Chromatography Reagents Market Report

Published Date: 31 January 2026 | Report Code: chromatography-reagents

Chromatography Reagents Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the chromatography reagents market, including market size, growth forecasts, industry trends, and regional insights from 2023 to 2033.

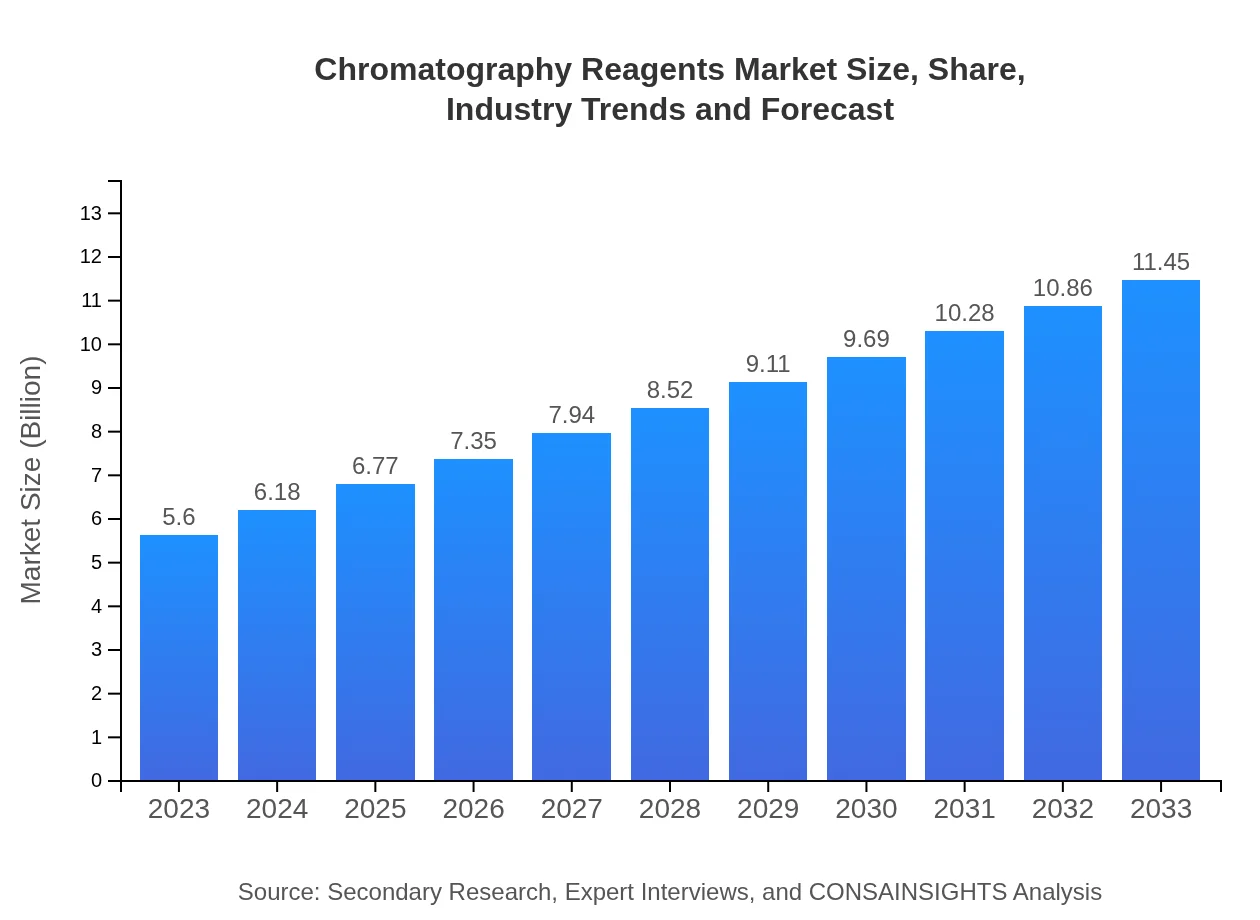

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Merck Group, Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories |

| Last Modified Date | 31 January 2026 |

Chromatography Reagents Market Overview

Customize Chromatography Reagents Market Report market research report

- ✔ Get in-depth analysis of Chromatography Reagents market size, growth, and forecasts.

