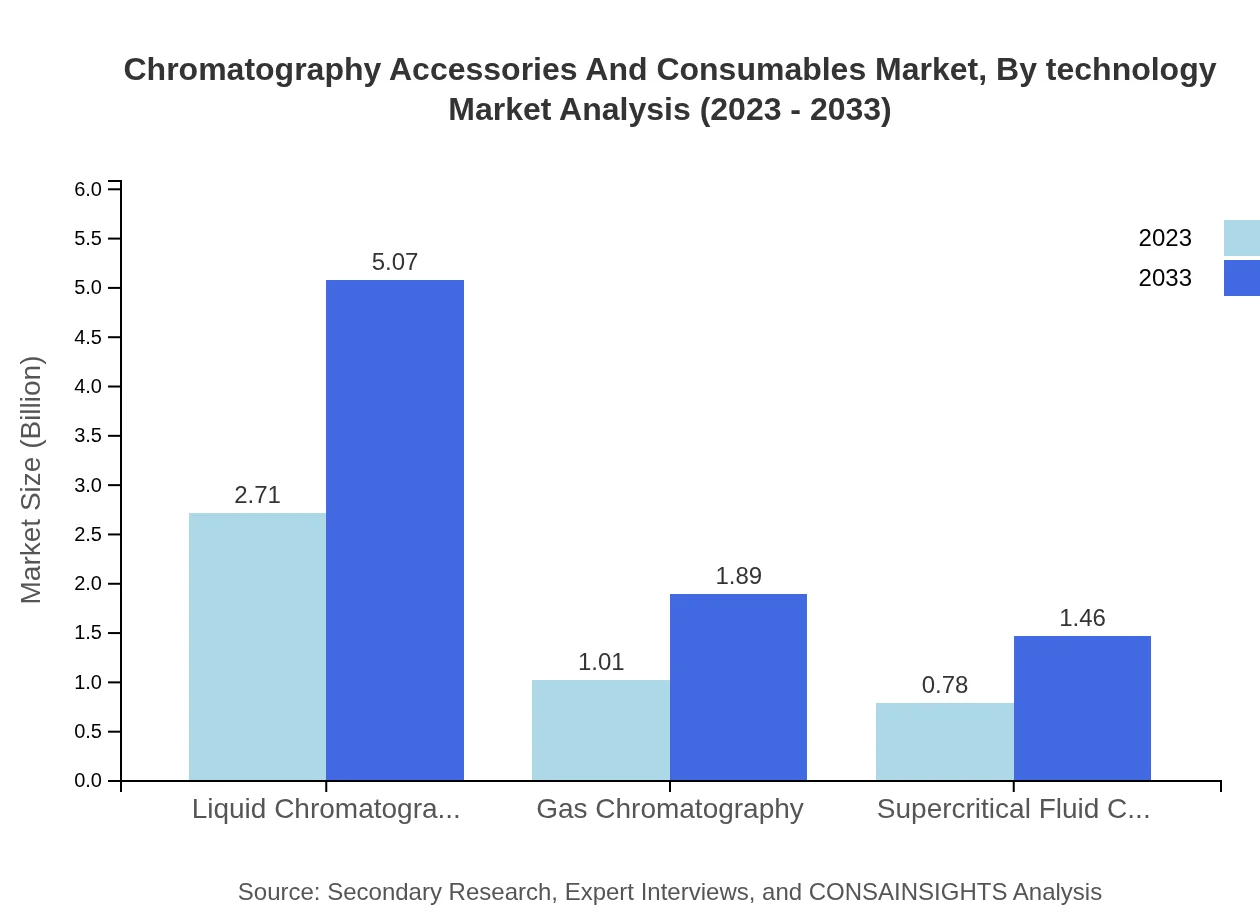

Chromatography Accessories And Consumables Market Analysis By Technology

The market is segmented by technology, including liquid chromatography, gas chromatography, and supercritical fluid chromatography. Liquid chromatography represents the largest segment, anticipated to grow from $2.71 billion in 2023 to $5.07 billion by 2033, owing to its widespread application in various analytical techniques.

