Citric Acid Market Report

Published Date: 31 January 2026 | Report Code: citric-acid

Citric Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the Citric Acid market, focusing on current trends, analysis of market size, growth rates, and regional performance alongside product segmentation and competitive landscape forecasts from 2023 to 2033.

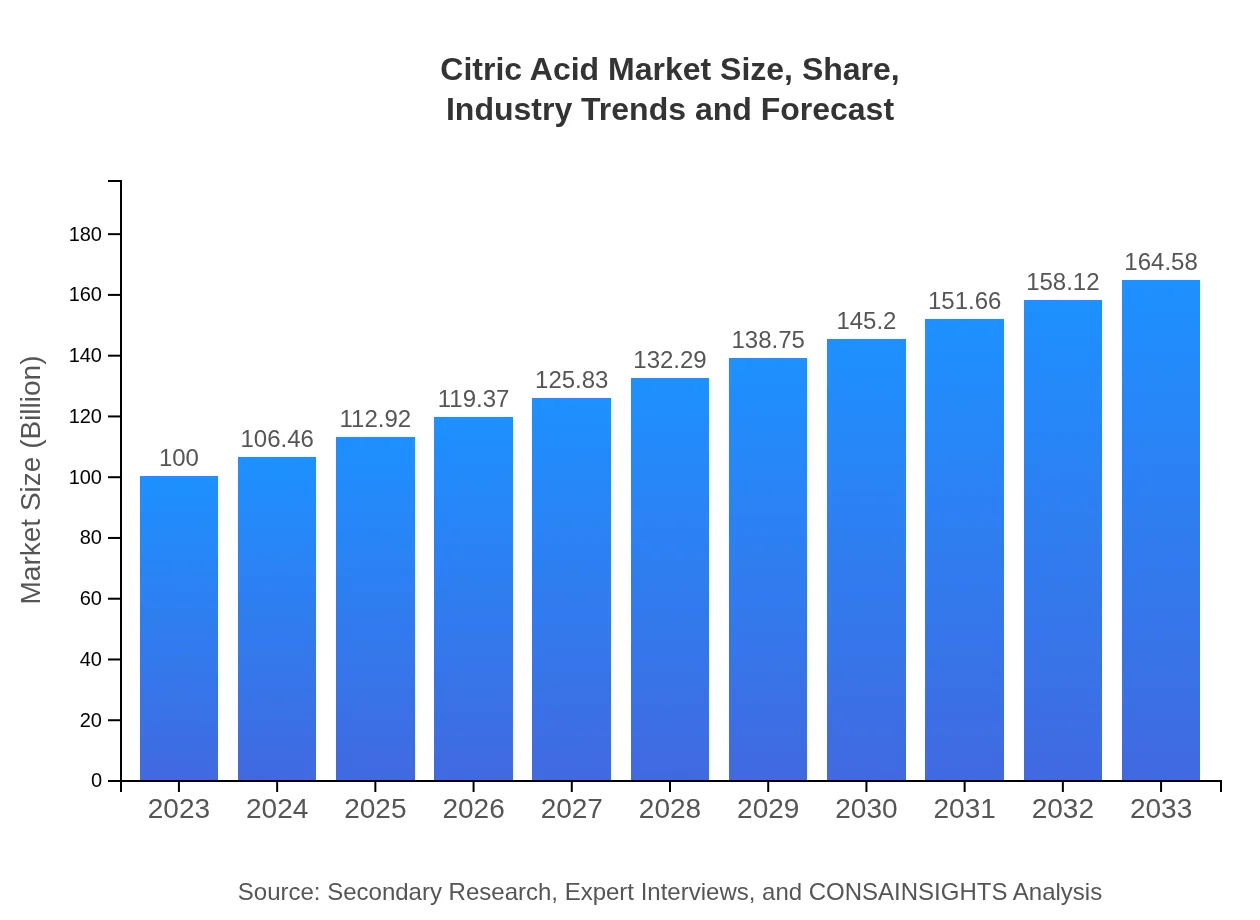

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Food Ingredient Solutions, Inc., IFF (International Flavors & Fragrances), Tate & Lyle PLC |

| Last Modified Date | 31 January 2026 |

Citric Acid Market Overview

Customize Citric Acid Market Report market research report

- ✔ Get in-depth analysis of Citric Acid market size, growth, and forecasts.