- ✔ Understand Chromatography Reagents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chromatography Reagents

What is the Market Size & CAGR of Chromatography Reagents market in 2023?

Chromatography Reagents Industry Analysis

Chromatography Reagents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chromatography Reagents Market Analysis Report by Region

Europe Chromatography Reagents Market Report:

Europe holds a substantial market share, with an initial valuation of $1.58 billion in 2023, projected to grow to $3.24 billion by 2033. The region's stringent quality control regulations and a strong focus on research and development are key growth factors.Asia Pacific Chromatography Reagents Market Report:

The Asia Pacific region exhibits significant growth potential due to increasing investment in biotechnology and pharmaceuticals. The market is projected to grow from $1.07 billion in 2023 to $2.18 billion by 2033. Growing awareness of quality control processes in industries and a rise in the number of research activities drive this expansion.North America Chromatography Reagents Market Report:

The North American market is one of the largest for chromatography reagents, starting at $2.10 billion in 2023 and increasing to $4.30 billion by 2033. The region benefits from advanced infrastructure, high investments in R&D, and a robust pharmaceutical sector, significantly driving the market.South America Chromatography Reagents Market Report:

In South America, the chromatography reagents market is expected to rise modestly, with an estimated market size of $0.09 billion in 2023, reaching $0.18 billion by 2033. Regulatory changes and the need for improved analytical methods are influencing market dynamics in this region.Middle East & Africa Chromatography Reagents Market Report:

In the Middle East and Africa, the chromatography reagents market is expected to grow from $0.76 billion in 2023 to $1.55 billion by 2033. Increased investment in healthcare and environmental testing sectors is expected to fuel this growth, alongside growing research initiatives.Tell us your focus area and get a customized research report.

