Clinical Risk Grouping Solutions Market Report

Published Date: 31 January 2026 | Report Code: clinical-risk-grouping-solutions

Clinical Risk Grouping Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Clinical Risk Grouping Solutions market from 2023 to 2033, focusing on market size, growth trends, regional insights, and key players in the industry.

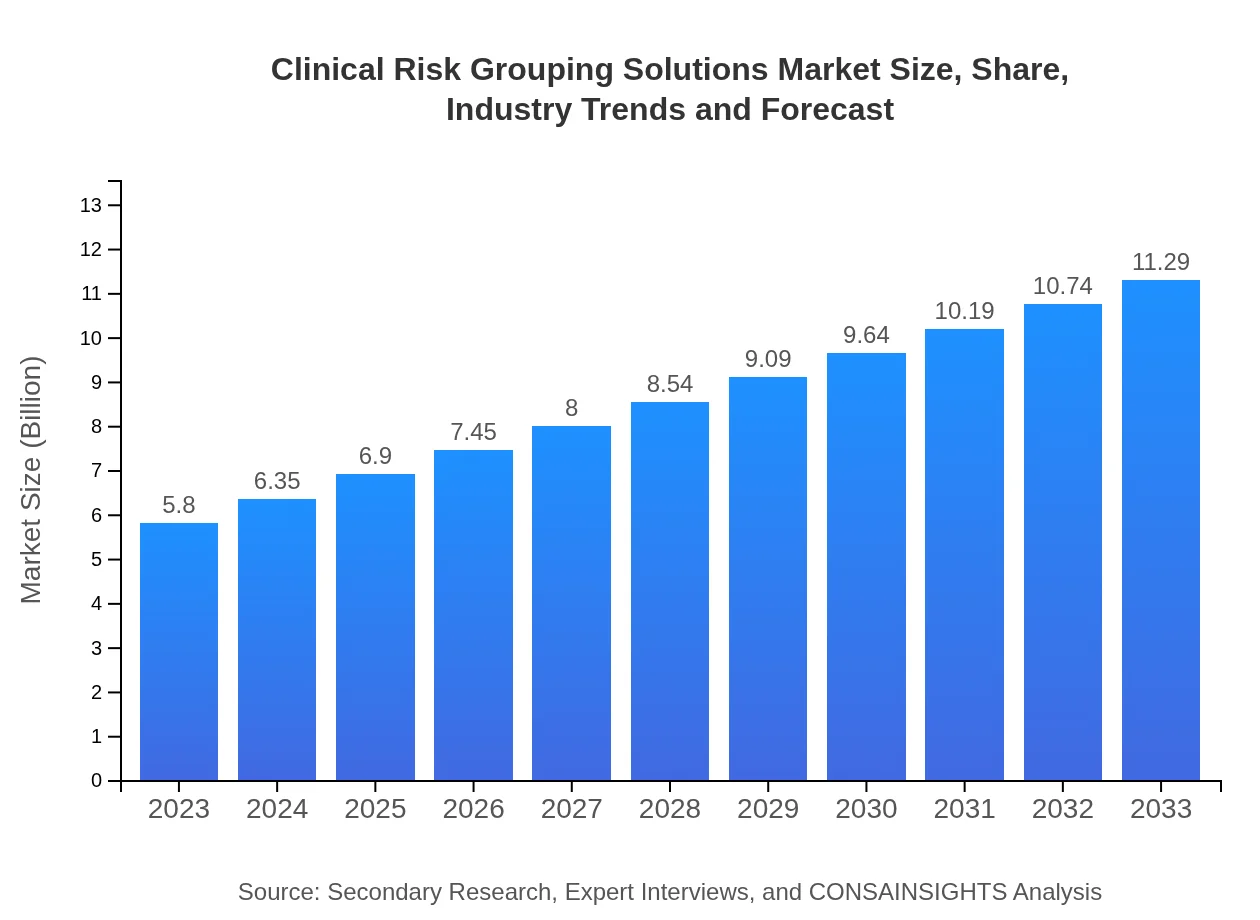

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $11.29 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, McKesson Corporation, OptumInsight |

| Last Modified Date | 31 January 2026 |

Clinical Risk Grouping Solutions Market Overview

Customize Clinical Risk Grouping Solutions Market Report market research report

- ✔ Get in-depth analysis of Clinical Risk Grouping Solutions market size, growth, and forecasts.