- ✔ Understand Citric Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Citric Acid

What is the Market Size & CAGR of Citric Acid market in 2023?

Citric Acid Industry Analysis

Citric Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Citric Acid Market Analysis Report by Region

Europe Citric Acid Market Report:

The European market for Citric Acid is forecasted to progress from $28.70 million in 2023 to $47.23 million by 2033, with consistent demand driven by food safety regulations and an inclination towards natural preservative alternatives.Asia Pacific Citric Acid Market Report:

The Asia Pacific region is projected to witness significant growth, with a market size of $19.08 million in 2023 expanding to $31.40 million by 2033. The surge is driven by rising population, urbanization, and the expanding food processing industry, particularly in countries like China and India.North America Citric Acid Market Report:

North America holds a substantial market share, with values rising from $37.07 million in 2023 to $61.01 million by 2033. The region's growth is attributable to the robust pharmaceutical sector and rising health-conscious trends among consumers.South America Citric Acid Market Report:

In South America, the Citric Acid market is expected to grow from $1.28 million in 2023 to $2.11 million by 2033. This growth is primarily fueled by increased consumption in food and beverage applications as consumer preferences shift towards natural ingredients.Middle East & Africa Citric Acid Market Report:

The Middle East and Africa market size is anticipated to grow from $13.87 million in 2023 to $22.83 million by 2033, spurred by increased food processing activities and growing consumer demand for packaged foods.Tell us your focus area and get a customized research report.