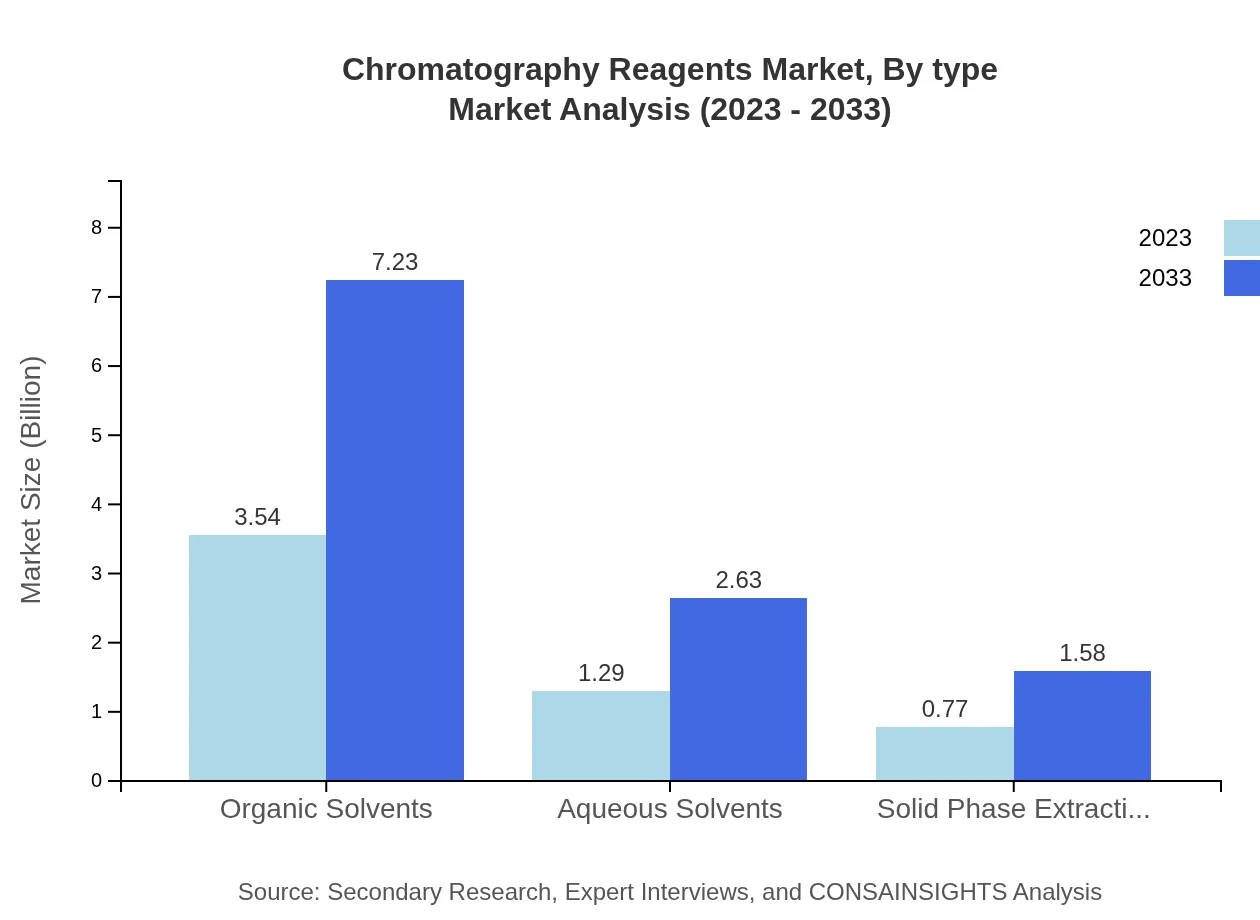

Chromatography Reagents Market Analysis By Type

The 'by type' segment shows significant differentiation, with organic solvents comprising the largest share. In 2023, organic solvents accounted for $3.54 billion, maintaining a stable share of 63.17% throughout the decade. Aqueous solvents followed, with a market size of $1.29 billion in 2023 and a share of 23.01%. Solid-phase extraction holds $0.77 billion and 13.82% share, reflecting its niche but growing presence in specialized applications.

