Chromatography Instrumentation Market Report

Published Date: 31 January 2026 | Report Code: chromatography-instrumentation

Chromatography Instrumentation Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the Chromatography Instrumentation market, providing insights on market size, trends, regional analysis, and competitive landscape for the forecast period from 2023 to 2033.

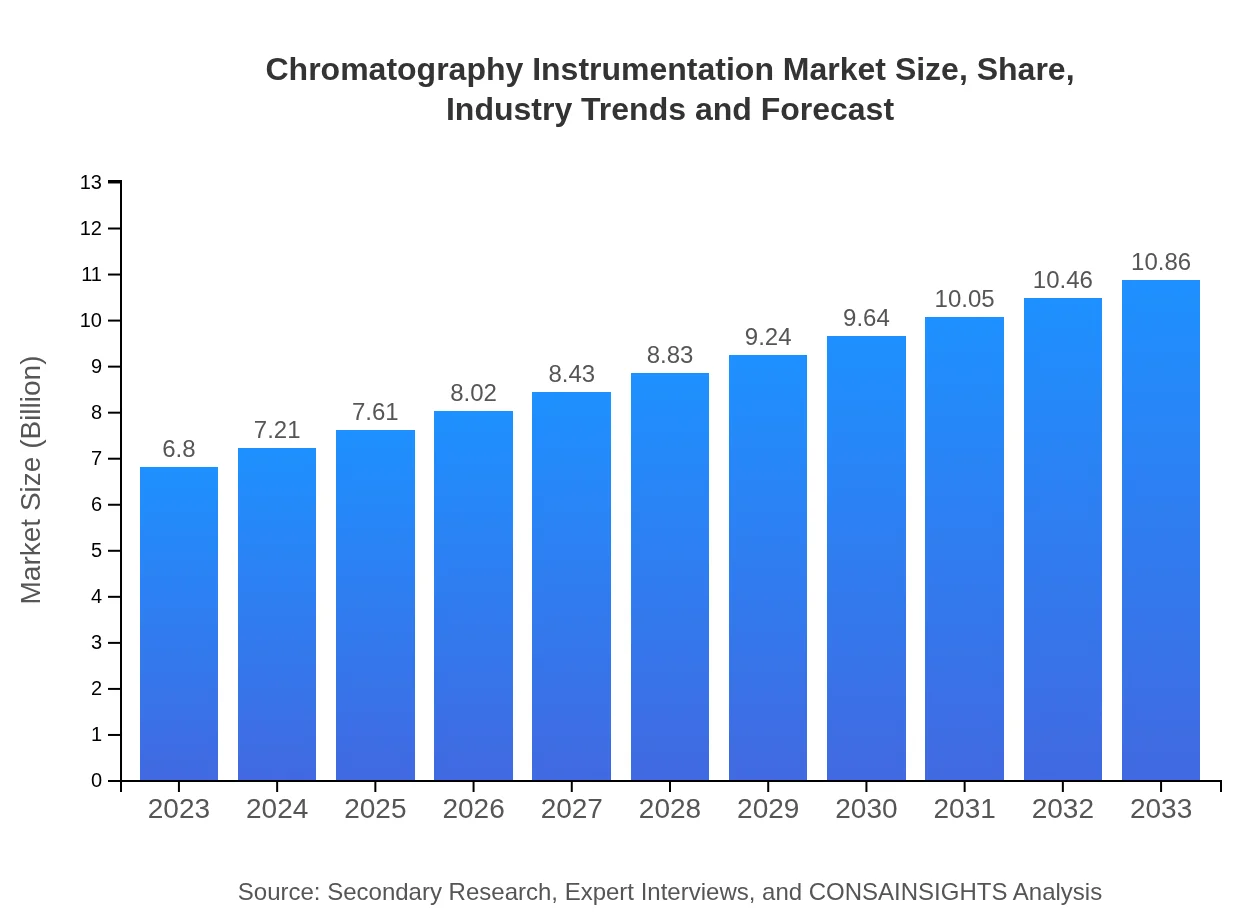

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $10.86 Billion |

| Top Companies | Agilent Technologies, Inc., Thermo Fisher Scientific Inc., PerkinElmer, Inc., Merck KGaA |

| Last Modified Date | 31 January 2026 |

Chromatography Instrumentation Market Overview

Customize Chromatography Instrumentation Market Report market research report

- ✔ Get in-depth analysis of Chromatography Instrumentation market size, growth, and forecasts.