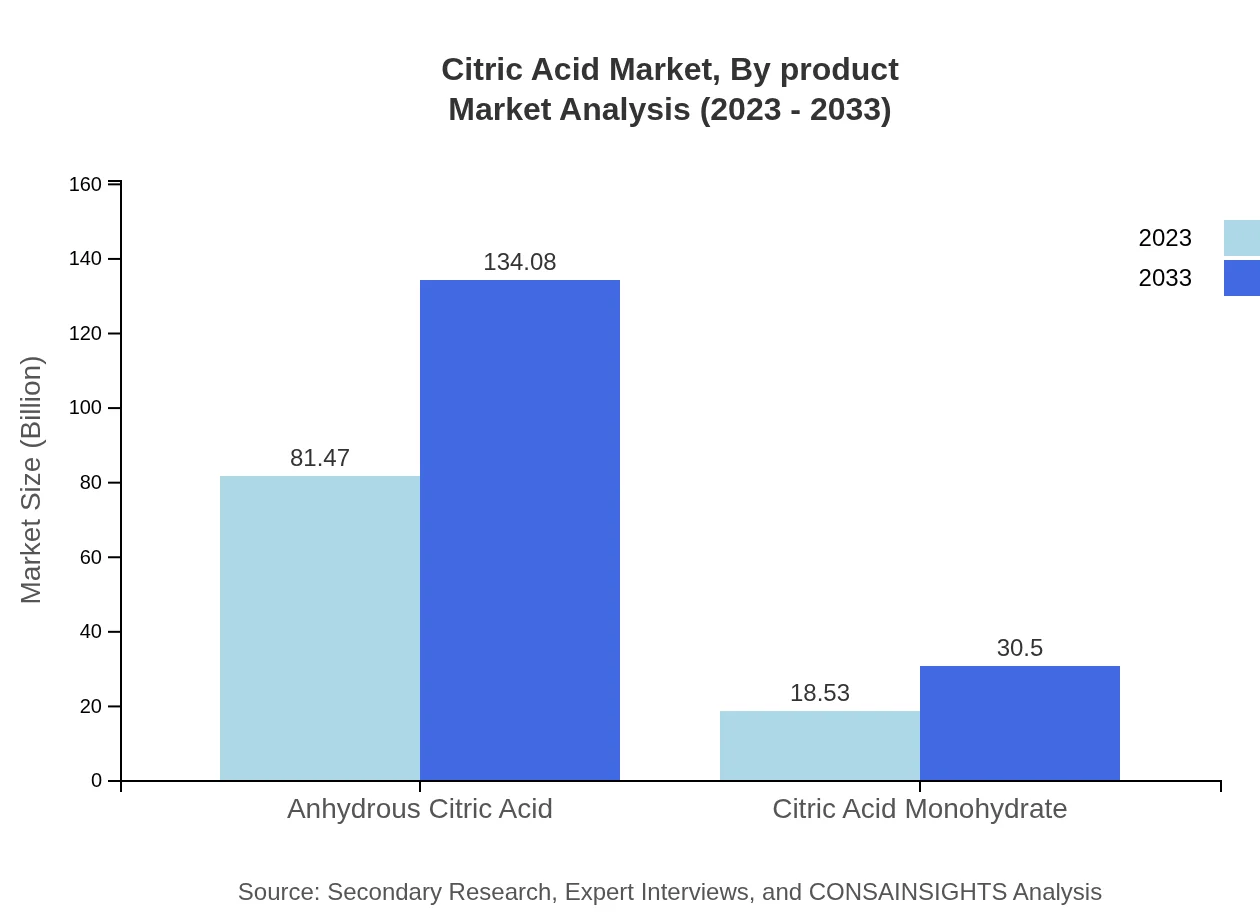

Citric Acid Market Analysis By Product

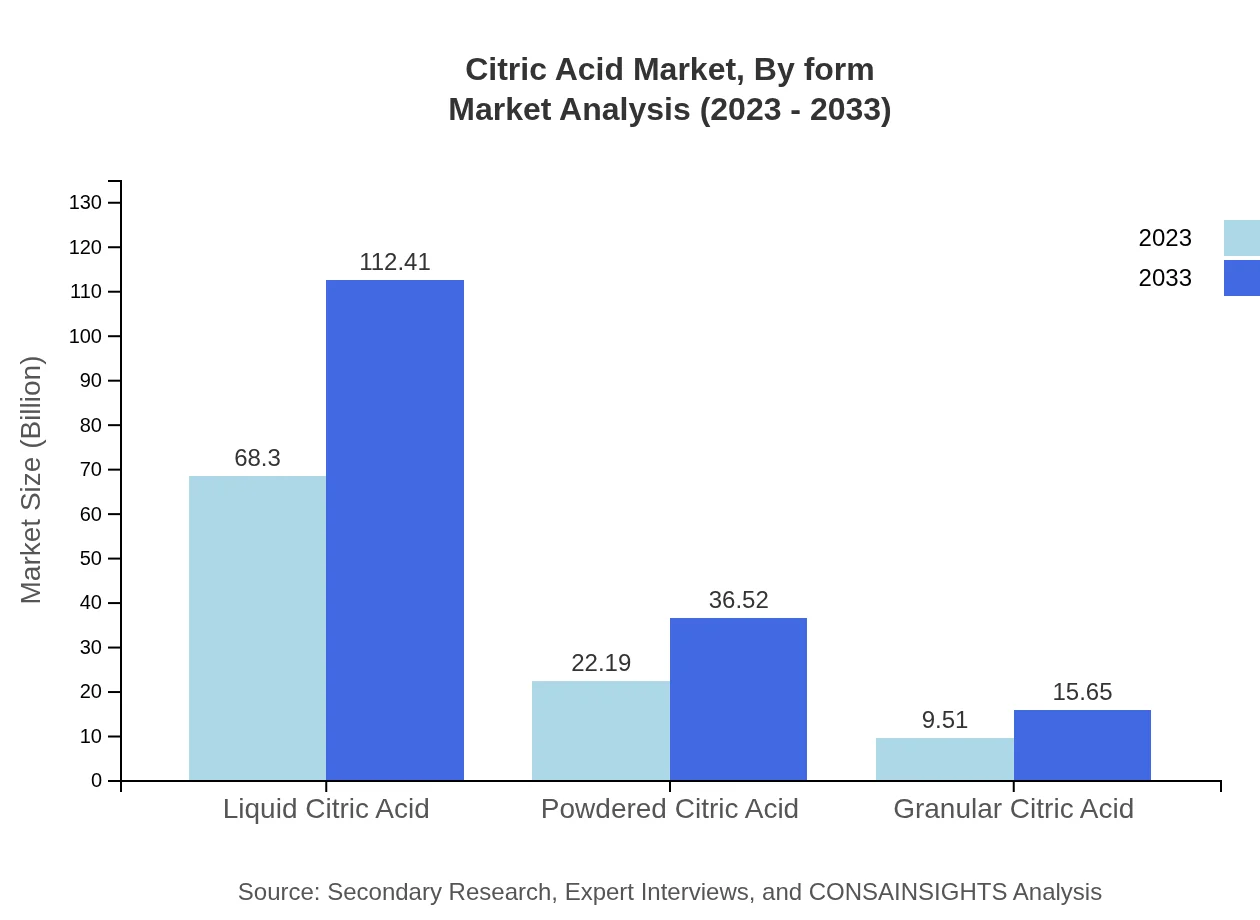

The analysis reveals a strong preference for liquid citric acid, with the market size escalating from $68.30 million in 2023 to $112.41 million by 2033. Powdered citric acid also shows promising growth, scaling from $22.19 million to $36.52 million within the same period, indicating a diverse range of applications across industries.