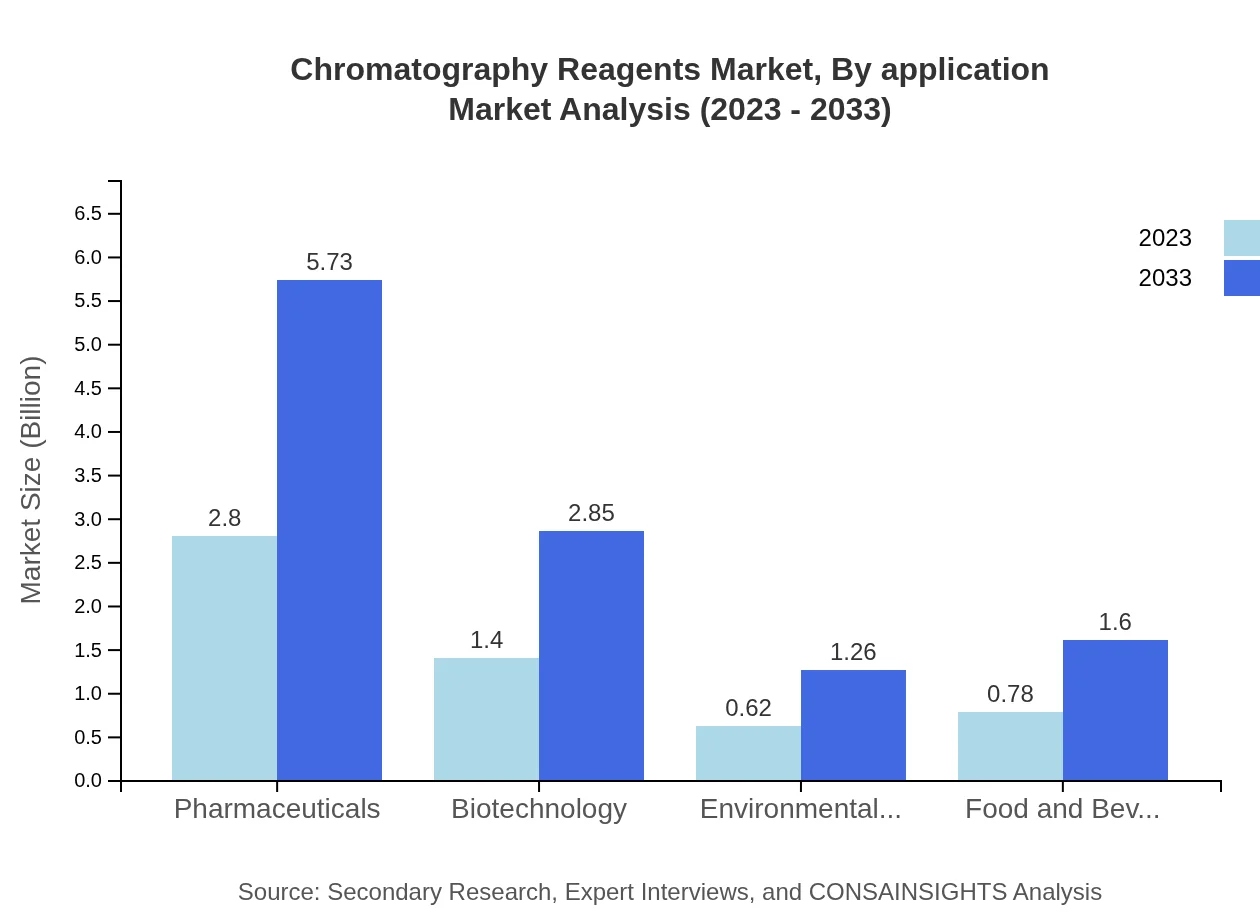

Chromatography Reagents Market Analysis By Application

The pharmaceuticals sector dominates the application segment, valued at $2.80 billion in 2023 with a significant share of 50.06%. The biotechnology sector, with a market size of $1.40 billion (24.94% share), is also growing due to increased demand for biotech drugs, reflecting an upward trend. Environmental testing and food and beverage applications hold about 11.04% and 13.96%, respectively, indicating their importance in regulatory compliance.