- ✔ Understand Chromatography Instrumentation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chromatography Instrumentation

What is the Market Size & CAGR of Chromatography Instrumentation market in 2023?

Chromatography Instrumentation Industry Analysis

Chromatography Instrumentation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chromatography Instrumentation Market Analysis Report by Region

Europe Chromatography Instrumentation Market Report:

The European market is estimated to grow from USD 2.31 billion in 2023 to USD 3.69 billion by 2033, supported by advanced healthcare systems and increasing research activities in universities and institutes. Moreover, the presence of prominent market players in the region facilitates continuous innovations and product developments.Asia Pacific Chromatography Instrumentation Market Report:

In the Asia Pacific region, the Chromatography Instrumentation market is expected to grow from USD 1.17 billion in 2023 to USD 1.87 billion by 2033. The increasing investments in research and development, along with a rising number of pharmaceutical companies establishing operations in countries like India and China, drive this growth. The demand for chromatography techniques in agricultural and environmental sectors further boosts the market's expansion in this region.North America Chromatography Instrumentation Market Report:

In North America, the market size is expected to reach USD 2.38 billion in 2023 and is projected to grow to USD 3.80 billion by 2033. This growth is primarily due to the strong presence of major pharmaceutical and biotechnology companies, along with stringent regulatory enforcement concerning product quality standards.South America Chromatography Instrumentation Market Report:

The South American market is projected to grow from USD 0.23 billion in 2023 to USD 0.37 billion by 2033. Factors influencing growth include an increase in the food and beverage industry and environmental monitoring activities. However, challenges such as limited access to technology and high operational costs may hinder market growth.Middle East & Africa Chromatography Instrumentation Market Report:

In the Middle East and Africa, the market is anticipated to grow from USD 0.71 billion in 2023 to USD 1.13 billion by 2033. The growth is driven by increasing investments in healthcare infrastructure and rising awareness regarding environmental testing and quality assurance in various industries.Tell us your focus area and get a customized research report.

