Chromatography Software Sales Market Report

Published Date: 31 January 2026 | Report Code: chromatography-software-sales

Chromatography Software Sales Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Chromatography Software Sales market from 2023 to 2033. It covers market size, growth trends, segmentation, regional insights, and information about key players, offering valuable insights for stakeholders in the industry.

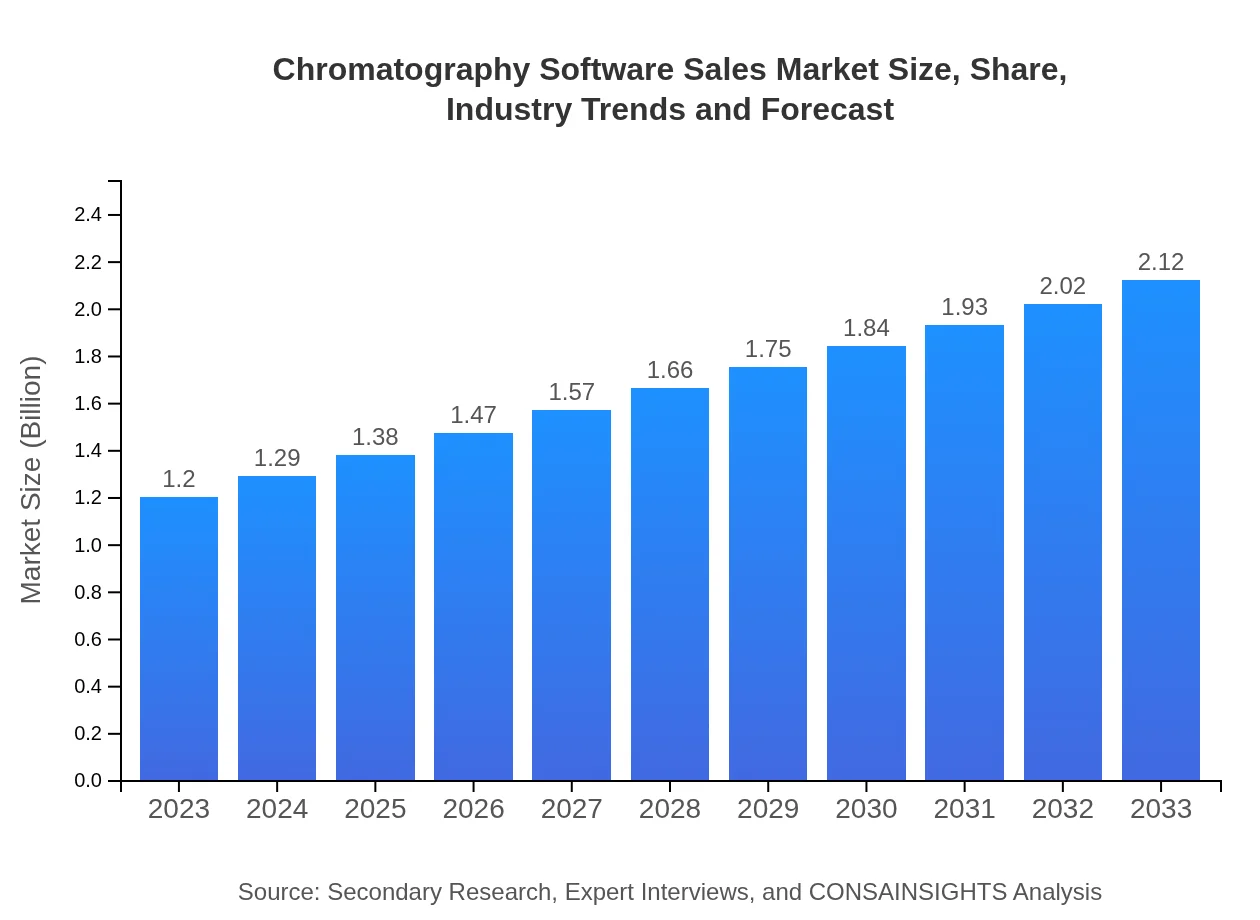

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $2.12 Billion |

| Top Companies | Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Shimadzu Corporation, PerkinElmer |

| Last Modified Date | 31 January 2026 |

Chromatography Software Sales Market Overview

Customize Chromatography Software Sales Market Report market research report

- ✔ Get in-depth analysis of Chromatography Software Sales market size, growth, and forecasts.