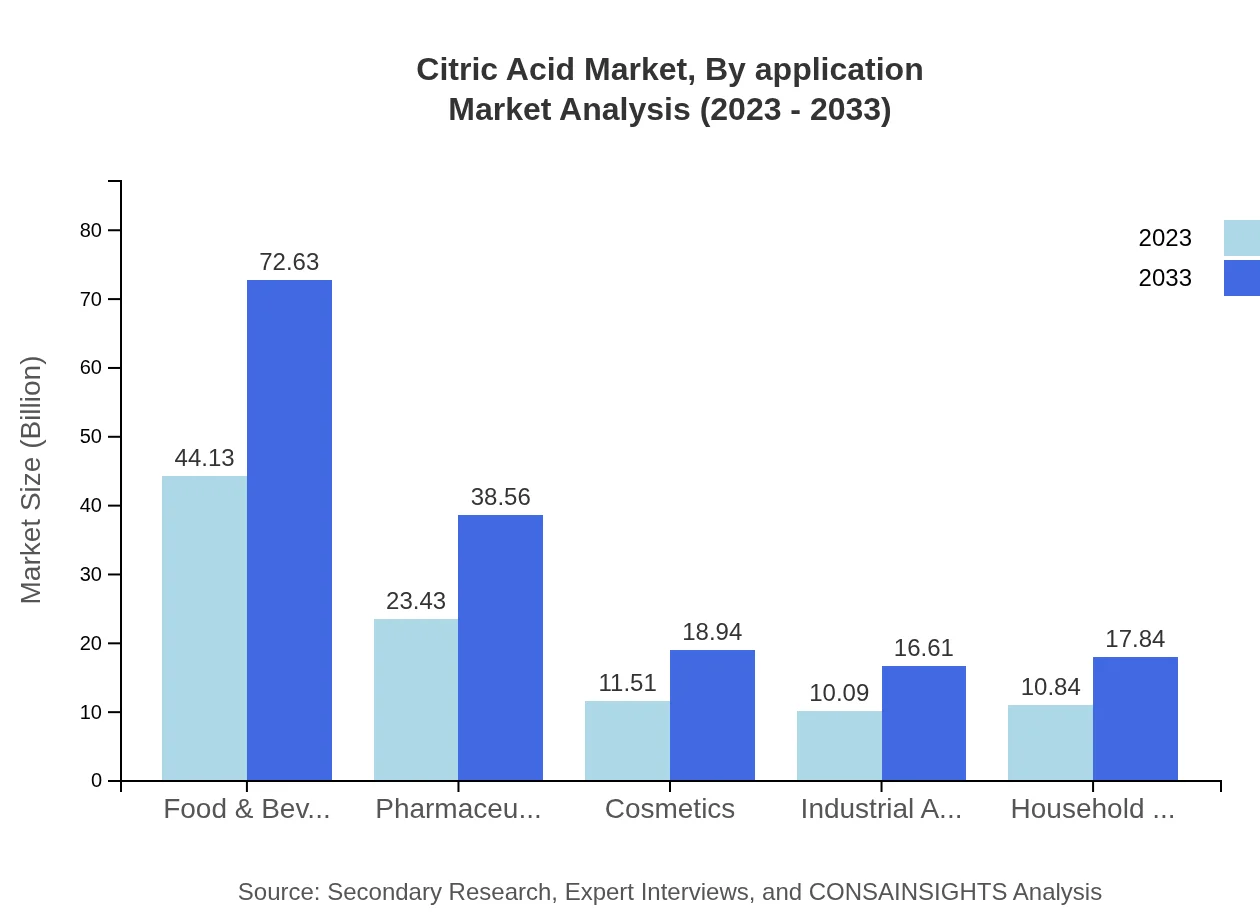

Citric Acid Market Analysis By Application

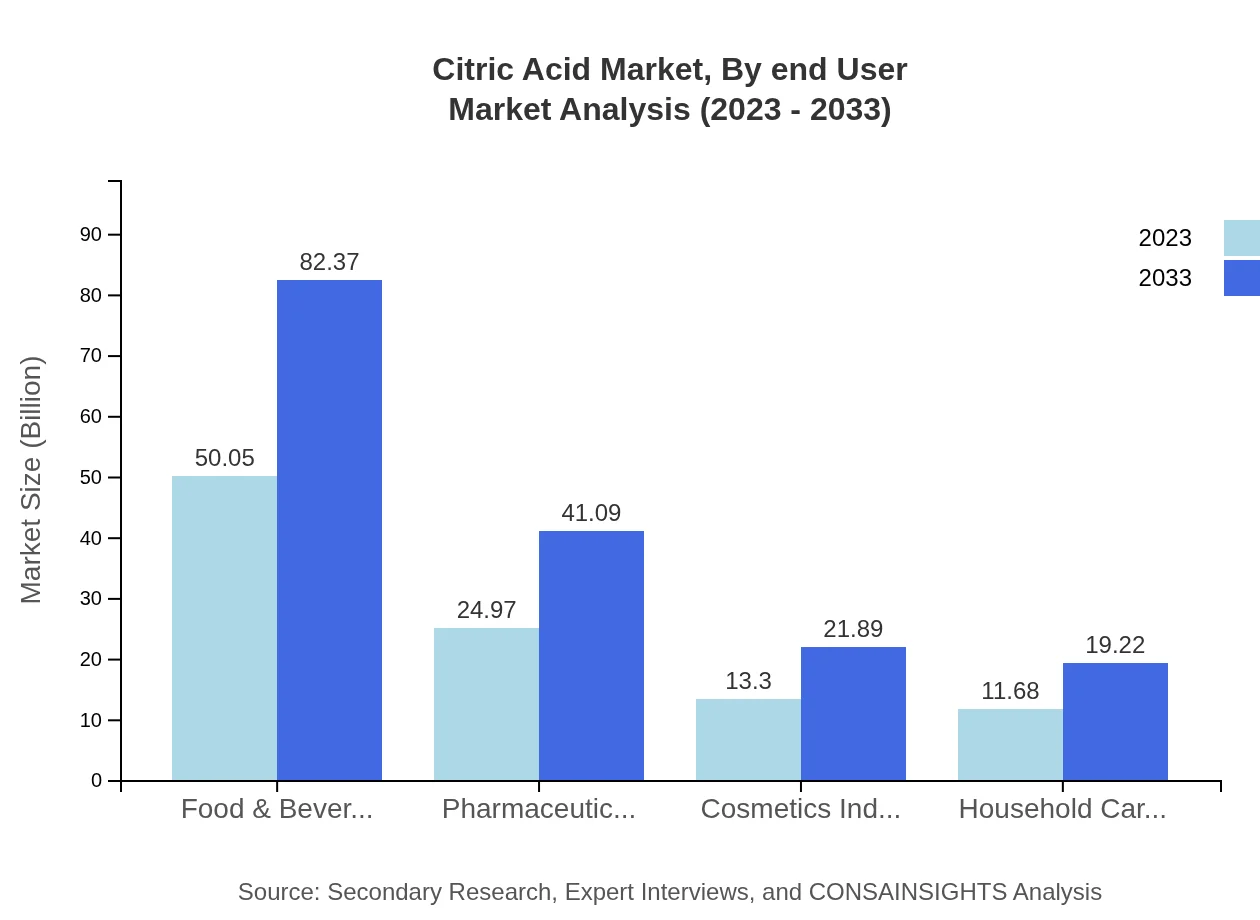

In terms of application, the food and beverage industry maintains the largest share, commencing at $50.05 million and rising to $82.37 million by 2033. Other notable segments include pharmaceuticals and cosmetics, which also exhibit steady growth reflecting their increasing application in formulations and beauty products respectively.

Citric Acid Market Analysis By Form

The form segment illustrates that liquid citric acid dominates, constituting more than 60% of total consumption. This form is favored for its ease of use in various processing applications, while granular and powdered forms hold respective sizes of $9.51 million and $22.19 million in 2023, projected to grow as industries diversify their sourcing methods.

