Clinical Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: clinical-diagnostics

Clinical Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Clinical Diagnostics market, focusing on market size, trends, segmentation, regional insights, and forecasts for 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

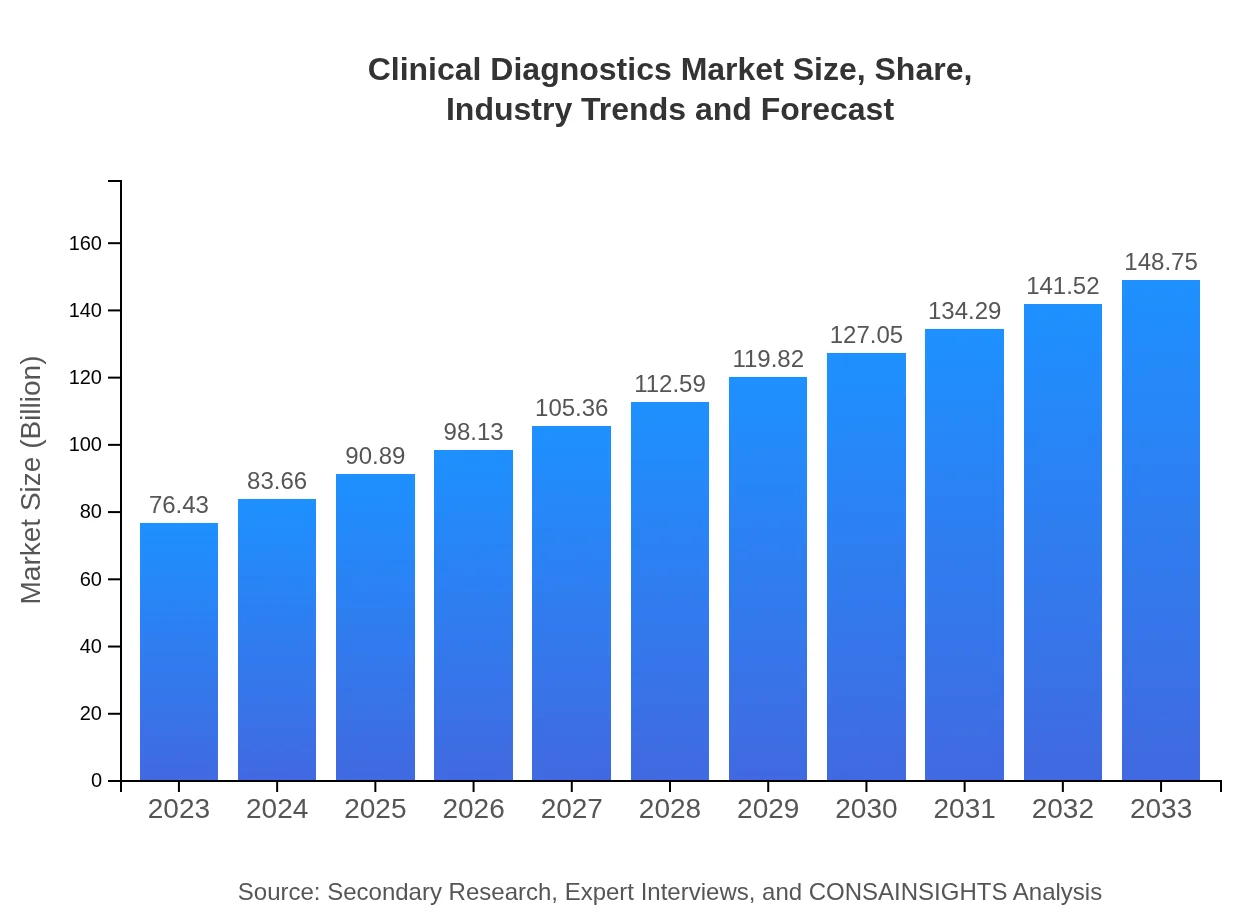

| 2023 Market Size | $76.43 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $148.75 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

Clinical Diagnostics Market Overview

Customize Clinical Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Clinical Diagnostics market size, growth, and forecasts.