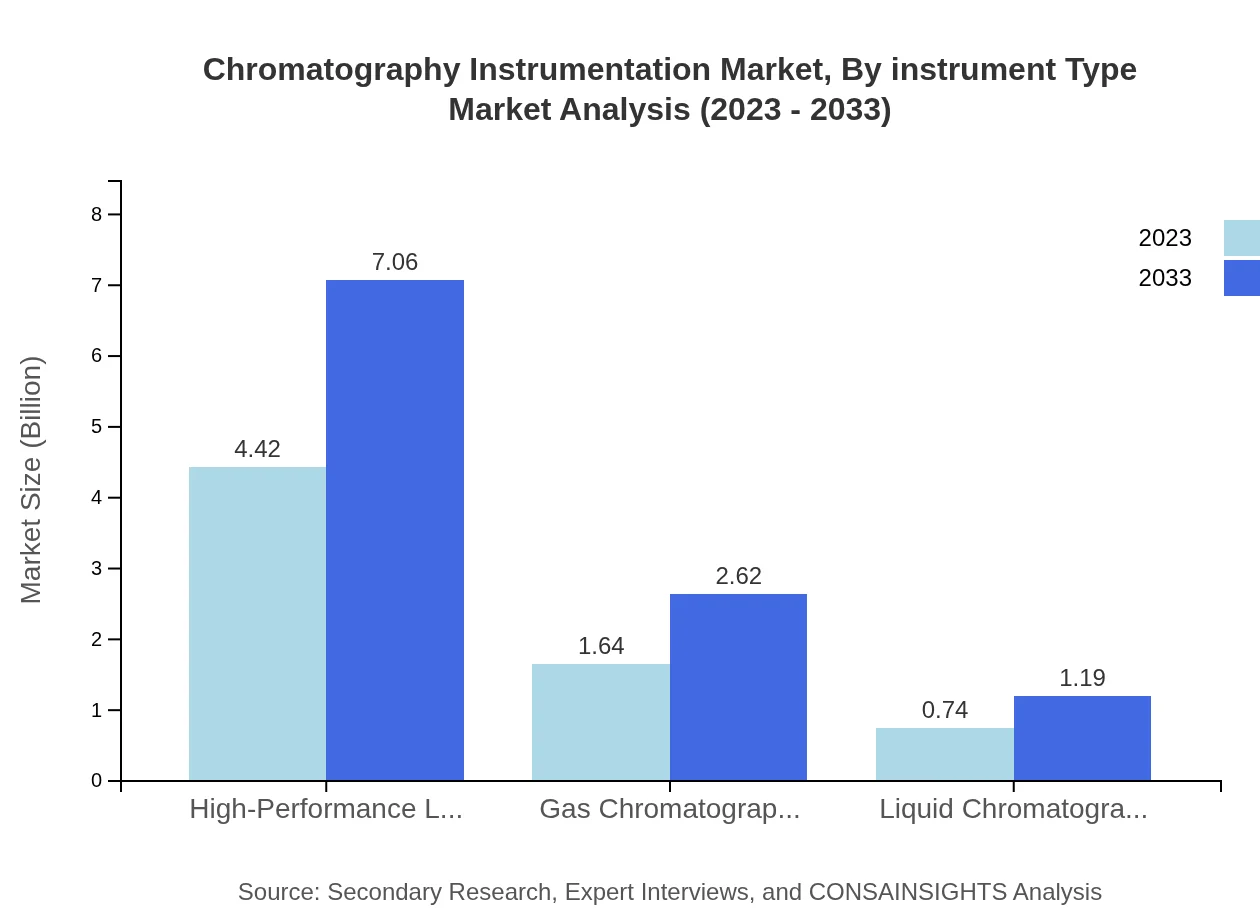

Chromatography Instrumentation Market Analysis By Instrument Type

High-Performance Liquid Chromatography (HPLC) dominated the market in 2023, with a market size of USD 4.42 billion and a market share of 64.95%. Gas Chromatography (GC) follows with a market size of USD 1.64 billion (24.12% share). Liquid Chromatography-Mass Spectrometry (LC-MS) holds a revenue of USD 0.74 billion (10.93% share). HPLC's widespread use across various applications, including pharmaceuticals and food quality analysis, significantly contributes to its leading position.