- ✔ Understand Chromatography Software Sales's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chromatography Software Sales

What is the Market Size & CAGR of Chromatography Software Sales market in 2023-2033?

Chromatography Software Sales Industry Analysis

Chromatography Software Sales Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chromatography Software Sales Market Analysis Report by Region

Europe Chromatography Software Sales Market Report:

Europe's chromatography software market is projected to rise from $400 million in 2023 to $700 million by 2033. This growth is supported by a strong focus on research and development in life sciences, combined with stringent regulatory frameworks that compel organizations to adopt advanced analytical tools.Asia Pacific Chromatography Software Sales Market Report:

In 2023, the Asia Pacific chromatography software market is valued at approximately $190 million, projected to grow to $330 million by 2033. This growth is fueled by increasing investments in biotechnology and pharmaceutical sectors across countries such as China and India, along with expanding healthcare infrastructure.North America Chromatography Software Sales Market Report:

North America holds the largest market share, approximately $440 million in 2023, expected to increase to $770 million by 2033. The region's dominance is attributed to the presence of leading pharmaceutical companies and advanced research facilities, coupled with the rapid adoption of innovative technologies.South America Chromatography Software Sales Market Report:

The South American market is relatively smaller, valued at around $40 million in 2023, with expectations to reach $70 million by 2033. Key growth drivers include an increased push for regulatory compliance in laboratory operations and rising health concerns, particularly in Brazil and Argentina.Middle East & Africa Chromatography Software Sales Market Report:

This region's market, valued at approximately $140 million in 2023, is expected to grow to $250 million by 2033. The growth is driven by increasing investments in laboratory infrastructure and rising awareness regarding food safety and environmental testing.Tell us your focus area and get a customized research report.