- ✔ Understand Clinical Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Clinical Diagnostics

What is the Market Size & CAGR of Clinical Diagnostics market in 2023?

Clinical Diagnostics Industry Analysis

Clinical Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Clinical Diagnostics Market Analysis Report by Region

Europe Clinical Diagnostics Market Report:

The European market will grow from $20.68 billion in 2023 to $40.25 billion by 2033. Key factors contributing to this growth include aging demographics, a rise in chronic diseases, and an increasing emphasis on personalized medicine and innovative diagnostic techniques.Asia Pacific Clinical Diagnostics Market Report:

The Asia Pacific region is anticipated to experience significant growth, with the market size expected to expand from $14.71 billion in 2023 to $28.63 billion in 2033. This growth is fueled by increasing investments in healthcare infrastructure, a growing prevalence of infectious diseases, and rising demand for advanced diagnostic procedures.North America Clinical Diagnostics Market Report:

North America remains the largest market for clinical diagnostics, projected to increase from $29.33 billion in 2023 to $57.09 billion by 2033. The growth is driven by high healthcare expenditure, advancement in healthcare technologies, and the presence of key industry players focused on innovation.South America Clinical Diagnostics Market Report:

In South America, the clinical diagnostics market is projected to grow from $5.48 billion in 2023 to $10.67 billion in 2033. Factors such as rising healthcare awareness and government initiatives to enhance disease detection capabilities are expected to drive market growth in this region.Middle East & Africa Clinical Diagnostics Market Report:

In the Middle East and Africa, the market is expected to expand from $6.22 billion in 2023 to $12.11 billion in 2033. This growth can be attributed to improvements in healthcare services, increased awareness, and the growing prevalence of diseases requiring diagnostic testing.Tell us your focus area and get a customized research report.