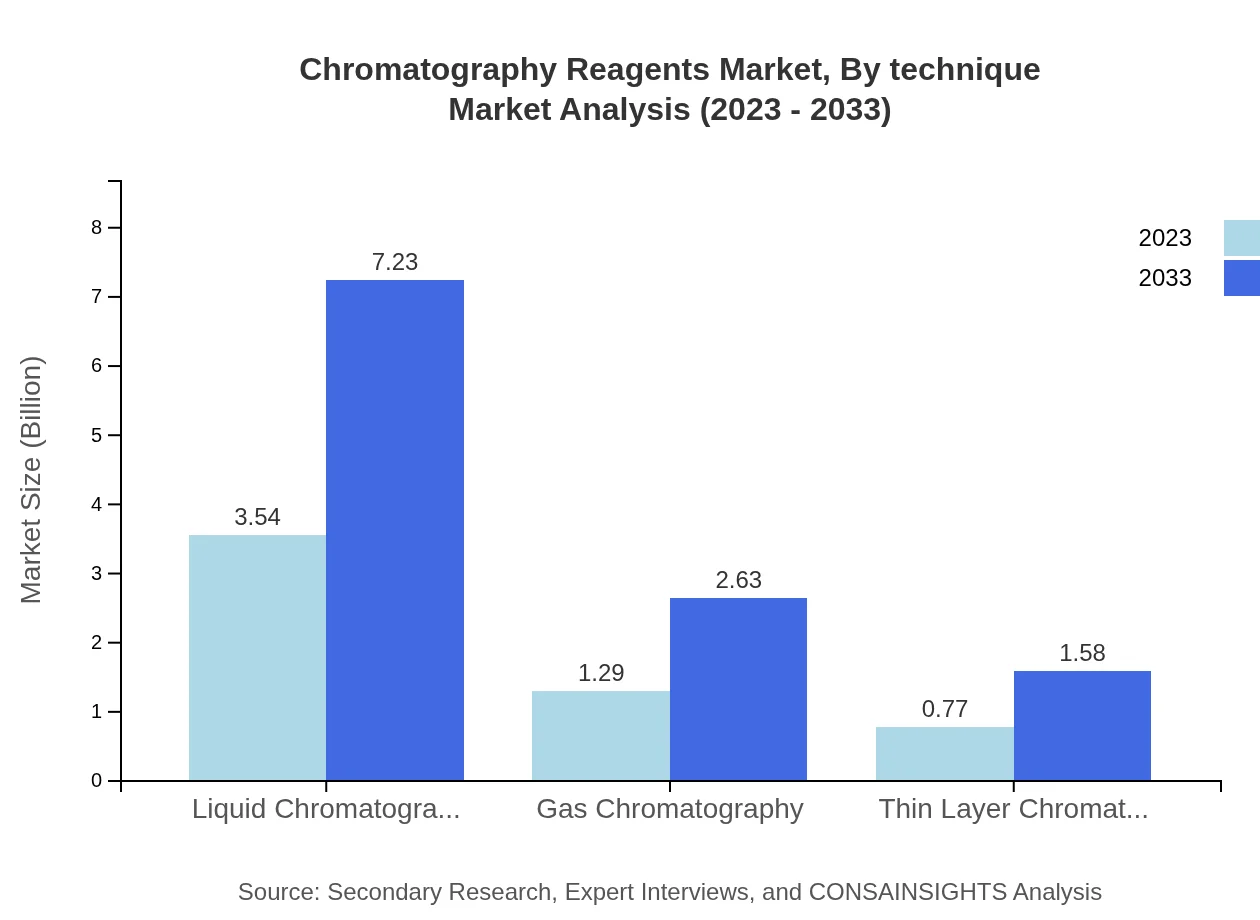

Chromatography Reagents Market Analysis By Technique

Liquid chromatography continues to lead the market, valued at $3.54 billion in 2023, commanding a 63.17% share. Gas chromatography follows with $1.29 billion and a 23.01% share, while thin-layer chromatography, though smaller at $0.77 billion, shares a similar percentage. As methods become more sophisticated, the demand for liquid chromatography is projected to accelerate significantly.