- ✔ Understand Clinical Risk Grouping Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Clinical Risk Grouping Solutions

What is the Market Size & CAGR of Clinical Risk Grouping Solutions market in 2023?

Clinical Risk Grouping Solutions Industry Analysis

Clinical Risk Grouping Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Clinical Risk Grouping Solutions Market Analysis Report by Region

Europe Clinical Risk Grouping Solutions Market Report:

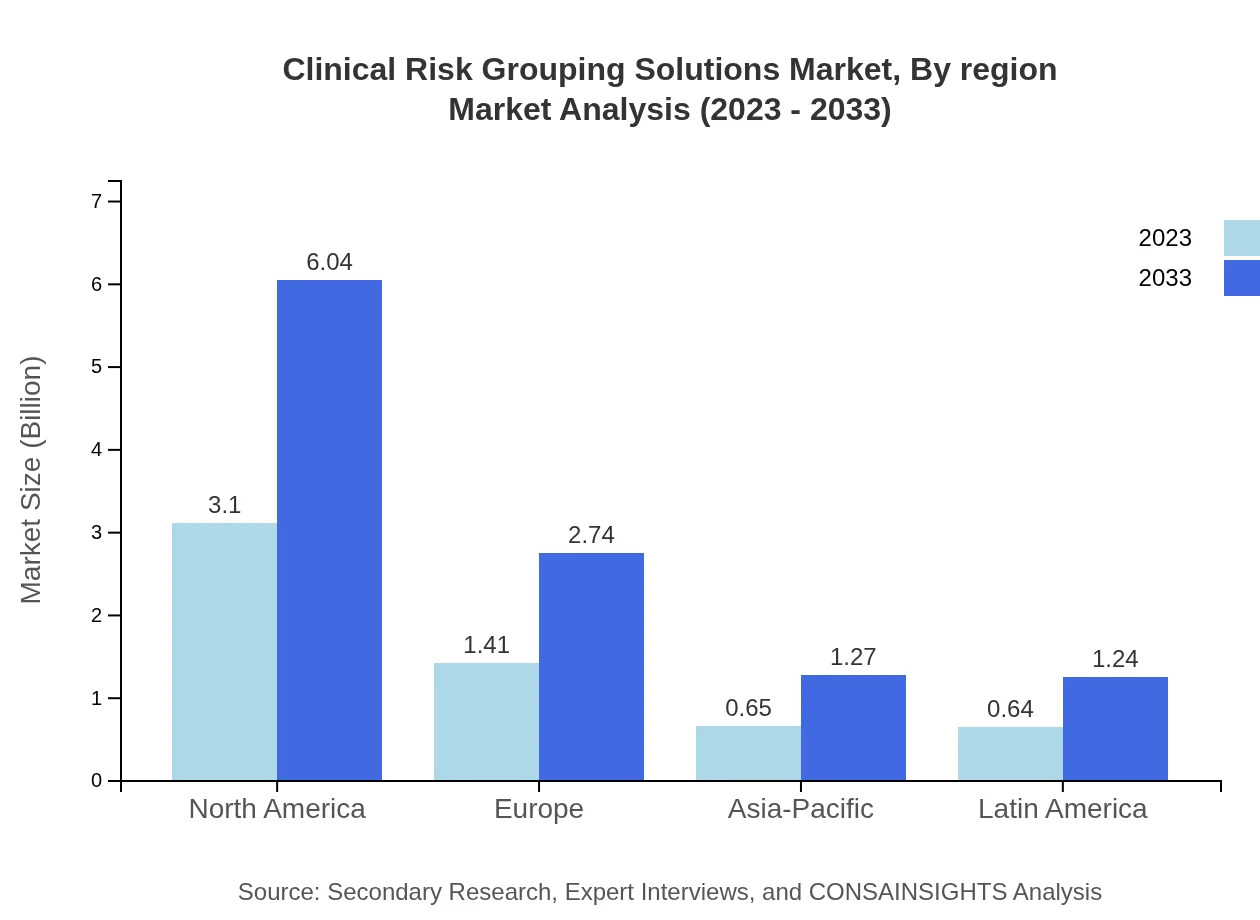

In Europe, the market is anticipated to expand from $2.02 billion in 2023 to $3.93 billion by 2033. This growth is driven by supportive government policies regarding healthcare digitization and a robust demand for patient-centered care solutions among hospitals and healthcare providers.Asia Pacific Clinical Risk Grouping Solutions Market Report:

In the Asia Pacific region, the Clinical Risk Grouping Solutions market size in 2023 is valued at $0.92 billion and is expected to grow to $1.79 billion by 2033. This growth is fueled by rising healthcare expenditures, government initiatives toward healthcare innovation, and an increase in the prevalence of chronic diseases across the region. The shift towards digital healthcare solutions is also a significant driver.North America Clinical Risk Grouping Solutions Market Report:

North America, leading the market, is projected to maintain a market size of $2.02 billion in 2023 and reach $3.92 billion by 2033. The region's growth is heavily supported by advanced healthcare systems, a high prevalence of chronic conditions, and substantial investment in health IT solutions.South America Clinical Risk Grouping Solutions Market Report:

In South America, the market is expected to grow from $0.24 billion in 2023 to $0.47 billion in 2033. Factors such as increased investment in healthcare infrastructure and a rising awareness of clinical risk management solutions among healthcare practitioners are encouraging market growth in this region.Middle East & Africa Clinical Risk Grouping Solutions Market Report:

The Middle East and Africa are poised for substantial growth, from a market size of $0.61 billion in 2023 to $1.18 billion by 2033. Focus on enhancing healthcare delivery systems and adoption of risk management technologies by government and private healthcare institutions are key factors.Tell us your focus area and get a customized research report.