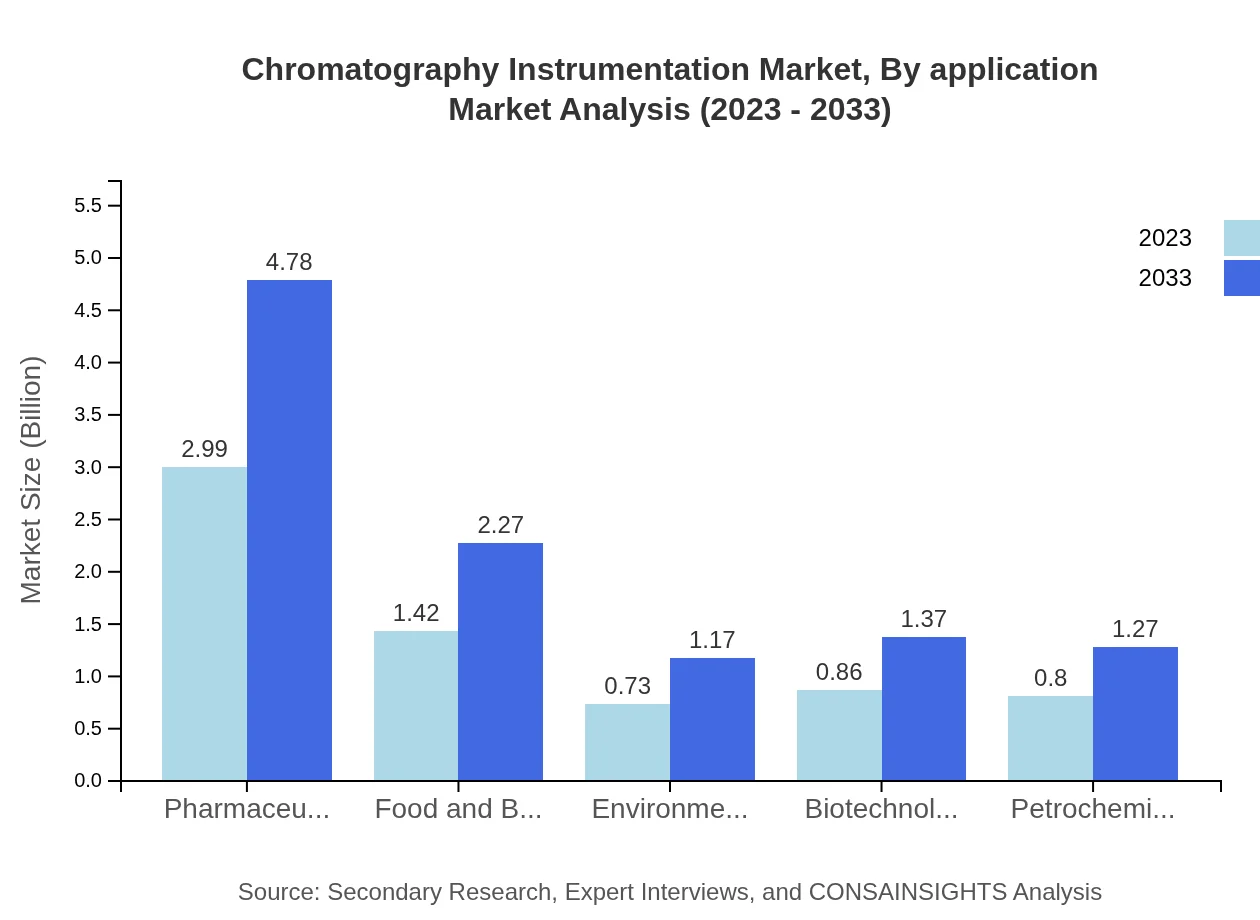

Chromatography Instrumentation Market Analysis By Application

In 2023, the pharmaceutical sector showcased its dominance in the Chromatography Instrumentation market with a share of 43.98% and expected growth of 2.99 billion, escalating to 4.78 billion by 2033. Other significant applications include clinical laboratories (20.92% in 2023), with an increasing focus on personalized medicine and advanced diagnostics driving demand. Environmental testing and food safety applications are also critical drivers for the market.