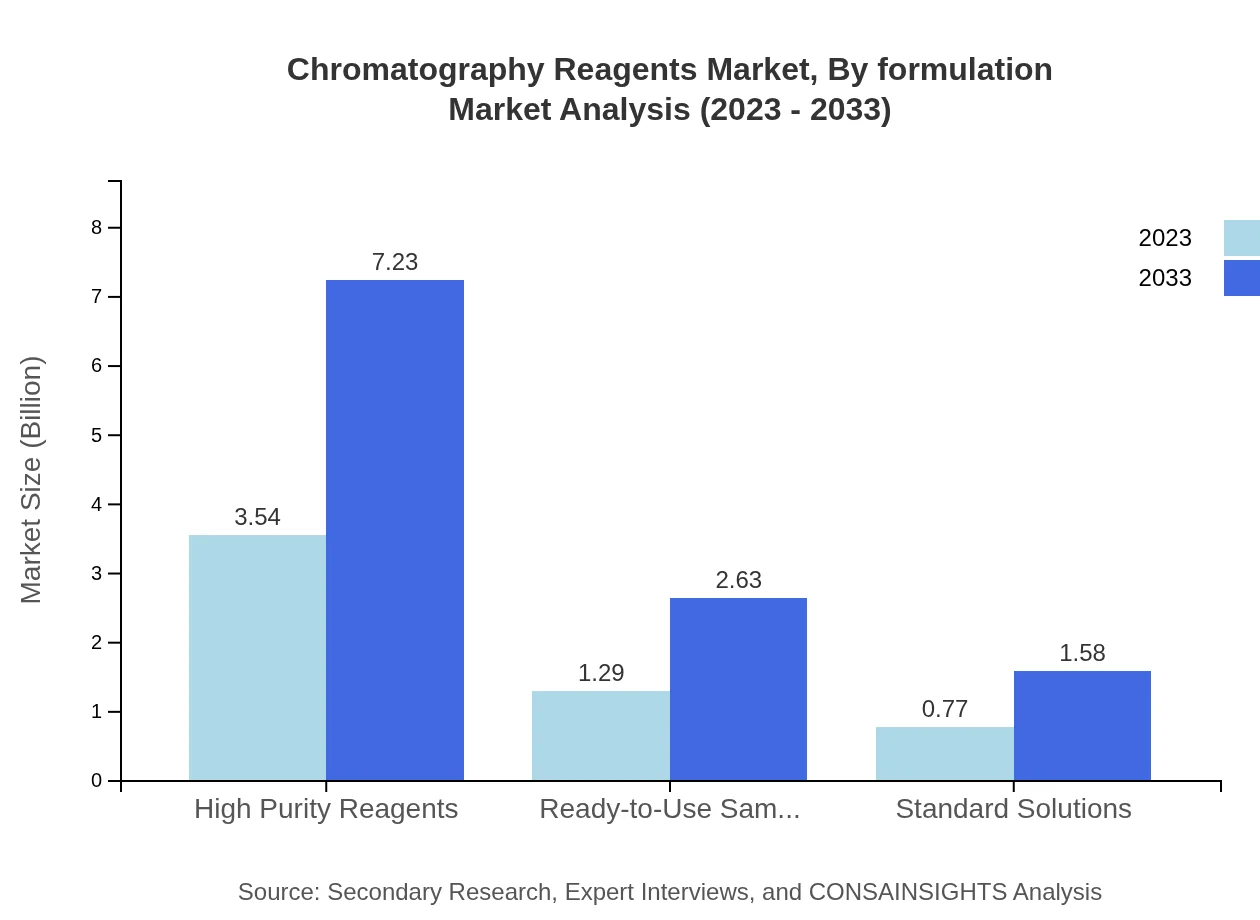

Chromatography Reagents Market Analysis By Formulation

High-purity reagents are at the forefront, valued at $3.54 billion in 2023, with a significant share of 63.17%. Ready-to-use samples and standard solutions have notable niches, couching at $1.29 billion and $0.77 billion, representing 23.01% and 13.82% shares respectively, indicating a stable demand for these formulations in research and commercial applications.

Chromatography Reagents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chromatography Reagents Industry

Merck Group:

A global leader in life science and performance materials, Merck provides high-quality chromatography reagents widely used in the pharmaceutical and biotechnology sectors.Thermo Fisher Scientific:

Known for its scientific instrumentation and reagents, Thermo Fisher offers a comprehensive range of chromatography reagents catering to various industries.Agilent Technologies:

Agilent is a frontrunner in developing innovative analytical solutions, including chromatography reagents aimed at improving precision and efficiency in laboratories.Bio-Rad Laboratories:

Bio-Rad is recognized for its contributions to life science research and clinical diagnostics, providing cutting-edge chromatography reagents and kits.We're grateful to work with incredible clients.

FAQs

What is the market size of chromatography Reagents?

The global chromatography reagents market is currently valued at approximately $5.6 billion, with a projected compound annual growth rate (CAGR) of 7.2% from 2023 to 2033, indicating significant growth potential in the industry.

What are the key market players or companies in this chromatography Reagents industry?

Key players in the chromatography reagents market include companies like Merck KGaA, Agilent Technologies, Thermo Fisher Scientific, and Sigma-Aldrich. These firms lead in product innovations and expanding their market presence globally.

What are the primary factors driving the growth in the chromatography reagents industry?

Growth in the chromatography reagents market is driven by factors such as increased demand in pharmaceuticals and biotechnology sectors, advancements in technology, and rising environmental testing requirements, which enhance its application scope.

Which region is the fastest Growing in the chromatography Reagents?

The Asia Pacific region is the fastest-growing market, projected to rise from $1.07 billion in 2023 to $2.18 billion in 2033, as countries in the area expand their pharmaceutical and biotechnology industries.

Does ConsaInsights provide customized market report data for the chromatography Reagents industry?

Yes, ConsaInsights offers tailored market report data for the chromatography reagents industry, allowing clients to access specific insights and analytics that meet their unique business requirements and strategic goals.

What deliverables can I expect from this chromatography Reagents market research project?

Expected deliverables from the chromatography reagents market research project include comprehensive market analytics, detailed segment analysis, growth forecasts, and insights into regional market trends and competitive landscape.

What are the market trends of chromatography Reagents?

Current market trends in chromatography reagents include a shift towards eco-friendly solvents, greater adoption of high-purity reagents, and advancements in chromatography techniques, which drive efficiency and accuracy in analytical processes.