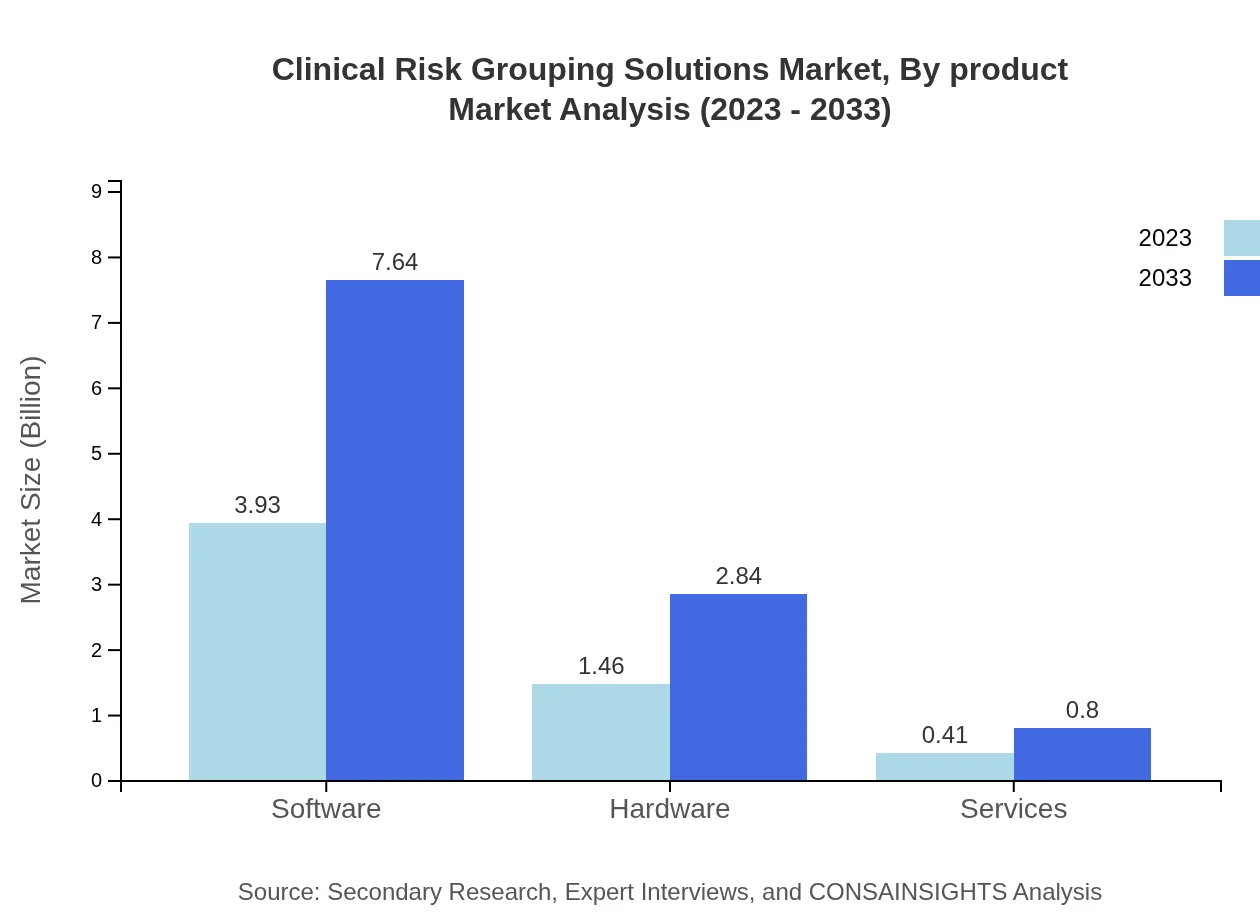

Clinical Risk Grouping Solutions Market Analysis By Product

The Clinical Risk Grouping Solutions market by product includes software, hardware, and services. Software solutions dominate the market, accounting for approximately 67.7% of the market share in 2023, with expectations to maintain this share through 2033. Hardware and service segments follow, with shares of 25.17% and 7.13%, respectively, reflecting a balanced market offering for comprehensive clinical risk management solutions.