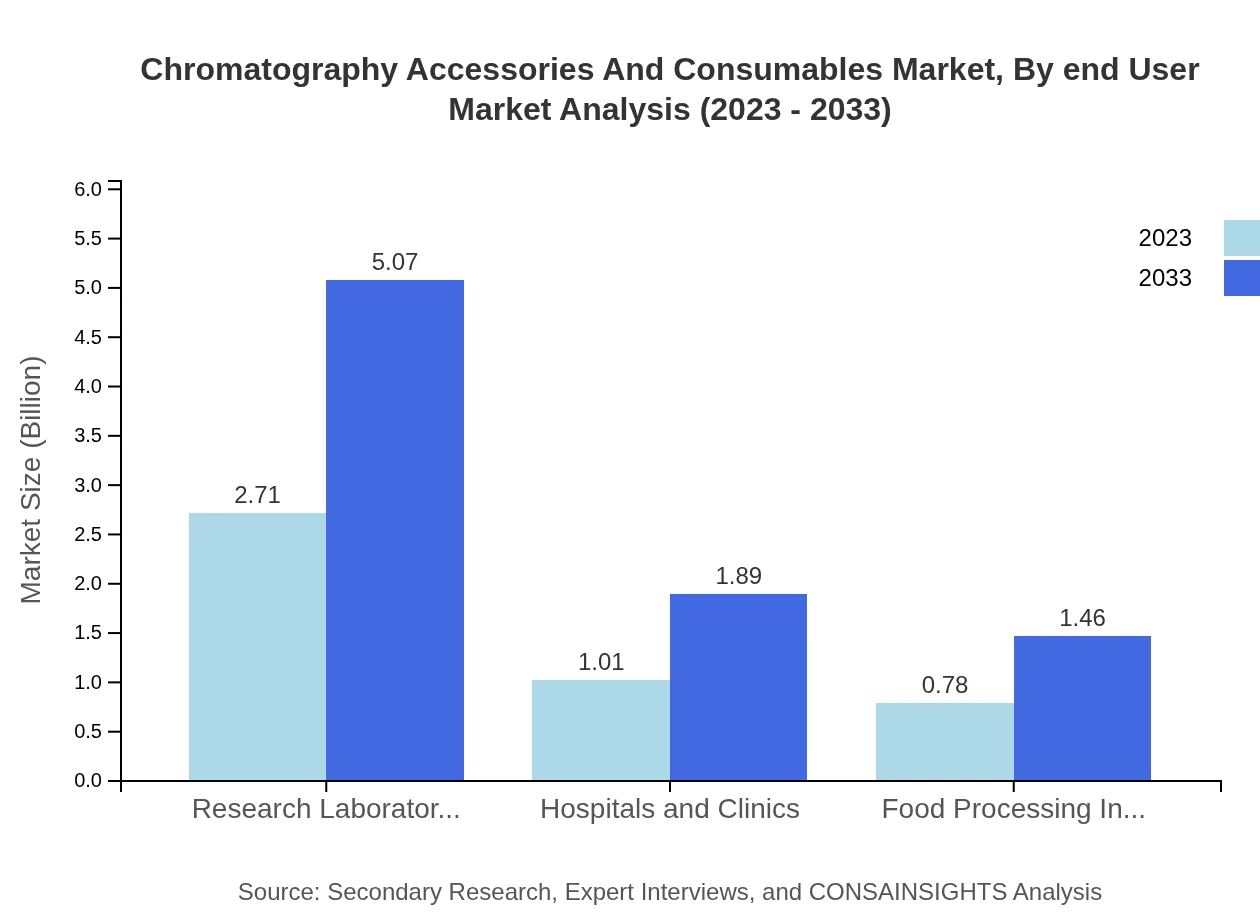

Chromatography Accessories And Consumables Market Analysis By End User

End-user industries including research laboratories, hospitals and clinics, food processing, and pharmaceuticals drive market demand. Research laboratories are expected to lead the market with a share of 60.24% in 2023, reflecting the crucial role of chromatography in research and analysis across diverse scientific fields.

Chromatography Accessories And Consumables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chromatography Accessories And Consumables Industry

Agilent Technologies, Inc.:

A leading provider of chromatography instruments and solutions, Agilent Technologies specializes in producing innovative analytical and laboratory systems, helping elevate research and development across multiple sectors.Thermo Fisher Scientific Inc.:

Thermo Fisher is a prominent manufacturer of laboratory products, including chromatography accessories. Their strong portfolio enhances laboratory efficiency and efficacy worldwide, focusing on innovative technologies and customer collaboration.Waters Corporation:

Waters Corporation is renowned for its high-performance liquid chromatography products, contributing significantly to the laboratory analytical equipment segment and known for pioneering advancements in chromatography technologies.PerkinElmer Inc.:

PerkinElmer develops and delivers chromatographic solutions tailored for various industries, including environmental and food testing, emphasizing safety and regulatory compliance in their product offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of chromatography Accessories And Consumables?

The chromatography accessories and consumables market is projected to grow from $4.5 billion in 2023 to significant levels by 2033, driven by a CAGR of 6.3%. This growth reflects increasing demand across various applications and regions.

What are the key market players or companies in the chromatography Accessories And Consumables industry?

Key players in the chromatography accessories and consumables market include leading manufacturers and suppliers recognized for innovations in technology and product quality. Their contributions significantly shape the market landscape and foster competition.

What are the primary factors driving the growth in the chromatography Accessories And Consumables industry?

The growth in the chromatography accessories and consumables market is primarily driven by rising research activities, increased drug development, advancements in chromatography technologies, and growing regulatory standards necessitating enhanced product quality and safety.

Which region is the fastest Growing in the chromatography Accessories And Consumables?

North America is the fastest-growing region in the chromatography accessories and consumables market, projected to expand from $1.61 billion in 2023 to $3.01 billion by 2033, driven by heightened research and pharmaceutical activities.

Does ConsaInsights provide customized market report data for the chromatography Accessories And Consumables industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of stakeholders in the chromatography accessories and consumables industry, ensuring that the insights align with the unique business objectives and market dynamics.

What deliverables can I expect from this chromatography Accessories And Consumables market research project?

From this market research project, you can expect comprehensive reports including market analysis, growth forecasting, segmentation insights, competitive landscape assessments, and tailored recommendations designed to support strategic decision-making in the chromatography accessories market.

What are the market trends of chromatography Accessories And Consumables?

Current market trends in chromatography accessories and consumables include increasing adoption of automation, advancements in miniaturization technology, and a shift toward environmentally friendly products, all contributing to evolving market dynamics and customer preferences.