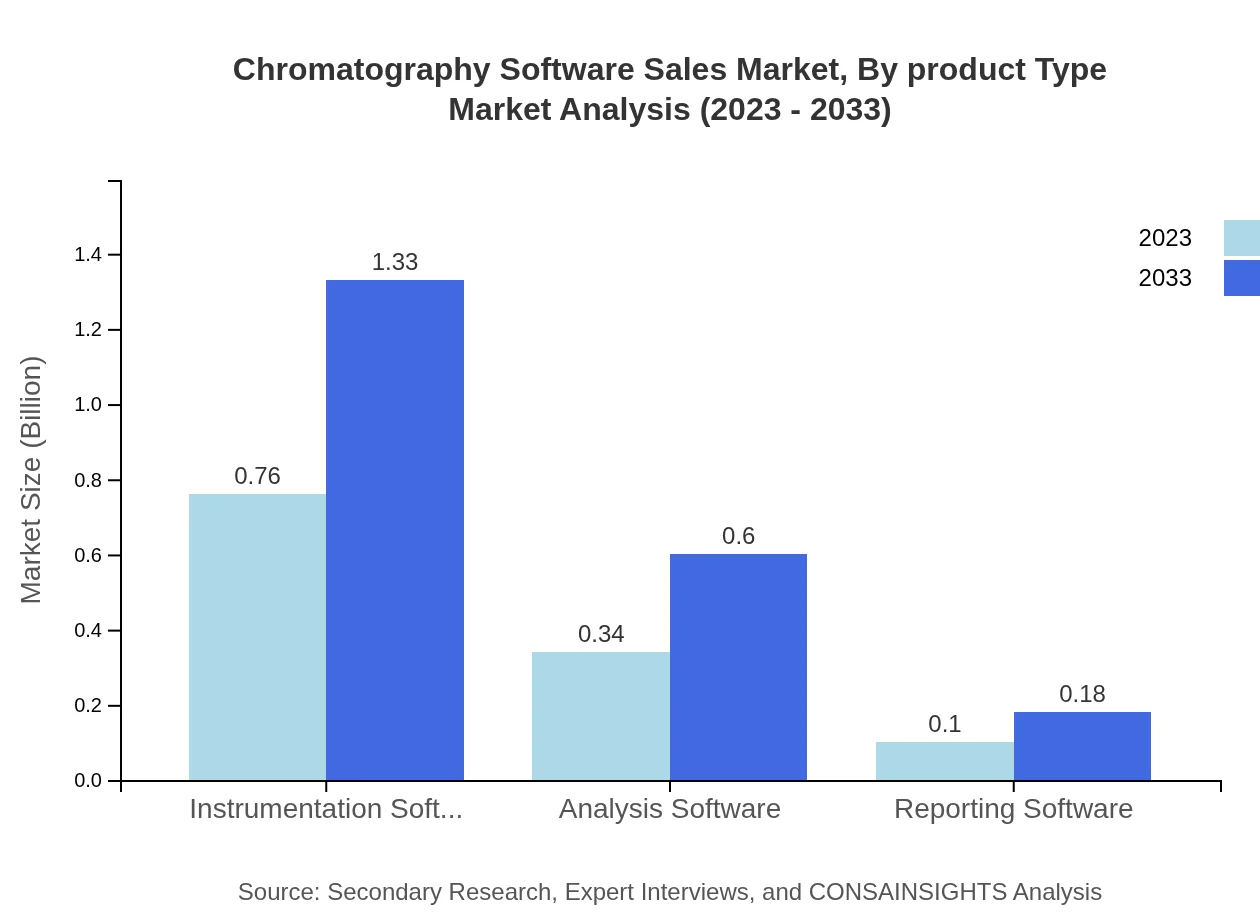

Chromatography Software Sales Market Analysis By Product Type

In the product type segment, instrumentation software is the largest revenue generator, accounting for approximately $760 million in 2023 with a growth forecast to $1.33 billion by 2033, capturing around 63% of the total market share. Analysis and reporting software also contribute significantly, catering to the rising demand for data analytics and reporting solutions.