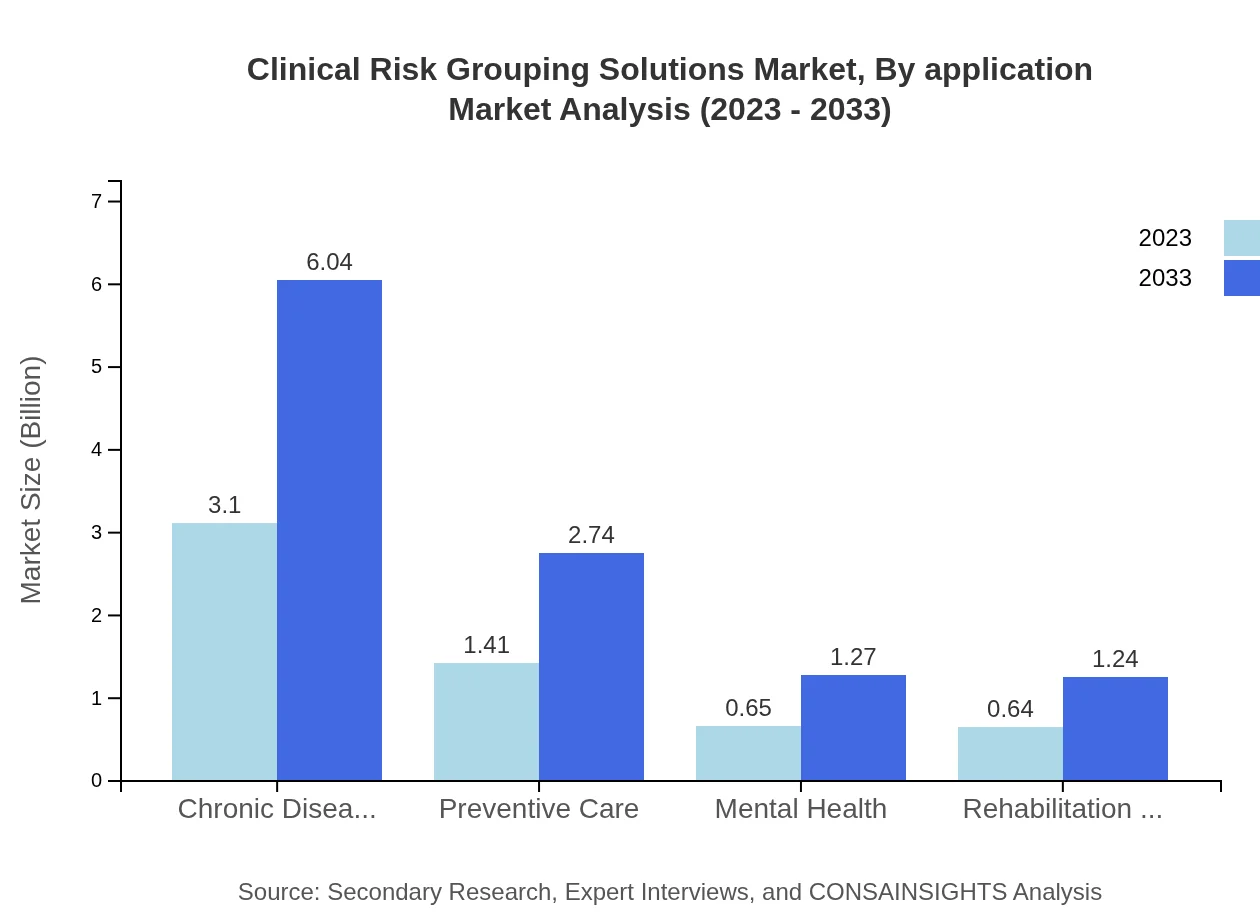

Clinical Risk Grouping Solutions Market Analysis By Application

Segmentation by application highlights the significance of chronic disease management, preventive care, mental health, and rehabilitation services. Chronic disease management accounts for 53.49% of the share in 2023, indicating its critical importance in the healthcare sector, while preventive care and other applications hold significant portions of the market, emphasizing the diverse applications of clinical risk grouping.