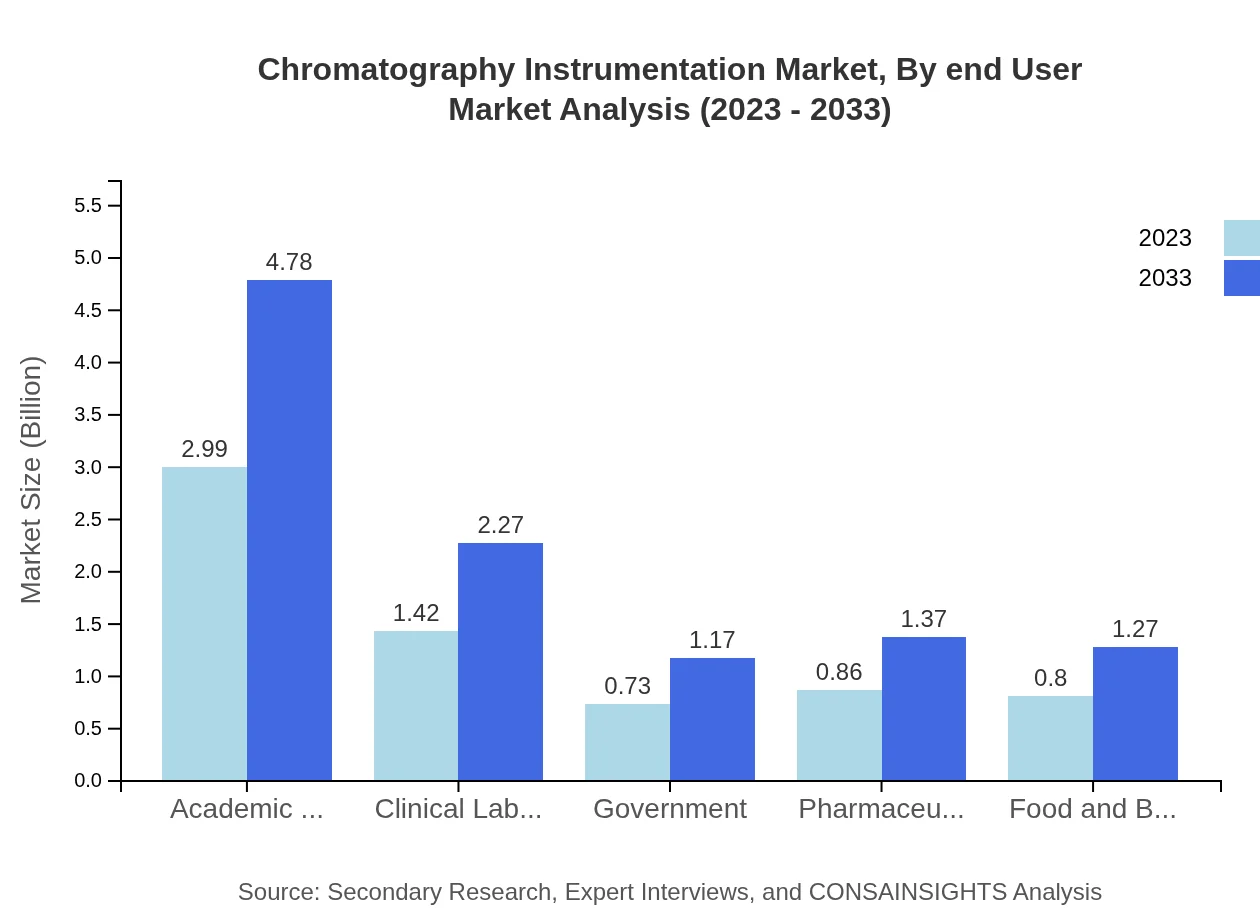

Chromatography Instrumentation Market Analysis By End User

The report indicates that academic and research institutes constitute a substantial portion of the market, attributing 43.98% of total share in 2023. The growing emphasis on research endeavors in life sciences and environmental studies propels this segment. Contribution from industrial sectors, including food and beverages, environmental testing, and clinical applications, further enhances market growth.