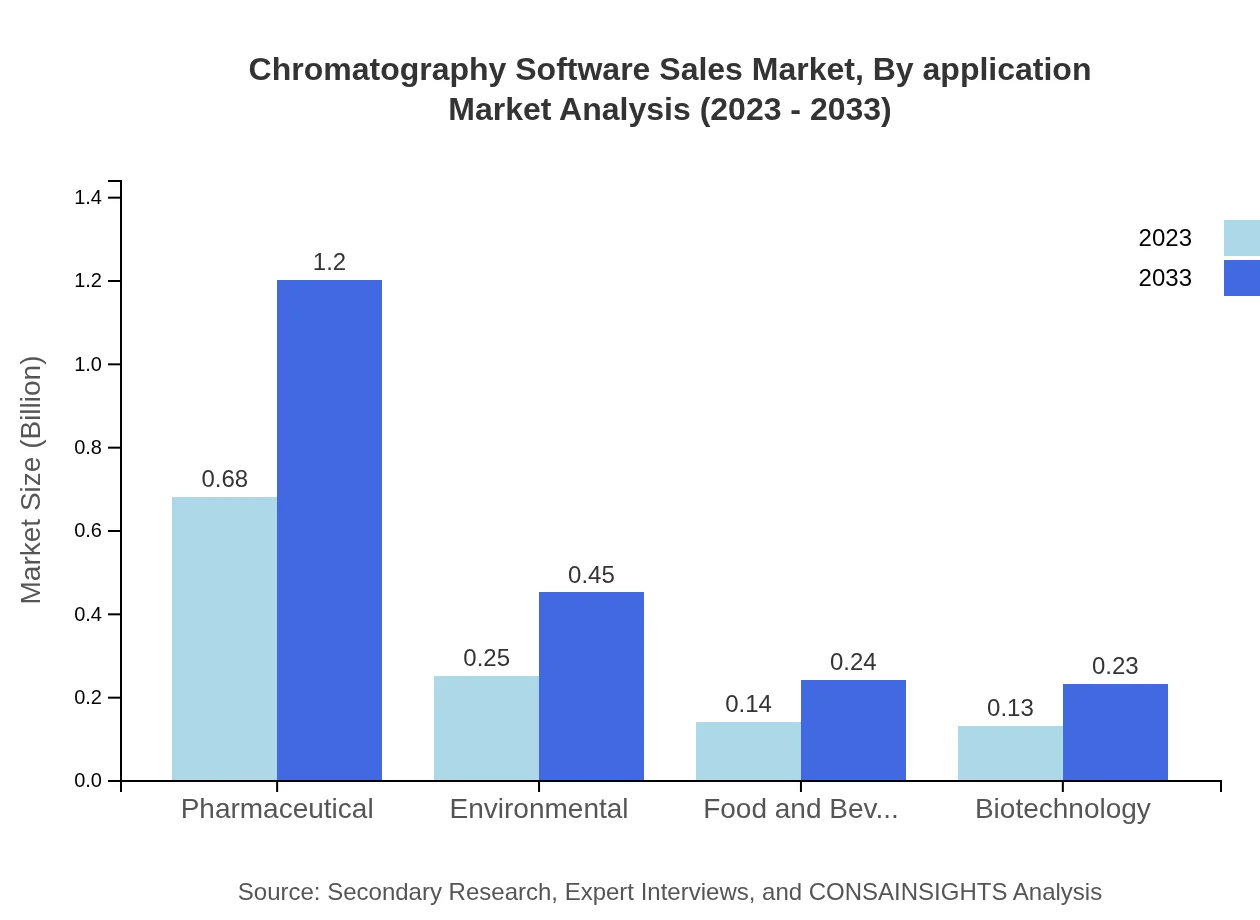

Chromatography Software Sales Market Analysis By Application

The pharmaceutical application segment remains the leader in the chromatography software market, expected to grow from $680 million in 2023 to $1.2 billion by 2033, representing a market share of over 56%. Other applications, such as environmental testing and academic research, are also becoming relevant as the focus on safety and education increases.