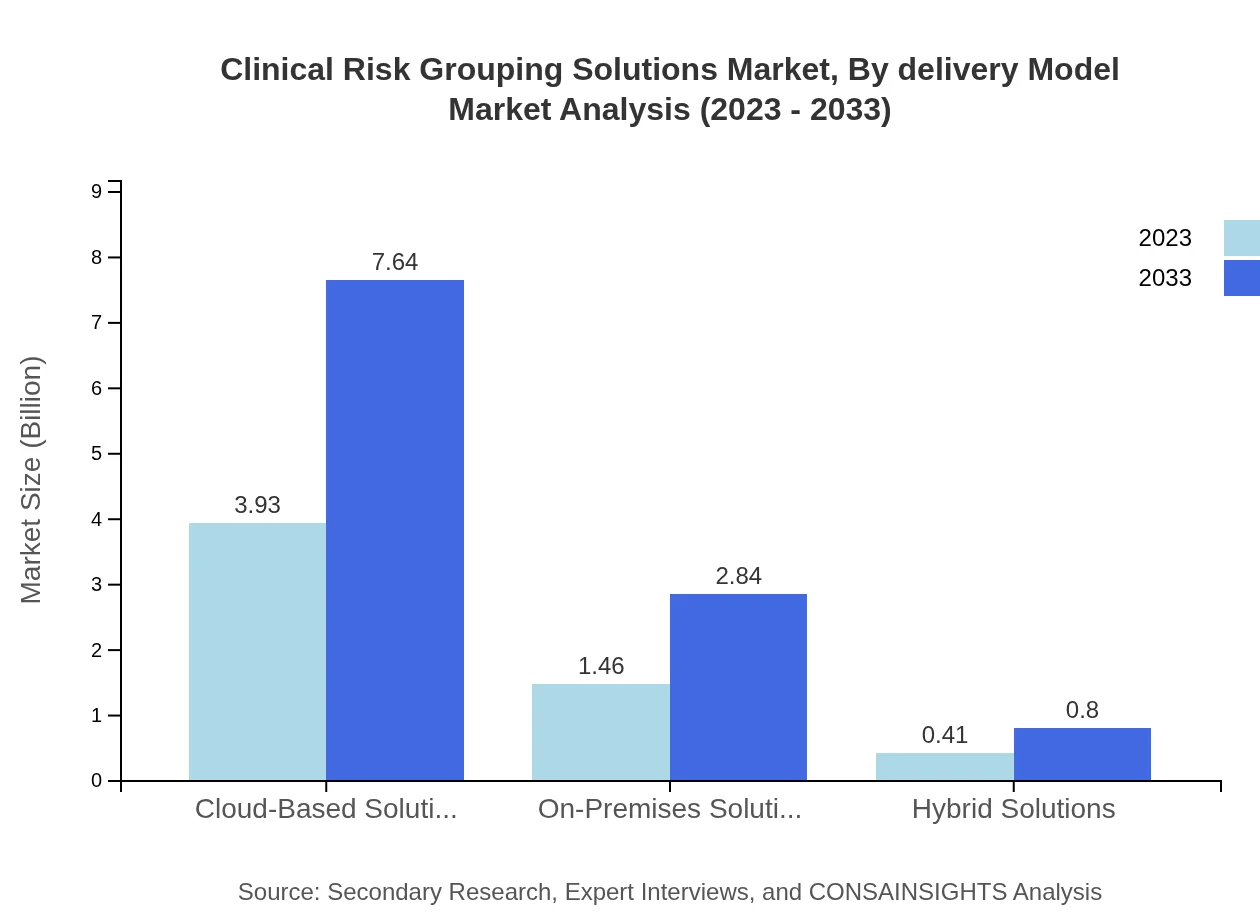

Clinical Risk Grouping Solutions Market Analysis By Delivery Model

Delivery model segmentation indicates a strong preference for cloud-based solutions, representing 67.7% of the market in 2023. On-premises and hybrid solutions, with market shares of 25.17% and 7.13%, respectively, indicate a mixed approach to technology adoption within healthcare settings.