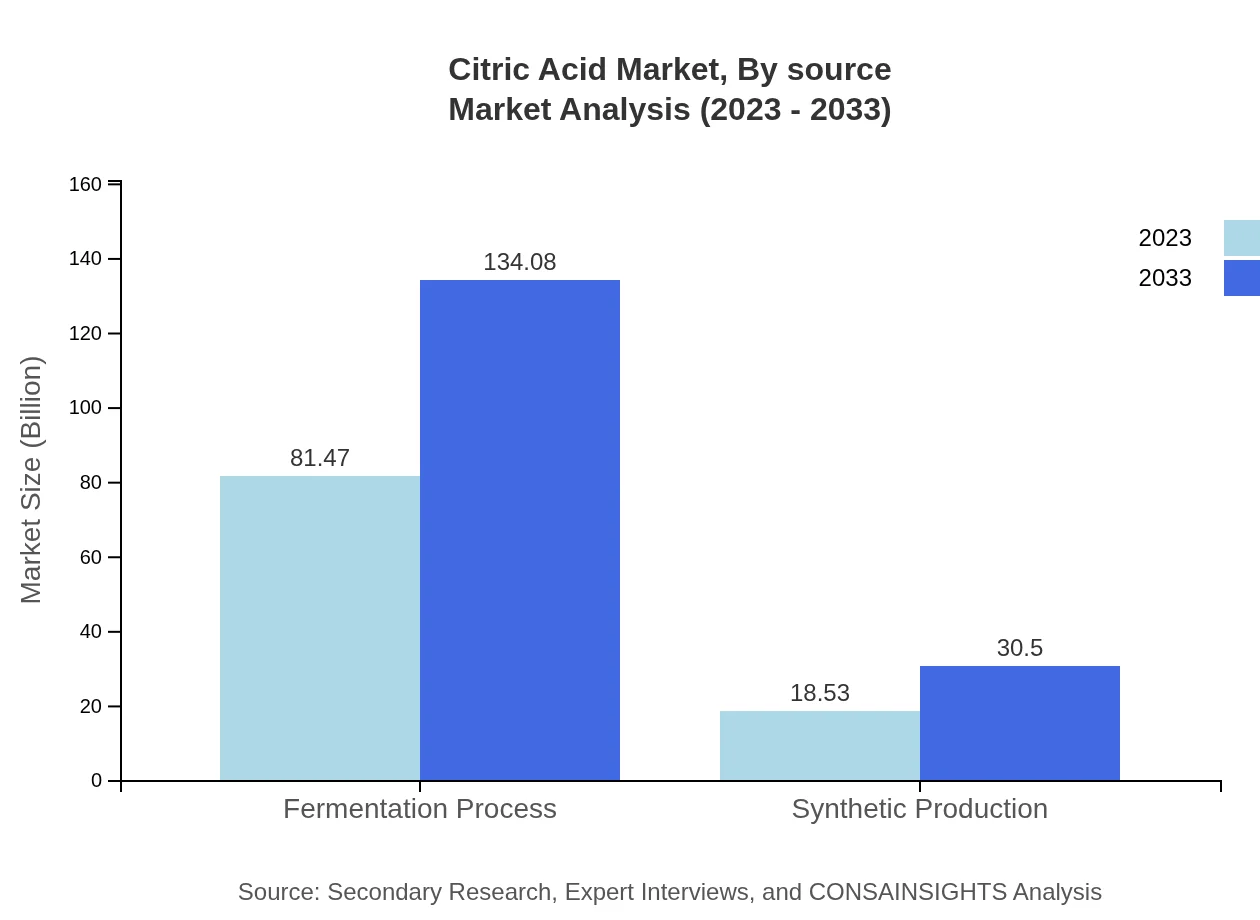

Citric Acid Market Analysis By Source

The Citric Acid production is primarily through fermentation processes, representing a market size of $81.47 million in 2023, and expected to reach $134.08 million by 2033. Synthetic production, while smaller, is also significant with sizes growing from $18.53 million to $30.50 million, reflecting advancements in production efficiency.

Citric Acid Market Analysis By End User

End-user analysis identifies food and beverage as the leading end-user sector, followed closely by pharmaceuticals and cosmetics. Expectations are that food services will fuel the highest growth, with values soaring from $44.13 million to $72.63 million between 2023 and 2033, led by inclination towards health-centric food products.

Citric Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Citric Acid Industry

Cargill, Incorporated:

Cargill is a global leader in food and agriculture, providing diverse food production solutions including citric acid. Their innovation and sustainability initiatives enhance the usability of this product across industries.Archer Daniels Midland Company (ADM):

ADM is a global leader in the production and trade of agricultural commodities, including citric acid, offering a wide range of innovative solutions for food processing and preservation applications.Food Ingredient Solutions, Inc.:

Specializing in natural food ingredients, FIS is a significant player in the citric acid market, focusing on quality and consumer safety by providing high-purity products.IFF (International Flavors & Fragrances):

IFF is heavily involved in the flavors and fragrances sector, leveraging its expertise in citric acid applications to enhance product offerings across multiple markets.Tate & Lyle PLC:

With a strong emphasis on food innovation, Tate & Lyle develops new uses for citric acid, primarily targeting beverage applications and specialty food markets.We're grateful to work with incredible clients.

FAQs

What is the market size of citric acid?

As of 2023, the global citric acid market size is approximately $100 million, with a projected CAGR of 5% leading to substantial growth by 2033.

What are the key market players in the citric acid industry?

Key players in the citric acid industry include multinational corporations such as Cargill Inc., Archer Daniels Midland Company (ADM), and Fuso Chemical Co., Ltd, among others.

What are the primary factors driving the growth in the citric acid industry?

Growth in the citric acid industry is primarily driven by increasing demand in food and beverages, pharmaceuticals, and cosmetic applications, along with health benefits associated with citric acid.

Which region is the fastest Growing in the citric acid market?

The North American region is projected to be the fastest-growing area in the citric acid market, expanding from $37.07 million in 2023 to $61.01 million by 2033.

Does ConsaInsights provide customized market report data for the citric acid industry?

Yes, ConsaInsights offers customized market report data for the citric acid industry to suit specific business needs and objectives.

What deliverables can I expect from the citric acid market research project?

Expect comprehensive market insights, trend analysis, competitive landscape overview, and detailed segment data tailored to your focus areas in the citric acid market.

What are the market trends of citric acid?

Current market trends for citric acid include a rising demand in sustainable product development, increased use in natural food preservatives, and ongoing innovation in production processes.