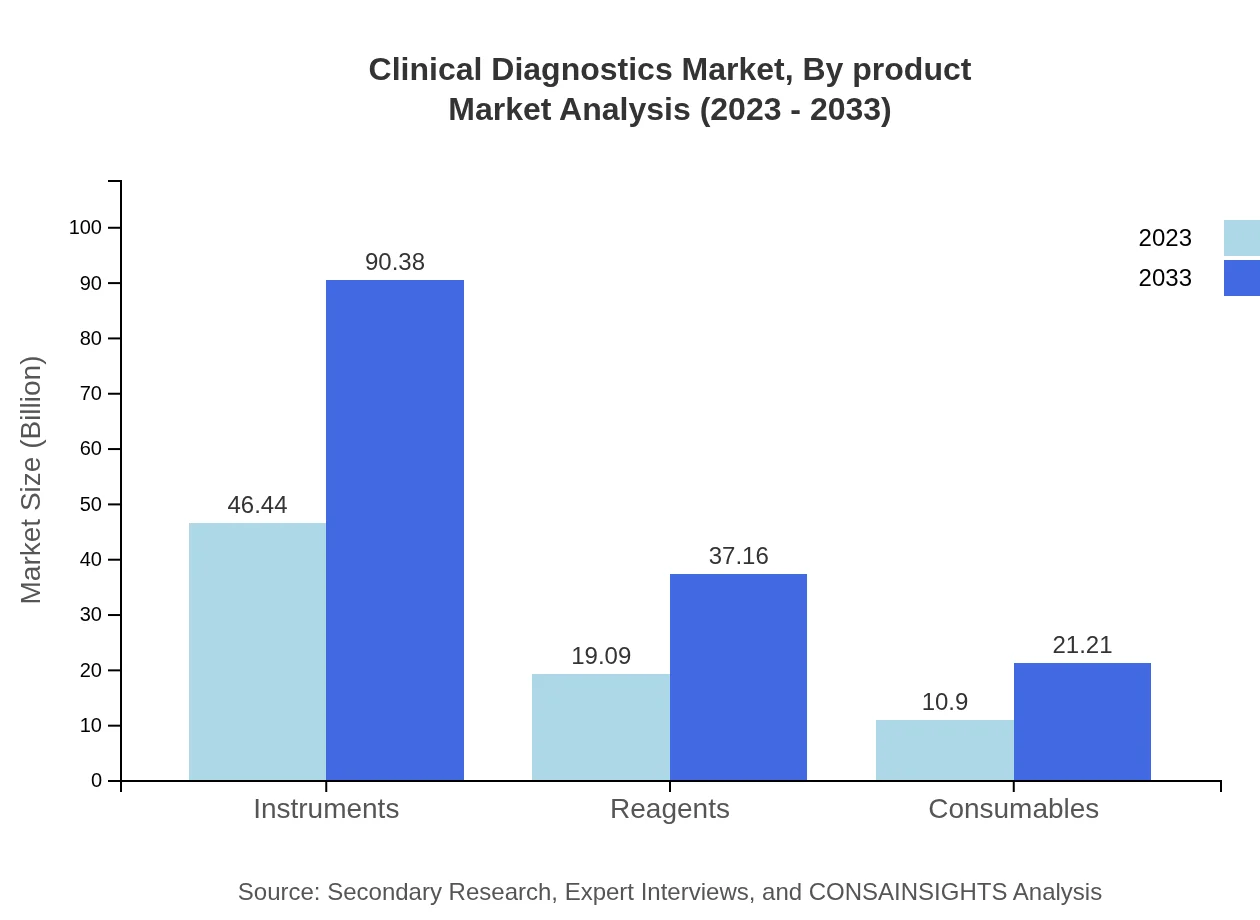

Clinical Diagnostics Market Analysis By Product

In 2023, the market for instruments is valued at $46.44 billion and is projected to nearly double to $90.38 billion by 2033. Reagents and consumables also show significant growth, with the former expected to grow from $19.09 billion to $37.16 billion and the latter from $10.90 billion to $21.21 billion during the forecast period.