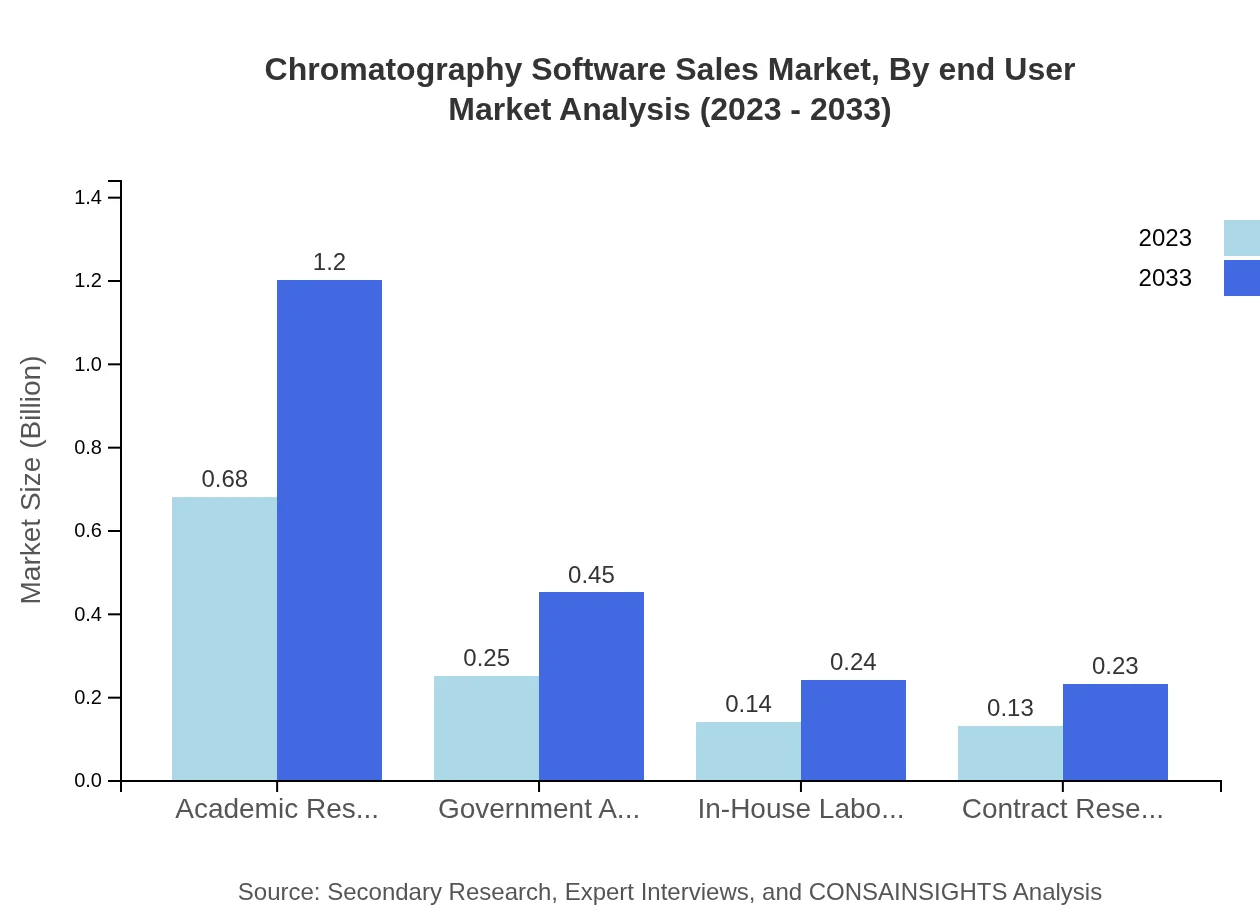

Chromatography Software Sales Market Analysis By End User

Academic research institutions dominate the end-user segment, accounting for an estimated $680 million in 2023, with strong growth to $1.2 billion forecasted by 2033. The importance of chromatography software in educational environments is critical as students and researchers leverage these tools for practical learning.