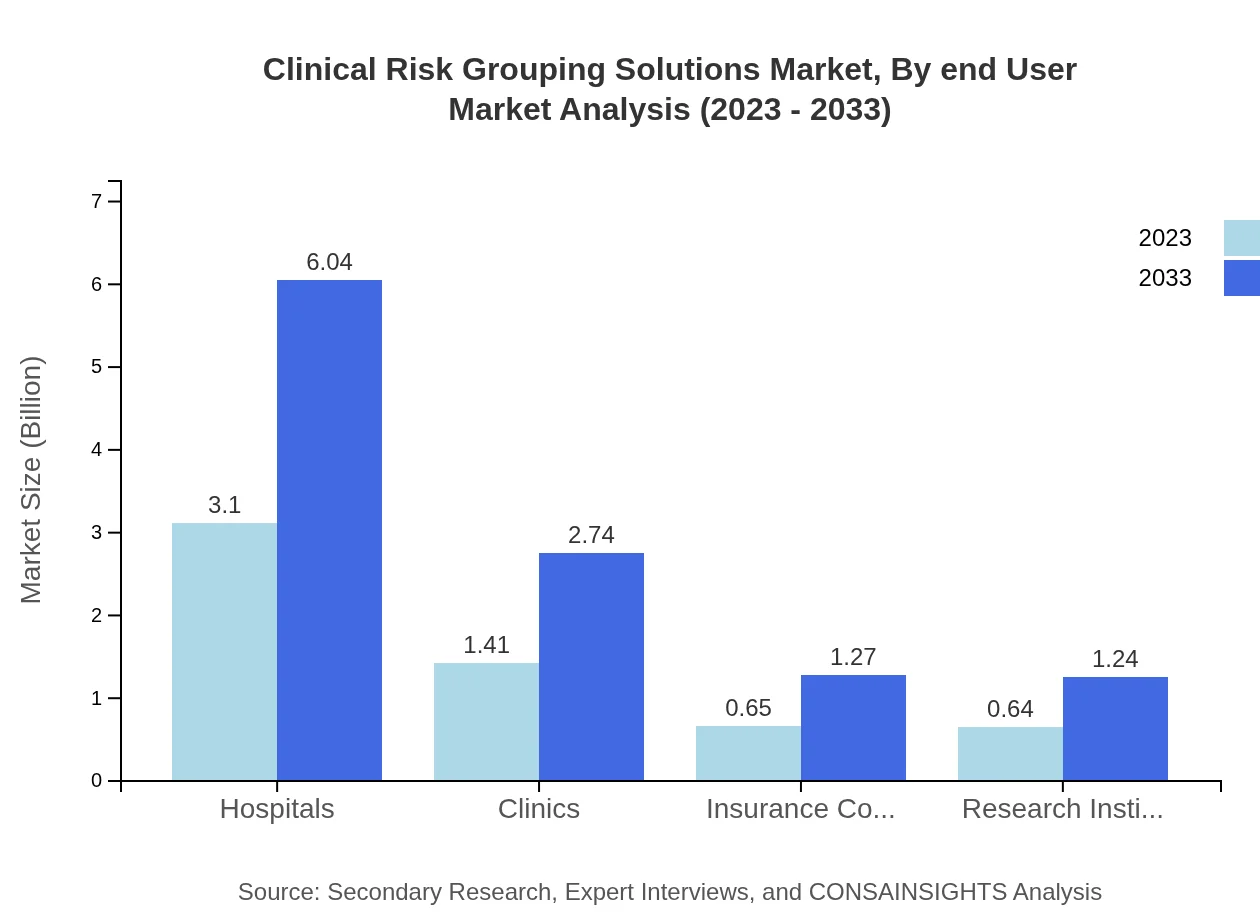

Clinical Risk Grouping Solutions Market Analysis By End User

The end-user analysis shows that hospitals command a significant share of 53.49% in 2023, followed by clinics at 24.28%, indicating the critical role these institutions play in adopting clinical risk grouping solutions. Insurance companies and research institutes also contribute notable shares, indicating a diverse application across various healthcare settings.

Clinical Risk Grouping Solutions Market Analysis By Region

The regional segmentation showcases varied growth trajectories, with North America, Europe, and the Asia Pacific driving the majority of the growth in the Clinical Risk Grouping Solutions market. Each region faces unique challenges and opportunities, necessitating tailored approaches to capture market potential.

Clinical Risk Grouping Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Clinical Risk Grouping Solutions Industry

Epic Systems Corporation:

Epic Systems is a leading provider of healthcare software, specializing in electronic health records (EHR) and clinical risk solutions, designed to enhance patient care.Cerner Corporation:

Cerner offers a wide array of health information technology solutions that include analytics and clinical risk grouping tools aimed at improving outcomes for providers and patients alike.Allscripts Healthcare Solutions:

Allscripts provides integrated healthcare solutions with a focus on data analytics and clinical risk management, empowering healthcare providers to deliver value-based care.McKesson Corporation:

Known for its extensive portfolio in health management services, McKesson plays a pivotal role in risk management and analytics, catering to healthcare providers globally.OptumInsight:

OptumInsight is a data and analytics leader in the healthcare industry, known for its innovative approaches to risk grouping and management strategies for improved patient care.We're grateful to work with incredible clients.

FAQs

What is the market size of clinical Risk Grouping Solutions?

The clinical risk grouping solutions market size is projected to reach approximately $5.8 billion by 2033, growing at a CAGR of 6.7% from the current valuation.

What are the key market players or companies in this clinical Risk Grouping Solutions industry?

Major players in the clinical risk grouping solutions sector include leading healthcare technology firms, specialized software solution providers, and integrated healthcare organizations focused on risk management and patient care efficiency.

What are the primary factors driving the growth in the clinical Risk Grouping Solutions industry?

Key growth drivers include increasing demand for effective patient risk management, advancements in healthcare analytics, and the need for improved operational efficiencies in healthcare systems globally.

Which region is the fastest Growing in the clinical Risk Grouping Solutions?

The Asia-Pacific region is recognized as the fastest-growing market for clinical risk grouping solutions, projected to grow from a market size of $0.92 billion in 2023 to $1.79 billion by 2033.

Does ConsaInsights provide customized market report data for the clinical Risk Grouping Solutions industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the clinical risk grouping solutions industry, ensuring relevant insights and strategic market guidance.

What deliverables can I expect from this clinical Risk Grouping Solutions market research project?

Expect detailed market analysis reports, segmented data insights, trends identification, competitive landscape breakdown, and actionable recommendations to aid strategic decision-making.

What are the market trends of clinical Risk Grouping Solutions?

Current trends in the clinical risk grouping solutions market include a shift towards cloud-based technologies, rising adoption of AI for predictive analytics, and a focus on patient-centric and value-based care.