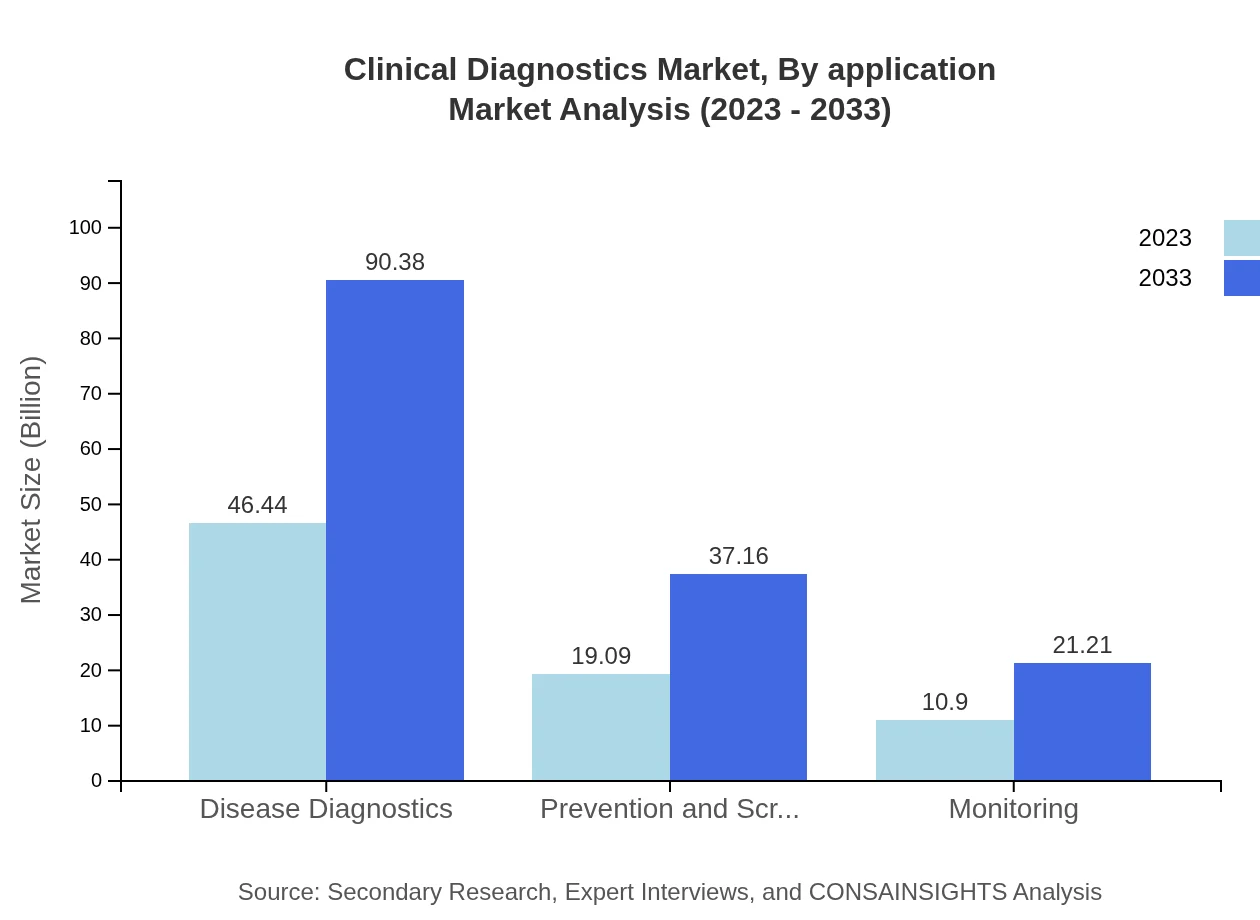

Clinical Diagnostics Market Analysis By Application

Disease diagnostics dominates the segment, with a size of $46.44 billion in 2023, projected to grow to $90.38 billion by 2033. Prevention and screening and monitoring applications also show substantial growth, with market sizes of $19.09 billion and $10.90 billion in 2023, respectively, and expected growth to $37.16 billion and $21.21 billion.