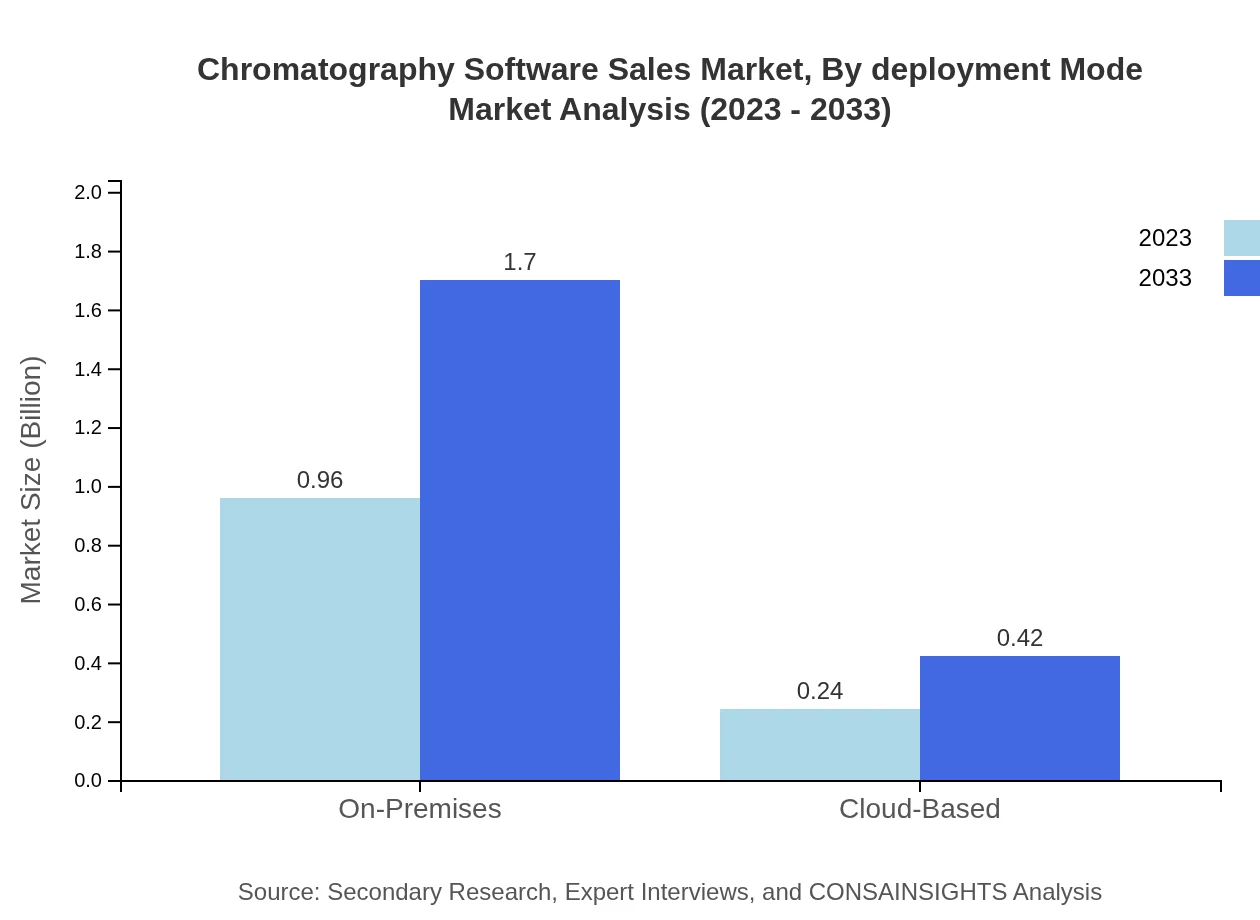

Chromatography Software Sales Market Analysis By Deployment Mode

Currently, on-premises solutions lead the deployment mode segment, valued at $960 million in 2023, anticipated to rise to $1.7 billion by 2033. Cloud-based software is gaining traction, projected to reach $420 million by 2033, driven by the need for flexible access to analytics and data management.

Chromatography Software Sales Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chromatography Software Sales Industry

Thermo Fisher Scientific:

Thermo Fisher offers a comprehensive range of chromatography solutions, including software that integrates seamlessly with their analytical instruments, enhancing productivity and compliance.Agilent Technologies:

Agilent is renowned for its advanced analytical instrumentation and software solutions that aid in biochemical analysis, contributing to increased efficiency in laboratories worldwide.Waters Corporation:

Waters specializes in advanced chromatography systems and software, enabling precise analysis for pharmaceutical, environmental, and food safety applications.Shimadzu Corporation:

Shimadzu provides innovative chromatography software and instrumentation, recognized for their reliability and performance in various analytical applications.PerkinElmer:

PerkinElmer offers chromatography software designed to address critical analytical needs in pharmaceutical and environmental sectors, focusing on compliance and data integrity.We're grateful to work with incredible clients.

FAQs

What is the market size of chromatography Software Sales?

The global chromatography software sales market is valued at approximately $1.2 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.7% over the next decade, indicating significant growth potential leading up to 2033.

What are the key market players or companies in this chromatography Software Sales industry?

Key players in the chromatography software sales market include major companies such as Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, and PerkinElmer. These companies dominate through continuous innovation and strategic partnerships, shaping market trends.

What are the primary factors driving the growth in the chromatography Software Sales industry?

Growth in the chromatography software sales industry is primarily driven by increased demand for analytical instruments in pharmaceuticals and environmental testing, advancements in technology, stringent regulatory requirements, and the expansion of laboratories in emerging markets.

Which region is the fastest Growing in the chromatography Software Sales market?

The Asia Pacific region is witnessing rapid growth in chromatography software sales, increasing from $0.19 billion in 2023 to $0.33 billion by 2033. This growth can be attributed to expanding pharmaceutical sectors and improving laboratory infrastructure.

Does ConsaInsights provide customized market report data for the chromatography Software Sales industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the chromatography software sales industry. This includes bespoke insights, market forecasts, and competitive analysis to meet unique client requirements.

What deliverables can I expect from this chromatography Software Sales market research project?

Deliverables from the chromatography software sales market research project include comprehensive reports, data analytics, market size estimations, competitive landscape assessments, and strategic recommendations tailored to improve decision-making.

What are the market trends of chromatography Software Sales?

Current market trends in chromatography software sales include the adoption of cloud-based solutions, integration of AI for data analysis, increasing demand for workflow automation, and a shift towards a more user-friendly software interface to enhance productivity.