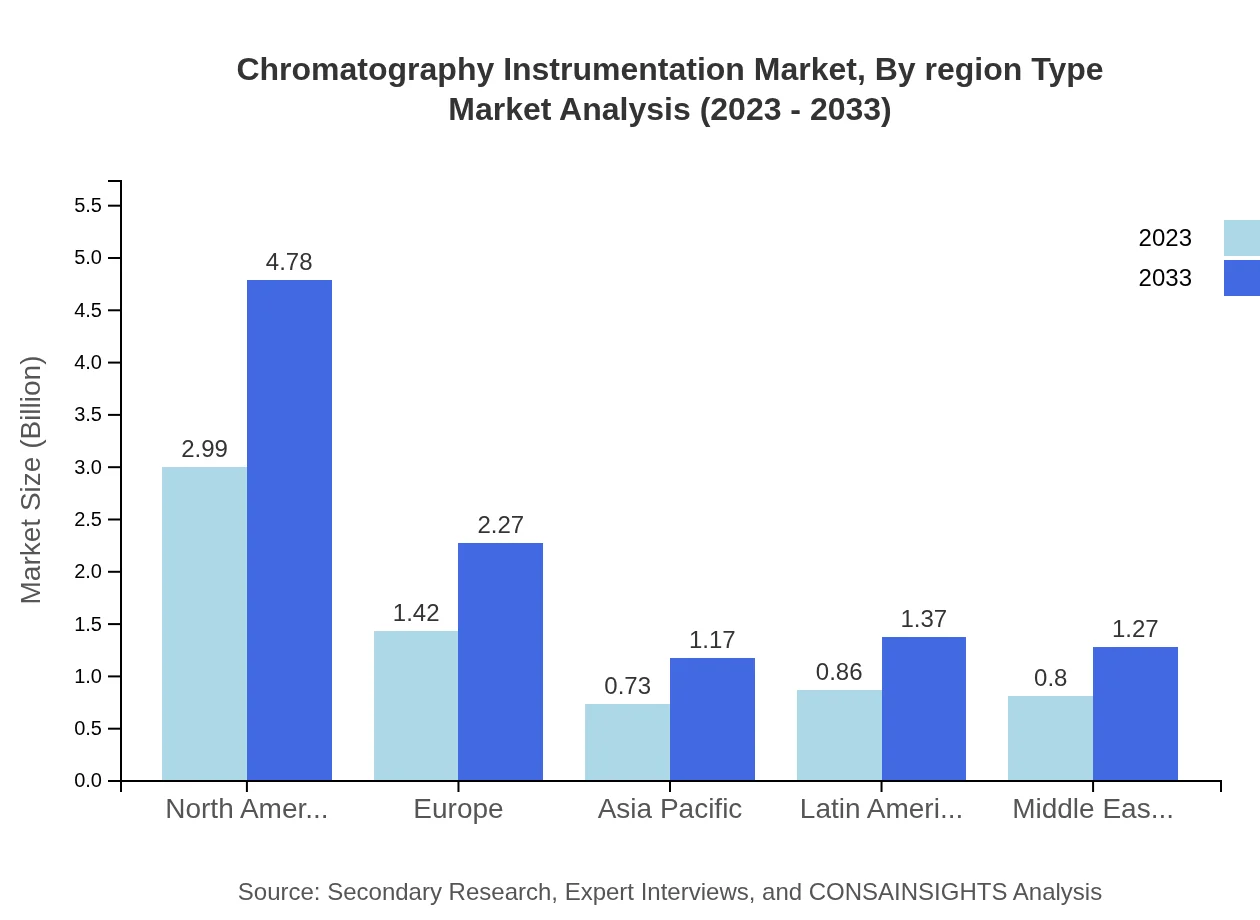

Chromatography Instrumentation Market Analysis By Region Type

The regional segmentation of the Chromatography Instrumentation market portrays a competitive landscape, with North America leading due to advanced technological adoption and strength in R&D infrastructure. Following closely are Europe and the Asia Pacific regions, where integral investments in healthcare and research sectors will bolster future prospects.

Chromatography Instrumentation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chromatography Instrumentation Industry

Agilent Technologies, Inc.:

A global leader in life sciences, Agilent provides advanced chromatographic solutions that support various applications in pharmaceuticals, food safety, and environmental testing.Thermo Fisher Scientific Inc.:

Thermo Fisher offers a broad spectrum of chromatography instrumentation and consumables, playing a critical role in driving innovations across the healthcare and life science sectors.PerkinElmer, Inc.:

PerkinElmer specializes in analytical instrumentation and is committed to delivering reliable chromatography solutions for diverse industrial uses.Merck KGaA:

With a strong focus on quality controls, Merck KGaA provides essential chromatography products and services tailored for pharmaceutical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of chromatography instrumentation?

The chromatography instrumentation market is currently valued at approximately $6.8 billion and is expected to grow at a CAGR of 4.7% from 2023 to 2033.

What are the key market players or companies in this chromatography instrumentation industry?

Key players in the chromatography instrumentation market include Agilent Technologies, Waters Corporation, Thermo Fisher Scientific, PerkinElmer, and Shimadzu Corporation, which dominate the industry with their advanced technologies.

What are the primary factors driving the growth in the chromatography instrumentation industry?

The growth in the chromatography instrumentation market is primarily driven by increasing demand in pharmaceuticals, biotechnology advancements, stringent regulations, and rising environmental concerns leading to enhanced testing processes.

Which region is the fastest Growing in chromatography instrumentation?

The fastest-growing region in the chromatography instrumentation market is projected to be North America, expected to grow from $2.99 billion in 2023 to $4.78 billion by 2033, reflecting strong demand for advanced analytical services.

Does ConsaInsights provide customized market report data for the chromatography instrumentation industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of businesses in the chromatography instrumentation industry, ensuring relevant and actionable insights.

What deliverables can I expect from this chromatography instrumentation market research project?

From this chromatography instrumentation market research project, clients can expect comprehensive reports including market analysis, trends, forecasts, and competitive landscape information tailored to specific segments.

What are the market trends of chromatography instrumentation?

Current trends in chromatography instrumentation include the growing adoption of high-performance liquid chromatography (HPLC), increased automation, and integration of analytical tools with advanced software for data analysis.