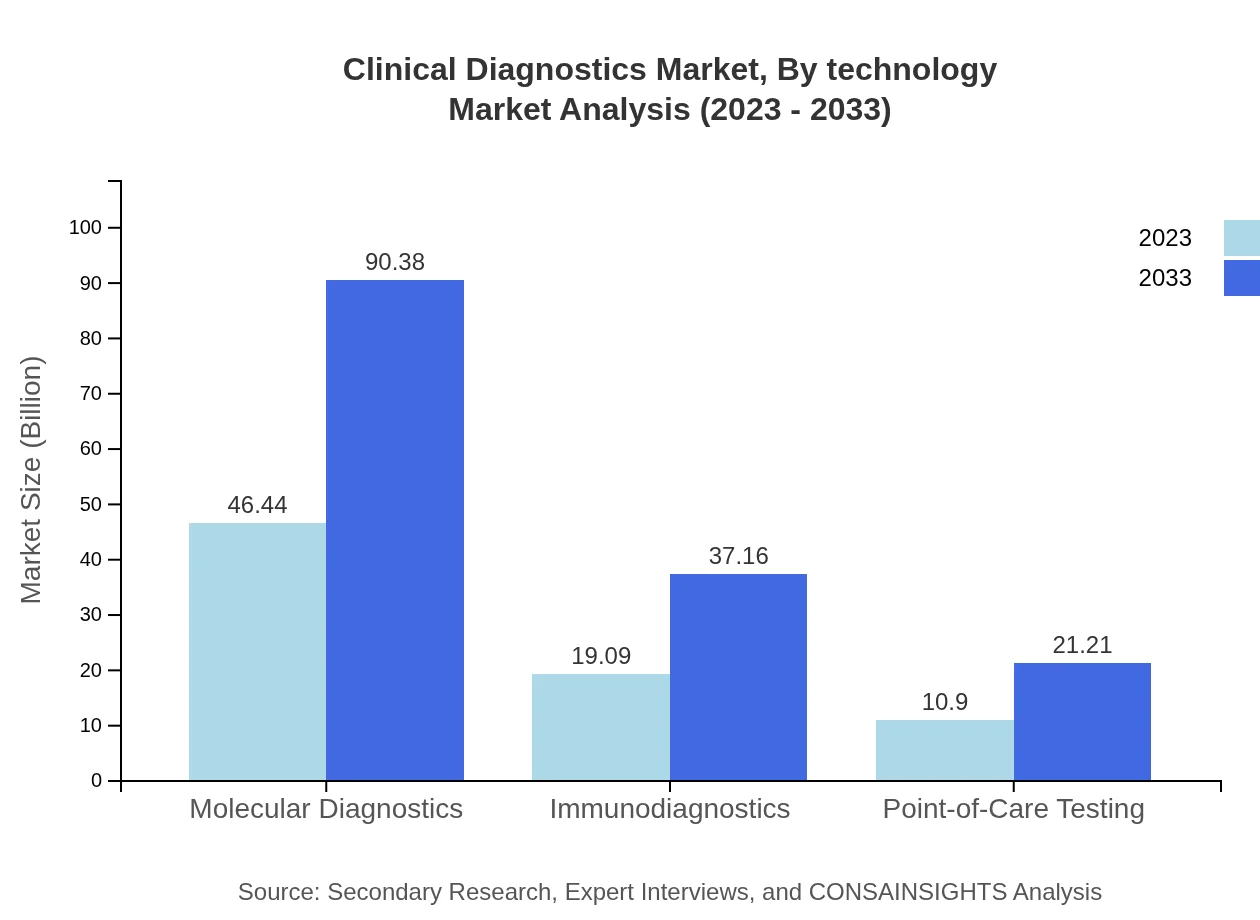

Clinical Diagnostics Market Analysis By Technology

Molecular diagnostics is anticipated to remain a key technological driver, increasing from $46.44 billion in 2023 to $90.38 billion by 2033. Similarly, immunodiagnostics and point-of-care testing segments are expected to grow significantly, supported by ongoing innovations and increased demand for accessible testing options.

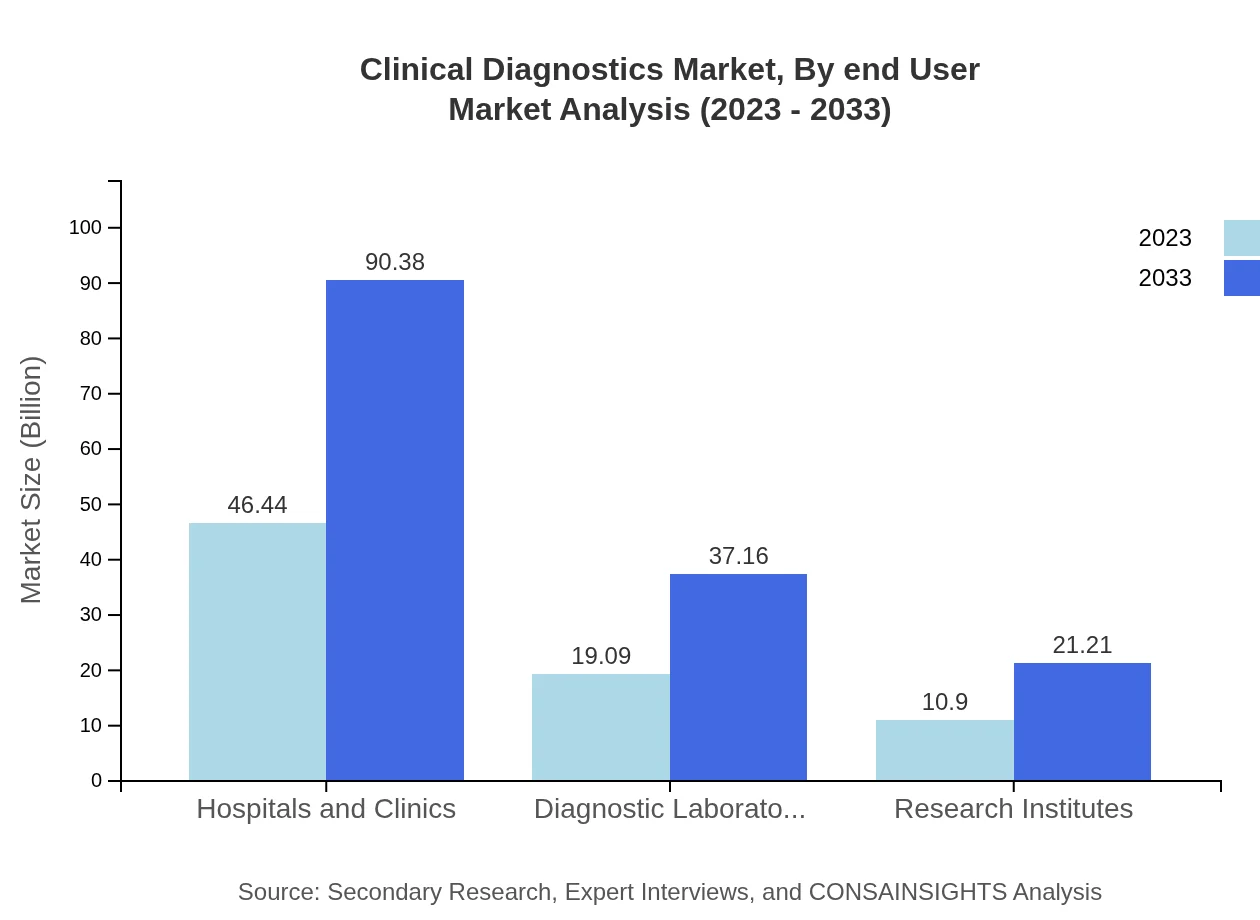

Clinical Diagnostics Market Analysis By End User

Hospitals and clinics represent the largest end-user segment, with a market size of $46.44 billion in 2023, forecasted to grow to $90.38 billion by 2033. Diagnostic laboratories and research institutes are also significant contributors, with respective market sizes of $19.09 billion and $10.90 billion in 2023, projected to reach $37.16 billion and $21.21 billion.

Clinical Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Clinical Diagnostics Industry

Roche Diagnostics:

Roche is a leader in clinical diagnostics, specializing in molecular and immuno-diagnostics technologies that enhance patient outcomes through innovative solutions.Abbott Laboratories:

Abbott is renowned for its advanced diagnostic tools and solutions, focusing on rapid diagnostics and improving disease detection methodologies.Siemens Healthineers:

Siemens Healthineers offers a diverse portfolio in clinical diagnostics, integrating digital tools and AI to enhance laboratory efficiency and diagnostic accuracy.Thermo Fisher Scientific:

Thermo Fisher provides a wide range of diagnostic products and services while driving innovations in laboratory and clinical diagnostics around the globe.We're grateful to work with incredible clients.

FAQs

What is the market size of Clinical Diagnostics?

The Clinical Diagnostics market is projected to grow significantly, with a market size of $76.43 billion in 2023 and an expected CAGR of 6.7% over the next decade. This growth reflects the increasing need for advanced diagnostic solutions.

What are the key market players or companies in this Clinical Diagnostics industry?

Key players in the Clinical Diagnostics market include major companies such as Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, and Thermo Fisher Scientific. These companies lead the industry in innovation, product development, and market reach.

What are the primary factors driving the growth in the Clinical Diagnostics industry?

Growth in the Clinical Diagnostics market is driven by several factors, including rising chronic diseases, advancements in technology such as molecular diagnostics, and increasing demand for personalized medicine. Additionally, regulatory support and investment in healthcare further boost market expansion.

Which region is the fastest Growing in the Clinical Diagnostics?

The fastest-growing region in the Clinical Diagnostics market is North America, with a market size of $29.33 billion in 2023 projected to reach $57.09 billion by 2033. Other significant regions include Europe and Asia Pacific, which also show strong growth rates.

Does ConsaInsights provide customized market report data for the Clinical Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the Clinical Diagnostics industry. Clients can request detailed insights that focus on specific areas of interest, including regional analysis, segments, and emerging trends.

What deliverables can I expect from this Clinical Diagnostics market research project?

Deliverables from the Clinical Diagnostics market research project include detailed market analysis reports, segmentation insights, regional data, competitive landscape assessments, and forecasts. These documents are designed to guide strategic decision-making in the industry.

What are the market trends of Clinical Diagnostics?

Current market trends in Clinical Diagnostics include a shift towards point-of-care testing, increased adoption of molecular diagnostics, and growing focus on preventive care and screening methods. Innovations and increasing investment in digital health technologies also shape these trends.